Market Overview

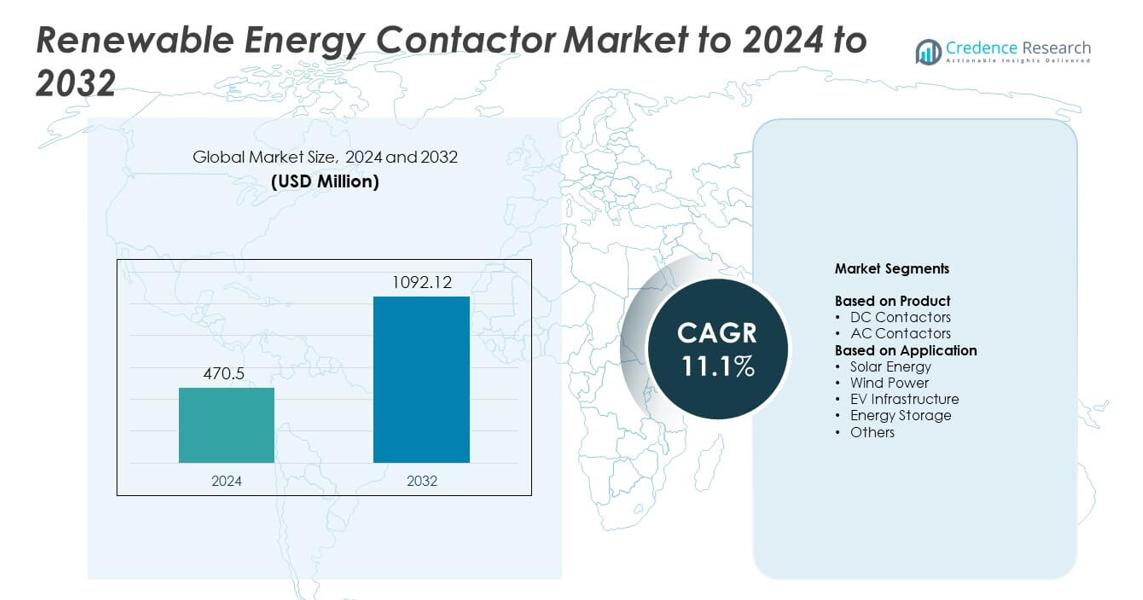

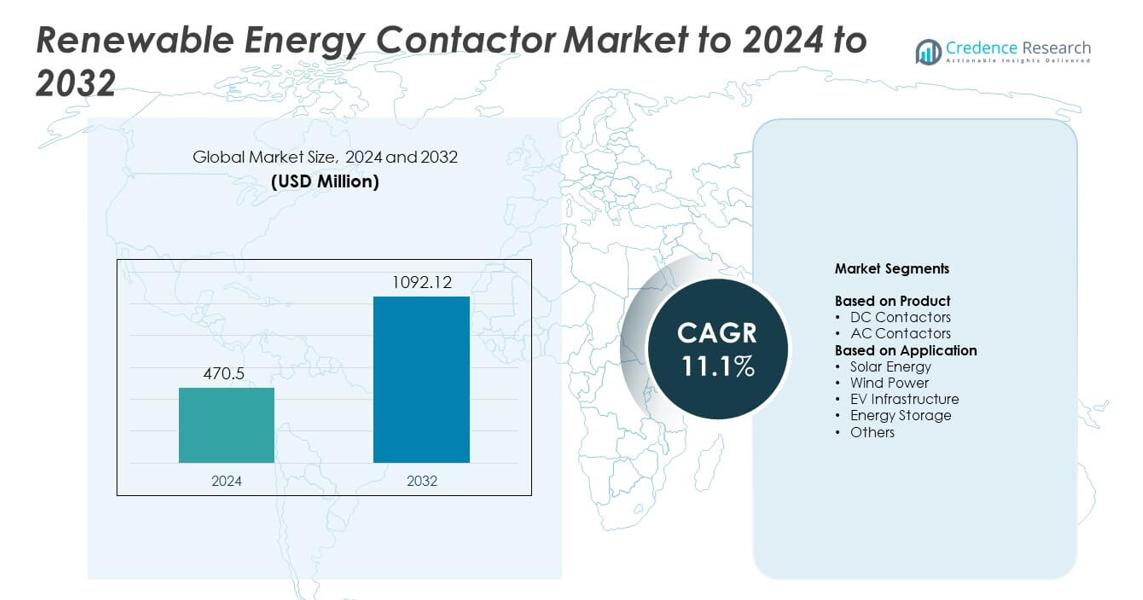

The renewable energy contactor market size was valued at USD 470.5 million in 2024 and is anticipated to reach USD 1,092.12 million by 2032, at a CAGR of 11.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Renewable Energy Contactor Market Size 2024 |

