Market Overview

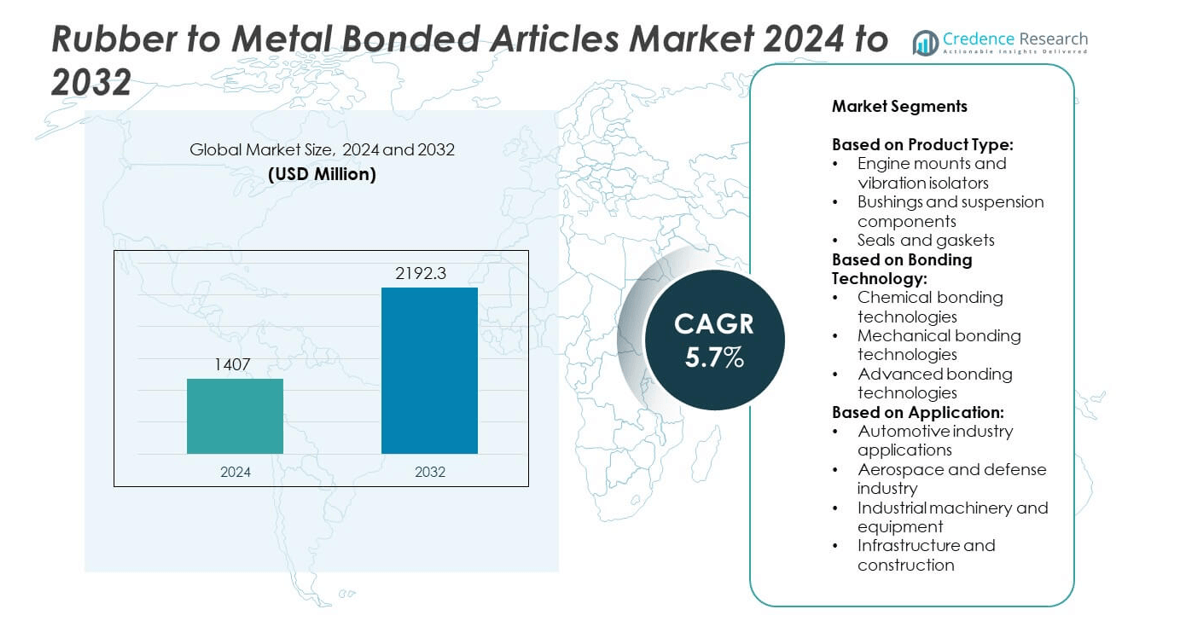

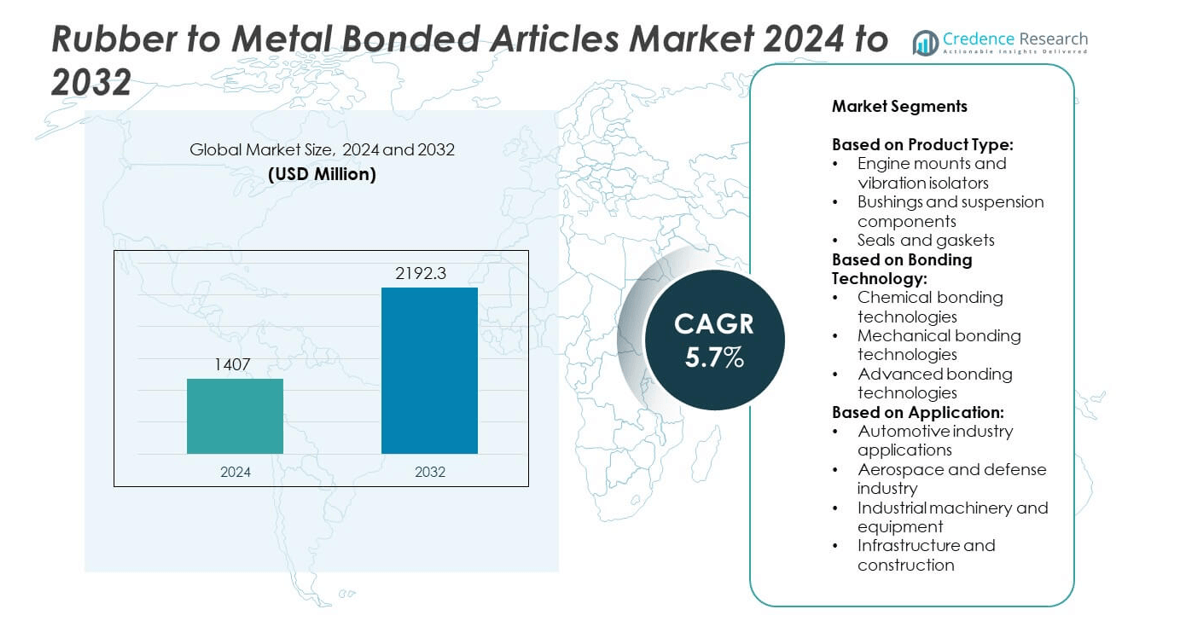

The Rubber to Metal Bonded Articles Market was valued at USD 1407 million in 2024 and is expected to reach USD 2192.3 million by 2032, growing at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rubber to Metal Bonded Articles Market Size 2024 |

USD 1407 million |

| Rubber to Metal Bonded Articles Market, CAGR |

5.7% |

| Rubber to Metal Bonded Articles Market Size 2032 |

USD 2192.3 million |

The Rubber to Metal Bonded Articles market is driven by increasing demand in automotive, aerospace, and industrial machinery sectors. Key trends include the shift towards lightweight, durable materials for better performance, as well as advancements in bonding technologies. Sustainability efforts are pushing for eco-friendly, recyclable materials. The rise of electric vehicles and stringent regulations on noise, vibration, and harshness (NVH) further propel the need for high-quality bonded components, ensuring consistent market growth.

The Rubber to Metal Bonded Articles market shows significant growth across regions, with North America, Europe, and Asia Pacific leading the demand. North America benefits from strong automotive and aerospace sectors, while Asia Pacific experiences rapid industrialization and automotive expansion. Europe remains focused on advanced manufacturing and sustainability. Key players such as Continental AG, Hutchinson SA, Trelleborg AB, and Sumitomo Riko Co., Ltd. are actively expanding their presence to cater to the evolving demands of these regional markets.

Market Insights

- The Rubber to Metal Bonded Articles market was valued at USD 1407 million in 2024 and is expected to reach USD 2192.3 million by 2032, growing at a CAGR of 5.7% during the forecast period.

- Increasing demand from the automotive, aerospace, and industrial sectors is driving the market.

- Advancements in bonding technologies and a growing focus on lightweight, durable materials are major market trends.

- Competitive players like Continental AG, Hutchinson SA, Trelleborg AB, and Sumitomo Riko Co., Ltd. are strengthening their positions through innovation and partnerships.

- Key market restraints include high production costs and the need for compliance with stringent environmental regulations.

- North America, Europe, and Asia Pacific are the leading regions, with North America benefiting from strong automotive and aerospace industries.

