Market Overview

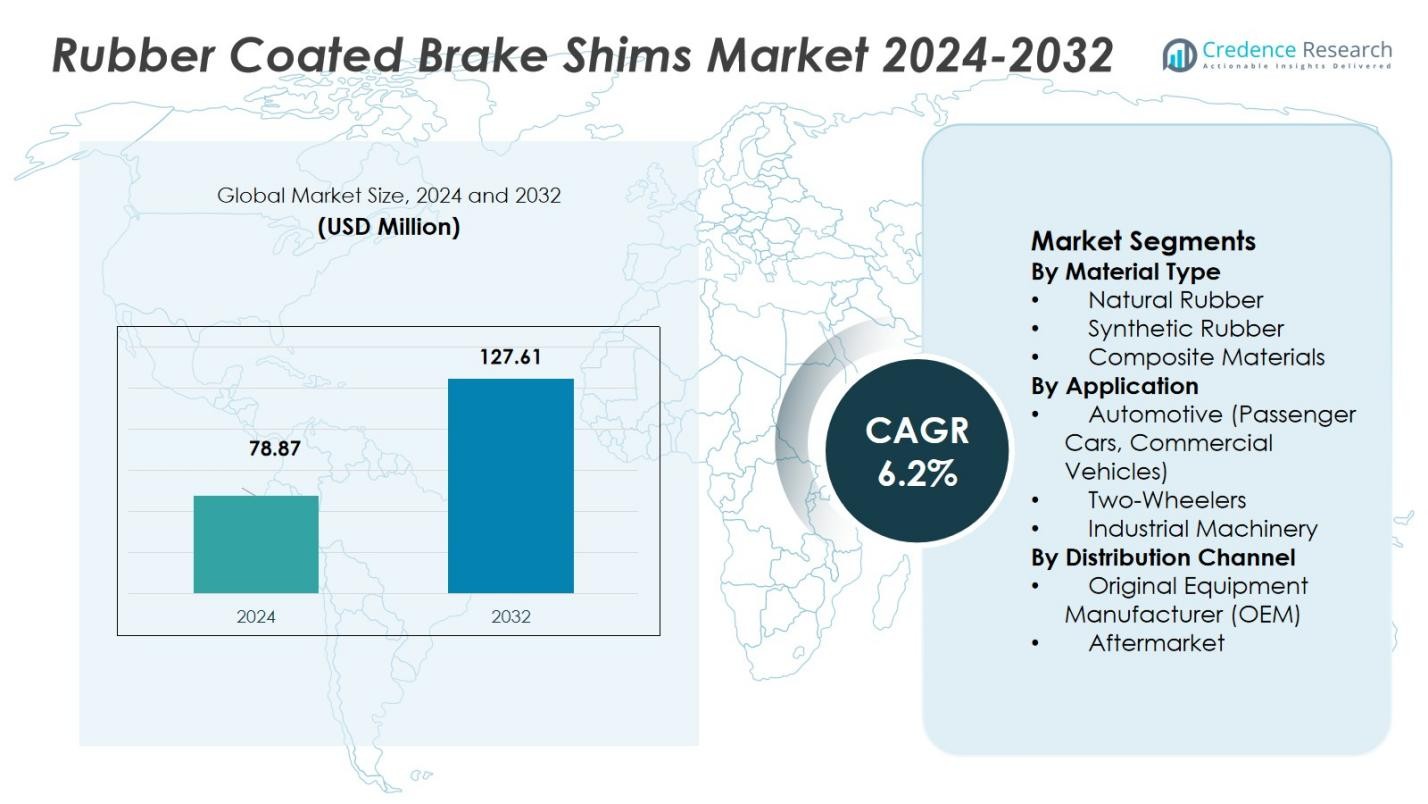

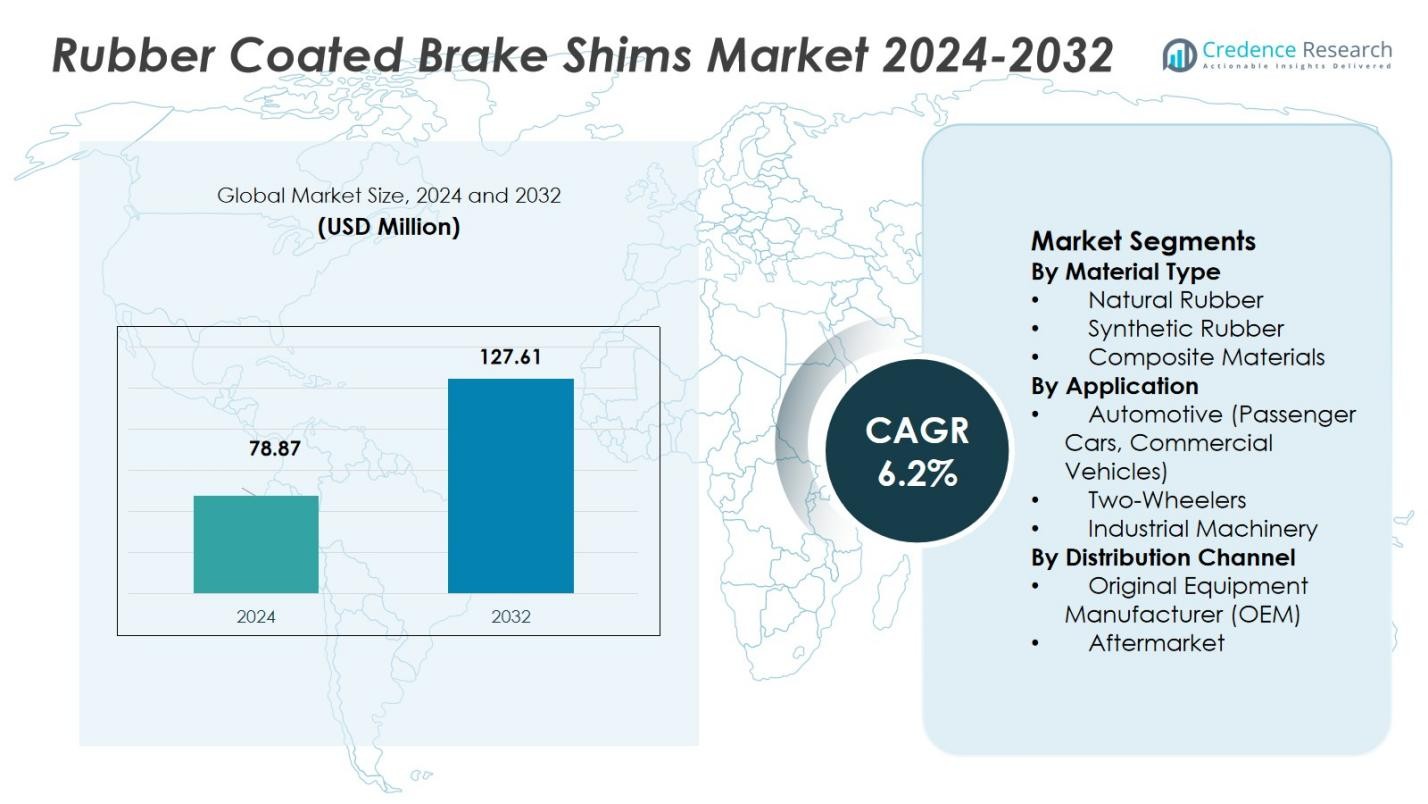

The Rubber Coated Brake Shims Market was valued at USD 78.87 million in 2024 and is anticipated to reach USD 127.61 million by 2032, at a CAGR of 6.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rubber Coated Brake Shims Market Size 2024 |

USD 78.87 Billion |

| Rubber Coated Brake Shims Market, CAGR |

6.2% |

| Rubber Coated Brake Shims Market Size 2032 |

USD 127.61 Billion |

The Rubber Coated Brake Shims Market is primarily driven by key players such as Trelleborg AB, Nisshinbo Holdings Inc., Robert Bosch GmbH, ZF Friedrichshafen AG, and Akebono Brake Industry Co., Ltd. These companies leverage strong OEM relationships, advanced material technologies, and global manufacturing capabilities to maintain leadership in the market. The market is experiencing significant growth, particularly in regions like Asia-Pacific, which holds the largest share at 44% in 2024, driven by the rapid expansion of automotive production in countries such as China and India. Europe, with a market share of 30%, follows closely due to stringent noise and safety regulations, while North America accounts for 40% of the global market. These regions continue to dominate due to high vehicle production rates and the rising demand for quieter, more efficient braking systems in both OEM and aftermarket segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Rubber Coated Brake Shims Market stood at USD 78.87 million in 2024 and is forecast to grow at a CAGR of 6.2%, reaching USD 127.61 million by 2032.

