Market Overview

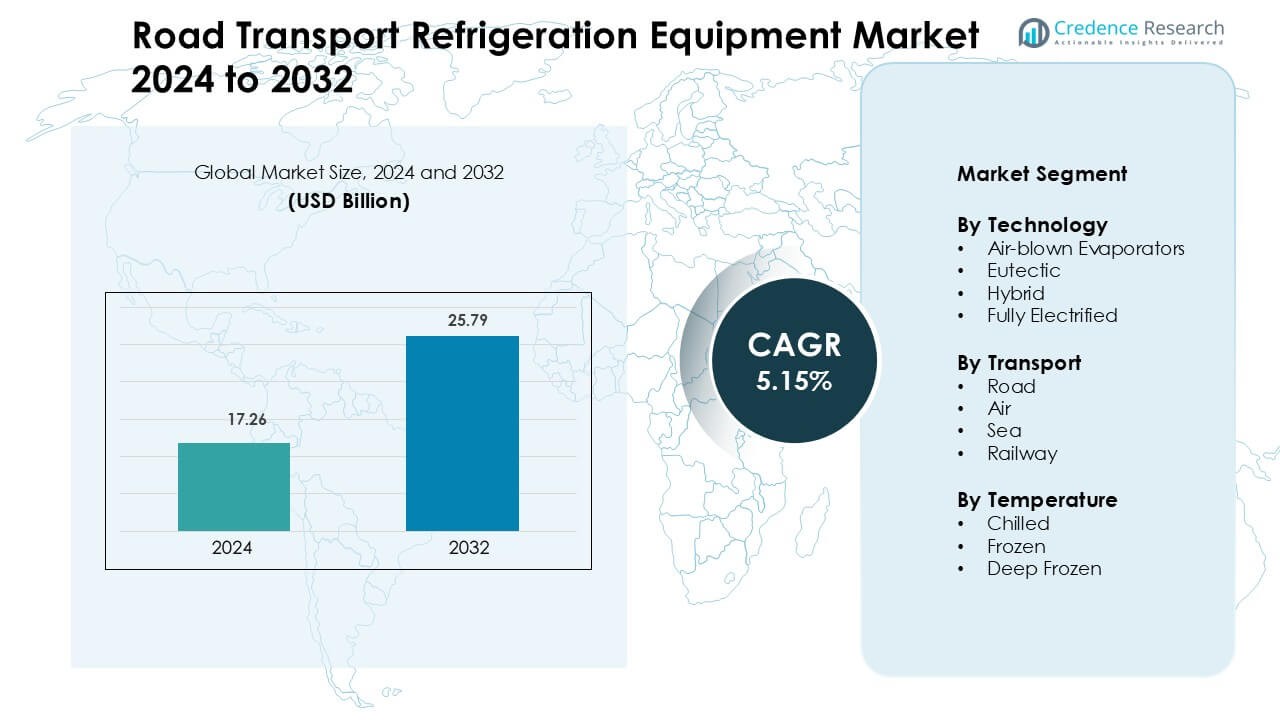

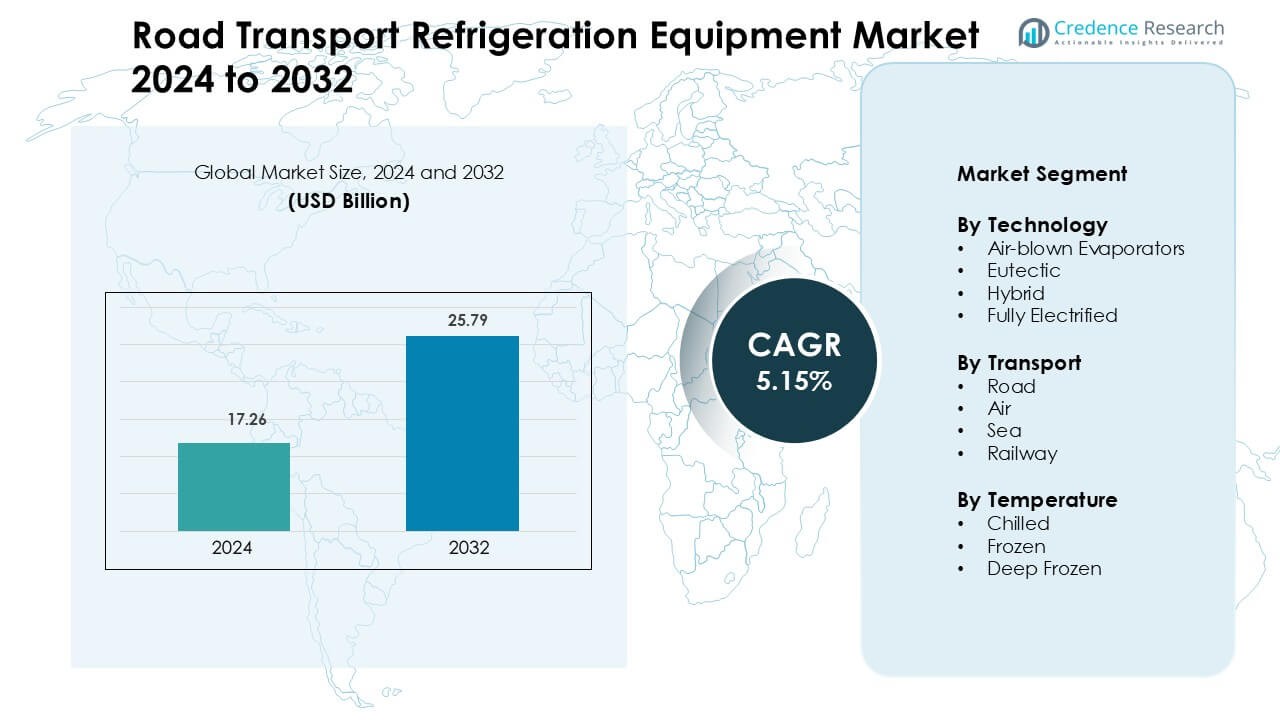

Road Transport Refrigeration Equipment Market was valued at USD 17.26 billion in 2024 and is anticipated to reach USD 25.79 billion by 2032, growing at a CAGR of 5.15 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Road Transport Refrigeration Equipment Market Size 2024 |

USD 17.26 Billion |

| Road Transport Refrigeration Equipment Market, CAGR |

5.15 % |

| Road Transport Refrigeration Equipment Market Size 2032 |

USD 25.79 Billion |

The Road Transport Refrigeration Equipment market is shaped by major players such as Daikin Industries, Wabash National Corporation, Great Dane LLC, C.R. England, Swift Transportation, Schneider National, J.B. Hunt Transport Services, Kuehne + Nagel, C.H. Robinson Worldwide, and emerging innovators like Fenagy. These companies compete through energy-efficient refrigeration units, telematics integration, and multi-temperature systems designed for food and pharmaceutical logistics. Many leaders expand fleets with hybrid and electric refrigeration to meet emission and fuel-efficiency targets. North America remains the leading region with 33% market share in 2024, supported by strong cold chain infrastructure, supermarket distribution networks, and rapid growth in last-mile grocery deliveries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Road Transport Refrigeration Equipment market was valued at USD 17.26 billion in 2024 and is projected to register a CAGR of 5.15 % through 2032.

- Growth is driven by expanding cold chain networks for fresh food, dairy, seafood, and pharmaceutical shipments, along with rising demand for temperature-controlled last-mile delivery fleets in urban areas.

- hybrid and fully electric refrigeration units gain traction as fleet owners target fuel savings, emission compliance, and quieter urban operations; IoT-based monitoring and telematics strengthen reliability and load visibility.

- Competition intensifies among Daikin Industries, Wabash National Corporation, Great Dane LLC, and major logistics fleets such as C.R. England and Schneider National, while smaller operators face restraints from high ownership and maintenance costs.

- North America leads with 33% regional share, followed by Asia Pacific at 28%; within technology, air-blown evaporators dominate with 48% segment share, supported by low maintenance needs and strong compatibility across refrigerated trucks and vans.

