Market overview

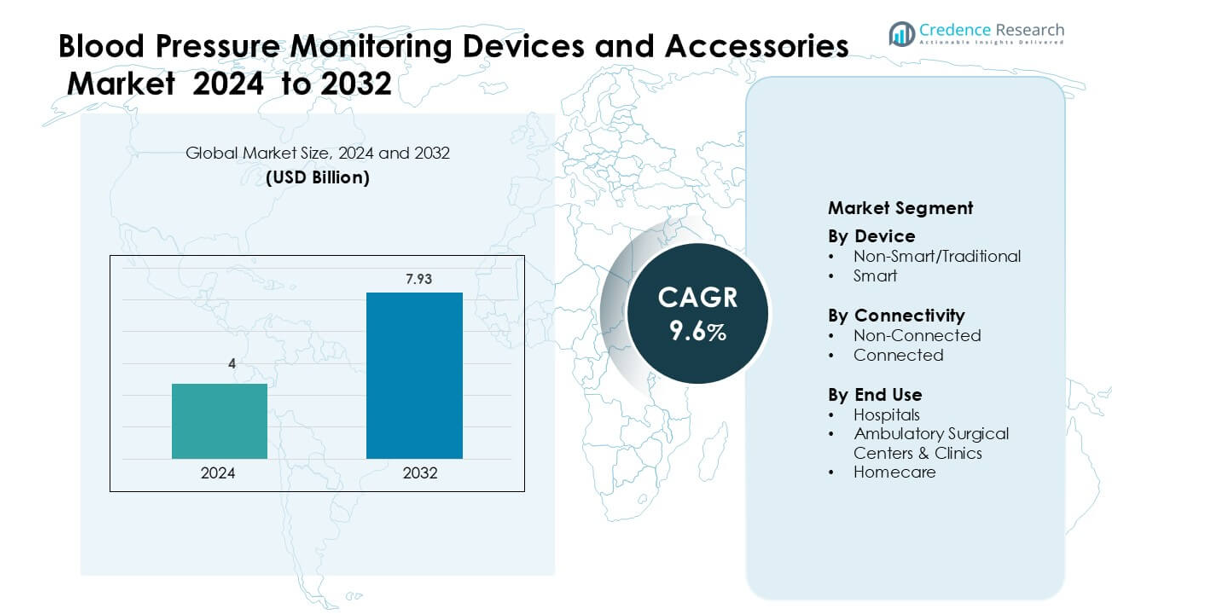

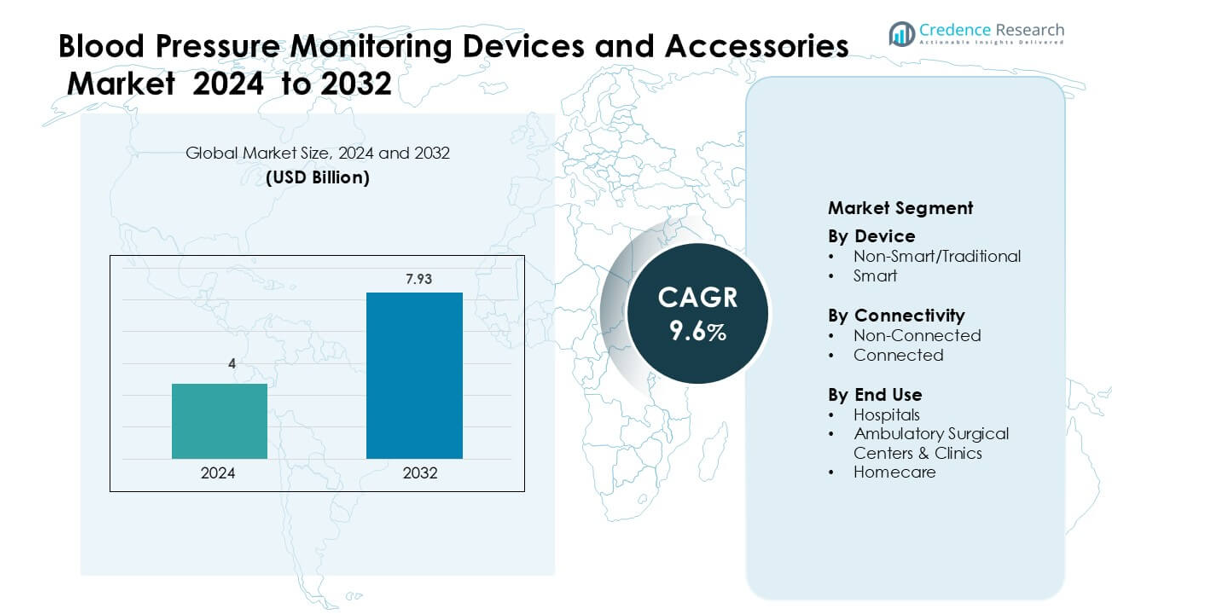

Blood Pressure Monitoring Devices and Accessories Market was valued at USD 4 billion in 2024 and is anticipated to reach USD 7.93 billion by 2032, growing at a CAGR of 9.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Blood Pressure Monitoring Devices and Accessories Market Size 2024 |

USD 4 billion |

| Blood Pressure Monitoring Devices and Accessories Market, CAGR |

9.6% |

| Blood Pressure Monitoring Devices and Accessories Market Size 2032 |

USD 7.93 billion |

The Blood Pressure Monitoring Devices and Accessories Market is shaped by leading players such as Microlife AG, GE Healthcare, A&D Medical Inc., Kaz Inc., SunTech Medical, Inc., Withings, Welch Allyn, Inc., Omron Healthcare, Briggs Healthcare, and American Diagnostics Corporation. These companies compete through advancements in digital accuracy, connected monitoring features, and user-friendly cuff designs for clinical and home settings. They continue to expand portfolios with smart devices that support remote care and chronic disease management. North America leads the market with a 34% share, driven by high hypertension prevalence, strong adoption of homecare monitors, and well-established digital health infrastructure.

Market Insights

- The Blood Pressure Monitoring Devices and Accessories Market reached USD 4 billion in 2024 and will grow at a 9.6% CAGR through 2032.

- Rising hypertension cases and expanding homecare monitoring drive strong adoption of digital and traditional devices across hospitals, clinics, and households.

- Smart, app-connected monitors, cloud data sharing, and wearable-based tracking shape major trends as users shift toward real-time monitoring and preventive care.

- The market remains competitive with companies improving accuracy, comfort, and connectivity, while restraints arise from data privacy concerns and accuracy variations in low-cost devices.

