Market Overview

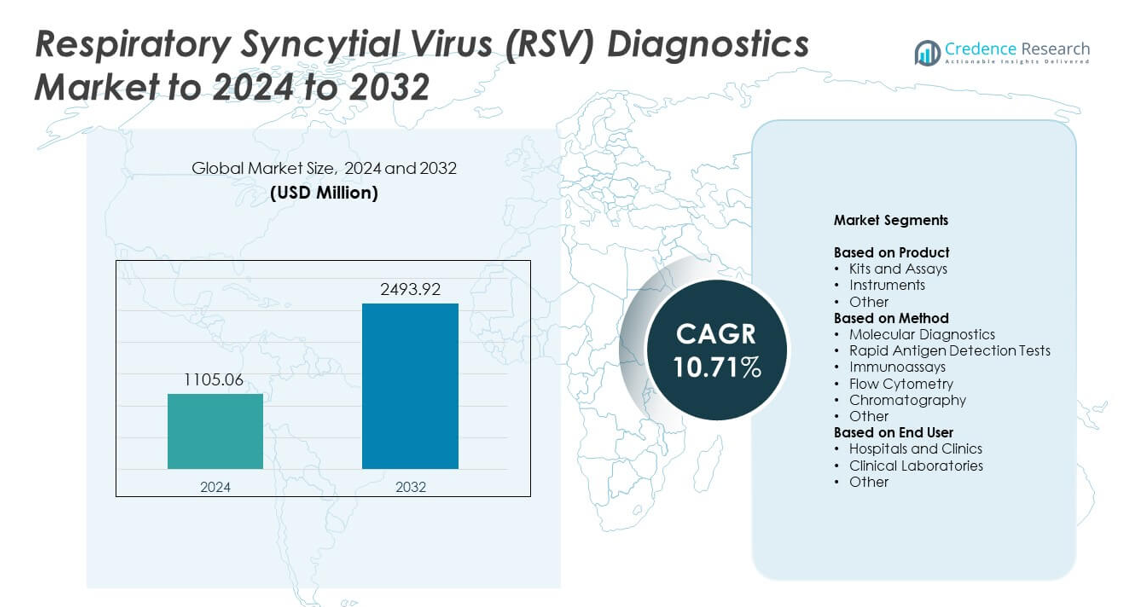

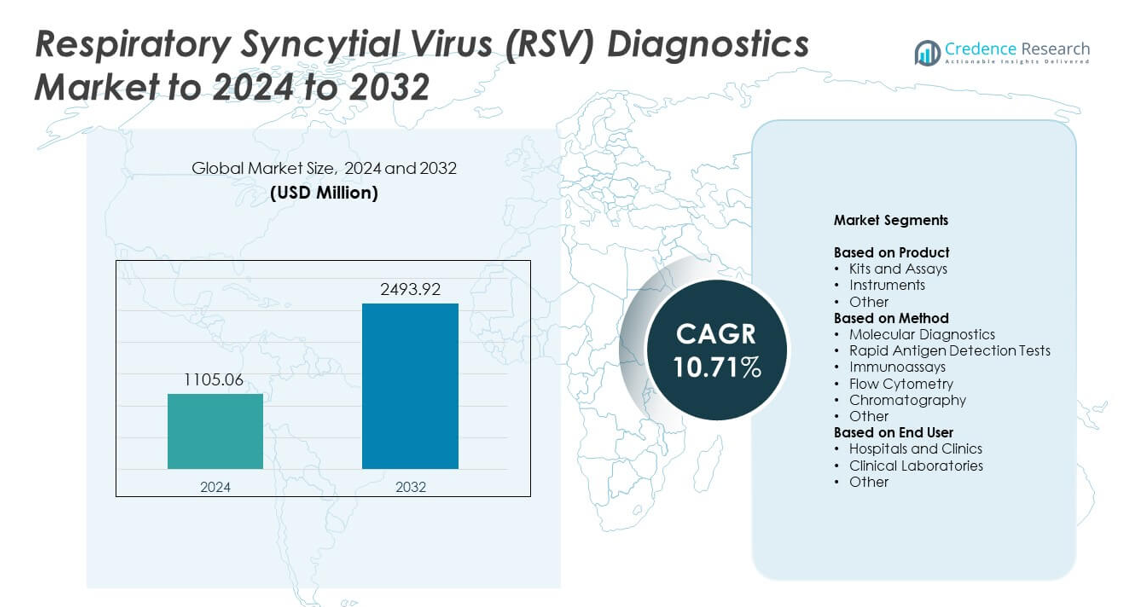

Respiratory Syncytial Virus (RSV) Diagnostics Market size was valued at USD 1105.06 million in 2024 and is anticipated to reach USD 2493.92 million by 2032, at a CAGR of 10.71% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Respiratory Syncytial Virus (RSV) Diagnostics Market Size 2024 |

