Market Overview

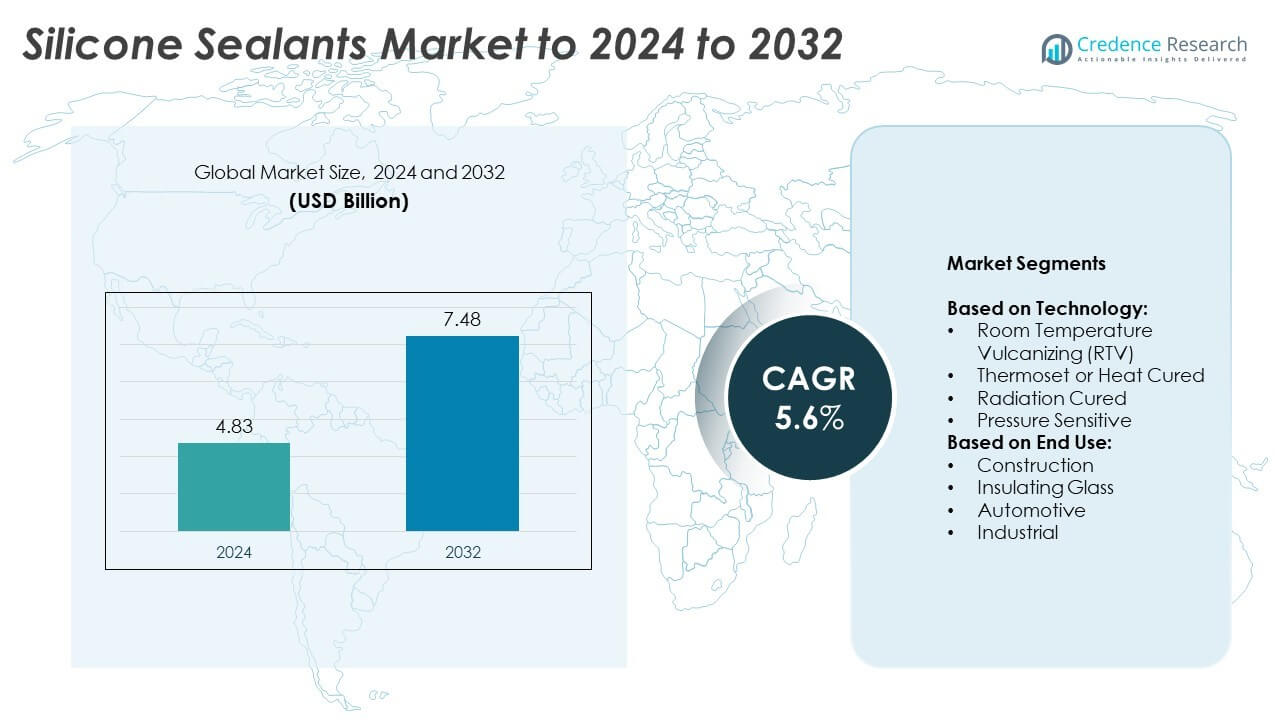

The Silicone Sealants Market size was valued at USD 4.83 Billion in 2024 and is anticipated to reach USD 7.48 Billion by 2032, at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Silicone Sealants Market Size 2024 |

USD 4.83 Billion |

| Silicone Sealants Market, CAGR |

5.6% |

| Silicone Sealants Market Size 2032 |

USD 7.48 Billion |

The silicone sealants market is highly competitive, with key players including Huntsman International LLC, Tremco Incorporated, Henkel Corporation, Wacker Chemie AG, Dow, H.B. Fuller, Shin-Etsu Chemical Company, Mapei, 3M, Sika AG, and Bostik driving growth through innovation, product diversification, and global expansion. These companies focus on advanced formulations, eco-friendly solutions, and strategic partnerships to strengthen their positions across construction, automotive, and industrial applications. Regionally, Asia Pacific led the market in 2024 with a 36% share, supported by rapid urbanization, infrastructure projects, and strong automotive production, while North America and Europe followed with 28% and 26% shares, respectively, benefiting from sustainability-focused building practices and advanced manufacturing capabilities.

Market Insights

Market Insights

- The silicone sealants market size was USD 4.83 Billion in 2024 and is projected to reach USD 7.48 Billion by 2032, growing at a CAGR of 5.6% from 2025 to 2032.

