| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sodium Silicate Market Size 2024 |

USD 10,277.26 million |

| Sodium Silicate Market, CAGR |

5% |

| Sodium Silicate Market Size 2032 |

USD 15,183.45 million |

Market Overview

The Global Sodium Silicate Market is projected to grow from USD 10,277.26 million in 2024 to an estimated USD 15,183.45 million by 2032, with a compound annual growth rate (CAGR) of 5.00% from 2025 to 2032. The demand for sodium silicate is driven by its wide applications in industries such as detergents, water treatment, paper and pulp, and construction.

Key drivers of market growth include the rising demand for sodium silicate in the detergent industry, where it acts as a cleaning agent and builder. Moreover, the increasing use of sodium silicate in the construction industry as a concrete additive and in water treatment applications is fueling its growth. The shift towards environmentally friendly and sustainable solutions is also promoting the use of sodium silicate, especially in formulations for detergents and personal care products. Additionally, the growth of the automotive and textile industries further supports market demand.

Geographically, Asia Pacific dominates the global sodium silicate market, driven by rapid industrial growth in countries like China and India. North America and Europe also hold significant shares, owing to advanced industrial practices and increased demand for water treatment solutions. Key players in the global sodium silicate market include PQ Corporation, Solvay S.A., and BASF SE, who are focusing on expanding production capacities and advancing product innovations to cater to the growing market needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global sodium silicate market is projected to grow from USD 10,277.26 million in 2024 to USD 15,183.45 million by 2032, with a CAGR of 5.00% from 2025 to 2032. It is driven by diverse applications across industries such as detergents, construction, and water treatment.

- Key drivers include the increasing demand for sodium silicate in the detergent industry, where it enhances cleaning power. The rise of infrastructure projects and industrial growth, particularly in emerging economies, further supports market expansion.

- Fluctuations in raw material prices and environmental concerns around production processes pose significant challenges. Additionally, regulatory hurdles regarding the use and disposal of chemicals may restrict market growth.

- Asia Pacific leads the global market, driven by industrial growth in China and India. North America and Europe follow closely, with strong demand from the water treatment and construction sectors.

- Increasing demand for eco-friendly products, particularly in detergents and water treatment, is driving the adoption of sodium silicate. Its non-toxic, biodegradable properties make it a preferred choice in sustainable formulations.

- Advancements in production technology are improving the efficiency of sodium silicate manufacturing. Innovations in production methods help reduce costs and enhance the quality of the final product, which benefits various industries.

- Sodium silicate’s growing use in the automotive, paper, and textile industries offers significant market opportunities. Its role in high-performance applications such as silica tires and fire-resistant materials further diversifies its market potential.

Report Scope

This report segments the Global Sodium Silicate Market as follows:

Market Drivers

Increasing Demand in Detergent and Soap Industries

The detergent and soap industries are among the primary consumers of sodium silicate, significantly contributing to its market growth. Sodium silicate, commonly known as water glass, is used as a builder and stabilizer in detergents. It enhances the cleaning power of detergents by softening water, enabling more efficient washing. For instance, Sakshi Chem Sciences reports that sodium silicate is a key ingredient in the formulation of dishwashing liquids, laundry detergents, and industrial cleaning agents, helping emulsify oils and stabilize detergent compositions. According to the European Chemical Industry Council (CEFIC), sodium silicate production data collected from 12 major European silicate producers shows that its application in cleaning products continues to expand. As the global population grows and urbanizes, the demand for household cleaning products, including detergents, has risen. This trend is especially prevalent in emerging economies, where rising disposable incomes have led to increased purchasing power for cleaning products. The increasing preference for liquid detergents, which require sodium silicate for stability, is further accelerating demand. Additionally, as consumer awareness about hygiene and cleanliness grows, the demand for cleaning products, particularly those that offer superior stain removal and fabric care, is likely to expand, propelling the growth of the sodium silicate market in the coming years.

