Market Overview

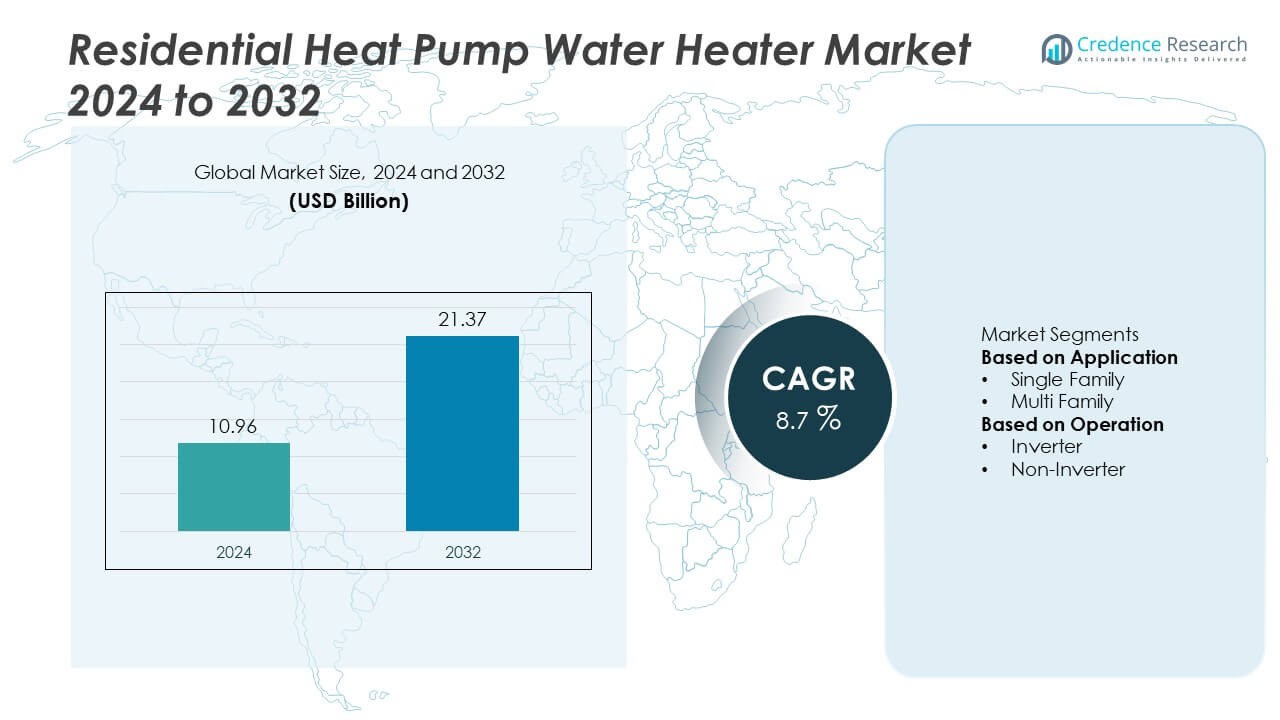

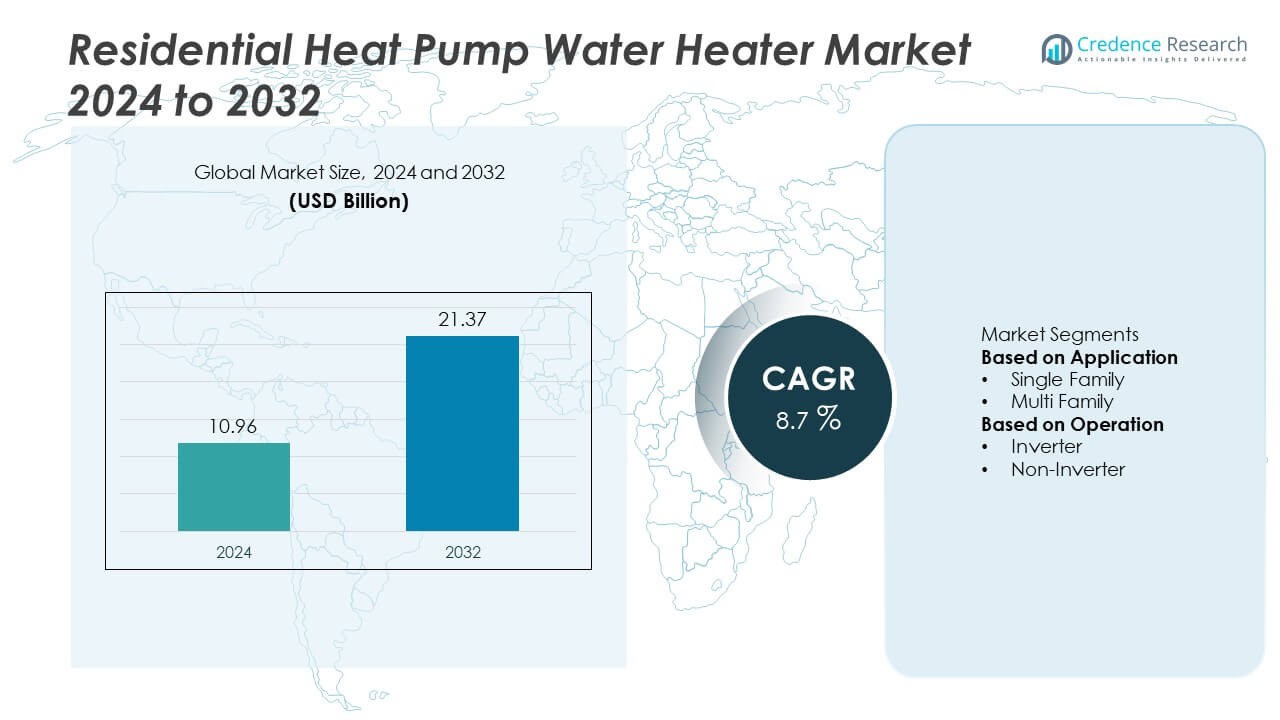

The residential heat pump water heater market was valued at USD 10.96 billion in 2024 and is projected to reach USD 21.37 billion by 2032, growing at a CAGR of 8.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Heat Pump Water Heater Market Size 2024 |

USD 10.96 Billion |

| Residential Heat Pump Water Heater Market, CAGR |

8.7% |

| Residential Heat Pump Water Heater Market Size 2032 |

USD 21.37 Billion |

The residential heat pump water heater market is led by major players such as Daikin, LG Electronics, Rheem Manufacturing Company, A. O. Smith, Ariston Holding, Bradford White Corporation, Rinnai America Corporation, Lochinvar, MIKEE, and American Water Heaters. These companies dominate through continuous innovation in inverter-driven and smart control systems, focusing on energy efficiency and low-carbon performance. North America remained the leading region in 2024 with a 34% market share, supported by strong policy incentives and widespread adoption of ENERGY STAR-certified models. Europe followed with a 29% share, driven by sustainability regulations and renovation programs, while Asia-Pacific accounted for 28%, propelled by rapid urbanization and government-backed clean energy initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The residential heat pump water heater market was valued at USD 10.96 billion in 2024 and is projected to reach USD 21.37 billion by 2032, growing at a CAGR of 8.7% during the forecast period.

- Rising demand for energy-efficient water heating systems and government incentives for decarbonization drive market expansion globally.

- Smart and inverter-driven technologies are gaining traction, with manufacturers focusing on connected and low-temperature models to enhance efficiency and user control.

- The market is moderately consolidated, with players such as Daikin, LG Electronics, Rheem, and A. O. Smith expanding R&D and regional manufacturing to meet growing demand.

