Market Overview

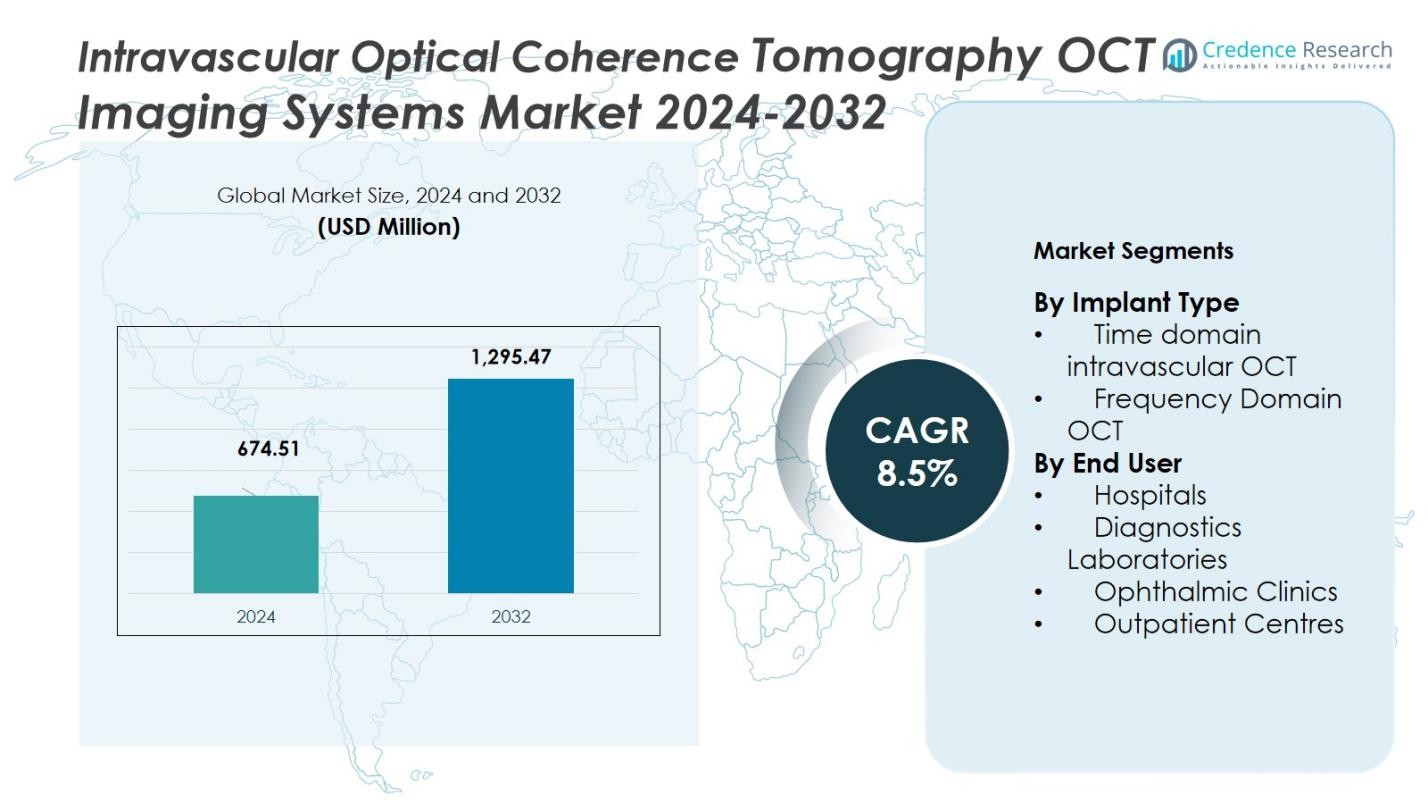

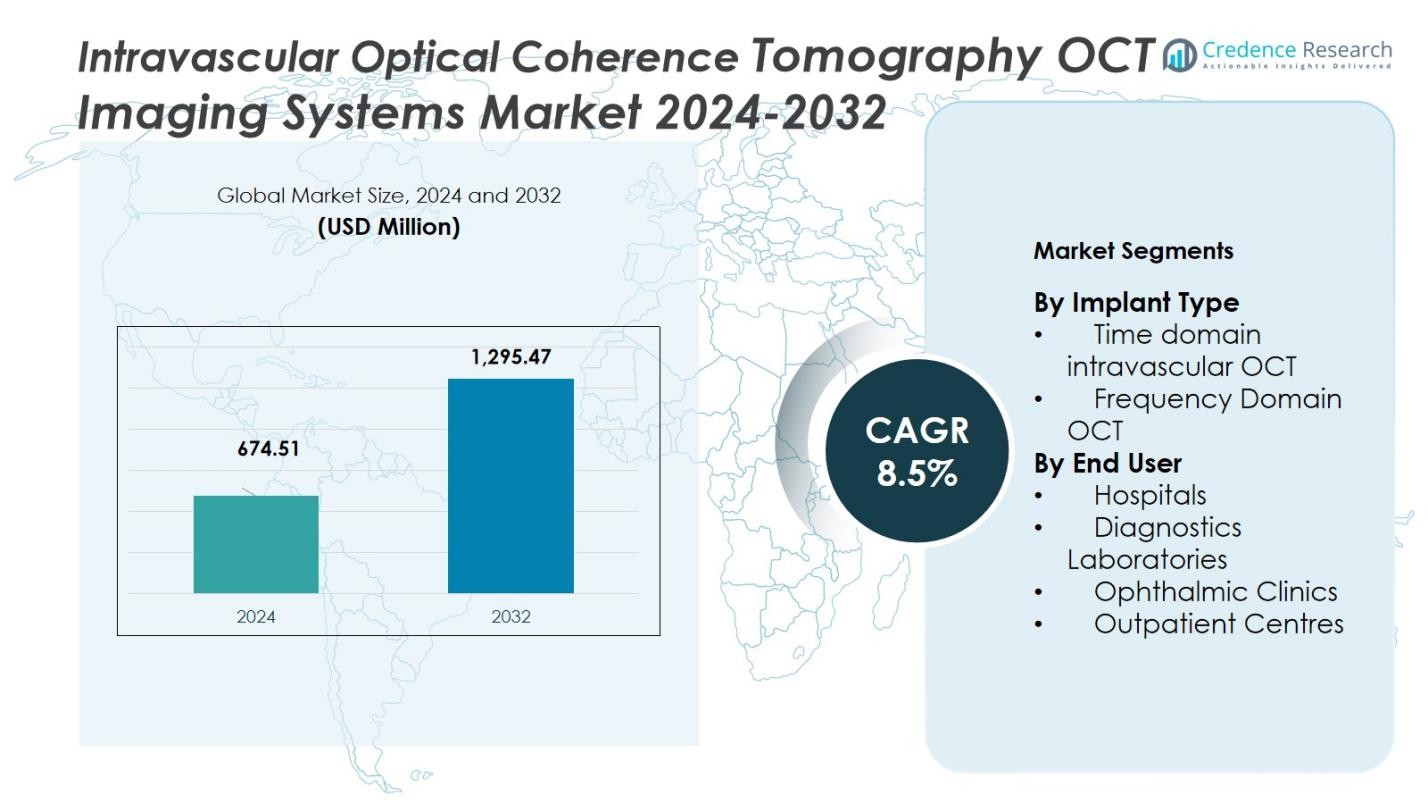

The Intravascular Optical Coherence Tomography (OCT) Imaging Systems Market size was valued at USD 674.51 million in 2024 and is anticipated to reach USD 1,295.47 million by 2032, growing at a CAGR of 8.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Intravascular Optical Coherence Tomography (OCT) Imaging Systems Market Size 2024 |

USD 674.51 Million |

| Intravascular Optical Coherence Tomography (OCT) Imaging Systems Market, CAGR |

8.5% |

| Intravascular Optical Coherence Tomography (OCT) Imaging Systems Market Size 2032 |

USD 1,295.47 Million |

The Intravascular Optical Coherence Tomography (OCT) Imaging Systems Market is dominated by key players such as Abbott Laboratories, Carl Zeiss AG, Heidelberg Engineering GmbH, Leica Microsystems, and TOPCON CORPORATION. These companies lead the market by advancing OCT technology, enhancing imaging resolution, and integrating AI-driven platforms to improve diagnostic capabilities. North America is the leading region, accounting for 45% of the market share in 2024, driven by a strong healthcare infrastructure and high adoption of advanced diagnostic systems. Europe follows closely with 30% market share, while Asia-Pacific is the fastest-growing region, holding 20% share due to increasing healthcare investments and rising cardiovascular disease prevalence. The growing demand for minimally invasive procedures and advanced imaging solutions continues to support the expansion of these key players across all regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Intravascular Optical Coherence Tomography (OCT) Imaging Systems market size stood at USD 674.51 million in 2024 and is projected to reach USD 1,295.47 million by 2032, registering a CAGR of 8.5%.

