Market Overviews

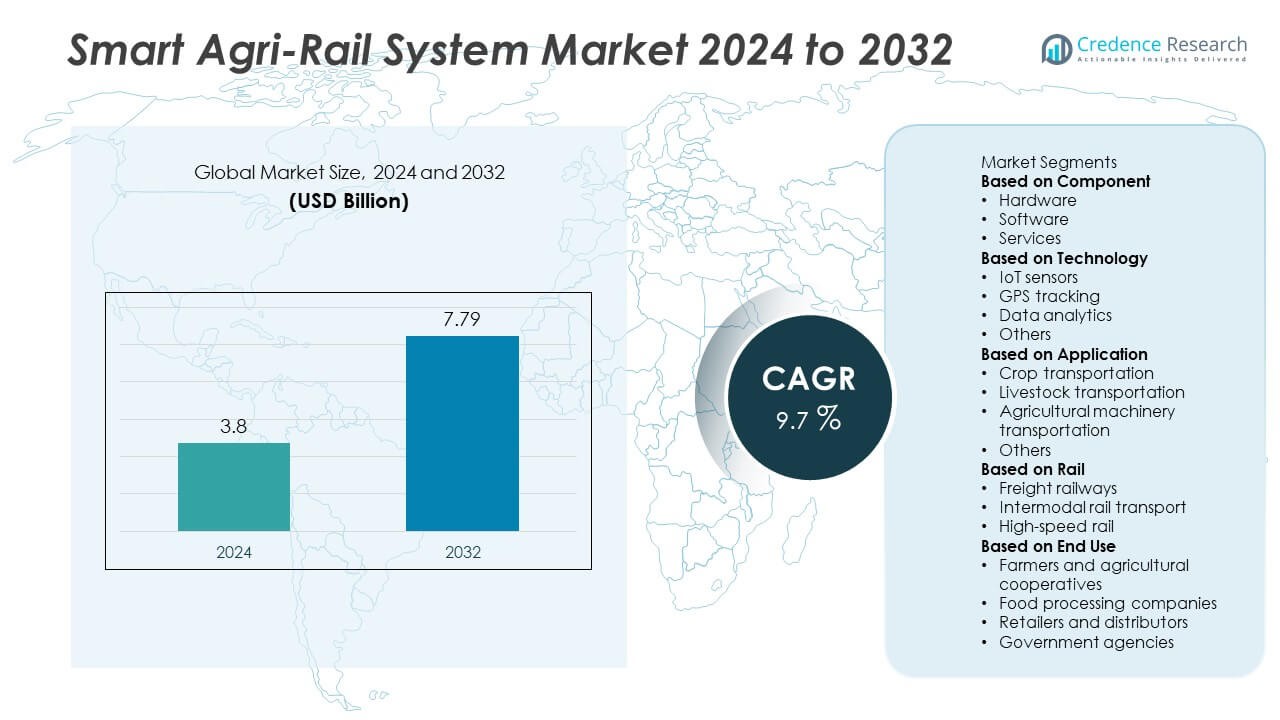

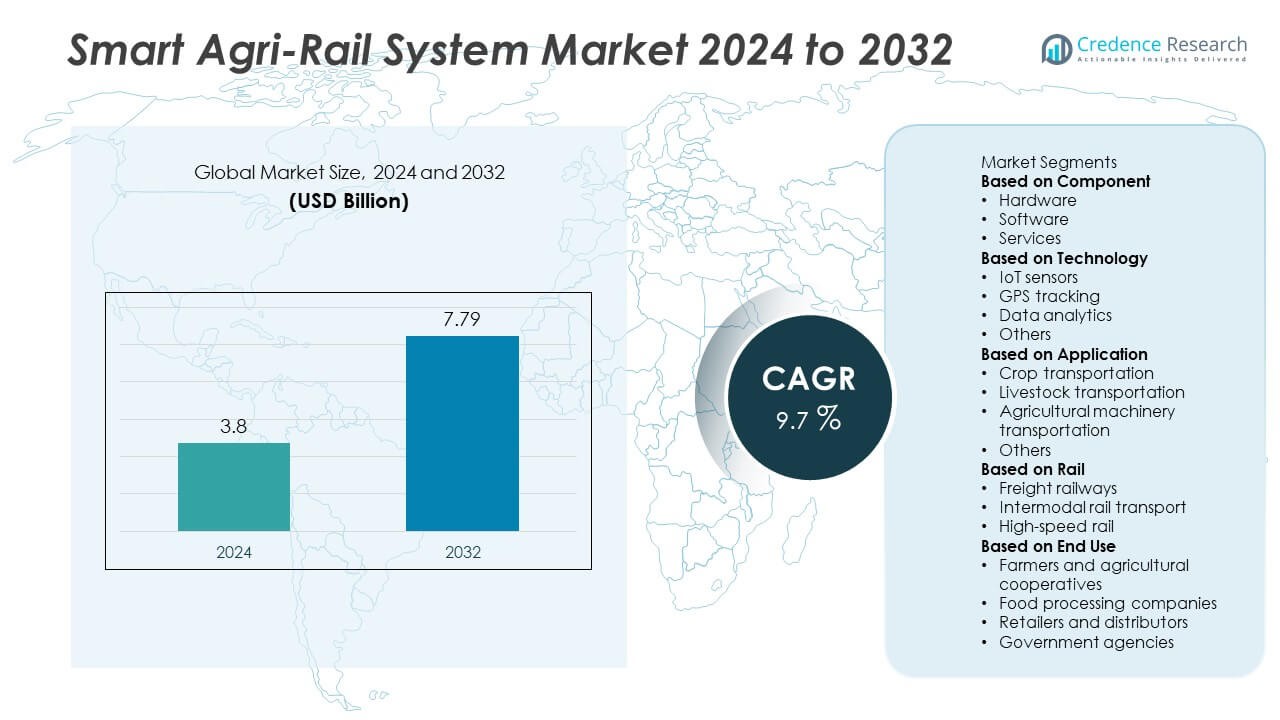

The global Smart Agri-Rail System market was valued at USD 3.8 billion in 2024 and is projected to reach USD 7.79 billion by 2032, expanding at a CAGR of 9.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Agri-Rail System Market Size 2024 |

USD 3.8 Billion |

| Smart Agri-Rail System Market, CAGR |

9.7% |

| Smart Agri-Rail System Market Size 2032 |

USD 7.79 Billion |

The Smart Agri-Rail System market is led by key players such as Hitachi Rail Limited, DB Cargo AG, ABB Ltd., CRRC Corporation Limited, Alstom Transport India Limited, Siemens Mobility GmbH, Nexxiot AG, Swire Shipping Pte. Ltd., AMCS Group Limited, and 2K Shipping Company Limited. These companies maintain leadership through advanced IoT-enabled sensors, GPS tracking, and data analytics platforms that optimize agricultural logistics. North America holds the largest share at 38.1%, supported by modern rail infrastructure and adoption of connected freight systems. Europe follows with 27.5% share, driven by sustainability initiatives and digital logistics networks. Asia-Pacific captures 24.3% share, fueled by urbanization, agri-trade growth, and government investment in smart transport corridors. The combined focus on operational efficiency, predictive maintenance, and real-time monitoring positions these players to capitalize on expanding demand across global agricultural supply chains.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Smart Agri-Rail System market was valued at USD 3.8 billion in 2024 and is projected to reach USD 7.79 billion by 2032, growing at a CAGR of 9.7%.

- Growth is driven by rising adoption of IoT sensors, GPS tracking, and data analytics to enhance agricultural logistics efficiency and reduce post-harvest losses.

- Key trends include the expansion of intermodal rail transport, integration of AI for predictive maintenance, and increasing deployment of portable monitoring devices across supply chains.

- The market is competitive, with major players such as Hitachi Rail, DB Cargo, ABB, CRRC Corporation, Alstom, and Siemens focusing on innovation, partnerships, and regional expansion to capture agricultural freight opportunities.

- Regionally, North America leads with 38.1% share, followed by Europe at 27.5%, Asia-Pacific at 24.3%, Latin America at 6.2%, and Middle East & Africa at 3.9%. Freight railways dominate the rail segment with 52.4% share, driven by bulk cargo efficiency.

