Market Overview

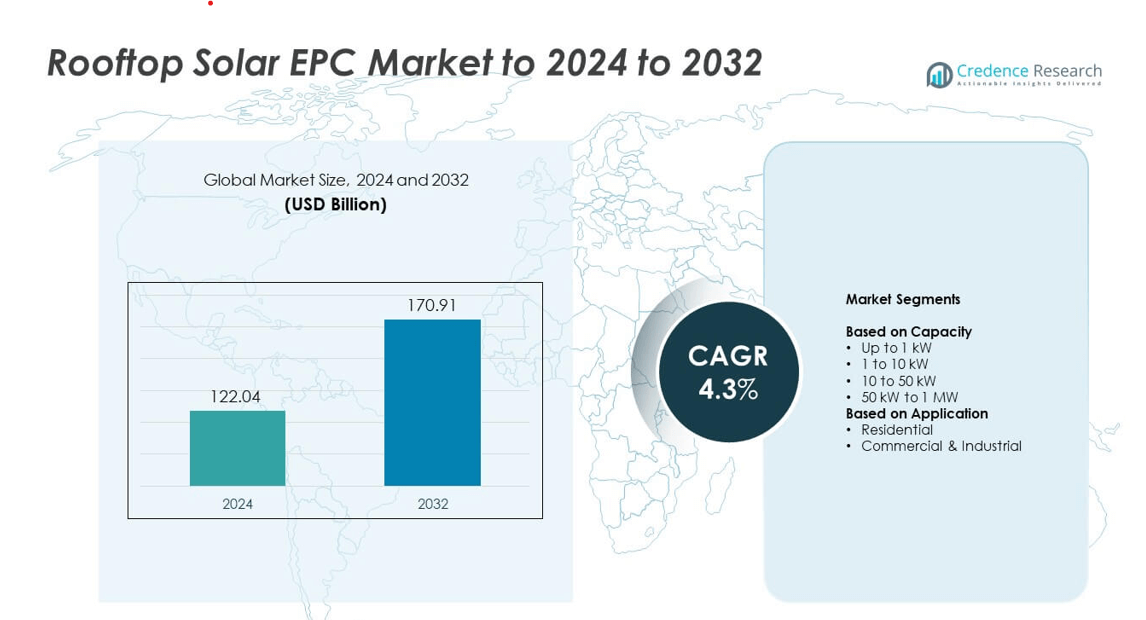

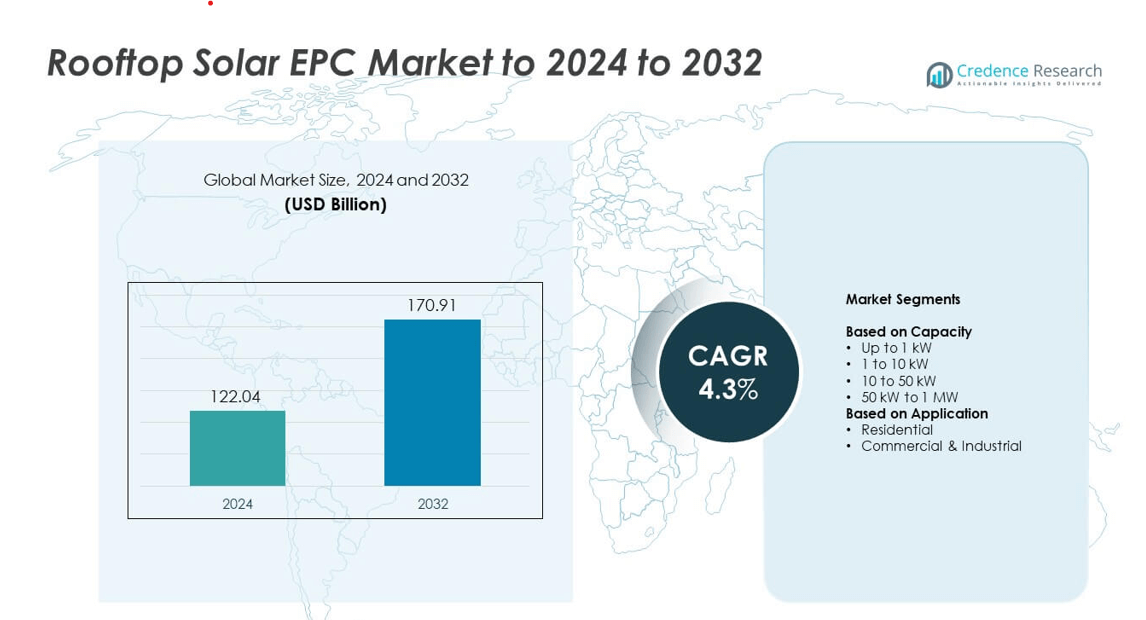

The rooftop solar EPC market size was valued at USD 122.04 billion in 2024 and is anticipated to reach USD 170.91 billion by 2032, at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rooftop Solar EPC Market Size 2024 |

USD 122.04 billion |

| Rooftop Solar EPC Market, CAGR |

4.3% |

| Rooftop Solar EPC Market Size 2032 |

USD 170.91 billion |

The rooftop solar EPC market is highly competitive, with major players such as TATA Power Solar, Mahindra Susten, Waaree Energies Ltd., VIKRAM SOLAR LTD., L&T, and Goldi Solar, Inc. leading global operations. These companies focus on integrated project delivery, technological innovation, and cost-efficient solutions to strengthen their market presence. Strategic partnerships, digital EPC platforms, and advanced energy storage integration are key differentiators among top players. Regionally, North America led the market with a 36% share in 2024, driven by robust government incentives and corporate sustainability goals, followed by Europe with 30% and Asia-Pacific with 28%.

Market Insights

- The rooftop solar EPC market was valued at USD 122.04 billion in 2024 and is projected to reach USD 170.91 billion by 2032, growing at a CAGR of 4.3%.

- Increasing demand for clean and cost-effective power solutions and favorable government incentives are key drivers supporting strong market expansion.

- Advancements in digital EPC platforms, AI-based monitoring, and energy storage integration are transforming project execution and operational efficiency.

- The market is highly competitive, with leading players focusing on turnkey solutions, strategic collaborations, and high-efficiency module integration to strengthen their positions.

- North America dominated with a 36% share in 2024, followed by Europe at 30% and Asia-Pacific at 28%, while the 50 kW to 1 MW capacity segment led the market with a 42% share due to growing adoption across industrial and commercial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Capacity

