Market overview

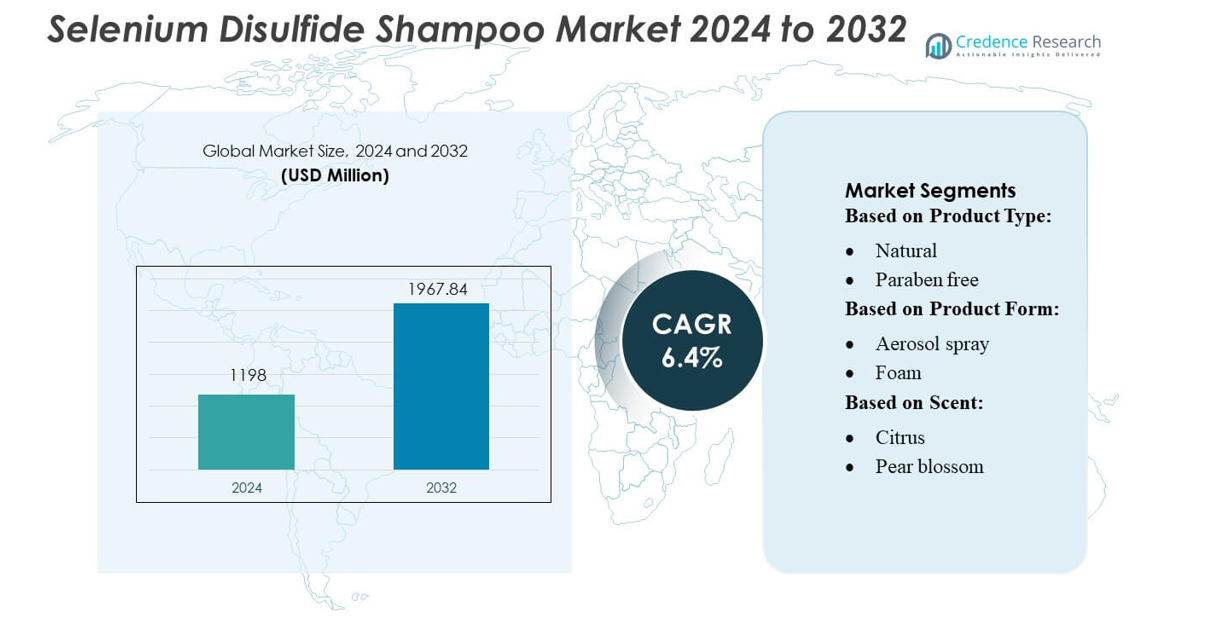

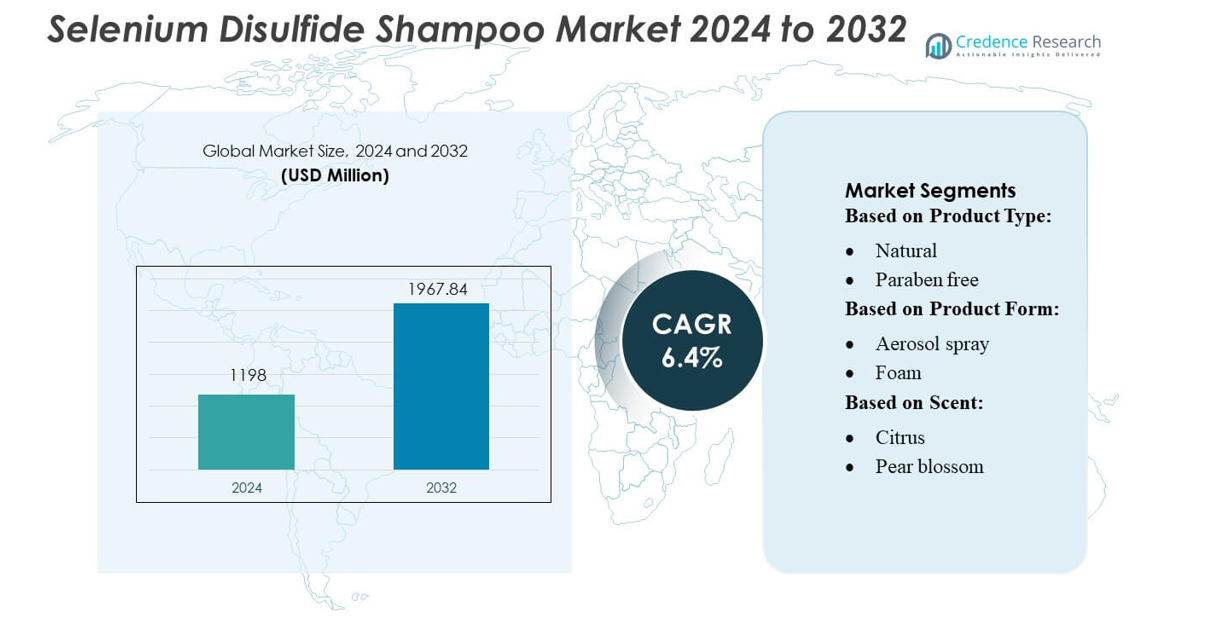

Selenium Disulfide Shampoo Market size was valued USD 1198 million in 2024 and is anticipated to reach USD 1967.84 million by 2032, at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Selenium Disulfide Shampoo Market Size 2024 |

USD 1198 million |

| Selenium Disulfide Shampoo Market , CAGR |

6.4% |

| Selenium Disulfide Shampoo Market Size 2032 |

USD 1967.84 million |

The Selenium Disulfide Shampoo Market features several prominent manufacturers that focus on high-purity active ingredients, advanced formulation capabilities, and strong distribution partnerships to support global demand. These companies compete through stringent quality control, regulatory adherence, and continuous product innovation aimed at enhancing scalp-care efficacy. The competitive environment remains moderately fragmented, with players expanding production capacity and leveraging e-commerce channels to strengthen market reach. Asia-Pacific leads the global market with an approximate 34% share, driven by a large consumer base, rising dermatological awareness, and increased adoption of medicated hair-care products across rapidly urbanizing economies.

Market Insights

- The Selenium Disulfide Shampoo Market was valued at USD 1198 million in 2024 and is projected to reach USD 1967.84 million by 2032, registering a CAGR of 6.4% during the forecast period.

- Rising cases of dandruff and seborrheic dermatitis, along with growing consumer preference for dermatology-backed scalp treatments, strongly drive demand across both medicated and OTC product segments.

- Market trends highlight increasing adoption of high-purity formulations, cleaner manufacturing practices, and expanding e-commerce channels that enhance product accessibility and global brand visibility.

- Competitive analysis shows a moderately fragmented landscape where manufacturers prioritize quality compliance, production expansion, and strategic partnerships, although raw material fluctuations and regulatory constraints remain key restraints.

