Market Overview

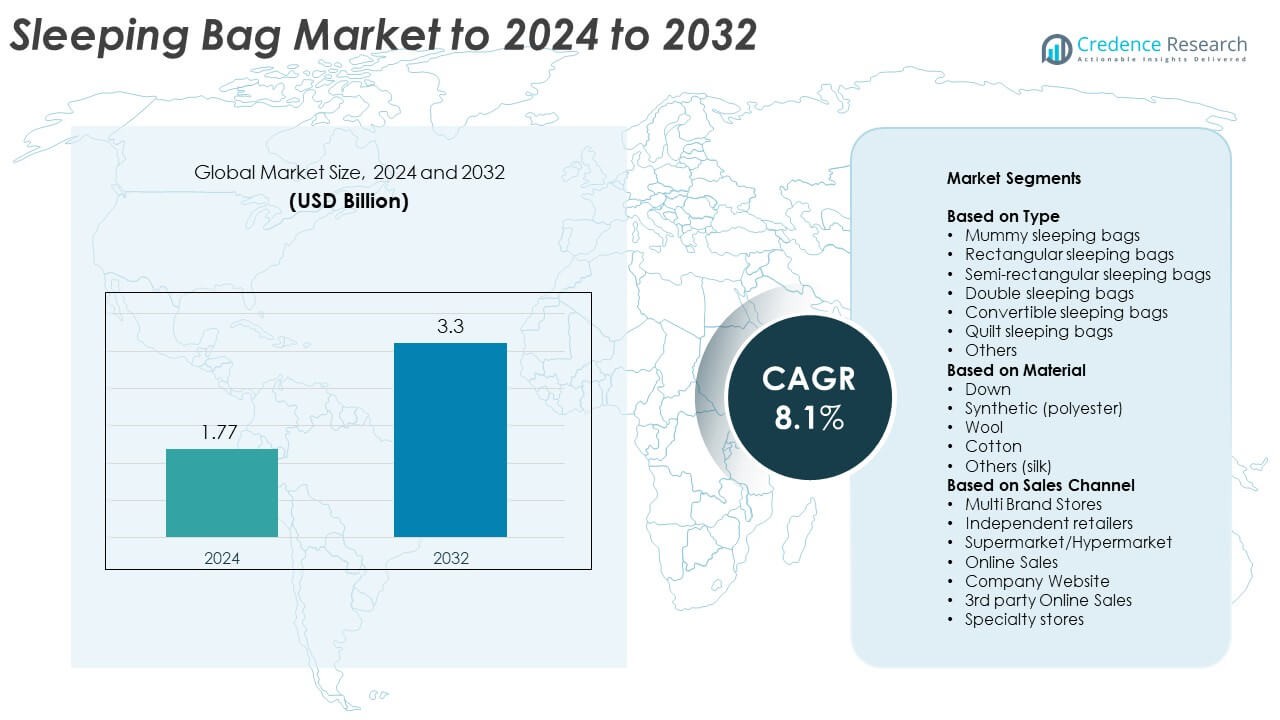

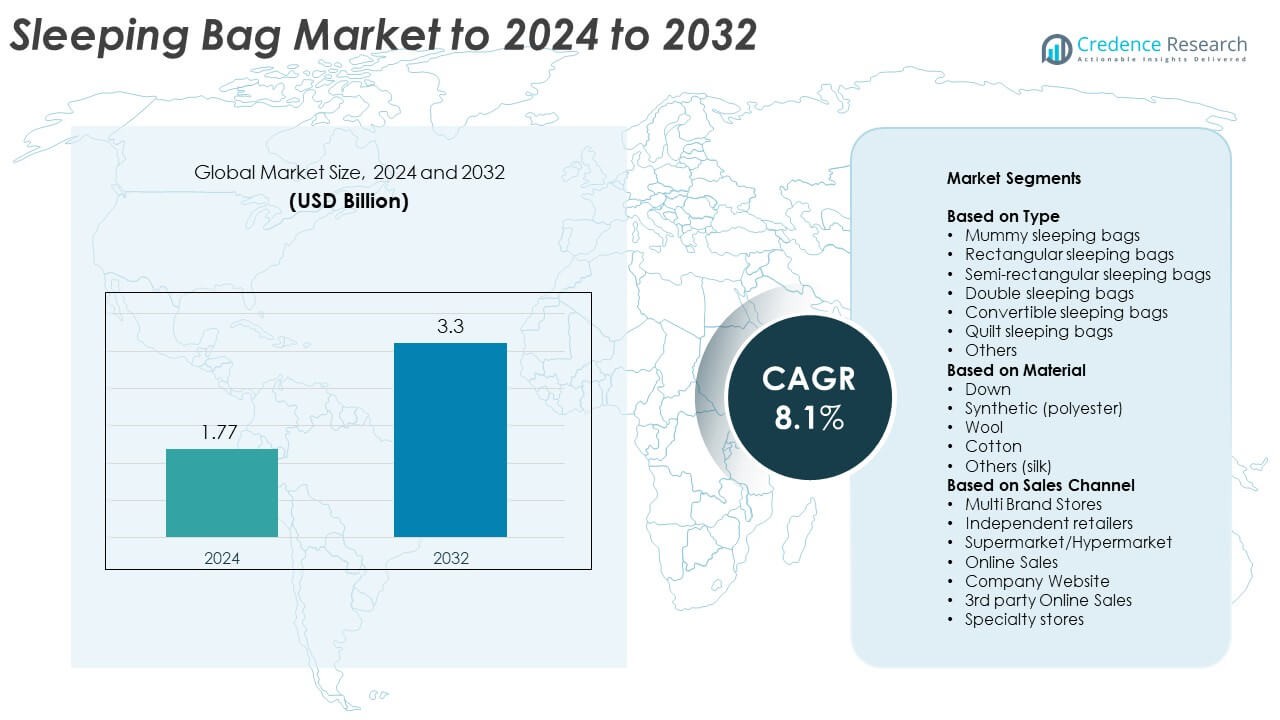

Sleeping Bag Market size was valued USD 1.77 billion in 2024 and is anticipated to reach USD 3.3 billion by 2032, at a CAGR of 8.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sleeping Bag Market Size 2024 |

USD 1.77 Billion |

| Sleeping Bag Market, CAGR |

8.1% |

| Sleeping Bag Market Size 2032 |

USD 3.3 Billion |

The sleeping bag market is led by key players including Marmot, Western Mountaineering, REI Co-op, Big Agnes, NEMO Equipment, The North Face, Feathered Friends, Sea to Summit, Coleman, Sierra Designs, L.L.Bean, Mountain Hardwear, Rab, Therm-a-Rest, and Kelty. These brands hold strong positions through advanced insulation materials, product innovation, and diversified retail presence. North America dominated the global market in 2024 with a 36.8% share, driven by high outdoor recreation participation and established brand networks. Europe followed with 28.4% market share, supported by growing adventure tourism. Asia Pacific, with 22.7% share, emerged as the fastest-growing region, fueled by increasing camping and trekking activities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The sleeping bag market was valued at USD 1.77 billion in 2024 and is projected to reach USD 3.3 billion by 2032, growing at a CAGR of 8.1%.

- Rising participation in camping, trekking, and adventure tourism is driving strong demand for high-performance and lightweight sleeping bags.

- Increasing adoption of eco-friendly and recycled materials, along with smart temperature-regulating features, is shaping current market trends.

- The market remains highly competitive, with leading brands focusing on product innovation, sustainability, and e-commerce expansion to gain a wider consumer base.

- North America led the market with a 36.8% share in 2024, followed by Europe at 28.4% and Asia Pacific at 22.7%, while the mummy sleeping bag type dominated with a 37.2% share.

Market Segmentation Analysis:

By Type