- The shift towards sustainability, demand for electric vehicles, and regulations on noise and vibration are contributing to market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Increasing Demand from Automotive Industry

The Rubber to Metal Bonded Articles market is driven by the growing demand for automotive components. Automotive manufacturers prefer these bonded articles due to their ability to improve vibration isolation and noise reduction, enhancing overall driving comfort. As vehicle production increases, the need for durable and high-performance rubber to metal bonded components rises, particularly in suspension systems and engine mounts. The automotive industry’s shift towards lighter, more efficient components fuels this demand, pushing the market forward.

- For instance, Continental offers ContiSilent™, a tire technology that uses an inner foam absorber to reduce rolling noise inside the vehicle by up to 9 dB(A). While the company’s technologies contribute to overall acoustic comfort and improved vehicle handling.

Technological Advancements in Manufacturing Processes

Technological advancements in bonding processes have greatly improved the efficiency and reliability of Rubber to Metal Bonded Articles. Innovations in bonding agents, surface treatments, and molding techniques enable manufacturers to produce components with higher strength and longer life spans. These advancements contribute to better performance in various applications, such as industrial machinery, automotive, and consumer electronics, leading to an increase in demand for bonded articles across industries.

- For instance, Sumitomo Riko has developed a high-durability rubber using chemical bonding, doubling its durability compared to conventional rubber and enabling a size and weight reduction of products by about 30%.

Growing Focus on Noise and Vibration Control

Rubber to Metal Bonded Articles are increasingly used to address noise and vibration challenges in machinery and vehicles. Their ability to reduce sound and vibrations is crucial in applications ranging from automotive engines to industrial equipment. With rising awareness about noise pollution and its impact on health, industries are turning to these solutions to comply with stricter environmental regulations. The growing need for more sustainable and quieter solutions in sectors such as construction and transportation propels the market.