Market Segmentation Analysis:

By Technology

The IoT sensors segment dominated the smart agri-rail system market in 2024, accounting for 41.6% share. These sensors play a crucial role in real-time monitoring of temperature, humidity, and vibration during agricultural goods transportation. Their integration ensures improved crop quality, reduced spoilage, and enhanced supply chain visibility. Growing adoption of connected logistics and predictive maintenance across freight systems further strengthens this segment. Governments and logistics providers are increasingly deploying IoT-based solutions to achieve higher operational efficiency and traceability, driving steady demand across developed and emerging economies.

- For instance, Siemens Mobility deployed IoT-enabled Railigent X sensors capable of capturing up to 50 data points per second on temperature, vibration, and pressure variations, allowing real-time diagnostics and predictive maintenance across over 7,000 connected rail assets in Europe.

By Application

The crop transportation segment held the largest share of 46.3% in 2024, driven by rising global food trade and the need for efficient post-harvest logistics. Smart agri-rail systems enable real-time tracking of perishables, ensuring freshness and reducing wastage. Automated temperature control and data analytics enhance quality assurance during long-distance transportation. With increasing exports of grains, fruits, and vegetables, demand for intelligent rail-based crop logistics continues to grow. The expansion of agri-supply chain digitization programs further boosts adoption of these smart rail systems worldwide.

- For instance, Hitachi Rail implemented its Lumada Intelligent Mobility Management suite in various projects to optimize city-wide transport operations, such as its partnership with the Municipality of Genoa and local public transport operator AMT to digitally connect all public and private hire transport via the 360Pass app, using data analytics from 7,000 Bluetooth sensors to provide real-time information and encourage a shift to sustainable mobility.

By Rail

The freight railways segment accounted for 52.4% share of the global market in 2024, reflecting its critical role in bulk agricultural transport. Freight railways provide cost-effective, energy-efficient solutions for large-scale movement of agricultural commodities. Integration of GPS tracking, IoT sensors, and data analytics has enhanced scheduling accuracy and cargo security. Major agricultural economies rely on freight networks to streamline farm-to-market connectivity and reduce transit delays. Continuous investment in smart freight infrastructure and modernization of rail fleets further strengthens the segment’s dominance in global agri-logistics.

Key Growth Drivers

Integration of IoT and Automation Technologies

The growing use of IoT-enabled sensors and automation in agricultural logistics is driving the smart agri-rail system market. These technologies provide real-time tracking of perishable goods, optimize temperature and humidity levels, and ensure efficient route management. The integration of automation in freight scheduling and cargo handling reduces delays and losses. As agriculture modernizes, connected systems enhance transparency, improve operational efficiency, and lower transport costs, encouraging widespread adoption across major agricultural economies.

- For instance, KONUX GmbH deployed its “Switch” IoT sensor solution for Deutsche Bahn, improving component lifetime by 20 and reducing repair downtime by 45.

Government Support for Smart Infrastructure

Rising government investments in smart transportation and digital agriculture are fueling market growth. Policies promoting intelligent logistics networks and sustainable food supply chains are driving adoption of smart rail systems. Funding for rural connectivity and infrastructure modernization supports integration of IoT, AI, and analytics in rail transport. Public-private collaborations are also expanding, aiming to improve agricultural export logistics and reduce food waste. This institutional backing ensures steady growth across both developed and emerging regions.

- For instance, Alstom implemented its HealthHub predictive maintenance platform across France’s high-speed TGV fleet, analyzing over 6 billion data points each month from connected train components to enhance reliability and cut maintenance time by 15,000 hours annually.

Rising Demand for Efficient Agricultural Logistics

Increasing global food trade and urbanization are creating a strong need for efficient transportation systems. Smart agri-rail solutions help move large agricultural volumes quickly while maintaining product quality. The systems enhance coordination between farms, processing centers, and distributors through data-driven planning. The growing pressure to minimize post-harvest losses and optimize cold-chain logistics drives continued investment. As climate variability affects supply chains, intelligent rail systems provide stable and sustainable transport solutions for agricultural goods.