- North America led with a 34% share in 2024, followed by Europe (29%) and Asia-Pacific (28%), while by application, single-family homes accounted for 63% share, supported by rising adoption of sustainable heating technologies.

Market Segmentation Analysis:

By Application

The single-family segment dominated the residential heat pump water heater market in 2024, accounting for 63% share. The leadership is driven by widespread adoption of energy-efficient water heating systems in detached and semi-detached homes. Government incentives for replacing conventional electric and gas heaters with heat pump models further accelerate adoption. Growing construction of single-family homes in North America and Europe also supports segment growth. Rising consumer focus on sustainability and lower utility costs continues to promote installation of smart and high-efficiency heat pump systems in this category.

- For instance, Rheem Manufacturing Company’s ProTerra® hybrid heat pump units are ENERGY STAR certified and eligible for federal, state, local, or electric utility rebates, which promote energy-efficient water heating.

By Operation

The inverter-based segment held the largest share of 58% in 2024, owing to its superior energy performance and precise temperature control. These systems adjust compressor speed according to heating demand, reducing power consumption and noise. Increasing adoption of variable-speed compressors in hybrid and air-source models enhances operational efficiency. Demand is further supported by government energy-labeling programs and building codes emphasizing low-emission technologies. Manufacturers are introducing inverter-driven models with smart connectivity features, meeting both residential comfort and environmental compliance standards.

- For instance, Daikin Industries Ltd. integrated its swing-compressor technology in the Altherma 3 H HT series, achieving discharge temperatures up to 70 °C while maintaining high COP performance.

