Market Overview

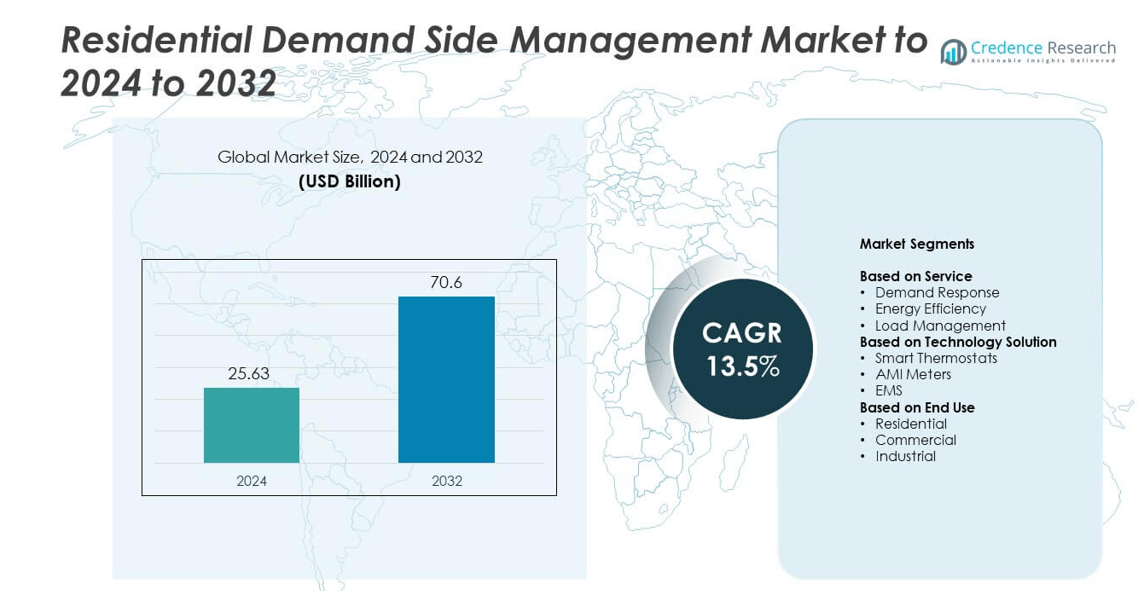

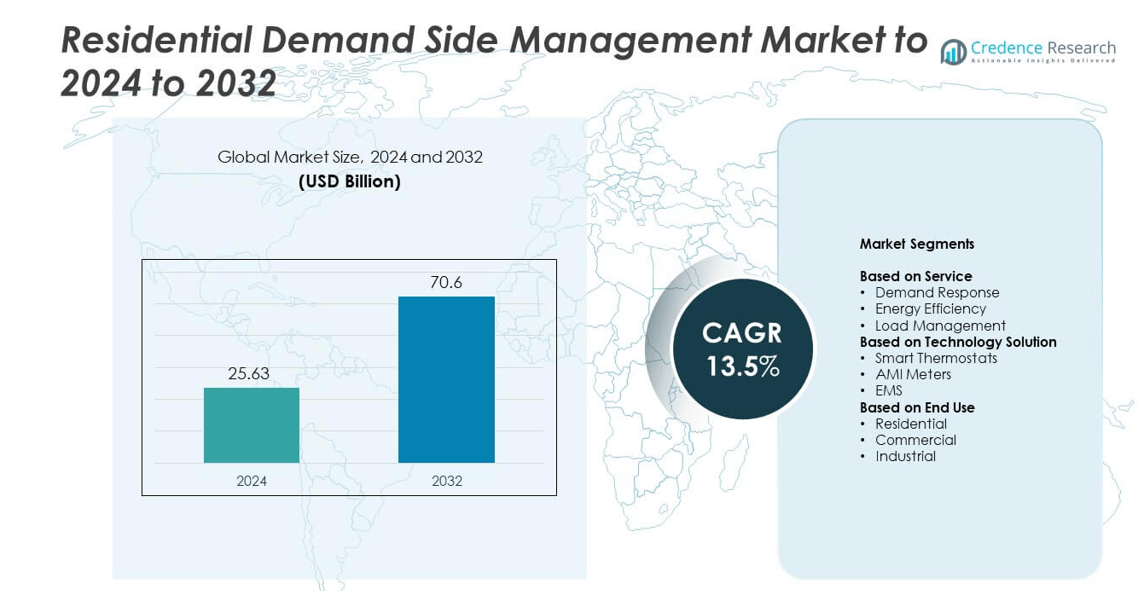

Residential Demand Side Management market size was valued at USD 25.63 billion in 2024 and is anticipated to reach USD 70.6 billion by 2032, at a CAGR of 13.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Demand Side Management Market Size 2024 |

