Market Overview

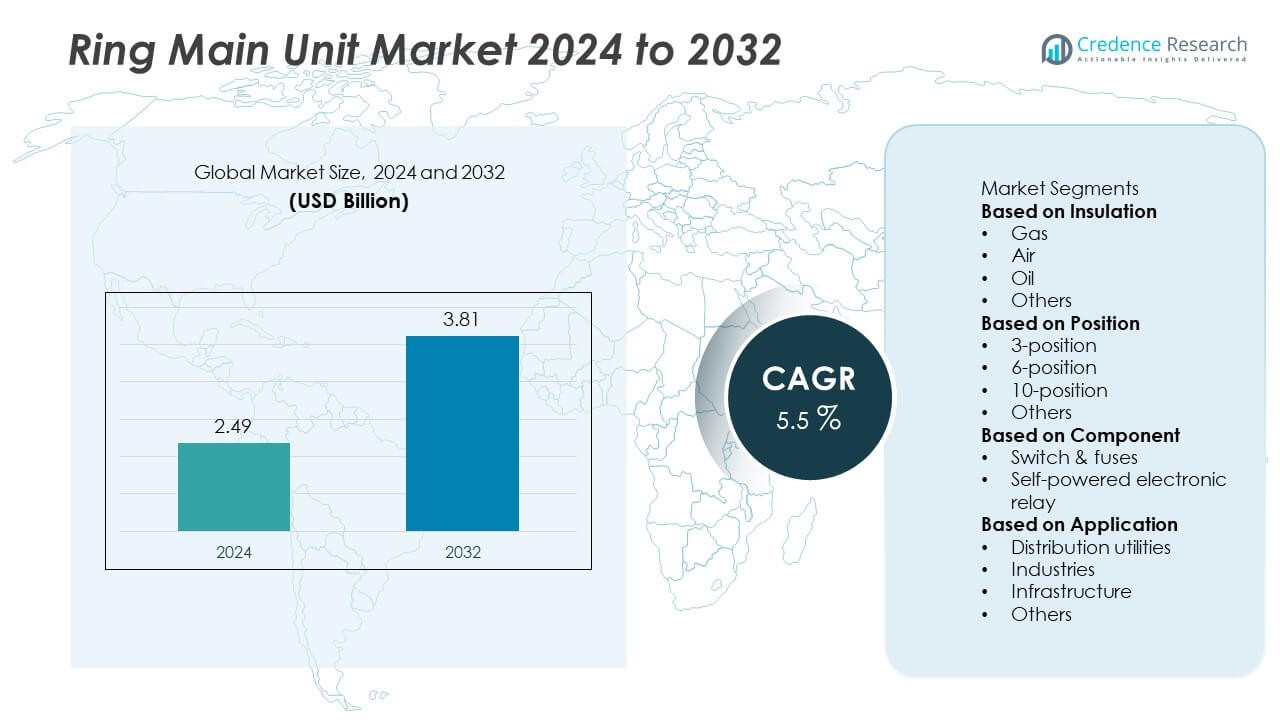

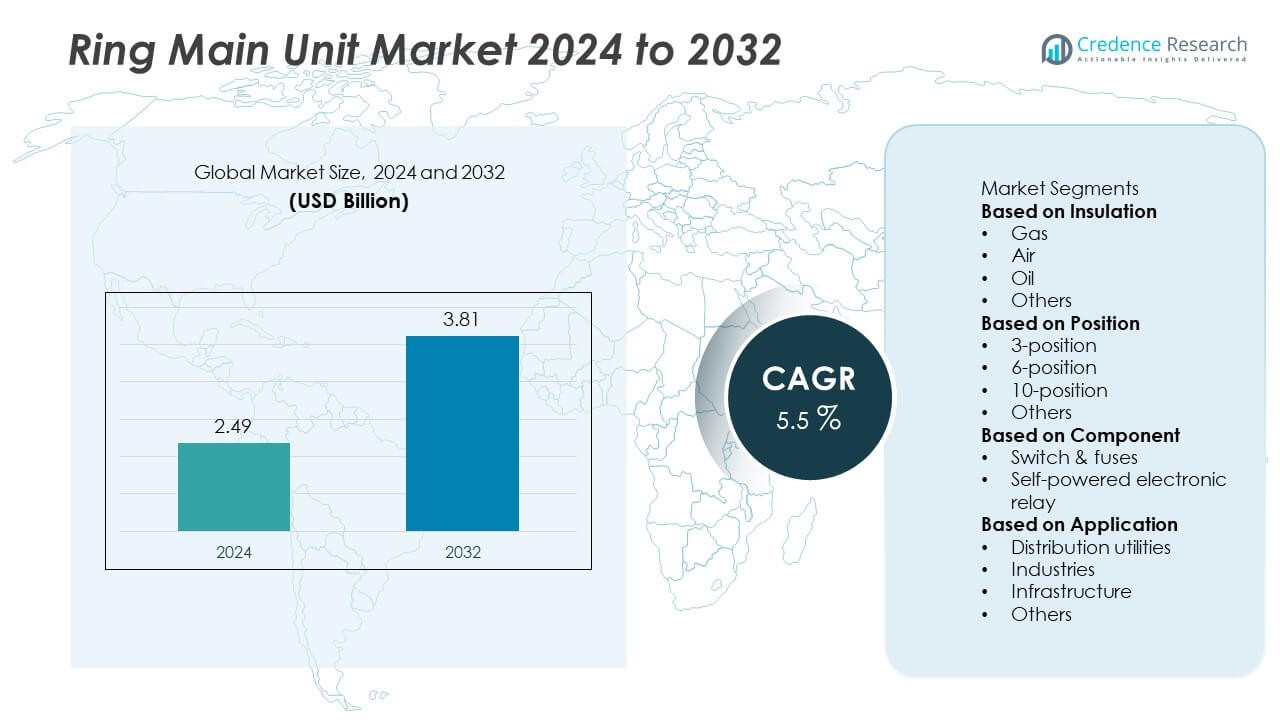

The global ring main unit market was valued at USD 2.49 billion in 2024 and is projected to reach USD 3.81 billion by 2032, growing at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ring Main Unit Market Size 2024 |

USD 2.49 Billion |

| Ring Main Unit Market, CAGR |

5.5% |

| Ring Main Unit Market Size 2032 |

USD 3.81 Billion |

The ring main unit market is led by major players such as CHINT Group, Lucy Group, Hyundai Electric & Energy Systems, Eaton, Ormazabal, LS ELECTRIC, ABB, CG Power, Alfanar Group, and Electric & Electronic. These companies dominate through advanced switchgear technologies, extensive product portfolios, and strong global networks. Asia Pacific emerged as the leading region with a 32% share in 2024, driven by large-scale electrification and renewable grid projects. Europe followed with 28%, supported by SF₆-free innovation and smart grid deployment. North America accounted for 31% of the market, driven by modernization of aging distribution infrastructure and increased automation adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The ring main unit market was valued at USD 2.49 billion in 2024 and is projected to reach USD 3.81 billion by 2032, growing at a CAGR of 5.5%.

- Rising electricity demand, rapid urbanization, and expansion of renewable energy grids are driving strong adoption of RMUs in utilities and industries.

- Growing preference for SF₆-free and compact modular RMUs is a major trend, supporting eco-friendly and space-efficient power distribution solutions.

- Key players such as ABB, Eaton, CHINT Group, and Lucy Group focus on smart grid integration, automation, and R&D for sustainable product innovation.

- Asia Pacific dominated with 32% share in 2024, followed by North America with 31% and Europe with 28%, while gas-insulated RMUs held 64% share due to superior safety, compactness, and reliability in medium-voltage networks.

