Market Overview

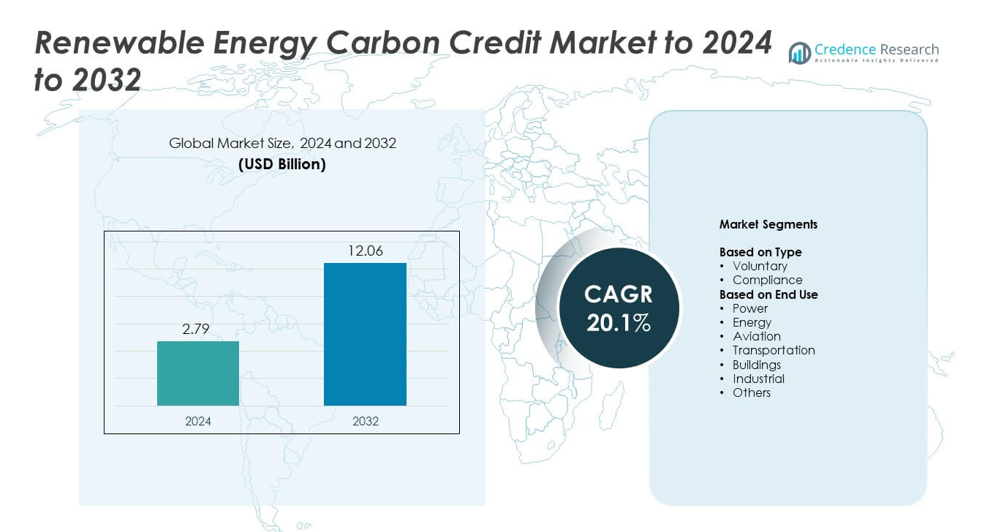

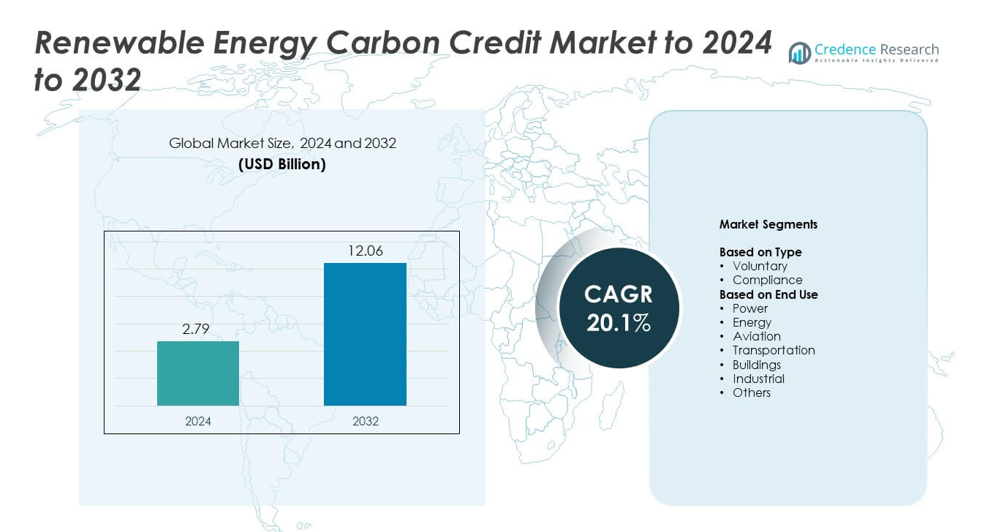

Renewable Energy Carbon Credit Market size was valued USD 2.79 billion in 2024 and is anticipated to reach USD 12.06 billion by 2032, at a CAGR of 20.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Renewable Energy Carbon Credit Market Size 2024 |

USD 2.79 billion |

| Renewable Energy Carbon Credit Market , CAGR |

20.1% |

| Renewable Energy Carbon Credit Market Size 2032 |

USD 12.06 billion |

The renewable energy carbon credit market features key players such as South Pole, Climeworks, 3Degrees, Atmosfair, EcoAct, and Climate Impact Partners. These companies lead through advanced carbon offset solutions, renewable project financing, and blockchain-based verification platforms that enhance transparency and accountability. They focus on expanding renewable energy portfolios across wind, solar, and biomass projects while aligning with global decarbonization targets. North America dominated the market in 2024 with a 37% share, driven by strong regulatory frameworks and corporate net-zero commitments. Europe followed with a 31% share, supported by stringent emission policies and active participation in cross-border carbon trading initiatives.