Key Growth Drivers

Rising Focus on Energy Efficiency and Decarbonization

Governments and consumers are shifting toward energy-efficient heating solutions to reduce carbon emissions. Heat pump water heaters use renewable ambient heat, cutting energy use by up to 60% compared to electric models. Policies promoting net-zero buildings and green home certifications are strengthening demand. For instance, the U.S. Department of Energy’s ENERGY STAR program and EU Ecodesign standards encourage replacement of fossil-fuel systems with high-efficiency heat pumps in residential applications.

- For instance, Ariston Group offers products like the Nuos Plus R290, a heat pump water heater using the low-GWP refrigerant R290, as part of its wider strategy to provide sustainable, highly efficient thermal comfort solutions.

Increasing Residential Construction and Retrofitting Activities

The expansion of residential housing and modernization of existing properties are key market drivers. Growing urbanization and consumer awareness of sustainable technologies are increasing the installation of heat pump systems in new homes and retrofit projects. In Asia-Pacific, rapid construction growth in China and India, coupled with government subsidies for energy-efficient appliances, supports market expansion. Builders are increasingly integrating smart, inverter-driven systems to meet stringent energy standards and reduce household operating costs.

- For instance, Midea Group expanded its heat pump production in Europe through a new facility in Italy with an annual capacity of 300,000 units, while its Chongqing factory, designated an AI-powered “lighthouse factory,” focuses on chillers and commercial air conditioning, both contributing to meeting the rising demand for high-efficiency solutions.

Supportive Government Incentives and Regulatory Policies

Financial incentives and policy frameworks play a major role in accelerating adoption. Tax rebates, subsidies, and low-interest financing for eco-friendly water heaters encourage homeowners to upgrade. Programs such as Japan’s Top Runner Program and Europe’s REPowerEU initiative promote clean heating transitions. These initiatives aim to reduce reliance on gas-based systems, driving steady demand for air-source and hybrid heat pump models across residential markets in developed and emerging regions.

Key Trends & Opportunities

Integration of Smart and Connected Technologies

Manufacturers are increasingly incorporating IoT-enabled controls and remote monitoring features in heat pump water heaters. Smart connectivity allows users to optimize energy consumption, monitor performance, and schedule heating cycles via mobile apps. This digital shift enhances convenience and supports demand response programs for grid efficiency. Partnerships between heating equipment makers and smart home solution providers create new revenue opportunities in the connected appliances segment.

- For instance, the A. O. Smith iCOMM™ Smart Connectivity platform utilizes the latest technology to connect iCOMM-enabled water heaters to a mobile app. This platform provides predictive maintenance alerts via cloud analytics.

Expansion of Low-Temperature and Cold-Climate Models

Technological advancements are enabling efficient performance of heat pump systems in colder regions. Modern compressors and refrigerants now allow operation in sub-zero temperatures while maintaining heating capacity. This innovation expands market penetration in Northern Europe, North America, and Japan. Manufacturers are also developing dual-source systems combining air and ground heat to improve year-round reliability, opening new opportunities in regions previously dependent on gas or oil-based water heating.

- For instance, Mitsubishi Electric expanded its Ecodan Ultra Quiet heat pump range, achieving consistent output at –25 °C and noise levels below 45 dB, enabling deployment in dense residential areas of Scandinavia and Canada.

Key Challenges

High Upfront Installation and Product Costs

Despite long-term savings, heat pump water heaters have higher upfront costs compared to conventional systems. Installation often requires specialized components and skilled labor, raising overall setup expenses. This limits adoption among cost-sensitive homeowners, particularly in developing economies. Manufacturers and governments are working to lower costs through localized production and subsidy programs, but affordability remains a major barrier to widespread deployment.

Performance Limitations in Extreme Climates

Heat pump water heaters can experience efficiency drops in very cold or humid environments, reducing output capacity. This limits their use in areas with harsh winters or limited indoor installation space. While hybrid and inverter-driven technologies mitigate some issues, consistent performance across diverse climatic conditions remains a technical challenge. Continuous R&D in refrigerants, insulation, and compressor design is critical to ensure stable operation and expand market accessibility globally.

Regional Analysis

North America

North America held the largest share of 34% in 2024, driven by high adoption of energy-efficient and smart home technologies. The U.S. leads the regional market with strong government incentives, including federal tax credits under the Inflation Reduction Act. Growing replacement of gas and electric resistance heaters with ENERGY STAR-certified heat pump units boosts sales. Canada also supports market growth through rebates for low-carbon residential heating. Increasing consumer awareness and rapid adoption of inverter-based systems in single-family homes continue to strengthen regional demand.

