Market Overview

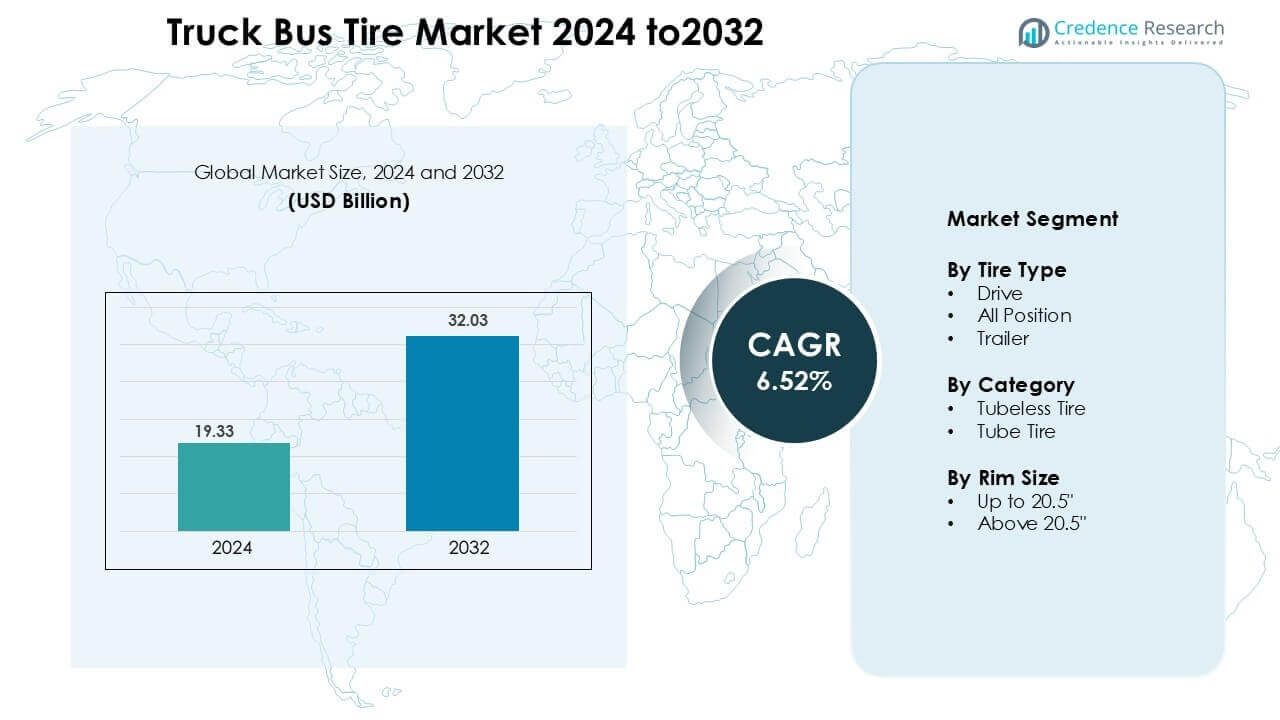

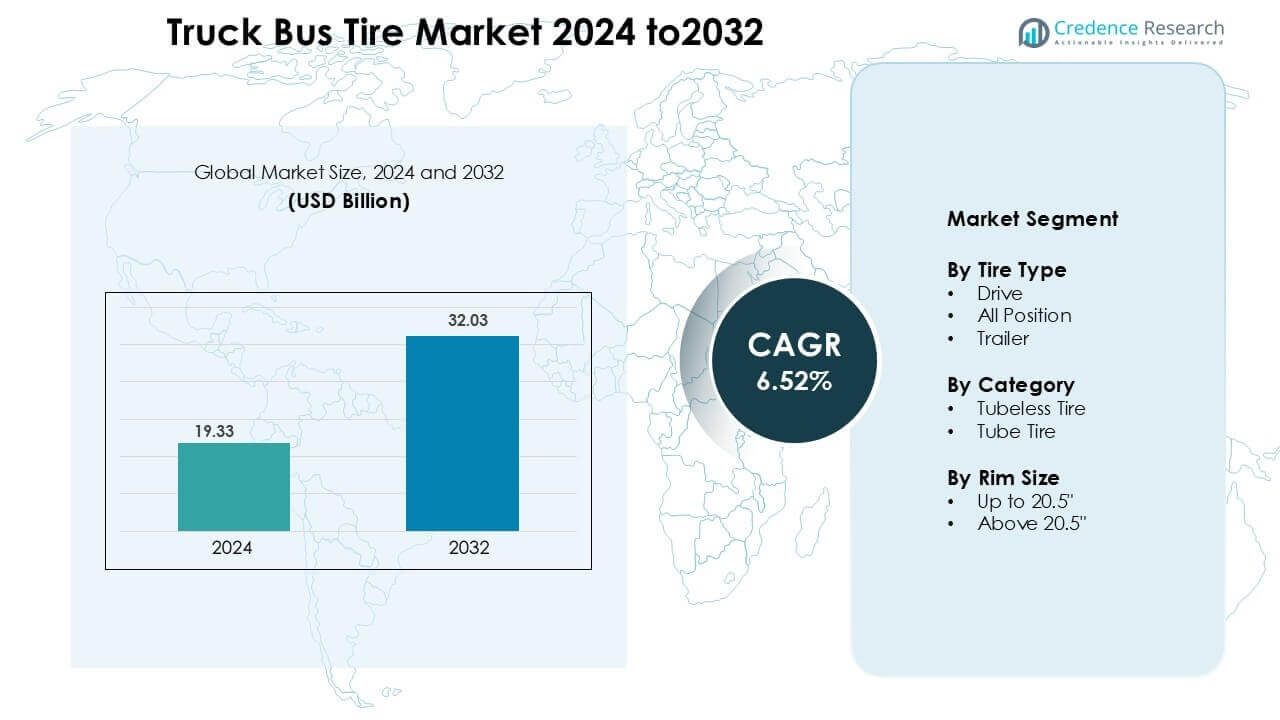

Truck Bus Tire Market was valued at USD 19.33 billion in 2024 and is anticipated to reach USD 32.03 billion by 2032, growing at a CAGR of 6.52 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Truck Bus Tire Market Size 2024 |

USD 19.33 Billion |

| Truck Bus Tire Market, CAGR |

6.52 % |

| Truck Bus Tire Market Size 2032 |

USD 32.03 Billion |

The competitive landscape of the truck and bus tire market features top players such as BRIDGESTONE Corporation, MICHELIN, The Goodyear Tire & Rubber Company, Continental AG, Yokohama Rubber Corporation, Sumitomo Rubber Industries, Ltd., Apollo Tyres, Giti Tire, Kumho Tire and Balkrishna Industries Limited (BKT). These firms compete globally through strong OEM channels, wide aftermarket networks and continuous innovation in fuel‑efficient, low‑rolling resistance tyres. Regionally, the leading market is North America, which holds an estimated 20 % share of the global truck & bus tire market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global truck and bus tire market reached USD 19.33 billion in 2023 and will grow at a CAGR of 6.52 % from 2024‑2032.

- Asia‑Pacific led regionally with a 39% market share in 2023, while the radial tyre segment held a dominant share in the market.

- Major growth drivers include rising e‑commerce logistics, urbanisation boosting commercial vehicle fleets, and infrastructure expansion across emerging economies.

- Market trends highlight adoption of low‑rolling resistance tyres, smart sensors for fleet operations, and increasing shift from tube‑type to tubeless tyres in commercial segments.

- Key restraints stem from raw material cost volatility and pricing pressures in mature markets, limiting margin expansion for tyre manufacturers.

Market Segmentation Analysis:

By Tire Type

Within the tire‑type segmentation, the Drive sub‑segment holds dominance in the global truck and bus tire market, capturing the largest share in 2024. This leadership stems from the drive tire’s critical function in traction and power transmission, especially in heavy‑duty trucks operating long‑haul and regional freight routes. The key drivers include rising logistics and e‑commerce volumes, increasing commercial vehicle mileage, and fleet owners’ demand for high‑durability drive‑axle tires. In contrast, the All‑Position and Trailer segments exhibit faster relative growth as fleets increasingly standardise inventory and opt for flexible tyre usage across axles.