Wide Applications in Water Treatment and Environmental Sustainability

Sodium silicate plays a vital role in the water treatment industry, where it is used as a coagulant in the removal of impurities and heavy metals from water. As global water contamination issues intensify, the need for effective water treatment solutions has become paramount. Sodium silicate is also used to treat wastewater in various industrial applications, ensuring that water is returned to the environment in a safe and purified state. For instance, a study published by the Royal Society of Chemistry highlights that sodium silicate has been used in drinking water treatment for decades, both as a sequestrant and corrosion inhibitor. Research has shown that sodium silicate reduces water discoloration caused by iron particles and improves water quality. In practical applications, sodium silicate is widely adopted in industrial wastewater treatment systems, ensuring compliance with environmental standards. Additionally, with growing concerns over environmental sustainability, there is an increasing preference for eco-friendly and non-toxic chemicals in water treatment processes. Sodium silicate, being a sustainable and relatively harmless chemical, fits well into the trend towards green chemicals, thus driving its demand in the water treatment sector.

Rising Applications in the Construction Industry

The construction industry is a significant consumer of sodium silicate, primarily in the production of concrete. Sodium silicate is used as an additive in concrete to improve its properties, such as strength, water resistance, and durability. This application is particularly important in areas exposed to harsh weather conditions, where concrete must endure extreme temperatures, moisture, and wear. The growing demand for infrastructure development, particularly in emerging markets, is one of the key drivers for sodium silicate consumption. Governments worldwide are investing in large-scale infrastructure projects, including bridges, roads, and buildings, which require high-quality concrete. The increasing need for durable and high-performance construction materials to meet these demands is boosting the market for sodium silicate. Moreover, sodium silicate is also used in fire-resistant coatings, which is gaining traction in the construction of high-rise buildings and other fire-sensitive structures, further promoting its use in the construction sector.

Technological Advancements and Innovations in Industrial Applications

Continuous advancements in technology and the development of innovative applications are playing a crucial role in driving the demand for sodium silicate. In industries like automotive, textiles, and paper manufacturing, sodium silicate is increasingly being used in advanced processes due to its cost-effectiveness and ability to meet stringent industry requirements. In the automotive industry, for example, sodium silicate is used in the manufacturing of silica tires, where it improves the performance and safety of the tires. The growing emphasis on improving fuel efficiency and reducing carbon emissions is encouraging automotive manufacturers to adopt silica tires, which are lighter and more durable than conventional tires. Similarly, in the textile industry, sodium silicate is used in the processing of fabrics, where it helps in the dyeing and printing processes. Its use in the paper industry also continues to grow, where it is used as a binder and stabilizer for paper coatings and as a deflocculant in the production of paper pulp. These ongoing innovations and expanded applications are expected to further stimulate market growth, as industries continue to look for more efficient and cost-effective solutions.

Market Trends

Shift Toward Eco-friendly and Sustainable Products

As environmental concerns continue to rise globally, there is a notable shift towards sustainable and eco-friendly chemicals in various industries. Sodium silicate, being a natural and environmentally benign substance, has gained popularity due to its non-toxic and biodegradable nature. Its increasing use in green formulations for detergents, paints, coatings, and water treatment solutions aligns with the growing consumer and regulatory demand for sustainable products. For instance, PQ Corporation, a leading producer of inorganic chemicals, has integrated sodium silicate into its eco-friendly detergent formulations, contributing to the industry’s sustainability efforts. OxyChem, another major player, has developed sodium silicate-based adhesives and coatings that minimize environmental impact. BASF, with a revenue of $78 billion in 2022, has focused on sustainable solutions, utilizing sodium silicate in water treatment applications to reduce pollution. Industries are under pressure to adopt environmentally responsible manufacturing practices, and sodium silicate’s ability to fulfill this demand, while offering functional benefits, makes it a preferred choice in many applications. Moreover, its role as a cleaning agent in wastewater treatment aligns with sustainability goals, helping to reduce environmental pollution and conserve water resources. This trend is expected to accelerate as regulations on chemical safety and environmental impact become stricter across key markets.

Rising Demand in the Automotive Industry

The automotive industry is witnessing increased demand for high-performance materials that contribute to improved fuel efficiency and sustainability. Sodium silicate plays a key role in manufacturing silica-based tires, which are lightweight and offer superior fuel efficiency compared to traditional tires. For instance, Ramcharan Company has developed a patented solid-state sodium battery using sodium silicate, demonstrating its potential in sustainable energy storage. Sodium silicate is also used in the production of silica, which, when incorporated into tires, enhances their durability, performance, and safety. As the global automotive industry shifts towards fuel-efficient and electric vehicles, the demand for silica tires is growing. This trend is particularly prevalent in regions with stringent emission regulations and a high focus on reducing the carbon footprint of vehicles. As automakers look for advanced materials to improve vehicle performance and reduce environmental impact, sodium silicate is becoming an increasingly important ingredient in the production of high-quality automotive components.

