Market Overview

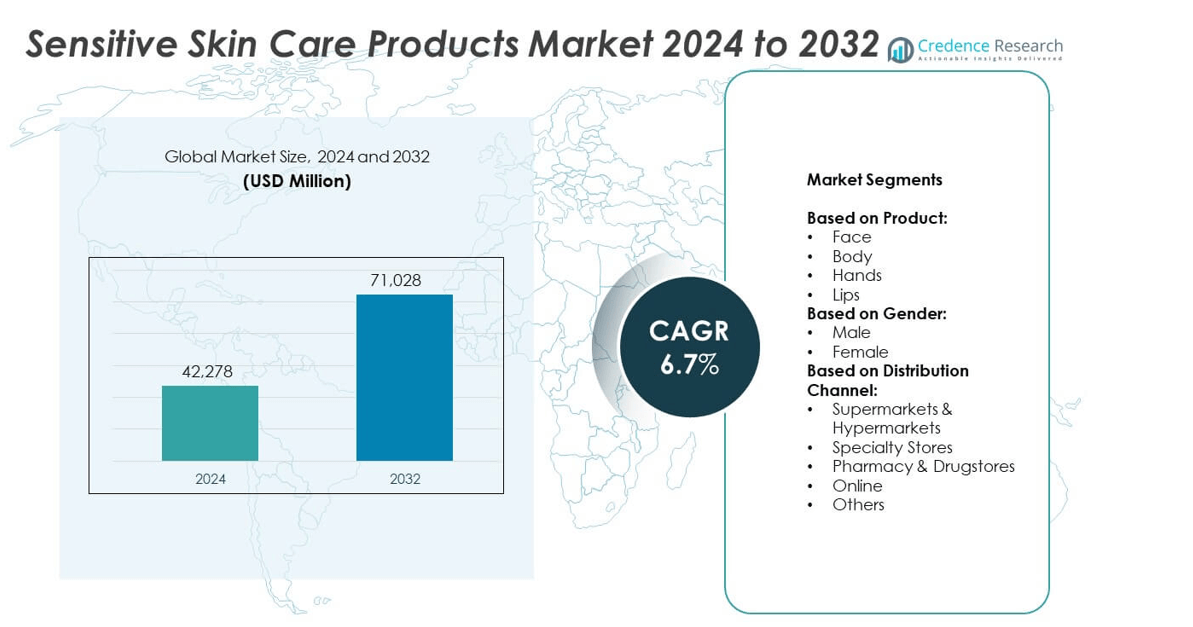

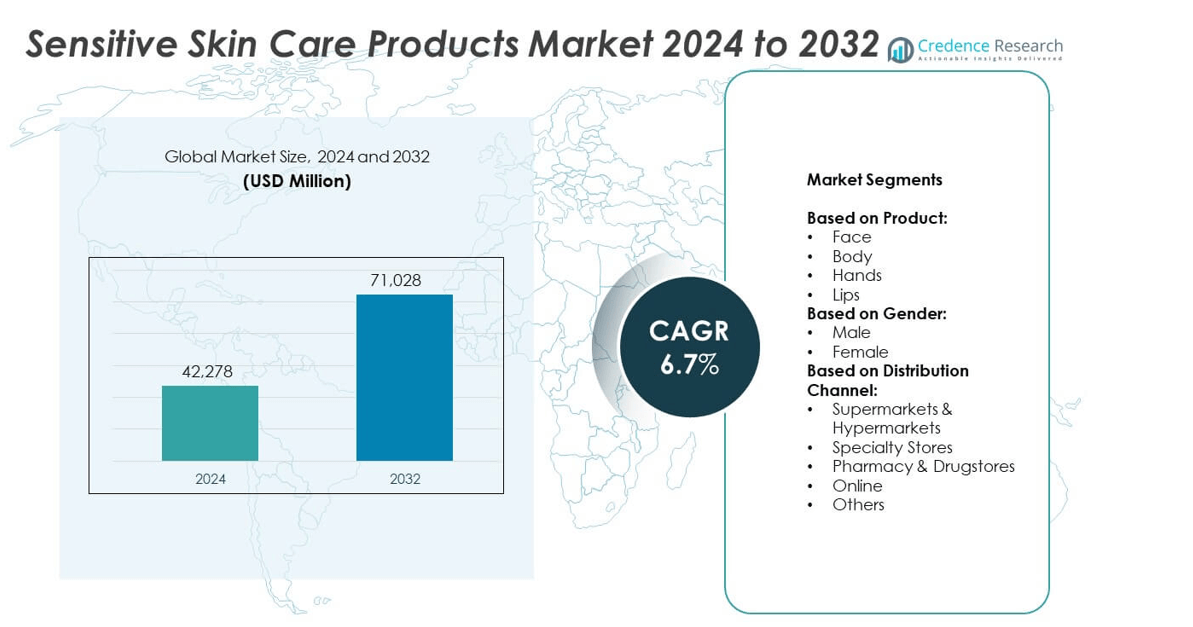

Sensitive Skin Care Products Market size was valued at USD 42,278 Million in 2024 and is expected to reach USD 71,028 Million by 2032, growing at a CAGR of 6.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sensitive Skin Care Products Market Size 2024 |

USD 42,278 Million |

| Sensitive Skin Care Products Market, CAGR |

6.7% |

| Sensitive Skin Care Products Market Size 2032 |

USD 71,028 Million |

Sensitive Skin Care Products market grows with rising cases of skin irritation, allergies, and pollution-driven sensitivities. Demand for hypoallergenic, fragrance-free, and dermatologist-tested products fuels innovation in clean-label and natural formulations. Consumers seek minimalist routines and multifunctional solutions, pushing brands toward simple, effective products. Digital engagement and influencer marketing educate buyers and drive adoption. E-commerce platforms expand product accessibility, while sustainability efforts such as recyclable packaging and cruelty-free certifications strengthen brand positioning and appeal to environmentally conscious consumers worldwide.

markets )n 80 words) do not write Markets share

North America leads the Sensitive Skin Care Products market due to high awareness and strong dermatology infrastructure. Europe follows with demand for safe, clinically tested products and strict regulatory compliance. Asia-Pacific grows rapidly with rising incomes and urbanization driving adoption of sensitive skin solutions. Key players include L’Oréal S.A., Johnson & Johnson Services Inc., Unilever PLC, and Amorepacific Corporation, focusing on innovation, sustainable packaging, and digital strategies to strengthen presence across established and emerging regions.

Market Insights

- Sensitive Skin Care Products market was valued at USD 42,278 Million in 2024 and is projected to reach USD 71,028 Million by 2032 at a CAGR of 6.7%.

- Rising cases of skin sensitivities, eczema, and allergies drive demand for hypoallergenic and dermatologist-tested solutions.

- Clean-label and natural formulations gain popularity, with consumers preferring plant-based and microbiome-friendly products.