The mummy sleeping bags segment dominated the market in 2024 with a 37.2% share. These bags offer superior thermal efficiency and body-hugging insulation, making them ideal for cold-weather camping. Their compact design and lightweight nature attract professional hikers and mountaineers. Rectangular and semi-rectangular bags follow due to their comfort and ease of movement, preferred by casual campers. Increasing demand for lightweight, compressible, and high-performance gear is driving the adoption of mummy sleeping bags across adventure tourism and outdoor recreational activities.

- For instance, Western Mountaineering lists the Kodiak MF mummy bag at 2 lb 12 oz (1.25 kg) and 0 °F / −18 °C rating, showing high warmth-to-weight design.

By Material

The synthetic (polyester) segment led the sleeping bag market with a 45.6% share in 2024. Synthetic sleeping bags are valued for their affordability, moisture resistance, and easy maintenance. These properties make them suitable for varied weather conditions and mass-market appeal. Down materials are also growing rapidly due to their premium insulation quality and comfort, particularly in extreme conditions. Expanding product innovations in recycled polyester fabrics are further promoting the segment’s dominance and sustainability appeal among eco-conscious consumers.

- For instance, Sea to Summit specifies ReviveLoft is 100% RCS-certified post-consumer recycled polyester insulation in its synthetic bags.

By Sales Channel

Online sales dominated the market in 2024 with a 34.9% share, driven by rising e-commerce penetration and brand-led digital campaigns. Consumers prefer online platforms for product variety, reviews, and price comparisons. Third-party online retailers and company websites offer discounts and customization options that enhance accessibility. Supermarkets and specialty stores continue to serve as key offline channels for consumers seeking in-person evaluation. The growth of omnichannel retail strategies and influencer-driven marketing continues to fuel online sales expansion globally.

