Market Overview

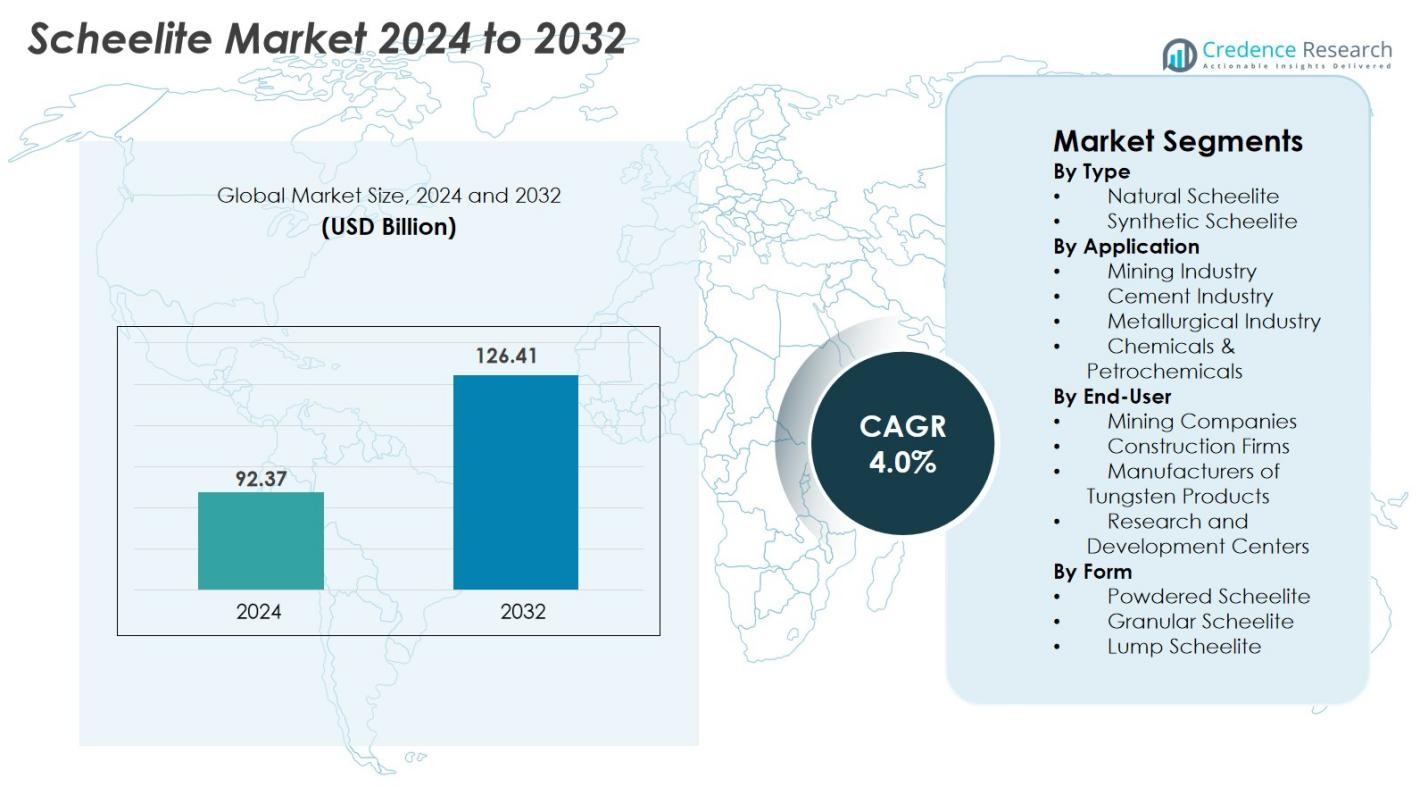

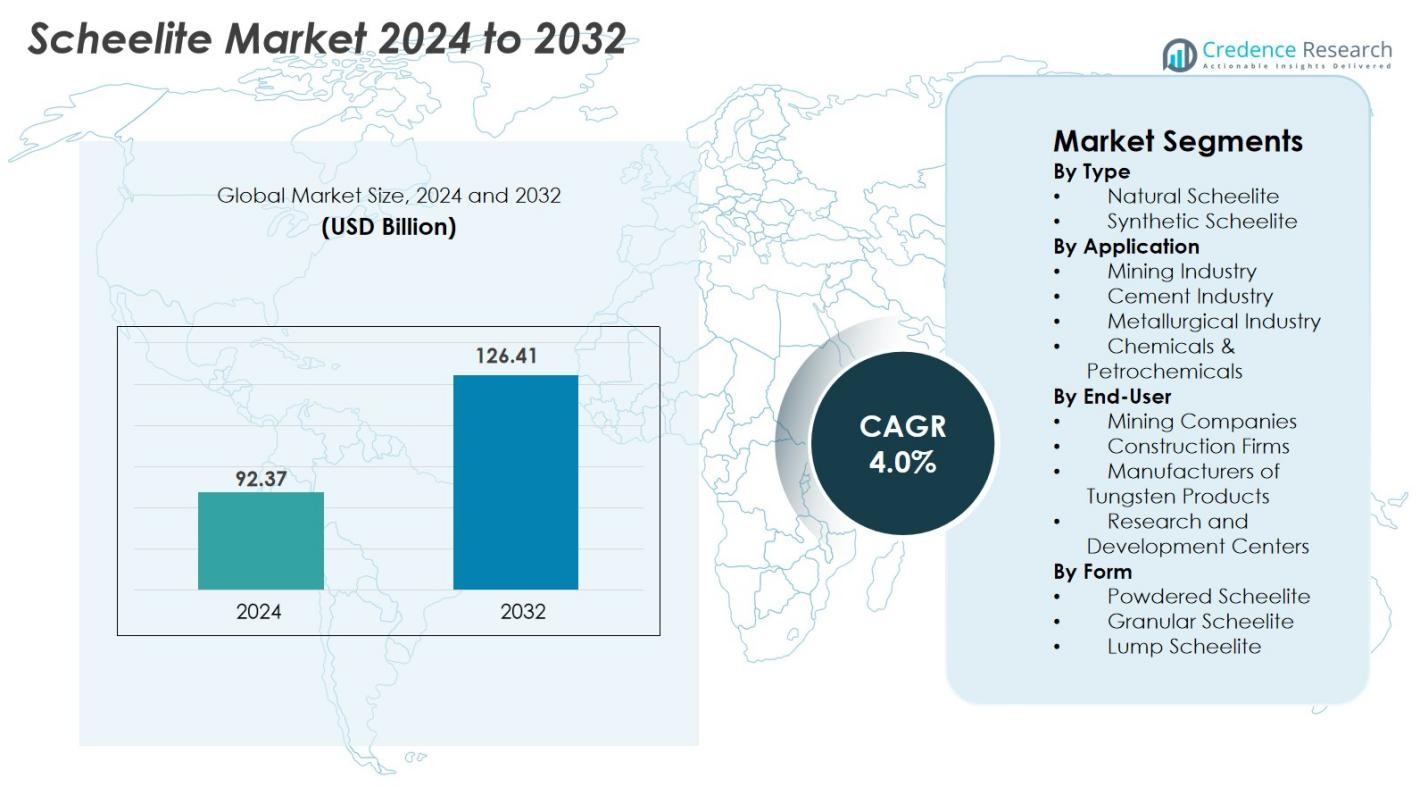

Scheelite Market size was valued at USD 92.37 Billion in 2024 and is anticipated to reach USD 126.41 Billion by 2032, at a CAGR of 4.0% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Scheelite Market Size 2024 |

USD 92.37 Billion |

| Scheelite Market, CAGR |

4.0% |

| Scheelite Market Size 2032 |

USD 126.41 Billion |

The Scheelite Market is led by prominent players such as American Elements, CMOC Group Limited, Almonty Industries Inc., Plansee Group, Sanher Tungsten Vietnam Co., Ltd., United Wolfram, and Arth Metallurgicals Pvt. Ltd., among others. These companies drive global supply through strategic mining operations, technological advancements, and expanded processing capabilities to meet rising tungsten demand. Asia-Pacific dominates the market with a commanding 51.3% share in 2024, supported by China’s extensive scheelite reserves and large-scale production. Europe follows with 23.4% due to strong industrial and manufacturing demand, while North America holds 19.8%, driven by critical mineral strategies and advanced tungsten applications.

Market Insights

- The Scheelite Market was valued at USD 92.37 Billion in 2024 and is projected to reach USD 126.41 Billion by 2032, registering a CAGR of 4.0% during the forecast period.

- Growing demand for tungsten in industries such as aerospace, electronics, mining, and manufacturing is a key driver, as scheelite is a primary source of tungsten for high-performance components and industrial tools.

- A major market trend includes the increasing adoption of advanced extraction and processing technologies, including AI-based ore sorting and recycling solutions, to improve recovery rates and sustainability.