- Leading players such as L’Oréal S.A., Johnson & Johnson Services Inc., Unilever PLC, and Procter & Gamble Company focus on innovation, clinical validation, and sustainable packaging.

- High product development costs and strict regulatory compliance pose challenges for smaller players and delay new launches.

- North America leads the market, followed by Europe, while Asia-Pacific shows fastest growth supported by urbanization and e-commerce adoption.

- Digital campaigns, influencer marketing, and personalized product recommendations strengthen consumer engagement and boost online sales globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Prevalence of Skin Sensitivities and Dermatological Issues

Sensitive Skin Care Products market expands with the growing number of consumers facing skin irritation, allergies, and conditions like eczema or rosacea. Increasing pollution, urban stress, and harsh weather trigger higher skin sensitivity cases. It pushes consumers to choose gentler, dermatologist-tested products. Rising awareness about skin barrier health fuels preference for hypoallergenic and fragrance-free solutions. Social media platforms educate users about skin-friendly routines and ingredients. Dermatologists recommend specialized products, strengthening trust and adoption.

- For instance, La Roche-Posay is recommended by 90,000 dermatologists worldwide.

Increasing Demand for Natural and Clean-Label Formulations

Consumers shift toward products with minimal chemicals, sulfates, and parabens, driving demand for natural solutions. Sensitive Skin Care Products market benefits from brands offering plant-based and non-toxic formulations. It aligns with rising health-conscious behavior and ethical consumption trends. Clean-label certifications enhance brand credibility and consumer loyalty. Manufacturers invest in botanical extracts and microbiome-friendly ingredients to improve product appeal. Regulatory push for safer cosmetic ingredients further encourages adoption of clean-label offerings.

- For instance, Cetaphil has tested its sensitive-skin products on over 32,000 patients across more than 550 clinical studies conducted by Galderma. The studies cover issues like dryness, irritation, roughness, and weakened skin barrier.