The 50 kW to 1 MW segment dominated the rooftop solar EPC market with a 42% share in 2024. This segment’s dominance is driven by large-scale installations across commercial and industrial facilities aiming to offset high energy costs. Businesses adopt systems in this range to achieve significant reductions in grid dependency and improve long-term energy security. The growing preference for medium to large-capacity systems among manufacturing units and logistics centers enhances market growth, supported by favorable net-metering policies and declining module prices that make larger installations financially viable.

- For instance, Amplus Solar built a 4 MW rooftop at Yamaha’s Greater Noida plant, then added a further 2 MW plus a 100 kWp carport at the same facility.

By Application

The commercial and industrial segment held the largest share of 61% in 2024, supported by rapid adoption across corporate campuses, warehouses, and retail chains. Companies are investing in rooftop solar to meet sustainability goals and reduce operational expenses. The segment’s expansion is fueled by government incentives, corporate ESG commitments, and increased availability of third-party financing models. Industrial users, in particular, prefer solar EPC solutions due to predictable project timelines, turnkey service delivery, and improved returns from self-consumption and energy trading opportunities.

- For instance, Prologis announced in December 2023 that it had crossed the 500 MW threshold for its global rooftop solar portfolio

Key Growth Drivers

Rising Demand for Clean and Cost-Effective Energy

The growing shift toward renewable energy is driving strong demand for rooftop solar EPC projects. Businesses and households seek cost-effective and sustainable power alternatives. Falling solar panel prices and improved financing models make installations more accessible. Long-term savings on electricity bills and reduced emissions further enhance adoption. This growing interest supports the global transition toward decentralized clean energy generation and increases investments in rooftop solar capacity.

- For instance, Sunrun installed 242.4 MW of solar and 392 MWh of storage in Q4 2024, reflecting strong household adoption of distributed energy.

