Market Overview

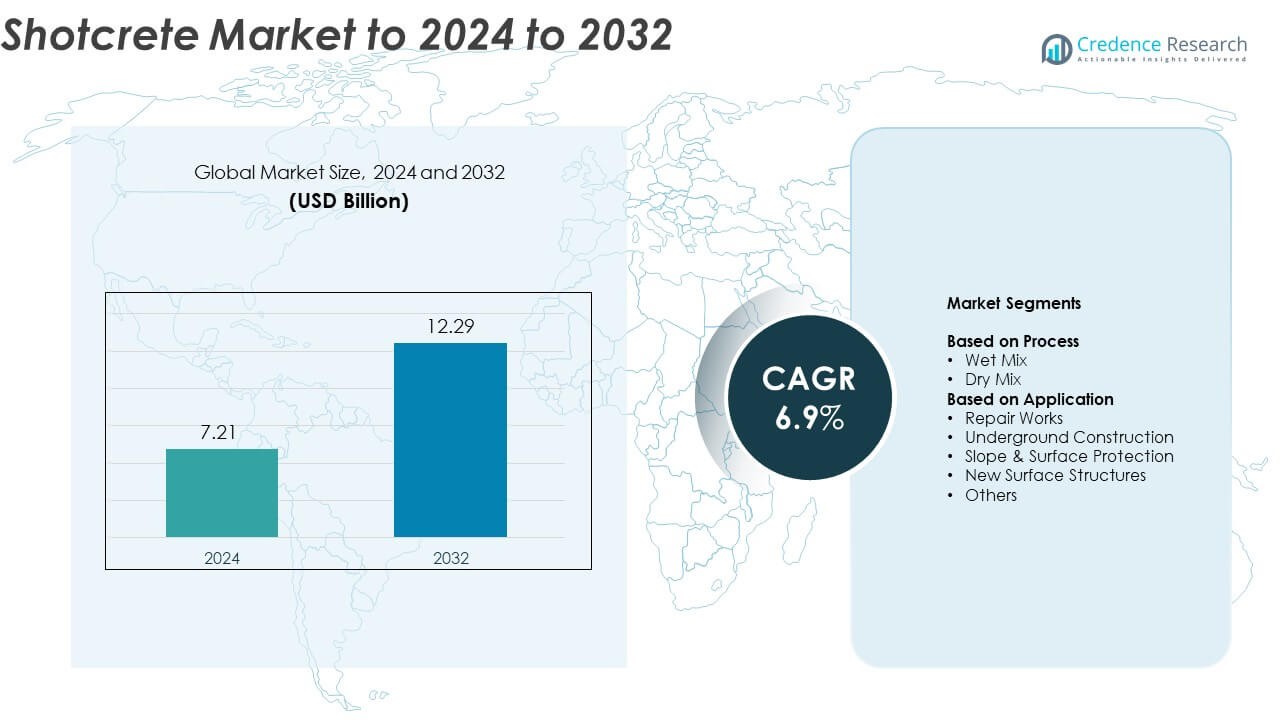

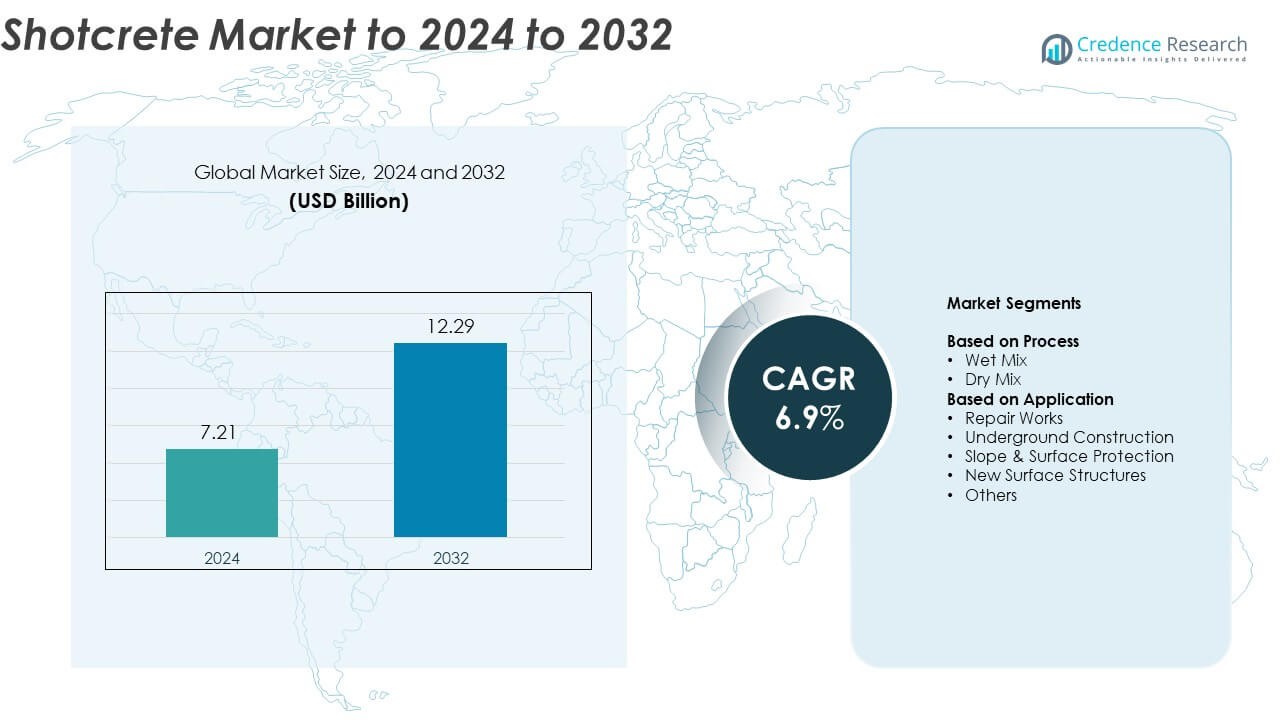

Shotcrete Market size was valued at USD 7.21 Billion in 2024 and is anticipated to reach USD 12.29 Billion by 2032, at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Shotcrete Market Size 2024 |

USD 7.21 Billion |

| Shotcrete Market, CAGR |

6.9% |

| Shotcrete Market Size 2032 |

USD 12.29 Billion |

The shotcrete market is led by prominent players including BASF SE, Mapei S.P.A., Cemex S.A.B. de C.V., Grupo ACS, Lafargeholcim Ltd., HeidelbergCement, GCP Applied Technologies, Sika AG, U.S. Concrete Inc, and Normet Group. These companies dominate through advanced material technologies, innovative admixtures, and automated spraying systems that enhance construction efficiency. Asia Pacific remains the leading region, commanding approximately 34.6% share in 2024, supported by large-scale infrastructure and underground transit projects across China, India, and Japan. Europe and North America follow, driven by sustainable construction initiatives, modernization of transport networks, and extensive tunneling developments supporting continued market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The shotcrete market was valued at USD 7.21 billion in 2024 and is projected to reach USD 12.29 billion by 2032, expanding at a CAGR of 6.9% during the forecast period.

- Rising infrastructure development, tunneling projects, and underground metro construction are major factors driving global demand for wet-mix shotcrete applications.

- Technological advancements such as robotic spraying systems, fiber-reinforced formulations, and eco-friendly admixtures are shaping market trends toward safety, efficiency, and sustainability.

- The market is moderately consolidated, with leading players focusing on innovation, strategic mergers, and green product development to strengthen their regional presence.

