Market Overview

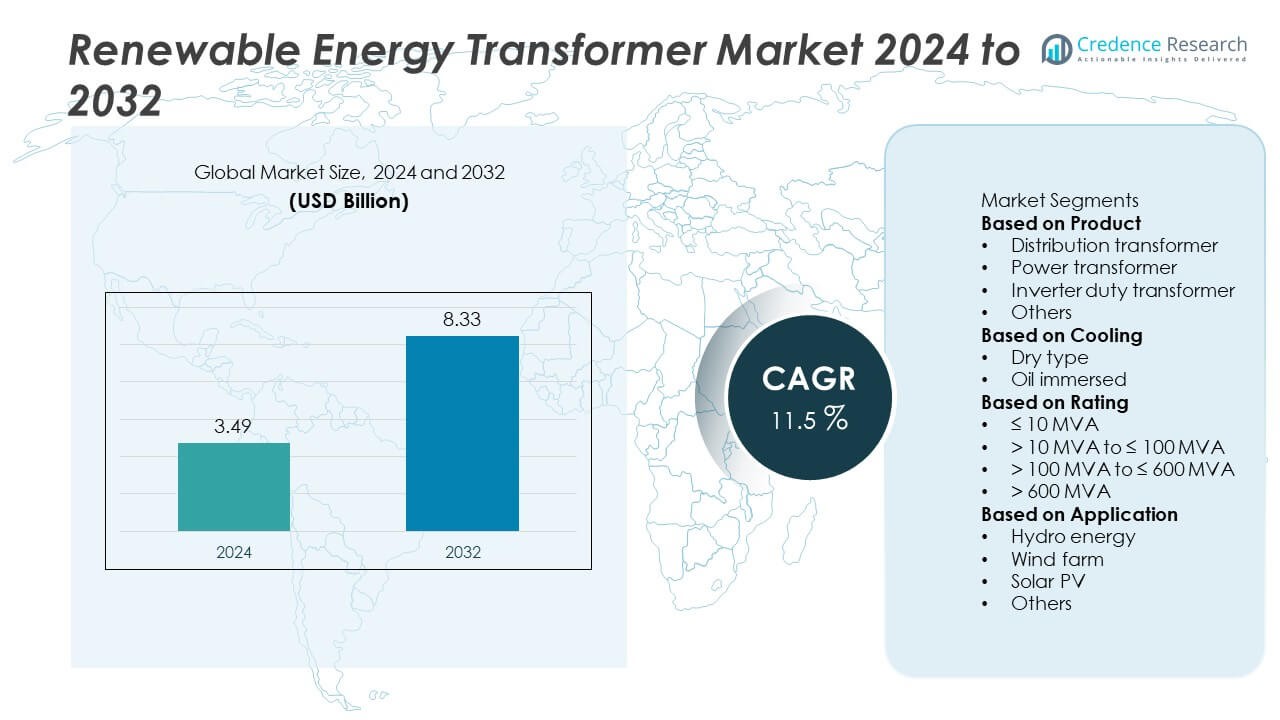

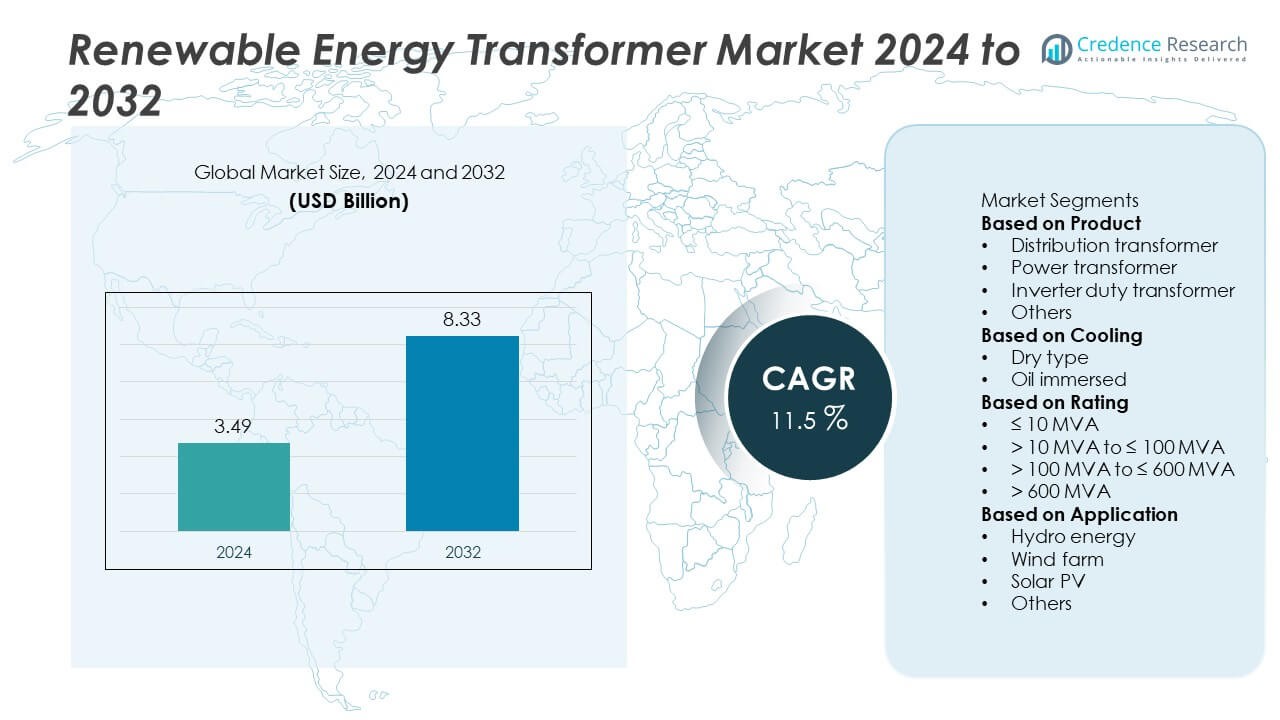

The Renewable Energy Transformer market was valued at USD 3.49 billion in 2024 and is projected to reach USD 8.33 billion by 2032, growing at a CAGR of 11.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Renewable Energy Transformer Market Size 2024 |

USD 3.49 Billion |

| Renewable Energy Transformer Market, CAGR |

11.5% |

| Renewable Energy Transformer Market Size 2032 |

USD 8.33 Billion |

The renewable energy transformer market is led by key players such as Aditya Energy, CG Power, ACTOM, Deltron Electricals, Daelim, Eaton, Celme, ABC Transformers, Acutran, and AEP Group. These companies dominate through advanced product portfolios, technological innovation, and strong regional distribution networks. They focus on high-efficiency, eco-friendly, and digitally connected transformer solutions that support renewable grid integration. Asia Pacific emerged as the leading region with a 35% share in 2024, driven by large-scale solar and wind installations across China and India. Europe followed with a 33% share, supported by clean energy transition goals, while North America accounted for 28%, emphasizing grid modernization and sustainable energy infrastructure expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global renewable energy transformer market was valued at USD 3.49 billion in 2024 and is projected to reach USD 8.33 billion by 2032, growing at a CAGR of 11.5% during the forecast period.

- Market growth is driven by rising renewable power generation, grid modernization initiatives, and government incentives supporting clean energy integration across major economies.

- Key trends include the adoption of smart, IoT-enabled transformers, eco-friendly insulation materials, and digital monitoring systems enhancing grid reliability and efficiency.

- The market is competitive, with major players such as Aditya Energy, CG Power, Eaton, ACTOM, and Daelim focusing on innovation in inverter-duty and oil-immersed transformer technologies.

- Asia Pacific led the market with a 35% share, followed by Europe at 33% and North America at 28%, while the distribution transformer segment dominated with a 46% share, supported by widespread renewable power grid deployment.