USD 470.5 million |

| Renewable Energy Contactor Market, CAGR |

11.1% |

| Renewable Energy Contactor Market Size 2032 |

USD 1,092.12 million |

The renewable energy contactor market is led by major players including Siemens AG, ABB Group, Schneider Electric, Eaton Corporation, and Mitsubishi Electric Corporation. These companies focus on developing advanced, energy-efficient, and digitally integrated contactor solutions tailored for solar, wind, and energy storage applications. Strategic collaborations, continuous R&D, and expansion of smart grid-compatible products strengthen their market positions globally. North America emerged as the leading region, accounting for a 34.6% share in 2024, driven by large-scale renewable energy installations, grid modernization efforts, and supportive government initiatives promoting clean energy infrastructure development across the U.S. and Canada.

Market Insights

- The renewable energy contactor market was valued at USD 470.5 million in 2024 and is projected to reach USD 1,092.12 million by 2032, growing at a CAGR of 11.1%.

- Market growth is driven by increasing renewable energy installations, rising demand for DC switching systems, and supportive government incentives for clean energy adoption.

- Emerging trends include the integration of IoT-enabled contactors, expansion of EV charging networks, and modernization of smart grid infrastructure for improved energy management.

- The market is competitive, with key players focusing on innovation, automation, and digital monitoring solutions to enhance operational reliability and efficiency.

- North America dominated the market with a 34.6% share in 2024, followed by Europe at 29.7% and Asia Pacific at 26.1%, while the DC contactors segment led with a 58.3% share, supported by widespread adoption in solar and energy storage applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The DC contactors segment dominated the renewable energy contractor market with a 58.3% share in 2024. Its growth is driven by expanding deployment of solar PV and energy storage systems that require efficient DC switching. The demand for high-voltage direct current (HVDC) applications and battery integration supports wider use of DC contactors in utility and commercial installations. AC contactors follow closely, supported by grid interconnection and inverter applications across renewable infrastructure, particularly in hybrid systems combining solar and wind energy.

- For instance, ABB GF1325 is rated 1,500 V DC and 1,325 A for PV inverters.

By Application

The solar energy segment held the largest market share of 46.2% in 2024, driven by rising solar farm installations and government incentives for clean energy adoption. Demand for reliable switching devices in PV arrays and battery storage units enhances contractor activity in this area. Wind power remains another major application due to increasing offshore projects requiring advanced contactor systems. Emerging segments such as EV infrastructure and energy storage are growing rapidly, propelled by electric mobility adoption and grid modernization efforts.

- For instance, Sensata (Gigavac) HX460 is 1,500 V DC, 1,000 A, with 10 kV isolation.

Key Growth Drivers

Regulatory and Policy Support

Supportive government policies and renewable energy mandates are key drivers for the renewable energy contactor market. Incentives such as tax credits and renewable portfolio standards encourage the installation of solar, wind, and storage systems. These frameworks lower financial barriers, enhance investor confidence, and expand contractor opportunities. Favorable regulations across major economies also promote grid upgrades and clean energy integration. Consistent policy backing enables contractors to scale operations, secure long-term projects, and maintain stable growth pipelines across residential, commercial, and utility sectors.

- For instance, Hitachi Energy won a 950-km HVDC link delivering 6 GW in India.

Expansion of Renewable Projects and Grid Upgrades

The increasing construction of solar parks, wind farms, and energy storage projects drives high demand for contactors. Contractors benefit from continuous infrastructure expansion as utilities upgrade grids to handle renewable integration. Rising investments in smart grids and transmission modernization enhance the need for advanced electrical components. The growth of hybrid and off-grid systems further expands project scopes for engineering and installation contractors. This wave of renewable deployment strengthens long-term demand for contactor installations across global energy transition initiatives.