Technological Advancements in Sodium Silicate Production

Ongoing advancements in sodium silicate production technology are improving efficiency, reducing costs, and increasing production capacity. Innovative methods are being developed to optimize the synthesis of sodium silicate, such as more energy-efficient processes and the use of alternative raw materials. These advancements are particularly relevant in regions with a growing demand for industrial-grade sodium silicate. For instance, advancements in furnace technology have led to better control over production processes, which results in higher-quality products with fewer impurities. Additionally, emerging production methods are being designed to use lower-cost raw materials, making sodium silicate more affordable and accessible to a broader range of industries. These technological innovations not only enhance product quality but also align with the global push towards energy efficiency and cost-effective manufacturing.

Growing Demand for Specialty and High-Performance Sodium Silicates

There is a rising trend toward the development and use of specialty and high-performance sodium silicates that offer tailored properties for specific applications. These formulations, designed to meet the exacting demands of industries such as electronics, automotive, and construction, are gaining traction. For example, high-performance sodium silicates are used in the production of advanced concrete that is more durable, water-resistant, and heat-resistant, making it ideal for use in infrastructure projects in extreme climates. In the electronics industry, specialized sodium silicates are employed in the production of semiconductors and as a key ingredient in the manufacture of coatings and adhesives. The demand for these high-performance products is expected to continue to grow as industries strive to meet higher standards for efficiency, longevity, and sustainability in their products. This trend is supported by increased research and development efforts aimed at expanding the scope of sodium silicate’s applications across various high-demand sectors.

Market Challenges

Fluctuations in Raw Material Prices

One of the primary challenges faced by the global sodium silicate market is the fluctuation in the prices of raw materials used in its production. Sodium silicate is typically derived from sand, soda ash, and other natural resources, and their prices can vary significantly due to factors such as supply chain disruptions, geopolitical tensions, and changes in demand for these materials in other industries. For instance, in 2024, the price of sodium carbonate, a key raw material, experienced a decline before stabilizing. Volatility in raw material prices impacts the overall production cost of sodium silicate, which in turn affects the pricing of the final product. This is particularly challenging for manufacturers who need to maintain price competitiveness while ensuring product quality. Furthermore, industries relying on sodium silicate for key applications, such as detergents and construction, are often faced with higher operational costs, which may lead to reduced margins or price hikes. The continuous fluctuations in raw material costs require sodium silicate manufacturers to find ways to optimize their production processes and mitigate the effects of such price volatility, often through strategic sourcing or long-term contracts with suppliers. Some manufacturers have invested in research and development to improve the chemical and physical properties of sodium silicate, aiming to enhance efficiency and reduce costs. Without effective cost management strategies, manufacturers may face challenges in maintaining profitability and market share in a highly competitive environment.

Environmental and Regulatory Compliance

Environmental regulations regarding the use and disposal of chemicals are becoming increasingly stringent across global markets. Sodium silicate manufacturers must navigate these regulations to ensure compliance and minimize their environmental footprint. While sodium silicate is considered relatively safe and eco-friendly compared to many other industrial chemicals, the production process itself can still have environmental impacts. For example, the energy-intensive nature of sodium silicate production, which involves high-temperature furnaces, contributes to carbon emissions. Additionally, wastewater and waste by-products generated during production may pose disposal challenges. As governments worldwide implement stricter environmental standards, manufacturers must invest in technologies and processes that reduce emissions, manage waste effectively, and improve energy efficiency. Meeting these regulatory requirements often requires significant investments in infrastructure and technology, which can increase operational costs. Furthermore, failure to comply with evolving environmental regulations can result in legal and financial penalties, reputational damage, and even the closure of non-compliant facilities. Therefore, navigating these challenges while maintaining a sustainable production process is crucial for companies in the global sodium silicate market to remain competitive and compliant with international standards.