Market Segmentation Analysis:

By Product

The distribution transformer segment dominated the renewable energy transformer market with a 46% share in 2024. Its dominance is driven by wide deployment across solar and wind farms for voltage regulation and grid stability. These transformers ensure efficient integration of variable renewable power into local distribution networks. Rising investments in decentralized energy systems and rural electrification projects further boost demand. Power transformers and inverter duty transformers follow, supported by large-scale renewable installations and the growing need for reliable grid interconnection solutions across utility-scale projects.

- For instance, CG Power & Industrial Solutions supplies 765kV and 400kV transformers for India’s power grid, including components of the Green Energy Corridor. These units feature on-load tap changers (OLTCs) and temperature monitoring, which are crucial for maintaining stable voltage output and ensuring transformer reliability, particularly when integrating variable renewable energy sources.

By Cooling

The oil-immersed transformer segment held a 58% market share in 2024, leading due to superior heat dissipation and long operational lifespan. These transformers are widely used in high-capacity wind and solar plants where thermal efficiency and durability are critical. Advancements in biodegradable insulating oils have strengthened their appeal for sustainable applications. Dry-type transformers, though gaining momentum, are mainly adopted in compact or indoor renewable setups for safety and low maintenance. The continued preference for oil-immersed models underscores their reliability in demanding renewable energy environments.

- For instance, Eaton has developed power transformers using Envirotemp FR3 natural ester fluid, which has a flash point of 330 °C, offering improved fire safety and biodegradability. The use of this fluid can also extend the insulation paper life and increase a transformer’s overload capability by allowing it to operate at higher temperatures.

By Rating

Transformers rated >10 MVA to ≤100 MVA accounted for a 41% share in 2024, making this segment the market leader. These units are extensively used in medium to large renewable power plants, ensuring efficient step-up or step-down voltage conversion. Their ability to handle fluctuating renewable power output enhances grid stability and minimizes energy losses. Growing deployment of 50–100 MW solar and wind farms globally fuels this segment’s growth. Meanwhile, ≤10 MVA transformers serve distributed networks, and >100 MVA units support large utility-scale renewable transmission systems.

Key Growth Drivers

Rising Renewable Power Generation Capacity

The rapid global expansion of solar and wind energy projects is a major growth driver for the renewable energy transformer market. Governments and utilities are increasing investments in grid modernization to accommodate fluctuating renewable inputs. Transformers enable stable voltage regulation and efficient energy transmission from variable sources. Expanding installation of distributed renewable systems and hybrid plants further drives transformer demand, especially in regions like Asia Pacific and Europe, where renewable power targets continue to rise annually.

- For instance, Daelim Industrial Co. Ltd. offers transformer solutions for renewable power plants that ensure efficient energy flow and integration with the electrical grid. The company provides a variety of transformer types, with designs that can be tailored for specific renewable energy projects, such as wind or solar farms.

Government Policies and Grid Modernization Initiatives

Supportive regulations promoting renewable energy integration into national grids are accelerating transformer adoption. Programs such as the EU’s Green Deal, the U.S. Infrastructure Investment and Jobs Act, and India’s National Smart Grid Mission encourage investment in advanced transmission infrastructure. These policies prioritize high-efficiency transformers for renewable projects. Upgrades in transmission networks to reduce power losses and improve grid reliability enhance the market potential, particularly for high-capacity and inverter-duty transformer models.

- For instance, ACTOM Power Transformers has supported Eskom and South Africa’s renewable energy sector with high-voltage transformers and advanced monitoring technology. For the new Sebenza intake substation near Kempton Park, ACTOM supplied three 315 MVA, 275 kV autotransformers.

Advancements in Transformer Efficiency and Design

Continuous innovation in transformer materials and designs is improving energy efficiency and lifespan. Manufacturers are adopting amorphous core materials, advanced insulation systems, and digital monitoring solutions to enhance reliability. Smart transformers equipped with IoT sensors allow real-time condition monitoring and predictive maintenance. These technological advances align with sustainability goals by minimizing losses and improving renewable energy utilization. The growing focus on intelligent, eco-efficient transformer systems supports their increasing deployment in modern renewable power infrastructure.