Market Segmentation Analysis:

By Technology

Air-blown evaporators hold the largest share, accounting for 48% of global demand in 2024. They remain dominant due to simple layouts, lower maintenance needs, and wide compatibility with trucks and vans used for food and pharma distribution. The system delivers steady air circulation, fast pull-down times, and reliable temperature recovery during frequent door openings. Growth also links to expansion in last-mile grocery delivery and medical logistics. Fully electrified units gain attention as fleet owners shift toward zero-emission transport, while hybrid designs support fuel savings for long-haul refrigerated trucks.

- For instance, Carrier Transicold’s Vector HE 19 hybrid units integrate electric standby capabilities delivering up to 14.88 kW of cooling power, ensuring temperature stability across food and pharmaceutical cold chains while reducing diesel engine use.

By Transport

Road transport leads the market with 61% share in 2024. The segment grows on rising cold chain expansion for dairy, fresh produce, seafood, vaccines, and biologics. Road fleets provide flexible routing, door-to-door reach, and lower handling risk. Demand strengthens in emerging economies where e-commerce and grocery delivery expand insulated van and truck fleets. Air and sea modes serve long-distance and export shipments, while rail supports bulk frozen cargo. However, road remains preferred for shorter lead times, temperature consistency, and strong service networks across urban and rural routes.

- For instance, DHL has a substantial fleet of temperature-controlled trucks and is continuously investing in its cold chain infrastructure in Asia-Pacific.

By Temperature

Chilled transport dominates with 54% share in 2024, driven by rising movement of fresh vegetables, fruits, beverages, and ready-to-eat food. Retailers prioritize chilled flow because most perishable goods require controlled temperatures rather than deep freeze. Supermarkets expand distribution centers with multi-temperature trucks to improve shelf life and reduce waste. Frozen and deep-frozen categories serve seafood, meat, and ice cream chains, but chilled loads run more frequently and use a wider fleet mix. Growth also links to health-focused buyers who prefer fresh food deliveries, boosting demand for reliable chilled logistics.

Key Growth Drivers

Expansion of Cold Chain Networks

Cold chain investments continue to rise as food retailers, pharma distributors, and e-commerce players demand reliable temperature-controlled transport across cities and remote areas. Governments support infrastructure upgrades with cold storage warehouses, reefer truck subsidies, and food safety compliance rules. Urban grocery delivery and quick-commerce models need insulated vans with fast temperature recovery and strong airflow. The pharma industry increases shipments of biologics, vaccines, and blood components that require accurate temperature retention during cross-border movement. As companies replace legacy diesel systems with energy-efficient units, adoption of modern road refrigeration equipment accelerates.

- For instance, Snowman Logistics in India expanded its temperature-controlled storage capacity to 154330 pallets across 21 locations, supporting integrated cold chain connectivity for food and pharma sectors.

Growth in Fresh and Processed Food Demand

Consumer preference has shifted toward fresh fruits, vegetables, dairy, meat, and ready-to-eat meals, which must remain chilled or frozen during transport. Supermarkets and food delivery companies expand temperature-controlled fleets to maintain product quality and meet strict shelf-life rules. Rise in exports of meat, seafood, and frozen bakery products strengthens the need for reliable reefer trucks across borders and ports. Food safety authorities impose stringent hygiene and traceability norms that push fleet owners to upgrade refrigeration units with digital monitoring and real-time temperature alerts. Companies also adopt multi-temperature trucks to reduce transportation costs and support diverse loads. These factors ensure continuous investments in advanced road refrigeration systems for consistent product movement.

- For instance, Thermo King’s TracKing telematics is a legitimate product used for monitoring refrigerated transport.

Shift Toward Energy-Efficient and Electric Refrigeration

Fleet operators increasingly adopt hybrid and fully electric refrigeration systems to lower fuel usage and comply with emission standards. Cities introduce low-emission zones, forcing companies to replace older diesel-based systems with greener technology. Government incentives, renewable adoption, and corporate sustainability programs strengthen demand for battery-powered units. Electrified refrigeration enables quieter operation, reduced maintenance, and stable temperature performance without relying on vehicle engines. Logistics companies also integrate solar-assisted power and intelligent controllers for smoother load management and energy savings. This transition creates long-term opportunities for manufacturers offering compact, lightweight, and low-emission cooling solutions.