Market Opportunities

Expansion of Applications in Renewable Energy and Environmental Solutions

The global sodium silicate market presents significant opportunities in the renewable energy and environmental sectors. Sodium silicate is increasingly being utilized in the development of advanced materials for energy storage and conversion systems. For instance, it plays a key role in the production of sodium-ion batteries, which are gaining attention as a cost-effective and sustainable alternative to lithium-ion batteries. These batteries are particularly useful for large-scale energy storage, making sodium silicate crucial in the renewable energy storage landscape. Additionally, as global attention shifts towards reducing carbon footprints, sodium silicate’s role in water treatment, wastewater management, and its use in eco-friendly formulations for detergents and coatings presents an opportunity to expand its market reach. With the increasing demand for sustainable solutions in energy, water, and industrial sectors, sodium silicate’s diverse applications offer promising growth prospects, especially in markets focused on green technologies.

Growing Demand from Emerging Economies

Emerging economies, particularly in Asia-Pacific, Latin America, and Africa, offer a significant growth opportunity for the global sodium silicate market. As industrialization accelerates in these regions, there is an increased demand for sodium silicate in applications such as detergents, construction, and water treatment. The rising middle class in these regions is driving greater consumer demand for cleaning products, which in turn boosts the use of sodium silicate in detergent formulations. Additionally, rapid urbanization and infrastructure development in countries like China, India, Brazil, and others are propelling the demand for durable construction materials, where sodium silicate is used in concrete production. The growing industrial and residential construction sectors in these regions represent an expanding market for sodium silicate, creating new avenues for manufacturers to explore.