Market Segmentation Analysis:

By Insulation

The gas-insulated segment dominated the ring main unit market with a 64% share in 2024. Its leadership is driven by superior reliability, compact design, and minimal maintenance compared to air or oil-insulated systems. Gas-insulated RMUs are widely used in urban substations and industrial facilities due to their ability to operate safely under harsh environmental conditions. Increasing investments in smart grids and renewable power distribution networks further strengthen segment growth. Utilities prefer SF₆ and eco-friendly gas variants for improved dielectric strength and lower operational risk in medium-voltage applications.

- For instance, ABB offers SF₆-free RMUs using AirPlus technology, which reduces global warming potential by 99.99% compared to SF₆. The eco-efficient technology provides dielectric performance equivalent to SF₆ units while maintaining compactness and maintenance-free operation for 30 years or more.

By Position

The 3-position segment accounted for the largest market share of 58% in 2024, attributed to its operational simplicity, cost efficiency, and wide use in compact substations. This configuration offers three main functionalities—on, off, and earthing—ensuring effective load management and enhanced safety. It is preferred for distribution networks in residential, commercial, and light industrial areas. The segment benefits from rising adoption of modular RMU systems that optimize switchgear space and improve grid reliability. Manufacturers focus on developing compact 3-position units compatible with renewable energy integration and digital monitoring systems.

- For instance, Eaton launched its Xiria E 3-position RMU with digital control integration, designed for voltages up to 24 kV. The system supports more than 10,000 mechanical operations without maintenance and includes vacuum-interrupter technology for enhanced arc protection. This innovation aligns with utilities’ demand for smart, compact, and durable switchgear solutions.

By Component

The switch and fuses segment held a 62% share of the ring main unit market in 2024, driven by their critical role in ensuring operational safety and fault protection. Switch-fuse combinations provide reliable circuit isolation and overcurrent protection in medium-voltage networks. Their robust design and ease of maintenance make them essential in both underground and overhead distribution systems. Growing demand for enhanced safety standards and grid modernization in utilities and industries continues to propel this segment’s dominance. Ongoing innovations in compact, arc-resistant switchgear designs further reinforce market growth globally.

Key Growth Drivers

Rising Demand for Reliable Power Distribution

Increasing urbanization and industrialization have accelerated the demand for reliable and uninterrupted electricity. Ring main units (RMUs) are vital in medium-voltage networks for ensuring operational continuity and safety during maintenance or fault conditions. Growing electricity consumption in developing regions and rapid infrastructure expansion drive their adoption. Governments are investing heavily in grid modernization projects to minimize power losses and enhance efficiency. The ability of RMUs to enable compact, safe, and flexible power distribution makes them a preferred choice across utilities and commercial facilities.

- For instance, LS ELECTRIC provides a range of Ring Main Units (RMUs) up to 36 kV for deployment in medium-voltage distribution networks in Korea and other countries. The company’s Susol RMUs feature SCADA connectivity via a Remote Terminal Unit (RTU), which allows for remote monitoring and control.

Expansion of Renewable Energy Integration

Rising integration of renewable energy sources, such as solar and wind, is fueling RMU adoption for efficient grid connection and distribution. RMUs play a key role in maintaining voltage stability and network reliability in renewable-based grids. Increasing installation of distributed energy systems across Asia, Europe, and North America boosts demand for compact and automated switchgear systems. Manufacturers are developing SF₆-free and eco-friendly RMUs to meet environmental standards while supporting clean energy expansion globally.

- For instance, Ormazabal supplied over 1,200 eco-designed RMUs for European wind and solar farms, each supporting up to 36 kV rated voltage. These SF₆-free units use solid insulation and digital sensors to ensure high dielectric performance with zero gas emissions. The deployment enhances renewable grid connectivity while meeting EU environmental compliance targets.

Smart Grid Development and Automation Initiatives

Governments and utilities worldwide are investing in smart grid infrastructure to enhance monitoring, control, and fault detection. RMUs integrated with intelligent electronic devices enable remote operation and real-time network diagnostics. This supports faster fault isolation, reduced outage times, and improved power reliability. The ongoing transition toward digital substations and smart cities further accelerates deployment. Major manufacturers are focusing on automation-ready RMUs compatible with IoT and SCADA systems, enhancing grid resilience and operational efficiency.

