Market Overview

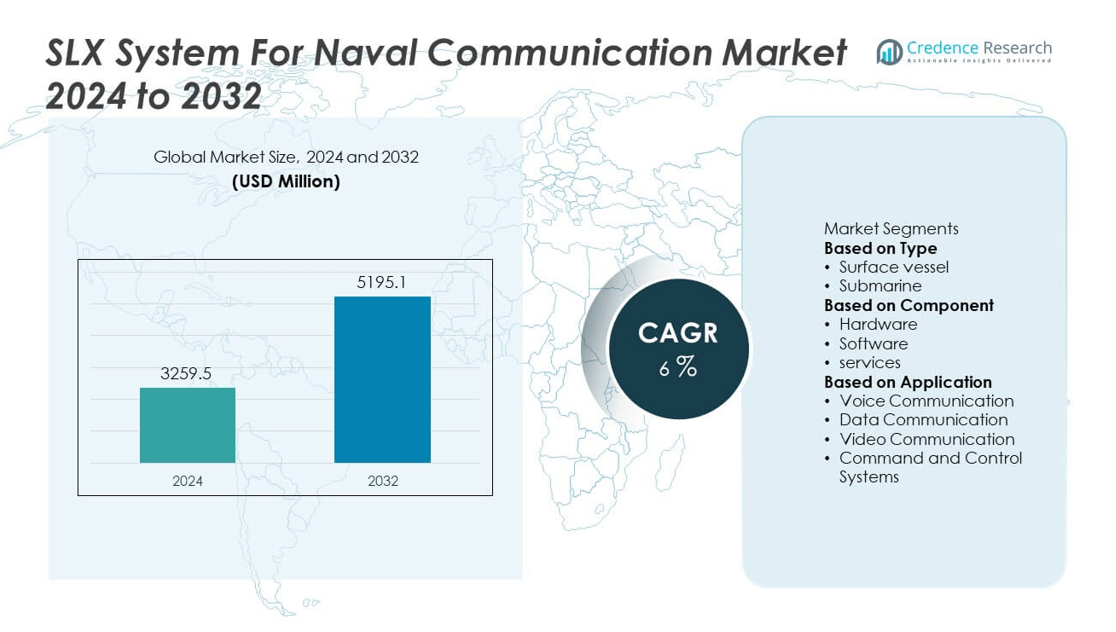

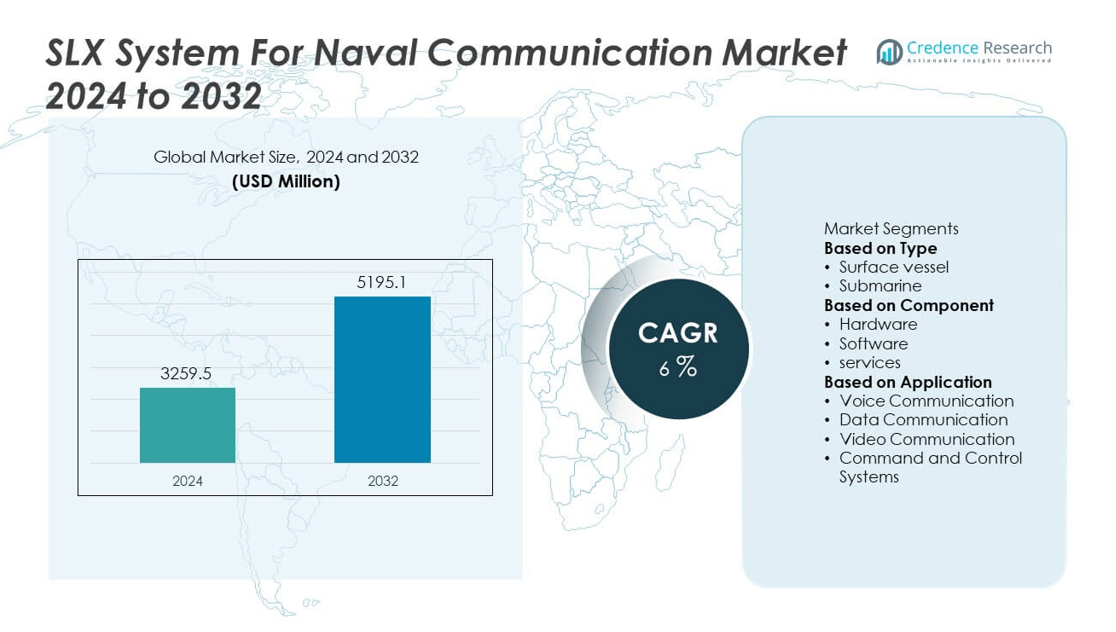

The SLX System for Naval Communication Market was valued at USD 3,259.5 million in 2024 and is projected to reach USD 5,195.1 million by 2032, growing at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| SLX System for Naval Communication Market Size 2024 |

USD 3,259.5 million |

| SLX System for Naval Communication Market, CAGR |

6% |

| SLX System for Naval Communication Market Size 2032 |

USD 5,195.1 million |

The SLX System for Naval Communication Market grows steadily, driven by rising demand for secure and reliable communication across naval fleets and increasing investments in modernization programs. Governments prioritize advanced systems that support real-time data exchange, interoperability, and resilience against cyber threats.

The SLX System for Naval Communication Market demonstrates strong growth across major regions, supported by rising defense investments and modernization programs. North America leads with advanced naval infrastructure and consistent funding for cutting-edge communication platforms, while Europe focuses on interoperability and cybersecurity within joint defense initiatives. Asia-Pacific emerges as the fastest-growing region, with countries like China, India, and Japan strengthening fleets to address maritime security challenges. The Middle East, Africa, and Latin America gradually adopt advanced systems to enhance coastal surveillance and protect critical trade routes. Prominent players shaping the market include BAE Systems plc, Northrop Grumman Corporation, Raytheon Technologies, and L3Harris Technologies, each leveraging innovation, partnerships, and defense contracts to expand their presence. These companies emphasize secure, AI-driven, and satellite-enabled communication solutions, aligning with the global shift toward network-centric warfare. The competitive environment highlights continuous innovation and collaboration as key strategies for maintaining long-term relevance.

Market Insights

- The SLX System for Naval Communication Market was valued at USD 3,259.5 million in 2024 and is projected to reach USD 5,195.1 million by 2032, registering a CAGR of 6% during the forecast period.

- The market is shaped by growing demand for secure naval communication systems that support encrypted data transfer, real-time information sharing, and seamless coordination between fleets and command centers. Increasing naval modernization programs and rising defense budgets across leading economies strongly drive adoption.