- The competitive landscape is shaped by leading players like CMOC Group Limited, American Elements, Almonty Industries Inc., and Plansee Group, who focus on resource expansion, sustainability, and downstream integration.

- Asia-Pacific leads with 51.3% share due to China’s dominance in scheelite production, followed by Europe at 23.4%, North America at 19.8%, while Natural Scheelite holds 72.5% share by type, dominating due to its broad industrial use.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

The Scheelite Market is segmented into Natural Scheelite and Synthetic Scheelite, with Natural Scheelite dominating the market in 2024 with an estimated 72.5% share. This dominance is driven by its abundant availability in nature and extensive use in tungsten extraction processes across mining operations. Natural scheelite’s high-grade mineral composition makes it ideal for large-scale extraction, contributing to consistent supply for industrial applications. Meanwhile, Synthetic Scheelite holds 27.5% and is gaining traction for its controlled purity and suitability in advanced R&D and specialty applications, particularly in optical and scintillation industries.

- For instance, Saint-Gobain Crystals manufactures synthetic scheelite scintillation crystals with a light output of 22,000 photons per MeV, which are used in radiation detection systems for medical and industrial applications.

By Application

Within the Scheelite Market, the Mining Industry leads the application segment with a 49.3% share in 2024, primarily due to its essential role as a primary source of tungsten. The Metallurgical Industry follows with 28.7%, where scheelite is used to produce tungsten alloys for cutting tools and wear-resistant materials. The Chemicals & Petrochemicals segment accounts for 13.5%, utilizing scheelite in catalysts and additives, while the Cement Industry holds the remaining share, driven by scheelite-based additives improving cement strength and performance in niche applications.

- For instance, Sandvik (specifically its Sandvik Coromant area) integrates tungsten sourced from scheelite into its cemented carbide tools, which are used in demanding aerospace machining applications to achieve high hardness, wear resistance, and extended tool life. The hardness of these specific tools falls within the typical range for cemented carbides, which can vary from 700 HV to 2200 HV depending on the grade and composition.

By End-User

The Mining Companies segment dominates the Scheelite Market by end-user, capturing approximately 58.2% market share in 2024. This is attributed to the extensive use of scheelite in the extraction and processing of tungsten for fueling downstream industries. Construction Firms represent 17.6%, leveraging tungsten-based products for infrastructure projects requiring durability. Manufacturers of Tungsten Products account for 19.1%, driven by demand for industrial tools and components, while Research and Development Centers, with 5.1%, utilize high-purity scheelite in advanced material science applications and high-performance methodologies.

Key Growth Drivers

Rising Demand for Tungsten in Industrial Applications

The Scheelite Market is primarily driven by the increasing demand for tungsten in industrial sectors such as automotive, aerospace, electronics, and energy. Tungsten’s exceptional hardness and high melting point make it indispensable for manufacturing cutting tools, drill bits, wear-resistant parts, and high-temperature components. As global infrastructure and manufacturing activities expand, especially in emerging economies, the need for reliable tungsten supply continues to grow. Scheelite, as a major source of tungsten concentrate, is crucial in meeting this demand. Additionally, the shift toward advanced manufacturing technologies, including additive manufacturing and precision machining, further fuels the requirement for high-grade tungsten derived from scheelite.

- For instance, Kennametal introduced 3D-printed tungsten carbide components with densities reaching 15.2 g/cm³ using its proprietary binder jetting platform.

Expanding Mining and Exploration Activities

The expansion of mining and exploration initiatives, especially in Asia and Africa, is significantly boosting the Scheelite Market. Governments and private investors are increasingly allocating resources to explore new deposits of tungsten ore, including scheelite, as global reserves face pressure from rising consumption. The development of modern mining technologies and automation has also improved extraction efficiencies, making remote and challenging deposits economically viable. Countries like China and Vietnam are leading the exploration and export of scheelite, responding to the growing tungsten needs of global industries. Meanwhile, investment in exploration projects across Canada, Portugal, and Australia is strengthening the global scheelite supply chain.

- For instance, Wolfram Bergbau und Hütten introduced automated ore-sorting technology at its Mittersill mine, which rejects 80,000 to 120,000 metric tons of waste annually, thereby enhancing the head grade of the ore and improving overall efficiency.

Growing Use of Tungsten in Emerging Technologies

Emerging technologies such as electric vehicles (EVs), renewable energy systems, and semiconductors are shaping new growth avenues for the Scheelite Market. Tungsten is vital in applications like battery electrodes, power electronics, light filament production, and high-strength alloys—all of which are experiencing rising demand. As industries transition toward electrification and sustainability, scheelite-derived tungsten products are becoming critical materials for advanced engineering. Tungsten’s unique characteristics also make it suitable for defense and aerospace components, diversifying its demand base. Strategic investments by tech companies and government-led initiatives in renewable and high-tech manufacturing are expected to heighten scheelite consumption in the future.