- Rising demand from the construction sector, which held over 35% share in 2024, acts as a primary growth driver, supported by infrastructure expansion, urbanization, and energy-efficient building requirements.

- Market trends highlight increasing adoption in automotive and EV applications, along with opportunities in electronics and healthcare through advanced curing technologies like radiation-cured and pressure-sensitive sealants.

- The competitive landscape features global players focusing on eco-friendly, low-VOC formulations and strategic partnerships to expand presence, while raw material price volatility remains a major restraint affecting profitability.

- Asia Pacific led the market with 36% share in 2024, followed by North America at 28% and Europe at 26%, while Latin America held 6% and the Middle East and Africa accounted for 4%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

Room Temperature Vulcanizing (RTV) silicone sealants dominated the market with more than 45% share in 2024, driven by their ease of application, strong adhesion, and resistance to temperature and moisture, making them widely used in construction and automotive applications. Thermoset or heat-cured silicone sealants accounted for a significant portion of demand in aerospace, electronics, and industrial uses due to their ability to withstand high temperatures and mechanical stress, supported by rising aerospace and electronics production. Radiation-cured silicone sealants, while a smaller segment, are gaining traction in medical devices and microelectronics where fast curing and precision are required, benefiting from the growth of advanced manufacturing. Pressure-sensitive silicone sealants are emerging in packaging and electronics, offering strong adhesion without curing, with demand rising from e-commerce packaging and miniaturized electronics assembly.

- For instance, in Europe, Dow’s Barry siloxane plant’s capacity was reduced to 145,000 tons/year in 2020 after an older production line was shut down. Previously, the plant’s capacity had reached 200,000 tons/year by 2005 following a major expansion in 1999.

By End Use

Construction held the largest share at over 35% in 2024, supported by heavy usage of silicone sealants in waterproofing, glazing, and joint sealing, driven by rapid urbanization and sustainable infrastructure projects worldwide. Insulating glass applications followed strongly, boosted by demand for energy-efficient glazing in residential and commercial buildings, reinforced by stricter building energy codes and sustainability certifications in North America and Europe. Automotive applications continue to expand, as silicone sealants are critical for gaskets, body sealing, and electric vehicle battery systems, with growth fueled by rising global vehicle output and electrification trends. Industrial applications are also growing, supported by heavy equipment, aerospace, and electronics manufacturing, where silicone sealants are valued for their durability under harsh thermal and chemical conditions, with Industry 4.0 automation further accelerating their adoption.

- For instance, Dow’s Zhangjiagang facility is sized to produce 12,000 tons of silicone resin annually.

Key Growth Drivers

Rising Demand from Construction Sector

The construction sector is the key growth driver for the silicone sealants market, accounting for the largest share of demand in 2024. Silicone sealants are extensively used for waterproofing, glazing, and joint sealing due to their flexibility and durability. Urbanization, government-backed infrastructure development, and green building initiatives continue to drive growth in this segment. The increasing focus on energy-efficient and sustainable structures, supported by regulations and certifications, ensures consistent demand. Expanding megaprojects in Asia-Pacific and the Middle East further solidify construction as the leading market driver.

- For instance, in 2023, silicone emerged as the leading resin type in the global sealants market, notably in construction applications. Another source indicates that silicone held approximately 43% of the global sealants market share in 2024 by value, due to its properties like elasticity and durability

Expansion in Automotive and EV Industry

The automotive sector significantly boosts the silicone sealants market, as these materials are critical for gaskets, body sealing, and electrical insulation. The growing adoption of electric vehicles adds to this demand, requiring advanced sealing for batteries and electronics. Automotive OEMs also prefer silicone sealants for lightweighting strategies, as they replace mechanical fasteners while enhancing durability. Expanding EV production in Asia, North America, and Europe amplifies growth. This driver is strengthened by government policies promoting clean mobility and increasing global vehicle production levels.

- For instance, in 2024, Elkem completed the Phoenix project at its Xinghuo Silicones plant in China, which increased silicon monomer capacity by 200,000 tons/year.

Technological Advancements in Manufacturing

Ongoing advancements in silicone sealant formulations and application technologies are driving adoption across industries. Innovations in radiation-cured and pressure-sensitive sealants improve curing speed, efficiency, and performance, enabling their use in electronics, packaging, and healthcare. Automation and robotics in industrial processes also expand opportunities for precision sealing solutions. These improvements support higher productivity and cost-effectiveness while meeting stricter environmental standards. Companies investing in R&D are introducing eco-friendly and high-performance products, ensuring the market remains competitive and adaptable to evolving end-user requirements.