- North America leads with a 34% share, while non-smart devices hold a 62% segment share due to strong use in hospitals; Asia Pacific shows the fastest growth supported by rising screening programs and growing homecare use.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Device

Non-smart blood pressure monitors lead the market with a 62% share due to wide use across hospitals and clinics. These devices offer stable readings, simple handling, and lower maintenance, which suits high-volume workflows. Demand remains strong as care teams rely on cuff-based systems for routine checks and rapid triage. Smart monitors grow as patients track readings through mobile apps for better chronic disease management. Their rise links to rising hypertension cases and remote care programs, but non-smart monitors remain dominant because medical staff still prefer manual validation during critical assessments.

- For instance, Welch Allyn’s Connex VSM 6000 series which supports non‑invasive blood pressure (NIBP) monitoring in hospital settings was cleared by the U.S. FDA and is used broadly on general medical and surgical floors.

By Connectivity

Non-connected devices dominate this segment with a 58% share because healthcare settings continue to rely on standalone monitors for quick, offline checks. These systems reduce data syncing issues and support smooth operation in emergency rooms and general wards. Growth stays steady as many providers prioritize durability and low cost. Connected monitors gain adoption as digital health expands, offering automated data transfer for long-term tracking. Demand rises in homecare and telehealth programs, but non-connected units hold the lead due to strong uptake in traditional clinical environments.

- For instance, the Welch Allyn Connex Pro BP 3400 supports up to 100 readings on a single lithium‑ion charge and operates in under 15 seconds per measurement, making it ideal for busy wards that cannot rely on network connectivity.