- Demand rises as automakers intensify focus on reducing noise, vibration, and harshness (NVH), boosting adoption of rubber‑coated brake shims especially in passenger cars and commercial vehicles (Automotive application sector: 72 % share, Synthetic Rubber material: 56 % share).

- Growing global vehicle production-especially in emerging markets-alongside rising aftermarket replacement needs supports steady expansion of the market.

- The increasing adoption of electric and hybrid vehicles drives demand for high‑performance, noise‑reducing brake components, presenting a key growth opportunity.

- Asia‑Pacific leads regionally with a 44 % share of the global market, followed by Europe (30 %) and North America (40 %), driven by robust OEM production, strong safety regulations, and growing consumer expectations for ride comfort.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Material Type

The Rubber Coated Brake Shims Market is primarily segmented by material type into Natural Rubber, Synthetic Rubber, and Composite Materials. The Synthetic Rubber sub-segment dominates this market, holding a share of 56% in 2024. This dominance is driven by the material’s superior durability, high heat resistance, and cost-effectiveness, which make it ideal for automotive and industrial applications. As synthetic rubber offers enhanced performance in high-stress conditions, its adoption continues to rise, further driving market growth.

- For instance, Uno Minda introduced heavy-duty organic brake pads using Rubber Metal Rubber (RMR) technology, enhancing friction stability and significantly reducing brake noise in passenger and light commercial vehicles.

By Application

The market for rubber-coated brake shims is segmented by application into Automotive, Two-Wheelers, and Industrial Machinery. The Automotive segment, which includes Passenger Cars and Commercial Vehicles, holds the largest share at 72% in 2024. This is attributed to the increasing demand for noise-reduction components in vehicle braking systems, along with the automotive industry’s ongoing focus on improving vehicle safety and performance. The automotive sector’s strong growth, fueled by rising vehicle production and stricter noise and vibration regulations, is expected to continue driving demand for rubber-coated brake shims.

- For instance, Avery Dennison supplies specialized adhesive tapes for brake shims that act as a barrier between the brake pad and caliper, effectively absorbing vibrations to minimize squeal and judder in automotive disc brakes.

By Distribution Channel

The Distribution Channel segment of the Rubber Coated Brake Shims Market is divided into Original Equipment Manufacturer (OEM) and Aftermarket. The OEM sub-segment holds a dominant share of 65% in 2024. This is mainly driven by the ongoing need for high-quality brake shims in the production of new vehicles and machinery, as OEMs require reliable components for their systems. Moreover, partnerships between OEMs and brake component manufacturers for long-term supply contracts continue to strengthen the position of the OEM channel, driving market growth.

Key Growth Drivers

Rising Demand for Automotive Safety and Comfort

The growing emphasis on automotive safety and comfort is a major driver in the Rubber Coated Brake Shims Market. As vehicle manufacturers increasingly focus on reducing noise, vibration, and harshness (NVH), the demand for advanced braking components like rubber-coated brake shims has surged. These shims play a key role in minimizing brake noise, improving the overall driving experience, and enhancing vehicle safety. This trend, combined with the rise in global vehicle production, particularly in emerging markets, continues to fuel market growth.

- For instance, Trelleborg’s rubber-coated brake shims have been rigorously tested under diverse braking conditions and varying climates, proving effective in noise elimination and vibration reduction, thus providing a smoother and more comfortable ride.

Expansion of the Automotive Aftermarket

The expansion of the automotive aftermarket sector is a significant growth driver for the Rubber Coated Brake Shims Market. As vehicles age, the need for replacement parts, including brake components, grows. The aftermarket segment is expected to witness continued expansion as consumers prioritize the maintenance and performance of older vehicles. The increasing adoption of brake shims in repair services due to their ability to reduce wear and enhance braking efficiency is further contributing to the demand for rubber-coated brake shims, supporting market growth.

- For instance, Tier-1 suppliers such as Trelleborg and Nisshinbo have expanded their rubber shim product lines to meet diverse vehicle needs, further supporting market growth.

