Market Overview

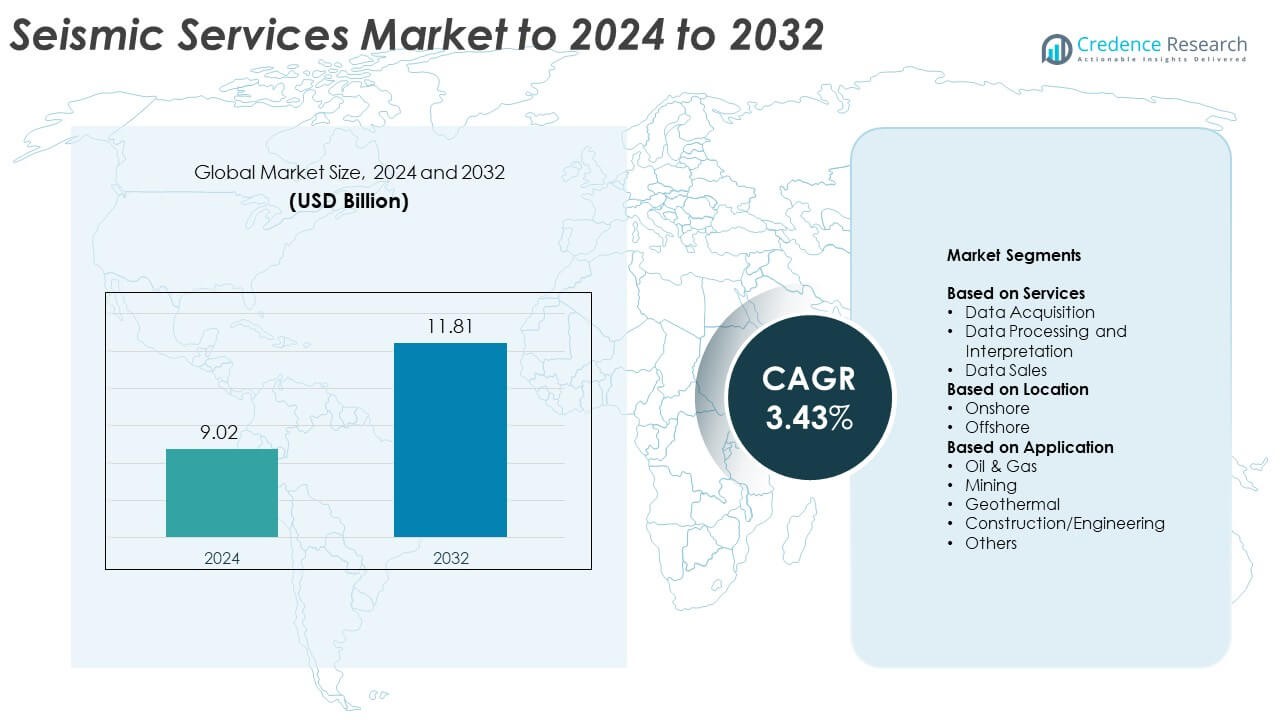

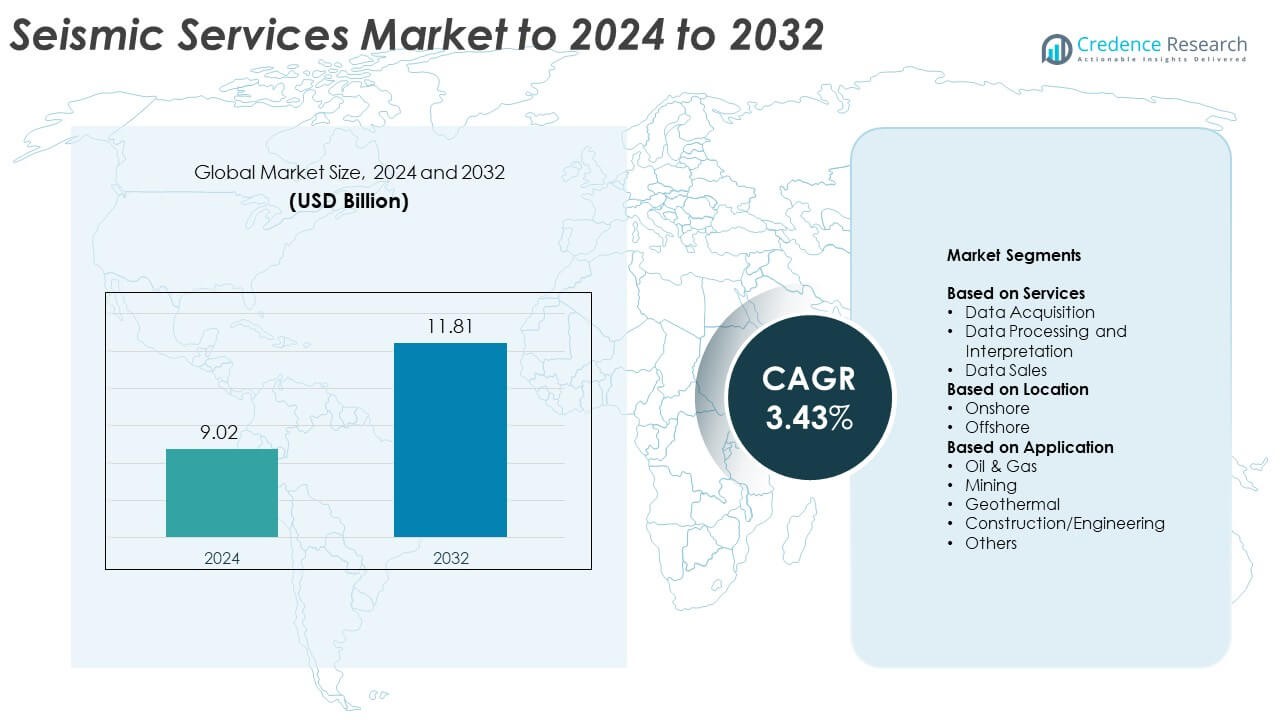

The Seismic Services Market size was valued at USD 9.02 Billion in 2024 and is anticipated to reach USD 11.81 Billion by 2032, at a CAGR of 3.43% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Seismic Services Market Size 2024 |

USD 9.02 Billion |

| Seismic Services Market, CAGR |

3.43% |

| Seismic Services Market Size 2032 |

USD 11.81 Billion |

The Seismic Services Market is led by major players such as SLB, TGS, BGP, Viridien, Petroleum Geo-Services, Fugro N.V., Halliburton, Seitel, China Oilfield Services Limited, and Asian Energy Services. These companies focus on advanced 3D and 4D seismic imaging, data analytics, and multi-client surveys to enhance exploration efficiency. Continuous innovation in AI-driven interpretation and digital platforms strengthens their global market position. Regionally, North America dominated the market in 2024 with a 36.5% share, supported by extensive offshore exploration in the Gulf of Mexico and robust shale developments, followed by Asia-Pacific and Europe showing steady growth through expanding offshore projects and technological investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The seismic services market was valued at USD 9.02 Billion in 2024 and is projected to reach USD 11.81 Billion by 2032, growing at a CAGR of 3.43%.

- Increasing deepwater and ultra-deepwater exploration activities, along with government initiatives for energy security, are key drivers fueling market growth.

- Advancements in 4D seismic technology, AI-based data interpretation, and cloud analytics are reshaping exploration efficiency and accuracy.

- The market is moderately consolidated, with leading players focusing on digital transformation, multi-client data expansion, and sustainable operations to strengthen competitiveness.