By End Use

Hospitals account for the largest share at 49%, driven by continuous patient monitoring needs in emergency, critical care, and general wards. These facilities use a large volume of cuffs, digital monitors, and wall-mounted units to support frequent checks across departments. Adoption grows as hospitals upgrade to accurate, automated systems that reduce manual error and improve workflow. Homecare expands fast as patients seek self-monitoring solutions for hypertension management. Clinics and ambulatory centers show stable demand, but hospitals remain dominant due to their high patient load and structured monitoring protocols.

Key Growth Drivers

Rising Hypertension Prevalence and Aging Population

The global rise in hypertension cases acts as a major driver for blood pressure monitoring devices. More adults develop lifestyle-related risk factors such as obesity, stress, and sedentary habits, which increase dependence on regular monitoring. The aging population further boosts demand because older adults require frequent assessment to manage chronic cardiovascular conditions. Healthcare systems now encourage routine blood pressure checks to reduce hospital admissions linked to stroke and heart failure. This shift increases the adoption of both clinic-grade and home-use monitors. Governments and health agencies also promote early screening programs, which supports higher sales across community health centers and retail channels. Growing awareness of preventive care strengthens the market and encourages users to invest in easy-to-use digital monitors for daily readings. Rising diagnosis rates ensure long-term growth across hospitals, clinics, and homecare settings, making hypertension prevalence a sustained growth catalyst.

- For instance, according to World Health Organization (WHO) data, an estimated 1.4 billion adults aged 30‑79 years have hypertension in 2024.

Expansion of Homecare and Remote Patient Monitoring

A rapid shift toward home-based care strongly accelerates uptake of blood pressure monitoring devices. Many patients prefer home monitoring to avoid frequent hospital visits and gain greater control over chronic conditions. Remote patient monitoring programs help clinicians track readings in real time and intervene early when levels fluctuate. This approach reduces emergency admissions and supports long-term disease management. Advancements in wireless cuffs, app-linked devices, and data-sharing platforms improve patient experience and drive adoption. Growing telehealth use encourages families to invest in digital monitors for continuous care. Healthcare providers also integrate remote tracking into chronic disease programs to support early detection and better follow-ups. As homecare adoption increases, device makers focus on simple interfaces, adjustable cuffs, and reliable digital outputs. This trend positions home monitoring as a primary growth engine across developed and emerging markets.

- For instance, OMRON’s “VitalSight™” remote patient monitoring service—launched commercially in September 2020—enables patients to measure blood pressure at home and send readings directly to their clinicians via a pre‑configured hub and monitor.

Technological Advancements and Smart Device Adoption

Rapid innovation in device accuracy, connectivity, and material quality drives strong market growth. Smart blood pressure monitors now offer automated data syncing, multi-user tracking, and cloud storage, making hypertension management easier for patients and providers. AI-based algorithms improve reading consistency by reducing motion-related errors. New cuff designs made with soft, skin-friendly materials support long, comfortable use. Integration with smartphones and health platforms allows users to share reports with clinicians instantly, improving care coordination. Device makers also focus on battery efficiency, compact forms, and digital displays to enhance usability. These upgrades encourage replacements of older devices in homes and clinics. The shift toward digital ecosystems creates new revenue opportunities for companies offering connected accessories and mobile apps.

Key Trends and Opportunities

Growing Demand for Connected Health Ecosystems

Connected monitoring ecosystems present a major growth opportunity as healthcare providers move toward integrated digital care. Many hospitals deploy electronic health records that require seamless input from blood pressure devices, creating demand for Bluetooth and Wi-Fi-enabled monitors. Patients increasingly prefer app-based tracking to observe trends, receive reminders, and maintain digital logs. These features strengthen adherence to hypertension treatment and support long-term disease management. Companies invest in interoperable platforms that link wearable sensors, BP monitors, and teleconsultation portals. As remote consultations grow, smart devices become central to chronic care programs. This shift opens opportunities for subscription-based apps, clinical dashboards, and AI-driven analytics.

