| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smartphone Enabled Medical Devices Market Size 2024 |

USD 18,633.07 Million |

| Smartphone Enabled Medical Devices Market, CAGR |

11.2% |

| Smartphone Enabled Medical Devices Market Size 2032 |

USD 43,454.95 Million |

Market Overview:

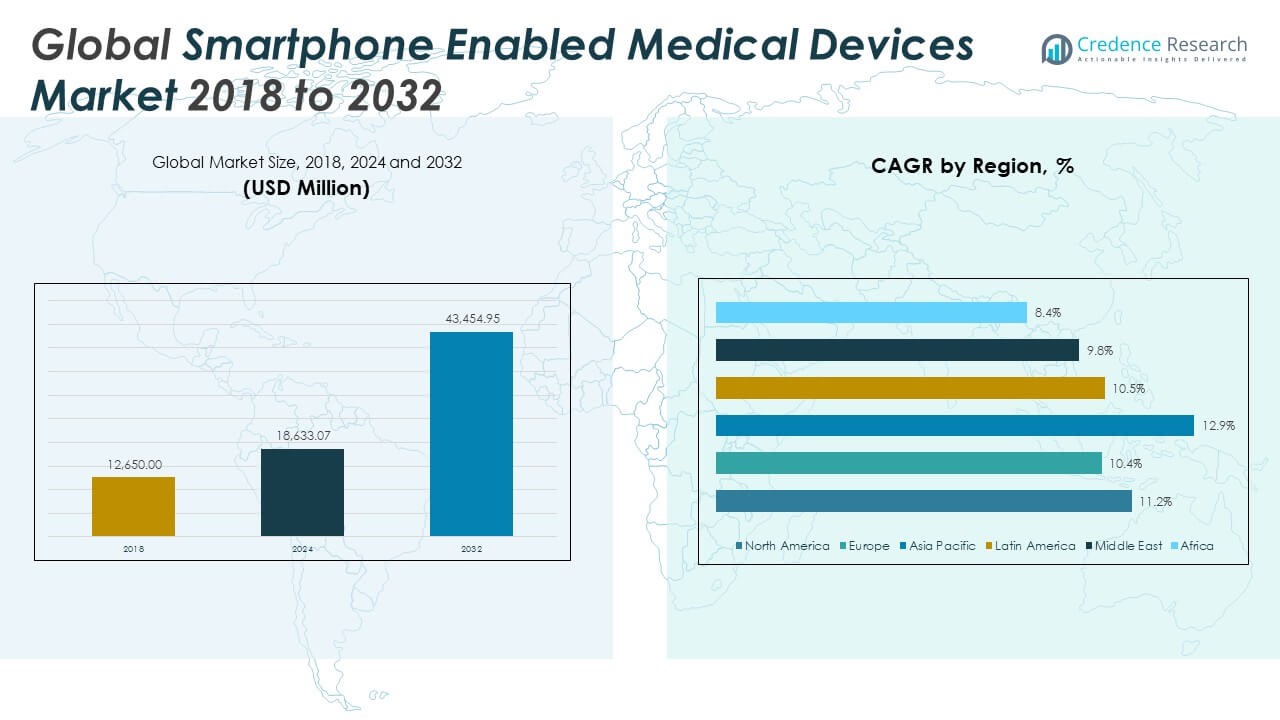

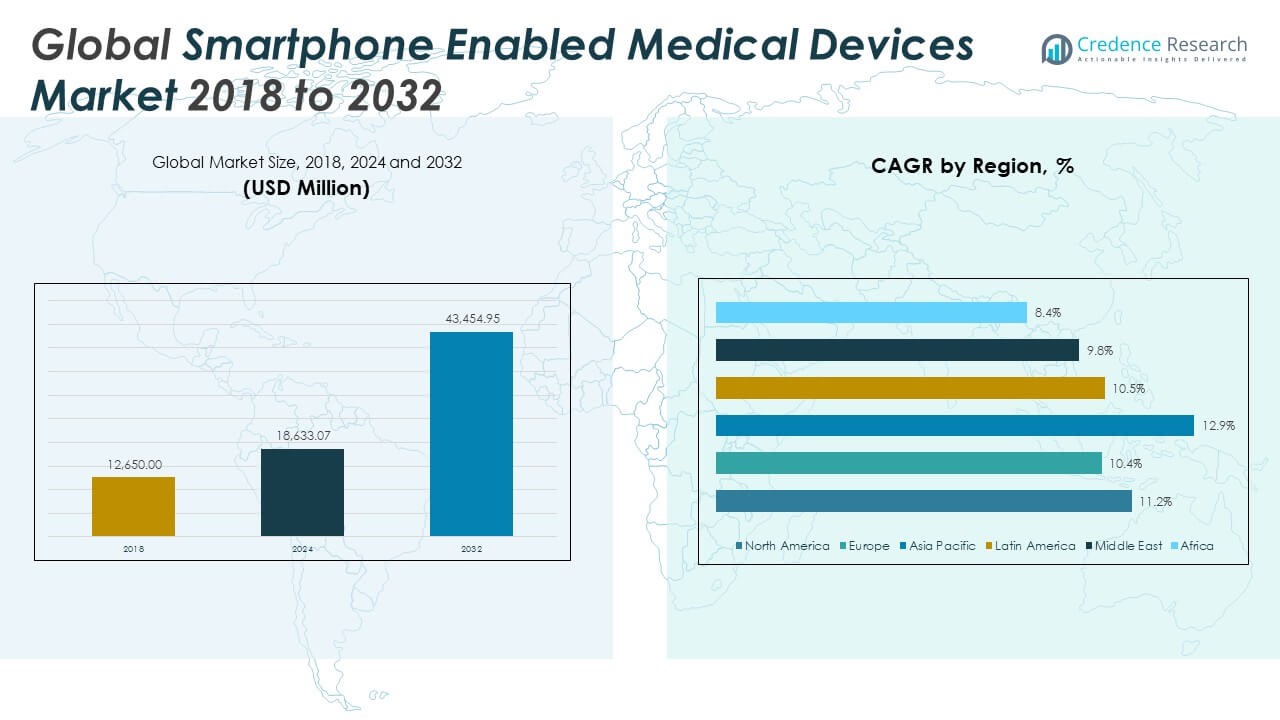

The Global Smartphone Enabled Medical Devices Market size was valued at USD 12,650.00 million in 2018 to USD 18,633.07 million in 2024 and is anticipated to reach USD 43,454.95 million by 2032, at a CAGR of 11.2% during the forecast period.

Key market drivers include the global increase in chronic conditions such as diabetes, cardiovascular disease, and respiratory disorders, which require ongoing monitoring and early detection. Smartphone-enabled medical devices provide affordable and scalable alternatives to traditional hospital visits, improving patient compliance and enabling clinicians to track health remotely. The COVID-19 pandemic accelerated both public and private sector investment in telehealth, home diagnostics, and connected care platforms. Continuous advancements in sensor miniaturization, Bluetooth and wireless integration, and artificial intelligence are enhancing device precision, usability, and clinical value. Health systems are under pressure to optimize resource use and improve outcomes, prompting greater use of smartphone-linked diagnostic tools for real-time decision-making. Regulatory bodies and insurers are supporting this transition with reimbursement frameworks and digital health policy updates that encourage adoption across diverse clinical settings.

