Market Overview

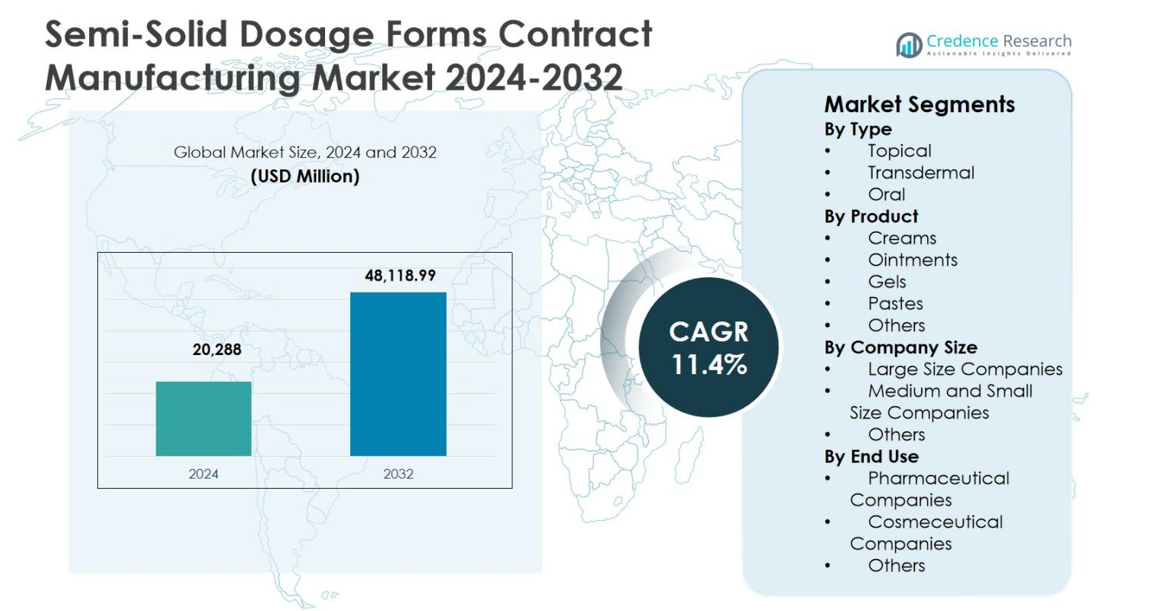

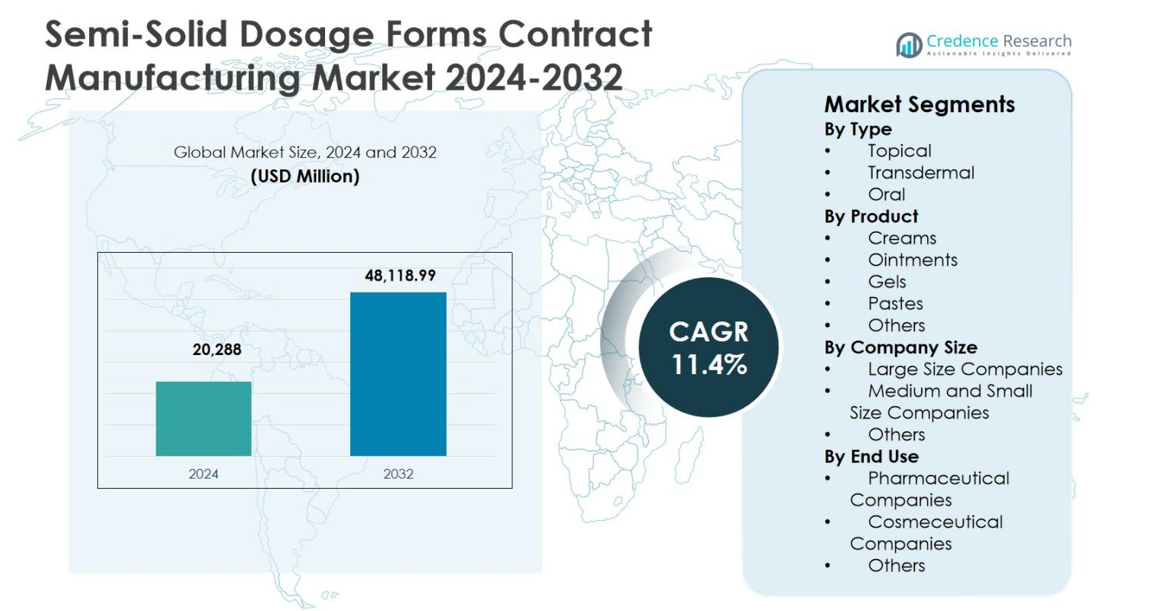

The Semi-Solid Dosage Forms Contract Manufacturing Market size was valued at USD 20,288 million in 2024 and is anticipated to reach USD 48,118.99 million by 2032, growing at a CAGR of 11.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Semi-Solid Dosage Forms Contract Manufacturing Market Size 2024 |

USD 20,288 million |

| Semi-Solid Dosage Forms Contract Manufacturing Market, CAGR |

11.4% |

| Semi-Solid Dosage Forms Contract Manufacturing Market Size 2032 |

USD 48,118.99 million |

Semi-Solid Dosage Forms Contract Manufacturing Market is led by established CDMOs such as Lonza Group Ltd., Cambrex Corporation, Piramal Pharma Solutions, Pierre Fabre Group, Lubrizol Life Science, MedPharm Ltd., Ascendia Pharmaceuticals, Contract Pharmaceuticals Limited, Bora Pharmaceutical CDMO, and DPT Laboratories. These companies strengthen their market presence through advanced formulation expertise, regulatory compliance capabilities, and scalable manufacturing services supporting dermatology, transdermal, and OTC products. North America leads the market with a 38.6% share, driven by high outsourcing penetration and strong pharmaceutical infrastructure, followed by Europe at 29.4%, supported by robust generic manufacturing and stringent quality standards. Asia-Pacific holds 22.8% share, reflecting rapid capacity expansion and cost-efficient production, while Latin America and the Middle East & Africa collectively account for the remaining market demand.

Market Insights

- Semi-Solid Dosage Forms Contract Manufacturing Market was valued at USD 20,288 million in 2024 and is projected to reach USD 48,118.99 million by 2032, expanding at a CAGR of 11.4% during the forecast period.