Market Insights

- The renewable energy carbon credit market was valued at USD 2.79 billion in 2024 and is projected to reach USD 12.06 billion by 2032, growing at a CAGR of 20.1%.

- Strong decarbonization commitments, government emission trading schemes, and renewable project expansion are key drivers of market growth.

- Increasing adoption of blockchain and AI in verification systems is shaping market trends, enhancing transparency and transaction efficiency.

- The market is highly competitive, with global players focusing on renewable project financing, technology integration, and digital trading platforms to strengthen credit credibility.

- North America led with a 37% share in 2024, followed by Europe at 31% and Asia-Pacific at 24%, while the compliance segment dominated overall with a 63% market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The compliance segment dominated the renewable energy carbon credit market with a 63% share in 2024. This dominance stems from mandatory emission reduction programs and regulatory frameworks such as the EU Emissions Trading System and California’s Cap-and-Trade. These programs drive demand for verified carbon credits among corporations seeking to meet legally binding emission targets. Voluntary credits are expanding as companies pursue net-zero goals and adopt internal carbon pricing models, but compliance markets continue to hold the largest volume due to government-enforced participation and transparent verification standards.

- For instance, VisEra Technologies bought 13,903,000 kWh with T-RECs and 50 VERs in 2023. Verification recorded 6,881.985 tonnes CO₂e avoided that year.

By End Use

The power sector held the leading position in 2024, accounting for 39% of the total market share. This leadership is driven by large-scale renewable energy adoption, including solar, wind, and hydroelectric projects replacing fossil-based generation. Utilities are increasingly purchasing carbon credits to offset emissions during transitional phases toward full renewable integration. Sectors such as aviation and industrial manufacturing are emerging users, investing in certified credits to balance hard-to-abate emissions, yet the power industry remains the primary driver of structured credit trading and certification growth.

- For instance, NextEra Energy Resources added ~5,000 MW of renewables and storage in 2023. Its backlog expanded by ~9,000 MW during 2023. These figures reflect utility-scale project growth.

Key Growth Drivers

Rising Corporate Decarbonization Commitments

Global corporations are setting science-based targets and investing in renewable energy carbon credits to meet net-zero goals. These commitments are accelerating credit demand, particularly among firms in energy, manufacturing, and technology sectors. Companies are increasingly aligning sustainability goals with renewable energy sourcing and verified offset programs. This surge in private-sector participation is strengthening market liquidity and boosting credit issuance from renewable projects, reinforcing the market’s long-term expansion.

- For instance, Apple and suppliers had 17.8 GW online in 2024. Supplier clean energy avoided 21.8 million tonnes CO₂e that year.

Government Policies and Emission Trading Regulations

National and regional governments are strengthening carbon pricing mechanisms to curb greenhouse gas emissions. Policies like the EU ETS, China’s National Carbon Market, and India’s Renewable Energy Certificate program are key enablers of market growth. Regulatory frameworks promote transparency and accountability in credit trading, ensuring standardized emission reductions. This compliance-driven demand is enhancing participation from high-emission sectors and stimulating investments in renewable generation and verification systems.

- For instance, SP Group’s blockchain REC marketplace issues 1 REC per 1 MWh. The platform supports fractional trades down to 0.001 units.

