Market Overview

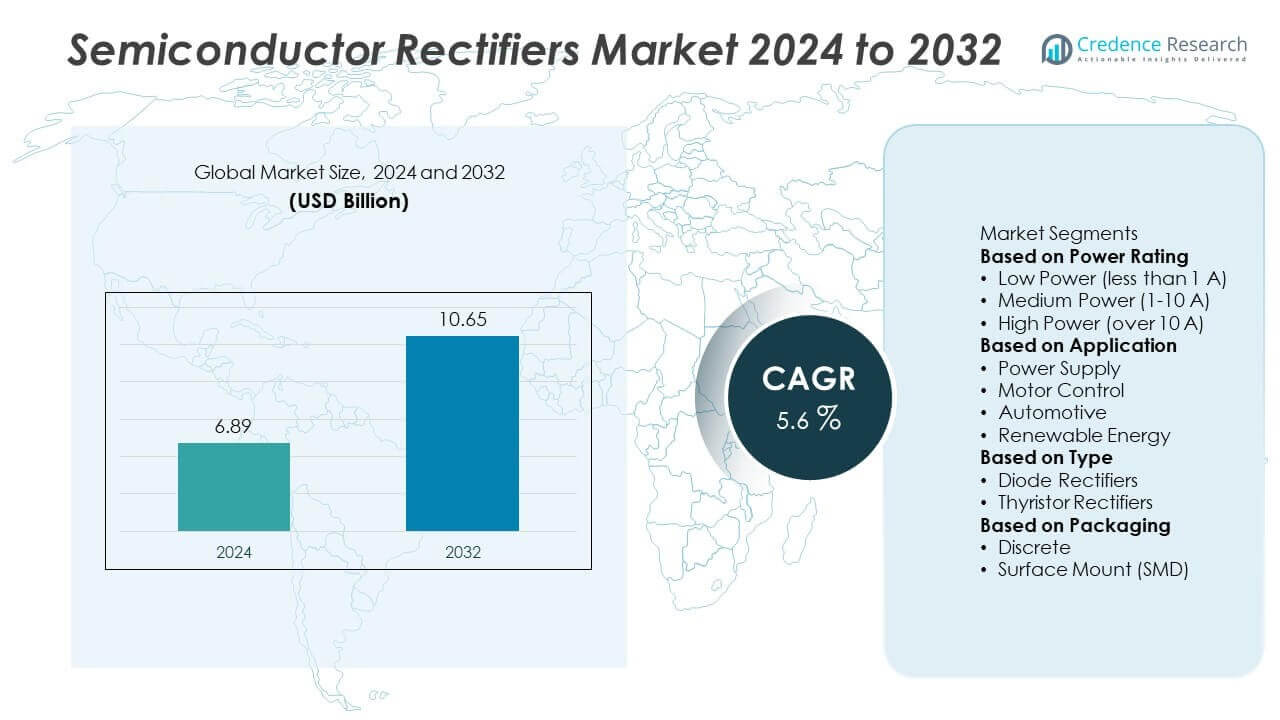

The Semiconductor Rectifiers Market size was valued at USD 6.89 billion in 2024 and is anticipated to reach USD 10.65 billion by 2032, growing at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Semiconductor Rectifiers Market Size 2024 |

USD 6.89 Billion |

| Semiconductor Rectifiers Market, CAGR |

5.6% |

| Semiconductor Rectifiers Market Size 2032 |

USD 10.65 Billion |

The Semiconductor Rectifiers Market grows steadily, supported by strong drivers and evolving trends across industries. Rising demand for consumer electronics, electric vehicles, and renewable energy systems accelerates adoption of high-performance rectifiers. It addresses the need for efficient power conversion, stable current flow, and improved energy management.