- Market growth is driven by rising pharmaceutical outsourcing, increasing dermatology and topical therapy demand, and high-volume production of generic and OTC products, with topical dosage forms holding 62.8% segment share due to strong prescription usage and lower systemic risk.

- Key market trends include advanced formulation technologies, growth in transdermal delivery systems, and capacity expansion by CDMOs, while competition intensifies as large players dominate 2% share through large-size companies offering integrated services and regulatory expertise.

- Market restraints include stringent regulatory compliance requirements, formulation complexity, and cost pressures related to raw materials, energy, and skilled labor, impacting margins for small and mid-sized manufacturers.

- Regionally, North America leads with 38.6% share, followed by Europe at 29.4% and Asia-Pacific at 22.8%, while Latin America and the Middle East & Africa show steady growth supported by expanding healthcare access and local manufacturing initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

The Semi-Solid Dosage Forms Contract Manufacturing Market shows strong demand across topical, transdermal, and oral applications, with topical formulations dominating at 62.8% market share. The dominance of topical dosage forms is driven by high prescription volumes for dermatology, pain management, and anti-inflammatory therapies, along with faster regulatory approvals and lower systemic risk. Growing prevalence of skin disorders, rising demand for generic dermatology products, and increasing outsourcing by pharmaceutical companies to reduce capital expenditure further support this segment’s leadership. Contract manufacturers benefit from repeat-volume orders and standardized production processes.

- For instance, Cambrex scaled up manufacturing of an FDA-approved prescription dermatological ointment from development to 900kg commercial batches in 45g tubes and 2g sample packets, ensuring consistent product attributes during site transfer.