USD 1105.06 million |

| Respiratory Syncytial Virus (RSV) Diagnostics Market , CAGR |

10.71% |

| Respiratory Syncytial Virus (RSV) Diagnostics Market Size 2032 |

USD 2493.92 million |

The Respiratory Syncytial Virus (RSV) Diagnostics Market is shaped by leading companies such as Abbott, Hologic, Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd., Siemens Healthcare S.A., Novartis AG, BD, BIOMÉRIEUX, Coris BioConcept, DiaSorin S.p.A., Merck KGaA, QuidelOrtho Corporation, and Bio-Rad Laboratories, Inc. These players compete through advanced molecular platforms, rapid testing solutions, and expanded respiratory panel technologies that meet rising clinical demand. North America led the global market in 2024 with about 39% share, supported by strong diagnostic infrastructure and high adoption of PCR-based assays, while Europe and Asia Pacific followed with expanding testing capacity and growing investments in RSV surveillance.

Market Insights

- The Respiratory Syncytial Virus (RSV) Diagnostics Market reached USD 1105.06 million in 2024 and is projected to reach USD 2493.92 million by 2032, growing at a CAGR of 10.71%.

- Strong demand for early detection in infants and older adults drives market growth, with molecular diagnostics holding the largest share at about 52% due to high accuracy and fast turnaround.

- Multiplex respiratory panels and point-of-care RSV testing continue to grow as healthcare providers shift toward rapid and decentralized diagnostic models.

- Major companies enhance competitiveness through improved PCR systems, automation, and high-sensitivity assays, while rising cost of advanced instruments remains a key restraint.

- North America led the market with about 39% share, followed by Europe at nearly 30% and Asia Pacific at about 23%, while kits and assays accounted for the dominant product share at around 58%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Kits and assays held the dominant share in 2024 with about 58% of the Respiratory Syncytial Virus (RSV) Diagnostics Market. Their lead came from high testing volumes, easy workflow, and strong suitability for point-of-care and laboratory use. Instruments grew at a steady pace as hospitals adopted automated PCR platforms for higher accuracy. Other product types maintained supportive demand through complementary consumables. The wider use of molecular test kits during seasonal RSV spikes further strengthened the leading position of kits and assays.

- For instance, Abbott’s ID NOW RSV test reports molecular RSV results in 13 minutes.

By Method

Molecular diagnostics accounted for the largest share in 2024 with nearly 52% of the Respiratory Syncytial Virus (RSV) Diagnostics Market. Strong adoption came from high sensitivity, fast turnaround, and reliable detection in early infection stages. Rapid antigen detection tests remained popular for quick screening in frontline settings, while immunoassays supported batch testing needs. Flow cytometry and chromatography served niche applications. The shift toward advanced nucleic acid amplification tools kept molecular diagnostics in the leading position.

- For instance, Cepheid’s Xpert Xpress CoV-2/Flu/RSV plus delivers results in about 36 minutes.

By End User

Hospitals and clinics led the market in 2024 with about 49% share of the Respiratory Syncytial Virus (RSV) Diagnostics Market. This dominance stemmed from high patient flow, early diagnosis needs in pediatric units, and wider use of PCR-based platforms in emergency departments. Clinical laboratories showed strong growth due to rising test volumes and expanded RSV surveillance programs. Other end users, including research centers, added steady demand. The focus on rapid isolation and treatment in hospital settings supported the leadership of hospitals and clinics.

Key Growth Drivers

Rising global RSV burden

Growing RSV infection rates in infants, older adults, and immunocompromised groups increased the need for early and accurate detection. Healthcare systems expanded testing programs to reduce hospitalization risks and improve clinical outcomes. Broader screening during peak respiratory seasons pushed laboratories and hospitals to adopt faster molecular tools. This rising disease load remained a major force behind higher diagnostic demand across high-income and emerging markets.

- For instance, Sanofi’s Beyfortus (nirsevimab) label specifies a single 50 mg or 100 mg dose by weight for infants in their first RSV season.