Key Trends & Opportunities

Shift Toward Eco-Friendly Gas Alternatives

The transition away from SF₆ gas toward sustainable insulating materials is a major trend shaping the RMU market. Environmental concerns and stringent emission regulations are prompting manufacturers to develop alternatives like fluoronitrile, fluoroketone, and dry air-based RMUs. These eco-friendly systems reduce greenhouse gas emissions while maintaining high dielectric strength. Companies investing in green switchgear technologies gain a competitive edge as utilities adopt sustainable infrastructure solutions aligned with carbon neutrality goals.

- For instance, ABB Ltd. launched its SafeRing Air/SafePlus Air RMU series using dry-air insulation medium and puffer-type load break switch technology. The portfolio supports rated currents up to 630 A and short-time withstand currents up to 20 kA (3 s) under 24 kV voltage levels.

Advancement in Compact and Modular RMU Designs

Rising space constraints in urban and industrial environments are increasing demand for compact and modular RMUs. These designs offer simplified installation, scalability, and reduced maintenance requirements. Modular units are widely adopted in smart grid projects and renewable energy substations. Technological innovation, including plug-in cable connections and self-powered relays, enhances operational flexibility. This trend presents strong opportunities for manufacturers targeting distributed and underground power distribution systems.

- For instance, Lucy Electric developed its Aegis Plus and Aegis36 modular RMUs, with the Aegis36 rated up to 36 kV. The Aegis Plus units are automation-ready with integrated Remote Terminal Units (RTUs) for digital monitoring.

Key Challenges

High Installation and Maintenance Costs

Despite their reliability, RMUs involve high initial setup and maintenance costs, which hinder adoption in cost-sensitive markets. Utilities in developing regions often prefer conventional switchgear due to budget limitations. The need for specialized components and gas handling equipment further increases operational expenses. Manufacturers must focus on cost-optimized designs and long-life components to overcome this barrier and expand adoption across low-income economies.

Stringent Environmental and Safety Regulations

The use of SF₆ gas in insulation has come under scrutiny due to its high global warming potential. Increasingly strict environmental regulations from authorities such as the EU and EPA are compelling manufacturers to redesign products and transition to alternative gases. This regulatory pressure adds R&D and certification costs, slowing product rollout. Adapting to diverse global compliance frameworks remains a key operational challenge for RMU manufacturers.

Regional Analysis

North America

North America held a 31% share of the ring main unit market in 2024, supported by strong investments in grid modernization and renewable energy integration. The United States leads due to ongoing replacement of aging distribution networks and adoption of smart grid technologies. Growing demand for compact, automated RMUs in commercial and utility sectors further drives regional growth. Major manufacturers are focusing on digital monitoring solutions and eco-friendly gas-insulated units to meet stringent environmental regulations. Increasing renewable connections and decentralized power systems continue to strengthen North America’s position in the global market.

Europe

Europe accounted for a 28% market share in 2024, driven by robust government initiatives for clean energy and emission reduction. Countries such as Germany, France, and the U.K. are investing heavily in modernizing medium-voltage networks and deploying SF₆-free RMUs. The presence of established switchgear manufacturers and strict grid reliability standards further enhance market development. Growing adoption of renewable energy systems and underground power networks supports consistent demand. Europe’s shift toward sustainable and digitalized power infrastructure continues to reinforce its leadership in advanced ring main unit technologies.

Asia Pacific

Asia Pacific dominated with a 32% share of the ring main unit market in 2024, driven by rapid industrialization, urban expansion, and rising electricity consumption. China, India, and Japan lead installations due to large-scale grid extension projects and growing renewable energy deployment. Government investments in rural electrification and substation automation are accelerating demand for compact and reliable RMUs. Local manufacturers are expanding production of cost-effective gas and air-insulated systems to serve domestic and export markets. The region’s strong economic growth and energy infrastructure development make it the fastest-growing regional market globally.