Key Trend & Opportunity

Digital Monitoring and Telematics Integration

The market sees strong adoption of telematics, IoT sensors, and data-driven fleet control. Logistics teams monitor temperature, fuel usage, compressor runtime, and door activity through cloud dashboards. Real-time alerts reduce spoilage, ensure regulatory compliance, and support insurance claims. Predictive maintenance lowers breakdown risk and improves fleet availability. Companies also use route optimization and load scheduling tools to cut operational cost. These features improve efficiency and transparency, making digital control a core value proposition. As more shippers demand visibility from farm to retail shelf, suppliers offering connected refrigeration solutions gain a competitive advantage.

- For instance, Fleet Complete has an established partnership with AWS and utilizes AWS IoT services, such as its CONNVEX platform, for fleet management and monitoring.

Growth of Last-Mile Refrigerated Delivery

Demand for refrigerated vans and small trucks rises with home delivery of dairy, meat, seafood, beverages, and ready-to-eat meals. Quick-commerce platforms require compact, energy-efficient units that maintain temperature during frequent door openings. Cities expand micro-fulfillment centers and dark stores that rely on short-range refrigerated fleets. Manufacturers introduce lightweight battery-powered units for quieter city operation and reduced emissions. Food tech startups also partner with cold chain logistics providers to build subscription-based cold delivery networks. This shift widens the addressable market for small and mid-size road refrigeration vehicles.

- For instance, by July 2023, Amazon had over 3,000 Rivian vans delivering packages in over 500 U.S. cities. By 20 June 2025, this number grew to more than 25,000 across the U.S.

Key Challenge

High Ownership and Maintenance Costs

Advanced refrigeration systems require high upfront investment in hardware, installation, and power sources. Fleet owners also face recurring costs for fuel, maintenance, refrigerant refilling, compressor repair, and spare parts. Small operators often delay technology upgrades and continue using legacy systems that consume more fuel and pose breakdown risks. Hybrid and electric refrigeration further increase cost due to battery packs and onboard electronics. Total cost of ownership becomes a barrier in price-sensitive regions, especially for small food transporters. Without subsidies, efficient financing, or leasing programs, adoption may slow among smaller logistics firms.

Skilled Workforce and Service Availability

Road refrigeration units require trained technicians for leak detection, temperature calibration, compressor repair, and sensor integration. Many emerging markets lack certified service centers, causing downtime, cargo loss, and higher operating cost. Rural delivery routes face limited availability of spare parts and on-spot repair. Drivers also need training to manage load distribution, door usage, and temperature settings to prevent spoilage. The shift toward digital and electric units makes workforce development even more crucial. Without strong service networks and training programs, fleet reliability and uptime remain major challenges for operators.

Regional Analysis

North America

North America holds the largest share at 33% in 2024, driven by strong cold chain penetration, high food safety standards, and established grocery retail networks. The United States leads adoption as supermarkets, e-commerce platforms, and pharma logistics demand temperature-stable delivery fleets. Fleet owners upgrade to energy-efficient, low-emission systems as states enforce strict emission regulations. Growth also rises from last-mile deliveries and cross-border food trade with Canada and Mexico. Investments in telematics, battery-powered refrigeration, and predictive maintenance platforms further support equipment replacement and fleet modernization across the region.

Europe

Europe accounts for 27% of the global market due to stringent environmental regulations, advanced logistics infrastructure, and strong adoption of electric and hybrid refrigeration units. Germany, the UK, France, and the Netherlands lead demand from large grocery chains and export-focused food processors. EU emission rules drive the shift toward low-GWP refrigerants and greener fleets. Road networks connecting farms, processing hubs, and ports support frequent chilled and frozen shipments. Fleet replacement accelerates as logistics providers target fuel savings and reduced carbon footprint. Telematics and temperature-traceability tools also strengthen compliance requirements across borders.