- North America held the largest regional share of 36.5% in 2024, while the data acquisition segment led globally with 47.2%, followed by growing demand from Asia-Pacific and Europe driven by offshore exploration and technological investments.

Market Segmentation Analysis:

By Services

The data acquisition segment dominated the seismic services market in 2024 with a 47.2% share. Its leadership is driven by the increasing exploration activities in deepwater and ultra-deepwater basins. Advanced technologies such as 3D and 4D seismic surveys enhance imaging accuracy and field mapping efficiency. Companies like CGG and Schlumberger have expanded multi-client data libraries and used high-density streamer acquisition systems to improve data precision. Growing investment in oilfield digitization further supports the dominance of data acquisition services across global exploration projects.

- For instance, TGS launched a multi-client 3D seismic survey covering 5,300 km² in the Barreirinhas Basin offshore Brazil.

By Location

The onshore segment led the market in 2024, accounting for a 58.4% share. Its dominance stems from extensive exploration in land-based oil fields across North America, Asia-Pacific, and the Middle East. Cost efficiency, accessibility, and growing shale development projects continue to drive demand. Firms such as BGP Inc. and SAExploration have strengthened their onshore operations with wireless nodal systems, improving survey productivity and safety. The rising need for real-time subsurface monitoring and reservoir analysis further boosts onshore seismic survey adoption.

- For instance, in February 2021, SAExploration deployed Geospace Technologies’ GCL Wireless Data Recorder (5 Hz node) for a survey in Northern Canada.

