Market Overview

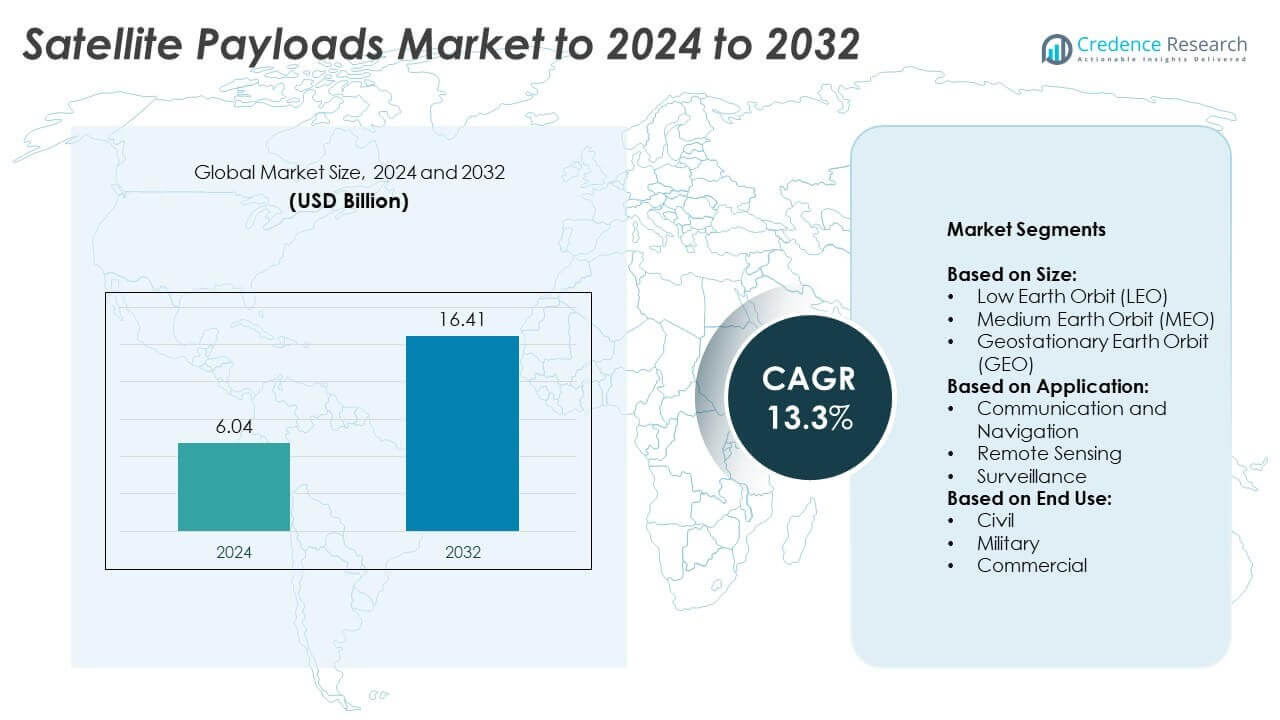

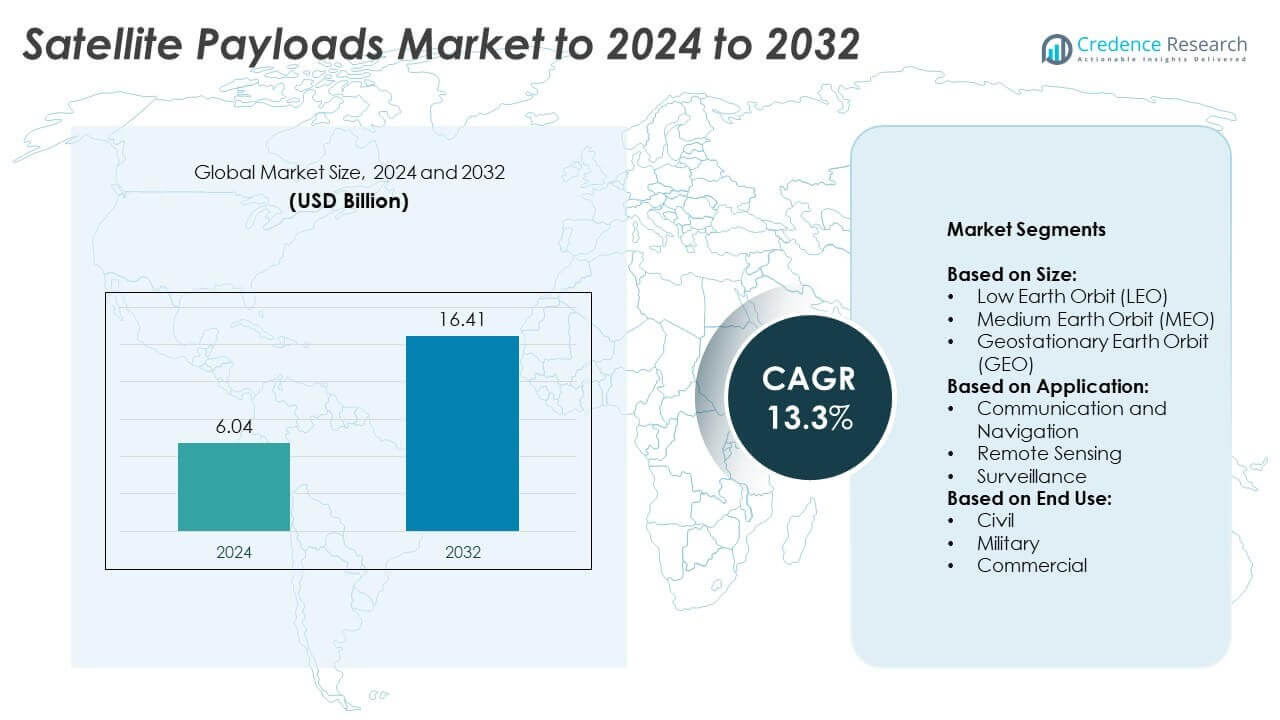

The Satellite Payloads Market size was valued at USD 6.04 billion in 2024 and is anticipated to reach USD 16.41 billion by 2032, at a CAGR of 13.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Satellite Payloads Market Size 2024 |

USD 6.04 Billion |

| Satellite Payloads Market, CAGR |

13.3% |

| Satellite Payloads Market Size 2032 |

USD 16.41 Billion |

The satellite payloads market is shaped by leading players including Thales Alenia Space, Boeing, SpaceX, Lockheed Martin, Airbus, Northrop Grumman, Honeywell International, General Dynamics, L3Harris Technologies, Sierra Nevada Corporation, Mitsubishi Heavy Industries, and Thales Group. These companies compete through innovation in communication, navigation, surveillance, and Earth observation payloads, with strong investments in modular designs and AI-driven systems. Strategic collaborations with government and commercial operators enhance their global presence and contract pipelines. Regionally, North America led the market with a 38% share in 2024, supported by extensive defense spending, broadband initiatives, and commercial satellite launches, while Europe held 27% and Asia Pacific accounted for 24%, reflecting growing space programs and rising private sector participation.

Market Insights

Market Insights

- The satellite payloads market was valued at USD 6.04 billion in 2024 and is expected to reach USD 16.41 billion by 2032, growing at a CAGR of 13.3%.

- Strong demand for broadband connectivity and Earth observation services is driving adoption of advanced payloads, with Low Earth Orbit systems accounting for over 55% share in 2024.

- Trends such as miniaturization of payloads, AI-based onboard processing, and commercialization of satellite services are shaping future growth opportunities.

- The market is competitive with global players investing in modular payload design, strategic partnerships, and research initiatives to strengthen their positions despite high deployment costs and orbital congestion challenges.