Regionally, North America dominates the Global Smartphone-Enabled Medical Devices Market due to its mature healthcare infrastructure, high smartphone usage, and favorable reimbursement models for remote monitoring technologies. The United States leads with rapid deployment of mobile diagnostic tools, supported by strong regulatory oversight and digital health integration across providers and payers. Europe holds the second-largest share, bolstered by national chronic disease management programs, digital innovation funding, and high adoption of electronic health records. The Asia-Pacific region is experiencing the fastest growth, with China, India, Japan, and South Korea expanding mobile health investments to improve care access, especially in rural and underserved regions. These countries are leveraging rising smartphone penetration, improved internet infrastructure, and growing healthcare awareness to scale adoption. Latin America, the Middle East, and Africa show steady progress, with governments and private providers increasingly adopting mobile diagnostics to address chronic disease burdens and improve care delivery in remote areas.

Market Insights:

- The Global Smartphone Enabled Medical Devices Market was valued at USD 12,650.00 million in 2018, increased to USD 18,633.07 million in 2024, and is projected to reach USD 43,454.95 million by 2032, growing at a CAGR of 11.2% from 2024 to 2032.

- The growing burden of chronic diseases such as diabetes, cardiovascular disorders, and respiratory conditions is driving sustained demand for smartphone-connected medical devices for home monitoring and early detection.

- Smartphone penetration continues to expand globally, with billions of users across both developed and emerging markets supporting mass adoption of health-monitoring applications and mobile-connected devices.