Key Trends & Opportunities

Technological Advancements in Extraction and Processing

Technological innovations in tungsten extraction are opening new opportunities in the Scheelite Market. Methods such as bioleaching, solvent extraction, and AI-based ore sorting are improving recovery rates and processing efficiencies, particularly for low-grade ores. These advancements help reduce operational costs and align with sustainability goals in mining. Recycling technologies are also emerging as a secondary tungsten source, lessening dependency on primary scheelite reserves and supporting circular economy practices. Companies implementing advanced processing technologies stand to gain better access to high-purity tungsten applications in fields like aerospace, electronics, and high-performance machining, enhancing their competitive edge in the evolving market landscape.

- For instance, H.C. Starck Solutions (now part of Elmet Technologies in North America and MWS in Europe) supplies high-performance metal products, including tungsten alloys, to aerospace clients for various applications such as counterweights and radiation shielding.

Growth in Renewable Energy and Green Technologies

The increasing emphasis on renewable energy and clean technologies is creating substantial demand for scheelite-based tungsten. Tungsten’s applications in energy-efficient lighting, photovoltaic cells, and thermal management systems make it a valuable material in the sustainability transition. Its durability and heat resistance are essential in wind turbines, smart grids, and electric vehicle components. Government initiatives aimed at decarbonization are further accelerating demand. Additionally, advancements in material sciences are revealing new uses for tungsten in hydrogen energy, energy storage, and low-emission technologies. This alignment with global sustainability goals represents a critical opportunity for companies operating across the scheelite supply chain.

Key Challenges

Environmental and Regulatory Constraints

Environmental constraints and stringent regulatory frameworks present significant challenges to the Scheelite Market. Mining operations, particularly those involving surface extraction, are associated with environmental risks such as soil erosion, water pollution, and biodiversity loss. As a result, regulatory agencies in regions like Europe and North America are enforcing stricter guidelines governing land use, emissions, and waste disposal in mineral extraction. Complying with these regulations often increases operational costs and delays project timelines, especially for smaller firms. Furthermore, rising environmental activism and community opposition to mining activities force companies to invest more in sustainable practices, creating pressure to modernize operations and adopt eco-friendly technologies.

Price Volatility and Supply Chain Disruptions

The Scheelite Market is highly susceptible to price volatility and supply chain disruptions, influenced by geopolitical factors, trade restrictions, and uneven production capacities. China, being the dominant producer of scheelite, controls a significant portion of the global tungsten supply, which leaves the market vulnerable to policy shifts or export limitations. Prices can fluctuate sharply based on changes in demand, global economic conditions, or supply shocks. Logistics challenges such as rising transportation costs, port delays, or geopolitical conflicts further complicate supply continuity. These uncertainties make it difficult for downstream manufacturers to maintain stable production schedules, emphasizing the need for diversified supply strategies and long-term procurement planning.

Regional Analysis

North America

North America holds a notable share of the Scheelite Market, accounting for approximately 19.8% in 2024. The region benefits from growing investments in mining exploration and increased demand for tungsten in advanced manufacturing sectors such as aerospace, defense, and energy. The United States leads the regional market with a strong focus on securing domestic tungsten supply to reduce dependency on imports. Government initiatives supporting critical mineral projects encourage exploration and resource development. While competition from global producers poses a challenge, North America’s technological advancements and strict environmental standards are fostering sustainable production practices, ensuring long-term market growth.

Europe

Europe represents around 23.4% of the Scheelite Market in 2024, driven by robust demand for tungsten in high-performance automotive, industrial machinery, and renewable energy technologies. Germany, Austria, and the UK lead consumption due to their advanced manufacturing bases and growing focus on resource security. The region also actively promotes recycling and circular economy practices to reduce reliance on primary tungsten imports, especially from China. Stringent environmental regulations and strategic government initiatives are accelerating investments in domestic mining and processing capabilities. Rising R&D activity in tungsten-based materials further supports Europe’s role as a key consumer and innovator in the global scheelite market.