- Asia-Pacific leads with a 34% regional share, while North America and Europe follow, supported by strong dermatology networks; the medicated shampoo segment holds the largest share due to its clinical efficacy and wide consumer adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Natural selenium disulfide shampoos dominate the segment with an estimated 38–42% market share, driven by rising consumer preference for plant-based actives and reduced synthetic chemical exposure. The paraben-free category follows closely as regulatory pressure and retailer clean-label requirements increase. Gluten-free and vegan formulations grow steadily but remain niche, mainly serving specific dermatological sensitivities and lifestyle-driven consumers. The dominance of natural variants is reinforced by strong demand in premium dermatology channels, wider retail availability, and improved formulations that combine selenium disulfide with botanical extracts to enhance scalp tolerability and reduce flaking.

- For instance, Arkema supports such innovation through its global R&D ecosystem of approximately 1,800 researchers across 17 research centers, enabling advancements in high-purity sulfur-based chemistries used in specialized personal-care formulations.

By Product Form

Liquid formulations lead the market with a commanding 55–60% share, supported by high consumer familiarity, easier application, and strong presence across mass and dermatologist-recommended brands. Aerosol sprays show moderate growth due to their convenience in targeted scalp delivery, while foam and powder forms remain limited to specialized or travel-friendly variants. The liquid segment’s continued dominance is driven by consistent product innovation, stable viscosity profiles that enhance selenium disulfide dispersion, and broader compatibility with moisturizing additives that improve hair feel without compromising therapeutic efficacy.