- The COVID-19 pandemic significantly accelerated remote patient monitoring and telehealth integration, where smartphone-enabled tools now play a critical role in post-discharge care and chronic disease management.

- Innovations in miniaturized sensors, wireless (Bluetooth) connectivity, and AI have improved device functionality, accuracy, and integration into electronic health record systems and cloud-based platforms.

- Regulatory complexity remains a major barrier, as companies must comply with multi-jurisdictional requirements from bodies like the FDA and EMA, often delaying time-to-market, especially for small to mid-size manufacturers.

- Data privacy concerns and lack of standardization in system interoperability present adoption hurdles, requiring strong encryption, HIPAA/GDPR compliance, and seamless integration with hospital IT systems to gain user and provider trust.

Market Drivers:

Rising Burden of Chronic Diseases Drives Long-Term Adoption:

The global increase in chronic diseases, particularly diabetes, cardiovascular disorders, and respiratory conditions, is fueling consistent demand for connected monitoring solutions. Patients require frequent and real-time health tracking to manage these conditions effectively. Smartphone-enabled medical devices offer convenient, non-invasive tools for at-home use, reducing the need for routine hospital visits. The Global Smartphone Enabled Medical Devices Market is responding with portable ECG monitors, glucometers, and pulse oximeters that deliver data directly to mobile apps. Clinicians benefit from continuous data flow that supports early detection and treatment adjustments. The rising chronic disease burden strengthens the long-term relevance of these technologies.

- For instance, AliveCor’s KardiaMobile ECG device has been used by more than one million users worldwide, with studies showing significant reductions in urgent healthcare visits and improved arrhythmia detection through smartphone integration.

Global Smartphone Penetration and Patient Willingness to Self-Monitor:

Smartphone adoption continues to grow across all income levels, creating a universal platform for mobile health solutions. Patients are increasingly open to using their smartphones for managing daily health routines, especially when devices are user-friendly and app interfaces are intuitive. This behavioral shift supports widespread use of smartphone-enabled medical devices in both clinical and non-clinical settings. It empowers users to take control of their health, track progress, and communicate data directly to healthcare providers. The Global Smartphone Enabled Medical Devices Market benefits from this growing comfort with mobile-based engagement. Device makers are leveraging this trend to deliver seamless health monitoring experiences across age groups.

- For instance, Dexcom’s G7 continuous glucose monitoring system, which syncs directly with smartphones, has been adopted globally and is cleared for use in the United States for adults with diabetes, offering real-time glucose tracking and data sharing with healthcare teams.

Expansion of Telehealth and Remote Patient Monitoring Programs:

Health systems and insurers are actively integrating smartphone-enabled diagnostics into telehealth workflows. These tools play a central role in enabling remote patient monitoring (RPM), allowing clinicians to make data-driven decisions without requiring in-person visits. During the COVID-19 pandemic, RPM platforms supported continuity of care and reduced patient exposure risks. The Global Smartphone Enabled Medical Devices Market is aligned with the broader shift toward decentralized care delivery models. Providers now prioritize mobile-compatible tools that connect with cloud platforms and support synchronous consultations. Remote diagnostics are becoming standard practice across chronic care management and post-discharge monitoring.

Advancements in Sensor Technologies and Data Integration Capabilities:

Miniaturization of sensors, improvements in wireless connectivity, and integration with cloud platforms have significantly enhanced device performance. These technological advancements enable accurate, real-time measurement of vital signs and physiological parameters through compact, mobile-linked devices. It enables smartphone-enabled medical devices to deliver clinical-grade data directly into electronic health records (EHRs) and digital platforms. The Global Smartphone Enabled Medical Devices Market is capitalizing on this progress by offering highly functional, scalable tools suitable for both consumer wellness and clinical diagnostics. Continued R&D investments ensure better battery life, interoperability, and AI-driven analytics, which improve decision-making and user adherence.

Market Trends:

Integration of Artificial Intelligence for Real-Time Clinical Insights:

Artificial intelligence is increasingly integrated into smartphone-enabled medical devices to provide predictive analytics, automated alerts, and clinical decision support. AI algorithms can analyze large volumes of patient-generated health data to detect anomalies, track trends, and guide interventions. Devices such as mobile ECGs and digital stethoscopes now include machine learning features that identify arrhythmias or respiratory irregularities in real time. The Global Smartphone Enabled Medical Devices Market is shifting toward intelligent platforms that offer not just monitoring, but also actionable recommendations. These capabilities enhance diagnostic accuracy, support early intervention, and reduce clinician workload. Manufacturers are focusing on AI-driven functions to strengthen the clinical value of mobile-connected solutions.