The Semiconductor Rectifiers Market demonstrates significant geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, each region contributing to growth through distinct drivers. North America advances with strong demand from consumer electronics, renewable energy, and electric vehicle infrastructure. Europe focuses on industrial automation and electric mobility, supported by strict energy efficiency regulations and sustainable energy policies. Asia-Pacific leads in production and adoption due to its robust semiconductor manufacturing base, high consumer electronics demand, and rapid growth in electric vehicles. Latin America and the Middle East & Africa show emerging opportunities through renewable energy projects and industrial modernization. Key players shaping this market include Mitsubishi Electric, NXP Semiconductors, Rohm Semiconductor, and Toshiba Semiconductor. Their focus on innovation, partnerships, and new product development enhances competitiveness and drives global adoption of rectifiers in industrial, automotive, and utility applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Semiconductor Rectifiers Market was valued at USD 6.89 billion in 2024 and is projected to reach USD 10.65 billion by 2032, growing at a CAGR of 5.6%.

- Rising demand for consumer electronics, electric vehicles, and renewable power systems drives adoption of efficient rectifiers.

- Miniaturization trends and advancements in wide bandgap materials such as silicon carbide and gallium nitride improve performance and efficiency.

- Leading companies including Mitsubishi Electric, NXP Semiconductors, Rohm Semiconductor, and Toshiba Semiconductor compete through innovation, partnerships, and technology development.

- High production costs, raw material price volatility, and supply chain disruptions act as restraints for smaller players and new entrants.

- North America and Europe show strong growth driven by renewable energy integration and electric mobility, while Asia-Pacific leads production due to a robust semiconductor base.

- Latin America and the Middle East & Africa provide emerging opportunities through renewable energy projects, infrastructure modernization, and industrial adoption.

Market Drivers

Rising Demand for Consumer Electronics and Power Devices

The Semiconductor Rectifiers Market benefits from the continuous expansion of consumer electronics and portable devices. Smartphones, tablets, and laptops require efficient rectifiers for charging and power conversion. It ensures stable performance while supporting compact designs and energy efficiency. Growth in household appliances also boosts demand for rectifiers that manage power fluctuations. The rising global penetration of connected devices strengthens this demand further. It highlights the importance of rectifiers in ensuring reliable and safe power supply.

- For instance, ON Semiconductor provides a range of power management integrated circuits (ICs), including rectifiers, used in consumer electronics like smartphones and laptops. While the company’s products are known to improve efficiency in these devices.

Growing Need for Energy-Efficient Power Conversion Systems

The Semiconductor Rectifiers Market gains momentum from the demand for energy-efficient systems across industries. Enterprises seek rectifiers that reduce power loss and improve conversion efficiency. It aligns with global efforts to lower energy consumption in power distribution networks. Renewable energy projects also rely on rectifiers to integrate variable sources into grids. Electric vehicle charging infrastructure depends on high-performance rectifiers to deliver safe and stable current. It underlines the expanding role of rectifiers in the global energy transition.

- For instance, Infineon launched the CoolSiC Schottky diode 2000 V G5 family. These diodes support current ratings from 10 A to 80 A and allow higher power levels while reducing component count.

Rapid Expansion of Industrial Automation and Smart Manufacturing

The Semiconductor Rectifiers Market is driven by the rise of automation in industrial processes. Rectifiers provide essential power conversion for robotics, drives, and automated machinery. It ensures consistent energy supply in advanced manufacturing plants and data-driven factories. Growth in Industry 4.0 initiatives further increases the adoption of high-capacity rectifiers. Automation in sectors like automotive, aerospace, and electronics requires reliable power systems. It supports the development of scalable and resilient industrial infrastructures.

Accelerated Deployment of Renewable Energy and Electric Mobility

The Semiconductor Rectifiers Market sees strong growth from renewable energy adoption and electric mobility. Solar and wind installations depend on rectifiers to manage current flow and optimize performance. It improves reliability in converting renewable power into usable electricity. Electric vehicles and hybrid models require rectifiers for battery charging and onboard power electronics. Governments encourage such adoption with subsidies and infrastructure investments. It ensures rectifiers remain critical to the long-term evolution of clean energy ecosystems.

Market Trends

Integration of Rectifiers into Electric Vehicle Infrastructure

The Semiconductor Rectifiers Market is shaped by the rising deployment of electric vehicles and charging networks. High-performance rectifiers are integrated into fast-charging stations to ensure stable current delivery. It improves charging efficiency and supports growing demand for quick turnaround times. Automotive manufacturers rely on advanced rectifiers for onboard electronics and battery management. Expanding EV adoption globally is accelerating the development of rectifier technologies tailored for mobility. It strengthens the link between semiconductor innovation and sustainable transport systems.