USD 25.63 billion |

| Residential Demand Side Management Market, CAGR |

13.5% |

| Residential Demand Side Management Market Size 2032 |

USD 70.6 billion |

The residential demand side management market is led by prominent companies including Schneider Electric, Honeywell, Siemens, IBM, Eaton, Johnson Controls, Rockwell Automation, Emerson Electric, and General Electric. These firms dominate through advanced energy management systems, AI-enabled analytics, and strong utility partnerships. Their focus on smart grid integration, IoT-based energy optimization, and customer-centric demand response programs drives competitive strength. North America emerged as the leading region with a 39% share in 2024, supported by widespread smart meter deployment, government efficiency initiatives, and growing adoption of connected home technologies across the United States and Canada.

Market Insights

- The residential demand side management market was valued at USD 25.63 billion in 2024 and is projected to reach USD 70.6 billion by 2032, growing at a CAGR of 13.5%.

- Rising adoption of smart home technologies, government energy-efficiency initiatives, and increased grid modernization efforts are key factors driving market growth.

- Integration of AI, IoT, and cloud-based analytics in home energy systems is shaping market trends and improving real-time load optimization.

- The market remains moderately consolidated, with major players focusing on innovation, digital energy platforms, and strategic utility collaborations to enhance competitiveness.

- North America led with a 39% share in 2024, followed by Europe at 28% and Asia-Pacific at 24%, while the demand response segment accounted for the largest share of 46% among all services.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Service

Demand Response dominated the market with a 46% share in 2024, driven by increasing adoption of real-time grid balancing and dynamic pricing programs. Utilities are deploying automated systems that shift household energy use during peak hours to reduce strain on power grids. Energy efficiency services are also growing due to smart appliance integration and government incentives promoting reduced power consumption. Load management solutions continue to gain traction as homeowners adopt connected devices to monitor and optimize electricity use, supporting grid stability and sustainability goals.

- For instance, in 2024, Resideo Grid Services managed a network of over 685,000 distributed energy resources, which include smart thermostats, to facilitate demand response events.

By Technology Solution

Smart Thermostats held the largest share of 41% in 2024, supported by widespread integration of IoT and Wi-Fi-enabled climate control systems. Consumers are adopting these devices to manage energy consumption and reduce utility bills through automated scheduling. Advanced Metering Infrastructure (AMI) meters and Energy Management Systems (EMS) are expanding due to the need for accurate data tracking and centralized control. Rising installation of smart home ecosystems and utility partnerships with thermostat manufacturers are key factors driving technological adoption in residential demand side management.

- For instance, Delhi demand response pilot programs provides different data, such as a behavioral demand response pilot conducted by Tata Power-DDL involving 2,041 customers who voluntarily participated in 16 events.

By End Use

The Residential segment accounted for 54% of the market share in 2024, leading due to increasing smart home penetration and government energy-efficiency mandates. Consumers are adopting intelligent devices and dynamic tariffs to optimize household power use. The Commercial and Industrial segments also show strong adoption, mainly to manage peak load and meet sustainability targets. Utilities and service providers are focusing on residential customers through tailored demand response programs, smart metering rollouts, and real-time energy insights, enhancing user engagement and energy cost savings.

Key Growth Drivers

Rising Adoption of Smart Home Technologies

Widespread use of smart home systems is driving strong demand for residential demand side management solutions. Consumers are increasingly installing connected devices such as smart thermostats, lighting controls, and home energy management systems. These technologies enable users to monitor and optimize power consumption, leading to energy savings and reduced utility costs. Growing availability of affordable IoT devices and integration with utility demand response programs further strengthen market adoption.