- Key trends include the integration of artificial intelligence to improve decision-making, wider use of satellite-based communication for long-range coverage, and the growing focus on cybersecurity to counter threats from electronic warfare. Interoperable and network-centric platforms are also gaining traction, enabling joint operations and multinational collaborations.

- The competitive landscape features major players such as BAE Systems plc, Northrop Grumman Corporation, Raytheon Technologies, Leonardo S.p.A., General Dynamics Corporation, and L3Harris Technologies, who invest heavily in research, partnerships, and defense contracts to maintain a strong market presence.

- High costs of system development and deployment, along with challenges in integrating advanced technologies into legacy platforms, restrain market growth. Vulnerability to cyberattacks and electronic jamming also presents a significant obstacle, requiring continuous innovation and resilience in system design.

- Regional growth is supported by advanced naval capabilities in North America, technological collaborations in Europe, and large-scale modernization initiatives in Asia-Pacific. The Middle East, Africa, and Latin America show steady but smaller contributions driven by coastal security and maritime protection needs.

- The market outlook remains positive as governments prioritize next-generation communication technologies, vendors expand product portfolios, and international defense collaborations accelerate the deployment of secure, reliable, and data-driven naval communication systems

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Secure Naval Communication Infrastructure

The SLX System for Naval Communication Market benefits from the rising importance of secure communication networks across naval fleets. Governments prioritize advanced systems that prevent interception and ensure uninterrupted connectivity in contested maritime zones. Nations invest heavily in upgrading naval assets to match modern security threats. The system provides encrypted and reliable communication, supporting mission-critical operations. It also enhances interoperability between allied naval forces during joint exercises. Continuous emphasis on secure data exchange drives adoption across defense agencies.

