| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Single Use Assemblies Market Size 2024 |

USD 2,284.13 Million |

| Single Use Assemblies Market, CAGR |

5.68% |

| Single Use Assemblies Market Size 2032 |

USD 3,545.24 Million |

Market Overview

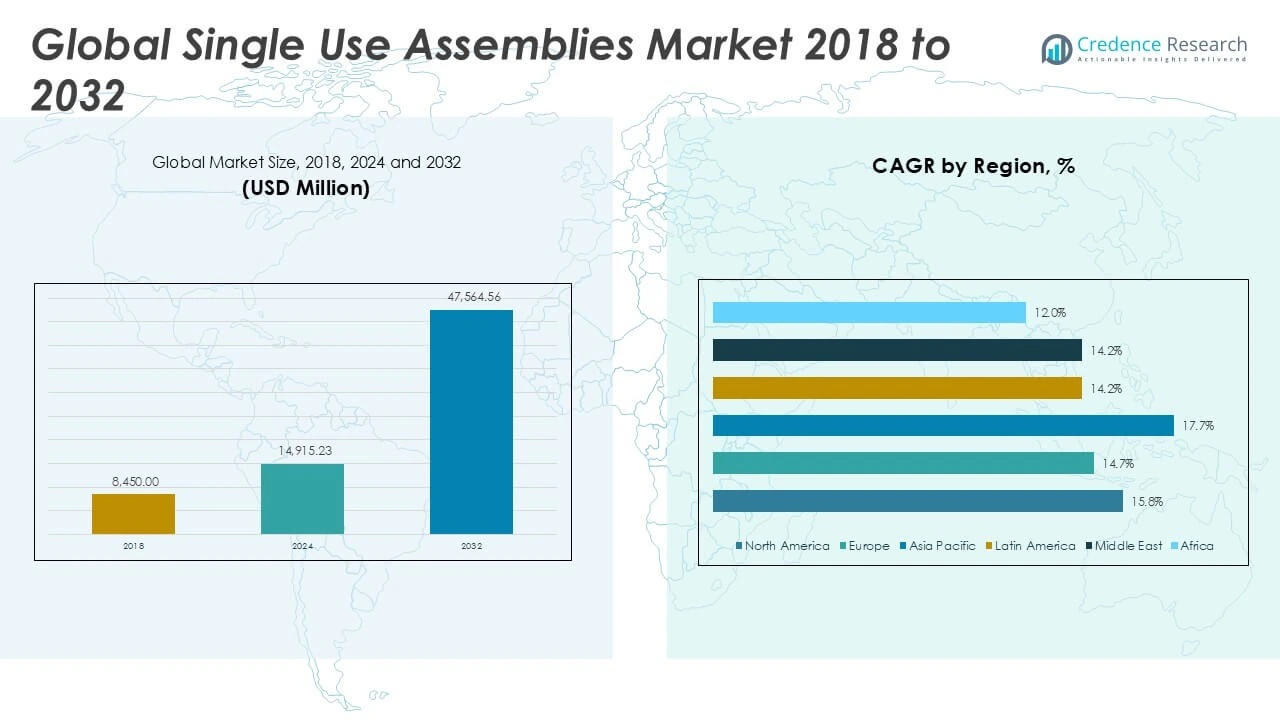

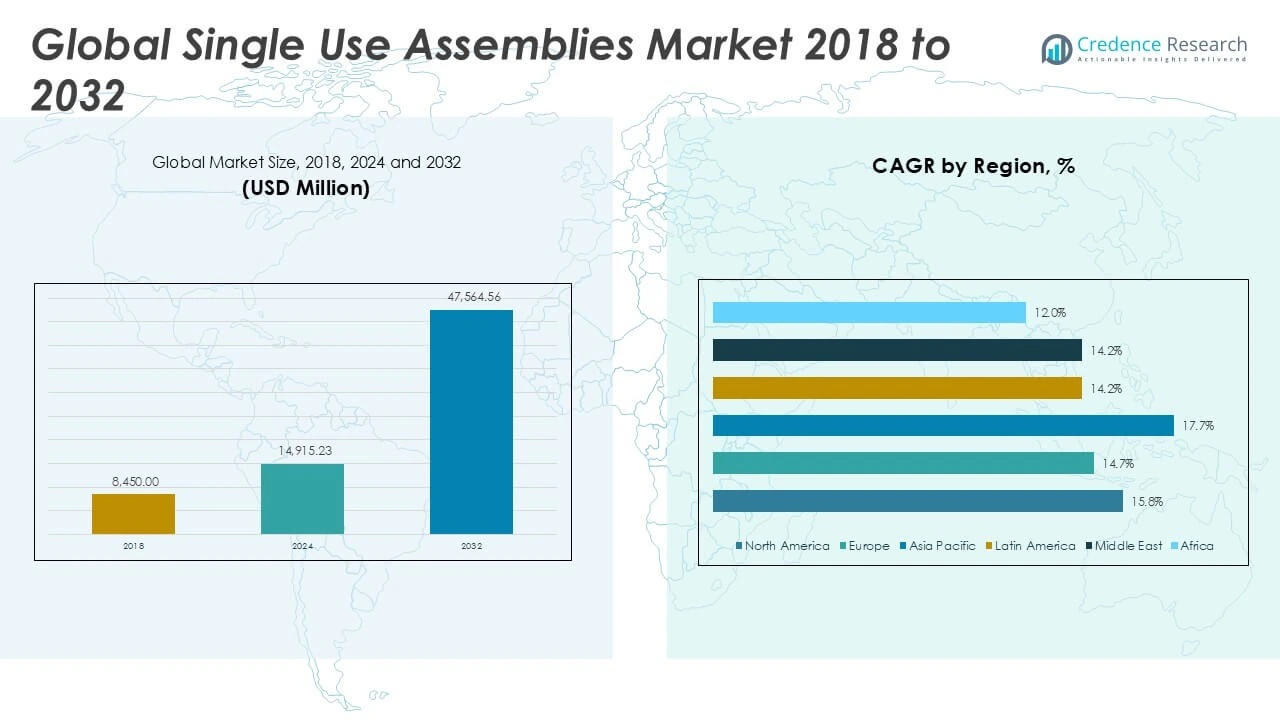

The Global Single Use Assemblies Market is projected to grow from USD 2,284.13 million in 2024 to an estimated USD 3,545.24 million by 2032, registering a compound annual growth rate (CAGR) of 5.68% from 2025 to 2032.

Market drivers include the growing preference for single use assemblies due to their ability to reduce cleaning and sterilization times, thereby minimizing cross-contamination risks. Trends such as the integration of advanced materials, automation compatibility, and disposable systems designed for complex bioprocessing are shaping the market landscape. Additionally, regulatory encouragement for flexible manufacturing and the shift toward continuous processing further propel the adoption of single use assemblies globally.

Geographically, North America holds a dominant market share owing to the presence of major biopharmaceutical companies and advanced healthcare infrastructure. Europe follows closely, driven by strong research activities and government support for biotechnological innovations. The Asia Pacific region is emerging rapidly due to expanding biomanufacturing facilities and growing demand for biosimilars. Key players shaping the market include Sartorius AG, Merck KGaA, Thermo Fisher Scientific, Danaher Corporation, and GE Healthcare Life Sciences, which focus on product innovation and strategic partnerships to strengthen their market presence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Single Use Assemblies Market is projected to grow steadily from USD 2,284.13 million in 2024 to USD 3,545.24 million by 2032, registering a CAGR of 5.68%.

- Rising demand for contamination-free and flexible bioprocessing solutions drives market expansion, supported by growing investments in biologics and biosimilars.

- The preference for disposable assemblies reduces cleaning and sterilization time, minimizing cross-contamination risks and operational costs.

- Challenges include high initial costs and compatibility issues with existing bioprocessing equipment, which may hinder broader adoption.

- North America dominates the market with the largest revenue share, due to its advanced healthcare infrastructure and concentration of biopharmaceutical companies.

- Europe follows closely, driven by strong government support and active research in biotechnology sectors.

- The Asia Pacific region is emerging rapidly with expanding biomanufacturing facilities and increasing demand for biosimilars, offering significant growth opportunities.