Advancements in molecular technologies

Improved PCR platforms, high-sensitivity assays, and automated sample-to-result systems strengthened diagnostic accuracy and reliability. Modern instruments reduced false negatives and supported rapid decision-making in acute care. Adoption grew as providers preferred high-precision tools that delivered quick detection during early infection stages. These molecular innovations acted as a strong driver, shaping investment in next-generation RSV testing solutions.

- For instance, Roche’s cobas liat SARS-CoV-2, Influenza A/B & RSV assay generates multiplex RT-PCR results in 20 minutes.

Expansion of point-of-care testing

Growing preference for decentralized and bedside testing improved access in emergency rooms, pediatric units, and remote clinics. Rapid antigen and molecular point-of-care systems enabled faster clinical triage and reduced patient wait times. Wider rollout supported early isolation measures and improved overall patient management. This shift toward near-patient testing continued as a major growth driver, especially during seasonal surges.

Key Trends & Opportunities

Shift toward multiplex respiratory panels

Healthcare providers moved to multiplex platforms that detect RSV along with influenza and other respiratory pathogens in a single test. This trend increased diagnostic efficiency and reduced testing costs per sample. Laboratories benefited from broader respiratory surveillance, especially during overlapping seasonal outbreaks. The expansion of multiplex technology created strong opportunities for companies offering integrated molecular solutions.

- For instance, bioMérieux’s BioFire RP2.1 Panel detects 22 respiratory targets in about 45 minutes.

Growth of home-based and remote testing models

Demand increased for self-collection kits and digital reporting tools that supported remote monitoring. Home-based testing expanded access for high-risk individuals and reduced the burden on emergency departments. Companies explored connected diagnostic devices that linked results to healthcare platforms. This trend created new opportunities in telehealth and decentralized care models.

- For instance, Pfizer’s Lucira COVID-19 & Flu at-home molecular test delivers results from a self-collected nasal swab in roughly 30 minutes.

Increased investments in pediatric testing capacity

Governments and health institutions enhanced RSV testing in neonatal and pediatric settings to reduce severe complications. Investments focused on high-throughput PCR systems and rapid screening tools designed for children. This created opportunities for companies offering specialized assays and child-friendly sample collection methods.

Key Challenges

High testing cost and limited affordability

Advanced molecular assays and automated instruments carried high acquisition and operational costs. Many low-income regions faced barriers due to limited budgets, restricting broader adoption. This cost challenge slowed the transition from antigen tests to more accurate molecular platforms. Affordability issues remained a major constraint, especially in public health facilities.

Shortage of skilled laboratory workforce

Many regions experienced limited availability of trained technicians to operate high-complexity molecular systems. This shortage affected test turnaround times and reduced operational efficiency in busy laboratories. Training gaps and high staff turnover added further strain during peak RSV seasons. Workforce limitations remained a significant challenge in scaling advanced diagnostic capacity.

Regional Analysis

North America

North America held the largest share of the Respiratory Syncytial Virus (RSV) Diagnostics Market in 2024 with about 39% of the global revenue. Strong adoption of molecular PCR platforms, well-developed hospital networks, and growing RSV screening in pediatric and elderly groups supported this lead. The region benefited from high testing awareness and continuous upgrades in diagnostic infrastructure. Expanded reimbursement coverage and wider use of multiplex respiratory panels further strengthened demand. Seasonal RSV surges also encouraged rapid procurement of advanced assays across clinics and laboratories, maintaining North America’s dominant position.

Europe

Europe accounted for nearly 30% share of the Respiratory Syncytial Virus (RSV) Diagnostics Market in 2024. Growth came from rapid expansion of molecular diagnostics, wider RSV surveillance programs, and improved testing capacity in hospitals. Countries focused on early detection in infants and older adults, which increased adoption of high-sensitivity PCR assays. Strong regulatory support for advanced diagnostic technologies also played a key role. Rising demand for point-of-care solutions in emergency and pediatric units strengthened regional testing volumes, keeping Europe one of the most active RSV diagnostic markets.

Asia Pacific

Asia Pacific captured about 23% share of the Respiratory Syncytial Virus (RSV) Diagnostics Market in 2024 and showed the fastest growth outlook. Rising RSV incidence in children, expanding healthcare access, and increasing investment in molecular laboratories boosted regional demand. Countries improved diagnostic readiness through wider deployment of rapid antigen kits and PCR platforms. Growing urbanization and higher awareness of respiratory diseases supported early testing. The presence of large pediatric populations, along with government programs to improve infectious disease detection, strengthened the region’s accelerating trajectory.