- For instance, A&D s UA‑656BLE telehealth blood pressure monitor features Bluetooth 5.1 LE communication and is Certified for Continua™ interoperability—ensuring the device can connect with broader health‑IT systems.

Rising Focus on Preventive Healthcare and Wellness Programs

Preventive healthcare campaigns create strong opportunities for device makers as governments and insurers promote routine blood pressure monitoring to reduce healthcare costs. Employers integrate wellness programs that track cardiovascular indicators, increasing adoption of portable monitors. Pharmacies and retail clinics now offer screening booths that rely on accurate and durable monitoring systems. Growing awareness of lifestyle diseases motivates younger users to adopt digital tools for self-care. Awareness campaigns by health agencies encourage periodic checks, expanding market reach into non-clinical environments. Preventive monitoring also supports early diagnosis, reducing future treatment burdens and driving long-term demand.

- For instance, in India the Omron Healthcare India import‑data shows 352 shipments by the company alone in one year, accounting for around 52% of all blood pressure monitor imports into the country.

Key Challenges

Accuracy Limitations in Low-Cost and Consumer-Grade Devices

Many low-cost monitors face accuracy concerns due to inconsistent sensor quality, poor calibration, or limited validation across diverse arm sizes. These issues reduce clinical acceptance and create mistrust among patients who rely on precise readings for hypertension management. Inaccurate measurements may lead to misdiagnosis or improper medication adjustments, increasing health risks. Manufacturers struggle to balance affordability with high-quality components. Regulatory bodies now push for stricter validation standards, which raises compliance costs for small players. Lack of physician confidence slows adoption of certain smart devices in clinical settings, making accuracy a persistent challenge.

Data Privacy and Integration Barriers in Connected Devices

Connected monitors generate sensitive health data, raising concerns about privacy, storage, and cyber risks. Many devices face issues integrating with hospital systems due to interoperability gaps and inconsistent data formats. Patients worry about unauthorized access to their health information, which limits use of cloud-based platforms. Healthcare providers must invest in secure IT infrastructure to support remote monitoring programs. These upgrades increase operational costs and slow digital adoption in resource-limited settings. Regulatory compliance for data protection also raises development burdens for manufacturers. As digital ecosystems expand, addressing data security becomes a major challenge for sustained market growth.

Regional Analysis

North America

North America holds a 34% share driven by strong adoption of digital and homecare monitoring devices across the U.S. and Canada. High hypertension prevalence, early diagnosis programs, and strong insurance support reinforce demand. Hospitals upgrade to automated systems to improve workflow and reduce manual errors, while consumers adopt smart monitors for remote care. Strong presence of global manufacturers speeds product innovation and regulatory approvals. The region benefits from mature telehealth infrastructure, which boosts use of connected cuffs. Growing focus on preventive care and chronic disease management ensures continued market expansion across clinical and home settings.

Europe

Europe accounts for a 29% share, supported by structured screening programs and high awareness of cardiovascular risks. Countries such as Germany, the U.K., and France invest in diagnostic upgrades and encourage routine monitoring in primary care centers. Hospitals adopt automated monitors to enhance accuracy, while aging populations drive strong homecare device demand. Manufacturers benefit from favorable regulations that promote safe, validated medical devices. Rising digital health investments improve integration of connected monitors into national healthcare systems. The region’s emphasis on preventive care and chronic disease control sustains long-term growth across home, clinic, and hospital segments.

Asia Pacific

Asia Pacific leads emerging growth with a 28% share, driven by rising hypertension cases, rapid urbanization, and expanding healthcare infrastructure. China, Japan, India, and South Korea witness strong uptake of digital devices as families shift toward home-based monitoring. Governments promote early screening to reduce rising cardiovascular disease burdens, increasing demand from primary care and diagnostic centers. Growing middle-class health spending boosts adoption of smart monitors with app connectivity. Local manufacturers expand production capacity, making devices more affordable. The region’s fast-growing telehealth ecosystem strengthens long-term demand for connected blood pressure monitoring solutions.