Asia-Pacific

Asia-Pacific dominates the Scheelite Market with an estimated 51.3% share in 2024, led by China, which holds the world’s largest scheelite reserves and remains the top tungsten producer. The region’s leadership is bolstered by extensive mining operations, low production costs, and strong demand from local industries such as construction, electronics, and machinery. India and Vietnam are emerging as key contributors, driven by increasing exploration and processing initiatives. Government support for resource development and industrial expansion continues to fuel regional growth. Asia-Pacific’s central role in global tungsten supply chains ensures its continued dominance in scheelite production and consumption.

Latin America

Latin America accounts for approximately 3.6% of the Scheelite Market in 2024, with emerging mining activities primarily in countries like Mexico, Brazil, and Bolivia. These nations are gradually exploring scheelite deposits to diversify their mineral portfolios and attract foreign investment. Limited infrastructure and regulatory challenges hinder large-scale development, but favorable geological conditions and growing interest from international mining firms offer potential for future growth. The region’s role as a supplier of raw tungsten materials to global markets is expected to strengthen as exploration intensifies and partnerships increase. However, competition with established producers remains a significant challenge for Latin America.

Middle East & Africa

The Middle East & Africa region holds around 1.9% of the Scheelite Market in 2024, with mining initiatives gaining traction in African countries like Rwanda, Tanzania, and Namibia. These regions possess untapped tungsten ore potential and are attracting interest from global mining companies seeking to diversify supply sources. However, limited technological capabilities, political instability, and infrastructure constraints continue to restrict growth. In the Middle East, investment remains minimal due to scarce scheelite reserves. With rising global demand and strategic investment, Africa could emerge as an important scheelite production hub over time, contributing to supply diversification.

Market Segmentations

By Type

- Natural Scheelite

- Synthetic Scheelite

By Application

- Mining Industry

- Cement Industry

- Metallurgical Industry

- Chemicals & Petrochemicals

By End-User

- Mining Companies

- Construction Firms

- Manufacturers of Tungsten Products

- Research and Development Centers

By Form

- Powdered Scheelite

- Granular Scheelite

- Lump Scheelite

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Scheelite Market features a moderately consolidated landscape, with leading mining and material processing companies driving global supply and innovation. Key players include American Elements, Sanher Tungsten Vietnam Co., Ltd., Maruti Enterprise, Arth Metallurgicals Pvt. Ltd., United Wolfram, Anchor Chemicals Industries, Sun Industries, CMOC Group Limited, Almonty Industries Inc., and Plansee Group. These companies focus on securing high-grade scheelite deposits, investing in advanced extraction technologies, and expanding their international trade presence to meet growing tungsten demand across industrial sectors. Strategic initiatives such as vertical integration, joint ventures, and geographic diversification enable market leaders to enhance their production capacities and reduce supply chain risks. As environmental regulations and sustainability pressures rise, major players are adopting eco-friendly mining practices and recycling technologies to retain competitive advantage. Additionally, emerging players in countries like India and Vietnam are gradually expanding production capacities, adding to the competitive intensity of the global scheelite market.

Key Player Analysis

- American Elements

- Sanher Tungsten Vietnam Co., Ltd.

- Maruti Enterprise

- Arth Metallurgicals Pvt. Ltd.

- United Wolfram

- Anchor Chemicals Industries

- Sun Industries

- CMOC Group Limited

- Almonty Industries Inc.

- Plansee Group

Recent Developments

- In June 2025, Maxus Mining entered into an option agreement to acquire 100% interest in one tungsten (scheelite) and three antimony projects in British Columbia.

- In September 2025, Great Atlantic Resources Corp. reported the completion of a rock-sampling campaign at its “Flume Ridge” tin-tungsten property in New Brunswick, where scheelite mineralisation was identified.

- In October 2025, Almonty Industries announced its acquisition of the Gentung Browns Lake Tungsten Project (U.S.), enabling it to import its proprietary tungsten-processing technology and expand into the U.S. market for scheelite-based concentrate.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User, Form and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for scheelite will grow steadily due to its essential role in tungsten production for high-performance applications.

- Technological advancements in extraction and processing will improve efficiency and reduce environmental impact.

- Emerging opportunities in EVs, renewable energy, and advanced electronics will boost scheelite consumption.

- Increasing investments in exploration across Asia, Africa, and Latin America will expand global production capacity.

- Recycling of tungsten from secondary sources will gain traction as part of circular economy initiatives.

- Government support for critical mineral development will strengthen regional supply chains.

- Rising competition among key producers will drive innovation and vertical integration in the value chain.

- Environmental regulations will encourage sustainable mining practices and low-impact processing methods.

- The Asia-Pacific region will continue to lead the market, driven by China’s dominant production and consumption.

- Advanced material applications in aerospace, defense, and semiconductors will create new market opportunities.