Key Trends & Opportunities

Shift Toward Smart and Digital Transformers

The adoption of smart transformers integrated with IoT, AI, and data analytics is reshaping the renewable transformer market. These systems provide real-time performance tracking, load forecasting, and fault detection, improving grid resilience. Digitalization supports predictive maintenance and reduces operational downtime. As renewable installations become more decentralized, intelligent transformer networks ensure efficient power flow and grid stability. The rising demand for connected energy infrastructure presents significant opportunities for manufacturers offering advanced digital solutions.

- For instance, Eaton developed its Power Xpert UX medium-voltage switchgear system, which supports IEC 61850 communication protocols for flexible power distribution applications. It uses a vacuum switching technology and is designed to provide reliable operation in utility substations and other industrial installations. The system also allows for remote operation.

Growing Demand for Eco-Friendly and High-Voltage Transformers

Environmental regulations and sustainability commitments are driving the development of eco-efficient transformers. The use of biodegradable insulating oils, low-loss cores, and recyclable materials is expanding. High-voltage transformers supporting large-scale solar and offshore wind projects are gaining traction, especially in Europe and Asia Pacific. These advanced systems help reduce transmission losses and integrate renewable energy into long-distance grids. The trend toward greener and high-capacity transformers creates strong growth potential for manufacturers aligned with global decarbonization goals.

- For instance, a major manufacturer introduced a 420 kV power transformer using natural ester fluid, a bio-based insulating liquid with a high flash point of around 330 °C and a dielectric strength that can exceed 70 kV.

Key Challenges

High Initial Investment and Installation Costs

The high capital requirement for renewable energy transformers remains a key challenge. Advanced materials, digital control systems, and insulation technologies significantly raise manufacturing and installation costs. Small and medium renewable developers often face financial constraints in adopting high-efficiency transformer solutions. Additionally, the need for skilled labor and specialized equipment during installation further adds to total project expenses, restraining market penetration, particularly in developing economies with limited grid modernization funding.

Supply Chain Constraints and Raw Material Volatility

Fluctuating prices of core materials such as copper, aluminum, and electrical steel impact production costs for renewable energy transformers. Global supply chain disruptions and geopolitical uncertainties can delay component availability, affecting project timelines. These constraints hinder consistent supply for large-scale renewable energy installations. Manufacturers must adopt flexible sourcing strategies and invest in localized production to mitigate risks. Managing raw material volatility remains essential for sustaining profitability and meeting growing global demand.

Regional Analysis

North America

North America held a 28% share of the renewable energy transformer market in 2024, driven by large-scale solar and wind projects in the United States and Canada. The region’s strong regulatory support for renewable grid integration, including federal tax credits and state-level clean energy mandates, boosts transformer demand. Manufacturers focus on smart, inverter-duty, and oil-immersed transformer designs to enhance reliability in high-capacity renewable plants. Continuous grid modernization efforts, coupled with investments in digital monitoring and power storage infrastructure, further strengthen North America’s leadership in advanced renewable energy transformer solutions.

Europe

Europe accounted for a 33% share of the renewable energy transformer market in 2024, supported by the region’s ambitious decarbonization and energy-transition goals. Countries such as Germany, the United Kingdom, and France are deploying large-scale offshore wind and solar projects that require high-efficiency grid transformers. EU directives promoting low-loss and eco-friendly systems accelerate product adoption. Ongoing upgrades to transmission networks and interconnections across member states strengthen cross-border renewable power flow. The strong focus on sustainability and smart grid integration positions Europe as a key hub for advanced transformer technologies.

Asia Pacific

Asia Pacific dominated the renewable energy transformer market with a 35% share in 2024, emerging as the fastest-growing region. Rapid expansion of solar and wind capacity in China, India, Japan, and South Korea fuels demand for high-capacity transformers. Government initiatives supporting renewable energy targets and grid resilience drive large-scale installations. Local manufacturers are investing in energy-efficient and digitally connected transformers to enhance power distribution efficiency. Rising industrialization, urbanization, and rural electrification projects further contribute to sustained market growth, establishing Asia Pacific as a global leader in renewable grid transformation.