Government Incentives and Policy Support

Supportive government policies, including subsidies, tax rebates, and net-metering schemes, are accelerating rooftop solar EPC growth. Regulatory frameworks in major markets such as India, China, and the U.S. encourage both residential and commercial installations. Streamlined project approvals and state-backed incentives enhance the profitability of EPC projects. Renewable purchase obligations and public investments provide additional momentum. These policy measures ensure long-term stability and strengthen investor confidence in the rooftop solar EPC sector.

- For instance, a July 4, 2025, press release from the parent company, Tata Power, mentions that its solar arm has reached a portfolio of 3.4 GW of total installed capacity, exceeding 2 lakh rooftop solar installations.

Corporate Sustainability and ESG Commitments

Corporations are increasingly investing in rooftop solar to meet sustainability and decarbonization targets. The rising focus on achieving net-zero emissions has driven industries to adopt on-site renewable energy systems. EPC providers benefit from corporate ESG mandates that prioritize clean energy procurement. This shift enhances brand value, improves energy security, and reduces long-term operational costs. As a result, corporate adoption continues to expand across manufacturing, retail, and logistics sectors.

Key Trends & Opportunities

Advancement in Smart Monitoring and Digital EPC Solutions

Technological innovation is transforming EPC operations through smart monitoring and digital project management tools. AI-based analytics, IoT sensors, and predictive maintenance platforms enable efficient performance tracking. These tools improve energy output, reduce downtime, and enhance asset optimization. EPC firms integrating such technologies can deliver high-value turnkey projects. This digital transformation supports cost efficiency and positions tech-driven EPC players as key beneficiaries in future solar infrastructure development.

- For instance, As of the end of the second quarter of 2025, Enphase reported that it had shipped approximately 83.1 million microinverters and deployed more than 4.9 million Enphase-based systems globally.

Growth of Battery Storage Integration

The integration of battery storage with rooftop solar systems is creating major opportunities for EPC firms. Businesses and households are adopting hybrid systems to store excess energy and ensure continuous power supply. Falling battery prices and advancements in lithium-ion technology drive adoption. EPC contractors offering combined solar-plus-storage projects gain competitive advantage. These systems improve grid resilience, enable peak-load management, and expand opportunities for distributed energy generation.

- For instance, Sungrow signed distribution deals for 1.7 GWh of C&I energy-storage systems in Australia, enabling large solar-plus-storage rollouts over three years.

Key Challenges

High Upfront Costs and Financing Barriers

The high initial cost of rooftop solar systems continues to limit adoption, particularly among small consumers. Access to affordable financing and awareness of financial incentives remain limited in developing regions. Many households and SMEs face difficulties obtaining loans for installations. EPC firms must collaborate with financial institutions to promote leasing and low-cost financing models. Addressing these financial barriers is crucial to accelerate adoption and sustain long-term market growth.

Grid Integration and Policy Uncertainty

Regulatory inconsistency and grid integration issues pose significant challenges to market expansion. In several regions, interconnection delays, voltage fluctuations, and capacity restrictions hinder smooth rooftop solar deployment. Unclear or changing net-metering regulations further discourage new adopters. Harmonized grid standards and predictable policies are vital for stable sector growth. Collaboration among EPC firms, utilities, and policymakers will be essential to overcome these integration challenges and ensure scalability.

Regional Analysis

North America

North America held the largest share of 36% in the rooftop solar EPC market in 2024. The region’s growth is driven by strong policy frameworks, net-metering benefits, and declining installation costs. The U.S. leads due to federal tax credits and state-level incentives promoting rooftop solar adoption in both residential and commercial sectors. Corporate sustainability targets and demand for energy independence further boost market expansion. Canada also supports growth through renewable energy mandates and increased investments in distributed solar projects, strengthening the overall regional market outlook.

Europe

Europe accounted for a 30% share in 2024, supported by ambitious renewable energy goals and carbon neutrality commitments. Germany, Italy, and the Netherlands lead rooftop solar adoption under the EU’s Fit for 55 initiative. Financial incentives and rooftop integration mandates in new buildings drive expansion. EPC firms benefit from established regulatory frameworks and mature financing models. Growing interest in decentralized energy generation and integration with storage systems strengthens project demand. Increased investments in digital EPC solutions and smart grid compatibility continue to support regional market growth.