- Asia Pacific leads the market with 34.6% share in 2024, followed by North America with 29.7% and Europe with 26.4%, while the wet-mix segment dominates by process, holding around 67.4% share due to superior quality, faster application, and reduced material rebound during large-scale infrastructure projects.

Market Segmentation Analysis:

By Process

The wet mix segment dominates the shotcrete market, accounting for about 67.4% share in 2024. Its leadership is attributed to superior homogeneity, reduced rebound loss, and enhanced strength in final applications. Wet mix shotcrete ensures consistent quality due to pre-mixed water and additives before spraying, which supports large-scale infrastructure and tunneling projects. Growing use in complex geometries, tunnel linings, and slope stabilization enhances demand. Advancements in robotic shotcreting systems and high-performance admixtures further improve efficiency and productivity, reinforcing the dominance of the wet mix process over the dry mix alternative.

- For instance, Normet’s technical documentation for the Spraymec 8100 VC confirms that it features a maximum vertical reach of 14 m.

By Application

Underground construction leads the market with approximately 42.8% share in 2024, driven by rising tunnel, mining, and metro rail projects worldwide. The segment benefits from shotcrete’s ability to provide immediate ground support and reduce cycle time in excavation environments. Increased government investment in transportation tunnels and hydroelectric plants strengthens growth. Rapid-setting admixtures and fiber-reinforced formulations enhance stability and durability under challenging conditions. Expanding urban infrastructure and underground transit developments across Asia and Europe further propel segment expansion, establishing underground construction as the primary application area for shotcrete.

- For instance, Putzmeister’s WETKRET 5 specifies a 17 m vertical reach and a maximum theoretical output of 33 m³/h (or 30 m³/h depending on the pump configuration) for tunnelling works.