- For instance, Northrop Grumman was selected as the systems architect for the U.S. Navy’s Consolidated Afloat Networks and Enterprise Services (CANES) program and delivered “dozens” of complex network infrastructure “shipsets” during the initial limited deployment phase. This work helped replace five separate legacy networks with a single, cyber-hardened, integrated network system.

Rising Naval Modernization Programs and Fleet Expansion

Modernization programs across leading naval forces strongly influence market growth. Countries in North America, Europe, and Asia-Pacific allocate higher budgets for next-generation naval platforms. The SLX System for Naval Com Market expands as navies replace outdated systems with advanced technologies that support high-bandwidth communication. Fleet expansion in emerging economies further strengthens demand. New vessels often integrate sophisticated communication suites as a standard requirement. Investments in modernization ensure long-term contracts and stable revenue streams for market players.

- For instance, BAE Systems is the prime contractor for the UK’s new Type 26 frigate program, a class of eight anti-submarine warfare ships designed to replace the Royal Navy’s aging Type 23 frigates. A key supplier for the program is Rohde & Schwarz, which provides the integrated internal and external communication system based on its NAVICS IP-based switching system.

Increasing Role of Real-Time Data in Naval Operations

Real-time information is a critical requirement for effective command and control in modern naval environments. The SLX System for Naval Communication Market responds to the need for systems that deliver rapid data exchange between ships, submarines, and command centers. It supports situational awareness, target tracking, and tactical decision-making. Enhanced data transmission capabilities reduce the risk of delayed responses during conflicts. Real-time connectivity also improves coordination between multiple naval assets. This growing reliance on data-centric operations ensures steady demand for advanced solutions.

Strong Support from Defense Budgets and Strategic Policies

Government defense budgets and maritime strategies strongly back investments in advanced communication systems. The SLX System for Naval Communication Market gains traction from initiatives that prioritize network-centric warfare and operational readiness. It aligns with long-term defense objectives, including enhanced surveillance and secure maritime borders. Strategic policies encourage adoption of resilient technologies that withstand electronic warfare threats. Defense procurement authorities also focus on vendor partnerships for sustained innovation. Stable funding ensures continuous deployment across naval fleets worldwide.

Market Trends

Integration of Artificial Intelligence and Automation in Naval Communication

The SLX System for Naval Communication Market shows a strong trend toward embedding artificial intelligence and automation into communication platforms. AI-powered tools enhance predictive maintenance and optimize bandwidth allocation across networks. Automation reduces human error and improves operational efficiency in dynamic naval environments. It also strengthens decision-making by delivering accurate insights in real time. The integration of AI-driven systems enables faster adaptation to evolving threats. This trend ensures communication systems remain advanced and resilient against cyber challenges.

- For instance, L3Harris Technologies is a major U.S. defense contractor that develops and integrates advanced maritime systems, including communication, control, and electronic warfare technologies, for the U.S. Navy. L3Harris and its partners are using AI in other naval applications, such as data analytics for the Department of Defense and electronic warfare.

Growing Adoption of Satellite-Based Communication Solutions

Satellite-based communication continues to shape the SLX System for Naval Com Market by offering reliable long-range connectivity. It supports uninterrupted communication in remote maritime regions where conventional systems fail. High-capacity satellites allow rapid transmission of voice, video, and data across naval fleets. The adoption of advanced satellite constellations improves redundancy and reduces latency. It enables fleets to coordinate during extended deployments without communication gaps. Governments prioritize satellite-enabled systems to ensure strategic maritime dominance.

- For instance, Lockheed Martin is the prime contractor and satellite designer for the U.S. Space Force and Navy’s Mobile User Objective System (MUOS) constellation, which consists of four operational satellites and one on-orbit spare. Other defense contractors, such as General Dynamics Mission Systems and Collins Aerospace (formerly Rockwell Collins), manufacture and provide the compatible radio terminals and ground systems for military forces.