- The Frequency Domain OCT implant‑type segment captured approximately 65% share in 2024, driven by superior imaging speed and resolution.

- Hospitals represent the dominant end‑user segment with around 55% market share in 2024, supported by high procedure volumes and advanced infrastructure.

- North America led the regional landscape with 45% market share in 2024, while Europe held 30% and Asia‑Pacific attained 20%, highlighting mature and emerging growth zones.

- Market uptake is constrained by high system and disposable costs and inconsistent reimbursement pathways, which limit adoption especially in smaller and mid‑tier healthcare facilities.

Market Segmentation Analysis:

By Implant Type

The Intravascular Optical Coherence Tomography (OCT) Imaging Systems market is segmented by implant type into Time Domain Intravascular OCT and Frequency Domain OCT. The Frequency Domain OCT sub-segment dominates the market, holding a significant share of 65% in 2024. This dominance is driven by its higher speed, better image resolution, and enhanced tissue penetration, making it the preferred choice in clinical diagnostics. The increasing demand for more accurate and detailed imaging for coronary artery disease and other vascular conditions further supports the growth of the Frequency Domain OCT segment.

- For instance, Abbott’s OPTIS™ Next Imaging System is a widely adopted Frequency Domain OCT platform used in cardiac catheterization labs globally. The system integrates with standard angiography setups and enables real-time, high-definition cross-sectional imaging of coronary arteries.

By End User

The market for Intravascular OCT Imaging Systems is segmented by end user into Hospitals, Diagnostics Laboratories, Ophthalmic Clinics, and Outpatient Centers. Hospitals dominate this segment, accounting for 55% of the market share in 2024. This dominance is driven by the advanced medical infrastructure available in hospitals, combined with the high volume of cardiac procedures and vascular imaging required. Hospitals are also the primary centers for the latest technology adoption, including advanced OCT imaging systems, to support cardiology and vascular imaging needs, enhancing diagnostic accuracy and patient outcomes.

- For instance, the Cleveland Clinic has integrated advanced Intravascular OCT systems in its cardiology departments to enhance the precision of coronary artery disease imaging and intervention, capitalizing on high patient inflow and sophisticated cardiovascular care facilities.

Key Growth Drivers

Advancements in Medical Imaging Technology

The continuous advancements in medical imaging technologies are a primary growth driver for the Intravascular Optical Coherence Tomography (OCT) Imaging Systems market. Innovations in Frequency Domain OCT systems, which offer enhanced image resolution, faster imaging speeds, and better tissue penetration, are driving their widespread adoption in clinical settings. These technological improvements enable healthcare providers to offer more accurate diagnoses, particularly in the detection and treatment of coronary artery disease, which in turn supports the growing demand for OCT systems.

- For instance, LightLab Imaging’s first-generation FD-OCT system offers faster frame rates and higher image line density than traditional Time Domain OCT, facilitating detailed visualization of coronary arteries in less time.

Rising Prevalence of Cardiovascular Diseases

The increasing prevalence of cardiovascular diseases (CVDs) worldwide is significantly fueling the demand for Intravascular OCT Imaging Systems. As CVDs remain one of the leading causes of death globally, the need for advanced diagnostic tools, such as OCT systems, to detect early signs of artery blockages and other vascular conditions has become more critical. This rise in cardiovascular health concerns is driving investments in OCT technology, as healthcare facilities seek to improve diagnostic accuracy and patient care.

- For instance, Conavi Medical has developed the Novasight Hybrid IVUS/OCT system, which integrates intravascular ultrasound with OCT to provide detailed, high-quality images of coronary arteries enhancing diagnosis and treatment of complex CVD cases.

Growing Preference for Minimally Invasive Procedures

The shift towards minimally invasive procedures in cardiovascular and vascular diagnostics is another major growth driver for the Intravascular OCT Imaging Systems market. OCT technology offers a non-invasive, highly detailed, and precise imaging method that allows physicians to assess vascular conditions in real-time with minimal patient discomfort. As patient preference for less invasive options grows, the demand for OCT imaging systems, which enable quick and accurate diagnosis without the need for surgery, is expected to continue rising.