Latin America

Latin America holds a 5% share, supported by rising awareness of hypertension and improving access to diagnostic tools. Brazil, Mexico, and Argentina show steady adoption as public hospitals procure automated monitors for chronic disease management programs. Homecare use grows as consumers seek affordable digital devices for routine tracking. Market expansion is limited by budget constraints in smaller countries, but private health networks drive moderate demand. Gradual growth in telemedicine improves adoption of connected monitors. Strengthening regulatory standards and imports from global players help raise product quality and availability across clinics and pharmacies.

Middle East & Africa

The Middle East & Africa region holds a 4% share, driven by rising incidence of lifestyle-related hypertension and increasing investment in hospital infrastructure. Gulf countries adopt advanced monitoring systems in large healthcare facilities, while urban centers in Africa see rising demand for affordable digital monitors. Government-led screening campaigns support early diagnosis, especially in high-risk populations. Limited access to homecare devices in rural areas slows overall penetration, but expanding private clinics improve availability. Growing telehealth pilot programs gradually raise interest in connected devices. The region shows steady long-term potential as healthcare modernization continues.

Market Segmentations:

By Device

- Non-Smart/Traditional

- Smart

By Connectivity

By End Use

- Hospitals

- Ambulatory Surgical Centers & Clinics

- Homecare

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Blood Pressure Monitoring Devices and Accessories Market features strong participation from global medical device leaders and specialized digital health companies. Key players focus on improving measurement accuracy, enhancing user comfort, and integrating smart connectivity features to meet rising demand from hospitals, clinics, and homecare users. Manufacturers invest in advanced sensors, adjustable cuff technologies, and cloud-linked platforms to support remote monitoring. Many companies strengthen portfolios through product upgrades, regulatory approvals, and regional expansion strategies. Partnerships with telehealth providers and healthcare networks help widen device adoption and improve long-term patient tracking. Competitive pressure remains high as firms introduce compact, easy-to-use digital monitors targeting chronic disease management. Growing demand for connected solutions pushes companies to offer mobile app integrations and multi-user data tracking. Together, these strategies shape a dynamic market where innovation, compliance, and user-centric designs determine leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Microlife AG

- GE Healthcare

- A&D Medical Inc.

- Kaz Inc.

- SunTech Medical, Inc.

- Withings

- Welch Allyn, Inc.

- Omron Healthcare

- Briggs Healthcare

- American Diagnostics Corporation

Recent Developments

- In October 2025, GE HealthCare expanded its Carevance platform with advanced patient monitoring features, including tools for detecting and managing perioperative hypotension, strengthening blood pressure management workflows.

- In September 2024, Nihon Kohden’s Board of Directors approved the purchase of a 71.4% stake in NeuroAdvanced Corp. (“NAC”), the parent company of Ad-Tech Medical Instrument Corporation (“Ad-Tech”) in the U.S. Following the acquisition, NAC and Ad-Tech were consolidated and designated as principal subsidiaries of Nihon Kohden, as their total capital represented 10% or more of Nihon Kohden’s overall capital.

- In May 2024, OMRON Healthcare India partnered with AliveCor to introduce portable ECG monitoring devices in India. This collaboration aims to offer advanced, easy-to-use solutions for heart health monitoring, enabling users to track their ECG readings conveniently

Report Coverage

The research report offers an in-depth analysis based on Device, Connectivity, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for home-based digital monitors will rise as users focus on continuous tracking.

- Smart, connected devices will gain wider use with stronger integration into telehealth platforms.

- AI-driven accuracy improvements will support better diagnosis and reduce reading errors.

- Wearable blood pressure technologies will expand and attract younger users.

- Hospitals will adopt more automated systems to improve workflow and reduce manual checks.

- Cloud data sharing will become standard for long-term hypertension management.

- Manufacturers will develop more comfortable, adjustable cuffs for diverse patient groups.

- Preventive health programs will boost routine monitoring across emerging markets.

- Regulatory bodies will push stricter validation standards to ensure measurement reliability.

- Global players will expand through partnerships and product upgrades to strengthen market presence.