- For instance, Eko Health’s DUO digital stethoscope, integrated with AI algorithms, has analyzed over 50 million heart and lung sounds, achieving FDA clearance for its AI-based atrial fibrillation and murmur detection capabilities in 2022.

Growth of Direct-to-Consumer (DTC) Health and Wellness Devices:

Consumers are increasingly purchasing smartphone-compatible health devices without a physician’s prescription. The expansion of the direct-to-consumer segment reflects rising interest in self-care, fitness monitoring, and early risk detection. Companies are marketing devices such as mobile heart rate monitors, sleep trackers, and digital thermometers through online and retail channels. The Global Smartphone Enabled Medical Devices Market is seeing strong demand from users who prioritize proactive health management. These consumer-focused devices often integrate with lifestyle apps and wearable platforms, creating comprehensive health ecosystems. The trend underscores a broader shift toward consumer autonomy in managing personal health data.

- For instance, Withings reported that its Body Comp smart scale, which syncs with smartphones and tracks multiple health metrics, logged over 10 million weigh-ins globally within the first year of launch, supporting users in managing cardiovascular and metabolic health.

Emergence of Cloud-Based Platforms and Interoperability Standards:

Smartphone-enabled devices increasingly rely on secure, cloud-based infrastructure to store, analyze, and transmit health data. Interoperability with electronic health records (EHRs), telehealth systems, and clinical dashboards is becoming a core product requirement. Device manufacturers are prioritizing HL7, FHIR, and other health IT standards to ensure seamless integration across platforms. The Global Smartphone Enabled Medical Devices Market is evolving toward connected ecosystems that support multi-device, multi-stakeholder coordination. Cloud platforms improve data accessibility and facilitate population-level analytics for public health and research. This trend is driving collaborations between device makers, cloud service providers, and healthcare organizations.

Customization of Devices for Disease-Specific Use Cases:

Companies are developing disease-specific smartphone-enabled solutions that target conditions such as asthma, hypertension, sleep apnea, and reproductive health. These devices offer specialized features, such as spirometry-linked apps for asthma or Bluetooth-connected BP monitors for hypertensive patients. The Global Smartphone Enabled Medical Devices Market is moving beyond general-purpose tools toward more personalized, condition-specific applications. Tailored devices improve user adherence and generate data relevant to specific clinical workflows. Pharmaceutical firms and digital health startups are partnering to create combination solutions that bundle medication, devices, and mobile platforms. This trend supports precision health strategies and strengthens market segmentation.

Market Challenges Analysis:

Regulatory Complexity and Approval Delays Hinder Market Entry:

Navigating diverse regulatory frameworks poses a significant challenge for manufacturers of smartphone-enabled medical devices. Obtaining approvals from agencies such as the FDA, EMA, and others involves rigorous testing, documentation, and compliance with evolving digital health standards. Many devices fall into hybrid categories—combining hardware, software, and data services—which complicates classification and lengthens approval timelines. The Global Smartphone Enabled Medical Devices Market faces delays in commercialization due to these multi-jurisdictional hurdles. Smaller firms often struggle with the cost and resources required for global compliance. Regulatory uncertainty can slow innovation and discourage entry into new markets.

Data Security, Privacy Concerns, and Integration Barriers Limit Adoption:

Smartphone-enabled devices handle sensitive health information, making data security and privacy critical concerns for both users and providers. Breaches, poor encryption, or non-compliance with HIPAA, GDPR, or local data laws can damage user trust and lead to legal penalties. The Global Smartphone Enabled Medical Devices Market must address these risks through robust cybersecurity frameworks and transparent consent protocols. Interoperability with hospital systems and electronic health records also presents challenges, particularly when platforms lack standardization. Inconsistent integration reduces clinical utility and increases provider resistance. Ensuring secure, seamless data flow is essential to unlocking the full value of mobile-connected health technologies.

Market Opportunities:

Expansion Across Emerging Economies with Rising Mobile Penetration:

Emerging markets offer significant growth opportunities driven by increasing smartphone adoption, improving internet access, and a growing middle-class population. Countries across Asia-Pacific, Latin America, and Africa are investing in healthcare digitization and infrastructure upgrades. The Global Smartphone Enabled Medical Devices Market can expand by introducing affordable, scalable solutions tailored to local needs. Government-led initiatives focused on remote diagnostics and chronic disease management further support adoption. Companies that align device functionality with mobile-first healthcare models will gain early traction. Strategic partnerships with local providers and public health systems will strengthen regional distribution and compliance.