Rising Focus on Cybersecurity in Naval Communication Platforms

The SLX System For Naval Communication Market increasingly reflects the growing emphasis on cybersecurity within naval operations. Communication systems face advanced cyber threats that demand stronger protective measures. It is critical for solutions to feature encryption, intrusion detection, and secure authentication protocols. Vendors invest in technologies that counteract electronic warfare tactics and prevent unauthorized access. Naval forces demand systems designed to maintain integrity under high-risk scenarios. This trend reinforces the role of cybersecurity as a key requirement for adoption.

Expansion of Interoperable and Network-Centric Communication Systems

Interoperability emerges as a vital trend shaping the SLX System for Naval Communication Market, with global navies seeking seamless coordination across diverse platforms. Network-centric communication systems support joint missions and multinational collaborations. It ensures effective coordination during disaster response, peacekeeping, and defense operations. The demand for interoperable solutions aligns with global defense alliances and strategic partnerships. Vendors develop systems that integrate easily with existing naval infrastructure. This trend highlights the market’s shift toward flexible and scalable solutions.

Market Challenges Analysis

High Costs and Complex Integration Across Naval Platforms

The SLX System for Naval Communication Market faces challenges linked to the high costs of development, deployment, and maintenance. Advanced communication systems require significant investment in infrastructure, training, and lifecycle support. It often proves difficult for smaller defense budgets to sustain such expenses, limiting adoption in certain regions. Integration with legacy naval platforms adds another layer of complexity, increasing timelines and technical risks. Vendors must ensure compatibility without compromising performance, which demands additional resources. These financial and operational hurdles slow the pace of widespread implementation.

Vulnerability to Cyber Threats and Electronic Warfare

Cybersecurity and electronic warfare threats pose serious challenges for the SLX System for Naval Communication Market. It remains difficult to build systems fully resistant to sophisticated hacking techniques and jamming technologies. Naval operations rely on uninterrupted communication, which makes any disruption highly damaging to mission success. Governments push for advanced security layers, yet evolving threats constantly pressure existing defenses. Vendors must balance performance, resilience, and affordability while keeping systems secure. Persistent vulnerabilities create uncertainty that may hinder long-term trust and adoption of advanced platforms.

Market Opportunities

Expansion in Emerging Naval Forces and Modernization Programs

The SLX System for Naval Communication Market holds significant opportunity in regions where naval forces are undergoing rapid modernization. Countries in Asia-Pacific, the Middle East, and Latin America are expanding fleets to strengthen maritime security. It creates demand for advanced communication platforms that improve command, control, and coordination. Investments in new vessels ensure that communication systems become an integral part of naval procurement. Vendors offering scalable and cost-efficient solutions can capture contracts in these fast-growing markets. Rising geopolitical tensions further accelerate the need for advanced technologies, creating steady growth prospects.

Technological Advancements in Satellite and AI-Driven Communication

Cutting-edge technologies create strong opportunities for the SLX System for Naval Communication Market. It benefits from innovations in satellite communication that enable broader coverage and improved resilience in remote waters. Artificial intelligence and automation enhance system performance by optimizing data flow and reducing operational risks. These advancements allow navies to operate more efficiently under high-threat conditions. Opportunities also arise in joint research initiatives between defense agencies and private players focused on next-generation platforms. Companies that align product development with these innovations position themselves strongly for long-term success.

Market Segmentation Analysis:

By Type

The SLX System for Naval Communication Market can be segmented by type into wired and wireless communication systems. Wired systems remain relevant in applications where reliability and minimal interference are critical. Wireless systems continue to expand rapidly due to their ability to provide flexible connectivity across large fleets and dynamic environments. It supports long-range and real-time communication, which is essential in modern naval operations. The shift toward wireless technologies aligns with the growing focus on mobility and operational efficiency. Market players invest in hybrid solutions that combine the strengths of both types to meet diverse operational demands.

- For instance, RTX (formerly Raytheon Technologies) is a major defense contractor that provides advanced systems, including communications and radar, to the U.S. Navy and the Arleigh Burke-class destroyer fleet.

