Market Overview

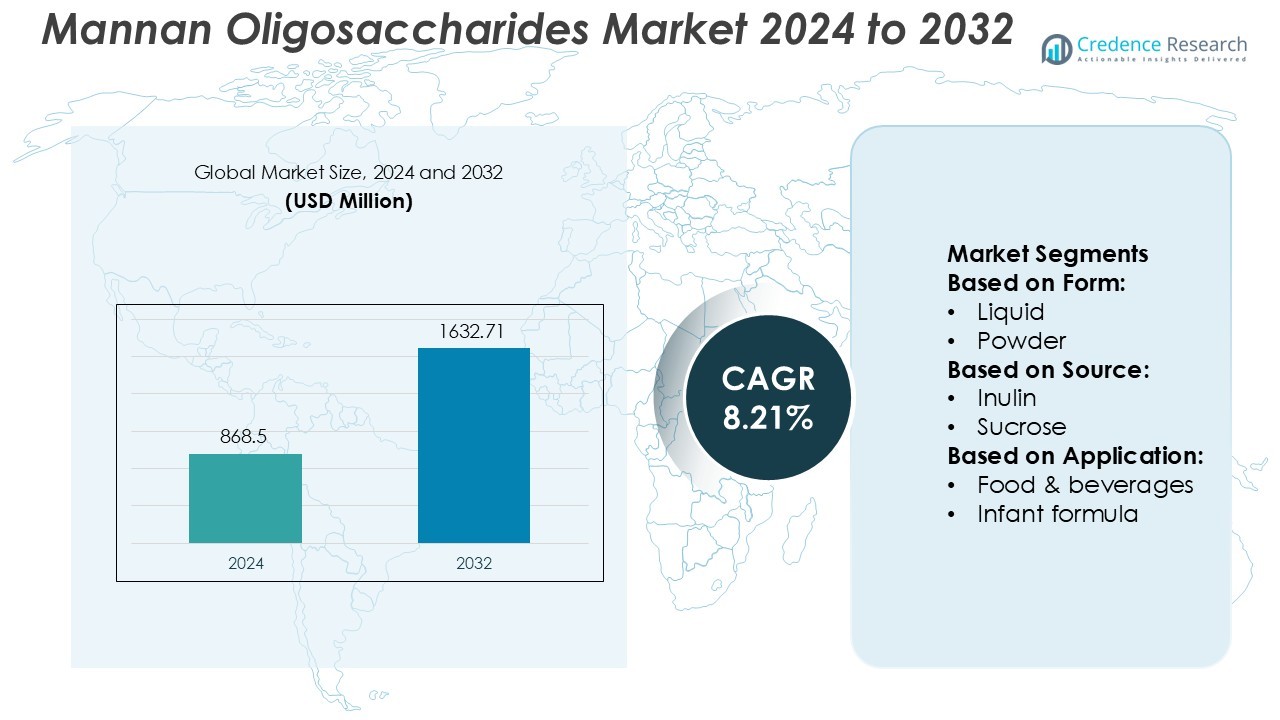

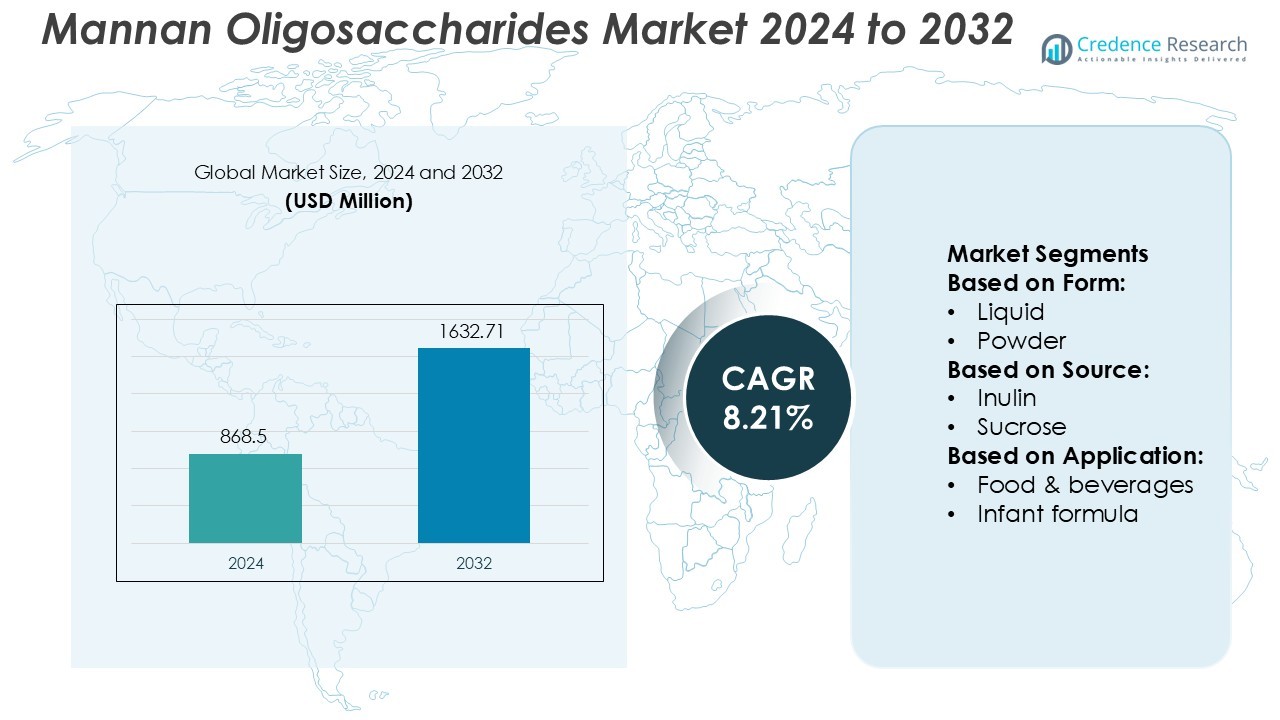

Mannan Oligosaccharides Market size was valued USD 868.5 million in 2024 and is anticipated to reach USD 1632.71 million by 2032, at a CAGR of 8.21% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mannan Oligosaccharides Market Size 2024 |

USD 868.5 Million |

| Mannan Oligosaccharides Market, CAGR |

8.21% |

| Mannan Oligosaccharides Market Size 2032 |

USD 1632.71 Million |

The Mannan Oligosaccharides Market features strong competition among leading players such as Galam Ltd, Jarrow Formulas, Cargill Incorporated, Cosucra, Sensus (part of Royal Cosun), Baolingbao Biology, Nutriagaves Group, Ingredion, BENEO GmbH, and Alkem Labs. These companies focus on innovation, sustainable sourcing, and product diversification across feed, food, and nutraceutical applications. Continuous investment in advanced extraction technologies and research on prebiotic functionality enhances product efficiency and quality. Strategic partnerships and regional expansions strengthen their global footprint. North America leads the global market with a 36% share, driven by established animal nutrition industries, regulatory restrictions on antibiotic growth promoters, and high consumer demand for natural, health-promoting ingredients.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Mannan Oligosaccharides Market was valued at USD 868.5 million in 2024 and is expected to reach USD 1632.71 million by 2032, growing at a CAGR of 8.21% during the forecast period.

- Rising demand for antibiotic-free feed additives and prebiotic ingredients drives market growth, supported by increasing awareness of animal and gut health benefits.

- Technological innovations in fermentation and extraction processes enhance product quality and expand applications across food, feed, and nutraceutical sectors.

- The market faces restraints from high production costs and limited consumer awareness in non-feed applications, affecting smaller manufacturers.

- North America leads the market with a 36% share, while the powder form segment dominates with 67% share, driven by its stability and easy incorporation in animal feed and dietary supplements.

Market Segmentation Analysis:

By Form

The powder segment dominates the Mannan Oligosaccharides Market with a 67% share in 2024. Powdered MOS is preferred for its stability, longer shelf life, and easy integration into feed and dietary formulations. Its ease of transportation and storage makes it ideal for large-scale animal nutrition and supplement industries. The segment growth is driven by its superior mixability in feed blends and reduced microbial contamination risk during production and handling. Manufacturers increasingly use spray-drying and microencapsulation technologies to improve powder solubility and product efficiency in livestock feed applications.