Latin America

Latin America accounted for nearly 5% share of the Respiratory Syncytial Virus (RSV) Diagnostics Market in 2024. Expansion of public health initiatives and rising awareness of severe RSV infections improved testing demand. Many hospitals adopted rapid antigen and molecular assays to strengthen early diagnosis, especially during peak respiratory seasons. Budget constraints slowed large-scale adoption of high-end molecular systems, but incremental upgrades continued. Support from international health programs and broader surveillance efforts helped improve diagnostic penetration across major countries in the region.

Middle East & Africa

Middle East & Africa held about 3% share of the Respiratory Syncytial Virus (RSV) Diagnostics Market in 2024. Limited access to advanced molecular platforms and uneven healthcare infrastructure restricted wider adoption. However, rising RSV hospitalization rates in infants encouraged gradual expansion of rapid testing tools. Investments in laboratory capacity and partnerships with global diagnostic firms increased availability of reliable kits. Urban centers showed stronger adoption of PCR-based assays, while rural areas continued to rely on antigen tests. Regional improvements remained steady but slower compared to other markets.

Market Segmentations:

By Product

- Kits and Assays

- Instruments

- Other

By Method

- Molecular Diagnostics

- Rapid Antigen Detection Tests

- Immunoassays

- Flow Cytometry

- Chromatography

- Other

By End User

- Hospitals and Clinics

- Clinical Laboratories

- Other

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Respiratory Syncytial Virus (RSV) Diagnostics Market features major participants such as Abbott, Hologic, Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd., Siemens Healthcare S.A., Novartis AG, BD (Becton, Dickinson, and Company), BIOMÉRIEUX, Coris BioConcept, DiaSorin S.p.A., Merck KGaA, QuidelOrtho Corporation, and Bio-Rad Laboratories, Inc. The competitive environment is shaped by strong emphasis on advanced molecular systems, high-sensitivity assay development, and rapid testing solutions tailored for both clinical laboratories and point-of-care settings. Companies increase their market presence through continuous innovation in PCR workflows, automation, and integrated respiratory panels that enhance diagnostic accuracy. Many firms invest in scalable platforms designed for high-throughput testing during seasonal RSV surges, improving supply reliability for hospitals and emergency departments. Strategic collaborations with healthcare systems, expansion into emerging markets, and improved connectivity features for digital reporting also strengthen competitive positioning. Growing demand for rapid turnaround times continues to drive innovation across product portfolios.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Abbott

- Hologic

- Thermo Fisher Scientific Inc.

- F. Hoffmann-La Roche Ltd.

- Siemens Healthcare S.A.

- Novartis AG

- BD (Becton, Dickinson, and Company)

- BIOMÉRIEUX

- Coris BioConcept

- DiaSorin S.p.A.

- Merck KGaA

- QuidelOrtho Corporation

- Bio-Rad Laboratories, Inc.

Recent Developments

- In 2024, Roche launched the cobas Respiratory flex test, which uses its novel TAGS (Temperature-Activated Generation of Signal) multiplex PCR technology.

- In 2024, QuidelOrtho Corporation received FDA 510(k) clearance for its QuickVue COVID-19 test, contributing to the trend of developing multi-panel rapid tests for respiratory infections.

- In 2023, Hologic Inc. received FDA approval for its Panther Fusion SARS-CoV-2/Flu A/B/RSV assay, designed to detect and differentiate four common respiratory viruses.

Report Coverage

The research report offers an in-depth analysis based on Product, Method, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as RSV screening becomes routine in hospitals and pediatric units.

- Molecular diagnostics will grow faster due to rising demand for high-accuracy detection.

- Point-of-care RSV testing will increase adoption in emergency and outpatient settings.

- Multiplex respiratory panels will gain stronger use for broad pathogen detection.

- Home-based and remote testing models will rise with digital health integration.

- Pediatric testing capacity will improve as governments prioritize infant health programs.

- Diagnostic companies will invest more in automation and faster sample-to-result systems.

- AI-enabled workflow tools will support better test interpretation and reporting.

- Emerging markets will adopt RSV diagnostics at a quicker pace due to expanded healthcare access.

- Partnerships between clinics and diagnostic firms will strengthen RSV surveillance and early intervention.