Market Overview:

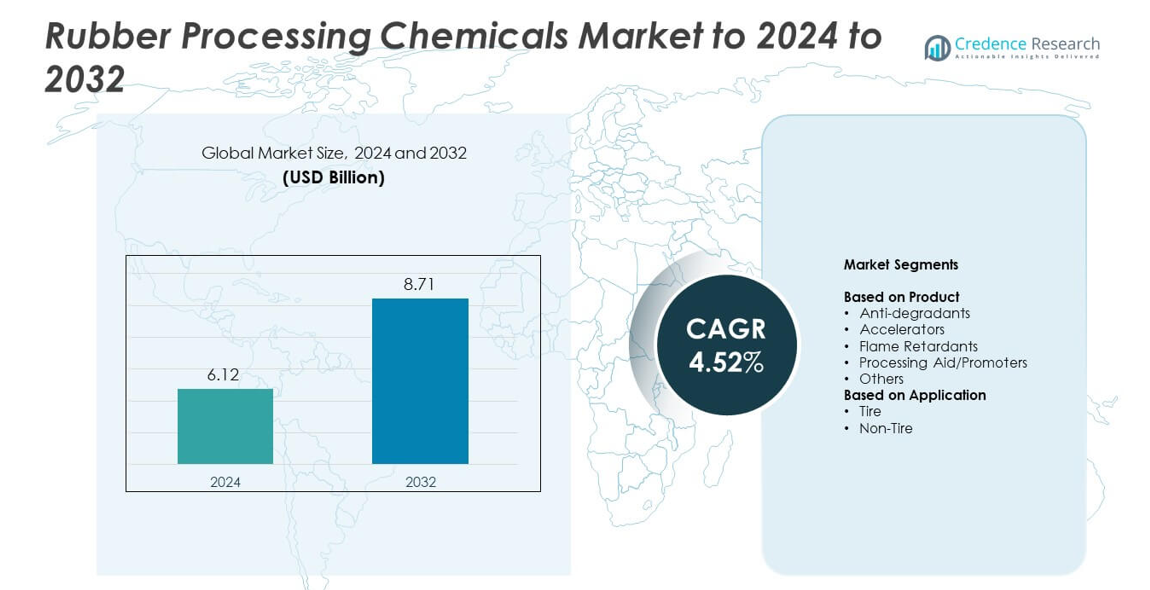

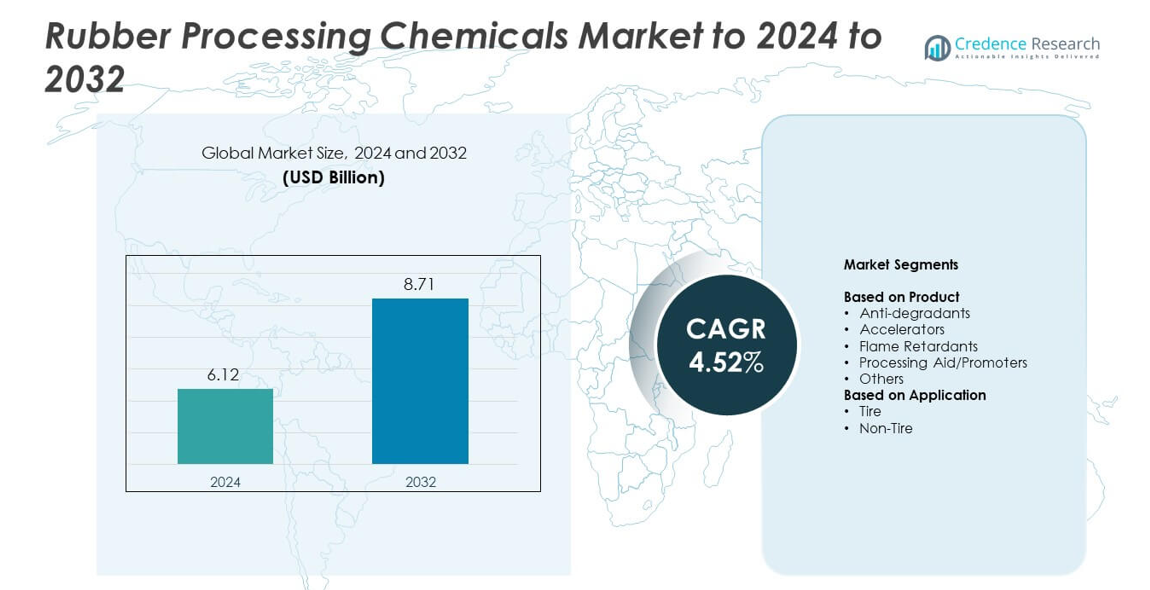

Rubber Processing Chemicals Market size was valued USD 6.12 Billion in 2024 and is anticipated to reach USD 8.71 Billion by 2032, at a CAGR of 4.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rubber Processing Chemicals Market Size 2024 |

USD 6.12 Billion |

| Rubber Processing Chemicals Market CAGR |

4.52% |

| Rubber Processing Chemicals Market Size 2032 |

USD 8.71 Billion |

The Rubber Processing Chemicals Market is shaped by major players including BASF SE, Paul & Company, China Petrochemical Corporation, Eastman Chemical Company, R.T. Vanderbilt Holding Company, Inc., Lanxess, Merchem Limited, Solvay, Akzo Nobel N.V., KUMHO PETROCHEMICAL, Behn Meyer, and Arkema. These companies strengthen the market through advanced anti-degradants, accelerators, and processing aids used across tire and industrial rubber production. Asia Pacific led the market in 2024 with about 41% share due to its dominant tire manufacturing base, followed by North America at nearly 28% and Europe at about 24%, supported by strong regulatory standards and high-performance material demand.

Market Insights

- The Rubber Processing Chemicals Market reached USD 6.12 Billion in 2024 and will reach USD 8.71 Billion by 2032 at a CAGR of 4.52%.

• Growth is driven by rising tire production, with the tire segment holding about 71% share due to high use of anti-degradants and accelerators.

• Key trends include a shift toward eco-friendly additives and rising demand for high-performance compounds used in EV tires and industrial rubber goods.

• Competitive activity remains strong as global companies expand additive portfolios and improve supply chains, while anti-degradants lead the product segment with nearly 46% share.

• Asia Pacific leads with about 41% share, followed by North America at 28% and Europe at 24%, while Latin America holds 4% and Middle East & Africa 3%, supported by steady industrial and mobility growth