- For instance, the Bridgestone Ecopia tire line, which includes models designed as all-position tires for commercial vehicles, delivers improved fuel economy through low rolling resistance while maintaining durability. This makes it a preferred choice for fleet operators aiming for greater flexibility across multiple axles.

By Category

In the category segmentation, the Tubeless tire segment emerged as the dominant share‑holder in 2024 and continues to expand most rapidly. Market preference for tubeless designs is driven by improved safety (less risk of blow‑outs), lower maintenance costs, rising adoption of smart‑sensor enabled tyres, and regulatory emphasis on durability in commercial vehicles. Tube tires remain relevant in niche or legacy fleets in select markets, but tubeless formats capture most new original‑equipment and replacement demand globally.

- For instance, Continental’s ContiPressureCheck system, which integrates tire pressure monitoring sensors in tubeless tires, helps reduce maintenance costs by detecting pressure issues in real-time, thus improving safety and extending tire life.

By Rim Size

For rim‑size segmentation in the truck and bus tire market, the “Above 20.5″” category dominates share in 2024 and is forecast to maintain leadership. The larger rim‑sized tyres align with heavy‑duty commercial vehicles, long‑haul freight trucks and intercity buses that demand higher load‑bearing capacity, enhanced stability and extended service life. Key growth drivers include growth in global freight transport, heavier vehicle axle loads, and infrastructure upgrades that support larger vehicles. The “Up to 20.5″” segment retains presence in medium‑duty trucks and regional haulage but grows more modestly compared to the larger‑rim cohort.

Key Growth Drivers

Expansion of Freight and Bus Fleet Activity

The global truck and bus tire market has been significantly propelled by the growth in freight transportation and passenger bus services. The expansion of e-commerce, coupled with burgeoning international trade, has led to increased road freight volumes and the consequent demand for heavy-duty commercial vehicles. Meanwhile, urbanisation and public transportation expansion in emerging markets are boosting the number of passenger buses in operation. As each truck and bus represents multiple tire sets over its lifetime, the overall tire replacement and OEM demand rises accordingly. Infrastructure investments such as highway construction and national transport corridors further strengthen vehicle fleet growth, thereby augmenting tire demand across both new builds and replacement cycles.

- For instance, in India, government initiatives promoting public transport expansion, such as the PM e-Bus Sewa scheme, have led to significant bus orders for manufacturers like Tata Motors, which in turn boosts demand for durable bus tires and components.

Technological Advancement & Efficiency Requirements

Manufacturers in the truck and bus tire sector are increasingly driven by performance criteria such as low rolling resistance, extended tread life, and improved durability under heavy loads. Regulatory mandates and fleet-operator demand for fuel economy have encouraged adoption of radial tire constructions and advanced compounds. Additionally, the introduction of smart tire technologies—embedded sensors for pressure, temperature and wear monitoring—adds value and differentiates offerings, thereby fostering growth of premium tire segments. As fleet operators shift toward total cost of ownership models, higher-efficiency tires gain traction, supporting growth in the segment.

- For instance, Michelin’s X-Line Energy tire range, designed for long-haul trucking, offers enhanced fuel efficiency by reducing rolling resistance, helping fleets comply with stringent fuel economy regulations.

Growth in Emerging Markets & Infrastructure Development

Emerging economies, especially in Asia-Pacific and Latin America, are major engines for market growth in the truck and bus tire space. Rapid urbanisation, expanding logistics networks, and government investment in transport infrastructure are driving fleet expansion in these regions. The Asia-Pacific region stands out with approximately half of the global demand in recent years. As new highways, bus rapid transit systems and logistics hubs are established, the need for reliable commercial vehicle tire solutions increases, offering scale opportunities for manufacturers and aftermarket service providers alike.

