Market Overview

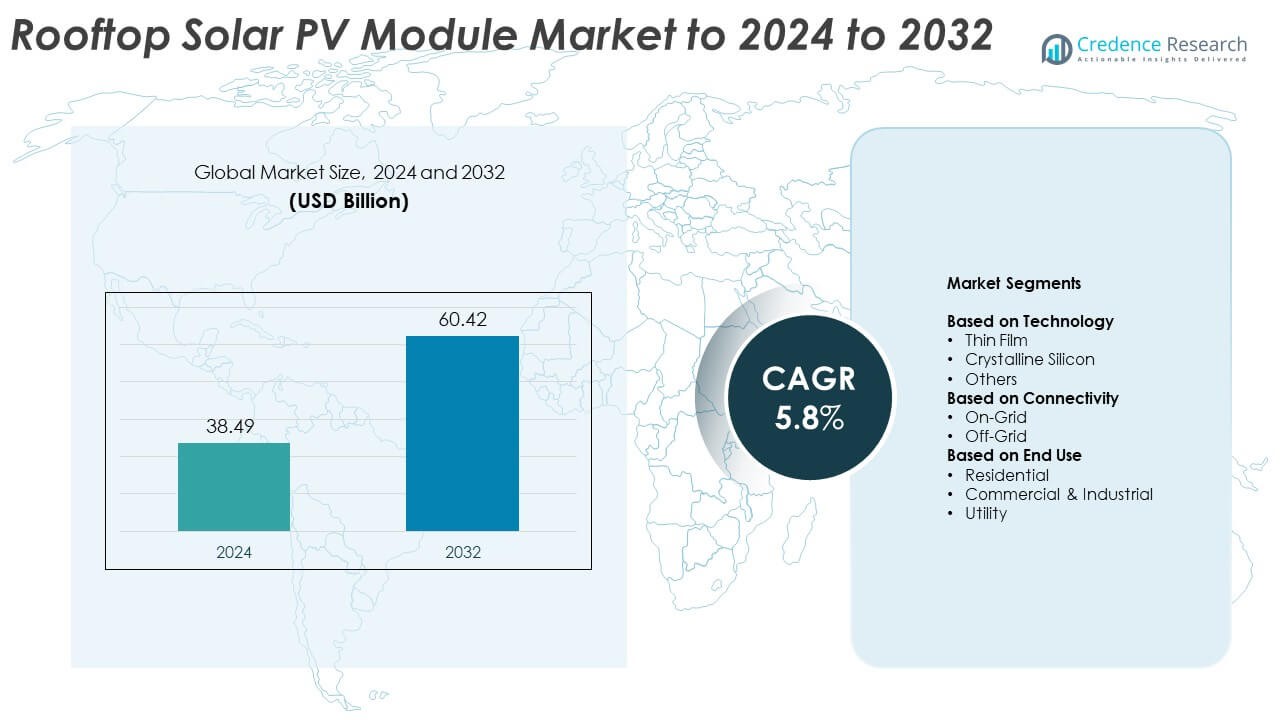

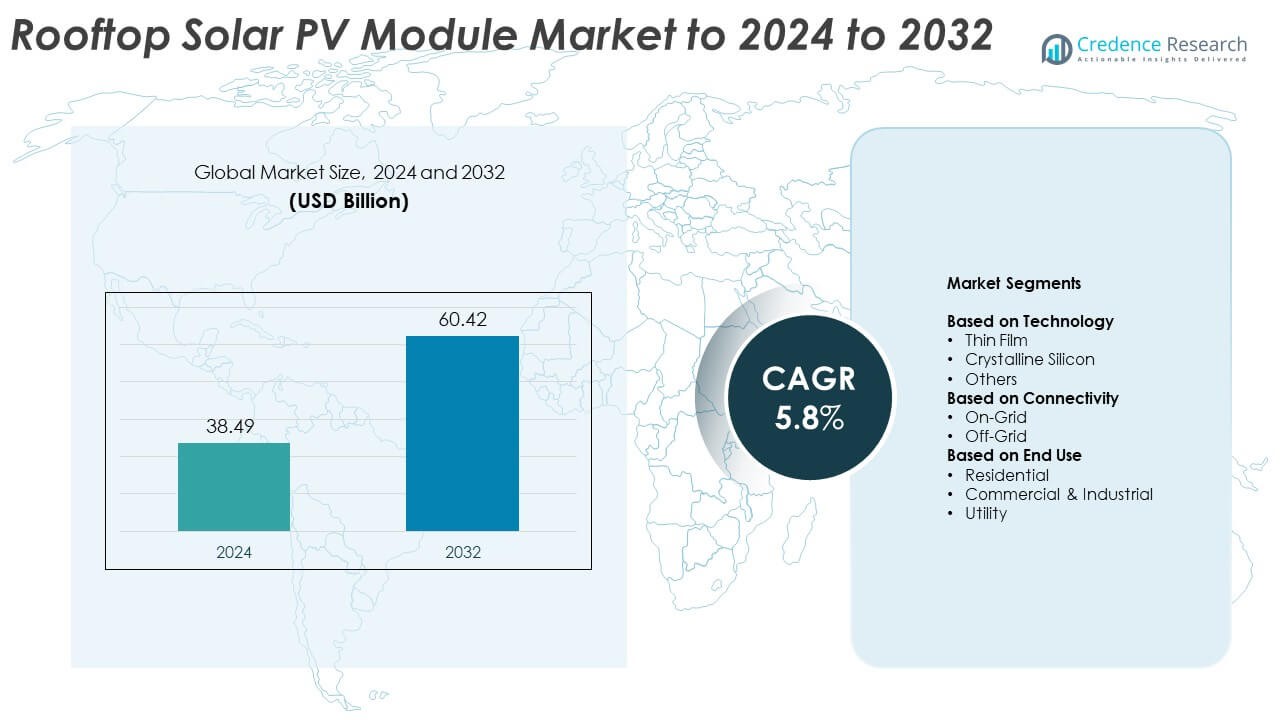

Rooftop Solar PV Module Market size was valued at USD 38.49 billion in 2024 and is anticipated to reach USD 60.42 billion by 2032, at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rooftop Solar PV Module Market Size 2024 |

USD 38.49 Billion |

| Rooftop Solar PV Module Market, CAGR |

5.8% |

| Rooftop Solar PV Module Market Size 2032 |

USD 60.42 Billion |

The rooftop solar PV module market is driven by key players such as LONGi Solar, Trina Solar, 3M, Panasonic, LG Electronics, A.O. Smith, and Koninklijke Philips N.V. These companies are advancing solar technology through high-efficiency modules, smart energy systems, and sustainable production practices. Strategic alliances and strong distribution networks enhance their global presence and competitiveness. Asia-Pacific led the market with a 34% share in 2024, driven by large-scale installations in China, India, and Japan. North America followed with a 31% share, supported by policy incentives and rising corporate adoption of rooftop solar systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The rooftop solar PV module market was valued at USD 38.49 billion in 2024 and is projected to reach USD 60.42 billion by 2032, growing at a CAGR of 5.8%.

- Rising government incentives, tax benefits, and renewable energy mandates are major drivers boosting residential, commercial, and industrial rooftop installations worldwide.

- Technological advancements such as bifacial panels, smart inverters, and integrated storage systems are shaping the market’s transition toward high-efficiency and intelligent energy solutions.

- The market is competitive, with key players focusing on expanding manufacturing capacity, optimizing costs, and forming partnerships to enhance technological strength and regional reach.

- Asia-Pacific dominated with a 34% share in 2024, followed by North America at 31% and Europe at 27%; among segments, crystalline silicon held a 74% share, reflecting its superior performance and cost-effectiveness across diverse climatic conditions.