- For instance, Jarrow Formulas markets a capsule product that contains 200 mg of a MOS yeast-fraction (minimum 35% mannan-oligosaccharides) plus 250 mg of Saccharomyces boulardii yeast (delivering 5 billion CFU per serving).

By Source

The inulin segment holds a 61% share of the market, making it the leading source category. Inulin-based MOS offers strong prebiotic functionality, promoting gut health and nutrient absorption in both humans and animals. Its natural extraction from chicory roots ensures a sustainable and cost-effective supply chain. Rising consumer preference for plant-derived functional ingredients supports this segment’s dominance. Food and feed manufacturers utilize inulin-derived MOS for improving digestive efficiency, fostering microbial balance, and enhancing immune response, driving demand across nutritional and pharmaceutical formulations.

- For instance, Cargill’s “Oliggo-Fiber® Inulin” from chicory root has been demonstrated to stimulate beneficial bifidobacteria at a dosage of 5 grams per day for human-food formulations.

By Application

The animal feed segment leads the market with a 54% share in 2024, supported by growing livestock health awareness and performance optimization needs. Mannan oligosaccharides enhance gut flora, improve feed conversion ratios, and reduce pathogen load in poultry, swine, and ruminants. Feed producers incorporate MOS to replace antibiotics as growth promoters, aligning with global regulatory trends favoring natural additives. Expanding commercial farming and demand for high-yield meat production in Asia-Pacific and Latin America further strengthen this segment’s position in the global market.

Key Growth Drivers

- Rising Demand for Natural Feed Additives

The growing shift toward antibiotic-free animal nutrition drives demand for mannan oligosaccharides (MOS). Farmers and feed manufacturers increasingly adopt MOS to improve gut health, immunity, and nutrient absorption in livestock. The ban on antibiotic growth promoters in regions like the EU and North America accelerates MOS usage in poultry and swine production. Its natural origin and prebiotic benefits make it a preferred solution for enhancing feed efficiency, reducing disease outbreaks, and supporting sustainable animal farming practices.

- For instance, Cosucra’s animal nutrition unit reports that its chicory-root derived inulin and fibre ingredients (such as FIBROFOS™ 60 and others) have been processed through dedicated production lines at their Belgium site since the 1980s, with industrial inulin production beginning in 1986.

- Expanding Functional Food and Dietary Supplement Market

Consumer interest in digestive health and immunity-boosting products fuels MOS adoption in functional foods and dietary supplements. Manufacturers incorporate MOS for its ability to support intestinal microflora and reduce gastrointestinal disorders. The growing aging population and rising awareness of gut–immune health connection contribute to market growth. Food and nutraceutical brands leverage MOS in prebiotic drinks, yogurts, and tablets, offering natural alternatives to synthetic supplements. Increasing clinical validation of MOS’s health benefits further enhances its consumer acceptance.

- For instance, Sensus reports that its chicory-root fibre product delivers a minimum of 90% inulin content (dry‐matter basis) after extraction and purification under its ultra-filtration process.

- Growth in Pet Nutrition and Livestock Productivity

The global surge in pet ownership and demand for premium pet food strengthen MOS inclusion in pet diets. MOS improves digestion and immune function in companion animals, enhancing overall health and longevity. In livestock, it supports better weight gain and disease resistance, improving farm profitability. Producers in poultry, dairy, and aquaculture sectors use MOS as a sustainable ingredient for high-performance feed formulations. Continuous product innovation targeting species-specific benefits further propels growth in this application segment.

Key Trends & Opportunities

- Innovation in Fermentation and Extraction Technologies

Advancements in bio-fermentation and enzymatic extraction improve MOS yield and purity. Manufacturers adopt microbial fermentation using yeast and plant-based enzymes to reduce production costs and enhance prebiotic functionality. These innovations enable consistent quality and scalability across feed and food-grade MOS. Companies are also investing in eco-friendly production techniques that minimize chemical usage and carbon emissions. Such technological upgrades open opportunities for sustainable sourcing and value-added MOS formulations catering to health-conscious consumers.

- For instance, typical industrial ‘fermentation-production of erythritol’ technology achieves a yield of approximately 40-60% of the target sugar alcohol, with some studies reporting yields of around 58% under optimized laboratory conditions using specific strains.