Advancement in Personalized and AI-Driven Health Technologies:

Personalized health solutions powered by artificial intelligence present new avenues for product innovation and user engagement. AI can deliver real-time alerts, individualized insights, and adaptive treatment recommendations directly through smartphone platforms. The Global Smartphone Enabled Medical Devices Market is well positioned to capitalize on this by integrating predictive analytics into condition-specific tools. Demand is rising for smart devices that support proactive health management, from fertility tracking to cardiovascular monitoring. Developers that offer user-centric designs and intelligent automation will meet expectations for precision and convenience. This shift supports value-based care models and long-term market scalability.

Market Segmentation Analysis:

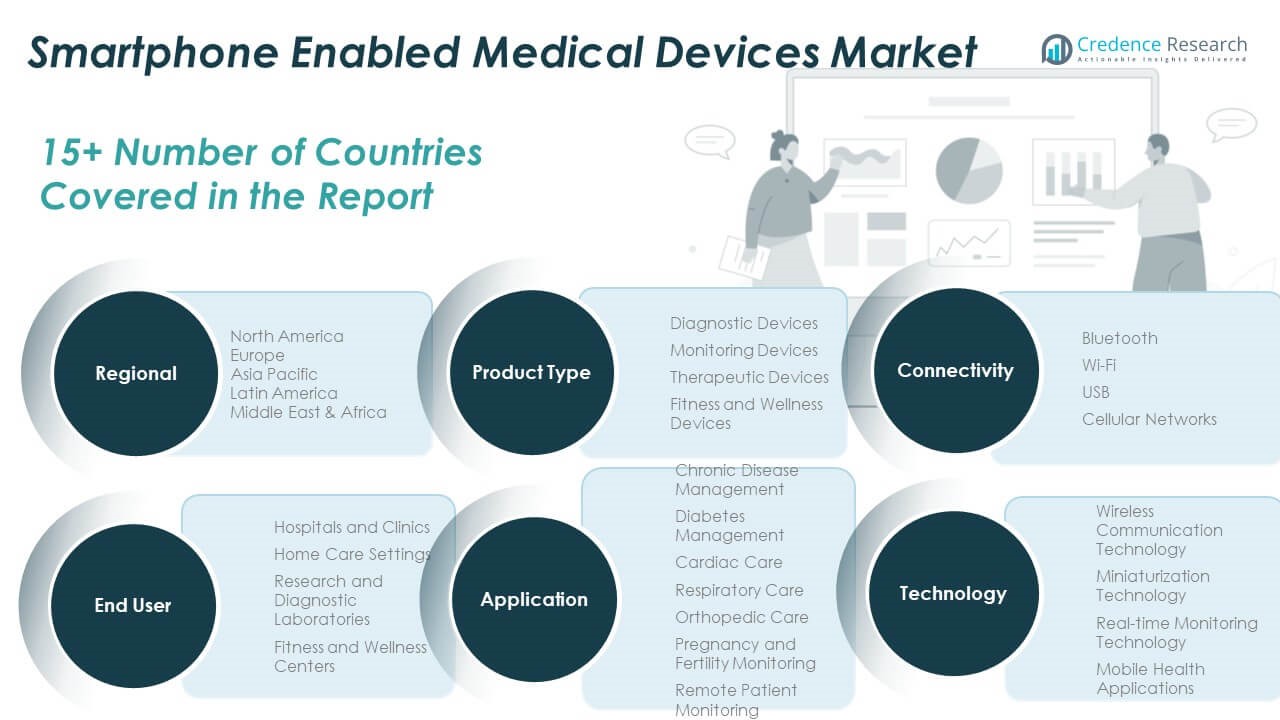

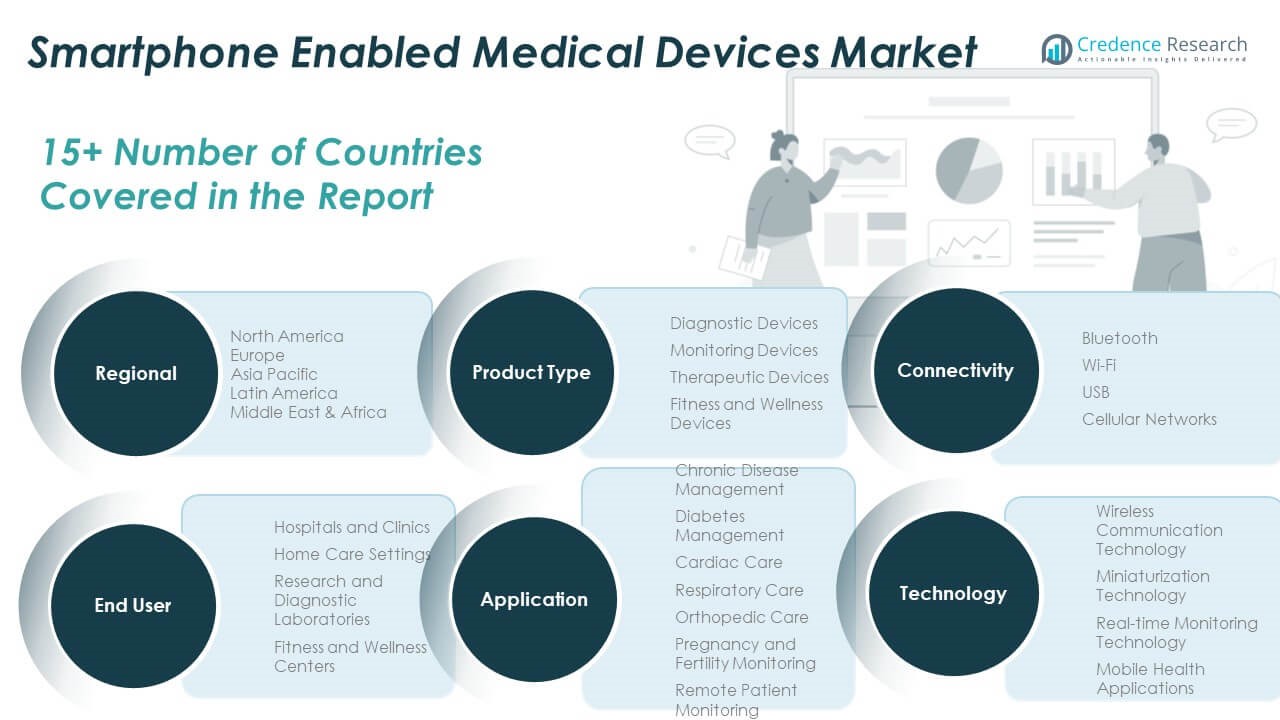

By Product Type

The market includes diagnostic devices, monitoring devices, therapeutic devices, and fitness and wellness devices. Diagnostic devices lead the segment due to rising demand for portable ECGs, glucometers, and oximeters. Monitoring devices are expanding use in chronic care, while therapeutic devices support medication delivery and rehabilitation. Fitness and wellness devices see strong adoption in preventive healthcare and consumer health tracking.

- For instance, Masimo’s MightySat Rx fingertip pulse oximeter, which connects to smartphones via Bluetooth, has been adopted by over 500 hospitals and used by thousands of patients for continuous oxygen saturation monitoring in both clinical and home settings.

By Application