By Component

Market segmentation by component includes hardware, software, and services. Hardware forms the backbone of communication systems, including antennas, transceivers, and satellite equipment. Software plays a growing role in enhancing encryption, data management, and system interoperability. Services ensure integration, maintenance, and continuous upgrades to meet evolving defense requirements. The SLX System For Naval Communication Market demonstrates strong growth in software and service components as naval forces demand scalable, secure, and adaptable platforms. It emphasizes lifecycle support and digital capabilities, reflecting the transition toward network-centric warfare.

- For instance, Orizzonte Sistemi Navali (OSN), a joint venture with Leonardo as a key partner, is responsible for providing and upgrading the secure communications, including encryption, for the Italian Navy FREMM frigates. These upgrades are part of a broader Through Life Sustainment Management (TLSM) contract, which enhances lifecycle support through digitalized maintenance services.

By Application

By application, the market covers surface ships, submarines, and shore-based command centers. Surface ships hold the largest share, driven by the need for uninterrupted communication during patrol, surveillance, and combat missions. Submarines require highly secure and stealth-oriented systems, creating demand for specialized solutions. Shore-based command centers rely on robust communication infrastructure to ensure effective coordination with naval fleets. The SLX System for Naval Communication Market continues to expand in applications where real-time data exchange and situational awareness are mission-critical. It positions itself as a vital enabler of strategic decision-making and fleet integration.

Segments:

Based on Type

Based on Component

- Hardware

- Software

- services

Based on Application

- Voice Communication

- Data Communication

- Video Communication

- Command and Control Systems

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the SLX System for Naval Communication Market, accounting for nearly 35% of the global revenue in 2024. The United States drives this dominance with its advanced naval fleet and strong defense budget allocation. It invests heavily in modernizing naval communication platforms to ensure secure, encrypted, and high-capacity data transfer. The U.S. Navy’s emphasis on network-centric warfare supports the integration of advanced communication technologies across aircraft carriers, destroyers, submarines, and command centers. Canada also contributes through its naval modernization projects, though at a smaller scale. The region’s strong research and development ecosystem, along with collaboration between defense agencies and private companies, ensures that North America maintains technological leadership in the market.

Europe

Europe represents around 25% of the global share in 2024, supported by major naval powers such as the United Kingdom, France, Germany, and Italy. The region benefits from joint European defense initiatives and collaborations within NATO, which encourage interoperability across naval fleets. It invests in modern communication systems that strengthen maritime security and ensure operational readiness in contested waters. The SLX System for Naval Com Market in Europe also benefits from the region’s focus on cybersecurity, as electronic warfare and data security are considered high-priority areas. It experiences growth through procurement programs linked to modernization of surface vessels and submarines. Vendors in the region also work closely with government defense agencies to deliver systems that meet both national and alliance requirements.

Asia-Pacific

Asia-Pacific commands nearly 28% of the global market share in 2024, making it one of the fastest-growing regions. Rising geopolitical tensions in the South China Sea, the Indian Ocean, and the Pacific drive countries such as China, India, Japan, and South Korea to expand their naval capabilities. The SLX System for Naval Communication Market in Asia-Pacific grows rapidly due to large-scale investments in fleet expansion, naval bases, and satellite-based communication infrastructure. It benefits from ambitious defense modernization programs aimed at building technologically advanced naval fleets. Countries across Southeast Asia also upgrade their systems to protect maritime borders and improve surveillance. Strong government funding, coupled with regional demand for interoperability in multinational exercises, ensures that Asia-Pacific remains a critical growth hub for the market.

Middle East and Africa

The Middle East and Africa together account for about 7% of the global market share in 2024. Countries in the Middle East, particularly Saudi Arabia, the United Arab Emirates, and Israel, invest significantly in naval communication systems to strengthen maritime defense. It supports the protection of key shipping routes and offshore energy assets in the Persian Gulf and Red Sea. Africa remains a smaller but emerging market, with South Africa and a few North African countries gradually upgrading their naval fleets. The SLX System for Naval Com Market in this region is supported by international partnerships and foreign defense suppliers. While budgetary constraints limit widespread adoption, the need to secure maritime borders ensures steady demand for advanced solutions.