- For instance, OmniOn Power’s EV100/EV101 rectifiers deliver 30 kW of constant DC output between 150 VDC and 1000 VDC, with up to twelve units operating in parallel to provide 360 kW of total capacity in fast-charging setups.

Growing Role of Rectifiers in Renewable Energy Applications

The Semiconductor Rectifiers Market gains momentum from their use in solar and wind energy projects. Rectifiers convert variable current into consistent power for grid integration. It ensures energy reliability and efficiency in large-scale renewable installations. The rise of distributed energy resources increases demand for rectifiers that can manage diverse inputs. Advanced designs help minimize power loss and extend system life. It reflects the market’s role in enabling the global clean energy transition.

- For instance, Servotech’s Sonipat facility has a new plant that will manufacture power modules, control circuits, and PLCs for EV chargers, with an initial production capacity of 24,000 power modules annually and plans to scale up to 240,000.

Advancements in Wide Bandgap Semiconductors and Materials

The Semiconductor Rectifiers Market is influenced by material innovations such as silicon carbide and gallium nitride. These wide bandgap materials provide higher efficiency, faster switching, and better thermal performance. It enhances the functionality of rectifiers in high-voltage and high-frequency applications. Power electronics in aerospace, defense, and industrial systems benefit from these advancements. Manufacturers are investing heavily in wide bandgap technologies to remain competitive. It positions rectifiers as key enablers of next-generation power systems.

Miniaturization and Integration in Consumer Electronics

The Semiconductor Rectifiers Market shows strong adoption trends in compact and integrated designs. Growing demand for smaller, lighter, and more energy-efficient consumer devices drives innovation. It requires rectifiers that can deliver high performance within limited space. Smartphones, laptops, and wearables benefit from miniaturized rectifier solutions. Integration with power management circuits reduces system complexity and enhances reliability. It reflects a broader industry trend toward high-efficiency, low-footprint semiconductor components.

Market Challenges Analysis

Price Volatility of Raw Materials and Supply Chain Constraints

The Semiconductor Rectifiers Market faces challenges from fluctuating prices of raw materials such as silicon, gallium, and rare earth metals. It increases production costs and reduces profit margins for manufacturers. Supply chain disruptions caused by geopolitical tensions and global shortages further intensify the issue. Limited availability of critical components delays production schedules for consumer electronics, automotive, and industrial applications. It forces companies to explore alternative sourcing strategies and regional diversification. These challenges hinder the ability of producers to meet rising demand consistently.

Technological Complexity and Competition from Alternative Solutions

The Semiconductor Rectifiers Market also encounters hurdles from the rapid pace of technological advancement. Designing high-efficiency rectifiers that meet stringent performance standards requires significant R&D investment. It raises barriers for smaller firms with limited resources. Competition from emerging alternatives such as advanced power converters and solid-state devices creates additional pressure. Regulatory compliance for safety and efficiency standards in multiple regions complicates product launches. It highlights the need for continuous innovation and adaptation to sustain competitiveness in a fast-evolving landscape.

Market Opportunities

Expansion of Renewable Energy and Smart Grid Projects

The Semiconductor Rectifiers Market presents strong opportunities through the global shift toward renewable energy and smart grids. Rectifiers play a critical role in converting variable current from solar and wind into stable electricity. It enables efficient grid integration and enhances the reliability of renewable power systems. Growing investments in distributed energy resources and microgrid projects create new demand for advanced rectifier solutions. Governments worldwide prioritize clean energy targets, which opens funding and partnership opportunities. It positions rectifiers as vital components in the energy transition toward sustainable power systems.

Rising Adoption in Electric Vehicles and Industrial Applications

The Semiconductor Rectifiers Market benefits from expanding electric mobility and industrial modernization. Electric vehicle charging infrastructure depends on high-performance rectifiers to ensure safe and efficient energy transfer. It also supports onboard power electronics for hybrid and battery-powered vehicles. Industrial automation and robotics require robust rectifiers for stable and efficient power supply. Emerging markets with rising manufacturing capacities create fresh opportunities for suppliers. It strengthens the market’s relevance across transportation, industrial automation, and high-growth energy applications.