Market Segmentation Analysis:

By Technology

The crystalline silicon segment dominated the rooftop solar PV module market in 2024, holding a 74% share. Its strong presence is driven by high efficiency, long lifespan, and established manufacturing infrastructure. Crystalline silicon modules, including monocrystalline and polycrystalline variants, deliver superior performance in diverse climatic conditions. Their declining production costs and higher energy yield make them preferred for both residential and commercial rooftops. Thin-film modules, though less efficient, are gaining traction for lightweight and flexible applications, especially in urban and industrial installations requiring innovative architectural integration.

- For instance, Maxeon 7 achieved 24.9% module aperture efficiency and a 40-year warranty.

By Connectivity

The on-grid segment accounted for a 79% market share in 2024, emerging as the leading connectivity type. Its dominance stems from widespread adoption in urban and semi-urban regions supported by net metering policies and government incentives. On-grid systems enable users to sell excess electricity to the grid, reducing payback periods and improving cost efficiency. Off-grid systems are also expanding in rural and remote areas, driven by demand for decentralized energy access and the growth of solar-plus-storage solutions enhancing energy independence.

- For instance, Tata Power-DDL reported that as of September 2025, it had reached a total grid-connected solar capacity of 116.14 MWp.

By End Use

The commercial and industrial segment held the largest share of 58% in 2024, driven by high energy consumption and favorable corporate sustainability initiatives. Businesses are investing in rooftop solar installations to offset operational costs and meet renewable energy targets. Industries benefit from predictable energy pricing and reduced grid dependency, enhancing long-term energy security. Residential installations are also growing rapidly due to declining module costs and supportive rooftop subsidy programs. Utility-scale projects, while smaller in share, continue to drive large-capacity rooftop deployments across industrial parks and institutions.

Key Growth Drivers

Government Incentives and Policy Support

Government programs offering subsidies, tax credits, and feed-in tariffs are major growth enablers for rooftop solar PV adoption. Policies such as India’s Rooftop Solar Programme Phase II and the U.S. Investment Tax Credit (ITC) encourage both residential and commercial users to invest in solar installations. Supportive net metering frameworks further enhance financial returns, driving rapid installations. These incentives, combined with decarbonization goals and renewable energy mandates, continue to accelerate the market’s expansion across developed and emerging economies.

- For instance, a BSES official stated in September 2025 that the company’s discoms, BSES Rajdhani Power Limited (BRPL) and BSES Yamuna Power Limited (BYPL), had energized a combined total of 11,100 rooftop solar connections.

Declining Solar Module Costs and Technological Advancements

Continuous reductions in photovoltaic module costs, driven by mass production and improved manufacturing efficiency, have made solar energy more affordable. Advances in monocrystalline PERC and bifacial cell technologies have increased energy output per unit area, improving system economics. Reduced balance-of-system costs and growing use of automation in production further lower installation expenses. These improvements enable faster project deployment and higher returns, fueling adoption across residential and commercial sectors globally.

- For instance, Trina’s Vertex S+ reaches 505 W and 22.7% efficiency with a 30-year power warranty.

Rising Corporate Sustainability Initiatives

The growing focus on corporate sustainability and energy independence has encouraged enterprises to adopt rooftop solar systems. Companies are setting net-zero targets and investing in on-site renewable generation to reduce emissions. Rooftop solar systems help businesses manage electricity costs while aligning with ESG reporting frameworks. Multinational corporations, industrial parks, and logistics facilities increasingly deploy large-scale rooftop systems to achieve energy efficiency and long-term environmental commitments.

Key Trends & Opportunities

Integration of Energy Storage Systems

The integration of battery storage with rooftop solar PV systems is gaining traction, enabling round-the-clock energy availability. Storage solutions help manage grid fluctuations, improve self-consumption, and enhance energy reliability during peak demand. Declining lithium-ion battery prices and innovations in hybrid inverter technologies are accelerating adoption. This trend is particularly strong in regions with unreliable grids, creating new opportunities for solar-plus-storage installations in both commercial and residential applications.