Europe

Europe accounted for 29% share in 2024, supported by stringent energy efficiency directives and climate goals. The European Green Deal and REPowerEU initiative promote large-scale deployment of renewable heating technologies. Germany, France, and the U.K. are key contributors, with strong subsidies for heat pump installation in residential buildings. Rising electricity prices and restrictions on fossil-fuel boilers accelerate replacement demand. Manufacturers focus on hybrid and air-to-water systems designed for cold climates. Growing retrofitting activities in aging residential structures further stimulate regional market expansion.

Asia-Pacific

Asia-Pacific captured 28% share in 2024, fueled by rapid urbanization and government-backed clean energy programs. China leads adoption due to large-scale housing development and carbon neutrality targets. Japan and South Korea are expanding use of inverter-driven models for better energy savings and grid stability. India’s growing middle-class population and rising disposable incomes also contribute to demand. Supportive policies, such as energy-labeling programs and incentives for high-efficiency appliances, encourage adoption across residential sectors. Continuous technological advancements and smart integration drive strong long-term growth across the region.

Latin America

Latin America held a 5% share in 2024, driven by expanding residential electrification and adoption of sustainable water heating systems. Brazil and Mexico lead the regional market, supported by government programs promoting efficient home appliances. Growing urban housing projects and preference for cost-effective, low-emission systems support market penetration. Limited awareness and high initial costs remain barriers to large-scale adoption. However, improving energy infrastructure and foreign investments in smart appliance manufacturing are expected to strengthen future market development across key economies in the region.

Middle East & Africa

The Middle East & Africa accounted for 4% share in 2024, supported by ongoing residential construction and efforts to reduce fossil fuel dependence. Gulf countries, particularly the UAE and Saudi Arabia, are promoting sustainable housing projects under Vision 2030 initiatives. Rising electricity demand and high solar potential encourage adoption of hybrid heat pump water heaters. In Africa, South Africa and Egypt are key markets due to urbanization and government energy efficiency programs. Gradual improvement in affordability and distribution networks is expected to boost adoption over the coming years.

Market Segmentations:

By Application

- Single Family

- Multi Family

By Operation

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the residential heat pump water heater market features key players such as LG Electronics, Daikin, Rheem Manufacturing Company, A. O. Smith, Ariston Holding, Bradford White Corporation, Rinnai America Corporation, Lochinvar, MIKEE, and American Water Heaters. These companies focus on energy-efficient designs, inverter-based technologies, and smart connectivity integration to enhance performance and reduce emissions. Strategic initiatives include expanding production capacities, developing hybrid and cold-climate models, and strengthening regional distribution networks. Partnerships with smart home solution providers and government-backed energy programs further support market positioning. Continuous investment in R&D for next-generation refrigerants and variable-speed compressors helps improve seasonal efficiency. The competitive environment remains moderately consolidated, with global brands competing through innovation, brand reliability, and customer-centric after-sales services to capture growing residential demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- LG Electronics

- Bradford White Corporation

- Smith

- Rheem Manufacturing Company

- Ariston Holding

- Daikin

- MIKEE

- Lochinvar

- Rinnai America Corporation

- American Water Heaters

Recent Developments

- In July 2025, Bradford White Corporation introduced its AeroTherm Series G2 hybrid electric heat pump water heaters, designed for residential use with multiple operation modes—heat pump only, electric only, hybrid, and vacation mode—enabling customized efficiency.

- In June 2025, LG Electronics further strengthened its position in the water heating market by acquiring OSO Hotwater, a leading European manufacturer of premium water heating solutions, expanding its footprint in the residential heat pump water heater sector across Europe.

- In 2025, LG Electronics showcased its latest ENERGY STAR-certified inverter-type residential heat pumps at the AHR Expo 2025 in Orlando, Florida, emphasizing enhanced energy efficiency and inverter scroll compressor integration for better climate control performance in home environments.

- In October 2023, LG Electronics committed to support California’s goal of installing 6 million electric heat pumps, expanding capacity and collaboration with the California Energy Commission.

Report Coverage

The research report offers an in-depth analysis based on Application, Operation and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Global demand for energy-efficient residential heating systems will continue to rise steadily.

- Government incentives and carbon reduction goals will drive faster adoption of heat pump water heaters.

- Inverter-driven and variable-speed compressor technologies will become industry standards.

- Smart connectivity and IoT integration will enhance user control and energy optimization.

- Manufacturers will focus on developing cold-climate and hybrid models for wider geographic use.

- Rising residential construction and retrofitting projects will strengthen long-term market growth.

- Advanced refrigerant technologies with low global warming potential will gain regulatory preference.

- Strategic collaborations among HVAC manufacturers and smart home solution providers will increase.

- Competitive pricing and improved product efficiency will boost adoption in developing economies.

- North America and Europe will remain key markets, while Asia-Pacific will emerge as the fastest-growing region.