Technological Integration in Credit Verification

The integration of blockchain, AI, and IoT technologies is revolutionizing carbon credit validation and trading efficiency. These tools provide transparent, traceable, and tamper-proof verification of renewable energy generation and carbon offset activities. Automation reduces administrative costs and enhances trust among buyers and regulators. Technology-driven validation platforms are fostering investor confidence and enabling seamless credit exchange, driving scalability in the renewable energy carbon credit ecosystem.

Key Trends and Opportunities

Expansion of Voluntary Carbon Markets

Voluntary carbon markets are rapidly expanding as organizations seek flexible and reputation-driven offset options. With growing awareness of sustainability and investor scrutiny, companies are purchasing voluntary credits to supplement regulatory compliance. The entry of new intermediaries and certification platforms enhances accessibility and liquidity. This trend supports innovative credit structures tied to renewable energy projects, offering both environmental impact and brand differentiation opportunities.

- For instance, Shell retired 17.3 million carbon credits in 2024, which included retirements from the VCS, ACR, Gold Standard, and ACCUs registries.

Integration of Nature-Based and Hybrid Credits

The market is witnessing the rise of hybrid credit models combining renewable energy with nature-based solutions such as reforestation and soil carbon capture. These diversified credits attract global buyers seeking holistic sustainability outcomes. Integration of renewable and natural offsets provides broader ecological benefits while improving project funding. This convergence of clean energy and environmental restoration is creating new investment opportunities within the carbon ecosystem.

- For instance, Microsoft agreed to buy 1,600,000 carbon removal credits from a Panama reforestation project. The project covers 10,000 hectares and plans 6,000,000 trees, targeting 3,200,000 tonnes removed.

Key Challenges

Lack of Global Standardization

The absence of uniform standards across carbon credit registries and trading systems limits transparency and interoperability. Varying methodologies for calculating emission reductions create confusion and hinder cross-border transactions. This inconsistency reduces investor confidence and delays project certification timelines. Establishing global frameworks and unified verification protocols remains essential to ensure credibility and comparability in carbon credit markets.

Price Volatility and Market Speculation

Fluctuating carbon credit prices driven by policy changes, supply constraints, and speculative trading undermine market stability. Investors face uncertainty in long-term returns, discouraging renewable project developers. Market imbalances between compliance and voluntary segments can further distort pricing. Ensuring consistent regulatory oversight and transparent pricing mechanisms is critical to sustaining confidence and encouraging steady capital flow into renewable carbon credit projects.

Regional Analysis

North America

North America accounted for a 37% share of the renewable energy carbon credit market in 2024. The region’s growth is driven by strong federal and state policies promoting renewable integration and carbon neutrality. The U.S. leads with active participation in voluntary and compliance programs, while Canada advances through renewable portfolio standards. Major corporations are adopting internal carbon pricing and renewable offset programs to meet sustainability targets. Increasing investment in wind and solar projects supports continuous credit generation, reinforcing the region’s dominant position in the global market.

Europe

Europe held a 31% share in 2024, supported by the European Union’s robust Emissions Trading System and green transition goals. Strict emission regulations and renewable integration targets have accelerated demand for verified carbon credits. Countries like Germany, France, and the U.K. are investing heavily in clean energy projects and cross-border credit trading platforms. Corporate sustainability initiatives and green finance frameworks further drive participation. The region’s well-established verification standards and transparent compliance structure continue to make it a key hub for renewable carbon credit development and trading.

Asia-Pacific

Asia-Pacific captured a 24% market share in 2024, propelled by rapid industrialization and renewable expansion across China, India, and Japan. China’s national carbon trading program and large-scale solar investments are key contributors to credit generation. India’s Renewable Energy Certificate (REC) mechanism is expanding participation from power producers and industrial firms. Japan’s voluntary market is strengthening as corporations commit to emission neutrality. The region’s fast adoption of renewable infrastructure and government-backed green policies enhance its role as a major growth driver in the global carbon credit ecosystem.