- Regionally, North America led with 38% share in 2024 due to defense spending and broadband projects, followed by Europe at 27% and Asia Pacific at 24%, while Middle East & Africa held 6% and Latin America accounted for 5%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Size

Low Earth Orbit (LEO) payloads accounted for the largest share of over 55% in 2024. Their dominance is driven by the rising deployment of small satellites, CubeSats, and mega-constellations for broadband internet and Earth observation. Companies such as SpaceX and OneWeb continue to expand LEO constellations to provide low-latency communication services globally. The lower cost of launch and shorter orbital periods further enhance adoption. In contrast, Medium Earth Orbit (MEO) and Geostationary Earth Orbit (GEO) payloads serve critical navigation and broadcasting applications but hold comparatively smaller shares.

- For instance, SpaceX’s Starlink program launched additional satellites throughout August 2024, expanding its global internet network. Later, following a launch on August 14, 2025, it was reported that Starlink’s active constellation exceeded 8,100 satellites. By the end of August 2024, SpaceX had launched over 6,800 satellites in total, contributing to the expansion of its network, the largest satellite constellation ever deployed.

By Application

Communication and navigation payloads led the market with nearly 60% share in 2024. This dominance stems from the rising demand for broadband connectivity, direct-to-home broadcasting, and GPS-based services across industries. Global navigation satellite systems (GNSS) operating in MEO orbit also play a key role in transportation and defense. Remote sensing applications are gaining momentum with increasing climate monitoring and agricultural analytics demand, while surveillance payloads are primarily deployed for military reconnaissance and border security, contributing steady but smaller growth in the segment.

- For instance, the European GNSS constellation Galileo operates 27 usable satellites in MEO as of September 2024, with its High Accuracy Service providing horizontal and vertical accuracies of 20 cm and 40 cm, respectively.

By End Use

The commercial sector captured the largest share of about 50% in 2024. Expansion of satellite internet services, high-throughput communication satellites, and Earth imaging for agriculture, logistics, and energy industries support this growth. Companies are increasingly investing in commercial payloads due to rising demand from telecom operators and private businesses. Military end use continues to drive advanced surveillance, navigation, and secure communication applications, while civil payloads are expanding steadily, supported by government-led projects for disaster management, environmental monitoring, and scientific research initiatives.

Key Growth Drivers

Rising Demand for Broadband Connectivity

The rapid expansion of broadband services via satellite networks is a primary growth driver for the satellite payloads market. Low Earth Orbit (LEO) constellations deployed by companies like SpaceX and OneWeb are enabling high-speed internet access in underserved and remote regions. This trend reduces the digital divide and creates new revenue streams for operators. The increasing reliance on broadband for e-learning, telemedicine, and remote work continues to accelerate payload deployment, making broadband demand the most significant driver in the market.

- For instance, Planet Labs operated over 200 Dove satellites in 2024, serving commercial agriculture, energy, and forestry clients with daily Earth imaging.

Expansion of Earth Observation Applications

Earth observation payloads are gaining importance as governments and private organizations adopt satellite imaging for agriculture, climate monitoring, and urban planning. Rising awareness of environmental challenges and the need for data-driven insights fuel this growth. Remote sensing payloads are increasingly used for precision farming, disaster management, and natural resource monitoring. The demand for high-resolution imaging and analytics strengthens the role of Earth observation, providing a reliable avenue for market expansion across both civil and commercial sectors.

- For instance, SES maintained 70 satellites in orbit in 2024, many supporting telecom operators and enterprise connectivity.

Growing Military and Defense Investments

Military applications of satellite payloads remain a critical growth driver, particularly for surveillance, navigation, and secure communication systems. Governments are allocating higher budgets to strengthen national security through space-based infrastructure. Defense agencies are also investing in advanced payload technologies to improve reconnaissance, missile tracking, and secure communication networks. The increasing use of satellites in modern warfare strategies further drives demand. With rising geopolitical tensions, military spending continues to ensure strong growth in this segment over the forecast period.

Key Trends & Opportunities

Miniaturization of Satellite Payloads

The trend of miniaturization is creating opportunities for cost-effective payload deployment. Smaller payloads designed for CubeSats and small satellites allow operators to reduce launch costs and accelerate constellation deployment. Advancements in microelectronics and modular designs support the integration of advanced functionalities within compact systems. This shift enables broader participation from startups and emerging space nations. As miniaturized payloads become more sophisticated, they open doors for new applications in communication, Earth observation, and scientific research.