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Anti-degradants held the dominant share in 2024 with about 46% due to rising use in extending rubber lifespan under heat, oxygen, and ozone exposure. These chemicals supported stronger durability in automotive and industrial products, which face harsh operating conditions. Accelerators expanded with growing demand for faster vulcanization in high-volume tire plants. Processing aids and promoters gained traction as manufacturers improved flow properties in complex molds. Flame retardants and other additives advanced as safety rules increased across transport, construction, and electrical goods.

- For instance, the LANXESS Jhagadia plant had an initial combined annual production capacity of 2,500 metric tons for Rhenogran and Rhenodiv rubber additives when the facilities first opened, a capacity that has since been expanded.

By Application

Tire applications led the market in 2024 with nearly 71% share, driven by high consumption of anti-degradants, accelerators, and processing aids in tire manufacturing. Global vehicle production and replacement cycles supported steady growth across passenger and commercial segments. Strong focus on performance, heat resistance, and longevity boosted chemical adoption in premium radial tires. Non-tire applications grew in hoses, belts, gaskets, rollers, and footwear as industrial expansion and material innovation increased demand for reliability and extended service life.

- For instance, Michelin reports producing close to 200 million tires every year worldwide.

Key Growth Drivers

Rising Tire Production Worldwide

Growing tire manufacturing remained the core driver of the Rubber Processing Chemicals Market as global vehicle sales recovered and replacement demand increased. Higher use of anti-degradants, accelerators, and processing aids supported performance needs in radial and high-end tires. Automakers focused on heat resistance, durability, and longer service life, which pushed chemical consumption across passenger, commercial, and off-road segments. Expanding mobility trends and steady logistics activity further strengthened demand from OEM and aftermarket channels.

- For instance, Yokohama targets India passenger car tire capacity of 4.5 million a year. This rises from an earlier level of 2.8 million tires.