Middle East and Africa

The Middle East and Africa region accounted for a 5% share in 2024, reflecting early-stage but rising participation in renewable credit markets. Gulf nations such as the UAE and Saudi Arabia are integrating carbon trading mechanisms aligned with their long-term net-zero commitments. Renewable projects in solar and green hydrogen are fostering regional credit generation. African countries, particularly South Africa and Kenya, are developing carbon offset programs through clean power initiatives. Increasing foreign investment and regional policy alignment are expected to strengthen market engagement over the forecast period.

Latin America

Latin America represented a 3% market share in 2024, driven by renewable project investments across Brazil, Chile, and Mexico. The region benefits from abundant solar and hydroelectric potential, facilitating credit generation for export to global markets. Brazil’s voluntary market expansion and participation in international carbon programs are supporting steady growth. Local policies promoting green energy financing and emission reduction certification are strengthening credit trading frameworks. As awareness of carbon neutrality increases among regional industries, Latin America is poised for gradual but consistent growth within the renewable energy credit landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Type

By End Use

- Power

- Energy

- Aviation

- Transportation

- Buildings

- Industrial

- Others

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The renewable energy carbon credit market is highly competitive, with major participants such as South Pole, Climeworks, 3Degrees, Atmosfair, EcoAct, Climate Impact Partners, Carbon Direct, The Carbon Trust, Green Mountain Energy Company, CarbonClear, TerraPass, PwC, ALLCOT, Carbon Better, Native Energy, ClimeCo LLC, Sterling Planet Inc., Carbon Credit Capital, WayCarbon, Allotrope Partners LLC, Ecosecurities, and The Carbon Collective Company. Market competition centers on verified credit issuance, transparent trading mechanisms, and integration of digital verification technologies. Companies focus on expanding renewable project portfolios, enhancing credit traceability, and ensuring compliance with international sustainability standards. Strategic partnerships with governments, corporations, and financial institutions strengthen credit trading platforms and encourage cross-border participation. Firms are also prioritizing blockchain-enabled verification and AI-driven monitoring to maintain data integrity. The competitive environment continues to evolve as participants invest in technology innovation, global project development, and climate-aligned investment frameworks to capture long-term growth opportunities in renewable energy carbon trading.

Key Player Analysis

- South Pole

- Climeworks

- 3Degrees

- Atmosfair

- EcoAct

- Climate Impact Partners

- Carbon Direct

- The Carbon Trust

- Green Mountain Energy Company

- CarbonClear

- TerraPass

- PwC

- ALLCOT

- Carbon Better

- Native Energy

- ClimeCo LLC

- Sterling Planet Inc.

- Carbon Credit Capital, LLC.

- WayCarbon

- Allotrope Partners LLC

- Ecosecurities

- The Carbon Collective Company

Recent Developments

- In 2025, Climate Impact Partners Announced the Panna afforestation project in India, a partnership with Microsoft that secures a long-term offtake agreement for carbon removal credits.

- In 2024, Climeworks revealed its Generation 3 DAC technology, which is more efficient and uses less energy, significantly reducing capture costs.

- In 2023, Allotrope Partners LLC Partnered with Axens North America and Sumitomo Corporation of Americas to explore a commercial-scale cellulosic ethanol plant in California, a project that could produce both biofuels and renewable energy credits.

Report Coverage

The research report offers an in-depth analysis based on Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Global participation in carbon credit trading will expand through stronger renewable integration.

- Governments will introduce more standardized carbon pricing and trading frameworks.

- Corporate net-zero commitments will drive continuous demand for verified renewable credits.

- Blockchain and AI-based verification platforms will enhance market transparency and trust.

- Cross-border carbon credit exchanges will become more common among developed and emerging economies.

- Hybrid credits combining renewable and nature-based projects will gain wider adoption.

- Investment in solar, wind, and hydrogen projects will generate new credit opportunities.

- Regional cooperation on climate financing will support credit market stability and growth.

- Voluntary carbon markets will attract increased participation from small and mid-sized enterprises.

- Enhanced monitoring standards will strengthen credibility and reduce risks of double counting.