Expansion of E-Commerce and Digital Consumer Engagement

Growth of online retail channels strengthens access to specialized sensitive skin care products. E-commerce platforms allow easy product comparison and ingredient research before purchase. It supports niche brands reaching a global audience cost-effectively. Social media influencers and dermatologists endorse trusted solutions, boosting consumer confidence. Subscription models and direct-to-consumer channels enhance convenience and repeat sales. Digital campaigns drive consumer education, encouraging informed buying decisions.

R&D Innovation and Technological Advancements in Product Formulation

Continuous innovation supports development of advanced solutions targeting sensitive skin concerns. Sensitive Skin Care Products market witnesses new delivery systems such as microencapsulation for improved ingredient stability. It helps maintain efficacy and reduce irritation risk. Companies adopt pH-balanced and non-comedogenic formulations to ensure wider acceptance. Clinical testing and dermatological trials validate product safety and effectiveness. Collaboration between cosmetic chemists and dermatologists drives breakthrough product launches.

Market Trends

Growing Popularity of Personalized and Customized Skin Care Solutions

Sensitive Skin Care Products market sees rising interest in tailored solutions for unique skin needs. Brands use AI-powered skin analysis to recommend suitable products. It enhances consumer satisfaction by reducing trial-and-error purchases. Customizable formulations like serums and creams allow precise ingredient selection. Data-driven platforms offer quizzes to guide consumers toward effective routines. This trend fosters deeper engagement and brand loyalty.

- For instance, Kenvue reported that 69% of its packaging portfolio is now recyclable or refillable, with a goal to reach 100% by 2025. Additionally, the company has reduced its use of virgin plastic by over 21% (from its 2020 baseline), aiming for 25% by 2025 and 50% by 2030.

Shift Toward Minimalist and Multi-Functional Product Formulations

Consumers demand simple, effective routines with fewer steps, boosting interest in multifunctional products. Sensitive Skin Care Products market benefits from cleansers, moisturizers, and sunscreens offering combined benefits. It appeals to time-conscious users seeking efficiency and safety. Brands emphasize minimal ingredient lists to lower irritation risks. Packaging highlights essential actives like ceramides and niacinamide to build trust. This shift supports a streamlined, skin-friendly approach.

- For instance, Graphic Packaging Holding Company reported in its 2024 Impact Report that 97% of its packaging products sold are now characterized as recyclable. It also replaced roughly 1 billion plastic packages with paperboard packaging.

Rising Influence of Social Media and Dermatologist Endorsements

Online platforms shape purchase decisions through influencer recommendations and expert advice. Sensitive Skin Care Products market gains momentum through clinical claims showcased on social media. It builds consumer confidence in ingredient transparency and proven results. Dermatologists collaborate with brands to create education-driven campaigns. Viral trends encourage mass adoption of products suitable for sensitive skin. User-generated content amplifies brand credibility and awareness.

Focus on Sustainable and Ethical Product Development

Sustainability drives innovation in packaging, sourcing, and manufacturing across the market. Sensitive Skin Care Products market players adopt recyclable materials and refillable formats. It meets consumer demand for eco-friendly beauty solutions. Brands integrate cruelty-free testing and ethical sourcing certifications. Transparency in supply chain practices strengthens brand image. Sustainable formulations with biodegradable ingredients gain preference among environmentally conscious buyers.

Market Challenges Analysis

High Product Development Costs and Stringent Regulatory Compliance

Sensitive Skin Care Products market faces rising costs due to complex formulation requirements. Brands must invest heavily in R&D to ensure safety, hypoallergenic claims, and clinical validation. It raises time-to-market and limits smaller players’ competitiveness. Regulatory bodies demand strict compliance with cosmetic safety and labeling standards. This pressure slows product launches and increases certification expenses. Failure to meet guidelines can lead to recalls, damaging brand reputation and consumer trust.

Intense Competition and Risk of Product Mislabeling

Fierce competition challenges brands to differentiate in a crowded market. Sensitive Skin Care Products market players struggle with greenwashing accusations and false hypoallergenic claims. It creates skepticism among consumers, affecting loyalty. Counterfeit and low-quality products increase risks of skin irritation and erode confidence. Price wars reduce profit margins for premium solutions. Maintaining consistent quality across multiple markets becomes difficult for global brands.