Key Trends & Opportunities

Smart Tire Integration and Predictive Maintenance

A pronounced trend in the truck and bus tire market is the integration of sensing technologies and predictive maintenance capabilities. Fleet operators are increasingly looking for tires that not only deliver durability but also generate real-time data about wear, pressure and road conditions, enabling proactive maintenance and reducing downtime. Smart tires equipped with embedded sensors support this shift, making them an opportunity for OEMs and aftermarket players to offer value-added services and lifetime support. This trend dovetails with the digitization of fleet operations and connected vehicle ecosystems, offering manufacturers a pathway to higher margin offerings.

- For instance, Goodyear’s SightLine platform, which uses smart tire sensors to monitor tire pressure and temperature in real-time, allows fleet operators to take preventive actions before issues arise, reducing the likelihood of tire failure.

Sustainability, Retreading and Eco-friendly Materials

Environmental concerns and regulatory pressures are compelling a transition toward sustainable tire solutions in the commercial segment. There is growing demand for low rolling-resistance tires, recycled rubber compounds, and retreadable casings which extend lifecycle and reduce waste. Retreading in particular offers fleet operators a cost-effective alternative without compromising performance, whilst enabling tire manufacturers to capture aftermarket value streams. As circular economy principles become more mainstream, investment in eco-friendly manufacturing and materials innovation represents a distinct opportunity in the truck and bus tire market.

- For instance, Goodyear’s “Endurance” tire series uses eco-friendly materials such as soybean oil-based rubber compounds, aiming to reduce environmental impact while maintaining high performance and durability.

Specialty Tires for Electric and Urban Commercial Vehicles

Though still nascent, an important emerging opportunity lies in the development of tires tailored for electric trucks and buses, and urban commercial fleets that face unique operating conditions. For example, electric powertrains impose different torque characteristics and drive cycles, which in turn require optimized tire designs. Urban delivery vehicles and last-mile fleets also create demand for tires capable of frequent stop-start cycles, high mileage, and constrained urban roads. By targeting these niche but growing segments, manufacturers can differentiate their offerings and capture first-mover advantage.

Key Challenges

Raw Material Price Volatility and Supply Chain Risks

Tire manufacturing is heavily dependent on raw materials such as natural rubber, synthetic rubber, steel cord, and carbon black. Fluctuations in natural rubber prices triggered by supply disruptions, climate variability and geopolitical factors impose significant cost pressures on tire producers. Moreover, the complexity of global supply chains for tire components makes the sector vulnerable to logistics disruptions, which can increase lead times and inventories. These cost and supply uncertainties constrain margin stability and may force manufacturers to pass on higher prices, which fleet operators may resist.

Intense Competition and Price Sensitivity in the Aftermarket

The aftermarket for truck and bus tires constitutes a significant share of market volumes, but it is characterized by high price sensitivity and competitive fragmentation. Manufacturers face pressure from low-cost regional producers and generic brands, which can erode pricing power and margin performance. At the same time, innovation cycles (smart tires, eco-materials) demand significant R&D investment, which may be difficult to recoup if the market remains cost-driven. Balancing the need for technological advancement with affordability, especially among fleet operators in emerging markets, remains a persistent strategic challenge.

Regional Analysis

Asia Pacific

The Asia Pacific region commanded the largest share of the truck & bus tire market in 2024, estimated at roughly 39% of global revenue Strong growth stemmed from expanding freight transport, major infrastructure spend in China and India, and rising commercial‑vehicle fleets in Southeast Asia. Additionally, domestic tyre manufacturing hubs and competitive pricing boosted aftermarket replacement demand. The robust logistics network, heavy‑duty operations and regulatory push for durability in tyres further strengthened this region’s leadership position.

North America

North America accounted for an estimated 20% of the global truck & bus tire market revenue in 2024. The region benefits from established long‑haul trucking infrastructure, a mature aftermarket replacement cycle and fleet operators adopting advanced tyre technologies. Demand is driven by fuel‑efficiency regulations and smart‑fleet management trends. Although growth is more moderate compared with emerging regions, technology adoption and premium‑segment tyres raise average selling prices.