Key Growth Drivers

Rising Infrastructure Development and Urbanization

Rapid global urbanization and infrastructure expansion are major factors fueling the growth of the shotcrete market. Increasing investments in tunnels, bridges, subways, and slope stabilization projects drive large-scale adoption. Shotcrete’s ability to provide high-strength, cost-effective, and durable structures supports its preference over conventional concrete methods. Growing government spending on transportation and energy projects in Asia-Pacific and Europe further accelerates market growth, making infrastructure development the most significant growth driver.

- For instance, BarChip reports the Divača–Koper rail tunnels used 850 t of fibers to reinforce over 150,000 m³ of shotcrete.

Advancements in Shotcrete Technology

Technological progress in wet-mix equipment, accelerator chemistry, and robotic spraying systems enhances shotcrete efficiency and application quality. Automated and remote-controlled shotcreting reduces labor dependency and ensures uniform material placement in complex structures. The introduction of fiber-reinforced and eco-friendly formulations improves structural integrity and sustainability. These innovations enable faster construction timelines and lower operational costs, strengthening shotcrete adoption across infrastructure and mining projects globally.

- For instance, Sika’s guidance for shotcrete applications targets J1 early strengths of 1.0–1.5 MPa within 1–2 hours of application (the prerequisite for vertical/overhead applications and single-pass thick layer application), with Sigunit® accelerators typically dosed at 3–10% by weight of binder in wet-mix processes to achieve these specific rapid early strength requirements.

Growing Adoption in Mining and Tunneling Applications

The mining and tunneling industries are witnessing increased reliance on shotcrete for rapid ground support and structural reinforcement. Rising mineral extraction and underground metro construction projects contribute significantly to demand. Shotcrete’s ability to form flexible and stable linings in difficult geological conditions enhances safety and operational efficiency. The growth of mechanized tunneling and increasing focus on worker protection continue to expand its use in underground construction environments.

Key Trends & Opportunities

Integration of Fiber-Reinforced Shotcrete (FRS)

The adoption of fiber-reinforced shotcrete is expanding due to its superior tensile strength, crack resistance, and durability. FRS replaces traditional steel mesh reinforcement, offering faster application and reduced maintenance. Its rising use in tunnels, slope protection, and hydroelectric projects presents new opportunities for manufacturers. The combination of synthetic and steel fibers further improves performance in extreme environments, making FRS a preferred choice for demanding structural applications.

- For instance, Bekaert’s documentation for tunnelling applications includes reference to specifications that require a residual strength of >3 MPa at deflections between 0.5 mm and 1.0 mm for fiber-reinforced shotcrete linings.

Sustainability and Green Construction Initiatives

Growing emphasis on sustainable construction practices promotes the use of shotcrete with low-carbon materials and recycled aggregates. Manufacturers are developing admixtures that reduce cement consumption and enhance durability. The increasing adoption of energy-efficient equipment and low-emission processes aligns with global sustainability goals. These eco-friendly advancements create significant opportunities in green infrastructure and public works projects.

- For instance, MacLean’s SS5 battery-electric sprayer removes diesel at the face and is documented with a pump capability of 23 m³/h.

Expansion of Robotic Shotcreting Systems

Automation in shotcrete application is gaining traction due to improved accuracy, safety, and consistency. Robotic systems are increasingly used in confined or hazardous environments like tunnels and mines. They reduce human exposure to risks and enhance productivity by ensuring even material distribution. The integration of digital control systems and real-time monitoring supports process optimization, offering strong growth potential for equipment manufacturers and contractors.

Key Challenges

High Initial Equipment and Maintenance Costs

The adoption of advanced shotcrete equipment involves high upfront investment and regular maintenance expenses. Smaller contractors often face budget constraints that limit technology integration. Frequent calibration and repair of pumps and spraying machines add operational challenges. These costs can restrain adoption in emerging markets despite long-term efficiency benefits, particularly in small-scale or remote construction projects.

Skilled Workforce Shortage

The shortage of trained professionals capable of handling shotcrete application equipment and admixture control remains a key hurdle. Proper nozzle operation and mix control are essential to ensure surface quality and structural performance. Inadequate training leads to material wastage and inconsistent results. The lack of skilled labor across developing regions continues to limit productivity and affects project timelines, slowing overall market expansion.

Regional Analysis

North America

North America holds around 29.7% share of the global shotcrete market in 2024, driven by robust infrastructure modernization and underground transit projects. The United States leads with significant investments in tunnel construction, hydroelectric facilities, and slope stabilization programs. Demand for wet-mix shotcrete continues to rise due to improved performance and reduced rebound loss. Growing adoption of robotic and automated shotcreting systems enhances safety and efficiency across construction sites. Canada’s mining and hydropower expansion further strengthens regional growth, supported by government initiatives to upgrade transportation networks and sustainable infrastructure.