Key Growth Drivers

Rising Outdoor Recreation and Camping Activities

The growing participation in outdoor recreation and adventure tourism is a primary driver for the sleeping bag market. Increasing consumer interest in hiking, trekking, and camping, especially among younger demographics, is boosting product demand. Governments and tourism agencies promoting eco-tourism and adventure destinations also support market expansion. The accessibility of organized camping sites and improved outdoor infrastructure further encourage consumers to invest in high-quality sleeping bags designed for comfort and temperature regulation.

- For instance, the Outdoor Industry reports 175.8 million U.S. participants in 2023 (57.3% of people aged six+), underpinning sleeping bag uptake.

Technological Advancements in Insulation Materials

Continuous innovation in lightweight, durable, and thermally efficient materials is fueling market growth. Manufacturers are adopting advanced insulation technologies using synthetic and down blends for enhanced warmth retention and moisture control. Improved compressibility and resistance to environmental conditions are also increasing product appeal among professional travelers. Developments in sustainable materials, including recycled polyester and eco-friendly coatings, are driving demand from environmentally conscious consumers and strengthening brand competitiveness.

- For instance, PrimaLoft Cross Core shows 11–52% more warmth at the same weight versus standard Gold Insulation.

Expansion of E-commerce and Omni-channel Distribution

The expansion of digital retail channels is significantly influencing market growth. Consumers are increasingly purchasing sleeping bags online due to convenience, product variety, and transparent reviews. Brands are adopting omnichannel strategies that integrate physical stores with digital platforms to improve accessibility and customer experience. Discounted pricing, fast delivery, and exclusive online launches by leading brands are attracting new consumers globally, further accelerating sales across the online distribution network.

Key Trends & Opportunities

Growing Demand for Sustainable and Recycled Materials

Sustainability has emerged as a major market trend as consumers prioritize eco-friendly products. Manufacturers are shifting to recycled polyester, organic cotton, and biodegradable fillings to meet environmental standards. This transition aligns with global sustainability goals and attracts eco-conscious buyers. Companies investing in green certifications and low-carbon manufacturing practices are gaining competitive advantages, opening opportunities for product differentiation and brand loyalty in developed and emerging markets.

- For instance, For the Fall 2025 season, Patagonia reports on its official website that 98% of all polyester-based fabrics by weight were made using recycled polyester fabric

Product Customization and Smart Features

Customization and integration of smart features are transforming the market landscape. Adjustable temperature zones, compact designs, and sensor-based comfort controls are enhancing user convenience. Some sleeping bags now include connectivity features for temperature monitoring and integrated power ports for outdoor electronics. These technological innovations not only improve usability but also target premium customer segments, offering strong potential for differentiation in the competitive outdoor equipment market.

- For instance, Coleman OneSource heated bags offer 4 heat settings with runtimes of 2 h (high), 2.5 h (medium), 4 h (low), and 3 h (pulse) per battery.

Key Challenges

High Price of Premium Materials

The cost of advanced materials such as down insulation and high-grade synthetics remains a major challenge. Price-sensitive consumers often opt for low-cost alternatives, limiting the adoption of premium sleeping bags. Fluctuations in raw material prices and production costs also affect profit margins. This poses challenges for manufacturers aiming to balance quality and affordability while maintaining competitiveness in both developed and emerging markets.

Seasonal Demand Fluctuations

Seasonal buying patterns impact the overall market stability. Sleeping bag sales peak during camping and holiday seasons but drop significantly in colder or off-tourism months. These fluctuations create challenges in managing inventory, supply chains, and pricing strategies. To mitigate this, manufacturers are diversifying product applications for indoor and travel use, but consistent year-round demand remains difficult to achieve in several regions.

Regional Analysis

North America

North America dominated the sleeping bag market in 2024 with a 36.8% share. The region’s strong outdoor culture, coupled with high participation in camping and adventure sports, drives consistent demand. The United States leads due to extensive national park networks and established outdoor brands offering innovative designs. Consumers increasingly favor lightweight, insulated, and eco-friendly products. Canada also contributes significantly, supported by cold-weather camping and hiking activities. The rising popularity of digital retail platforms and sustainability-focused product offerings further strengthen the region’s leadership in the global sleeping bag market.

Europe

Europe accounted for a 28.4% share of the sleeping bag market in 2024, driven by a growing interest in recreational camping and nature-based tourism. Countries such as Germany, France, and the United Kingdom are key contributors due to their strong outdoor sports culture and increasing adventure tourism activities. Demand for lightweight and high-insulation sleeping bags suitable for diverse climates continues to grow. The expansion of eco-certified and recycled material products aligns with the region’s stringent environmental standards, while well-established retail networks further support market growth.