Asia Pacific

Asia Pacific captures a 28% share, supported by population growth, urbanization, and rising demand for fresh food and pharmaceuticals. China and India expand refrigerated truck fleets to serve supermarkets, online grocery platforms, seafood exporters, and vaccine distribution. Cold chain investment increases as governments improve highway connectivity and food safety monitoring. Rapid growth of organized retail boosts the need for chilled and frozen logistics in urban clusters. Manufacturers supply cost-efficient diesel, hybrid, and small-van refrigeration systems for short-haul delivery. APAC remains the fastest-growing region due to large consumer bases and expanding export markets.

Latin America

Latin America holds an 8% share, led by Brazil, Mexico, and Chile. Growth links to increasing consumption of chilled meat, beverages, and dairy, along with rising seafood exports. Retail chains improve cold chain infrastructure with insulated trucks and telematics-enabled monitoring. Limited fleet modernization and high ownership costs slow adoption among smaller transporters, but larger distributors invest in energy-efficient units to reduce fuel expenses. Government focus on reducing food waste and improving hygiene drives demand for reliable cold transport. E-commerce grocery delivery also boosts small and medium refrigerated vehicle deployment.

Middle East & Africa

The Middle East & Africa represent 4% of the market, driven by food imports, tourism, and expansion of cold storage hubs. Gulf countries rely heavily on reefer trucks for dairy, meat, and fresh produce distribution across high-temperature climates. Large retailers and foodservice chains invest in modern fleets with strong insulation and fast cooling recovery. In Africa, market growth remains uneven due to limited infrastructure and high capital cost, though vaccine logistics and rising urban retail create opportunities. Manufacturers introduce rugged, low-maintenance units to operate in remote areas with challenging weather and road conditions.

Market Segmentations

By Technology

- Air-blown Evaporators

- Eutectic

- Hybrid

- Fully Electrified

By Transport

By Temperature

- Chilled

- Frozen

- Deep Frozen

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Road Transport Refrigeration Equipment market includes fleet operators, logistics companies, and refrigeration system manufacturers focused on efficient, low-emission cooling solutions. Leading suppliers invest in hybrid and electric refrigeration units to reduce fuel consumption and comply with emission rules across North America and Europe. Companies also integrate IoT sensors, telematics, and smart controllers to improve temperature accuracy, route management, and predictive maintenance. Customized multi-temperature systems gain traction in grocery and pharma delivery. Strategic partnerships with vehicle OEMs strengthen product reach, while rental and leasing models attract small operators seeking lower ownership cost. Manufacturers expand in Asia Pacific and Latin America with cost-competitive diesel and battery-powered units designed for local climates and long road cycles. Continuous innovation in lightweight body panels, low-GWP refrigerants, and fast pull-down evaporators further intensifies competition.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Schneider reported faster CPKC cross-border transits and 99.98% security. These lanes serve food and produce shippers needing cold-chain reliability.

- In November 2023, Daikin unveiled full-electric and plug-in hybrid transport refrigeration. The lineup included Exigo and the Daikin Telematics platform.

Report Coverage

The research report offers an in-depth analysis based on Technology, Transport, Temperature and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Fleet owners will adopt more electric and hybrid refrigeration systems to meet emission rules.

- Battery-powered units will support silent, fuel-free cooling for urban and night-time deliveries.

- IoT and telematics will become standard for real-time temperature tracking and route optimization.

- Predictive maintenance analytics will reduce breakdowns and improve fleet uptime.

- Multi-temperature trucks will expand to handle mixed chilled and frozen loads in a single trip.

- Automation will rise in door sensors, load balancing, and cooling control for food and pharma logistics.

- Low-GWP refrigerants and lightweight materials will improve environmental performance.

- Last-mile refrigerated vans will grow with e-commerce grocery and meal delivery.

- Rental and leasing models will attract small operators seeking low upfront cost.

- Emerging markets will increase refrigerated fleet investments as food exports and cold chain infrastructure expand.