By Application

The oil and gas segment dominated the market in 2024 with a 63.7% share. Its leadership is supported by increasing exploration and production in offshore fields and unconventional reserves. Seismic services play a vital role in hydrocarbon detection, field mapping, and risk reduction. Key players such as TGS and PGS have invested in multi-client seismic data covering over 1 million sq. km of offshore areas to enhance exploration insights. Expanding offshore drilling activities and energy security initiatives globally continue to strengthen this segment’s dominance.

Key Growth Drivers

Rising Exploration Activities in Deepwater and Ultra-Deepwater Basins

Expanding exploration in deepwater and ultra-deepwater regions drives seismic service demand. Advanced imaging technologies enable precise subsurface mapping under complex geological structures. Oil majors are investing heavily in frontier exploration to offset declining production from mature fields. High-resolution 3D and 4D seismic data improve reservoir understanding, enhancing exploration success rates and project economics across challenging offshore environments.

- For instance, in 2017, CGG (now Viridien) deployed its proprietary TopSeis™ offshore broadband seismic solution over the Loppa High in the Barents Sea for Lundin Norway. The TopSeis acquisition method, which places seismic sources directly above the streamers, was designed to improve imaging of a complex carbonate reservoir located at depths of between 400 and 2000 meters below the seabed, particularly beneath hard, fast-velocity sediments.

Adoption of 4D Seismic and Real-Time Data Analytics

The adoption of 4D seismic monitoring and real-time analytics is accelerating. These tools enhance reservoir management and recovery efficiency through continuous monitoring. Integration of machine learning with seismic interpretation supports faster, more accurate decision-making. The combination of time-lapse seismic surveys and cloud-based analytics helps operators optimize drilling plans and production performance.

- For instance, The original Geo-Mapping for Energy and Minerals (GEM) program was a 12-year, $200-million collaborative program (2008–2020) conducted by the Geological Survey of Canada.

Government Support and Energy Security Investments

Government-driven exploration programs and national energy strategies are boosting seismic survey contracts. Many nations are incentivizing data acquisition and offshore licensing rounds to enhance domestic production. Strategic investments in energy independence and hydrocarbon reserves mapping are fueling steady demand. Regional collaborations and geological data-sharing initiatives further expand exploration opportunities globally.

Key Trends & Opportunities

Expansion of Multi-Client Data Libraries

The growing preference for multi-client seismic data licensing is transforming the industry. Service providers build large seismic datasets that multiple operators can access, reducing costs and survey redundancy. This shared-data model accelerates exploration decisions while improving profitability. Enhanced imaging libraries covering major basins help operators assess untapped reserves efficiently.

- For instance, TGS’s Mauritania expansion added over 101,500 km² of 3D seismic data, supplementing an existing library of over 19,000 km² of reprocessed PSDM data.

Integration of Artificial Intelligence and Automation

Artificial intelligence and automation are redefining seismic data processing and interpretation. Automated workflows shorten analysis time, reduce human error, and improve imaging accuracy. Companies are investing in AI-driven seismic inversion, pattern recognition, and predictive modeling to boost reservoir insights. These advances enhance exploration outcomes and lower operational costs.

- For instance, PGS has used high-density streamer acquisition with cross-line sampling at 12.5 meters for various projects, including the Jeanne d’Arc High Density 3D (HD3D) multi-client project offshore Newfoundland.

Key Challenges

High Capital and Operational Costs

Seismic data acquisition and processing require substantial investment in advanced equipment and specialized vessels. High operational costs limit smaller operators from conducting large-scale surveys. Fluctuating oil prices further impact survey budgets and contract volumes. Cost pressures often delay exploration campaigns, restraining market expansion.

Environmental and Regulatory Constraints

Environmental restrictions on seismic surveys, particularly in ecologically sensitive offshore zones, hinder operations. Regulatory approvals for seismic activities are becoming stricter, extending project timelines. Noise pollution from airgun arrays and marine ecosystem concerns have led to increased monitoring requirements. Balancing exploration needs with environmental compliance remains a major challenge.

Regional Analysis

North America

North America dominated the seismic services market in 2024, holding a 36.5% share. The region’s leadership is driven by extensive exploration in the Gulf of Mexico and shale-rich basins across the United States. Advancements in 3D and 4D seismic imaging and high adoption of digital interpretation systems have improved exploration success rates. Strong investments by major oilfield service companies and government support for domestic hydrocarbon development further strengthen regional growth. Increasing offshore drilling in deepwater areas continues to create consistent demand for advanced seismic acquisition and processing solutions.