- For instance, Sunrun has 195,000+ solar-and-storage systems and 3.2 GWh networked storage, with a 70% attachment rate in Q2 2025.

Emergence of Smart Rooftop Solutions

The market is witnessing a shift toward smart rooftop systems equipped with IoT sensors, AI-based monitoring, and predictive analytics. These technologies enhance performance tracking, optimize maintenance, and ensure higher system uptime. Smart inverters and digital platforms allow real-time energy management and integration with demand response programs. Such advancements are enabling end users to maximize energy savings and system longevity, creating new growth avenues for technology-driven solar providers.

- For instance, In 2024, Enphase shipped approximately 6.5 million microinverters, a 58% decrease from the 15.5 million shipped in 2023. This decline occurred amid a challenging residential solar market but was offset by a significant increase in battery storage deliveries, which reached 521 megawatt-hours (MWh) in 2024, up from 351.6 MWh in 2023.

Expansion of Building-Integrated Photovoltaics (BIPV)

BIPV technologies are emerging as an attractive opportunity for urban areas, combining aesthetics and functionality. Integrating solar modules into rooftops, façades, and skylights enables energy generation without additional space requirements. Advancements in lightweight and transparent module designs are promoting adoption in modern architecture and green buildings. This trend aligns with sustainability goals and supports smart city development, offering high potential for future market growth.

Key Challenges

Intermittent Power Generation and Grid Integration Issues

Solar energy’s dependence on sunlight leads to fluctuating power generation, creating challenges in grid stability and energy management. Without efficient energy storage or smart grid solutions, excessive variability can disrupt electricity supply. Utilities face difficulties balancing demand and generation, especially in high-penetration markets. Addressing this issue requires advanced grid infrastructure, improved forecasting, and integration of hybrid systems to ensure reliable energy distribution.

High Initial Investment and Space Constraints

Despite falling module prices, the upfront installation cost of rooftop solar PV systems remains a key barrier. Many small and medium enterprises, along with residential users, face financing challenges. Additionally, limited rooftop space, especially in urban environments, restricts scalability. These constraints slow adoption, particularly in cost-sensitive markets. Innovative financing models, leasing solutions, and compact high-efficiency modules are needed to overcome these limitations and drive broader deployment.

Regional Analysis

North America

North America held a 31% share of the rooftop solar PV module market in 2024, driven by strong policy support and increasing rooftop installations across the United States and Canada. Federal tax credits, state-level incentives, and net metering programs continue to encourage residential and commercial solar adoption. The U.S. leads the region, supported by corporate renewable energy commitments and advanced grid integration. Growing demand for clean energy, declining module prices, and the presence of leading solar manufacturers strengthen market penetration across both urban and suburban applications.

Europe

Europe accounted for a 27% share of the global rooftop solar PV module market in 2024, propelled by stringent carbon reduction goals and favorable renewable energy directives. Countries such as Germany, the Netherlands, and Italy lead adoption due to strong feed-in tariffs and rooftop installation subsidies. The European Green Deal and the REPowerEU plan continue to drive rapid deployment. Expanding smart grid infrastructure and building-integrated PV solutions are enhancing efficiency and flexibility. The region’s focus on energy independence and decarbonization further supports long-term market expansion.

Asia-Pacific

Asia-Pacific dominated the global rooftop solar PV module market with a 34% share in 2024, led by China, India, Japan, and Australia. Large-scale government initiatives promoting distributed solar generation and declining module costs have accelerated installations. China’s rooftop solar expansion under its national carbon neutrality plan and India’s target of 40 GW rooftop capacity are major growth contributors. The region also benefits from manufacturing cost advantages and expanding residential solar programs. Increasing urbanization and industrialization further boost adoption across commercial and industrial buildings.