By Product:

Based on product, creams lead the Semi-Solid Dosage Forms Contract Manufacturing Market with a 39.6% share, followed by ointments, gels, pastes, and other formulations. Creams dominate due to their superior patient compliance, ease of application, and wide use in dermatology, antifungal, and cosmetic-dermatological therapies. Their balanced oil-water composition supports stable drug delivery and scalability in manufacturing. Pharmaceutical companies increasingly outsource cream production to leverage specialized formulation expertise, high-volume filling capabilities, and compliance with stringent quality standards, reinforcing sustained demand within this segment.

- For instance, DPT Laboratories provides cGMP manufacturing for creams from pilot batches to commercial scale, including specialized handling of hormones and XP solvents in controlled environments.

By Company Size:

By company size, large-size companies account for 54.2% of the Semi-Solid Dosage Forms Contract Manufacturing Market, reflecting their strong infrastructure, regulatory expertise, and global client base. Large CDMOs offer end-to-end services, including formulation development, clinical batch manufacturing, commercial-scale production, and packaging, making them preferred partners for multinational pharmaceutical firms. Their ability to handle complex formulations, ensure consistent quality, and meet international regulatory requirements drives segment dominance. Long-term supply agreements and investments in advanced manufacturing technologies further strengthen their market position.

Key Growth Driver

Rising Outsourcing of Pharmaceutical Manufacturing

The Semi-Solid Dosage Forms Contract Manufacturing Market is strongly driven by increasing outsourcing strategies among pharmaceutical and biotechnology companies. Drug manufacturers aim to reduce capital investment, shorten time-to-market, and improve operational flexibility by partnering with specialized contract manufacturers. Semi-solid formulations require dedicated equipment, formulation expertise, and strict compliance with regulatory standards, making outsourcing a cost-effective solution. Growing demand for dermatology and topical therapies further accelerates this trend, as contract manufacturers provide scalable production, quality assurance, and regulatory support, enabling brand owners to focus on core research and commercialization activities.

- For instance, Flexion Therapeutics partnered with Patheon to manufacture its intra-articular sustained-release steroid FX006 for osteoarthritis treatment, establishing a dedicated sterile suite in Swindon, England, to ensure redundant supply and scale production.

Expanding Dermatology and Topical Therapeutics Demand

Rising prevalence of dermatological disorders, including eczema, psoriasis, acne, and fungal infections, significantly drives the Semi-Solid Dosage Forms Contract Manufacturing Market. Aging populations, increasing pollution exposure, and heightened awareness of skin health contribute to sustained demand for topical medications. Pharmaceutical companies increasingly expand dermatology pipelines, driving higher outsourcing volumes for creams, ointments, and gels. Contract manufacturers benefit from recurring production orders, stable demand cycles, and high prescription volumes, supporting long-term growth across both generic and branded semi-solid formulations.

- For instance, Pfizer secured FDA approval for EUCRISA (crisaborole) ointment, 2%, as a steroid-free topical treatment for mild to moderate atopic dermatitis, initially for patients 2 years and older and later extended to infants as young as 3 months.

Growth of Generic and OTC Pharmaceutical Products

The expanding market for generic and over-the-counter (OTC) medicines plays a crucial role in driving the Semi-Solid Dosage Forms Contract Manufacturing Market. Patent expirations and cost-sensitive healthcare systems push manufacturers toward affordable alternatives, increasing production volumes of topical generics. OTC products, including antifungal creams and pain relief gels, require rapid scaling and regulatory compliance, favoring outsourcing models. Contract manufacturers offer cost efficiencies, flexible batch sizes, and fast turnaround, making them preferred partners for companies targeting high-volume, price-competitive markets.

Key Trend & Opportunity

Advancements in Formulation and Delivery Technologies

Technological advancements in formulation science create strong growth opportunities in the Semi-Solid Dosage Forms Contract Manufacturing Market. Enhanced drug delivery systems, including nanoemulsions and controlled-release topical formulations, improve efficacy and patient outcomes. Contract manufacturers investing in advanced formulation capabilities can support complex products with higher value margins. Growing demand for transdermal and enhanced-penetration therapies further expands opportunities, as pharmaceutical companies increasingly rely on specialized CDMOs to develop differentiated products that meet evolving therapeutic and regulatory requirements.

- For instance, companies like DPT Labs have developed fatty-acid-based emulsion formulations with specialized neutralization processes, enhancing stability and bioavailability.