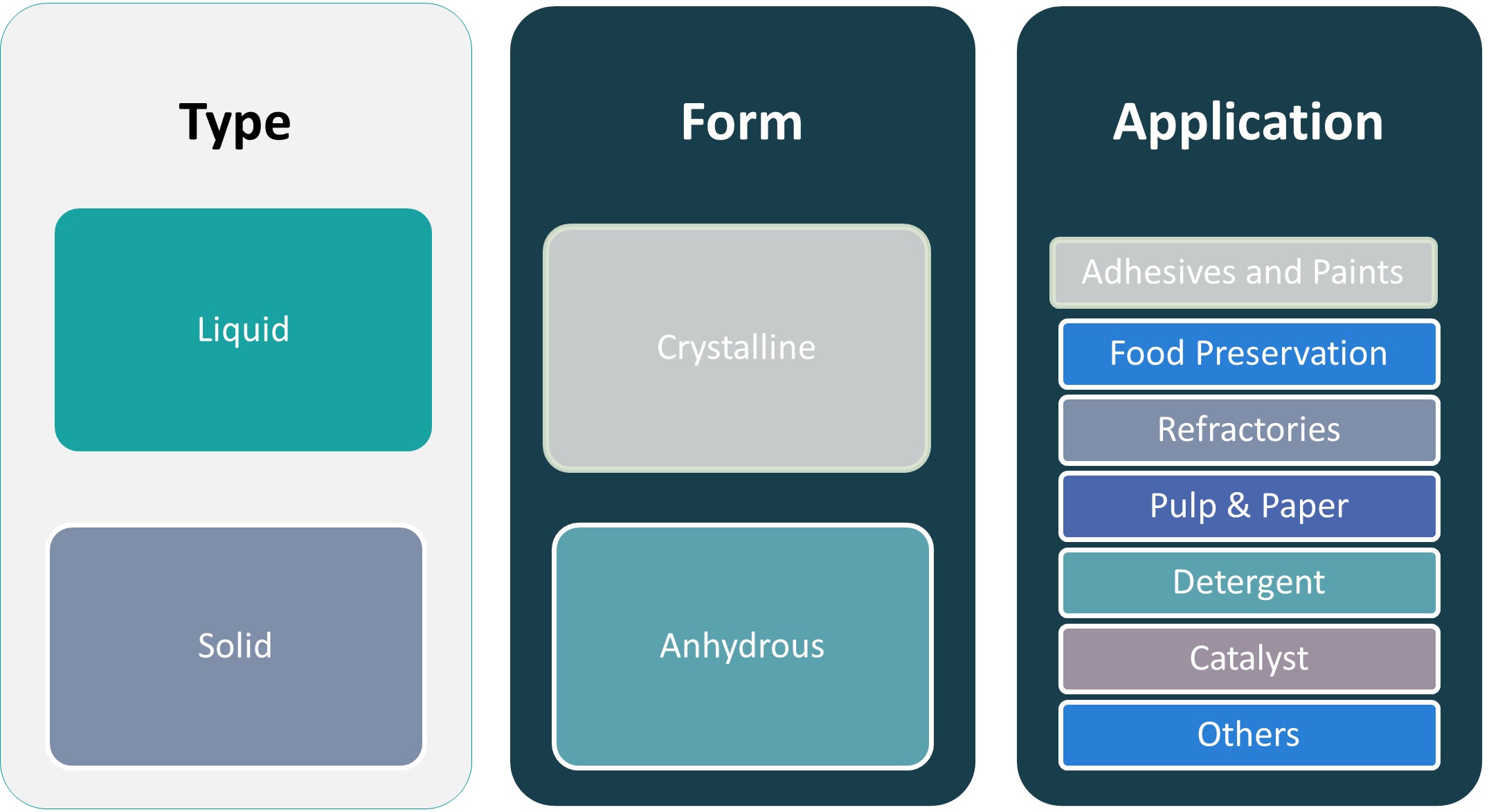

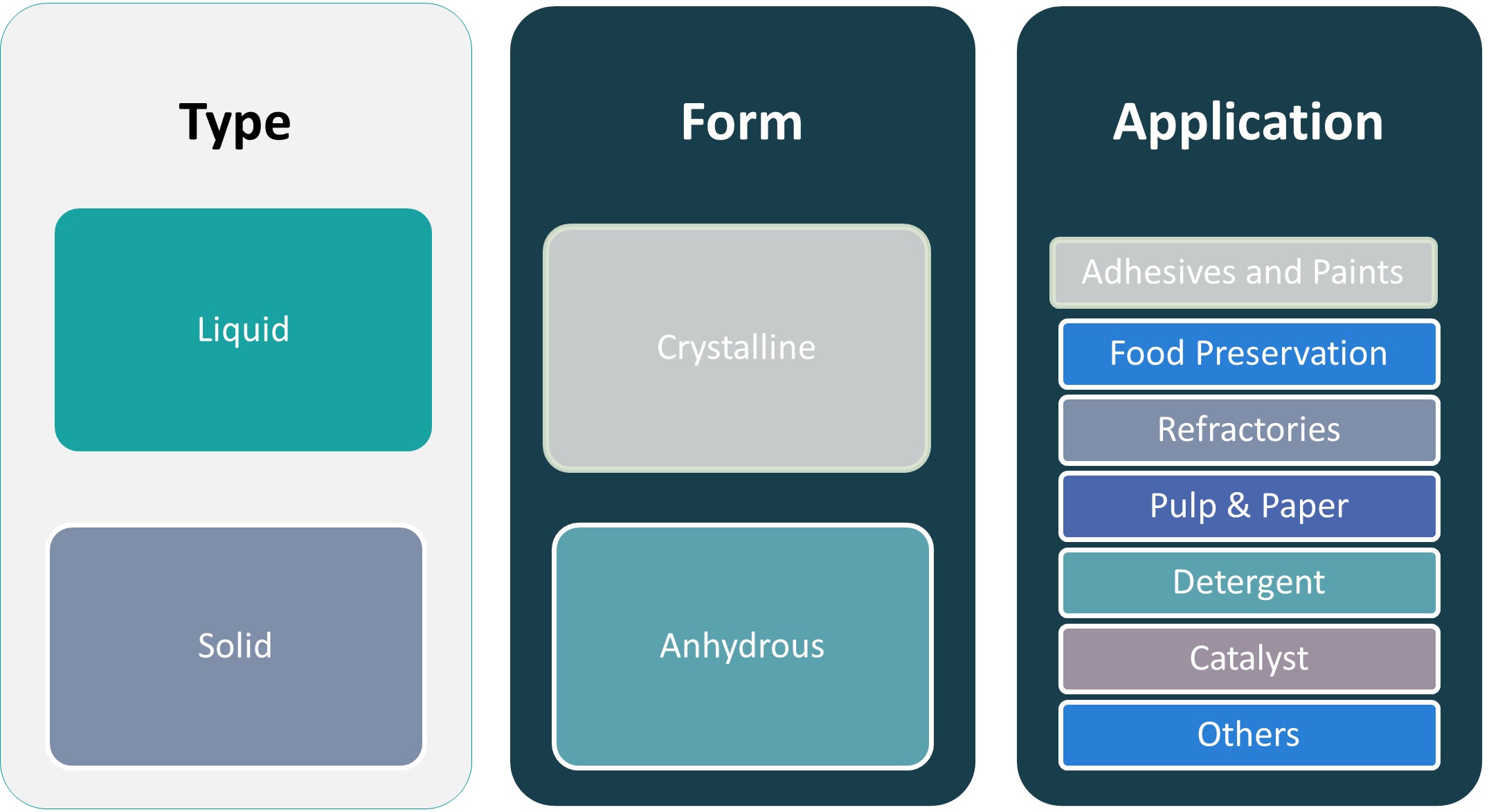

Market Segmentation Analysis

By Type

The sodium silicate market is primarily segmented by type into liquid and solid forms. Liquid sodium silicate holds a larger market share due to its wide applicability in various industrial sectors. It is used extensively in detergents, water treatment, and as a concrete additive. Its liquid form is preferred for processes that require quick and efficient mixing, such as in detergents where it functions as a detergent builder, stabilizer, and anti-corrosive agent. Solid sodium silicate, on the other hand, is often used in the production of adhesives, refractories, and in applications where a more stable and durable form is necessary. While liquid sodium silicate continues to dominate, solid sodium silicate is gaining traction due to its applications in industries requiring higher thermal resistance and structural integrity, such as in the manufacture of ceramic and metal products.

By Form

Sodium silicate is also classified by its form into crystalline and anhydrous types. Crystalline sodium silicate is often used in applications where a defined structure is required, such as in the production of detergents and concrete additives. Its ability to form specific crystal structures makes it valuable for controlled reactivity and bonding. Anhydrous sodium silicate, which lacks water content, is typically used in high-temperature applications such as in the manufacture of refractory materials and catalysts. The anhydrous form is favored for industrial processes that demand higher purity levels and are sensitive to moisture. As industries look for materials that offer specific performance characteristics, both forms continue to find diverse applications across multiple sectors.

Segments

Based on Type

Based on Form

Based on Application

- Adhesives and Paints

- Food Preservation

- Refractories

- Pulp & Paper

- Detergent

- Catalyst

- Others

Based on Region

- orth America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

Asia Pacific (40%)

