Market Overview

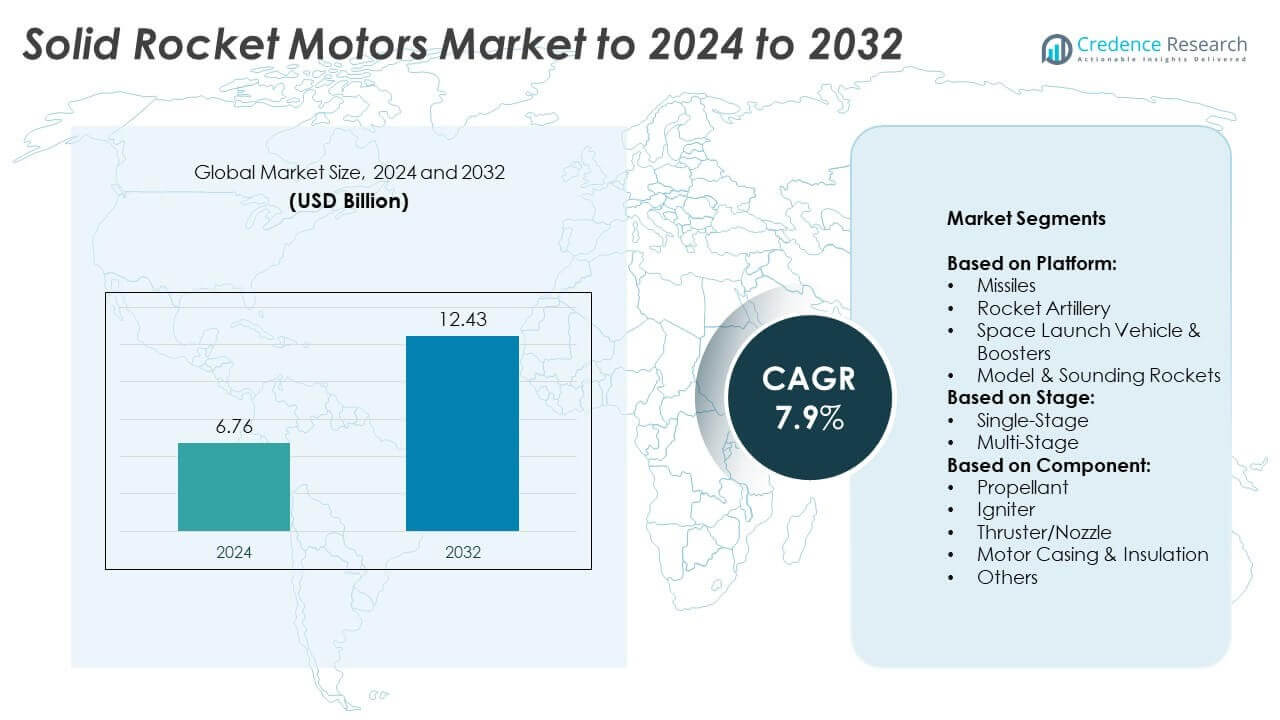

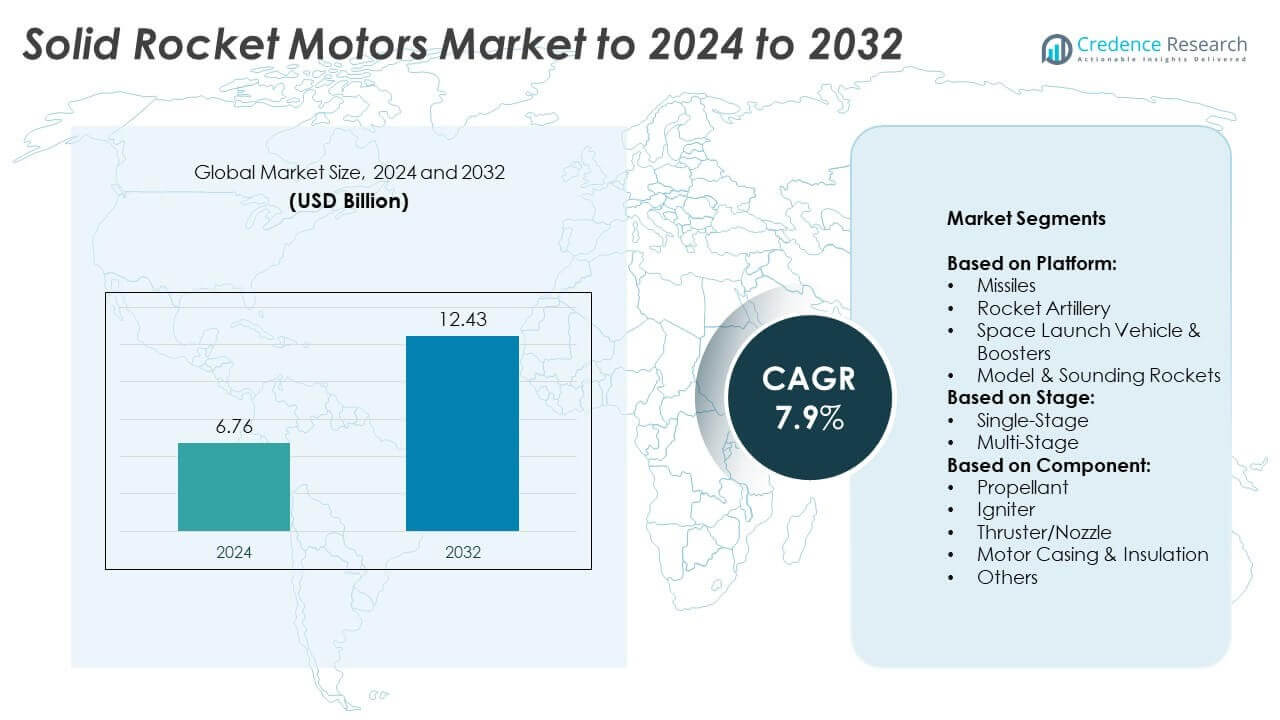

The Solid Rocket Motors Market size was valued at USD 6.76 billion in 2024 and is anticipated to reach USD 12.43 billion by 2032, at a CAGR of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Solid Rocket Motors Market Size 2024 |

USD 6.76 Billion |

| Solid Rocket Motors Market, CAGR |

7.9% |

| Solid Rocket Motors Market Size 2032 |

USD 12.43 Billion |

The Solid Rocket Motors market is driven by prominent players including Northrop Grumman Corp, Aerojet Rocketdyne, Nammo AS, Rafael Advanced Defense Systems, Avio S.p.A., L3Harris Technologies Inc., and China Aerospace Science and Technology Corporation. These companies focus on advanced propulsion technologies, defense modernization, and space launch programs to maintain competitiveness. North America led the global market in 2024 with a 38% share, supported by strong defense budgets and active space initiatives. Europe followed with 27%, driven by missile development and ESA-backed space programs, while Asia Pacific held 22%, emerging as the fastest-growing region due to expanding missile systems and ambitious space exploration projects.

Market Insights

Market Insights

- The Solid Rocket Motors market size was valued at USD 6.76 billion in 2024 and is projected to reach USD 12.43 billion by 2032, growing at a CAGR of 7.9%.

- Rising defense expenditure and increasing demand for tactical and strategic missile systems are driving steady market expansion worldwide.

- Emerging trends include the integration of solid rocket motors into hypersonic systems, advances in composite propellants, and miniaturized modular designs for flexible applications.

- The market is highly competitive with established players focusing on R&D, strategic contracts, and collaborations with private space firms to strengthen their global presence.

- North America led with 38% share in 2024, followed by Europe at 27% and Asia Pacific at 22%; missiles dominated by platform with 45% share, while single-stage motors accounted for 55% of the stage segment, making them the most widely adopted across defense and space applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Platform

The missiles segment accounted for the largest share of the Solid Rocket Motors market in 2024, holding nearly 45%. Demand is driven by rising defense modernization programs and investments in missile systems for national security. Countries such as the U.S., China, and India are expanding missile stockpiles, boosting adoption of solid rocket motors due to their reliability and rapid launch capabilities. Space launch vehicles and boosters also show strong growth, supported by increasing satellite launches and commercial space exploration initiatives, but remain behind missiles in overall market share.

- For instance, NASA’s SLS uses two SRBs, each at 3.6 million lbf thrust for 126 s, with 1.6 million lb total weight. These SRBs burn about six tons per second.