Market Opportunities

Expansion into Emerging Markets and Untapped Consumer Segments

Sensitive Skin Care Products market holds strong potential in Asia-Pacific, Latin America, and Middle East regions. Rising disposable incomes and growing awareness about skin health drive product demand. It creates opportunities for brands to introduce dermatologist-tested and affordable solutions. Localized formulations targeting regional skin concerns enhance acceptance. Distribution partnerships with pharmacies and online retailers expand market reach. Brands that invest in education campaigns can build trust with first-time buyers.

Innovation in Advanced Formulations and Technology Integration

Advances in biotechnology and dermatological research open new growth avenues. Sensitive Skin Care Products market benefits from probiotic-based, microbiome-friendly, and peptide-enriched products. It allows brands to offer targeted solutions with proven clinical results. AI-driven skin diagnostics support personalized product recommendations. Smart packaging with QR codes provides ingredient transparency and usage guidance. Collaborations with research institutes accelerate development of next-generation sensitive skin care lines.

Market Segmentation Analysis:

By Product:

Sensitive Skin Care Products market shows strong demand across multiple product categories. Face care segment leads with high adoption of moisturizers, cleansers, and sunscreens formulated for sensitive skin. It benefits from rising awareness of facial skin health and preference for fragrance-free, pH-balanced solutions. Body care products follow, supported by lotions and shower gels designed to reduce irritation and dryness. Hand care segment grows due to frequent handwashing and sanitizer use, which increase skin dryness. Lip care products gain popularity with demand for hydrating balms and SPF-infused options.

- For instance, Galderma conducted a large global survey involving nearly 17,000 participants in 2025. The results showed up to 70% of people worldwide describe having some degree of sensitive skin.

By Gender:

Female consumers as the dominant buyers of sensitive skin solutions. Women seek targeted face serums, creams, and anti-aging products tailored to delicate skin. It also shows rising adoption among male consumers due to increasing grooming habits and awareness of skin health. Male-oriented products like aftershave balms, facial cleansers, and soothing moisturizers address irritation from shaving and pollution exposure. Brands launch gender-neutral lines to appeal to a wider audience. This shift supports inclusive marketing strategies and product positioning.

- For instance, a JAMA Dermatology–backed pilot survey in 2023 found that 57% of respondents self-reported sensitive skin. Within that group, 15% said they experienced their skin symptoms daily. The study also revealed women (60%) reported sensitive skin more often than men (46.2%).

By Distribution Channel:

Supermarkets and hypermarkets as leading sales points due to broad product availability and convenience. Specialty stores attract consumers seeking dermatologist-recommended and premium solutions. It benefits from in-store consultations and expert guidance. Pharmacies and drugstores maintain steady demand from health-conscious buyers prioritizing clinically tested products. Online channels grow rapidly with the influence of e-commerce, offering personalized recommendations and reviews to guide buyers. Other channels, including direct-to-consumer and department stores, contribute to niche demand, helping brands expand reach across regions.

Segments:

Based on Product:

Based on Gender:

Based on Distribution Channel:

- Supermarkets & Hypermarkets

- Specialty Stores

- Pharmacy & Drugstores

- Online

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Sensitive Skin Care Products market, accounting for 35% of global revenue. High awareness about skin sensitivities and strong dermatological infrastructure support market dominance. Consumers in the U.S. and Canada demand fragrance-free, dermatologist-tested, and hypoallergenic products. It benefits from rising cases of eczema, rosacea, and contact dermatitis linked to pollution and stress. The region sees a surge in demand for clean-label and natural formulations, pushing companies to invest in plant-based ingredients and transparent labeling. Major players focus on clinical validation and dermatologist endorsements to build consumer trust. E-commerce platforms and specialty stores play a critical role in educating buyers and promoting premium products.

Europe

Europe represents 28% of the global market share, supported by high regulatory standards and preference for safe, clinically proven solutions. Consumers in Germany, France, and the UK are highly aware of skin health and seek allergen-free products. It encourages brands to maintain compliance with strict EU regulations, including REACH and Cosmetics Directive standards. Demand rises for sustainable and cruelty-free products, aligning with regional focus on ethical beauty. Growing popularity of pharmacy chains and dermo-cosmetic brands like La Roche-Posay and Avène strengthens sales. Influencer-driven marketing and dermatologist collaborations further expand awareness. Premiumization trends fuel growth in facial serums, moisturizers, and sunscreen products specifically for sensitive skin.