Key Trends & Opportunities

Integration with Artificial Intelligence

A key trend in the Intravascular OCT Imaging Systems market is the integration of Artificial Intelligence (AI) to enhance diagnostic capabilities. AI-driven OCT systems are improving image interpretation, accelerating diagnostic processes, and providing automated analysis of complex vascular conditions. As AI continues to evolve, the potential to streamline workflows and improve accuracy will drive further market growth, creating opportunities for innovations in both software and hardware that integrate AI algorithms with OCT imaging systems.

- For instance, Abbott’s Ultreon 2.0 software employs AI to provide real-time insights during percutaneous coronary interventions (PCI), enabling faster decision-making and improved stent placement accuracy.

Expanding Applications Beyond Cardiology

The growing recognition of the potential of OCT technology beyond cardiology is opening new opportunities in the market. OCT imaging systems are increasingly being used in ophthalmology, dermatology, and other medical specialties due to their high-resolution imaging capabilities. This trend offers significant market expansion as the versatility of OCT systems is explored across various healthcare applications, encouraging new product developments and partnerships in diverse medical fields.

Key Challenges

High Cost of Intravascular OCT Systems

One of the key challenges facing the Intravascular OCT Imaging Systems market is the high cost associated with these advanced technologies. The price of OCT systems, including the necessary software and training, can be prohibitively expensive for smaller healthcare facilities, limiting the widespread adoption of these systems. While large hospitals and diagnostic centers can afford these systems, the cost remains a significant barrier for other healthcare providers, slowing market growth in certain regions.

Regulatory and Reimbursement Issues

Regulatory hurdles and reimbursement issues also pose challenges to the growth of the Intravascular OCT Imaging Systems market. Many regions require extensive regulatory approvals for new medical devices, and the process can be time-consuming and costly. Additionally, reimbursement policies for OCT-based procedures vary across countries, which can limit the adoption of this technology. The lack of consistent reimbursement models can discourage healthcare providers from investing in OCT systems, despite their potential benefits in diagnostic accuracy.

Regional Analysis

North America

North America commands a dominant position in the Intravascular OCT Imaging Systems Market, accounting for 45% of the global market share in 2024. The region benefits from advanced cardiovascular care infrastructure, high adoption of image‑guided interventional procedures, and favorable reimbursement policies. Healthcare providers invest heavily in cutting‑edge diagnostic technologies to improve patient outcomes, driving demand for intravascular OCT systems. Strong R&D activity paired with regulatory support facilitates continuous innovation and uptake, enabling the region to maintain leadership and act as a launch platform for next‑generation OCT solutions.

Europe

Europe holds 30% of the global intravascular OCT imaging systems market, positioning it as the second‑largest regional market in 2024. The region’s growth reflects robust healthcare systems, regulatory frameworks that support medical‑device innovation, and increasing demand for minimally invasive diagnostics. Key markets such as Germany, the United Kingdom and France lead installations of advanced imaging equipment. With rising incidence of cardiovascular diseases and government initiatives promoting preventive care, Europe is poised for sustained expansion as hospitals upgrade their imaging suites and interventional cardiology volumes rise.

Asia‑Pacific

Asia‑Pacific accounts for 20% of the global intravascular OCT imaging systems market in 2024 and is recognised as the fastest‑growing region. Growth is driven by rapidly expanding healthcare infrastructure, rising incidence of cardiovascular disorders, and increased awareness of advanced diagnostic technologies across countries such as China, India and Japan. Governments are increasing healthcare spending and encouraging private‑sector expansion. The region offers significant potential for entry of cost‑competitive devices and local manufacturing, as well as large‑scale upgrade cycles in emerging markets, supporting robust demand for intravascular OCT systems.

Middle East & Africa

The Middle East & Africa (MEA) region captures 5% of the global intravascular OCT imaging systems market in 2024. Growth is being supported by rising healthcare investment, expansions of private hospital networks and increasing focus on non‑communicable diseases such as cardiovascular disorders. Despite a smaller base compared to other regions, MEA offers emerging opportunity hotspots like the UAE, Saudi Arabia and South Africa where governments are modernising diagnostic capabilities. Adoption remains constrained by cost sensitivity and limited specialist training, but these factors are gradually being addressed.