Asia Pacific holds the largest market share in the global sodium silicate market, accounting for approximately 40% of the total market. The region’s dominance is primarily due to rapid industrialization, urbanization, and the burgeoning manufacturing sector in countries like China, India, and Japan. The demand for sodium silicate is driven by its use in detergents, concrete additives, and water treatment applications, which are critical to the growing urban infrastructure in these countries. Additionally, the strong presence of industries such as automotive, textiles, and paper production further boosts market demand. China, in particular, is a major consumer of sodium silicate due to its extensive costruction and manufacturing activities.

North America (25%)

North America holds a significant share of around 25% in the global sodium silicate market, with the United States being the largest contributor. The demand in this region is driven by the automotive, construction, and detergent industries, where sodium silicate plays a key role in product formulations and manufacturing processes. Additionally, there is a growing focus on sustainable and eco-friendly chemicals, which supports the adoption of sodium silicate in green technologies such as water treatment and energy storage. The increasing demand for high-performance materials in automotive and construction sectors is also contributing to market growth in North America.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key players

- Occidental Petroleum Corporation

- Evonik Industries

- CIECH Group

- Nippon Chemical Industrial Co. Ltd.

- Oriental Silicas Corporation

Competitive Analysis

The global sodium silicate market is highly competitive, with several key players holding significant market shares. Occidental Petroleum Corporation, a major player, leverages its extensive petrochemical portfolio to enhance its sodium silicate offerings, particularly in high-demand sectors such as detergents and construction. Evonik Industries stands out for its innovation in specialty chemicals, with a strong focus on developing sustainable sodium silicate formulations that meet environmental standards. CIECH Group has strengthened its position in the market through its diverse product portfolio and robust distribution network across Europe. Nippon Chemical Industrial Co. Ltd. and Oriental Silicas Corporation focus on regional markets in Asia, offering tailored sodium silicate solutions for industries like automotive and paper manufacturing. Overall, these companies are increasingly focusing on sustainability, technological advancements, and expanding their product ranges to gain a competitive edge in the global market.

