Table of Content

Chapter No. 1 :….. Introduction.. 21

1.1. Report Description. 21

Purpose of the Report 21

USP & Key Offerings 21

1.2. Key Benefits for Stakeholders 22

1.3. Target Audience. 22

Chapter No. 2 :….. Executive Summary.. 23

Chapter No. 3 :….. MARKET FORCES & INDUSTRY PULSE.. 25

3.1. Foundations of Change – Market Overview.. 25

3.2. Catalysts of Expansion – Key Market Drivers 27

3.2.1. Momentum Boosters – Growth Triggers 28

3.2.2. Innovation Fuel – Disruptive Technologies 28

3.3. Headwinds & Crosswinds – Market Restraints 29

3.3.1. Regulatory Tides – Compliance Challenges 30

3.3.2. Economic Frictions – Inflationary Pressures 30

3.4. Untapped Horizons – Growth Potential & Opportunities and Strategic Navigation – Industry Frameworks 31

3.5. Market Equilibrium – Porter’s Five Forces 32

3.6. Ecosystem Models Dynamics – Value Chain Analysis 34

3.7. Macro Forces – PESTEL Breakdown. 36

Chapter No. 4 :….. COMPETITION ANALYSIS. 38

4.1. Company Market Share Analysis 38

4.1.1. Singapore Modular System Scaffolding Market Company Revenue Market Share, by Key Players 38

4.2. Strategic Developments 40

4.2.1. Acquisitions & Mergers 40

4.2.2. New Product Type Launch. 41

4.2.3. Agreements & Collaborations 42