Chronic disease management dominates the application segment, supported by growing cases of diabetes, cardiovascular, and respiratory disorders. Diabetes management and cardiac care require continuous monitoring through connected tools. Respiratory care, orthopedic support, pregnancy and fertility monitoring, and remote patient monitoring are expanding across both clinical and home environments.

- For instance, Abbott’s FreeStyle Libre system, a smartphone-enabled continuous glucose monitoring device, surpassed 5 million users globally by 2024, providing real-time glucose data for diabetes management in both clinical and home care.

By End-User

Hospitals and clinics remain the primary end-users due to integration of connected diagnostic tools into routine care. Home care settings follow closely, driven by the shift toward decentralized healthcare. Research and diagnostic laboratories adopt mobile-connected systems for data analysis. Fitness and wellness centers use consumer-grade wearables to promote active lifestyles.

By Technology

Wireless communication and miniaturization technologies are central to portable device design. Real-time monitoring enables timely interventions. Mobile health applications provide user-friendly interfaces that improve patient engagement and clinical communication.

By Connectivity

Bluetooth is the preferred connectivity option due to its simplicity and compatibility. Wi-Fi supports real-time syncing in home environments. USB enables direct, secure data transfer. Cellular networks allow remote monitoring in areas with limited infrastructure. The Global Smartphone Enabled Medical Devices Market aligns across these segments to support scalable, mobile healthcare delivery.