Expansion in Industrial Rubber Goods

A surge in demand for belts, hoses, gaskets, and sealing materials boosted chemical usage across industrial applications. Manufacturing, construction, mining, and energy sectors adopted high-performance rubber components to improve efficiency and reduce downtime. Anti-degradants and flame-retardant additives gained wider use as equipment standards tightened. Growth in conveyor systems, fluid-handling lines, and protective rubber parts supported consistent uptake of processing chemicals in both developed and emerging economies.

- For instance, Semperit’s Odry plant can produce nearly 200 million metres of hose every year.

Stricter Quality and Safety Regulations

Safety rules in automotive, electrical, and construction industries increased the need for advanced rubber formulations. Regulatory bodies mandated stronger resistance to heat, abrasion, and chemical exposure, driving higher consumption of performance-enhancing additives. Manufacturers adopted optimized vulcanization systems and protective chemicals to comply with material certification norms. These regulations encouraged investments in cleaner, safer, and more durable rubber products across global supply chains.

Key Trends and Opportunities

Shift Toward Eco-Friendly Additives

Demand grew for sustainable and low-toxicity rubber chemicals as industries moved toward greener production. Manufacturers explored non-carcinogenic accelerators, bio-based anti-degradants, and safer processing aids to meet environmental standards. Interest increased in formulations that minimize emissions during curing and reduce long-term ecological impact. This shift created opportunities for innovation in renewable materials and compliance-oriented chemical solutions.

- For instance, Evonik’s LCA for VESTAMID eCO LX9039 BBM100 reports 2.7 kilograms CO2 per kilogram. The same study shows blue water use of 27 kilograms per kilogram of material.

Advancement in High-Performance Rubber Compounds

Automotive and industrial customers adopted advanced rubber compounds that withstand higher loads, temperatures, and operational stress. This trend increased the use of specialty accelerators, reinforcement promoters, and high-efficiency anti-degradants. As electric vehicles required improved traction and thermal stability, chemical suppliers expanded R&D for EV-specific tire compounds. Growing focus on durability opened new avenues for customized additive systems.

- For instance, at the 2023 24 Hours of Le Mans, Goodyear brought over 2,500 tires and more than 65 team members to support its teams.

Growth of Automation and Smart Manufacturing

Rubber product manufacturers invested in automated mixing, dosing, and curing systems that require precise chemical formulations. The shift to digital monitoring and predictive maintenance created demand for chemicals that deliver consistent performance in controlled production environments. As factories modernized, suppliers gained opportunities to offer tailored additive packages compatible with advanced processing lines.

Key Challenges

Environmental and Health Concerns

Growing scrutiny of certain accelerators, anti-oxidants, and processing chemicals posed challenges for producers. Regulations targeted compounds linked to emissions and occupational hazards, forcing companies to adjust formulations. Manufacturers faced pressure to reduce harmful substances while maintaining product performance. Compliance costs increased as firms adopted cleaner technologies and safer alternatives, impacting pricing and supply-chain planning.

Volatile Raw Material Prices

Fluctuations in raw materials such as petrochemical derivatives affected cost stability across the market. Price swings disrupted production planning and reduced margins for both chemical suppliers and rubber manufacturers. Companies struggled to balance performance needs with cost efficiency during periods of supply constraints. Dependence on global oil and chemical supply networks added further unpredictability, challenging long-term procurement strategies.

Regional Analysis

North America

North America held about 28% share in 2024, driven by strong tire replacement demand and a mature automotive sector. The region benefited from strict performance and safety standards that increased consumption of anti-degradants, accelerators, and specialty processing aids. Industrial rubber goods also supported growth as manufacturing plants upgraded machinery and sealing systems. Rising interest in sustainable chemical formulations encouraged suppliers to expand greener product lines. Steady infrastructure renewal and logistics activity kept chemical demand stable across both tire and non-tire applications.

Europe

Europe accounted for nearly 24% share in 2024, supported by advanced automotive manufacturing hubs and strict environmental policies. The region emphasized low-toxicity and high-performance rubber chemicals to meet emission and durability rules. Strong production of premium tires and industrial components encouraged wider use of accelerators, anti-degradants, and flame-retardant additives. Growth in electric vehicle output created new demand for heat-resistant compounds. Industrial machinery, building materials, and mobility services further strengthened adoption across non-tire rubber products.