Europe

Europe accounted for a 21.3% share of the seismic services market in 2024. The region benefits from growing exploration in the North Sea, Barents Sea, and Eastern Mediterranean basins. Rising investments in carbon capture and storage (CCS) and geothermal energy also expand seismic service applications. Countries such as Norway and the United Kingdom are integrating digital subsurface mapping technologies to extend field life and enhance reservoir performance. The shift toward low-emission energy projects continues to support seismic activities aimed at efficient resource utilization and sustainable exploration.

Asia-Pacific

Asia-Pacific held a 26.7% share in 2024, emerging as one of the fastest-growing regional markets. Strong exploration efforts in offshore basins across China, India, Indonesia, and Australia drive demand for seismic acquisition services. Governments in the region are investing in exploration programs to strengthen domestic energy security. Expanding use of 3D seismic surveys and integrated data processing tools supports hydrocarbon and geothermal resource assessment. Increasing offshore licensing rounds and partnerships with international service providers further enhance the region’s seismic data infrastructure and operational capacity.

Middle East & Africa

The Middle East and Africa captured a 10.9% share of the seismic services market in 2024. Abundant oil and gas reserves across Saudi Arabia, the UAE, and Nigeria sustain strong exploration demand. National oil companies are investing in advanced seismic imaging to boost recovery from mature fields and identify untapped reserves. Offshore projects in West Africa and the Red Sea are also stimulating regional growth. Strategic focus on reservoir optimization and efficient exploration supports continued demand for high-resolution seismic technologies.

Latin America

Latin America held a 4.6% share of the seismic services market in 2024. The region’s growth is driven by expanding offshore exploration in Brazil, Mexico, and Guyana. Investments in deepwater seismic surveys are rising as governments open new blocks for international bidders. Advanced 4D imaging and wide-azimuth survey techniques are increasingly adopted to enhance exploration precision. Strong participation of major service providers and favorable regulatory reforms continue to position Latin America as a key emerging hub for seismic service expansion.

Market Segmentations:

By Services

- Data Acquisition

- Data Processing and Interpretation

- Data Sales

By Location

By Application

- Oil & Gas

- Mining

- Geothermal

- Construction/Engineering

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The seismic services market is characterized by strong competition among leading global and regional players such as SLB, TGS, BGP, Viridien, Petroleum Geo-Services, Fugro N.V., Halliburton, Seitel, China Oilfield Services Limited, and Asian Energy Services. Companies are focusing on expanding multi-client data portfolios, deploying next-generation 4D seismic imaging, and investing in AI-driven data interpretation technologies. Strategic collaborations with national oil companies and government agencies are enhancing project pipelines across offshore and frontier basins. The market is also witnessing increased adoption of cloud-based analytics and automation for faster processing and improved reservoir visualization. Continuous investment in environmentally sustainable operations and digital workflows supports competitive differentiation, while regional partnerships and mergers strengthen service coverage and resource optimization globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SLB

- TGS (Norway)

- BGP (China)

- Viridien (France)

- Petroleum Geo-Services (PGS) (Norway)

- Fugro N.V. (Netherlands)

- Halliburton (UAE)

- Seitel (U.S.)

- China Oilfield Services Limited (China)

- Asian Energy Services (India)

Recent Developments

- In 2025, PXGEO announced it would begin a two-year contract to provide offshore seismic data acquisition services in Malaysia using the seismic vessel PXGEO 2

- In 2024, Halliburton partnered with Latin American oil and gas company GeoPark to provide seismic data processing services for its projects.

- In 2023, SLB partnered with TGS and PGS for a multi-client 3D seismic survey offshore Malaysia.

Report Coverage

The research report offers an in-depth analysis based on Services, Location, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing offshore exploration projects will continue to boost demand for advanced seismic technologies.

- Rising adoption of 4D seismic surveys will enhance reservoir management and recovery efficiency.

- Integration of artificial intelligence and cloud-based analytics will improve data interpretation speed.

- Expansion of multi-client data libraries will make exploration more cost-efficient and collaborative.

- Government-backed energy security programs will drive new exploration contracts globally.

- Growing investment in geothermal and carbon capture projects will diversify seismic service applications.

- Technological advances in nodal systems and marine streamers will improve data quality and safety.

- Regional collaborations and digital data sharing will accelerate frontier basin exploration.

- Increased focus on environmentally sustainable operations will shape seismic survey design.

- Strategic mergers and acquisitions among service providers will strengthen global market competitiveness.