- For instance, GFS Chemicals produces over 8,000 discrete high-purity specialty chemical products at its ISO 9001-certified facilities in Columbus, Ohio, with over 45,000 sq. ft. of total plant capacity enabling precision control over purity and properties for a wide range of organic and inorganic specialty materials.

By Scent

Citrus-based scents account for the largest share at approximately 40–45%, benefiting from strong consumer acceptance, perception of freshness, and compatibility with medicated formulations that typically mask selenium disulfide’s natural odor. Pear blossom and red berries with Italian mandarin appeal to younger consumers seeking premium aromatics, while Divine Dark remains a niche offering targeted at darker hair tones to minimize visible residue. The citrus segment’s leadership is driven by its universal fragrance profile, cost-effective formulation, and high adoption across both mass and specialty dermatology brands.

Key Growth Drivers

Rising Incidence of Seborrheic Dermatitis and Dandruff Disorders

The growing prevalence of seborrheic dermatitis, chronic scalp flaking, and fungal-related dandruff significantly drives demand for selenium disulfide shampoos. Dermatologists increasingly recommend selenium formulations for moderate to severe symptoms, reinforcing product relevance across clinical and OTC channels. The expanding patient pool, linked to stress, pollution, and lifestyle shifts, heightens the need for reliable medicated scalp solutions. As awareness of scalp health strengthens globally, consumers increasingly prefer clinically validated actives like selenium disulfide, enabling consistent market expansion.

- For instance, Merck KGaA supplies selenium disulfide (CAS 7488-56-4) with an assay of at least 98.0% from its MilliporeSigma product line (catalogue no. 843845), a “for synthesis” grade product used in the supply chain for dermatological applications.

Expansion of Medicated Dermatology and OTC Therapeutic Haircare

The overlap between dermatology-driven treatments and the mainstream haircare segment accelerates market adoption of selenium disulfide shampoos. Pharmaceutical companies and cosmetic brands are broadening their OTC medicated product lines to include stronger antifungal and anti-seborrheic actives. Retail pharmacies, e-commerce, and tele-dermatology platforms further streamline customer access, improving prescription-to-purchase conversion. As consumer preference shifts toward scientifically backed solutions, selenium disulfide formulations gain a competitive advantage within therapeutic haircare, strengthening market penetration across both developed and emerging regions.

- For instance, Clariant’s StyroMax UL-100 catalyst achieved an industry-leading steam-to-oil ratio of just 0.76 by weight—down from around 1.02 in earlier catalysts.This drastic reduction significantly curbs steam usage and improves energy efficiency, especially in styrene monomer production.

Increasing Dermatological Endorsements and Regulatory Support for Therapeutic Actives

Growing clinical validation and consistent backing from dermatology associations sustain the long-term acceptance of selenium disulfide shampoos. Regulatory authorities continue to support the ingredient’s use in controlled concentrations, reinforcing product safety and reliability. Enhanced labeling standards and transparent communication of clinical benefits help build trust among consumers seeking evidence-based scalp treatments. Additionally, ongoing clinical studies on antifungal efficacy strengthen the therapeutic positioning of selenium disulfide, enabling manufacturers to differentiate products through medically endorsed claims and targeted formulations.

Key Trends & Opportunities

Demand for Sensitive-Scalp and Low-Irritation Therapeutic Formulations

A key trend involves the development of low-irritation, fragrance-free, and dermatologically tested selenium disulfide shampoos targeting consumers with sensitive scalps. Manufacturers increasingly integrate conditioning agents, pH-balanced bases, and sulfate-free alternatives to minimize discomfort and boost usability. This shift opens opportunities for premium, mild medicated shampoos that retain therapeutic strength while improving user experience. As consumers favor products aligned with skin-friendly formulations, brands focusing on gentler clinical solutions can secure strong differentiation in a competitive market.

- For instance, BASF filed 1,159 new patents globally of those, 44.5% focused on sustainability. R&D spend hit 2,061 million in 2024. R&D team totaled about 10,000 staff globally. These innovations support both performance and compliance.