Key Trends & Opportunities

Adoption of Predictive Data Analytics

Data analytics is becoming a core component of smart agri-rail systems. Predictive algorithms analyze cargo data to forecast maintenance needs, monitor shipment conditions, and reduce spoilage. This proactive approach ensures cost savings and higher reliability in logistics operations. Companies are leveraging cloud-based analytics to enhance decision-making, while AI integration improves accuracy and performance. The trend toward data-driven rail systems offers significant opportunities for technology providers and logistics operators to strengthen efficiency and sustainability.

- For instance, SBB Cargo AG gathers telematic data from over 185,000 tonnes of freight handled daily and uses the Railnova Railgenius remote-monitoring platform to predict component failures across its fleet.

Expansion of Intermodal Transport Networks

The combination of rail, road, and sea transport is emerging as a key opportunity. Intermodal systems equipped with smart tracking enable seamless movement of agricultural commodities from farms to global markets. Governments and logistics firms are investing in smart terminals that connect rail networks with other transport modes. This approach enhances flexibility, reduces fuel consumption, and supports greener logistics operations. The expansion of intermodal connectivity is expected to reshape the global agricultural supply chain landscape.

- For instance, CargoBeamer AG announced that its forthcoming terminal in Kaldenkirchen, Germany will have a handling capacity of 228,000 loading-units per annum via its automated road-rail transshipment system.

Increasing Focus on Sustainable Transportation

Sustainability is becoming a major driver of innovation in the market. Smart agri-rail systems reduce carbon emissions by optimizing routes and replacing road freight with energy-efficient rail transport. Electrification of freight networks and adoption of renewable-powered locomotives are gaining traction. Environmental regulations and corporate sustainability goals encourage investment in low-emission logistics. This growing emphasis on green transportation offers long-term opportunities for market expansion and stakeholder collaboration.

Key Challenges

High Implementation and Maintenance Costs

The deployment of IoT-based smart rail systems requires significant upfront investment in sensors, connectivity, and digital infrastructure. Developing nations face budget limitations that slow technology adoption. Additionally, ongoing maintenance of sensors, communication networks, and analytics platforms adds operational costs. Limited technical expertise and uneven digital infrastructure further restrain implementation. Reducing costs through scalable technologies and public-private partnerships remains essential to achieving broader adoption across agricultural supply chains.

Data Security and Connectivity Limitations

Data protection and connectivity challenges continue to hinder widespread adoption. Smart agri-rail systems rely heavily on real-time data exchange between multiple stakeholders, making them vulnerable to cyber threats. Inadequate internet coverage in rural or remote farming areas disrupts communication and tracking. Addressing these challenges requires strong cybersecurity frameworks and reliable digital networks. Collaboration between technology providers and railway authorities is vital to ensure secure, uninterrupted operations and build user confidence in connected agri-logistics.

Regional Analysis

North America

North America dominated the smart agri-rail system market in 2024 with a 38.1% share. The region’s leadership is supported by advanced digital infrastructure, strong integration of IoT in logistics, and robust investment in agricultural automation. The United States leads due to the early adoption of connected freight technologies and AI-driven rail management systems. Strategic collaborations between rail operators and agri-tech firms enhance operational efficiency and crop transport safety. Government initiatives promoting smart transportation and sustainable logistics continue to strengthen market growth across the U.S. and Canada.

Europe

Europe accounted for 27.5% share of the global smart agri-rail system market in 2024, driven by strict sustainability regulations and advanced rail infrastructure. Countries such as Germany, France, and the Netherlands are leading adopters due to their focus on digital logistics and green transport. The European Union’s funding for smart mobility and agricultural supply chain modernization supports large-scale implementation. Increasing use of predictive analytics and automated freight monitoring improves rail efficiency. The region’s commitment to reducing emissions and food waste further boosts demand for smart agri-rail systems.

Asia-Pacific

Asia-Pacific captured 24.3% share of the global market in 2024 and is projected to record the fastest growth during the forecast period. Rapid urbanization, expanding agri-trade, and government investment in smart transport corridors drive adoption. China, India, and Japan are leading markets due to large-scale agricultural exports and logistics modernization initiatives. The integration of IoT-enabled freight monitoring and data analytics enhances transparency in perishable goods transportation. Growing demand for real-time tracking and smart rail networks aligns with regional digitalization programs, positioning Asia-Pacific as a major future growth hub.