By Stage

Single-stage solid rocket motors dominated the market with a share of around 55% in 2024. Their simplicity, cost-effectiveness, and widespread application in tactical missiles and short-range rockets make them the preferred choice. Multi-stage motors are growing at a faster pace, mainly fueled by the rising number of space launches and long-range missile programs. The flexibility and performance of multi-stage systems enhance thrust efficiency, but single-stage solutions remain dominant due to high-volume adoption across defense and artillery applications.

- For instance, the European Space Agency’s (ESA) P120C solid rocket motor carries 142,000 kg of solid propellant, burns for approximately 130-135 seconds, and delivers a maximum thrust of 4,650 kN.

By Component

Propellant led the component segment with over 40% share in 2024, as it is the core material determining motor performance, burn rate, and payload capacity. Increasing R&D for high-energy composite propellants strengthens its position in defense and space applications. The motor casing and insulation also play a significant role, ensuring structural integrity under extreme pressure and temperature conditions. However, propellants remain the dominant sub-segment, supported by ongoing advances in energetic materials that enhance propulsion efficiency and reduce overall launch costs.

Key Growth Drivers

Rising Defense Expenditure

Increasing defense spending across major economies is the leading growth driver for the Solid Rocket Motors market. Countries such as the U.S., China, Russia, and India are allocating higher budgets to strengthen missile capabilities and upgrade their existing defense systems. Solid rocket motors are preferred in military applications because of their rapid launch readiness, long storage life, and high reliability under combat conditions. Governments are expanding procurement of tactical and strategic missile systems, boosting large-scale production of solid rocket motors. The growing emphasis on national security, missile defense programs, and modernization of armed forces ensures that demand for these propulsion systems remains strong and sustained over the coming years.

- For instance, Lockheed Martin produced 500+ PAC-3 MSE interceptors in 2024, with plans targeting 650 per year by 2027. Reported deliveries in 2025 are projected at ~600+ units.

Expansion of Space Exploration Programs

The growing focus on satellite deployment, interplanetary missions, and commercial space travel has created strong demand for solid rocket motors. Government agencies like NASA, ESA, ISRO, and CNSA, along with private companies, are increasingly using solid rocket boosters for their ability to deliver powerful initial thrust and support heavy payload launches. Solid motors remain integral in multi-stage rockets, offering high energy efficiency at relatively lower costs. The surge in low-Earth orbit satellite constellations for communications and navigation also drives usage. Furthermore, the increasing interest in lunar exploration and Mars missions amplifies their demand. With both government-backed and private-led exploration activities expanding, space applications are becoming one of the most lucrative growth drivers for the market.

- For instance, the first stage of ISRO’s Polar Satellite Launch Vehicle (PSLV) carries 138 metric tons of HTPB-based solid propellant, producing a maximum thrust of approximately 4,800 kN.

Technological Advancements in Propellants

Innovations in propellant chemistry and design have significantly strengthened the efficiency of solid rocket motors. Advancements in composite propellants allow for improved burn rates, enhanced thrust, and better stability under extreme conditions, which directly benefits defense and space applications. In addition, the integration of lightweight materials and additive manufacturing is reducing production costs while improving design flexibility and performance. Efforts to develop eco-friendly and low-toxicity propellants are also gaining momentum as regulatory pressures grow. These technological shifts are reshaping the industry by providing more reliable and environmentally conscious propulsion systems. Continuous R&D investments ensure that improvements in thrust capability, fuel efficiency, and structural integrity keep solid rocket motors highly competitive against alternative propulsion technologies.

Key Trends & Opportunities

Commercialization of Space Activities

The growing role of private aerospace companies is reshaping the solid rocket motors landscape, creating fresh opportunities for propulsion suppliers. Firms like SpaceX, Rocket Lab, and Blue Origin are ramping up launches for telecommunications, navigation, and scientific research, often requiring reliable boosters and motor stages. The rise in small satellite constellations has created new demand for cost-effective launch vehicles where solid motors play a crucial role. With more companies entering the space sector and developing affordable launch services, the dependence on solid rocket motors is expected to increase. This commercialization trend broadens the customer base beyond government agencies and drives sustained long-term growth opportunities.