Europe

Europe held around 15‑18% of global market share for truck & bus tyres in 2024, supported by robust commercial‑vehicle usage and retrofit markets. Infrastructure modernisation, stringent emissions and tyre performance standards, and replacement cycles of heavy commercial fleets underpin demand. Growth is stable, driven by regional logistics consolidation and premium product uptake, though market maturity limits the pace of expansion compared to Asia‑Pacific.

Latin America

Latin America represented approximately 10% of the global truck & bus tire market in 2024. A surge in regional freight, infrastructure upgrades and fleet renewal in Brazil, Argentina and Mexico underlie this share. Still, weaker replacement cycles, currency volatility and lower average selling prices constrain volume growth. Opportunities lie in aftermarket expansion and increasing usage of tubeless and larger rim‑sized tyres.

Middle East & Africa (MEA)

The MEA region captured roughly 8% of the global truck & bus tyre market in 2024. Growth is driven by rising logistics in oil‑and‑gas, mining operations and road‑transport infrastructure expansion across GCC and African markets. However, challenging terrain, high import duties, limited local manufacturing and slower fleet replacement hinder faster growth. Nonetheless, the region offers opportunity for premium tyres and retreading services as fleet durability demands rise.

Market Segmentations

By Tire Type

- Drive

- All Position

- Trailer

By Category

By Rim Size

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the global truck & bus tire market features a moderately concentrated structure in which the top ten players command approximately 60 % of global sales, underscoring significant scale advantages. Bridgestone Corporation, MICHELIN and The Goodyear Tire & Rubber Company maintain leading positions through strong brand recognition, extensive global manufacturing networks, and large fleets of commercial‑vehicle customers. Regional entrants particularly Chinese manufacturers are expanding rapidly, leveraging cost‑efficient production and rising export capabilities to challenge legacy brands. Innovation in product technologies such as low‑rolling‑resistance compounds, smart sensors and tubeless constructions serves as a key differentiator. Meanwhile, firms pursue vertical integration of raw materials, strategic acquisitions and channel expansion to strengthen margins amid raw‑material volatility and pricing pressures. The combined effect of global scale, technological leadership and regional adaption shapes competitive dynamics for new entrants and incumbent firms alike.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Continental unveiled the Conti Urban HA 5 NXT city-bus tire. Up to 60% renewable/recycled materials, and 25% lower rolling resistance. Continental cites up to 15% more range for e-buses

- In July 2025, Yokohama launched the BluEarth 718L long-haul drive tire. Sizes include 295/75R22.5, 11R22.5, 285/75R24.5, and 11R24.5.

Report Coverage

The research report offers an in-depth analysis based on Tire Type, Category, Rim Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Truck and bus tire demand will expand steadily as global freight and logistics networks grow and commercial vehicle fleets increase.

- Adoption of smart tyres and IoT sensors will advance significantly, enabling real‑time monitoring of pressure, wear and temperature across fleets.

- Demand for low rolling resistance and fuel‑efficient tyres will rise as fleet operators focus on cost reduction and regulatory compliance.

- Radial tyres will continue to replace bias‑ply types in commercial vehicles, especially in heavy‑duty applications.

- Emerging markets (Asia‑Pacific, Africa, Latin America) will capture a larger share of the market as infrastructure investment and vehicle penetration accelerate.

- After‑market replacement demand will strengthen as older commercial vehicles reach end of tyre life and fleet operators opt for upgraded tyre formats.

- Tyre manufacturers will face increased pressure to integrate sustainable materials and retreading solutions to meet environmental and circular‑economy mandates.

- Larger rim‑size segments and heavy‑duty tyre formats will grow faster due to heavier axle loads and longer haulage operations in global trade

- The OEM channel will maintain importance, but the aftermarket segment will grow faster and drive volume increases in mature markets.

- Competitive pressure will escalate from cost‑efficient regional and Chinese manufacturers, forcing global players to differentiate via premium products, technology and global service‑networks.