Expansion into Emerging Pharmaceutical Markets

Emerging economies present significant opportunities for the Semi-Solid Dosage Forms Contract Manufacturing Market due to expanding healthcare infrastructure and rising pharmaceutical consumption. Increased access to healthcare services and growing demand for affordable topical therapies drive regional production needs. Pharmaceutical companies seek regional contract manufacturing partners to reduce logistics costs and meet local regulatory standards. CDMOs expanding manufacturing footprints and regulatory capabilities in these regions can secure long-term contracts, diversify revenue streams, and strengthen their global presence.

- For instance, LGM Pharma expanded its Texas facility in March 2025 with a USD 6 million investment to boost production of semi-solids, suspensions, and suppositories, aiding pharmaceutical firms targeting emerging markets with scalable U.S.-based capabilities.

Key Challenge

Stringent Regulatory and Quality Compliance Requirements

Strict regulatory standards pose a major challenge for the Semi-Solid Dosage Forms Contract Manufacturing Market. Compliance with evolving global regulations requires continuous investments in quality systems, documentation, and validation processes. Semi-solid formulations are sensitive to contamination and stability issues, increasing inspection scrutiny. Smaller contract manufacturers face difficulties meeting regulatory expectations, limiting scalability and market entry. Regulatory delays and non-compliance risks can disrupt production timelines and increase operational costs, affecting long-term profitability.

High Formulation Complexity and Cost Pressures

Formulation complexity presents a critical challenge in the Semi-Solid Dosage Forms Contract Manufacturing Market. Maintaining consistency, stability, and bioavailability across large-scale production requires specialized expertise and equipment. Rising raw material costs, energy expenses, and labor shortages further compress margins. Price pressures from generic manufacturers intensify competition among CDMOs, limiting pricing flexibility. Contract manufacturers must balance cost efficiency with innovation and quality assurance to remain competitive while meeting client expectations and regulatory requirements.

Regional Analysis

North America

North America holds a 38.6% market share in the Semi-Solid Dosage Forms Contract Manufacturing Market, driven by a strong pharmaceutical base, high outsourcing penetration, and advanced regulatory infrastructure. The region benefits from large volumes of dermatology and topical drug production, supported by rising prevalence of chronic skin conditions and strong OTC consumption. Pharmaceutical companies increasingly rely on specialized CDMOs to manage formulation complexity, regulatory compliance, and scalable production. The presence of major branded and generic drug manufacturers, combined with consistent R&D investments, reinforces North America’s leadership in high-value and regulated semi-solid manufacturing services.

Europe

Europe accounts for 29.4% market share in the Semi-Solid Dosage Forms Contract Manufacturing Market, supported by robust generic drug manufacturing and strict quality standards. Countries such as Germany, France, Italy, and the UK drive demand through strong dermatology pipelines and growing preference for outsourcing to reduce operational costs. Regulatory harmonization under European frameworks enhances cross-border manufacturing efficiency. Rising demand for prescription and OTC topical products, along with sustainability-focused manufacturing practices, further supports market expansion. European CDMOs benefit from long-term partnerships with pharmaceutical companies seeking consistent quality and regulatory reliability.

Asia-Pacific

Asia-Pacific represents 22.8% market share in the Semi-Solid Dosage Forms Contract Manufacturing Market, reflecting rapid growth in pharmaceutical outsourcing and manufacturing capacity expansion. The region benefits from cost-effective production, improving regulatory capabilities, and increasing domestic demand for topical therapies. Countries including China, India, and South Korea attract global pharmaceutical companies seeking scalable and cost-efficient CDMO services. Rising healthcare access, growth of generic medicines, and expanding dermatology treatment adoption drive production volumes. Continuous investments in GMP-compliant facilities and skilled workforce development strengthen Asia-Pacific’s position as a global manufacturing hub.