- For instance, Ariane 6/Vega-C P120C uses a carbon-fibre filament-wound case and HTPB propellant of ~142 t. This reduces mass while maintaining high thrust.

Integration with Hypersonic Systems

Hypersonic weapon development is a major trend shaping the solid rocket motors market. Defense organizations are focusing on missiles capable of speeds above Mach 5, which demand high-thrust propulsion systems. Solid rocket motors are being adapted to meet these requirements, providing the initial acceleration and energy needed for hypersonic glide vehicles and maneuverable warheads. Countries like the U.S., China, and Russia are heavily investing in these programs, opening significant opportunities for manufacturers to align with next-generation defense technologies. The rapid global race for hypersonic supremacy ensures that demand for advanced solid rocket motors will remain high in the near future.

- For instance, L3Harris (formerly via Aerojet Rocketdyne) hot-fired the eSR-19 solid motor design, which uses a graphite composite case and improved propellant formulation.

Miniaturized and Modular Designs

The development of compact, modular solid rocket motors is emerging as a vital trend to serve evolving defense and space needs. These motors provide flexibility for integration across small tactical missiles, portable rocket artillery, and low-cost satellite launches. Modular designs also reduce costs, simplify production, and enhance scalability across applications. Growing demand for responsive launch capabilities, particularly for micro- and nano-satellites, further strengthens this trend. By addressing the needs of both large defense contractors and small aerospace companies, miniaturized and modular solutions are creating new market segments and unlocking wider adoption opportunities.

Key Challenges

Environmental and Safety Concerns

Environmental and safety issues are among the most pressing challenges in the solid rocket motors market. Traditional propellants contain chemicals that release toxic emissions during production, testing, and launches, raising ecological and health concerns. International environmental regulations are becoming more stringent, forcing manufacturers to adopt sustainable solutions or risk compliance penalties. Additionally, handling and storing hazardous propellant materials require strict safety measures and advanced facilities, increasing operational complexity and cost. Companies are investing in developing greener propellants, but the transition is slow and expensive. Addressing these environmental and safety concerns is crucial to ensuring long-term market growth without regulatory restrictions.

High Development and Testing Costs

The production and validation of solid rocket motors involve extremely high costs, limiting participation from smaller firms and emerging players. Advanced facilities are needed for propellant formulation, casing design, and full-scale testing, making the process capital intensive. Defense and space applications demand rigorous quality checks, adding further expense and complexity. The reliance on specialized materials and technologies drives costs even higher, slowing down new entrants and innovation cycles. For established companies, scaling production is feasible, but for smaller players, barriers to entry remain high. These financial challenges continue to restrict the competitive landscape and create dependency on large government contracts for revenue sustainability.

Regional Analysis

North America

North America held the largest share of the Solid Rocket Motors market in 2024, accounting for nearly 38%. The region benefits from strong defense budgets, advanced aerospace capabilities, and active space exploration programs led by NASA and private firms. The U.S. dominates regional demand with continuous investments in missile defense, tactical weapon systems, and satellite launches. Canada also contributes through defense modernization and collaborations with U.S. aerospace companies. Growing adoption of hypersonic programs further supports market expansion, positioning North America as the global leader in solid rocket motor development and deployment during the forecast period.

Europe

Europe captured around 27% of the global Solid Rocket Motors market in 2024, driven by increasing missile programs and space missions led by ESA and national defense agencies. Countries such as France, Germany, and the UK are investing in tactical and long-range missile systems, strengthening defense reliance on solid rocket propulsion. The Ariane space launch program also contributes significantly to demand for boosters and multi-stage motors. Collaborative defense initiatives and NATO-backed modernization projects further fuel adoption. With emphasis on both defense security and space innovation, Europe remains a strong market, maintaining its position as the second-largest regional contributor.

Asia Pacific

Asia Pacific accounted for nearly 22% of the Solid Rocket Motors market in 2024, supported by rising defense modernization and rapid growth in space activities. China, India, Japan, and South Korea are expanding missile programs while boosting satellite launch capabilities. ISRO’s frequent launches and China’s ambitious lunar and planetary missions highlight growing reliance on solid rocket boosters. Rising territorial tensions also accelerate demand for missile-based defense systems across the region. With expanding government funding and increasing participation of private aerospace companies, Asia Pacific is projected to witness the fastest growth among all regions in the forecast period.