Market Drivers

Rising Demand for Flexible and Contamination-Free Bioprocessing Solutions

The Global Single Use Assemblies Market benefits from increasing demand for flexible manufacturing systems that reduce contamination risks in biopharmaceutical production. Single use assemblies eliminate the need for cleaning and sterilization between batches, which accelerates production cycles and lowers operational costs. Biotech companies seek disposable solutions to maintain product integrity and comply with stringent regulatory standards. The ability to quickly switch between products without extensive downtime supports the growing biopharmaceutical pipeline, particularly in personalized medicine and biosimilars development. It provides manufacturers with agility and scalability to meet fluctuating market demands efficiently.

For instance, a leading biopharmaceutical company reported utilizing over 500,000 single-use assemblies in 2024 to streamline production and enhance sterility in biologics manufacturing

Expansion of Biologics and Biosimilars Driving Market Growth

The rising development of biologics and biosimilars acts as a significant driver for the Global Single Use Assemblies Market. Biologics manufacturing requires highly specialized and sterile environments, where single use assemblies offer optimal contamination control and operational flexibility. Increasing investments by pharmaceutical companies in biologics research and production facilities directly boost demand for disposable assemblies. The complexity and cost-effectiveness of single use technologies help reduce upfront capital expenditure and maintenance expenses compared to traditional stainless steel systems. This trend supports faster time-to-market and meets the increasing patient demand for advanced therapies worldwide.

For instance, the global biologics sector saw over 1,200 new biologics and biosimilars enter various stages of development in 2024, reflecting the growing demand for advanced therapies

Technological Advancements Enhancing Assembly Efficiency and Integration

Technological innovations improve the performance and usability of single use assemblies, contributing to market expansion. The development of advanced materials that withstand harsh chemicals and extreme conditions enhances product durability and reliability. Integration with automation systems enables streamlined bioprocessing, reducing human error and improving batch consistency. The introduction of modular and customizable assemblies allows manufacturers to tailor solutions to specific processes, increasing operational efficiency. These advancements make single use assemblies more attractive to end-users by addressing critical challenges in biomanufacturing workflows.

Growing Adoption in Emerging Markets Supported by Expanding Biomanufacturing Infrastructure

Emerging economies in the Asia Pacific and Latin America are increasing their share in the Global Single Use Assemblies Market due to expanding biomanufacturing infrastructure. Government initiatives to promote biotechnology and pharmaceutical sectors stimulate facility expansions and new manufacturing plants. Rising healthcare awareness and demand for innovative therapies drive investments in flexible, cost-effective production technologies like single use assemblies. The shift toward local production of biosimilars and biologics creates opportunities for disposable assembly providers. It helps these regions reduce dependency on imports while improving accessibility to advanced medicines.

Market Trends

Increasing Integration of Automation and Digital Technologies in Bioprocessing

The Global Single Use Assemblies Market shows a clear trend toward integrating automation and digital technologies within biomanufacturing workflows. Manufacturers adopt single use assemblies compatible with automated systems to enhance process control and reduce manual intervention. Digital monitoring tools and sensors embedded in assemblies enable real-time data collection, improving batch consistency and regulatory compliance. The trend supports continuous processing and allows faster decision-making, optimizing production efficiency. It also reduces human error and operational risks, which aligns with growing industry demands for quality and productivity. Companies invest in smart, connected assembly solutions to stay competitive in the evolving biopharmaceutical landscape.

For instance, more than 250 biopharmaceutical companies have integrated automated single-use assemblies with digital monitoring tools to enhance process control and regulatory compliance

Shift Toward Modular and Customized Single Use Solutions for Diverse Applications

The market is witnessing growing demand for modular and customizable single use assemblies tailored to specific bioprocessing requirements. Users increasingly seek flexible designs that accommodate a variety of applications, including upstream and downstream processing steps. Modular assemblies allow rapid reconfiguration of manufacturing lines, reducing changeover times and enhancing production agility. This trend meets the needs of contract manufacturing organizations and multi-product facilities that require adaptable solutions. It enables biopharmaceutical companies to optimize resource utilization and reduce costs. Customization also extends to material selection and assembly size, supporting diverse process conditions and product types.