Middle East & Africa

The Middle East and Africa captured a 5% share of the rooftop solar PV module market in 2024, supported by growing investments in distributed renewable energy. The UAE and Saudi Arabia are driving installations through sustainability programs such as the Dubai Clean Energy Strategy and Vision 2030. Falling solar costs and abundant sunlight make rooftop PV systems economically viable for businesses and households. In Africa, nations like South Africa and Kenya are adopting solar to overcome grid instability, creating new opportunities for off-grid and hybrid rooftop systems.

Latin America

Latin America accounted for a 3% share of the rooftop solar PV module market in 2024, with Brazil, Mexico, and Chile emerging as key contributors. Supportive regulatory frameworks, including net metering and tax exemptions, are promoting small-scale solar installations. Brazil’s distributed generation law has accelerated adoption in residential and commercial sectors. Falling installation costs and increasing consumer awareness of energy savings are boosting deployment across urban areas. The region’s growing renewable investments and policy reforms continue to strengthen market participation and encourage private-sector engagement.

Market Segmentations:

By Technology

- Thin Film

- Crystalline Silicon

- Others

By Connectivity

By End Use

- Residential

- Commercial & Industrial

- Utility

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Key players in the rooftop solar PV module market include LONGi Solar, Trina Solar, 3M, Koninklijke Philips N.V., Pentair PLC, Panasonic, Unilever PLC, LG Electronics, EcoWater Systems, A.O. Smith, Culligan International, and Kinetico Incorporated. The competitive landscape is characterized by strong technological innovation, extensive product portfolios, and expanding global distribution networks. Companies are focusing on enhancing module efficiency, integrating smart monitoring solutions, and improving manufacturing sustainability. Strategic partnerships with utility providers, rooftop installers, and energy storage companies are supporting large-scale deployment. Continuous investments in R&D, automation, and advanced materials are reducing production costs and boosting performance reliability. Leading players are also aligning with renewable energy policies and certification standards to strengthen their global presence. The competition remains intense, with firms emphasizing differentiation through product quality, after-sales service, and localized production facilities to meet the rising demand for clean, cost-effective rooftop solar systems worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- LONGi Solar

- Trina Solar

- 3M

- Koninklijke Philips N.V.

- Pentair PLC

- Panasonic

- Unilever PLC

- LG Electronics

- EcoWater Systems

- O. Smith

- Culligan International

- Kinetico Incorporated

Recent Developments

- In 2025, Trina Solar Unveiled new and upgraded N-type TOPCon modules for residential, commercial, and utility-scale projects at the RE+ exhibition.

- In 2025, LG Energy Solutions announced its partnership with Aptera Motors to supply 2170 cylindrical batteries that advance solar EV innovation and sustainable mobility to promote solar-powered transportation in the U.S.

- In 2025, LONGi Solar Achieved two new world records for cell efficiency, including a 33% efficiency for its large-area perovskite-silicon tandem solar cell

Report Coverage

The research report offers an in-depth analysis based on Technology, Connectivity, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The rooftop solar PV module market will expand steadily due to rising energy demand and decarbonization efforts.

- Advancements in high-efficiency monocrystalline and bifacial technologies will boost power generation capacity.

- Supportive government incentives and net metering schemes will continue to drive large-scale adoption.

- Integration of AI-enabled monitoring systems will improve energy optimization and performance tracking.

- Growing adoption of solar-plus-storage systems will enhance reliability and off-grid capabilities.

- Urban infrastructure development and smart city projects will increase rooftop solar installations.

- Expansion of leasing and financing models will make installations more accessible to small consumers.

- Sustainability commitments from corporations will accelerate commercial rooftop deployments.

- Emerging markets in Asia-Pacific and Africa will offer strong growth potential through policy reforms.

- Continued innovation in lightweight and flexible modules will promote adoption in constrained rooftop spaces.