- For instance, China launched Yaogan-39 satellites in August 2023, enhancing surveillance and reconnaissance capacity.

Commercialization of Space Services

Commercial enterprises are increasingly dominating satellite payload investments, offering new opportunities for private players. Payloads supporting high-throughput communication, direct-to-consumer services, and real-time Earth monitoring are in high demand. Partnerships between governments and private companies accelerate innovation and reduce financial risk. The commercialization trend also fosters competition, which drives down costs while expanding service offerings. This opens significant growth avenues for new entrants and strengthens the role of commercial payloads in shaping the global market landscape.

- For instance, OneWeb launched its final batch of 36 first-generation satellites in March 2023, completing its 618-satellite constellation for global coverage. While the constellation size later reached 634 satellites with additional launches for resiliency, the initial operational fleet was finalized in March 2023.

Integration of AI and Data Analytics

The use of artificial intelligence (AI) and advanced data analytics in satellite payloads presents strong opportunities. AI enhances onboard processing, enabling satellites to deliver real-time insights rather than raw data. This reduces latency and improves efficiency in applications like disaster response, defense surveillance, and climate monitoring. Enhanced data analytics also boosts the commercial value of satellite imagery for industries such as energy, insurance, and logistics. The integration of AI-driven payloads will play a transformative role in shaping next-generation satellite services.

Key Challenges

High Cost of Deployment and Maintenance

Despite technological advancements, the satellite payload market faces challenges due to high costs of launch, deployment, and ongoing maintenance. Building sophisticated payloads requires significant investment in research, design, and manufacturing. Launch costs, though decreasing with reusable rockets, remain a substantial barrier for smaller operators. Additionally, ensuring long-term functionality in harsh orbital conditions adds to expenses. These financial burdens limit entry for startups and constrain market growth, particularly in developing regions with fewer resources to support space activities.

Space Debris and Orbital Congestion

The increasing number of satellites and payloads in orbit creates challenges related to space debris and congestion. LEO, in particular, is becoming overcrowded with mega-constellations, raising risks of collisions and disruptions. Managing orbital traffic and ensuring sustainability have become pressing concerns for regulators and satellite operators. The lack of standardized global regulations further complicates debris mitigation. Without effective measures, space debris poses a threat to the operational safety of payloads, potentially hampering future deployments and market growth.

Regional Analysis

North America

North America held the largest share of 38% in the satellite payloads market in 2024. The region benefits from strong investments by NASA, the U.S. Department of Defense, and commercial players like SpaceX and Northrop Grumman. Rising demand for broadband internet, navigation services, and advanced surveillance drives the adoption of payloads. Government programs supporting space exploration and defense modernization further strengthen the market. Canada also contributes with Earth observation initiatives and communication satellite projects. The region’s leadership is reinforced by continuous innovation, robust funding, and extensive satellite launches across military, commercial, and civil applications.

Europe

Europe accounted for 27% of the satellite payloads market share in 2024, supported by programs from the European Space Agency (ESA) and private companies. The region invests heavily in communication, navigation, and Earth observation payloads, with Galileo being a prime example of MEO-based navigation services. Countries like France, Germany, and the UK drive the market with advanced payload development and commercial satellite services. Growing focus on climate monitoring and sustainable space operations boosts demand for remote sensing payloads. Strategic collaborations and cross-border space projects also expand Europe’s influence in global satellite payload advancements.

Asia Pacific

Asia Pacific captured 24% of the global satellite payloads market in 2024, emerging as one of the fastest-growing regions. China, India, and Japan lead with strong government-backed programs such as BeiDou, ISRO missions, and JAXA projects. Commercial enterprises are also expanding their role with increasing satellite launches for communication and Earth observation. Rising demand for broadband in remote areas, urbanization, and national security initiatives strengthen adoption. Competitive launch costs from countries like India further enhance the region’s appeal. Asia Pacific continues to expand rapidly with ambitious payload programs and large-scale satellite deployments.