- Increasing Focus on Gut Health Research

Rising research investments in microbiome science present significant opportunities for MOS application expansion. Studies highlight MOS’s role in promoting beneficial bacteria and reducing pathogen colonization in the gut. Universities and biotech companies collaborate to develop MOS-based functional ingredients targeting specific health outcomes such as immunity, metabolism, and nutrient absorption. This trend supports the use of MOS in pharmaceuticals and clinical nutrition sectors, where scientifically backed prebiotics are in high demand for preventive healthcare products.

- For instance, Ingredion and related industry reports highlighted the effectiveness of NutraFlora at a specific, low daily dose. A dosage of 1.1 g per serving has been cited to effectively enhance digestive health.

- Expansion Across Emerging Economies

Rapid livestock growth in Asia-Pacific, Latin America, and Africa creates strong potential for MOS adoption. Governments promoting sustainable farming and animal health standards encourage the use of natural feed enhancers. Expanding middle-class populations and increased meat consumption in these regions boost feed production volumes. Local manufacturers are investing in MOS processing facilities to meet domestic demand and reduce import dependence. These emerging economies represent untapped opportunities for both global and regional MOS suppliers.

Key Challenges

- High Production Costs and Raw Material Dependence

MOS production involves complex extraction and purification processes, resulting in higher costs than conventional additives. Dependence on yeast and plant-based sources exposes manufacturers to price fluctuations and supply constraints. This limits cost competitiveness, especially in price-sensitive markets like Asia-Pacific. Small and medium feed producers often prefer cheaper synthetic alternatives. To overcome this, industry players are exploring fermentation-based cost optimization and waste valorization to improve production efficiency and maintain profitability.

- Limited Consumer Awareness in Non-Feed Applications

While MOS is well-established in animal nutrition, consumer understanding of its human health benefits remains low. Lack of education regarding prebiotics’ role in digestive and immune health limits market penetration in functional food and supplement sectors. Many consumers associate prebiotics solely with inulin or fructooligosaccharides, overlooking MOS-based alternatives. Marketing efforts and clinical trials demonstrating MOS’s efficacy are essential to boost recognition and trust. Expanding awareness campaigns will be key to driving adoption in the human nutrition market.

Regional Analysis

North America

North America leads the Mannan Oligosaccharides Market with a 36% share in 2024. The region’s dominance is driven by strong demand for antibiotic-free feed additives and advanced livestock farming practices. The U.S. and Canada are key contributors, supported by strict regulations on antibiotic use and a growing focus on animal health. Major feed producers integrate MOS to enhance nutrient absorption and reduce pathogen risks in poultry and swine. Rising consumer preference for organic meat and growing pet ownership further stimulate product adoption across both livestock and companion animal nutrition sectors.

Europe

Europe accounts for a 28% share of the global Mannan Oligosaccharides Market, supported by robust regulatory frameworks promoting sustainable and antibiotic-free feed solutions. Countries like Germany, France, and the Netherlands are leading adopters due to their developed poultry and dairy industries. The European Food Safety Authority’s guidelines favoring natural prebiotics have accelerated MOS inclusion in feed and functional food products. Additionally, growing demand for clean-label and plant-based ingredients in the nutraceutical sector contributes to market growth. Strategic collaborations between feed producers and biotechnology firms further strengthen Europe’s position in the global market.

Asia-Pacific

Asia-Pacific holds a 26% market share and is the fastest-growing region in the Mannan Oligosaccharides Market. Expanding livestock and aquaculture industries in China, India, and Southeast Asia drive large-scale adoption. Rapid urbanization, dietary shifts toward protein-rich foods, and government initiatives promoting animal health support growth. Regional feed producers increasingly use MOS to improve feed conversion efficiency and reduce antibiotic dependency. Rising consumer awareness of gut health also encourages MOS use in dietary supplements. Strong production capacities and lower manufacturing costs position Asia-Pacific as a key hub for MOS supply and export activities.