4.3. Competitive Dashboard. 43

4.4. Company Assessment Metrics, 2024. 44

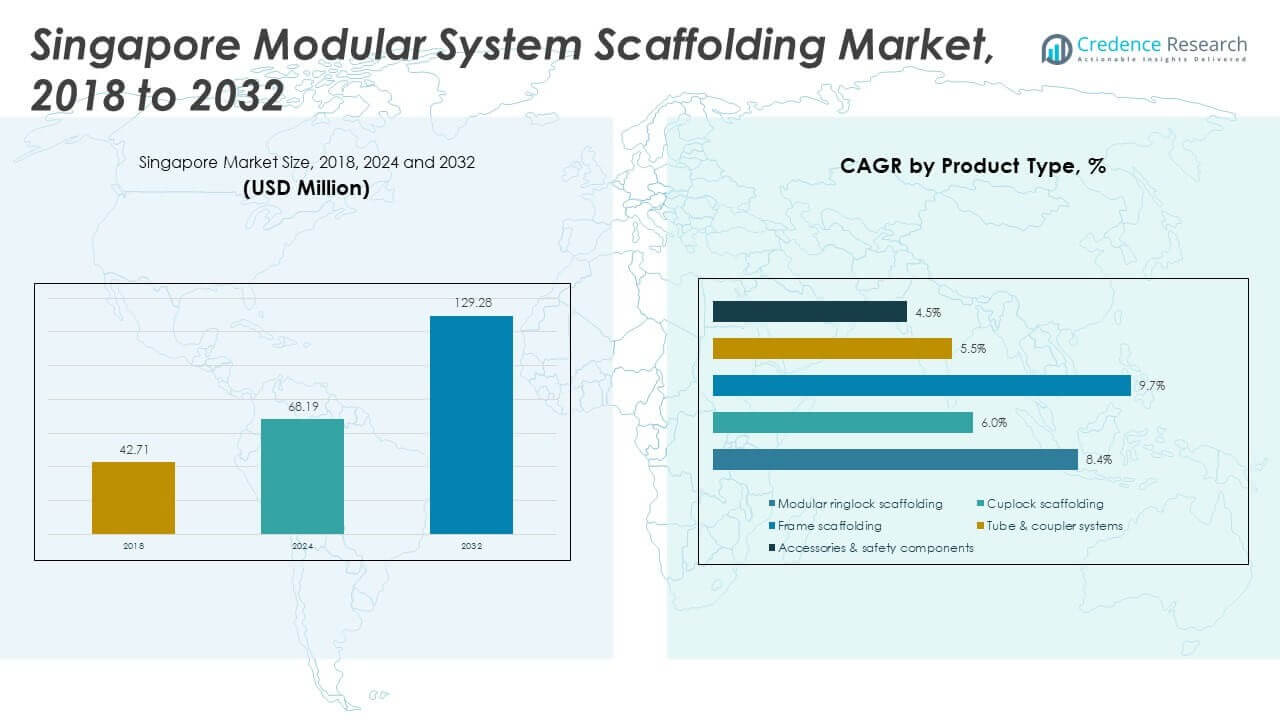

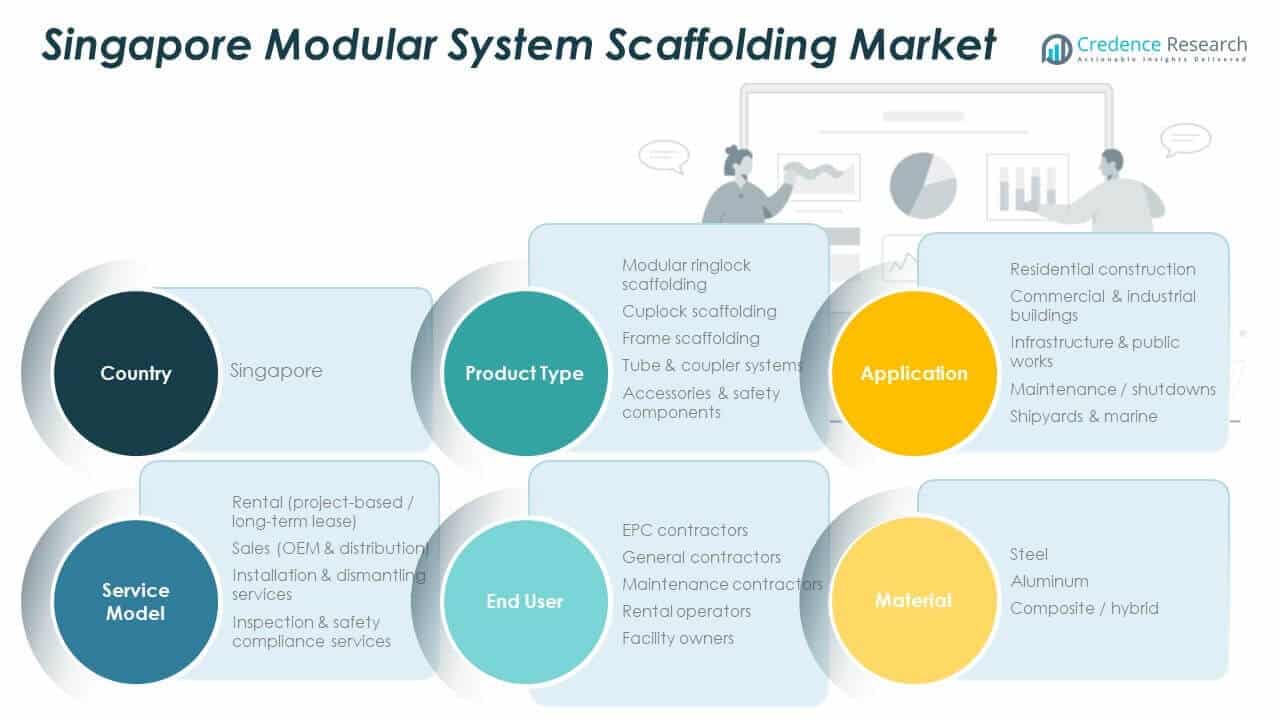

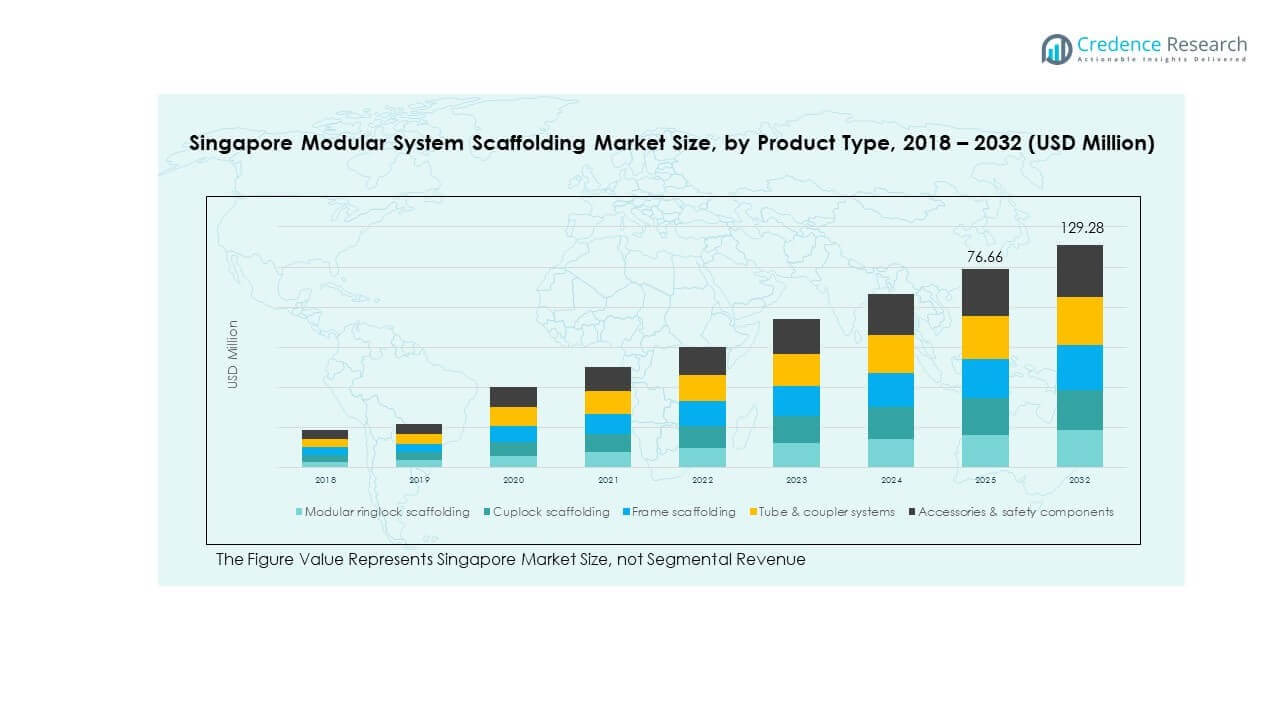

Chapter No. 5 :….. Singapore Market Analysis, Insights & Forecast, by Product Type.. 45

Chapter No. 6 :….. Singapore Market Analysis, Insights & Forecast, by Application.. 50

Chapter No. 7 :….. Singapore Market Analysis, Insights & Forecast, by Service Model.. 55

Chapter No. 8 :….. Singapore Market Analysis, Insights & Forecast, by End User.. 60

Chapter No. 9 :….. Singapore Market Analysis, Insights & Forecast, by Material.. 65

Chapter No. 10 :… Singapore Market Analysis, Insights & Forecast, by Compliance / Certification.. 70

Chapter No. 11 :… Singapore Market Analysis, Insights & Forecast, by Compliance / Certification.. 76

Chapter No. 12 :… Company Profile.. 83

12.1. Tiong Seng Contractors / TS Group. 83

12.2. United U-LI / U-LITE. 86

12.3. PERI Singapore. 86

12.4. Layher Asia Pte Ltd. 86

12.5. Yew Chuan Scaffolding & Construction Pte Ltd. 86

List of Figures

FIG NO. 1……… Modular System Scaffolding Market Revenue Share, By Product Type, 2024 & 2032. 45