Technological Advancements in Brake System Components

Technological advancements in brake systems, especially the integration of high-performance materials, have accelerated the adoption of rubber-coated brake shims. Innovations such as improved formulations of rubber compounds and enhanced manufacturing techniques are allowing for better durability and performance of brake shims. These advancements are particularly relevant in high-performance automotive sectors, including electric vehicles (EVs) and hybrid vehicles, where efficient braking systems are crucial. The demand for advanced braking technologies continues to drive the market, offering significant growth opportunities for rubber-coated brake shim manufacturers.

Key Trends & Opportunities

Increased Focus on Electric Vehicles (EVs)

The rise of electric vehicles (EVs) presents a promising opportunity for the Rubber Coated Brake Shims Market. As EV adoption grows globally, the need for specialized components like rubber-coated brake shims becomes more prominent. EVs are equipped with regenerative braking systems, which require high-quality brake components to maintain optimal performance. Rubber-coated brake shims are ideal for EVs due to their ability to reduce noise and improve braking efficiency, making them a key component for automakers in the EV sector. This trend is expected to boost demand in the coming years.

- For instance, KLINGER RCM USA manufactures rubber-coated metal brake shims that enhance braking performance by significantly reducing noise through vibration damping, and their shims also provide thermal insulation and corrosion resistance, which are critical for EV brake systems operating under varied conditions.

Sustainability and Environmental Regulations

Growing awareness of environmental concerns and stricter regulations regarding vehicle emissions and noise control are driving the adoption of rubber-coated brake shims. These shims help reduce noise and improve the overall environmental performance of braking systems. Additionally, as manufacturers aim to meet increasingly stringent regulatory standards, the demand for high-performance materials like rubber-coated brake shims is expected to rise. This trend aligns with the global push towards sustainability and eco-friendly vehicle technologies, offering significant opportunities for market players.

- For instance, US Patent 6,105,736 details an anti-squeal shim with a 200-800 micron thick fiber-reinforced rubber compound layer (non-asbestos) on the brake pad side, eliminating asbestos per global environmental legislation while damping vibrations.

Key Challenges

Rising Raw Material Costs

One of the key challenges facing the Rubber Coated Brake Shims Market is the rising cost of raw materials. The cost of synthetic rubber, which is a primary material used in brake shims, has fluctuated due to supply chain disruptions and price volatility in global markets. These increasing costs put pressure on manufacturers to maintain profitability while offering competitively priced products. As raw material prices continue to rise, manufacturers may face difficulties in balancing cost-effectiveness with product quality, potentially affecting market growth.

Competition from Alternative Materials

The Rubber Coated Brake Shims Market also faces significant competition from alternative materials and technologies. As manufacturers explore new materials like ceramics, composites, and metals, rubber-coated brake shims may lose some market share due to the appeal of these alternatives in terms of performance and cost. These materials offer similar or superior benefits, such as higher heat resistance and longer durability, which could challenge the widespread adoption of rubber-coated brake shims. The need for continuous innovation and differentiation is essential for market players to overcome this challenge.

Regional Analysis

Asia‑Pacific

Asia‑Pacific commands the largest share in the global rubber‑coated brake shims market, holding 44% of total revenue in 2024. The rapid expansion of automotive production in countries such as China and India, along with rising demand for two‑wheelers and passenger cars, underpins this dominance. Additionally, increasing OEM investments in braking systems and growing consumer preference for vehicles with low NVH (noise, vibration, harshness) continue to drive adoption of rubber‑coated brake shims across the region.

Europe

Europe holds the second-largest share of the market with 30% in 2024. The region’s strong automotive manufacturing base, stringent noise and safety regulations, and early adoption of advanced braking technologies foster robust demand for rubber‑coated brake shims. Additionally, Europe’s ongoing shift toward hybrid and electric vehicles enhances demand for quieter, high-performance braking components, which further supports market growth in this region.

North America

North America accounts for 40% share in the global automotive brake shims market overall and holds a substantial portion of demand for rubber‑coated variants. The region benefits from high vehicle production outputs, strong aftermarket demand, and consumer preference for comfort and performance. The regulatory environment focused on safety and braking performance also encourages OEM and aftermarket adoption of brake shims, sustaining steady demand.