Latin America

Latin America held 6.2% share of the smart agri-rail system market in 2024, fueled by expanding agricultural exports and modernization of rail logistics. Brazil and Mexico dominate due to strong government initiatives supporting agri-transport infrastructure. Increasing adoption of smart sensors and GPS-enabled freight management systems enhances efficiency and reduces post-harvest losses. Growing collaboration between rail operators and agri-tech firms supports wider implementation. Regional efforts to improve food supply chains and boost export competitiveness are expected to drive steady market expansion in the coming years.

Middle East & Africa

The Middle East & Africa region represented 3.9% share of the smart agri-rail system market in 2024. Growth is supported by rising focus on food security, agricultural diversification, and smart transport infrastructure. The UAE and Saudi Arabia are leading adopters, driven by investments in digital logistics networks. Africa’s agricultural exporters, including South Africa and Kenya, are beginning to adopt IoT-enabled freight systems to reduce wastage and improve traceability. Although infrastructure gaps remain, expanding trade routes and government-backed digital transformation programs are expected to accelerate regional market development.

Market Segmentations:

By Component

- Hardware

- Software

- Services

By Technology

- IoT sensors

- GPS tracking

- Data analytics

- Others

By Application

- Crop transportation

- Livestock transportation

- Agricultural machinery transportation

- Others

By Rail

- Freight railways

- Intermodal rail transport

- High-speed rail

By End Use

- Farmers and agricultural cooperatives

- Food processing companies

- Retailers and distributors

- Government agencies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Smart Agri-Rail System market features key players such as Hitachi Rail Limited, DB Cargo AG, ABB Ltd., CRRC Corporation Limited, Alstom Transport India Limited, Siemens Mobility GmbH, Nexxiot AG, Swire Shipping Pte. Ltd., AMCS Group Limited, and 2K Shipping Company Limited. These companies are at the forefront of integrating advanced technologies like IoT sensors, GPS tracking, and data analytics into rail-based agricultural logistics. Their strategies include forming strategic partnerships, investing in automation, and expanding intermodal transport solutions to enhance efficiency and sustainability in agricultural supply chains. For instance, Siemens Mobility has introduced ‘Signaling X’, a centralized control system that integrates mainline and mass transit signaling using standardized hardware, optimizing freight operations. Similarly, Alstom’s collaboration with Flox aims to develop AI systems to prevent train-wildlife collisions, showcasing a commitment to safety and innovation. As the market evolves, these players continue to drive advancements, positioning themselves as leaders in the smart agri-rail sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens

- Hitachi Rail

- Alstom

- Wabtec

- CRRC Corporation

- Bombardier Transportation

- GE Transportation

- Kawasaki Heavy Industries

- ABB

- Honeywell

Recent Developments

- In 2025, Hitachi Rail announced the deployment of its HMAX digital asset-management platform integrated with the NVIDIA IGX Thor solution, delivering up to 8× higher AI compute and 2× better connectivity for real-time sensor processing on trains and infrastructure.

- In February 2024, Siemens Mobility founded its subsidiary Smart Train Lease GmbH to offer short-term leasing of battery, hydrogen and electric multiple-unit trains initially in Germany, supported by a fleet of 12 electric Mireo Smart units planned for the German market.

- In 2023, Alstom launched its Digital Experience Centre in Bangalore (India) spanning 5 000 sq ft (with associated lab infrastructure of 60 000 sq ft) to support the engineering of next-generation signalling solutions for both urban and main-line rail.

Report Coverage

The research report offers an in-depth analysis based on Component, Technology, Application, Rail, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Smart agri-rail systems will see wider adoption in emerging agricultural markets.

- IoT and data analytics will increasingly optimize crop transportation and reduce spoilage.

- Integration with AI will enhance predictive maintenance and operational efficiency.

- Intermodal transport solutions will expand, linking rail, road, and sea networks.

- Governments will continue funding smart transport corridors and agri-logistics modernization.

- Freight railways will maintain dominance due to cost-efficiency and bulk cargo capabilities.

- Demand for real-time monitoring of perishable goods will drive technology upgrades.

- Sustainability initiatives will promote electrification and low-emission rail operations.

- Private-public partnerships will accelerate infrastructure development and smart system deployment.

- Regional digitalization programs will position Asia-Pacific and North America as key growth hubs.