Key Trends & Opportunities

Shift Toward Sustainable and Energy-Efficient Solutions

A key trend shaping the silicone sealants market is the growing emphasis on sustainable, energy-efficient building solutions. Increasing adoption of insulating glass sealants for double- and triple-glazed windows reflects this shift. Governments and developers worldwide are aligning projects with carbon reduction targets and green certification programs. As building codes become stricter, silicone sealants offering durability and energy savings find stronger demand. This trend opens opportunities for manufacturers to develop low-VOC and eco-friendly sealants that align with global sustainability goals and regulatory frameworks.

- For instance, Tremco offers a variety of low-VOC sealants, including the Dymonic 100 polyurethane sealant, which is designed with low VOC content. Additionally, Tremco also produces the Low VOC TPO and EPDM Single-Ply Primer with a VOC content less than 250 g/L. Many of Tremco’s products are designed to meet or exceed modern Volatile Organic Compound (VOC) standards.

Growing Penetration in Electronics and Healthcare

Another important opportunity is the rising use of silicone sealants in electronics and medical devices. In electronics, sealants ensure protection against moisture, heat, and vibration, supporting growth in consumer devices and miniaturized components. In healthcare, radiation-cured silicone sealants are favored for fast curing and high precision in device assembly. The expansion of wearable technologies and advanced medical equipment further boosts adoption. This diversification into high-growth industries provides strong opportunities for manufacturers beyond traditional construction and automotive applications.

- For instance, in 2023, H.B. Fuller was recognized for its leadership in sustainable innovation, but the company’s innovation award was for EV Protect 4006, an encapsulant for electric vehicle batteries.

Key Challenges

Volatility in Raw Material Prices

One of the key challenges in the silicone sealants market is the fluctuation of raw material costs, particularly silicon and petrochemical derivatives. Price volatility impacts production costs and squeezes profit margins for manufacturers. Smaller players are more vulnerable to these fluctuations, as they lack economies of scale to manage cost pressures. Uncertainty in supply chains, driven by global trade disruptions, further complicates procurement. This challenge forces companies to adopt cost optimization strategies and diversify suppliers to remain competitive.

Stringent Environmental and Regulatory Standards

Compliance with stringent environmental and health regulations is another major challenge. Restrictions on VOC emissions, hazardous substances, and chemical formulations increase the cost and complexity of product development. Manufacturers must invest heavily in R&D to create compliant yet high-performance sealants. Smaller companies may struggle to meet evolving standards, limiting their competitiveness. At the same time, non-compliance can result in penalties, reputation loss, and restricted market access. This regulatory burden creates barriers to entry while driving innovation among established players.

Regional Analysis

North America

North America held a 28% share of the silicone sealants market in 2024, driven by strong demand from construction, automotive, and industrial applications. The United States leads the region, supported by infrastructure modernization, residential projects, and high EV adoption rates. Energy-efficient building standards further boost insulating glass applications, while the aerospace sector adds to specialized usage. Canada contributes steadily, with construction and industrial manufacturing being key growth areas. Regulatory emphasis on sustainable materials and the presence of major global manufacturers strengthen market performance, ensuring steady growth across multiple end-use industries in the forecast period.

Europe

Europe accounted for 26% of the silicone sealants market share in 2024, supported by high adoption in construction and automotive sectors. Countries such as Germany, France, and the UK lead demand with advanced manufacturing and stringent environmental regulations. Growth in energy-efficient building solutions and expanding EV production drive applications in glazing and automotive sealing. The region benefits from strong innovation in eco-friendly and low-VOC sealants, aligned with EU Green Deal initiatives. Industrial and aerospace applications also contribute to market expansion, positioning Europe as a mature but innovation-driven market during the forecast period.

Asia Pacific

Asia Pacific dominated the silicone sealants market with a 36% share in 2024, making it the leading region globally. Rapid urbanization, infrastructure growth, and strong automotive production in China, India, and Japan fuel demand. Construction megaprojects and large-scale residential developments further accelerate consumption in the region. Expanding EV manufacturing and rising electronics assembly strengthen adoption of high-performance sealants. The region benefits from cost-effective production hubs and strong government investments in industrialization. Growing emphasis on energy efficiency and sustainability also boosts insulating glass applications, positioning Asia Pacific as the fastest-growing and most influential market segment.