Asia Pacific

Asia Pacific held a 22.7% share of the sleeping bag market in 2024, emerging as the fastest-growing region. The increasing popularity of trekking, mountaineering, and camping across China, Japan, India, and Australia drives demand. Rising disposable incomes and lifestyle shifts toward outdoor leisure activities further support expansion. Manufacturers are targeting regional preferences by offering compact, affordable, and climate-appropriate products. The growth of e-commerce platforms and brand collaborations with travel communities are accelerating adoption, positioning Asia Pacific as a key growth hub in the global sleeping bag industry.

Latin America

Latin America captured an 8.1% share of the sleeping bag market in 2024. Growth is supported by rising adventure tourism and expanding participation in outdoor recreation across Brazil, Chile, and Argentina. The increasing promotion of camping and eco-tourism activities by regional governments also fuels product demand. Consumers favor durable, breathable, and affordable sleeping bags suited to varied climates. Local and international brands are focusing on online retail expansion and regional partnerships to enhance distribution, contributing to steady growth across emerging outdoor recreation markets.

Middle East & Africa

The Middle East and Africa region accounted for a 4% share of the sleeping bag market in 2024. Growth is driven by increasing camping tourism, desert expeditions, and mountaineering activities in countries such as the UAE, South Africa, and Kenya. Rising disposable incomes and improving adventure tourism infrastructure are creating new opportunities for global brands. Consumers seek durable, lightweight, and temperature-adaptable sleeping bags. Although market penetration remains moderate, increasing awareness of outdoor leisure and growing retail availability are gradually strengthening regional demand.

Market Segmentations:

By Type

- Mummy sleeping bags

- Rectangular sleeping bags

- Semi-rectangular sleeping bags

- Double sleeping bags

- Convertible sleeping bags

- Quilt sleeping bags

- Others

By Material

- Down

- Synthetic (polyester)

- Wool

- Cotton

- Others (silk)

By Sales Channel

- Multi Brand Stores

- Independent retailers

- Supermarket/Hypermarket

- Online Sales

- Company Website

- 3rd party Online Sales

- Specialty stores

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The sleeping bag market features strong competition among leading players such as Marmot, Western Mountaineering, REI Co-op, Big Agnes, NEMO Equipment, The North Face, Feathered Friends, Sea to Summit, Coleman, Sierra Designs, L.L.Bean, Mountain Hardwear, Rab, Therm-a-Rest, and Kelty. These companies compete through product innovation, material advancements, and performance-oriented designs targeting diverse camping and trekking needs. Manufacturers emphasize lightweight, weather-resistant, and thermally efficient sleeping bags that meet both recreational and professional user requirements. Increasing focus on eco-friendly fabrics, sustainable insulation, and recyclable components is shaping product development strategies. Companies are also expanding their global reach through online channels, direct-to-consumer platforms, and strategic partnerships with outdoor retailers. The growing adoption of premium and customizable sleeping bags for extreme weather conditions further intensifies market competition, pushing brands to differentiate through innovation, comfort, and durability while maintaining affordability across key consumer segments worldwide.

Key Player Analysis

- Marmot

- Western Mountaineering

- REI Co-op

- Big Agnes

- NEMO Equipment

- The North Face

- Feathered Friends

- Sea to Summit

- Coleman

- Sierra Designs

- L.Bean

- Mountain Hardwear

- Rab

- Therm-a-Rest

- Kelty

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Recent Developments

- In 2025, Big Agnes showcased new backpacking sleeping bags with PFAS-free water resistance, focusing on warmth and packability for modern adventure.

- In 2024, Sierra Designs continued to emphasize its existing innovative and award-winning sleeping bag lines, such as the Cloud and Nitro series, which feature designs focused on comfort and functionality.

- In 2023, NEMO updated its popular Disco and Riff down sleeping bags to be part of its Endless Promise Collection, a sustainability initiative ensuring the bags are designed for full recyclability at the end of their lives

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The sleeping bag market will expand steadily, driven by rising outdoor and adventure activities.

- Demand for lightweight, compact, and high-insulation products will continue to grow.

- Manufacturers will focus more on sustainable and recycled material innovations.

- Online sales channels will become the primary mode of product distribution worldwide.

- Asia Pacific will witness the fastest growth due to increasing camping participation.

- Technological advancements in insulation and moisture resistance will enhance product appeal.

- Customizable and multifunctional sleeping bags will attract premium consumers.

- Partnerships with tourism and outdoor gear brands will boost global visibility.

- Rising consumer awareness of eco-friendly travel products will shape purchasing trends.

- Continuous product innovation and ergonomic design improvements will strengthen market competitiveness.