Middle East & Africa

The Middle East & Africa region represented about 8% of the global Solid Rocket Motors market in 2024. Growth is primarily driven by strong defense investments in countries like Saudi Arabia, Israel, and the UAE, where missile defense programs remain a strategic priority. Local collaborations with international defense suppliers further enhance regional capabilities. Africa shows limited adoption but is gradually increasing participation through joint defense projects. Although smaller in share, the region demonstrates consistent growth prospects due to rising geopolitical tensions and the continuous focus on strengthening national security through advanced missile systems and propulsion technologies.

Latin America

Latin America held a 5% share of the global Solid Rocket Motors market in 2024, with Brazil being the primary contributor due to its space program and defense modernization efforts. The Brazilian Space Agency’s satellite launches and missile development initiatives drive regional demand. Other countries like Argentina and Mexico show limited adoption but are gradually increasing defense spending. Although the region lags behind others in scale, investments in space exploration and localized defense industries are supporting steady growth. The focus on expanding aerospace capabilities ensures that Latin America remains a developing but important contributor to the global market.

Market Segmentations:

By Platform:

- Missiles

- Rocket Artillery

- Space Launch Vehicle & Boosters

- Model & Sounding Rockets

By Stage:

By Component:

- Propellant

- Igniter

- Thruster/Nozzle

- Motor Casing & Insulation

- Others

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Solid Rocket Motors market is shaped by leading companies such as Kratos Defense & Security Solutions, Nammo AS, Rafael Advanced Defense Systems, Ursa Major, Avio S.p.A., L3Harris Technologies, China Aerospace Science and Technology Corporation, Anduril, Bayern-Chemie, Aerojet Rocketdyne, X-Bow, IHI Corporation, and Northrop Grumman Corp. These companies compete through advanced product portfolios, strategic partnerships, and investments in new technologies to strengthen their positions in defense and space applications. The market is characterized by innovation in high-energy propellants, modular designs, and eco-friendly propulsion systems. Global players are focusing on meeting rising defense demands for tactical and strategic missiles, while also catering to the growing commercial space sector. Strategic contracts with defense agencies, expansion into emerging regions, and collaboration with private space firms are key competitive strategies. Strong R&D pipelines, coupled with large-scale production capabilities, ensure these players maintain a dominant role in the evolving global solid rocket motors market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kratos Defense & Security Solutions (U.S.)

- Nammo AS (Norway)

- Rafael Advanced Defense Systems Ltd (Israeli)

- Ursa Major (U.S.)

- Avio S.p.A. (Italy)

- L3Harris Technologies Inc. (U.S.)

- China Aerospace Science and Technology Corporation (China)

- Anduril (U.S.)

- Bayern-Chemie (Germany)

- Aerojet Rocketdyne

- X-Bow (U.S.)

- IHI Corporation (Japan)

- Northrop Grumman Corp (U.S.)

Recent Developments

- In 2023, Northrop Grumman successfully manufactured the first set of solid rocket motor cases for the Missile Defense Agency’s NGI program, demonstrating new case designs and manufacturing processes.

- In 2023, Aerojet Rocketdyne secured a $215.6 million cooperative agreement with the Department of Defense (DoD). This investment was used to modernize and expand production facilities in Arkansas, Alabama, and Virginia to increase output of GMLRS, Stinger, and Javelin missiles.

- In 2023, Anduril acquired Adranos, a specialized manufacturer of solid rocket motors. This acquisition was aimed at increasing competition and strengthening the US SRM supply base.

Report Coverage

The research report offers an in-depth analysis based on Platform, Stage, Component and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily, supported by defense modernization programs worldwide.

- Missile systems will remain the dominant application due to rising security concerns.

- Space launch vehicles will gain traction with increasing satellite deployment.

- Technological innovation in composite propellants will enhance motor efficiency.

- Hypersonic missile development will create strong demand for advanced solid rocket motors.

- Modular and miniaturized designs will expand adoption across defense and space sectors.

- North America will continue leading, while Asia Pacific will record the fastest growth.

- Environmental regulations will push research toward greener propellant alternatives.

- High R&D investments will drive competitiveness among global players.

- Collaboration between defense agencies and private space firms will accelerate market expansion.

Market Insights

Market Insights