Latin America

Latin America represents a smaller but steadily growing region in the rubber‑coated brake shims market, contributing 6% share of global demand in 2024. This region’s growth is driven by increasing vehicle ownership rates and rising consumer awareness of braking performance and comfort. The expanding light and commercial vehicle segments, combined with growing aftermarket services, continue to generate demand for brake shims in this region.

Middle East & Africa (MEA)

Middle East & Africa accounts for 5% of the global market share in 2024. The market growth in MEA is supported by rising demand for commercial vehicles, increasing urbanization, and expanding automotive sales in GCC countries. As consumer awareness about vehicle safety and comfort increases, adoption of rubber‑coated brake shims particularly for noise reduction and vibration damping is gaining traction, albeit at a slower pace compared to other regions.

Market Segmentations:

By Material Type

- Natural Rubber

- Synthetic Rubber

- Composite Materials

By Application

- Automotive (Passenger Cars, Commercial Vehicles)

- Two-Wheelers

- Industrial Machinery

By Distribution Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Rubber Coated Brake Shims Market is dominated by key players such as Trelleborg AB, Nisshinbo Holdings Inc., Robert Bosch GmbH, ZF Friedrichshafen AG, and Akebono Brake Industry Co., Ltd. These companies lead with strong OEM relationships, extensive product portfolios, and global presence. Major players focus on enhancing the NVH (Noise, Vibration, Harshness) performance of brake shims, especially for electric vehicles (EVs), while integrating advanced materials and technologies. Smaller firms often target niche segments, offering specialized solutions for aftermarket applications or specific vehicle types. As demand for quieter, more durable braking systems rises, market players are investing in R&D to improve material properties such as heat resistance and acoustic damping. The competitive environment is expected to intensify with increasing demand for high-performance, lightweight brake components driven by stricter safety and environmental regulations, as well as the growing trend toward electric and hybrid vehicles.

Key Player Analysis

- Brake Performance

- Meneta Advanced Shim Technology

- Nichias Corporation

- Nucap Industries, Inc.

- Stanztechnik Schulte GmbH

- Trelleborg AB (Trelleborg Sealing Solutions / Trelleborg Group)

- Util Industries S.P.A.

- Avery Dennison Corporation

- Brembo S.p.A.

- Akebono Brake Industry Co., Ltd.

Recent Developments

- In September 2024, Trelleborg AB entered into an agreement with SSAB to source fossil‑free steel for use in brake‑shim manufacturing, aiming to reduce carbon footprint and offer more sustainable rubber‑coated brake shims.

- In November 2025, Akebono Brake Industry Co., Ltd. showcased new high‑performance braking technologies including motorsport‑grade calipers at the Japan Mobility Show 2025, signalling its expanding commitment to advanced brake components.

- In November 2025, Delphi Technologies Plc showcased its advanced brake shim technology designed to deliver quieter, more comfortable, and more reliable braking performance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Material Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for rubber-coated brake shims is expected to rise significantly as automotive manufacturers increasingly focus on reducing noise, vibration, and harshness (NVH) in their vehicles.

- The growing adoption of electric vehicles (EVs) will drive the need for high-performance brake shims that enhance braking efficiency and reduce noise in low-maintenance brake systems.

- As automotive safety standards become more stringent, the market for rubber-coated brake shims will benefit from increased demand for braking components that ensure smoother and quieter braking performance.

- Technological advancements in materials and manufacturing processes will improve the durability and performance of rubber-coated brake shims, attracting more automotive and industrial applications.

- The expansion of the global automotive aftermarket will offer substantial growth opportunities for brake shim manufacturers, as demand for replacement parts increases.

- The rise of hybrid and plug-in hybrid vehicles will further fuel the need for rubber-coated brake shims due to their importance in enhancing overall vehicle performance and comfort.

- Increased focus on environmental sustainability will drive innovations in eco-friendly rubber materials, creating new growth avenues for the market.

- The integration of smart technologies in braking systems may influence the development of more advanced brake shim products that offer enhanced functionality.

- The market is likely to experience consolidation, with key players expanding their product offerings through acquisitions and collaborations to maintain a competitive edge.

- Asia-Pacific will continue to dominate the global market, driven by the rapid growth of automotive manufacturing and increasing vehicle ownership in emerging economies.

Market Segmentation Analysis:

Market Segmentation Analysis: