Market Overview

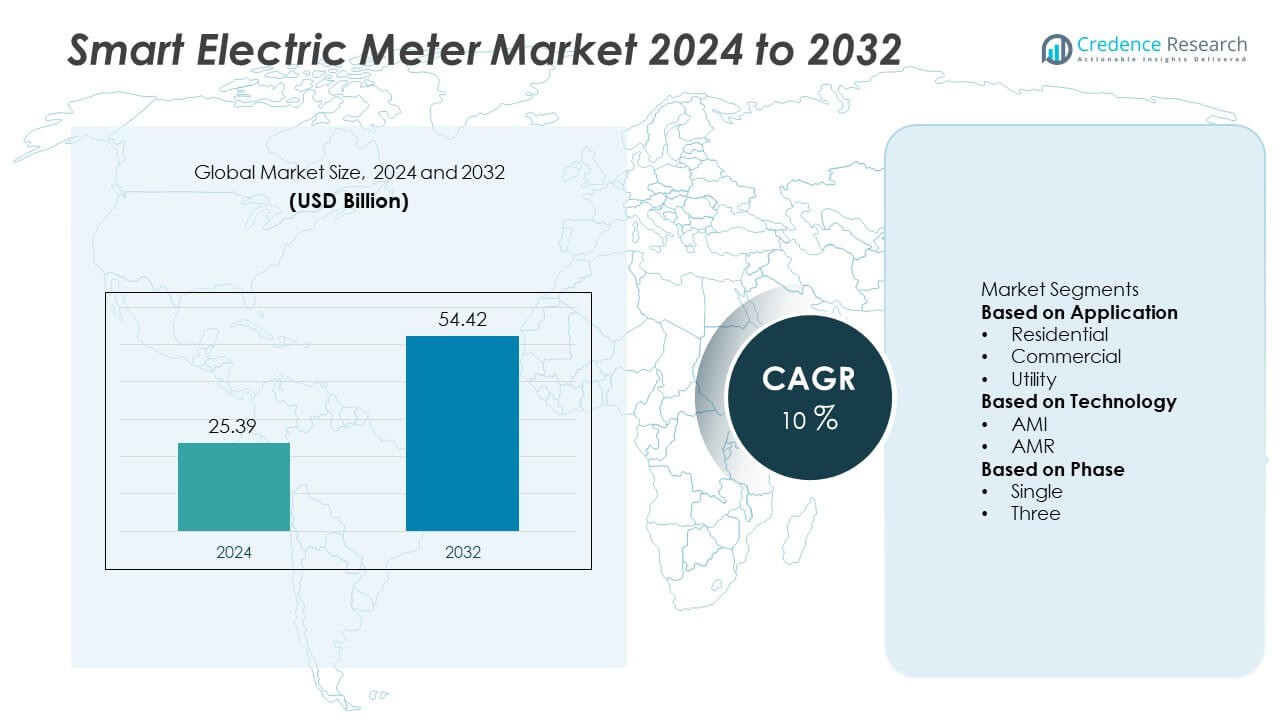

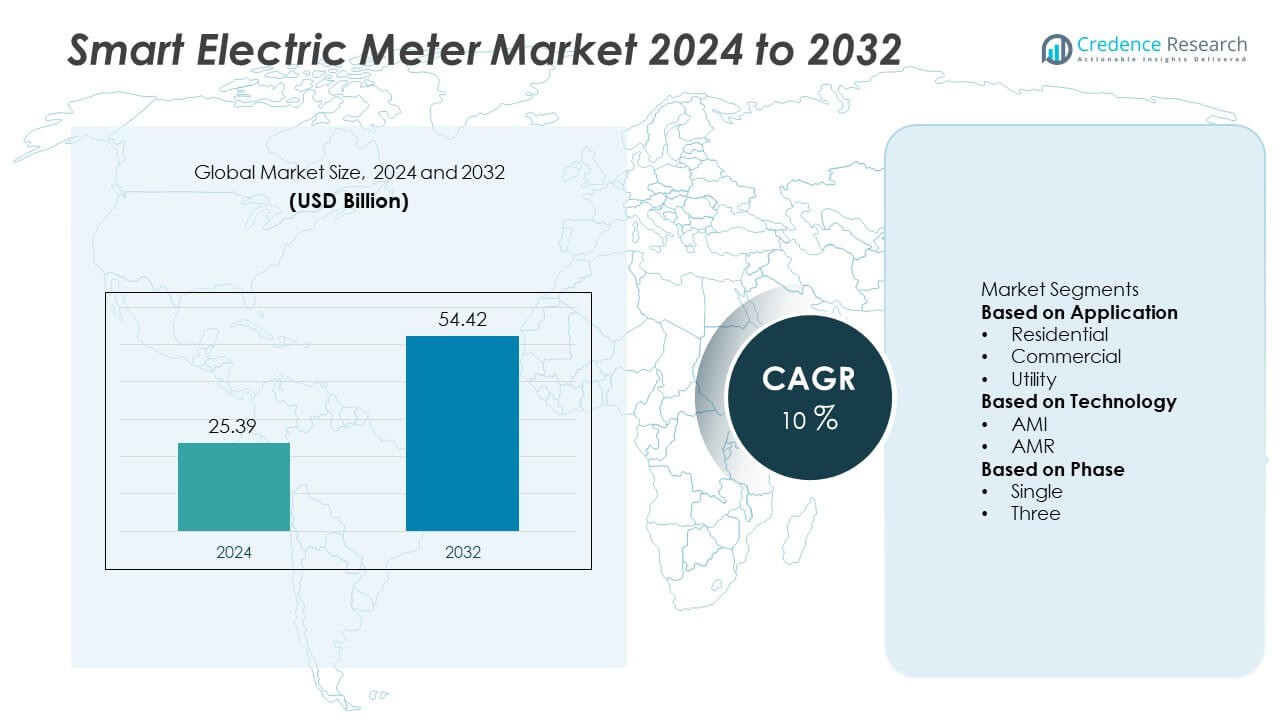

The Smart Electric Meter market was valued at USD 25.39 billion in 2024 and is projected to reach USD 54.42 billion by 2032, registering a CAGR of 10% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Electric Meter Market Size 2024 |

USD 25.39 Billion |

| Smart Electric Meter Market, CAGR |

10% |

| Smart Electric Meter Market Size 2032 |

USD 54.42 Billion |

The smart electric meter market is led by major companies such as Enel Spa., Cisco Systems, Inc., General Electric, Honeywell International Inc., Iskraemeco Group, Apator SA, Circutor, CyanConnode, Aclara Technologies LLC, and Advanced Electronics Company (AEC). These players dominate through strategic collaborations, product innovation, and large-scale smart grid deployments. Asia Pacific emerged as the leading region with a 34.7% share in 2024, driven by extensive government initiatives in China, India, and Japan. The region’s rapid digital transformation, growing electricity demand, and policy support for energy efficiency continue to strengthen its leadership in global smart meter adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The smart electric meter market was valued at USD 25.39 billion in 2024 and is projected to reach USD 54.42 billion by 2032, growing at a CAGR of 10% during the forecast period.

- Increasing investment in smart grid infrastructure and energy efficiency programs is driving global demand. Utilities are adopting advanced metering systems to enhance power reliability and reduce transmission losses.

- Integration of IoT, AI-based analytics, and real-time monitoring is reshaping the industry, enabling better load management and predictive maintenance.

- The market is competitive, with leading players such as Enel Spa., Cisco Systems, General Electric, and Honeywell focusing on innovation and strategic partnerships.

- Asia Pacific led the market with a 34.7% share in 2024, followed by North America at 31.6%, supported by large-scale AMI deployments and strong regulatory backing.

Market Segmentation Analysis:

By Application

The residential segment dominated the smart electric meter market with a 46.8% share in 2024. Widespread deployment of smart meters in households is driven by rising electricity consumption, energy efficiency mandates, and dynamic tariff programs. Governments are encouraging smart home integration through incentives for real-time energy monitoring and load control. Increasing consumer awareness about energy management and reduced billing errors supports further adoption. Utilities are prioritizing residential rollouts to enhance grid visibility and support distributed energy resource management.

- For instance, Enel S.p.A. deployed over 32 million second-generation smart meters across Italy under its Open Meter program. The units are capable of recording consumption data every 15 minutes, enabling time-of-use billing. Communication with the meters allows for remote management and service activation.

By Technology

The Advanced Metering Infrastructure (AMI) segment held the largest share of 62.3% in 2024, outperforming AMR systems due to its two-way communication capability and data analytics integration. AMI enables real-time monitoring, remote disconnection, and outage detection, improving grid reliability and operational efficiency. Utilities favor AMI to implement dynamic pricing and enhance customer engagement. Growing investment in digital grid modernization and IoT-based smart metering projects accelerates AMI installations across developed and emerging economies.

- For instance, Honeywell has deployed its Smart Energy AMI platform in North America, including a documented three-year project with a major North American utility involving the upgrade of 2.7 million AMI meters. The company offers solutions using various communication technologies, including RF mesh and NB-IoT, to enable the remote collection of meter data.

By Phase

The three-phase segment accounted for the highest market share of 57.9% in 2024, primarily used in industrial, commercial, and utility-scale applications. Three-phase meters support higher load capacities and provide superior power quality monitoring compared to single-phase units. The segment benefits from rapid industrialization, expansion of commercial infrastructure, and smart grid upgrades in high-demand regions. Growing integration of renewable energy systems and distributed generation further boosts demand for accurate three-phase power measurement and advanced metering analytics.

Key Growth Drivers

Rising Smart Grid Deployment

The expansion of smart grid infrastructure is a major growth driver in the smart electric meter market. Utilities are investing in advanced systems that enhance energy efficiency, reliability, and real-time monitoring. Smart meters enable two-way communication, supporting better load management and faster fault detection. Integration with digital platforms and analytics improves operational transparency, helping utilities reduce losses and optimize energy distribution across networks.

- For instance, companies like Wirepas have enabled the deployment of over 5 million smart meters in India, leveraging advanced mesh technology to provide utilities with real-time data for improved energy management. These smart grid technologies enable utilities to manage energy consumption and respond to service disruptions more effectively.

Government Mandates and Energy Efficiency Regulations

Supportive government policies promoting energy-efficient infrastructure continue to drive market growth. Many nations are implementing programs that replace traditional meters with connected smart systems. These initiatives aim to curb energy theft, improve billing accuracy, and enhance power reliability. Financial incentives, policy mandates, and public-private collaborations strengthen the momentum for large-scale installations, particularly in developing economies seeking modernized grid systems.

- For instance, Iskraemeco Group collaborated with the Egyptian Electricity Holding Company to supply and install 1.2 million smart meters under the national energy efficiency initiative. The meters record interval data every 30 minutes and transmit it via PLC and RF hybrid communication, enabling authorities to identify energy losses in real time and improving billing accuracy across urban and rural networks.

Rising Demand for Real-Time Energy Monitoring

Growing awareness of efficient energy consumption among consumers and businesses is accelerating adoption. Smart meters provide accurate, real-time data that supports cost optimization and sustainable energy use. Utilities benefit from better demand forecasting, reduced outage response time, and improved customer engagement. This shift toward data-driven energy management aligns with global sustainability goals and supports the growing focus on resource conservation.

Key Trends & Opportunities

Integration of IoT and Advanced Analytics

The integration of IoT and data analytics is transforming the capabilities of smart electric meters. These technologies enable predictive maintenance, remote monitoring, and enhanced load forecasting. Utilities can use data insights to optimize energy delivery and detect system anomalies early. The trend supports digital transformation across the power sector, creating opportunities for more efficient and intelligent grid management solutions.

- For instance, Iberdrola implemented its “STAR” project to digitize its electricity distribution network in Spain, integrating over 11 million smart meters and automating more than 90,000 transformation centers. The project relies on advanced telecommunications, including the open-standard Power Line Communications (PLC), to enable real-time monitoring and data analytics that improve network efficiency and allow for better integration of renewable energy.

Expansion of Renewable and Distributed Energy Systems

The rise in renewable energy generation is creating new opportunities for smart metering technologies. Smart meters help utilities manage distributed energy resources such as solar and wind systems. They enable bi-directional energy tracking and support demand-response initiatives. As energy systems become more decentralized, the role of advanced metering becomes vital in maintaining grid stability and enhancing energy flow efficiency.

- For instance, Apator SA, a Polish company, produces bi-directional smart electricity meters for Poland’s renewable energy sector. The system accurately settles prosumer energy and aids in integrating renewable generation into the national grid.

Key Challenges

High Installation and Infrastructure Costs

High upfront investment in equipment and communication infrastructure remains a key barrier to widespread adoption. Utilities face significant costs associated with large-scale deployment, system upgrades, and integration with existing grids. In emerging markets, funding limitations further delay implementation. Despite long-term efficiency gains, initial financial commitments continue to slow project execution.

Data Privacy and Cybersecurity Risks

Data security is a growing concern as smart meters handle vast amounts of consumer information. Risks such as data breaches, hacking, and unauthorized access to grid systems pose serious threats. Utilities must strengthen cybersecurity frameworks through encryption and strict compliance protocols. Ensuring consumer trust and protecting critical infrastructure remain major priorities for sustainable market growth.

Regional Analysis

North America

North America held a 31.6% share in 2024, driven by strong adoption of advanced metering infrastructure and supportive government programs. The United States leads the region due to large-scale smart grid projects funded by federal and state initiatives. Utilities are focusing on replacing legacy systems with digital meters to enhance grid resilience and reduce non-technical losses. Canada is also expanding smart meter rollouts to support renewable energy integration and dynamic pricing. The region benefits from mature infrastructure, strong data management frameworks, and a growing emphasis on energy efficiency and consumer awareness.