FIG NO. 2……… Market Attractiveness Analysis, By Product Type. 46

FIG NO. 3……… Incremental Revenue Growth Opportunity by Product Type, 2024 – 2032. 47

FIG NO. 4……… Modular System Scaffolding Market Revenue Share, By Application, 2024 & 2032. 50

FIG NO. 5……… Market Attractiveness Analysis, By Product Type. 51

FIG NO. 6……… Incremental Revenue Growth Opportunity by Application, 2024 – 2032. 52

FIG NO. 7……… Modular System Scaffolding Market Revenue Share, By Service Model, 2024 & 2032. 55

FIG NO. 8……… Market Attractiveness Analysis by Service Model, 2024 – 2032. 56

FIG NO. 9……… Incremental Revenue Growth Opportunity by Service Model, 2024 – 2032. 57

FIG NO. 10……. Modular System Scaffolding Market Revenue Share, By End User, 2024 & 2032. 60

FIG NO. 11……. Market Attractiveness Analysis by End User, 2024 – 2032. 61

FIG NO. 12……. Incremental Revenue Growth Opportunity by End User, 2024 – 2032. 62

FIG NO. 13……. Modular System Scaffolding Market Revenue Share, By Material, 2024 & 2032. 65

FIG NO. 14……. Market Attractiveness Analysis, By Material 66

FIG NO. 15……. Incremental Revenue Growth Opportunity by Material, 2024 – 2032. 67

FIG NO. 16……. Modular System Scaffolding Market Revenue Share, By Compliance / Certification, 2024 & 2032. 70