Latin America

Latin America captured a 5% share of the ring main unit market in 2024, supported by gradual grid expansion and modernization initiatives. Brazil and Mexico dominate due to industrial growth and urban infrastructure development. Increasing renewable power generation, particularly from wind and solar, drives the adoption of RMUs for stable distribution. However, limited investment in rural power networks and economic fluctuations hinder faster growth. International players are entering the region through joint ventures to provide compact and low-maintenance switchgear solutions tailored to emerging market needs.

Middle East & Africa

The Middle East & Africa region held a 4% share in 2024, driven by rising electricity demand, industrialization, and power infrastructure expansion. The United Arab Emirates, Saudi Arabia, and South Africa lead regional adoption due to ongoing grid reinforcement projects. Harsh climatic conditions and high urbanization encourage use of gas-insulated RMUs for reliable operations. Increasing investments in renewable projects, especially solar power, further stimulate demand. However, uneven electrification and budget constraints in parts of Africa limit large-scale deployment. Government-led infrastructure programs are expected to create steady market growth opportunities.

Market Segmentations:

By Insulation

By Position

- 3-position

- 6-position

- 10-position

- Others

By Component

- Switch & fuses

- Self-powered electronic relay

By Application

- Distribution utilities

- Industries

- Infrastructure

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the ring main unit market is characterized by the strong presence of key players such as CHINT Group, Lucy Group, Hyundai Electric & Energy Systems, Eaton, Ormazabal, LS ELECTRIC, ABB, CG Power, Alfanar Group, and Electric & Electronic. These companies compete on product reliability, technology innovation, and energy efficiency. Market leaders focus on developing eco-friendly, SF₆-free RMUs and modular switchgear systems to meet global sustainability standards. Continuous investment in smart grid integration and digital monitoring capabilities strengthens their market positions. Strategic collaborations, mergers, and product launches are common to enhance regional penetration and customer reach. Asian and European players emphasize cost-effective and compact solutions for industrial and utility applications, while North American firms focus on advanced automation and digital grid technologies. This competitive environment drives innovation and accelerates the global transition toward intelligent, safe, and environmentally sustainable power distribution networks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CHINT Group

- Lucy Group

- Hyundai Electric & Energy Systems

- Eaton

- Ormazabal

- LS ELECTRIC

- ABB

- CG Power

- Alfanar Group

- Electric & Electronic

Recent Developments

- In October 2025, Ormazabal applied its SF6-free medium-voltage switchgear (including RMU-relevant tech) in the Geldern wind farm grid connection in Germany.

- In April 2025, CHINT Group launched its NG7-40.5 kV gas-insulated ring main unit model for global energy transformation.

- In March 2024, Lucy Group unveiled the EcoTec RMU, the UK’s first non-SF6 medium-voltage ring main unit.

- In May 2023, CHINT Group reported its intelligent RMU project in Saudi Arabia passed certification and entered the grid ahead of schedule.

Report Coverage

The research report offers an in-depth analysis based on Insulation, Position, Component, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for ring main units will grow steadily due to expanding smart grid projects worldwide.

- Urbanization and industrial development will continue to increase the need for reliable medium-voltage power distribution.

- Adoption of SF₆-free and environmentally friendly insulation systems will accelerate under global emission policies.

- Manufacturers will invest more in digital monitoring and automation to enhance grid reliability.

- Modular and compact RMU designs will gain popularity for space-constrained substations and renewable integration.

- Utilities will emphasize life-cycle cost optimization and maintenance-free operation.

- Partnerships between local and global companies will improve regional production capacity.

- Asia Pacific will remain the fastest-growing market due to large-scale electrification and renewable expansion.

- Europe will lead innovation in sustainable RMU technologies and regulatory compliance.

- Continuous investment in modernization of aging power infrastructure will sustain long-term market growth globally.