Asia-Pacific

Asia-Pacific captures 22% of the Sensitive Skin Care Products market, making it the fastest-growing region. Rising disposable incomes and growing awareness about skincare routines drive strong adoption. It benefits from urbanization, pollution-related skin concerns, and cultural emphasis on skin health. Countries like China, Japan, and South Korea lead demand for innovative formulations, including microbiome-friendly and lightweight textures suitable for humid climates. K-beauty and J-beauty trends influence product development worldwide, inspiring brands to create advanced solutions for sensitive skin. E-commerce platforms dominate distribution, offering localized products and subscription models. Local players compete with global brands by introducing affordable, dermatologist-approved options.

Latin America

Latin America accounts for 9% of the market share, driven by rising middle-class population and increasing grooming awareness. Consumers in Brazil and Mexico focus on affordable, soothing formulations to address skin irritation from climate and pollution. It creates opportunities for mass-market brands and pharmacy-led sales. Marketing campaigns focus on educating consumers about skin sensitivity and prevention of allergic reactions. Growth of specialty stores and dermatology clinics expands access to premium brands. Regional demand for sun protection and lightweight moisturizers strengthens product sales. Local players collaborate with dermatologists to increase trust and market penetration.

Middle East & Africa

Middle East & Africa represent 6% of global revenue but offer strong potential for future expansion. Harsh climatic conditions, including heat and dryness, heighten the need for hydrating and protective products. It encourages demand for soothing creams, sunscreens, and barrier-repair formulations. Consumers in the UAE, Saudi Arabia, and South Africa prefer dermatologist-endorsed brands and premium solutions. E-commerce and pharmacy channels are growing rapidly, offering better accessibility and variety. Rising awareness about skin health through social media and medical campaigns supports market growth. Global players invest in localized marketing and product launches to cater to specific skin concerns in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kao Corporation

- Johnson & Johnson Services Inc.

- Pevonia International Inc

- The Estée Lauder Companies Inc.

- maxingvest AG (Beiersdorf AG)

- L’Oréal S.A.

- Amorepacific Corporation

- Unilever PLC

- Sebapharma GmbH & Co. KG

- Procter & Gamble Company

Competitive Analysis

The competitive landscape of the Sensitive Skin Care Products market is shaped by leading players such as Kao Corporation, Johnson & Johnson Services Inc., Pevonia International Inc, The Estée Lauder Companies Inc., maxingvest AG (Beiersdorf AG), L’Oréal S.A., Amorepacific Corporation, Unilever PLC, Sebapharma GmbH & Co. KG, and Procter & Gamble Company. These companies compete through strong brand portfolios, continuous product innovation, and global distribution networks. They invest in advanced formulations such as pH-balanced, fragrance-free, and microbiome-friendly products to meet the rising demand for sensitive skin solutions. Leading players focus on clinical validation and dermatologist endorsements to build consumer trust and credibility. Many launch gender-neutral and multifunctional products to capture wider consumer segments. Sustainability initiatives, including recyclable packaging and cruelty-free certifications, strengthen brand positioning among eco-conscious buyers. Strategic mergers, acquisitions, and collaborations expand market presence and accelerate R&D efforts. Digital marketing and e-commerce partnerships allow them to engage directly with consumers and boost online sales. Regional expansion strategies target high-growth markets like Asia-Pacific and Latin America, aligning offerings with local preferences. The intense competition encourages constant innovation and drives the overall market toward premiumization and transparency in product labeling.

Recent Developments

- In 2024, Unilever launched a body wash collection addressing nine skincare needs, including hydration with 6% hyaluronic acid serum and Acne Clear formula targeting acne-prone sensitive skin on body areas

- In 2023, L’Oréal acquired Aesop, expanding its footprint in high-end natural sensitive skincare products, especially in China

- In 2022, La Roche-Posay (a L’Oréal brand) launched Anthelios UVMune 400 technology with products offering broad photoprotection designed for sensitive skin including an oily skin formulatio

Report Coverage

The research report offers an in-depth analysis based on Product, Gender, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for dermatologist-tested and hypoallergenic products will continue to rise.

- Brands will focus on clean-label and natural ingredient formulations for sensitive skin.

- E-commerce will grow as a leading sales channel, offering wider product accessibility.

- Personalized skin care solutions using AI and data-driven tools will gain popularity.

- Sustainable packaging and eco-friendly production methods will become a key differentiator.

- Collaborations with dermatologists and medical professionals will boost product credibility.

- Emerging markets will see rapid adoption due to rising income and awareness levels.

- Multifunctional and minimalist products will dominate consumer preferences.

- Clinical testing and regulatory compliance will remain critical for market trust.

- Digital marketing and influencer collaborations will drive stronger consumer engagement.