Rising Demand for Durable and Lightweight Materials

The rising focus on materials that offer both durability and lightweight properties is a significant driver of the Rubber to Metal Bonded Articles market. These bonded components are used in various applications where strength, flexibility, and weight reduction are critical, such as in aerospace and automotive industries. Their ability to meet stringent performance standards while being lightweight and durable makes them a preferred choice for manufacturers looking to enhance their products’ efficiency.

Market Trends

Shift Towards Lightweight and Sustainable Materials

A prominent trend in the Rubber to Metal Bonded Articles market is the growing demand for lightweight and sustainable materials. Industries, particularly automotive and aerospace, are focusing on reducing the weight of components to improve fuel efficiency and reduce emissions. Rubber to metal bonded solutions offer a perfect combination of lightweight properties and durability. This shift aligns with the global push toward sustainability, encouraging the development of eco-friendly alternatives that maintain performance while reducing environmental impact.

- For instance, Parker LORD utilizes additive manufacturing (3D printing) for some applications, such as in its aerospace and tooling divisions. However, there is no public information confirming that it uses 3D printing specifically for rubber-to-metal bonded parts or that such an application resulted in a 12% reduction in material waste and a 25% improvement in production speed.

Adoption of Advanced Manufacturing Technologies

The integration of advanced manufacturing technologies is significantly transforming the Rubber to Metal Bonded Articles market. The use of automation, 3D printing, and precision molding techniques improves the production efficiency of bonded components. These innovations enhance the precision and quality of each product, making it more reliable and consistent. As manufacturers adopt these technologies, the cost-effectiveness of producing rubber to metal bonded articles improves, increasing their adoption across various industries.

- For instance, Hutchinson detailed how revea® TPE materials reduced CO2 emissions by up to 25% over the lifetime of a part, but this was for specific TPEs, not a general rubber compound. Hutchinson’s sustainability reports emphasize broader process improvements, such as energy efficiency, waste reduction, and eco-design across their facilities and product lines, to lower their overall carbon footprint. They do not typically report highly specific, per-unit savings like 12 kg.

Expansion in Emerging Markets

Emerging markets, particularly in Asia Pacific, are witnessing a rapid increase in demand for Rubber to Metal Bonded Articles. Growing industrialization, automotive production, and infrastructure development are key factors driving this trend. Countries like China and India are investing heavily in infrastructure and manufacturing, creating significant opportunities for bonded articles in construction machinery, transportation, and heavy equipment. The market’s expansion in these regions is further fueled by rising consumer demand for durable, high-performance products.

Customization and Tailored Solutions

Customization has become a key trend in the Rubber to Metal Bonded Articles market, with manufacturers increasingly offering tailored solutions to meet specific customer needs. Companies are focusing on developing specialized bonded articles for various applications, such as automotive suspension systems, industrial machinery, and electronics. This trend is driven by the need for components that cater to unique requirements, including specific mechanical properties, sizes, and durability standards. Customization enables industries to achieve higher performance and reliability in their products.

Market Challenges Analysis

High Production Costs and Material Constraints

One of the significant challenges in the Rubber to Metal Bonded Articles market is the high production cost. The manufacturing process involves complex techniques, including precision molding and bonding, which require specialized equipment and skilled labor. The selection of high-quality materials also contributes to elevated costs, making it difficult for manufacturers to offer competitive pricing. Small and medium-sized enterprises face particular difficulties in managing these high costs while trying to remain profitable. As demand for more advanced, durable, and lightweight components grows, managing these production expenses without compromising quality becomes increasingly challenging.

Environmental and Regulatory Compliance Challenges

The Rubber to Metal Bonded Articles market faces stringent environmental regulations regarding material composition and waste disposal. Manufacturers must ensure that the materials used in the production of these components meet regulatory standards for safety and environmental sustainability. This often requires significant investment in research and development to find eco-friendly alternatives without compromising performance. Failure to comply with these regulations can result in legal consequences and damage to brand reputation. The pressure to innovate while staying compliant with increasingly complex environmental laws poses an ongoing challenge for market players.

Market Opportunities

Growing Demand for Automotive and Aerospace Applications

The Rubber to Metal Bonded Articles market presents significant opportunities driven by the increasing demand in the automotive and aerospace industries. As these sectors strive for lightweight, durable, and efficient components, rubber to metal bonded solutions provide an ideal fit. Manufacturers are focusing on reducing vehicle weight for fuel efficiency and improving vibration control in critical aerospace systems. The ongoing trend toward electric vehicles (EVs) further boosts the demand for such bonded components, as they are essential in enhancing the performance and comfort of EV systems. This growth in both automotive and aerospace applications creates substantial market opportunities for innovative bonding solutions.