Latin America

Latin America held a 6% share of the silicone sealants market in 2024, with Brazil and Mexico leading demand across construction and automotive applications. Infrastructure projects, urban housing developments, and rising industrial activity support steady growth. The automotive sector benefits from increasing vehicle production, while construction projects tied to urban expansion enhance sealant consumption. Limited but growing adoption of insulating glass applications contributes to regional demand. Economic fluctuations and supply chain dependencies pose challenges, yet ongoing government investments in housing and transportation projects ensure gradual growth in silicone sealant adoption across the region.

Middle East and Africa

The Middle East and Africa captured a 4% share of the silicone sealants market in 2024, supported by large-scale construction and infrastructure projects. The Gulf countries dominate demand with investments in smart cities, commercial complexes, and megaprojects. Rising adoption of insulating glass in high-rise buildings adds to growth. Industrial activity, particularly in oil and gas processing, also supports demand for high-performance sealants. Africa shows steady growth, led by South Africa’s construction sector. Despite challenges from economic instability, increasing urbanization and government-backed infrastructure development drive opportunities for silicone sealant consumption in this region.

Market Segmentations:

By Technology:

- Room Temperature Vulcanizing (RTV)

- Thermoset or Heat Cured

- Radiation Cured

- Pressure Sensitive

By End Use:

- Construction

- Insulating Glass

- Automotive

- Industrial

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the silicone sealants market is shaped by leading players such as Huntsman International LLC, Tremco Incorporated, Henkel Corporation, Wacker Chemie AG, Dow, H.B. Fuller, Shin-Etsu Chemical Company, Mapei, 3M, Sika AG, and Bostik. These companies compete on innovation, product performance, and regional expansion to strengthen their market positions. Continuous investment in research and development supports the introduction of advanced formulations, including eco-friendly and low-VOC products that align with regulatory requirements. Strategic partnerships and acquisitions are common, enabling access to new markets and technologies. Expansion into emerging economies, especially in Asia Pacific and Latin America, provides significant growth opportunities as demand rises in construction, automotive, and industrial sectors. Sustainability and energy efficiency trends are pushing manufacturers to diversify offerings with durable and high-performance solutions. With increasing competition, differentiation through quality, cost optimization, and global distribution networks remains critical for maintaining leadership in this dynamic market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Huntsman International LLC

- Tremco Incorporated

- Henkel Corporation

- Wacker Chemie AG

- Dow

- B. Fuller

- Shin-Etsu Chemical Company

- Mapei

- 3M

- Sika AG

- Bostik

Recent Developments

- In 2024, H.B. Fuller strategically acquired companies like CutisSeal and GEM S.r.l. & Medifill Ltd. to enhance its market position in specialized areas, particularly medical adhesives. The company also received the 2024 Adhesive and Sealant Council (ASC) Innovation Award, acknowledging its ongoing emphasis on developing innovative adhesive technologies for various industries.

- In 2023, Dow launched its DOWSIL™ PV product line, featuring six silicone-based sealants and adhesives specifically designed for photovoltaic (PV) module assembly.

- In 2023, Shin-Etsu Chemical Co., Ltd. established a new department dedicated to developing eco-friendly silicone products, focusing on reducing environmental impact and contributing to carbon neutrality.

Report Coverage

The research report offers an in-depth analysis based on Technology, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The silicone sealants market will expand steadily with consistent demand from construction and automotive industries.

- Growth in electric vehicles will boost adoption of silicone sealants in battery and component sealing.

- Rising urbanization will increase usage in glazing, waterproofing, and infrastructure development projects worldwide.

- Energy-efficient building standards will drive demand for insulating glass sealants across all major regions.

- Advancements in radiation-cured and pressure-sensitive technologies will open new applications in electronics and healthcare.

- Asia Pacific will remain the leading region due to rapid industrialization and large-scale manufacturing capacity.

- Sustainability trends will encourage development of eco-friendly, low-VOC, and recyclable silicone sealant formulations.

- Expansion in aerospace and industrial equipment manufacturing will create opportunities for high-performance sealants.

- Volatility in raw material prices will push manufacturers to adopt cost-optimized supply chain strategies.

- Increasing automation and robotics in production processes will support faster curing and precision applications.