Asia Pacific

Asia Pacific dominated the global market with about 41% share in 2024, driven by large-scale tire production in China, India, Japan, and Southeast Asia. Expanding automotive manufacturing, rising two-wheeler ownership, and rapid industrial growth boosted consumption of rubber processing chemicals. Strong infrastructure development supported demand for hoses, belts, and sealing products. Local suppliers invested in high-quality additives to meet global export standards. The region continued to lead due to cost-efficient manufacturing and expanding domestic consumption.

Latin America

Latin America captured roughly 4% share in 2024, supported by moderate growth in automotive production and rising replacement tire demand. Countries such as Brazil and Mexico increased use of processing aids and accelerators in tire and non-tire applications. Industrial expansion in mining, agriculture, and construction encouraged adoption of durable rubber components. Supply-chain upgrades and investment in modern manufacturing improved the region’s chemical usage pattern. Environmental compliance trends also encouraged gradual shifts toward cleaner formulations.

Middle East and Africa

Middle East and Africa held about 3% share in 2024, driven by growing demand for industrial rubber goods in construction, energy, and transport sectors. The rise of automotive assembly operations in regions like the Gulf and North Africa supported higher use of accelerators and anti-degradants. Infrastructure expansion increased demand for hoses, gaskets, and sealing materials. The region relied heavily on imported chemicals, but local processing capacity continued to grow. Adoption improved as manufacturers aimed for better durability under harsh climate and load conditions.

Market Segmentations:

By Product

- Anti-degradants

- Accelerators

- Flame Retardants

- Processing Aid/Promoters

- Others

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Rubber Processing Chemicals Market features leading participants such as BASF SE, Paul & Company, China Petrochemical Corporation, Eastman Chemical Company, R.T. Vanderbilt Holding Company, Inc., Lanxess, Merchem Limited, Solvay, Akzo Nobel N.V., KUMHO PETROCHEMICAL, Behn Meyer, and Arkema. Global competition strengthened as manufacturers expanded product portfolios to meet rising demand for advanced anti-degradants, accelerators, and processing aids across tire and non-tire segments. Companies focused on improving performance, safety, and environmental compliance through continuous R&D and modernization of production technologies. Strategic moves such as capacity expansion, digital manufacturing upgrades, and regional distribution enhancements supported stronger market positioning. Rising demand for eco-friendly formulations encouraged investments in greener additive chemistry, while partnerships with automotive and industrial rubber producers helped align products with evolving technical needs. Competition intensified as suppliers improved supply-chain resilience, targeted high-growth regions, and introduced specialized solutions for premium tire compounds and high-stress industrial applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Paul & Company

- China Petrochemical Corporation

- Eastman Chemical Company

- T. Vanderbilt Holding Company, Inc.

- Lanxess

- Merchem Limited

- Solvay

- Akzo Nobel N.V.

- KUMHO PETROCHEMICAL

- Behn Meyer

- Arkema

Recent Developments

- In 2025, BASF showcased advancements in sustainable materials at SIMAC 2025, introducing Elastollan® RC with up to 100% recycled content for shoe parts and strategies using depolymerization for post-consumer footwear waste in polyurethane soles.

- In 2025, Kumho Petrochemical announced it would focus on establishing an optimal business portfolio and specifically highlighted its Solution Styrene Butadiene Rubber (SSBR) technology as a key material for electric vehicle (EV) tires.

- In 2025, Solvay Signed an MoU with Hankook to co-develop circular silica made from bio-based and waste feedstocks for tire treads, supporting higher use of sustainable raw materials

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as global tire production expands across passenger and commercial segments.

- Adoption of eco-friendly and low-toxicity rubber chemicals will grow due to stricter regulations.

- EV-specific tire formulations will boost the need for advanced heat-resistant additives.

- Industrial rubber goods will see steady growth as machinery and infrastructure investments increase.

- Automation in rubber processing plants will drive demand for consistent and high-purity chemical systems.

- Flame-retardant and safety-oriented additives will gain traction in transport and construction sectors.

- Suppliers will invest more in bio-based anti-degradants and greener accelerator technologies.

- Asia Pacific will remain the core growth center due to expanding manufacturing capacity.

- Digital quality-control tools will enhance formulation accuracy and chemical performance.

- Global players will expand partnerships to support localized production and reduce supply risks.