Europe

Europe accounted for a 28.4% share in 2024, supported by strict energy efficiency directives and smart grid investments. Countries such as the United Kingdom, Germany, France, and Italy have implemented national mandates to achieve full smart meter coverage. The region’s focus on carbon neutrality and digital transformation in utilities strengthens market growth. Ongoing investments in IoT-based metering systems and integration of renewable energy resources further enhance adoption. Collaboration between public authorities and private technology providers continues to accelerate infrastructure modernization across residential and commercial segments.

Asia Pacific

Asia Pacific dominated the market with a 34.7% share in 2024, fueled by massive smart meter rollouts in China, India, Japan, and South Korea. Government-led initiatives and utility reforms promote large-scale installations to improve grid stability and energy access. China remains the largest contributor due to state-backed modernization programs and strong manufacturing capabilities. India’s national smart metering mission and digital utility reforms are creating substantial opportunities. Rapid urbanization, growing electricity demand, and policy support for smart infrastructure drive sustained regional growth.

Middle East & Africa

The Middle East & Africa region captured a 3.1% share in 2024, with emerging investments in grid automation and energy digitization. Gulf countries are implementing smart metering to optimize water and electricity usage under national sustainability strategies. South Africa and Egypt are initiating pilot projects to curb electricity losses and improve billing efficiency. Although adoption remains gradual, ongoing renewable energy developments and government funding programs are encouraging modernization. The region’s long-term focus on smart infrastructure is expected to accelerate adoption over the forecast period.

Latin America

Latin America represented a 2.2% share in 2024, supported by gradual modernization of power distribution networks. Brazil, Mexico, and Chile are leading with government-backed initiatives to replace outdated metering systems. Utilities are increasingly adopting smart meters to reduce power theft and improve service reliability. Regulatory efforts promoting energy efficiency and demand-side management also enhance regional market penetration. Despite limited funding in some countries, rising urban electricity demand and digital grid programs are expected to drive steady expansion in the coming years.

Market Segmentations:

By Application

- Residential

- Commercial

- Utility

By Technology

By Phase

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The competitive landscape of the smart electric meter market features prominent players such as Enel Spa., Apator SA, Cisco Systems, Inc., Iskraemeco Group, General Electric, Circutor, CyanConnode, Honeywell International Inc., Aclara Technologies LLC, and Advanced Electronics Company (AEC). These companies compete through technology innovation, large-scale deployments, and partnerships with utilities to expand their global reach. Leading players focus on advanced metering infrastructure, IoT integration, and data analytics to enhance performance and connectivity. Strategic collaborations, mergers, and R&D investments drive continuous improvement in accuracy, cybersecurity, and cost efficiency. Growing demand for grid modernization and renewable integration further intensifies competition, with manufacturers aligning offerings to evolving regulatory and sustainability requirements worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Enel Spa.

- Apator SA

- Cisco Systems, Inc.

- Iskraemeco Group

- General Electric

- Circutor

- CyanConnode

- Honeywell International Inc.

- Aclara Technologies LLC

- Advanced Electronics Company (AEC)

Recent Developments

- In March 2025, Honeywell International, Inc. introduced the NXU Residential Smart Gas Meter, designed to help protect gas customers and utilities across North America through automation and remote operability.

- In August 2024, CyanConnode reported that its smart meter connectivity platform had deployed over 2 million (or 20 lakh) installed RF communication endpoints, primarily in India.

- In March 2024, Aclara Technologies LLC partnered with Nvidia and Utilidata to integrate embedded AI modules into its smart meters at scale, enabling device-level anomaly detection using up to 400 data features per second.

- In May 2023, Honeywell announced the Next Generation Mobile Module (NXCM), which enables an Advanced Measurement Infrastructure (AMI) solution.

Report Coverage

The research report offers an in-depth analysis based on Application, Technology, Phase and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of smart meters will accelerate with expanding smart grid modernization programs worldwide.

- Utilities will increasingly use real-time data analytics to improve load management and reduce losses.

- Government incentives and energy efficiency mandates will continue to drive large-scale installations.

- Integration with renewable and distributed energy systems will enhance demand for two-way metering solutions.

- IoT-enabled smart meters will gain traction for predictive maintenance and advanced energy monitoring.

- Manufacturers will focus on cybersecurity and data protection to ensure safe network operations.

- AMI technology will dominate as utilities move toward fully digitalized infrastructure.

- Partnerships between technology providers and utilities will expand to support grid automation.

- Emerging markets will see rapid adoption driven by electrification projects and digital reforms.

- Sustainability goals and consumer awareness will strengthen long-term demand for intelligent energy management systems.