Segmentation:

By Product Type

- Diagnostic Devices

- Monitoring Devices

- Therapeutic Devices

- Fitness and Wellness Devices

By Application

- Chronic Disease Management

- Diabetes Management

- Cardiac Care

- Respiratory Care

- Orthopedic Care

- Pregnancy and Fertility Monitoring

- Remote Patient Monitoring

By End-User

- Hospitals and Clinics

- Home Care Settings

- Research and Diagnostic Laboratories

- Fitness and Wellness Centers

By Technology

- Wireless Communication Technology

- Miniaturization Technology

- Real-time Monitoring Technology

- Mobile Health Applications

By Connectivity

- Bluetooth

- Wi-Fi

- USB

- Cellular Networks

By Region & Country

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Smartphone Enabled Medical Devices Market size was valued at USD 5,154.88 million in 2018, reached USD 7,510.88 million in 2024, and is anticipated to reach USD 17,495.04 million by 2032, at a CAGR of 11.2% during the forecast period. North America holds the largest market share in the Global Smartphone Enabled Medical Devices Market, led by high smartphone usage, advanced healthcare infrastructure, and supportive reimbursement models. The U.S. drives regional growth through integration of mobile diagnostics into routine care and chronic disease management programs. Remote patient monitoring and telehealth adoption continue to expand due to policy incentives and digital health investments. Strong regulatory oversight supports trust in connected care platforms. The market in this region remains focused on clinical-grade devices and scalable remote care delivery.

Europe

The Europe Smartphone Enabled Medical Devices Market size was valued at USD 3,216.90 million in 2018, rose to USD 4,547.82 million in 2024, and is projected to reach USD 9,996.93 million by 2032, with a CAGR of 10.4% during the forecast period. Europe is the second-largest regional market, driven by national health programs focused on chronic care, aging populations, and digital health adoption. Countries like Germany, the UK, and France are investing in mobile diagnostic tools and real-time monitoring platforms. Electronic health record integration and funding for innovation support wide-scale implementation. The Global Smartphone Enabled Medical Devices Market benefits from Europe’s regulatory alignment and public-private initiatives. Device interoperability and patient data portability are key to sustained market growth in this region.

Asia Pacific

The Asia Pacific Smartphone Enabled Medical Devices Market was valued at USD 2,457.90 million in 2018, reached USD 3,822.50 million in 2024, and is expected to grow to USD 10,064.20 million by 2032, at a CAGR of 12.9% during the forecast period. Asia Pacific is the fastest-growing region in the Global Smartphone Enabled Medical Devices Market, supported by rapid smartphone penetration and healthcare digitization across China, India, Japan, and South Korea. Rural healthcare access challenges are prompting governments to adopt mobile-enabled monitoring and diagnostics. Public awareness campaigns and mobile health apps are improving patient engagement. Investments in 5G infrastructure and AI-driven health platforms are enhancing real-time diagnostics. Local start-ups and global players are expanding product offerings to meet diverse population needs.

Latin America

The Latin America Smartphone Enabled Medical Devices Market size stood at USD 1,106.88 million in 2018, grew to USD 1,619.03 million in 2024, and is expected to reach USD 3,579.38 million by 2032, growing at a CAGR of 10.5%. Latin America is seeing steady growth in the Global Smartphone Enabled Medical Devices Market, driven by rising chronic disease incidence and limited access to traditional healthcare infrastructure. Brazil and Mexico lead adoption through government-supported remote care pilots and growing telemedicine platforms. Smartphone-based diagnostic devices are helping reduce patient load in urban hospitals and extend reach into remote areas. The region is adopting Bluetooth-enabled tools for diabetes and cardiac monitoring. Infrastructure limitations persist but are being addressed through digital health partnerships.

Middle East

The Middle East Smartphone Enabled Medical Devices Market was valued at USD 478.17 million in 2018, reached USD 659.49 million in 2024, and is forecast to reach USD 1,386.45 million by 2032, at a CAGR of 9.8%. The market in the Middle East is gaining momentum due to increasing demand for mobile-based chronic care management. GCC countries are deploying smartphone-enabled health solutions to strengthen primary and post-acute care. National health digitization plans in UAE and Saudi Arabia are supporting broader adoption of connected devices. The Global Smartphone Enabled Medical Devices Market benefits from regional smart city initiatives that include digital health as a core component. Device vendors are targeting urban populations with wellness tracking and remote diagnostics.