Recent Developments

- In May 2025, Evonik announced a global net price increase of up to 5–8% for its MetAMINO (DL-methionine 99% feed grade) product, effective immediately. All existing contracts and supply agreements will be honored.

- In November 2024, Kraton announced a global price increase of \$330 per metric ton for all SIS polymer products, effective January 1, 2025. This decision was driven by rising raw material and process chemical costs.

- In September 2024, CIECH Vitrosilicon initiated the construction of a new warehouse at its Żary plant to enhance sodium silicate production capabilities and logisticsefficiency.

- In May 2024, Orablue Chem Pvt. Ltd. participated in ChemExpo 2024 in Mumbai, showcasing its range of sodium metabisulphite and sodium metasilicate products.

- In April 2024, Wacker Chemie AG reported a 22% decline in sales for 2023, attributed to lower prices and volumes, reflecting challenges in the global chemical market.

- In March 2024, Sasol announced plans to expand its sodium silicate production capacity to meet increasing demand in the detergent and water treatment sectors.

Market Concentration and Characteristics

The global sodium silicate market exhibits moderate concentration, with a few key players dominating the industry. Companies such as Occidental Petroleum Corporation, Evonik Industries, and CIECH Group hold significant market shares due to their established production capabilities, extensive product portfolios, and strong distribution networks. The market is characterized by a high degree of product diversification, catering to a wide range of industries including detergents, construction, water treatment, and automotive. Technological advancements, sustainable product formulations, and the ability to meet stringent environmental regulations are becoming key competitive factors. While large corporations lead in terms of production volume and market reach, regional players like Nippon Chemical Industrial Co. Ltd. and Oriental Silicas Corporation maintain strong positions in specific geographical markets, particularly in Asia. As demand for eco-friendly and high-performance materials grows, companies are increasingly focused on innovation and sustainability to differentiate themselves in this competitive landscape.

Report Coverage

The research report offers an in-depth analysis based on Type, Form, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The growing global demand for detergents, driven by increasing urbanization and higher living standards, will continue to bolster the sodium silicate market. As a key ingredient in detergent formulations, sodium silicate will see sustained demand.

- Increasing emphasis on sustainability will drive the adoption of sodium silicate in environmentally friendly products, especially in detergents and water treatment solutions. Manufacturers will focus on developing more eco-friendly sodium silicate formulations.

- Rapid industrialization and urbanization in emerging economies, particularly in Asia Pacific, will offer significant growth opportunities for the sodium silicate market. The demand for infrastructure and consumer products will continue to rise, boosting market prospects.

- Technological innovations in sodium silicate production, including more energy-efficient processes, will enhance manufacturing capabilities and reduce production costs. This will improve the overall market supply and affordability of sodium silicate.

- Growing concerns about water scarcity and contamination will drive the demand for sodium silicate in water treatment applications. Its role in purifying water and wastewater will expand in both industrial and municipal sectors.

- With the rise of infrastructure projects globally, particularly in developing regions, sodium silicate will continue to be a key component in construction materials, especially for producing durable concrete and fire-resistant coatings.

- New and advanced applications of sodium silicate, particularly in the automotive, electronics, and paper industries, will diversify its market potential. These innovations will allow sodium silicate to penetrate new industrial sectors.

- The market will witness a shift toward specialty and high-performance sodium silicate products tailored to specific industries, offering enhanced properties like better heat resistance and durability, especially in refractories and catalysts.

- Consumer demand for environmentally conscious products will continue to drive the sodium silicate market, especially in sectors like food preservation and personal care, where non-toxic, biodegradable ingredients are increasingly sought after.

- Governments worldwide are likely to introduce more favorable regulations for sustainable chemicals, providing an opportunity for the sodium silicate market to expand further. Support for green manufacturing practices will encourage the use of sodium silicate in diverse applications.