Middle East & Africa

The Middle East and Africa region represented 6% of the satellite payloads market in 2024. Governments and regional organizations invest in communication and surveillance payloads to support security and national development. The UAE’s space program and Saudi Arabia’s investments in communication satellites highlight regional progress. Africa increasingly uses satellite payloads for connectivity in remote areas, supporting education, healthcare, and disaster management. Limited infrastructure development remains a challenge, but partnerships with global satellite operators strengthen access. Growing ambitions in space exploration and commercial services are gradually driving market growth across the region.

Latin America

Latin America held a 5% share of the satellite payloads market in 2024. Countries like Brazil, Mexico, and Argentina are leading with investments in communication and Earth observation payloads. Brazil’s space initiatives and collaborations with international agencies support local industry growth. The demand for enhanced internet connectivity in rural and underserved regions is a key driver for commercial payloads. Despite economic challenges, the region is strengthening its role through joint ventures and regional cooperation programs. Continued government focus on scientific research and communication infrastructure is expected to support steady growth in the satellite payloads market.

Market Segmentations:

By Size:

- Low Earth Orbit (LEO)

- Medium Earth Orbit (MEO)

- Geostationary Earth Orbit (GEO)

By Application:

- Communication and Navigation

- Remote Sensing

- Surveillance

By End Use:

- Civil

- Military

- Commercial

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the satellite payloads market features major players such as Thales Alenia Space, Honeywell International, Inc., Boeing, SpaceX, Lockheed Martin Corporation, Thales Group, Sierra Nevada Corporation, Northrop Grumman, Mitsubishi Heavy Industries, Ltd., Airbus, General Dynamics Corporation, and L3Harris Technologies, Inc. These companies compete through strong portfolios spanning communication, navigation, surveillance, and Earth observation payloads. Strategic initiatives focus on innovation in miniaturization, advanced data processing, and integration of AI-driven technologies. Partnerships with government agencies and commercial operators are central to securing large-scale contracts and expanding market reach. Investments in research and development remain high, enabling the design of cost-efficient, modular, and flexible payload systems. Increasing global demand for high-throughput satellites and low-latency services further intensifies competition. Regional diversification, collaborative ventures, and long-term service offerings also enhance competitiveness, as players adapt to the rising need for broadband access, security-focused payloads, and sustainability-driven solutions in the evolving space ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Thales Alenia Space

- Honeywell International, Inc.

- Boeing

- SpaceX

- Lockheed Martin Corporation

- Thales Group

- Sierra Nevada Corporation

- Northrop Grumman

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- AIRBUS

- General Dynamics Corporation

- L3Harris Technologies, Inc.

Recent Developments

- In 2025, SpaceX launched the first 21 satellites for a new U.S. military constellation. These secure communication and tracking payloads were deployed for the U.S. Space Force.

- In 2025, Thales Alenia Space led a 5G direct-to-device demonstration payload for CNES, using an active antenna and a 5G satellite payload to test direct communication with mobile devices.

- In 2024, Northrop Grumman built two GEOStar satellites for Space Norway’s Arctic Satellite Broadband Mission (ASBM).

Report Coverage

The research report offers an in-depth analysis based on Size, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The satellite payloads market will expand rapidly with increasing demand for broadband connectivity.

- Low Earth Orbit constellations will dominate future deployments due to cost efficiency and low latency.

- Earth observation payloads will grow as climate monitoring and precision agriculture gain importance.

- Defense agencies will continue to invest heavily in surveillance and secure communication payloads.

- Miniaturized payloads for small satellites will create new opportunities for startups and emerging nations.

- Artificial intelligence integration will enhance onboard processing and real-time data delivery.

- Commercial sector demand will rise with expanding satellite internet and broadcasting services.

- Space sustainability initiatives will shape payload design to address orbital congestion and debris.

- International collaborations will strengthen innovation and reduce costs in payload development.

- Emerging regions will increase their market presence through government programs and private partnerships.

Market Insights

Market Insights