For instance, over 180 new modular single-use assembly designs were introduced in 2024 to support diverse bioprocessing applications

Sustainability Initiatives Influencing Single Use Assembly Development and Adoption

Sustainability considerations influence the Global Single Use Assemblies Market with a focus on reducing environmental impact. Manufacturers explore recyclable and bio-based materials for disposable assemblies to address waste management challenges. Efforts target minimizing plastic consumption and enhancing product lifecycle sustainability without compromising performance. The industry recognizes the need for greener manufacturing practices while maintaining sterility and safety standards. It encourages innovation toward assemblies that balance disposability benefits with ecological responsibility. Growing regulatory pressure and corporate social responsibility commitments further propel sustainable development in single use technologies.

Expansion of Single Use Assemblies in Emerging Biopharmaceutical Markets

Emerging markets in Asia Pacific, Latin America, and parts of the Middle East exhibit increased adoption of single use assemblies driven by biopharmaceutical sector growth. Expanding contract manufacturing organizations and new biologics production facilities create demand for cost-effective and scalable disposable solutions. The trend aligns with regional efforts to localize advanced manufacturing capabilities and reduce dependence on traditional stainless steel systems. Rising healthcare infrastructure investments and government support accelerate market penetration. It enables faster production setups and operational flexibility, essential for dynamic and evolving markets. The growing presence of key suppliers in these regions strengthens accessibility and customer support for single use assemblies.

Market Challenges

High Initial Costs and Compatibility Issues Restricting Wider Adoption

The Global Single Use Assemblies Market faces challenges related to the high initial costs of adopting disposable systems compared to traditional stainless steel equipment. Though single use assemblies reduce operational expenses over time, the upfront investment in new infrastructure and validation can deter smaller manufacturers. Compatibility concerns between different suppliers’ assemblies and existing bioprocessing equipment also limit seamless integration. Variations in design standards may cause operational inefficiencies and increase the need for customization. It complicates procurement decisions and can delay implementation timelines. Manufacturers often require extensive technical support to overcome these interoperability barriers.

For instance, Entegris developed the Aramus single-use bag assembly, which was used for COVID-19 vaccine storage, demonstrating its effectiveness in extreme temperature conditions.

Waste Management and Regulatory Compliance Constraints Impacting Market Growth

Waste disposal and environmental concerns present significant challenges for the Global Single Use Assemblies Market. The disposable nature of these assemblies generates substantial plastic waste, raising sustainability questions and disposal costs. Regulatory frameworks regarding biomedical waste management vary by region, creating compliance complexities for manufacturers and end-users. Stringent regulations demand thorough documentation and validation of single use materials to ensure safety and quality. Meeting these requirements increases operational burdens and costs. Market participants must innovate to develop recyclable or biodegradable materials that align with evolving environmental standards while maintaining performance and sterility.

Market Opportunities

Expansion of Biopharmaceutical Production and Contract Manufacturing Creating Growth Opportunities

The Global Single Use Assemblies Market benefits from rapid expansion in biopharmaceutical production and contract manufacturing organizations (CMOs). Increasing demand for biologics, biosimilars, and personalized medicines drives the need for flexible and scalable manufacturing solutions. CMOs seek efficient single use assemblies to offer versatile services without extensive capital investments. It enables faster product development and reduces time-to-market, appealing to pharmaceutical companies worldwide. Growing investments in emerging markets further open avenues for market penetration. The rising trend of outsourcing manufacturing processes creates sustained demand for disposable assembly solutions, supporting long-term growth.

Advancements in Material Science and Sustainable Solutions Driving Market Potential

Innovations in material science present new opportunities for the Global Single Use Assemblies Market to address sustainability concerns and enhance product performance. Development of recyclable and bio-based materials offers potential to reduce environmental impact and meet regulatory requirements. Improving assembly durability and chemical resistance broadens applications in complex bioprocesses. It also supports integration with automation and digital monitoring technologies, increasing operational efficiency. Collaborations between material scientists and manufacturers facilitate rapid innovation cycles. These advancements position the market to capitalize on evolving industry demands for eco-friendly and high-performance single use assemblies.