Market Segmentation Analysis:

By Power Rating

The Semiconductor Rectifiers Market by power rating is segmented into low-power, medium-power, and high-power categories. Low-power rectifiers are widely used in consumer electronics such as smartphones, laptops, and small appliances. It provides efficient power conversion while meeting compact design requirements. Medium-power rectifiers are applied in industrial automation, telecom systems, and renewable projects where balanced performance and cost efficiency are critical. High-power rectifiers dominate in applications like electric vehicle charging infrastructure, grid integration, and heavy industrial systems. It supports large-scale energy conversion and ensures reliability under high-voltage conditions.

- For instance, the ON Semiconductor MB10S bridge rectifier handles an average forward current of 0.5 A and withstands surge currents of 35 A in a footprint around 35 mm².

By Application

The Semiconductor Rectifiers Market by application covers consumer electronics, automotive, industrial, and power utilities. Consumer electronics hold a strong share due to the increasing demand for portable devices and household appliances. It enhances charging performance and ensures safe energy transfer across devices. Automotive applications are expanding rapidly with the adoption of electric vehicles and hybrid models requiring efficient rectifiers. Industrial applications rely on rectifiers for robotics, drives, and automation systems. Power utilities integrate rectifiers into renewable energy projects and grid stability solutions. It highlights the versatility of rectifiers across diverse industries.

- For instance, Infineon’s 1200 V CoolSiC MOSFET modules offer on‑resistance values as low as 52.9 mΩ, aiding efficient grid conversion systems.

By Type

The Semiconductor Rectifiers Market by type includes single-phase rectifiers, three-phase rectifiers, and controlled rectifiers. Single-phase rectifiers dominate in small-scale and consumer-level applications, providing reliable performance in compact systems. It is preferred for electronics requiring consistent low-voltage conversion. Three-phase rectifiers are widely used in industrial equipment, motor drives, and heavy-duty applications due to their high efficiency. Controlled rectifiers, such as silicon-controlled rectifiers (SCRs), offer flexibility in regulating voltage and current, making them valuable in high-performance environments. It ensures precise power control for applications in renewable energy and advanced industrial processes.

Segments:

Based on Power Rating

- Low Power (less than 1 A)

- Medium Power (1-10 A)

- High Power (over 10 A)

Based on Application

- Power Supply

- Motor Control

- Automotive

- Renewable Energy

Based on Type

- Diode Rectifiers

- Thyristor Rectifiers

Based on Packaging

- Discrete

- Surface Mount (SMD)

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a 33% share of the Semiconductor Rectifiers Market, supported by strong demand from consumer electronics, automotive, and renewable energy sectors. The United States leads with widespread adoption of rectifiers in smartphones, laptops, and home appliances. It benefits from large-scale investments in electric vehicle infrastructure and renewable energy integration, where rectifiers ensure efficient power conversion. Canada contributes through expanding smart grid initiatives and growing adoption of electric mobility. The presence of major semiconductor companies and advanced R&D facilities strengthens the regional position. It is expected that North America will maintain a leading role, driven by technological innovation and rising demand for energy-efficient systems across industries.

Europe

Europe accounts for a 28% share of the Semiconductor Rectifiers Market, fueled by strict energy efficiency regulations and ambitious carbon reduction goals. Germany, France, and the UK are leading adopters, supported by strong manufacturing bases in automotive and industrial automation. It benefits from the European Union’s focus on sustainable energy, which encourages deployment of rectifiers in renewable power projects and smart grids. The automotive sector plays a major role, with electric vehicle production requiring rectifiers for charging and onboard electronics. The region’s emphasis on research in wide bandgap materials such as silicon carbide and gallium nitride strengthens market competitiveness. It positions Europe as a critical hub for innovation and sustainable power electronics adoption.

Asia-Pacific

Asia-Pacific commands a 30% share of the Semiconductor Rectifiers Market, with China, Japan, South Korea, and India driving demand. China dominates through high consumer electronics production and rapid expansion of electric vehicle manufacturing. It also integrates rectifiers into large-scale renewable energy projects, especially solar and wind. Japan and South Korea invest heavily in next-generation materials and miniaturized devices for high-tech applications. India contributes through rising industrial automation and strong government backing for renewable energy adoption. The region benefits from large-scale semiconductor manufacturing facilities, skilled workforce, and supportive policies. It remains the fastest-growing market, driven by strong demand from consumer electronics, automotive, and industrial sectors.