Latin America

Latin America captures a 7% share of the global market, fueled by expanding poultry and cattle farming sectors. Brazil and Mexico are the primary contributors, focusing on improving livestock performance and disease resistance. Feed manufacturers in the region increasingly integrate MOS to support gut health and enhance productivity. Government incentives for sustainable farming and export-oriented meat production also boost adoption. Rising pet care expenditure and awareness of functional feed benefits provide additional opportunities for growth. The availability of yeast-based raw materials strengthens the region’s production capabilities for MOS manufacturing.

Middle East & Africa

The Middle East & Africa region accounts for a 3% share of the Mannan Oligosaccharides Market. Growth is supported by increasing investments in poultry and dairy farming to meet rising domestic food demand. Countries such as South Africa, Saudi Arabia, and the UAE are gradually adopting MOS-based feed additives to improve animal health and performance. Import dependence on livestock feed additives remains high, offering opportunities for local production expansion. The growing trend toward sustainable agriculture and the adoption of natural feed enhancers contribute to gradual market development across this emerging region.

Market Segmentations:

By Form:

By Source:

By Application:

- Food & beverages

- Infant formula

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Mannan Oligosaccharides Market is characterized by strong competition among key players such as Galam Ltd, Jarrow Formulas, Cargill Incorporated, Cosucra, Sensus (part of Royal Cosun), Baolingbao Biology, Nutriagaves Group, Ingredion, BENEO GmbH, and Alkem Labs. The Mannan Oligosaccharides Market is defined by continuous innovation, strategic expansion, and product diversification. Companies are investing in advanced fermentation and extraction technologies to enhance yield, purity, and cost efficiency. Partnerships between feed manufacturers and biotechnology firms are driving large-scale adoption of MOS in animal nutrition and functional foods. The industry also sees growing emphasis on sustainability, with firms adopting eco-friendly production processes and plant-based raw materials. Rising demand for clean-label, natural prebiotics encourages players to expand their portfolios across feed, dietary supplements, and food applications, ensuring broader global market penetration.

Key Player Analysis

- Galam Ltd

- Jarrow Formulas

- Cargill Incorporated

- Cosucra

- Sensus (part of Royal Cosun)

- Baolingbao Biology

- Nutriagaves Group

- Ingredion

- BENEO GmbH

- Alkem Labs

Recent Developments

- In March 2024, Chr. Hansen passed the biosafety review by China’s Ministry of Agriculture and Rural Affairs for all five single HMOs of its MyOli blend. This positioned the company well for infant formula innovation in China, offering a comprehensive mix of HMOs known to support immune system development and gut microbiome health, including the particularly noteworthy 3-FL, which aligns with empirical studies of Chinese mothers’ breastmilk.

- In January 2024, Chr. Hansen A/S merged with Denmark-based Novozymes A/S to form Novonesis. This new company aimed to be a leader in sustainable solutions with a focus on health, food, and reducing environmental impact. The company has ESG goals of carbon neutrality by 2050.

- In January 2024, G-Teck BioScience launched “Pure Seaweed Oligosaccharide,” a new product extracted through cutting-edge bioenzyme hydrolysis and membrane filtration methods. This new product provides enhanced liquid solubility, aiding in the development of complex formulations.

- In May 2023, Beneo unveiled Beneo-scL85, a flexible short-chain fructooligosaccharide (scFOS) aimed at reducing sugar levels and increasing dietary fiber in foods. Derived from beet sugar, this short-chain FOS delivers a mild sweetness, excellent solubility, and natural qualities that enhance both taste and texture.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Form, Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for antibiotic-free feed additives will continue to drive MOS adoption in livestock nutrition.

- Growing consumer interest in gut health will expand MOS use in functional foods and supplements.

- Technological advancements in fermentation will improve production efficiency and product purity.

- Rising pet ownership will increase the inclusion of MOS in premium pet food formulations.

- Expanding aquaculture activities will create new growth opportunities for MOS-based feed solutions.

- Regional manufacturers in Asia-Pacific will strengthen their market presence through cost-effective production.

- Collaborations between biotechnology firms and feed producers will enhance innovation in product applications.

- Increasing research on microbiome health will boost MOS integration into pharmaceutical and nutraceutical products.

- Sustainability-focused production methods will gain traction among global MOS suppliers.

- Growing regulatory support for natural and safe feed additives will accelerate overall market expansion.