Market Segmentation Analysis

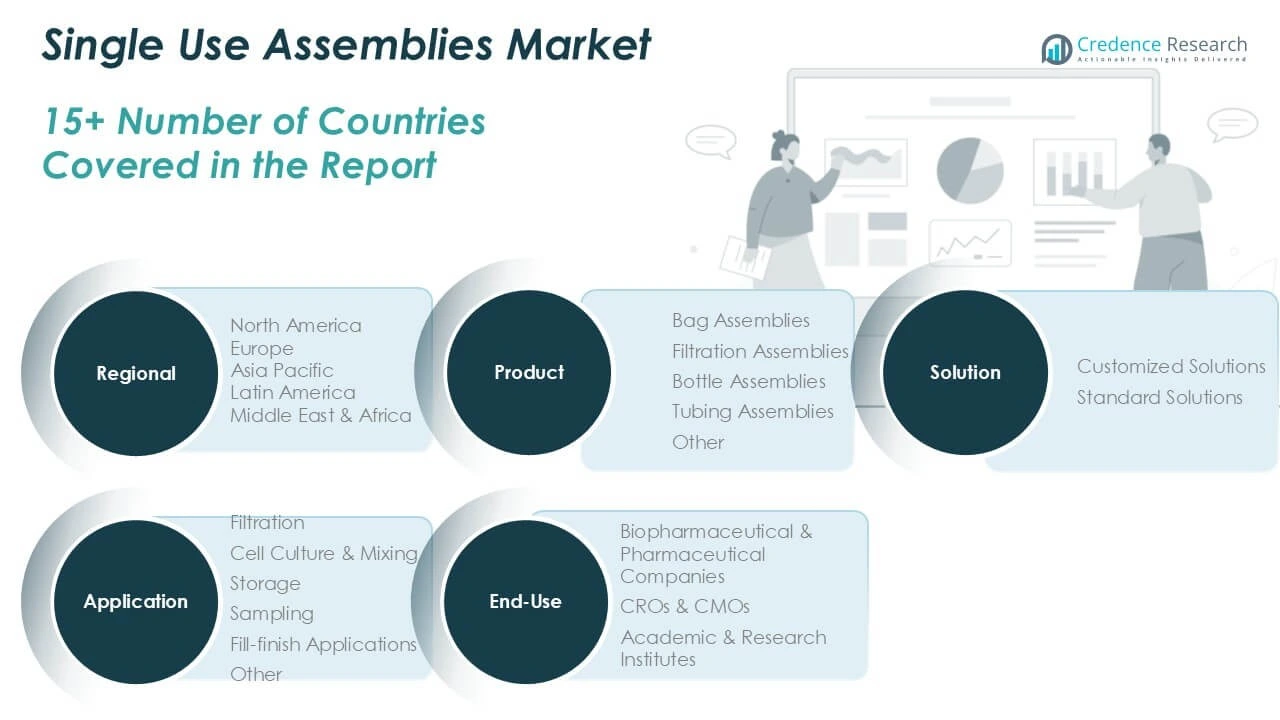

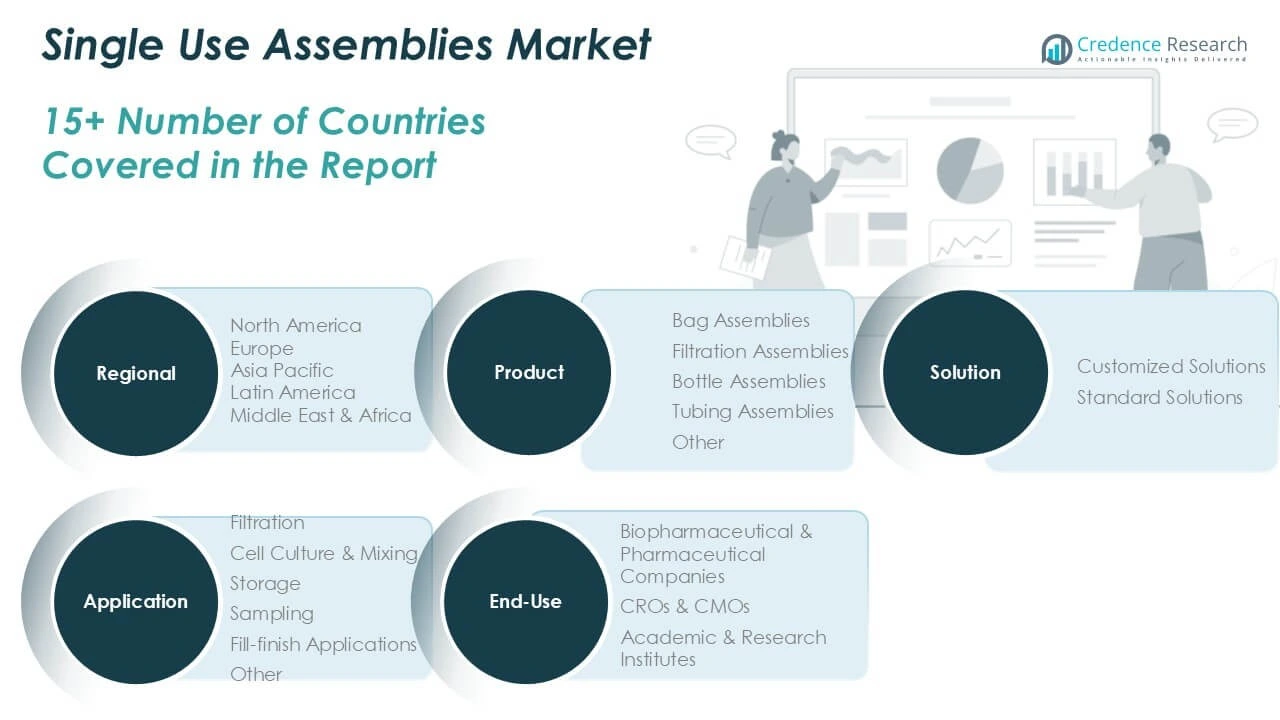

By Product Segment

The Global Single Use Assemblies Market is segmented by product into bag assemblies, filtration assemblies, bottle assemblies, tubing assemblies, and other components. Bag assemblies, including 2D and 3D configurations, dominate the market due to their critical role in bioprocess fluid handling and storage. Filtration assemblies hold a significant share, driven by the increasing need for contamination control and sterile processing. Tubing assemblies facilitate fluid transfer with flexibility and reliability, supporting diverse bioprocess applications. Bottle assemblies and other product types contribute to specialized functions within manufacturing workflows. The product diversity enables tailored solutions that meet specific process requirements across the biopharmaceutical industry.

By Application Segment

The market segments by application include filtration, cell culture and mixing, storage, sampling, fill-finish applications, and other uses. Filtration represents a substantial share owing to stringent sterility standards in biomanufacturing. Cell culture and mixing applications utilize single use assemblies to improve process efficiency and reduce contamination risks. Storage and sampling applications benefit from disposable components that maintain product integrity while simplifying operations. Fill-finish applications gain from flexible single use solutions that streamline final drug formulation and packaging processes. This segmentation highlights the versatility of single use assemblies in addressing various bioprocess needs.

By End-Use Segment

End-use segmentation comprises biopharmaceutical and pharmaceutical companies, contract research organizations (CROs) and contract manufacturing organizations (CMOs), and academic and research institutes. Biopharmaceutical and pharmaceutical companies represent the largest market share due to their high-volume manufacturing and stringent quality requirements. CROs and CMOs increasingly adopt single use assemblies to provide flexible, scalable manufacturing services. Academic and research institutes utilize disposable assemblies in pilot studies and small-scale production. This segmentation reflects the broad adoption of single use technologies across different user types in the life sciences sector.

By Solution Segment

The Global Single Use Assemblies Market divides into customized and standard solutions. Customized solutions gain traction by offering tailored configurations that fit unique bioprocessing demands, enabling improved efficiency and reduced waste. Standard solutions cater to routine applications with established design and compatibility, ensuring cost-effectiveness and ease of integration. The availability of both solution types allows manufacturers to select options aligned with their operational scale and complexity. This flexibility supports widespread adoption and drives innovation within the market.