Europe

Europe accounts for approximately 26.4% share of the shotcrete market, supported by the region’s focus on sustainable construction and tunnel rehabilitation projects. Countries such as Germany, Switzerland, and Norway are advancing large-scale tunneling and slope stabilization operations. The European Union’s investment in green and energy-efficient infrastructure drives demand for shotcrete materials with low carbon footprints. The adoption of fiber-reinforced shotcrete and advanced admixtures improves durability in complex terrains. Increasing renovation of aging transport tunnels and the growth of underground urban mobility solutions sustain steady market growth across Western and Northern Europe.

Asia Pacific

Asia Pacific dominates the global market with nearly 34.6% share in 2024, led by massive infrastructure investments in China, India, Japan, and South Korea. Expanding metro rail projects, hydropower plants, and mining activities accelerate shotcrete adoption. Governments across the region are prioritizing underground construction for urban development and disaster prevention. The growing use of wet-mix processes and robotic application systems improves construction speed and safety. Strong demand from developing economies and rapid industrialization continue to position Asia Pacific as the fastest-growing market, driven by large-scale urban expansion and smart city initiatives.

Latin America

Latin America represents about 5.4% share of the global shotcrete market, driven by expanding mining operations and infrastructure improvements. Countries such as Chile, Peru, and Brazil are investing in underground mining, tunnels, and slope stabilization projects. Increasing adoption of wet-mix shotcrete enhances productivity and structural integrity in complex geological conditions. Government-backed transportation and energy infrastructure programs further boost regional demand. Despite economic fluctuations, advancements in construction practices and growing interest in sustainable materials are expected to strengthen market growth across key Latin American economies.

Middle East & Africa

The Middle East and Africa collectively hold around 3.9% share of the shotcrete market, primarily supported by ongoing infrastructure and energy projects. The United Arab Emirates and Saudi Arabia lead with large-scale urban development and tunneling initiatives. Africa’s mining and hydropower sectors increasingly rely on shotcrete for ground support and structural reinforcement. Growing investments in smart city projects and underground transportation systems contribute to steady demand. While the market is still emerging, technological advancements and government efforts to diversify construction capabilities are expected to accelerate growth in the coming years.

Market Segmentations:

By Process

By Application

- Repair Works

- Underground Construction

- Slope & Surface Protection

- New Surface Structures

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the shotcrete market features key players such as BASF SE, Mapei S.P.A., Cemex S.A.B. de C.V., Grupo ACS, Lafargeholcim Ltd., HeidelbergCement, GCP Applied Technologies, Sika AG, U.S. Concrete Inc, and Normet Group. The market remains moderately consolidated, with global players focusing on technological innovation, strategic partnerships, and capacity expansion. Companies are emphasizing product diversification through high-performance admixtures and fiber-reinforced formulations to improve strength, durability, and sustainability. Investment in automated spraying equipment and digital control systems enhances efficiency and safety across large-scale projects. Major participants are also aligning with green construction trends by developing low-carbon and energy-efficient solutions. Continuous R&D activities, coupled with collaborations between material manufacturers and construction contractors, support product innovation and customized applications. Competitive intensity is further driven by expanding infrastructure projects, particularly in Asia-Pacific and Europe, where underground construction, tunneling, and transportation sectors continue to generate strong demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Mapei S.P.A.

- Cemex S.A.B. De C.V.

- Grupo ACS

- Lafargeholcim Ltd.

- Heidelbergcement

- GCP Applied Technologies

- Sika AG

- U.S. Concrete Inc

- Normet Group

Recent Developments

- In 2024, Mapei launched Planitop Shotcrete, a silica-fume-enhanced cementitious mortar designed for machine application on horizontal, vertical, and overhead concrete surfaces, improving adhesion and durability

- In 2023, Sika AG established a technology hub for shotcrete accelerators in Kirchberg, Switzerland, expanding manufacturing capacities for the concrete admixture Sigunit®, which is used mainly in tunneling and excavation stabilization.

- In 2023, Cemex launched a new low-carbon sprayed concrete formulation focused on reducing CO2 emissions in shotcrete applications, aligning with their sustainability initiative “Future in Action”.

Report Coverage

The research report offers an in-depth analysis based on Process, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The shotcrete market will expand steadily with rising infrastructure and urban tunnel projects worldwide.

- Advancements in fiber-reinforced shotcrete will enhance durability and structural performance.

- Automation and robotic spraying systems will improve accuracy and reduce labor dependency.

- Growing investment in underground metro and mining construction will sustain long-term demand.

- Eco-friendly formulations and low-carbon shotcrete mixes will align with global sustainability goals.

- Technological innovations in admixtures will improve setting time and application efficiency.

- Asia Pacific will remain the fastest-growing region driven by rapid urbanization and industrial projects.

- Integration of digital monitoring in spraying systems will optimize construction quality control.

- Increased government spending on transportation and hydropower projects will fuel market growth.

- Continuous research in material science will lead to stronger, more resilient, and cost-efficient shotcrete solutions.