Latin America

Latin America holds a 5% share of the Semiconductor Rectifiers Market, reflecting early-stage adoption but growing opportunities. Brazil leads with strong demand for rectifiers in consumer electronics and renewable energy projects. It also invests in expanding electric mobility solutions, supported by government incentives. Mexico contributes through its manufacturing sector, particularly in automotive and electronics production. Countries across the region are adopting rectifiers to improve power distribution efficiency and reduce energy losses. It highlights the potential for gradual expansion with support from international investments. The region is set to grow steadily as infrastructure modernization and energy transition initiatives gain momentum.

Middle East & Africa

The Middle East & Africa account for a 4% share of the Semiconductor Rectifiers Market, supported by diversification in energy and industrial projects. Gulf countries such as Saudi Arabia and the UAE adopt rectifiers as part of renewable energy and electric mobility plans. It complements large-scale solar and wind projects aligned with clean energy targets. South Africa leads adoption in Africa through industrial modernization and renewable integration efforts. Limited semiconductor manufacturing capacity in the region remains a challenge. It represents an emerging market with long-term opportunities driven by sustainable energy goals and industrial development programs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cree

- Mitsubishi Electric

- Littelfuse

- Toshiba Semiconductor

- Rohm Semiconductor

- ON Semiconductor

- IXYS Corporation

- Fairchild Semiconductor

- Taiwan Semiconductor

- NXP Semiconductors

Competitive Analysis

The competitive landscape of the Semiconductor Rectifiers Market features leading players such as Mitsubishi Electric, NXP Semiconductors, Rohm Semiconductor, Toshiba Semiconductor, ON Semiconductor, Littelfuse, Cree, IXYS Corporation, Fairchild Semiconductor, and Taiwan Semiconductor. These companies focus on strengthening their portfolios through innovation in wide bandgap materials such as silicon carbide and gallium nitride, which deliver higher efficiency and performance. They invest heavily in research and development to enhance power conversion, thermal management, and miniaturization to meet the growing demand from automotive, renewable energy, and consumer electronics sectors. Strategic collaborations with automotive manufacturers and energy companies enable them to align with the rising adoption of electric vehicles and renewable energy systems. Expansion of production capacities and integration of advanced technologies help them capture opportunities in industrial automation and smart grids. With global competition intensifying, these players emphasize sustainability, cost efficiency, and regional expansion to secure their positions in a dynamic and evolving market.

Recent Developments

- In June 2025, Mitsubishi Electric Signed a memorandum of understanding with GE Vernova to supply IGBT power semiconductors for HVDC transmission systems.

- In June 2025, Toshiba Semiconductor, Toshiba developed technology that significantly reduces on-resistance in SiC trench MOSFETs and enhances ruggedness in semi-super junction Schottky barrier diodes.

- In May 2025, Toshiba Semiconductor, Toshiba introduced a diode lineup featuring US2H packages with heatsinks, compact 2.5 × 1.25 mm, and the small DFN 8×8 package to improve thermal performance and power handling.

- In November 2024, Mitsubishi Electric Commenced shipping samples of silicon carbide (SiC) MOSFET bare dies for electric vehicle inverters.

Report Coverage

The research report offers an in-depth analysis based on Power Rating, Application, Type, Packaging and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow with rising adoption of electric vehicles and charging infrastructure.

- Consumer electronics will continue to drive strong demand for compact and efficient rectifiers.

- Renewable energy projects will expand the role of rectifiers in solar and wind integration.

- Wide bandgap materials such as silicon carbide and gallium nitride will shape next-generation rectifiers.

- Industrial automation and robotics will require high-performance rectifiers for stable operations.

- Smart grid development will increase the need for rectifiers in power distribution systems.

- Companies will invest in miniaturization and thermal management technologies to enhance efficiency.

- Strategic partnerships will support innovation and global market expansion.

- Emerging economies will create opportunities through industrial growth and energy transition initiatives.

- Sustainability goals will position rectifiers as critical components in cleaner power systems.