Asia-Pacific

Asia-Pacific held a 28% share in 2024, emerging as one of the fastest-growing regions in the rooftop solar EPC market. China, India, and Japan dominate installations due to large-scale urban solar adoption and government-driven programs. Subsidies, net-metering schemes, and rooftop solar mandates for industrial buildings stimulate growth. Declining solar component costs and the presence of major EPC providers enhance competitiveness. Rapid industrialization, urban energy demand, and corporate sustainability goals make Asia-Pacific a critical hub for distributed renewable power deployment across both residential and industrial sectors.

Latin America

Latin America captured a 4% share in 2024, supported by increasing energy diversification efforts and favorable climatic conditions. Brazil and Mexico are leading markets, driven by policy reforms promoting rooftop solar systems under net-metering frameworks. Industrial users and small businesses adopt rooftop solar EPC solutions to lower energy costs and improve reliability. However, limited financing availability and regulatory delays slightly restrain broader expansion. Growing interest from international EPC players and public-private partnerships is expected to strengthen project deployment in the coming years.

Middle East & Africa

The Middle East & Africa region accounted for a 2% share in 2024, showing steady progress in rooftop solar EPC adoption. The United Arab Emirates and Saudi Arabia lead the regional transition through national renewable strategies and solar energy diversification plans. Urban development projects and large commercial facilities increasingly integrate rooftop systems to reduce grid dependence. In Africa, rooftop solar EPC growth is driven by the need for reliable off-grid power solutions. Expanding government support and international EPC collaborations are expected to improve long-term market penetration.

Market Segmentations:

By Capacity

- Up to 1 kW

- 1 to 10 kW

- 10 to 50 kW

- 50 kW to 1 MW

By Application

- Residential

- Commercial & Industrial

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

Key players in the rooftop solar EPC market include TATA Power Solar, Mahindra Susten, Waaree Energies Ltd., VIKRAM SOLAR LTD., L&T, Goldi Solar, Inc., Amplus Solar, BELECTRIC, JUWI, CJR Renewables, CHINT Group, Jakson, Candi Solar, and Eternia Solar. The competitive landscape is characterized by turnkey service providers offering end-to-end project execution from design and procurement to installation and maintenance. Companies are focusing on cost optimization, high-efficiency module integration, and digital project management tools to improve operational performance. Strategic partnerships with financial institutions and government agencies are helping EPC firms expand their customer base. Growing adoption of rooftop systems across residential, commercial, and industrial sectors has intensified competition, leading to continuous advancements in installation speed, quality, and scalability. Firms are also prioritizing energy storage integration and smart monitoring systems to enhance long-term reliability and optimize power generation efficiency in decentralized solar energy infrastructure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- TATA POWER SOLAR

- Mahindra Susten

- Waaree Energies Ltd.

- VIKRAM SOLAR LTD.

- L&T

- Goldi Solar, Inc.

- Amplus Solar

- BELECTRIC

- JUWI

- CJR Renewables

- CHINT Group

- Jakson

- Candi Solar

- Eternia Solar

Recent Developments

- In 2025, Amplus Solar planned to commission its first on-site integrated hybrid solar, wind, and battery storage project.

- In 2025, Candi Solar Focused on developing solar projects in emerging markets, with plans to develop 200 MW in India and South Africa.

- In 2024, L&T carved out a separate business vertical for Renewable EPC from its Power Transmission & Distribution segment.

Report Coverage

The research report offers an in-depth analysis based on Capacity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The rooftop solar EPC market will continue expanding due to rising clean energy adoption worldwide.

- Growing government incentives and renewable mandates will strengthen commercial and industrial rooftop installations.

- Technological innovations in solar tracking and digital EPC platforms will enhance project efficiency.

- Battery storage integration will create new business opportunities for hybrid rooftop systems.

- Falling module and inverter prices will improve project affordability and accelerate installation rates.

- Corporate ESG commitments will boost demand for large-scale rooftop solar solutions.

- Urbanization and distributed power generation initiatives will drive adoption in emerging economies.

- Improved financing models and leasing options will attract small-scale residential users.

- Digital monitoring and predictive maintenance tools will optimize long-term system performance.

- Collaboration between EPC firms, utilities, and governments will shape a resilient and sustainable rooftop solar ecosystem.