Latin America

Latin America captured a 3% share of the renewable energy transformer market in 2024, driven by expanding solar and wind projects in Brazil, Mexico, and Chile. National energy reforms and incentives promoting renewable integration into power grids support steady market growth. Governments are investing in transmission upgrades to improve rural electrification and grid reliability. The adoption of medium-capacity and oil-immersed transformers is increasing across emerging renewable hubs. Despite limited local manufacturing, rising foreign investments and public-private partnerships continue to enhance the region’s renewable energy infrastructure and transformer deployment.

Middle East & Africa

The Middle East & Africa region accounted for a 1% share of the renewable energy transformer market in 2024, reflecting gradual adoption of clean energy technologies. Countries such as Saudi Arabia, the UAE, and South Africa are expanding solar and wind capacities to diversify energy sources. Ongoing smart city and grid modernization projects are increasing transformer installations. However, limited renewable infrastructure and high investment costs slow widespread deployment. Strategic partnerships and government-backed clean energy programs are expected to support steady growth and enhance transformer demand across developing markets.

Market Segmentations:

By Product

- Distribution transformer

- Power transformer

- Inverter duty transformer

- Others

By Cooling

By Rating

- ≤ 10 MVA

- > 10 MVA to ≤ 100 MVA

- > 100 MVA to ≤ 600 MVA

- > 600 MVA

By Application

- Hydro energy

- Wind farm

- Solar PV

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The renewable energy transformer market is highly competitive, featuring major players such as Aditya Energy, CG Power, ACTOM, Deltron Electricals, Daelim, Eaton, Celme, ABC Transformers, Acutran, and AEP Group. These companies compete through innovation in transformer design, energy efficiency, and grid integration capabilities. Leading manufacturers focus on developing high-performance oil-immersed and inverter-duty transformers to meet the growing demand for renewable grid stability. Strategic investments in smart monitoring technologies and eco-friendly materials enhance product reliability and sustainability. Partnerships with renewable developers and utilities support expansion in emerging markets. Continuous R&D in digitalized transformer systems and advanced insulation solutions enables these firms to align with global clean energy goals. Moreover, regional production facilities and aftersales service networks strengthen their competitiveness in addressing evolving grid modernization requirements across solar, wind, and hybrid renewable energy projects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Aditya Energy

- CG Power

- ACTOM

- Deltron Electricals

- Daelim

- Eaton

- Celme

- ABC Transformers

- Acutran

- AEP Group

Recent Developments

- In October 2025, ACTOM acquired SGB-SMIT Power Matla to enhance its transformer manufacturing capacity up to class 3 units of 500 MVA 500 kV, targeting increased production for large-scale renewable energy and utility sector projects across Africa, and strengthening local manufacturing for grid expansion initiatives.

- In July 2025, CG Power disclosed that its order backlog includes transformers up to 1500 MVA and up to 765 kV classes, indicating increasing demand for high-capacity units in transmission for renewable energy integration.

- In June 2025, ACTOM announced the completion of a major upgrade at its Wadeville transformer factory, boosting production capacity by 35% to support rising demand from utility and renewable energy sectors, and positioning itself as a regional leader with in-house ISO/IEC-accredited transformer test capabilities and more than 60 renewable energy project references across the continent.

Report Coverage

The research report offers an in-depth analysis based on Product, Cooling, Rating, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for renewable energy transformers will increase with the global expansion of solar and wind projects.

- Energy-efficient, eco-friendly, and smart transformer technologies will drive long-term product innovation.

- Digital monitoring and IoT integration will become standard for optimizing transformer performance and maintenance.

- Manufacturers will focus on high-voltage and inverter-duty models to support large-scale renewable installations.

- Government incentives and renewable integration policies will continue to boost transformer deployment.

- The oil-immersed transformer segment will maintain dominance due to superior heat management and durability.

- Asia Pacific will remain the leading market, driven by high renewable capacity additions.

- Europe will emphasize green transformer adoption aligned with strict environmental regulations.

- North America will focus on grid modernization and replacement of aging transformer infrastructure.

- Strategic collaborations and local manufacturing expansion will shape future competitiveness in the renewable transformer market.