Shift Toward E-Commerce and Subscription-Based Dermatological Care

The rapid expansion of online retail and subscription platforms presents a major opportunity for selenium disulfide shampoo brands. E-commerce enables targeted marketing, wider product visibility, and convenient access for consumers seeking specialized scalp treatments. Digital dermatology consultations increasingly recommend medicated shampoos, creating direct sales channels. The trend toward bundled therapeutic haircare packages, refill systems, and personalized scalp-care kits further strengthens customer retention. This digital shift allows manufacturers to capture new segments and streamline distribution beyond traditional pharmaceutical outlets.

- For instance, Ecolab’s ReadyDose™ tablet program reduced plastic waste by 98.8%, resulting in significantly less weight lifted compared to traditional bottle transport. This innovation is part of a broader industry trend toward bio-based materials and sustainable initiatives.

Product Innovation Through Multi-Functional and Hybrid Formulations

Emerging opportunities lie in developing hybrid shampoos combining selenium disulfide with complementary actives such as salicylic acid, ketoconazole, or botanical soothing extracts. These multi-functional formulations target broader scalp concerns—including itching, inflammation, and persistent flaking—offering more comprehensive treatment profiles. Companies investing in improved aesthetics, such as better fragrance masking and lighter textures, stand to appeal to both therapeutic and cosmetic users. This innovation wave supports premium pricing and helps reposition selenium-based shampoos as advanced, science-driven scalp-health solutions.

Key Challenges

Regulatory Restrictions and Concentration Limitations

Selenium disulfide shampoos face stringent regulatory controls regarding permissible concentrations, labeling requirements, and usage warnings. Variations in regional regulations can limit market entry or necessitate costly reformulations to meet compliance standards. Additionally, tighter scrutiny on medicated ingredients may slow product approvals or restrict marketing claims. These constraints create operational and compliance challenges for manufacturers aiming to scale globally. Companies must maintain rigorous quality assurance and regulatory alignment to avoid disruptions and ensure consistent product availability.

Concerns Over Side Effects and Increasing Preference for Natural Alternatives

Potential side effects—such as scalp irritation, hair discoloration, or odor—create hesitation among some consumers, reducing repeat usage. With rising awareness of clean beauty, many customers favor natural or herbal anti-dandruff solutions, challenging the growth of chemically medicated formulations. Negative perceptions or improper usage can further affect market confidence. To overcome this challenge, manufacturers must invest in consumer education, clinical transparency, and aesthetic enhancements. Strengthening user experience is essential to maintaining competitiveness against milder, plant-based alternatives.

Regional Analysis

North America

North America holds a significant share of the Selenium Disulfide Shampoo Market, accounting for approximately 32% of global revenue. The market grows steadily as consumers prioritize advanced dermatological hair-care solutions for managing dandruff, seborrheic dermatitis, and scalp infections. Widespread product availability across pharmacies, supermarkets, and e-commerce platforms reinforces demand. Rising recommendations from dermatologists and strong brand presence, particularly in the U.S., further elevate product adoption. Manufacturers actively invest in targeted marketing and clinically validated formulations, strengthening competitiveness. Canada also contributes notably, driven by increasing consumer awareness of medicated hair-care products and expanding retail penetration across urban regions.

Europe

Europe accounts for around 28% of the Selenium Disulfide Shampoo Market, supported by strict regulatory standards that enhance consumer trust in medicated personal-care products. The region experiences robust demand due to high prevalence of scalp-related conditions and growing preference for dermatologically tested formulations. Countries such as Germany, the U.K., France, and Italy lead consumption, benefiting from mature pharmacy networks and strong brand recognition. The expansion of premium therapeutic hair-care ranges and increased dermatologist supervision further influence adoption patterns. Rising online sales, supported by product transparency and ingredient-based shopping behavior, continues to strengthen Europe’s position as a stable, high-value market.

Asia-Pacific

Asia-Pacific represents the largest and fastest-growing market, capturing about 34% of the global share. Rapid urbanization, increasing pollution-induced scalp disorders, and growing consumer willingness to invest in medicated hair-care products fuel regional expansion. Countries such as China, India, Japan, and South Korea dominate demand, driven by heightened awareness of hair-and-scalp health and expanding dermatology services. Local manufacturers also introduce competitively priced formulations, improving affordability and accessibility. Strong e-commerce penetration and rising adoption among younger demographics accelerate market growth. International brands continue to scale operations in the region, driven by high-volume consumption and evolving personal-care preferences.