Segments

Based on Product

- Bag Assemblies

- 2D bag assemblies

- 3D bag assemblies

- Filtration Assemblies

- Bottle Assemblies

- Tubing Assemblies

- Other

Based on Application

- Filtration

- Cell Culture & Mixing

- Storage

- Sampling

- Fill-finish Applications

- Other

Based on End-use

- Biopharmaceutical & Pharmaceutical Companies

- CROs & CMOs

- Academic & Research Institutes

Based on Solution

- Customized Solutions

- Standard Solutions

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Single Use Assemblies Market

The North America Single Use Assemblies Market holds the largest regional share, accounting for approximately 34.2% of the global market in 2024 with a market size of USD 781.91 million. It is projected to grow to USD 1,217.98 million by 2032 at a CAGR of 5.7%. The region benefits from advanced biopharmaceutical infrastructure, extensive research and development activities, and strong presence of key market players. High adoption of single use technologies in the U.S. and Canada drives demand for flexible, contamination-free bioprocessing solutions. Regulatory support and increasing biologics manufacturing capacity further strengthen market growth. The emphasis on personalized medicine and biosimilars sustains expansion in this region.

Europe Single Use Assemblies Market

Europe accounts for 27.7% of the global Single Use Assemblies Market with a value of USD 633.33 million in 2024. It is expected to reach USD 926.27 million by 2032, growing at a CAGR of 4.9%. Strong pharmaceutical and biotechnology sectors in countries like Germany, France, and the UK underpin market growth. The presence of established contract manufacturing organizations and government initiatives to foster biotechnological innovation stimulate adoption. European companies focus on sustainability and regulatory compliance, encouraging the development of eco-friendly disposable assemblies. Collaborative research efforts also enhance market penetration.

Asia Pacific Single Use Assemblies Market

The Asia Pacific region represents 22.1% of the global market with a 2024 valuation of USD 504.66 million. Forecasts project growth to USD 903.36 million by 2032 at a robust CAGR of 7.7%. Expanding pharmaceutical manufacturing hubs in China, India, Japan, and South Korea fuel demand. Increasing healthcare infrastructure investments and rising biosimilar production support adoption of single use assemblies. The growing presence of contract manufacturing organizations and rising biopharmaceutical exports contribute to regional market momentum. Cost advantages and government incentives accelerate market expansion.

Latin America Single Use Assemblies Market

Latin America contributes 6.2% to the global market, with a 2024 size of USD 141.14 million. It is expected to reach USD 200.06 million by 2032, growing at a CAGR of 4.5%. Brazil, Mexico, and Argentina lead market activity through expanding pharmaceutical manufacturing and biologics production. Increasing healthcare spending and regulatory modernization drive interest in flexible and disposable bioprocessing technologies. Contract manufacturing organizations in the region adopt single use assemblies to meet dynamic client demands. The market benefits from growing regional pharmaceutical exports.

Middle East Single Use Assemblies Market

The Middle East accounts for 4.1% of the global market with a 2024 valuation of USD 93.18 million. It is projected to grow to USD 130.44 million by 2032 at a CAGR of 4.3%. Regional governments promote biotechnology initiatives and healthcare infrastructure development. Increasing biopharmaceutical production capacity in countries like the UAE and Saudi Arabia drives demand for disposable assemblies. The growing contract manufacturing sector supports market adoption. Efforts to localize drug manufacturing to reduce import dependence create further opportunities.

Africa Single Use Assemblies Market

Africa holds a 5.7% share of the global market, valued at USD 129.92 million in 2024. Market growth is expected to reach USD 167.13 million by 2032, with a CAGR of 2.7%. Expanding healthcare infrastructure and increased focus on pharmaceutical manufacturing stimulate demand. Limited local production and dependency on imports present challenges but also opportunities for growth. Investments in biosimilar development and regional manufacturing hubs encourage adoption of flexible single use technologies. Market expansion relies on improving regulatory frameworks and capacity building initiatives.