Latin America

Latin America holds 5% of the global intravascular OCT imaging systems market in 2024. The region is experiencing growth due to rising healthcare awareness, an increasing burden of cardiovascular diseases, and the modernization of medical facilities in key countries like Brazil, Mexico, and Argentina. Although challenges such as limited healthcare budgets and uneven access to advanced diagnostic technologies exist, the growing adoption of minimally invasive diagnostic techniques and government initiatives to improve healthcare infrastructure are expected to drive market expansion. This region presents a significant growth opportunity as healthcare providers upgrade their diagnostic equipment to meet rising patient needs.

Market Segmentations:

By Implant Type

- Time domain intravascular OCT

- Frequency Domain OCT

By End User

- Hospitals

- Diagnostics Laboratories

- Ophthalmic Clinics

- Outpatient Centres

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the intravascular optical coherence tomography (OCT) imaging systems market features key players such as Abbott Laboratories, Carl Zeiss AG, Heidelberg Engineering GmbH, Leica Microsystems and TOPCON CORPORATION positioned for innovation and global reach. These companies compete by advancing imaging resolutions, rolling out AI‑enabled OCT platforms, and forming strategic alliances that expand catheter‑based intravascular solutions. For example, one large player enhanced its software to support automatic plaque detection and guidance during interventional procedures. Strong patent portfolios, worldwide distribution networks and service‑capability in interventional cardiology give leading firms a competitive edge. Meanwhile, smaller specialist players emphasise niche innovation—such as ultra‑miniaturised catheter optics or multi‑modal imaging hybrids—to carve growth pockets. As market adoption increases in emerging geographies, competitive pressure intensifies on pricing, system integration, and service‑after‑sales to maintain market share and customer loyalty.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Leica Microsystems

- TOPCON CORPORATION

- Agfa Healthcare India Pvt. Ltd.

- Agiltron Inc.

- Shenzhen MOPTIM Imaging Technique Co., Ltd.

- Canon Inc.

- Häag‑Streit Group

- Nikon Instruments Inc.

- Abbott Laboratories

- Heidelberg Engineering GmbH

Recent Developments

- In August 2025, Gentuity LLC announced an agreement to collaborate with GE HealthCare to expand access to its advanced intravascular imaging platform.

- In October 2024, Gentuity LLC’s HF‑OCT imaging system (with its 1.8 F Vis‑Rx micro‑imaging catheter) received 510(k) clearance from the Food and Drug Administration for pre‑ and post‑coronary intervention imaging.

- In October 2023, Abbott Laboratories launched its vascular imaging platform powered by Ultreon™ 1.0 Software in India, integrating OCT with artificial‑intelligence capabilities to guide stent deployment and optimize vessel sizing.

- In August 2023, Abbott unveiled late‑breaking results from the landmark ILUMIEN IV trial showing that intravascular imaging via OCT can improve stent procedural outcomes, especially in complex cases.

Report Coverage

The research report offers an in-depth analysis based on Implant Type, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Wider adoption of hybrid imaging systems that combine OCT with other modalities, enabling comprehensive vessel wall assessment and driving higher utilization in interventional cardiology.

- Use of artificial intelligence and machine‑learning algorithms in OCT imaging workflows to automate plaque detection, stent optimization, and outcome prediction, enhancing diagnostic speed and consistency.

- Expansion of OCT system applications beyond coronary arteries into peripheral vascular, neurovascular, and structural heart disease interventions, broadening end‑user base and procedural volume.

- Increasing penetration of OCT imaging in emerging markets across Asia‑Pacific and Latin America, fueled by rising cardiovascular disease burden, improving healthcare infrastructure, and favourable reimbursement trends.

- Advancement in catheter miniaturisation and imaging resolution allowing improved intravascular access in smaller vessels and more complex anatomies, driving new procedure types.

- Growing emphasis on value‑based healthcare and procedure guidance metrics (such as reduced restenosis rates, improved stent apposition), which positions OCT as a tool to demonstrate clinical and economic benefits.

- Partnerships and strategic acquisitions among key players to accelerate innovation, extend geographic reach, and integrate digital platforms alongside OCT hardware to offer full procedural solutions.

- Rising demand for minimally invasive diagnostics and real‑time procedural imaging in interventional cardiology, which underscores the importance of high‑resolution OCT systems in optimizing outcomes.

- Regulatory harmonisation and improved reimbursement frameworks for intravascular imaging procedures, which will lower adoption barriers and create more predictable market conditions.

- Emergence of data‑driven patient‑specific treatment planning using OCT image datasets coupled with computational models, enabling personalized therapy and influencing device design and imaging protocols.