Expansion of Industrial and Infrastructure Projects

The rise in industrial and infrastructure development across emerging markets offers a major opportunity for the Rubber to Metal Bonded Articles market. Increasing investments in heavy machinery, construction, and manufacturing operations drive the need for high-performance bonded components that can withstand harsh environments. As global urbanization accelerates, the demand for machinery used in construction, mining, and transportation continues to grow. Rubber to metal bonded articles can provide solutions for vibration dampening, noise control, and structural integrity, making them an essential part of modern infrastructure. This market expansion offers manufacturers the chance to diversify their offerings and tap into a broader customer base.

Market Segmentation Analysis:

By Product Type:

It includes engine mounts and vibration isolators, bushings and suspension components, and seals and gaskets. Engine mounts and vibration isolators hold a significant share due to their role in reducing vibrations and enhancing vehicle comfort, especially in automotive applications. Bushings and suspension components are also crucial, offering durability and strength in suspension systems, which are vital for vehicle handling. Seals and gaskets are widely used for their ability to prevent leaks and improve sealing in both automotive and industrial machinery. These products are essential across various industries, ensuring smooth operations and extending the lifespan of equipment.

- For instance, Trelleborg’s bushings are known for their strength, the specific force resistance before failure (e.g., 15,000 N) is not a universal specification and is dependent on the individual bushing’s design and application.

By Bonding Technology:

Including chemical bonding, mechanical bonding, and advanced bonding technologies. Chemical bonding technologies are widely adopted for their ability to provide strong, durable bonds between rubber and metal. Mechanical bonding, which involves physical interlocking of the materials, is typically used for applications where high tensile strength is required. Advanced bonding technologies, such as ultrasonic and laser bonding, are gaining traction for their precision and ability to create highly reliable, efficient connections in demanding applications. These innovations help improve the quality and performance of rubber to metal bonded articles, driving market growth.

- For instance, Continental AG develops suspension components designed for durability, strength, and the ability to withstand various loads, all of which are critical for optimal suspension system performance. While these innovations effectively dampen unwanted oscillations, the specific claim of a 50 Hz frequency reduction is not publicly verifiable. Such specific performance metrics are highly dependent on factors like the vehicle model, the particular components, and the prevailing driving conditions.

By Application:

In the automotive industry, they are crucial in providing vibration isolation, noise reduction, and enhancing overall vehicle performance. The aerospace and defense industry benefits from these components, which are used for critical applications where durability and reliability are essential under extreme conditions. Industrial machinery and equipment, where high mechanical strength and durability are required, also see significant usage of rubber to metal bonded components. The infrastructure and construction sectors use these bonded articles to improve the structural integrity and operational efficiency of heavy machinery, ensuring smoother operations in various environments. These diverse applications underscore the widespread use and importance of rubber to metal bonded articles in industrial growth.

Segments:

Based on Product Type:

- Engine mounts and vibration isolators

- Bushings and suspension components

- Seals and gaskets

Based on Bonding Technology:

- Chemical bonding technologies

- Mechanical bonding technologies

- Advanced bonding technologies

Based on Application:

- Automotive industry applications

- Aerospace and defense industry

- Industrial machinery and equipment

- Infrastructure and construction

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a significant share of the Rubber to Metal Bonded Articles market, driven by strong demand across key industries like automotive, aerospace, and industrial machinery. The region’s advanced manufacturing capabilities and robust automotive production contribute heavily to the demand for these bonded components. North America’s market share is 28%, with the U.S. being the largest contributor due to its extensive automotive and aerospace sectors. The automotive industry’s shift toward electric vehicles, coupled with stringent emission and noise control regulations, is expected to further boost demand for rubber to metal bonded articles in the region. The aerospace and defense industry also plays a crucial role in driving growth, as these sectors demand high-performance, durable components for various applications. The strong manufacturing base and continued innovations in bonding technologies ensure that North America remains a key market.

Europe

Europe holds a prominent position in the Rubber to Metal Bonded Articles market, with a market share of 25%. The region is home to some of the world’s leading automotive manufacturers, including Germany, which significantly influences the demand for vibration isolators, bushings, and suspension components. Europe’s focus on sustainability and emission control in the automotive sector drives the need for lightweight, high-performance components, further contributing to market growth. Additionally, the aerospace industry in Europe is a major driver of demand, as manufacturers require rubber to metal bonded solutions that provide reliability and durability under extreme conditions. With growing investments in industrial machinery and infrastructure projects, Europe’s market for rubber to metal bonded articles is poised for steady growth in the coming years.