- For instance, according to the IEA’s July 2023 update on demand response, in 2021, more than 10 million residential, commercial, and industrial customers in the United States were enrolled in demand response programs. As a result, the country registered 29 gigawatts (GW) of peak demand savings potential that year.

Government Incentives and Energy Efficiency Regulations

Supportive government policies promoting energy conservation are a major market driver. Many countries are introducing rebate programs and tax incentives for energy-efficient appliances and smart grid integration. Regulatory bodies are also implementing strict energy performance standards for residential buildings. These initiatives encourage households to participate in demand response schemes and adopt smart devices. The combination of financial benefits and compliance requirements continues to accelerate market penetration.

- For instance, Landis+Gyr’s 2023 financial reports and sustainability report confirm that the company helped avoid more than 8.9 million tons of CO₂ in FY 2023 through its large installed smart metering base, using a new methodology developed with the Carbon Trust.

Growing Demand for Grid Stability and Peak Load Reduction

Rising electricity demand and grid congestion have increased the focus on demand side management solutions. Utilities are deploying advanced systems to shift or reduce residential energy loads during peak hours. This improves grid reliability and lowers the need for costly infrastructure expansion. Integration of renewable energy sources, such as solar and wind, further boosts the need for flexible demand management programs. Enhanced communication between utilities and consumers enables more efficient energy distribution.

Key Trends & Opportunities

Integration of AI and Data Analytics in Energy Management

Artificial intelligence and data analytics are transforming the residential demand side management landscape. Utilities and technology providers use predictive algorithms to forecast energy usage patterns and optimize load control. AI-enabled platforms enhance decision-making by providing real-time insights into household consumption. This helps consumers automatically adjust usage based on tariff structures. Continuous innovation in data-driven energy optimization creates new opportunities for efficiency and cost reduction.

- For instance, an update from Kraken on July 16, 2025, reported that its AI-powered platform managed over 500,000 connected domestic devices, including EVs, home batteries, and heat pumps, to orchestrate 2 GW of power.

Expansion of Smart Metering Infrastructure

Rapid deployment of smart metering systems is expanding opportunities for real-time energy monitoring. Advanced metering infrastructure provides two-way communication between consumers and utilities, improving billing transparency and demand response effectiveness. Utilities leverage this data to design personalized energy-saving programs. The rising number of connected meters and interoperability with home management systems enhances participation in energy efficiency initiatives.

- For instance, Itron Inc. held about 63 % market share for network endpoints in North America’s smart-electric-meter segment.

Key Challenges

High Initial Costs and Infrastructure Requirements

The high installation and integration cost of smart devices and management systems remains a major barrier. Many residential users are reluctant to invest in advanced metering and automation technologies without clear short-term financial returns. Upgrading existing grid infrastructure and ensuring interoperability among devices also increase expenses. Limited access to affordable technology in developing regions further constrains large-scale adoption.

Data Privacy and Cybersecurity Concerns

Growing connectivity in energy management systems raises security and privacy challenges. Smart meters and home energy devices collect sensitive user data, which can be vulnerable to cyberattacks. Unauthorized access to energy usage data or control systems poses significant risks to consumers and utilities. Ensuring secure communication protocols, encryption, and regulatory compliance has become critical to maintain trust and safeguard network integrity.

Regional Analysis

North America

North America dominated the residential demand side management market with a 39% share in 2024, driven by widespread adoption of smart meters, connected thermostats, and advanced grid programs. The United States leads regional deployment with strong regulatory support and utility-driven demand response initiatives. Canada is rapidly expanding energy efficiency programs targeting residential users through government incentives. Major utility collaborations and increasing smart home penetration strengthen the region’s leadership position. Rising consumer awareness of energy savings and emission reduction further supports market expansion across urban and suburban households.

Europe

Europe held a 28% share in 2024, supported by stringent energy efficiency directives and sustainability goals under the European Green Deal. Countries such as Germany, the United Kingdom, and France are accelerating smart grid modernization to enhance residential energy flexibility. Demand response participation is increasing through time-of-use tariffs and smart appliance integration. Widespread deployment of smart meters and renewable integration projects are key regional growth drivers. The emphasis on carbon neutrality and reduction of peak power demand continues to stimulate adoption across the European residential sector.