FIG NO. 17……. Market Attractiveness Analysis, By Compliance / Certification. 71

FIG NO. 18……. Incremental Revenue Growth Opportunity by Compliance / Certification, 2024 – 2032. 73

FIG NO. 19……. Modular System Scaffolding Market Revenue Share, By Compliance / Certification, 2024 & 2032. 76

FIG NO. 20……. Market Attractiveness Analysis, By Compliance / Certification. 77

FIG NO. 21……. Incremental Revenue Growth Opportunity by Compliance / Certification, 2024 – 2032. 78

List of Tables

TABLE NO. 1. :. Singapore Modular System Scaffolding Market Revenue, By Product Type, 2018 – 2024 (USD Million). 48

TABLE NO. 2. :. Singapore Modular System Scaffolding Market Revenue, By Product Type, 2025 – 2032 (USD Million). 48

TABLE NO. 3. :. Singapore Modular System Scaffolding Market Volume, By Product Type, 2018 – 2024 (Metric Tons). 49

TABLE NO. 4. :. Singapore Modular System Scaffolding Market Volume, By Product Type, 2025 – 2032 (Metric Tons). 49

TABLE NO. 5. :. Singapore Modular System Scaffolding Market Revenue, By Application, 2018 – 2024 (USD Million). 53

TABLE NO. 6. :. Singapore Modular System Scaffolding Market Revenue, By Application, 2025 – 2032 (USD Million). 53

TABLE NO. 7. :. Singapore Modular System Scaffolding Market Volume, By Application, 2018 – 2024 (Metric Tons). 54

TABLE NO. 8. :. Singapore Modular System Scaffolding Market Volume, By Application, 2025 – 2032 (Metric Tons). 54

TABLE NO. 9. :. Singapore Modular System Scaffolding Market Revenue, By Service Model, 2018 – 2024 (USD Million). 58

TABLE NO. 10. :…. Singapore Modular System Scaffolding Market Revenue, By Service Model, 2025 – 2032 (USD Million). 58

TABLE NO. 11. :….. Singapore Modular System Scaffolding Market Volume, By Service Model, 2018 – 2024 (Metric Tons). 59

TABLE NO. 12. :………………………………………………………………………………………….. Total 59

TABLE NO. 13. :. Singapore Modular System Scaffolding Market Revenue, By End User, 2018 – 2024 (USD Million). 63

TABLE NO. 14. :. Singapore Modular System Scaffolding Market Revenue, By End User, 2025 – 2032 (USD Million). 63

TABLE NO. 15. :.. Singapore Modular System Scaffolding Market Volume, By End User, 2018 – 2024 (Metric Tons). 64

TABLE NO. 16. :.. Singapore Modular System Scaffolding Market Volume, By End User, 2025 – 2032 (Metric Tons). 64

TABLE NO. 17. :.. Singapore Modular System Scaffolding Market Revenue, By Material, 2018 – 2024 (USD Million). 68

TABLE NO. 18. :.. Singapore Modular System Scaffolding Market Revenue, By Material, 2025 – 2032 (USD Million). 68

TABLE NO. 19. :… Singapore Modular System Scaffolding Market Volume, By Material, 2018 – 2024 (Metric Tons). 69

TABLE NO. 20. :… Singapore Modular System Scaffolding Market Volume, By Material, 2025 – 2032 (Metric Tons). 69

TABLE NO. 21. :……. Singapore Modular System Scaffolding Market Revenue, By Compliance / Certification, 2018 – 2024 (USD Million). 74

TABLE NO. 22. :……. Singapore Modular System Scaffolding Market Revenue, By Compliance / Certification, 2025 – 2032 (USD Million). 74

TABLE NO. 23. :…….. Singapore Modular System Scaffolding Market Volume, By Compliance / Certification, 2018 – 2024 (Metric Tons). 75

TABLE NO. 24. :…….. Singapore Modular System Scaffolding Market Volume, By Compliance / Certification, 2025 – 2032 (Metric Tons). 75

TABLE NO. 25. :……. Singapore Modular System Scaffolding Market Revenue, By Compliance / Certification, 2018 – 2024 (USD Million). 79

TABLE NO. 26. :……. Singapore Modular System Scaffolding Market Revenue, By Compliance / Certification, 2025– 2032 (USD Million). 80

TABLE NO. 27. :…….. Singapore Modular System Scaffolding Market Volume, By Compliance / Certification, 2018 – 2024 (Metric Tons). 81

TABLE NO. 28. :…….. Singapore Modular System Scaffolding Market Volume, By Compliance / Certification, 2025– 2032 (Metric Tons). 82