Latin America

Latin America holds 5.6% market share in the Semi-Solid Dosage Forms Contract Manufacturing Market, supported by growing pharmaceutical consumption and regional manufacturing initiatives. Expanding access to healthcare services and increasing demand for affordable topical treatments drive local production needs. Pharmaceutical companies partner with regional CDMOs to comply with local regulations and reduce import dependence. Countries such as Brazil and Mexico lead regional activity through expanding generic drug manufacturing and dermatology product demand. While infrastructure development continues, rising outsourcing trends and government support for local pharmaceutical production support steady market growth.

Middle East & Africa

The Middle East & Africa region captures 3.6% market share in the Semi-Solid Dosage Forms Contract Manufacturing Market, driven by gradual expansion of pharmaceutical manufacturing capabilities. Increasing investments in healthcare infrastructure and growing demand for topical treatments support regional production. Governments encourage local drug manufacturing to enhance supply security and reduce reliance on imports. Contract manufacturing activity remains concentrated in select markets, supported by partnerships with international pharmaceutical companies. While regulatory and infrastructure challenges persist, rising healthcare spending and growing awareness of dermatological treatments contribute to incremental market development.

Market Segmentations:

By Type

By Product

- Creams

- Ointments

- Gels

- Pastes

- Others

By Company Size

- Large Size Companies

- Medium and Small Size Companies

- Others

By End Use

- Pharmaceutical Companies

- Cosmeceutical Companies

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis of the Semi-Solid Dosage Forms Contract Manufacturing Market highlights active competition among established global CDMOs and specialized formulation providers. Lonza Group Ltd., Cambrex Corporation, Piramal Pharma Solutions, and Pierre Fabre Group leverage strong regulatory expertise, integrated development services, and large-scale manufacturing capacity to support multinational pharmaceutical clients. Lubrizol Life Science, MedPharm Ltd., and Ascendia Pharmaceuticals differentiate through advanced formulation science, transdermal delivery expertise, and innovation-driven dermatology solutions. Contract Pharmaceuticals Limited, Bora Pharmaceutical CDMO, and DPT Laboratories strengthen their positions through flexible manufacturing, cost-efficient operations, and strong client relationships in generic and OTC segments. Strategic collaborations, facility expansions, and investments in quality systems remain central to sustaining competitiveness and long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- MedPharm Ltd

- Lubrizol Life Science

- Piramal Pharma Solutions

- Cambrex Corporation

- DPT Laboratories, LTD

- Lonza Group Ltd.

- Ascendia Pharmaceuticals

- Pierre Fabre Group

- Contract Pharmaceuticals Limited

- Bora Pharmaceutical CDMO

Recent Developments

- In March 2025, LGM Pharma invested over USD 6 million to expand its manufacturing facility in Rosenberg, Texas, boosting production capacity for semi-solid dosage forms, suspensions, liquids, and suppositories to meet rising demand for U.S.-based contract manufacturing.

- In August 2025, Piramal Pharma Solutions and NewAmsterdam Pharma expanded their global operations with enhanced manufacturing facilities in the USA and India to increase production efficiency and capacity for oral solid dosage and related services.

- In June 2024, Aterian Investment Partners acquired Contract Pharmaceuticals Limited (CPL) Canada, enhancing its capabilities in semi-solid dosage forms manufacturing and positioning it for expanded global partnerships in pharmaceutical outsourcing

Report Coverage

The research report offers an in-depth analysis based on Type, Product, Company Size, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Semi-Solid Dosage Forms Contract Manufacturing Market will continue to benefit from increasing pharmaceutical outsourcing to specialized CDMOs.

- Rising demand for dermatology, pain management, and topical therapies will support sustained production volumes.

- Growth in generic and over-the-counter product launches will drive high-volume contract manufacturing requirements.

- Advancements in formulation science will enable development of more complex and differentiated semi-solid products.

- Expanding transdermal drug delivery applications will create new revenue opportunities for contract manufacturers.

- Regulatory compliance and quality excellence will remain key differentiators among market participants.

- Capacity expansions and facility upgrades will support scalability and faster time-to-market.

- Strategic partnerships between pharmaceutical companies and CDMOs will increase long-term manufacturing agreements.

- Emerging markets will gain importance as pharmaceutical production and outsourcing activity rises.

- Focus on cost efficiency, innovation, and reliability will shape competitive positioning over the forecast period.