Key players

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Sartorius AG

- Danaher Corporation

- Avantor

- Lonza

- Saint-Gobain

- Corning Incorporated

- Entegris

- KUHNER AG

Competitive Analysis

The Single Use Assemblies Market features intense competition among leading global players focused on innovation, product differentiation, and strategic partnerships. Companies invest heavily in research and development to enhance product performance, durability, and compatibility with advanced bioprocessing technologies. It benefits from a diverse supplier base offering customized and standard solutions to address specific customer needs. Major players leverage their extensive distribution networks and strong customer relationships to expand market reach. Competitive pricing strategies and acquisitions further strengthen their position in the market. Focus on sustainability and integration with digital systems remains a key differentiator. The market’s competitive landscape drives continuous improvements and adoption of single use assemblies across biopharmaceutical manufacturing globally.

Recent Developments

- In January 2025, Lonza reported a 7% underlying sales growth, excluding COVID-related mRNA business impacts, and projected a 20% sales growth for its CDMO business in 2025, driven by high demand for commercial services.

- In May 2025, Avantor announced the expansion of its sterile PETG single-use bottle assemblies, enhancing its product offerings for bioprocessing applications.

- In April 2025, Saint-Gobain introduced the BioSimplex and EZ Top single-use bioprocessing bags, designed for reliable and sterile fluid transfer in biomanufacturing.

- In January 2025, Corning Incorporated expanded its single-use technology portfolio, focusing on opto-mechanical assemblies for bioprocessing applications.

- In March 2025, Entegris launched a new line of single-use filtration assemblies, aimed at improving efficiency and sterility in biopharmaceutical manufacturing processes.

- In February 2025, KUHNER AG introduced a new single-use bioreactor system, enhancing its product range for scalable cell culture applications.

Market Concentration and Characteristics

The Single Use Assemblies Market exhibits a moderately concentrated structure, dominated by a few key players with strong global presence and advanced technological capabilities. It features a blend of large multinational corporations and specialized manufacturers offering both standardized and customized solutions. Market leaders focus on innovation, quality, and regulatory compliance to maintain competitive advantages. The demand for flexible, contamination-free bioprocessing drives investments in research and development, fueling product diversification. It benefits from increasing collaborations and strategic partnerships that enhance distribution channels and customer reach. The market’s characteristics include rapid adoption of disposable technologies in biopharmaceutical production and a growing emphasis on sustainability and automation compatibility. These factors collectively shape the competitive dynamics and growth trajectory within the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-use, Solution and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Single Use Assemblies Market will continue expanding due to rising demand for flexible and contamination-free bioprocessing solutions. Increasing biologics and biosimilars production will drive sustained adoption of disposable technologies.

- Technological advancements will enhance the durability and integration capabilities of single use assemblies, enabling seamless compatibility with automated biomanufacturing systems. This will improve process efficiency and reduce operational risks.

- Customized single use assemblies will gain prominence, allowing manufacturers to tailor solutions to specific process requirements. This trend will support multi-product facilities and contract manufacturing organizations in optimizing operations.

- Emerging markets in Asia Pacific, Latin America, and the Middle East will exhibit rapid growth, fueled by expanding biopharmaceutical infrastructure and government initiatives promoting local production. Market players will increase regional investments to capture opportunities.

- Sustainability will shape product development, with innovations in recyclable and bio-based materials reducing environmental impact. Regulatory pressures and corporate social responsibility will accelerate adoption of eco-friendly single use assemblies.

- Increasing collaboration between material scientists, technology providers, and end-users will drive faster innovation cycles. This cooperation will yield assemblies with enhanced chemical resistance and lifecycle performance.

- Integration of real-time digital monitoring and sensor technologies into assemblies will improve data-driven decision-making in bioprocessing. Enhanced process transparency will support regulatory compliance and quality assurance.

- The rise of continuous processing techniques will increase demand for adaptable single use systems capable of supporting non-traditional manufacturing workflows. Manufacturers will focus on solutions that enable operational flexibility.

- Strategic mergers and acquisitions will continue, allowing companies to broaden product portfolios and strengthen global distribution networks. This consolidation will intensify competition while expanding market reach.

- Market participants will emphasize cost-effective single use assembly solutions to attract small and medium-sized biomanufacturers. Affordable and scalable products will enable wider adoption across diverse end-users, sustaining long-term market growth.