Latin America

Latin America holds around 5% of the global market share in 2024, with Brazil, Mexico, and Argentina being the key contributors. Brazil leads regional adoption through its naval modernization programs and focus on protecting offshore oil reserves. The SLX System for Naval Com Market in Latin America grows gradually, supported by the need for enhanced surveillance of vast coastlines. Mexico and Argentina pursue upgrades in naval communication infrastructure to strengthen maritime defense. It faces challenges from limited defense budgets, but regional governments show growing interest in secure communication technologies. International collaborations and procurement agreements provide opportunities for vendors to expand in this market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Northrop Grumman Corporation

- Leonardo S.p.A.

- BAE Systems plc

- Raytheon Technologies

- Kongsberg Gruppen

- General Dynamics Corporation

- L3Harris Technologies

- Lockheed Martin Corporation

- Elbit Systems

- Harris Corporation (now L3Harris Technologies)

Competitive Analysis

Competitive landscape of the SLX System for Naval Communication Market features leading players including Northrop Grumman Corporation, Leonardo S.p.A., BAE Systems plc, Raytheon Technologies, Kongsberg Gruppen, General Dynamics Corporation, L3Harris Technologies, Lockheed Martin Corporation, Elbit Systems, and Harris Corporation (now L3Harris Technologies). These companies compete on the basis of advanced technology integration, secure communication platforms, and long-term defense contracts. They focus on delivering solutions that ensure encrypted, reliable, and interoperable communication across naval fleets. Strong research and development investment supports continuous innovation, while strategic partnerships with defense agencies enhance their global presence. Market leaders maintain competitiveness by expanding product portfolios and aligning offerings with modernization programs in North America, Europe, and Asia-Pacific. Many players emphasize cyber-resilient systems to address rising threats from electronic warfare. The competitive structure is further influenced by mergers, acquisitions, and collaborations that strengthen technological expertise and broaden customer bases. While established players dominate through scale and reputation, opportunities exist for specialized vendors delivering niche capabilities such as AI-driven platforms and advanced satellite communication. The market remains highly consolidated, with competition centered on securing high-value government contracts and meeting evolving operational requirements of naval forces worldwide.

Recent Developments

- In December 2024, Northrop Grumman Corporation launched its Enhanced Polar System – Recapitalization (EPS‑R) payload aboard a satellite, enabling jam-resistant, secure military satellite communications in polar regions.

- In December 2024, The U.S. Navy awarded the Northrop Grumman a multi-billion-dollar contract to integrate mission systems into the new E‑130J aircraft, the successor to the E‑6B Mercury.

- In September 2024, Northrop Grumman Corporation completed a demonstration of its hybrid SATCOM solution under the U.S. Air Force Research Lab’s Global Lightning initiative, successfully linking hybrid satellite terminals to both low-Earth orbit (LEO) and geostationary (GEO) commercial internet satellites—marking a significant advancement in resilient naval communications.

- In September 2024, L3Harris Technologies regained the Next Generation Jammer Low-Band (NGJ-LB) contract after a recompete process.

Report Coverage

The research report offers an in-depth analysis based on Type, Component, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with continuous naval modernization initiatives across advanced and emerging economies.

- Demand for secure and encrypted communication solutions will remain a top priority for governments and defense agencies.

- Artificial intelligence and automation will play a greater role in optimizing communication efficiency and resilience.

- Satellite-based communication will strengthen its position by offering global coverage and low-latency connectivity for naval fleets.

- Cybersecurity-focused solutions will become essential to counter evolving electronic warfare and cyber threats.

- Interoperable platforms will gain importance to support multinational missions and joint naval operations.

- Investment in research and development will accelerate innovation in real-time data exchange and decision-support systems.

- Smaller and cost-efficient solutions will find opportunities in regions with limited defense budgets.

- Strategic partnerships between defense contractors and governments will shape long-term procurement opportunities.

- The market will evolve toward integrated, network-centric communication ecosystems designed for future naval warfare requirements.