Africa

The Africa Smartphone Enabled Medical Devices Market was valued at USD 235.29 million in 2018, reached USD 473.36 million in 2024, and is projected to hit USD 932.95 million by 2032, at a CAGR of 8.4%. Africa represents an emerging opportunity in the Global Smartphone Enabled Medical Devices Market, supported by growing smartphone availability and digital health pilot projects. Mobile health tools are being used to extend care delivery to rural areas with limited healthcare infrastructure. Governments and NGOs are driving deployment of connected diagnostics for maternal health, diabetes, and infectious diseases. Bluetooth and cellular network-based devices are supporting low-cost, scalable monitoring solutions. While challenges in infrastructure and regulation exist, partnerships are enabling slow but steady growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- IBM Watson

- EBSCO Health

- AT&T

- Apple

- Accenture

- MIM Software

- McKesson Corporation

- Fitbit

- Dexcom

- AthenaHealth

Competitive Analysis:

The Global Smartphone Enabled Medical Devices Market features a competitive landscape marked by a mix of established medical device manufacturers and emerging digital health innovators. Key players include Apple Inc., Philips Healthcare, Medtronic, AliveCor, Omron Healthcare, Dexcom, and iHealth Labs. These companies leverage strong R&D capabilities, regulatory expertise, and robust distribution networks to maintain market presence. It is characterized by continuous product innovation, AI integration, and ecosystem partnerships that enhance device connectivity and real-time analytics. Competition centers around device accuracy, user experience, interoperability, and integration with electronic health records and telehealth platforms. Strategic alliances between device makers and software providers are accelerating the development of condition-specific solutions. Companies are also focusing on direct-to-consumer channels and global expansion in emerging markets to broaden their reach. The market rewards firms that deliver scalable, secure, and personalized solutions aligned with evolving digital healthcare models.

Recent Developments:

- As of July 2025, Dexcom’s G7 continuous glucose monitoring system continues to expand its global reach. The G7 syncs directly with smartphones, providing real-time glucose data and integration with digital health platforms for diabetes management. The system is cleared for use in the United States and widely adopted by adults with diabetes for mobile-enabled self-monitoring.

- In June 2025, GE HealthCare and MIM Software announced the integration of MIM Encore, a unified digital imaging and workflow platform. This collaboration delivers advanced post-processing tools for GE HealthCare systems, streamlining diagnostic workflows and supporting mobile access to high-quality imaging for clinicians and researchers.

- In May 2025, Apple reported a technology transformation at Emory Hillandale Hospital, where iPhone, iPad, and Apple Watch became standard tools for clinicians. This initiative, powered by Epic healthcare apps, has improved mobility, efficiency, and collaboration in patient care, demonstrating the impact of Apple devices in healthcare delivery.

- In February 2025, Apple launched the Apple Health Study in collaboration with Brigham and Women’s Hospital. The study, available through the Research app on iPhone, aims to understand how data from Apple devices—including iPhone, Apple Watch, and AirPods—can be used to predict, detect, and manage health and wellbeing. The study explores multiple health domains, leveraging smartphone-enabled data collection for large-scale research.

Market Concentration & Characteristics:

The Global Smartphone Enabled Medical Devices Market shows moderate concentration, with a combination of global medical device leaders and agile startups competing across diverse product categories. It is defined by rapid innovation, short product life cycles, and strong demand for connectivity, miniaturization, and real-time analytics. Companies differentiate based on device accuracy, ease of integration, mobile compatibility, and data security. The market favors firms with cross-disciplinary capabilities in hardware, software, and digital health compliance. Demand spans both clinical and consumer segments, creating space for prescription-grade tools and wellness-focused solutions. It continues to evolve with growing emphasis on interoperability, AI integration, and direct-to-consumer accessibility.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, end-user, technology, and connectivity. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising chronic disease prevalence will sustain demand for mobile-connected diagnostic and monitoring devices.

- Expansion of telehealth services will drive deeper integration of smartphone-enabled tools in remote care workflows.

- Advancements in AI and machine learning will enhance diagnostic accuracy and enable predictive health insights.

- Growth in direct-to-consumer channels will boost adoption of wellness and preventive care devices.

- Personalized, condition-specific tools will support precision health and long-term patient engagement.

- Increased smartphone penetration in emerging markets will unlock new adoption opportunities.

- Regulatory support for digital therapeutics and remote monitoring will improve reimbursement viability.

- Interoperability with electronic health records and cloud platforms will become a standard requirement.

- Strategic collaborations between device makers and software developers will accelerate product innovation.

- Consumer expectations for convenience, mobility, and real-time feedback will shape future product design.