- For instance, Vestas secured 810 MW for Empire Wind 1 using 54 V236-15 MW turbines.

Growth in Energy Storage and EV Infrastructure

The accelerating adoption of energy storage systems and electric vehicle charging infrastructure supports market expansion. Storage units require advanced contactors for current control and safety, while EV charging networks depend on switching solutions for grid connections. The rising synergy between renewables, batteries, and EV systems generates additional project opportunities. Contractors engaged in designing, installing, and maintaining these systems experience steady growth. The increasing push toward electrified transport and grid flexibility continues to broaden the contractor market landscape.

Key Trends & Opportunities

Integration of Smart and Digital Solutions

Digitalization and IoT-enabled maintenance are reshaping the renewable energy contactor industry. Smart monitoring systems enhance operational efficiency, minimize downtime, and optimize performance of renewable assets. Contractors adopting digital platforms for predictive analytics and remote diagnostics gain a competitive edge. Growing demand for data-driven asset management promotes recurring service contracts beyond project completion. The trend supports higher reliability and cost optimization across renewable infrastructure.

- For instance, Eaton DILDC contactors are rated for up to 150,000 electrical operations.

Rise of Distributed and Hybrid Energy Systems

The expansion of distributed generation, microgrids, and hybrid renewable systems presents strong opportunities for contractors. Increasing deployment of rooftop solar, community energy systems, and off-grid storage installations drives localized project demand. Contractors providing integrated solutions across solar, wind, and battery systems gain market advantage. The shift toward decentralized energy supports resilient power infrastructure and enhances flexibility in emerging economies. This trend widens the application scope for contactors and engineering service providers globally.

- For instance, Schneider Electric has deployed more than 500 microgrids globally.

Key Challenges

Supply Chain Constraints and Cost Pressures

Fluctuating raw material prices and supply disruptions challenge contractor profitability. Components such as inverters, transformers, and switching equipment face extended lead times due to global shortages. Rising logistics and procurement costs increase project expenses and delay schedules. Contractors must strengthen supply chain partnerships, diversify sourcing, and adopt cost-control strategies to sustain margins. Managing these pressures remains vital for maintaining competitiveness and on-time project delivery in the expanding renewable sector.

Skilled Workforce Shortage and Execution Delays

The renewable energy contractor industry faces a shortage of trained technicians, engineers, and system integrators. This workforce gap affects project execution timelines and quality standards. The rising volume of complex installations intensifies the demand for specialized skills in electrical and digital systems. Companies unable to attract or retain talent face cost overruns and missed project milestones. Strengthening workforce development programs and technical training initiatives is essential to ensure timely and efficient renewable energy deployment.

Regional Analysis

North America

North America held a 34.6% share of the renewable energy contactor market in 2024, driven by large-scale solar and wind installations across the U.S. and Canada. Federal tax credits and clean energy mandates continue to strengthen renewable deployment. The region’s focus on modernizing grid infrastructure and integrating energy storage systems further boosts contractor demand. Expanding EV charging networks and investments in smart grid technologies create additional opportunities for contractors. The presence of major renewable project developers and equipment suppliers supports steady market expansion across both residential and utility-scale sectors.

Europe

Europe accounted for 29.7% of the market share in 2024, led by countries such as Germany, the U.K., and France with strong renewable energy policies. The European Green Deal and Fit-for-55 initiatives accelerate investments in wind, solar, and hybrid renewable systems. Widespread electrification, coupled with growing EV infrastructure, fuels demand for contactors and system integrators. Contractors benefit from retrofit programs aimed at decarbonizing existing grids and replacing fossil-based power networks. Ongoing innovation in grid interconnection and offshore wind projects further reinforces Europe’s position as a key regional contributor.

Asia Pacific

Asia Pacific captured a 26.1% share of the renewable energy contactor market in 2024, supported by rapid renewable expansion in China, India, Japan, and South Korea. Strong government targets for clean energy adoption and favorable financing frameworks encourage large-scale solar and wind installations. Growing urbanization and industrialization drive continuous investment in power infrastructure and energy storage. Contractors in this region benefit from expanding EPC projects and rising demand for efficient grid connectivity. Domestic manufacturing capabilities and renewable energy capacity additions enhance the region’s competitiveness in global supply chains.