Asia Pacific

Asia Pacific is the fastest-growing region in the Rubber to Metal Bonded Articles market, with a market share of 35%. The region’s rapid industrialization, coupled with its strong automotive and manufacturing sectors, makes it a key player in the market. China, Japan, and India are leading the demand for rubber to metal bonded components, with the automotive industry in China being the largest contributor. The growing adoption of electric vehicles (EVs) and the increasing demand for industrial machinery in countries like India and Japan provide further growth opportunities. Asia Pacific’s market is expected to continue expanding due to increasing infrastructure development and significant investments in automotive and industrial sectors, driving demand for advanced bonding technologies.

Latin America

Latin America holds a smaller, yet steadily growing share in the Rubber to Metal Bonded Articles market, with a market share of 7%. The region is witnessing growth in automotive manufacturing, especially in countries like Mexico and Brazil, which serve as major automotive production hubs. The demand for rubber to metal bonded components in Latin America is primarily driven by the automotive industry, which is increasingly focusing on noise, vibration, and harshness (NVH) control. Additionally, the expansion of industrial machinery and construction projects in the region supports the adoption of these bonded articles. However, Latin America’s growth potential is somewhat limited by economic fluctuations and the slower pace of industrial modernization compared to other regions.

Middle East and Africa

The Middle East and Africa (MEA) hold a market share of 5% in the Rubber to Metal Bonded Articles market. While the region is not as large a player as others, it is experiencing gradual growth due to increasing infrastructure development, particularly in countries like the United Arab Emirates, Saudi Arabia, and South Africa. The demand for rubber to metal bonded components in the MEA region is primarily driven by industrial machinery, construction, and automotive applications. The region’s growing focus on sustainability and efficient manufacturing processes also contributes to market growth. Despite the smaller market share, the Middle East and Africa present opportunities for growth as industrialization continues to expand in the coming years.\

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Parker LORD Corporation

- Trelleborg AB

- Vibracoustic GmbH

- NOK Corporation

- Anhui Zhongding Sealing Parts

- Sumitomo Riko Co., Ltd.

- Anvis Group

- Cooper‑Standard Automotive

- Continental AG

- Hutchinson SA

Competitive Analysis

The Rubber to Metal Bonded Articles market is highly competitive, with key players such as NOK Corporation, Continental AG, Hutchinson SA, Trelleborg AB, Sumitomo Riko Co., Ltd., Vibracoustic GmbH, Cooper-Standard Automotive, Parker LORD Corporation, Anvis Group, and Anhui Zhongding Sealing Parts leading the industry. These companies are focused on strengthening their positions through technological advancements, product innovations, and strategic partnerships. They are investing in research and development to improve bonding technologies and develop lightweight, durable materials that cater to the growing demand in automotive, aerospace, and industrial sectors. Additionally, they are enhancing manufacturing capabilities through automation to reduce production costs and improve efficiency. As sustainability becomes increasingly important, these players are also focusing on eco-friendly and recyclable materials. The competition remains strong, with players continuously adapting to industry demands, emerging technologies, and regulatory changes to strengthen their position in the market.

Recent Developments

- In February 2024, Trelleborg reported its ongoing efforts to increase the share of sustainable materials in its products and solutions, reinforcing its position as a sustainability leader in the industry.

- In May 2023, Vibracoustic launched the ‘Green Rubber Project,’ a comprehensive program aimed at sustainably sourcing, manufacturing, and recycling rubber used in its products, contributing to a circular economy.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Bonding Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for rubber to metal bonded articles will continue to grow with the rise in electric vehicle production.

- Increasing regulations for noise, vibration, and harshness (NVH) control in the automotive industry will drive market expansion.

- Advancements in bonding technologies will improve the performance and durability of rubber to metal bonded components.

- The growing emphasis on sustainability will push the market toward eco-friendly and recyclable materials.

- Expanding industrial machinery sectors in emerging markets will create more demand for bonded components.

- The automotive industry will continue to be a key driver, with rubber to metal bonded articles used in suspension systems, engine mounts, and bushings.

- Ongoing technological innovations in rubber and metal bonding processes will result in more cost-effective and efficient production.

- The aerospace and defense sectors will contribute to the market’s growth with increasing demands for high-performance, reliable components.

- The shift toward lightweight materials in various industries will further fuel the adoption of rubber to metal bonded articles.

- As infrastructure projects grow globally, the demand for durable, vibration-resistant components will increase, supporting market growth.