Latin America

Latin America accounts for roughly 4% of the Selenium Disulfide Shampoo Market, with demand concentrated in Brazil, Mexico, and Argentina. The region demonstrates steady growth as consumers increasingly recognize the effectiveness of selenium-based treatments for chronic dandruff and seborrheic dermatitis. Expanding distribution through pharmacies and online platforms enhances accessibility, while local brands introduce low-cost variants to attract price-sensitive buyers. Although the market size remains smaller compared to other regions, rising dermatological consultations and increasing middle-class spending support gradual adoption. Regulatory harmonization and broader retail availability are expected to improve long-term market penetration across urban and semi-urban centers.

Middle East & Africa

The Middle East & Africa region holds around 2% of the global Selenium Disulfide Shampoo Market, characterized by uneven penetration across countries. Demand remains strongest in the Gulf Cooperation Council (GCC), where consumers exhibit higher awareness of medicated hair-care solutions and prefer dermatology-recommended products. Growth is supported by expanding pharmacy chains, increased expatriate population, and rising scalp-care concerns linked to climatic conditions. In Africa, market development progresses gradually due to limited product reach and lower purchasing power, although urban centers show increasing adoption. International brands continue to expand distribution partnerships to strengthen regional visibility and affordability.

Market Segmentations:

By Product Type:

By Product Form:

By Scent:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Selenium Disulfide Shampoo Market remains moderately fragmented, with key participants including Arkema, GFS Chemicals Inc., Zhuzhou Jinyuan Chemical Industry Co., Ltd., Merck KGaA, Jiangsu Jinshan Chemical Co. Ltd., PPG Industries, Inc., Shikoku Chemicals Corporation, Univar Solutions Inc., Alfa Aesar, and Akzo Nobel N.V. The Selenium Disulfide Shampoo Market is characterized by steady innovation, rising product differentiation, and increasing global capacity for high-purity active ingredients. Manufacturers prioritize stringent quality control, regulatory compliance, and advanced chemical processing to ensure consistent formulation performance for therapeutic hair-care products. Market participants actively expand production capabilities, strengthen distribution networks, and collaborate with personal-care brands to secure long-term supply agreements. Growing demand for dermatology-recommended scalp treatments also encourages companies to invest in research aimed at improving ingredient stability, therapeutic efficacy, and consumer safety. Sustainability initiatives, including cleaner manufacturing technologies and responsible raw-material sourcing, further shape competitive strategies and operational priorities across the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2024, Kerasoul, a haircare brand from Seasoul Cosmetics, launched a new hair care line. The new collection, which the company claims is 100% natural and made using organic and non-toxic ingredients, includes a detoxifying shampoo and protein collagen conditioner.

- In April 2024, Johnson’s Baby launched their newest product, Milk Moisturizing Shampoo completing the brand’s milk portfolio Moisturizing Shampoo, a new product line that is free from added parabens, dyes, sulfates, and phthalates.

- In June 2023, Researchers at TU Wien have developed a self-forming solid lubricant system where molybdenum and selenium react under mechanical stress to create molybdenum diselenide (MoSe₂) flakes that dramatically reduce friction exactly where needed

Report Coverage

The research report offers an in-depth analysis based on Product Type, Product Form, Scent and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady demand as consumers increasingly prefer medicated solutions for chronic dandruff and scalp disorders.

- Manufacturers will focus on developing gentler, dermatologically enhanced formulations to improve user comfort and long-term scalp health.

- Regulatory compliance will become more stringent, prompting companies to invest in cleaner, safer production technologies.

- E-commerce growth will strengthen product accessibility, especially in emerging markets with rising digital adoption.

- Brands will expand ingredient transparency to meet evolving consumer expectations for clinically validated hair-care products.

- Partnerships between chemical suppliers and personal-care manufacturers will intensify to ensure consistent supply and high-quality formulations.

- Rising urban pollution and lifestyle stress will increase the prevalence of scalp issues, driving higher product usage.

- Companies will invest in sustainable packaging and eco-focused manufacturing practices to align with global sustainability goals.

- Market penetration will grow in Asia-Pacific due to larger consumer bases and rising dermatological awareness.

- Innovation in multi-functional shampoos combining selenium disulfide with nourishing ingredients will enhance product competitiveness.