Latin America

Latin America represented 6.5% of the global market share in 2024, with Brazil, Chile, and Mexico leading renewable adoption. Expanding solar and wind generation projects, backed by policy reforms and foreign investments, create steady growth opportunities. Contractors in the region focus on grid modernization and integration of distributed renewable systems. Renewable auctions and public-private partnerships have encouraged cross-border collaboration in project execution. Rising investments in battery storage and clean transport infrastructure also support long-term demand. However, market progress remains dependent on stable policy frameworks and economic reforms.

Middle East & Africa

The Middle East & Africa accounted for 3.1% of the renewable energy contactor market in 2024, primarily driven by increasing solar investments in the UAE, Saudi Arabia, and South Africa. National strategies promoting energy diversification and emission reduction underpin market growth. Contractors play a central role in large-scale solar and hybrid projects across desert regions. Grid interconnection projects linking renewables to urban demand centers are expanding steadily. The region’s growing focus on green hydrogen and sustainable industrial energy solutions offers emerging opportunities for contactor suppliers and project developers.

Market Segmentations:

By Product

- DC Contactors

- AC Contactors

By Application

- Solar Energy

- Wind Power

- EV Infrastructure

- Energy Storage

- Others

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The renewable energy contactor market is characterized by strong competition among leading players such as Siemens AG, ABB Group, Schneider Electric, Eaton Corporation, and Mitsubishi Electric Corporation,etc. The market’s competitiveness is driven by continuous innovation in contactor design, improved switching efficiency, and smart grid compatibility. Companies focus on developing compact, energy-efficient, and IoT-enabled solutions that meet global safety and performance standards. Strategic alliances, mergers, and technology collaborations enhance production capabilities and expand global presence. Firms are also emphasizing renewable-specific product lines designed for solar, wind, and storage systems to meet the rising demand for sustainable infrastructure. In addition, participants are investing in automation and advanced materials to improve durability and reduce maintenance needs. The integration of digital monitoring platforms enables predictive maintenance, optimizing asset performance for end users. Intense price competition, coupled with the growing need for customization, pushes manufacturers to balance innovation, reliability, and cost-effectiveness to sustain market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens AG

- ABB Group

- Schneider Electric

- Eaton Corporation

- Mitsubishi Electric Corporation

- Rockwell Automation

- TE Connectivity

- LS Electric

- Fuji Electric Co., Ltd

- WEG Industries

- Littelfuse, Inc.

- Sensata Technologies

- Hubbell Incorporated

- NOARK Electric

- Delixi Electric Co., Ltd

- Kraus & Naimer

- Albright International

- CHINT Group

- People Electric Appliance Group Co., Ltd.

- Yueqing Aiso Electric Co., Ltd.

- NextEra Energy Resources

- Ørsted

- AGEL

Recent Developments

- In 2025, NextEra Energy Resources (NEER) Expanded its renewable energy backlog to almost 30 GW, including a significant portion for technology and data center customers.

- In 2025, Ørsted began offshore construction on the 920 MW Greater Changhua 2b and 4 wind farms in Taiwan.

- In 2025, AGEL announced the incorporation of a new subsidiary, Adani Ecogen Three Limited, in September to further its presence in renewable power generation.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The renewable energy contactor market will expand steadily with growing solar and wind installations.

- Rising demand for energy storage systems will strengthen adoption of advanced DC contactors.

- Governments will continue to support renewable infrastructure through incentives and policy reforms.

- Digital monitoring and predictive maintenance will become standard in contractor operations.

- Expansion of EV charging networks will create new opportunities for contactor installations.

- Hybrid and distributed energy systems will increase contractor participation in local grids.

- Technological advancements will improve contactor durability and switching efficiency.

- Strategic partnerships between contractors and equipment manufacturers will enhance project capabilities.

- Asia Pacific will emerge as the fastest-growing regional market due to rapid renewable expansion.

- Ongoing workforce training and automation adoption will improve project timelines and quality outcomes.