Asia-Pacific

Asia-Pacific accounted for a 24% market share in 2024, fueled by rising electricity demand and rapid urbanization. China leads the regional market with large-scale deployment of smart metering and home energy management systems. Japan, South Korea, and India are adopting grid-interactive technologies supported by national energy efficiency policies. Expanding smart city projects and growing digitalization of households are major factors driving demand. Increasing government investments in grid modernization and renewable energy integration further enhance market opportunities for residential demand side management providers.

Middle East & Africa

The Middle East & Africa region captured a 5% share in 2024, with growing investments in smart grid infrastructure and energy conservation programs. Countries such as the United Arab Emirates and Saudi Arabia are implementing residential energy efficiency initiatives as part of national sustainability visions. Africa shows emerging potential through pilot programs promoting smart meters and solar-based demand management. Gradual adoption of digital home energy systems and rising electricity costs encourage consumer participation. Government-backed initiatives aimed at improving energy reliability support future market growth across the region.

Latin America

Latin America held a 4% market share in 2024, supported by increasing smart meter installations and utility reforms. Brazil and Mexico lead the region’s adoption of residential demand side management programs. Government-led initiatives to reduce energy losses and enhance distribution efficiency are key growth contributors. Rising electricity tariffs and expanding awareness of energy optimization among households boost participation in demand response schemes. Partnerships between utilities and technology providers are driving modernization, setting a foundation for broader adoption of smart energy solutions in the coming years.

Market Segmentations:

By Service

- Demand Response

- Energy Efficiency

- Load Management

By Technology Solution

- Smart Thermostats

- AMI Meters

- EMS

By End Use

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The residential demand side management market features major participants such as Schneider Electric, Honeywell, Siemens, IBM, Eaton, Johnson Controls, Rockwell Automation, Emerson Electric, General Electric, C3.ai, Enphase Energy, Dexma Sensors, eSight Energy, Optimum Energy, SkyFoundry, and Telkonet. The competitive environment is defined by strong emphasis on digitalization, automation, and integration of IoT-enabled energy management platforms. Companies are focusing on developing advanced energy analytics, predictive maintenance tools, and interoperable smart home solutions. Strategic partnerships with utilities and software firms enhance grid connectivity and customer engagement. Continuous R&D investment supports innovation in cloud-based platforms and AI-driven optimization. Firms also prioritize sustainability through energy-efficient technologies and scalable demand response systems. Mergers, acquisitions, and regional expansion strategies further strengthen market presence, while increasing competition accelerates product differentiation and cost-effective service delivery across residential segments globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Schneider Electric

- Honeywell

- Siemens

- IBM

- Eaton

- Johnson Controls

- Rockwell Automation

- Emerson Electric

- General Electric

- ai

- Enphase Energy

- Dexma Sensors

- eSight Energy

- Optimum Energy

- SkyFoundry

- Telkonet

Recent Developments

- In 2024, Eaton launched a residential microgrid platform that combines solar generation, battery storage, and intelligent load management.

- In 2024, Schneider Electric offered more solutions for residential DSM, including smart panels and energy management systems that help homeowners monitor and control their electricity usage.

- In 2023, Enphase Energy introduced its third-generation battery, optimizing the product for grid-tied applications and setting the stage for future VPP and DSM programs.

Report Coverage

The research report offers an in-depth analysis based on Service, Technology Solution, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing integration of IoT and AI technologies will enhance real-time energy optimization.

- Utilities will expand demand response programs to manage peak load and grid stability.

- Smart home penetration will rise, driving adoption of intelligent energy management systems.

- Governments will strengthen policies supporting energy efficiency and carbon reduction goals.

- Collaboration between utilities and technology providers will accelerate innovation in residential solutions.

- Advanced metering infrastructure will improve consumer engagement and data-driven energy control.

- Integration of renewable energy sources will create new opportunities for flexible energy management.

- Growing electrification of homes will increase demand for dynamic load management systems.

- Enhanced cybersecurity measures will become vital to protect smart energy networks.

- Emerging markets will witness rapid adoption supported by smart city and sustainability initiatives.