Market Overview

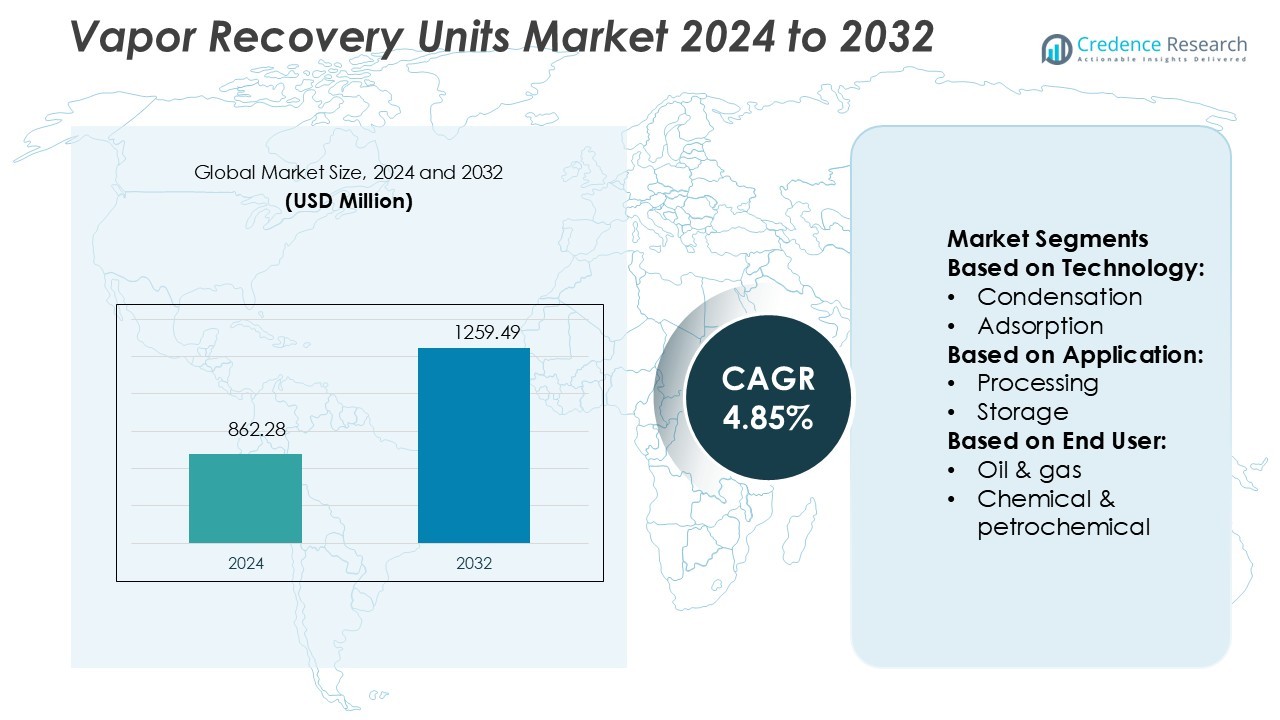

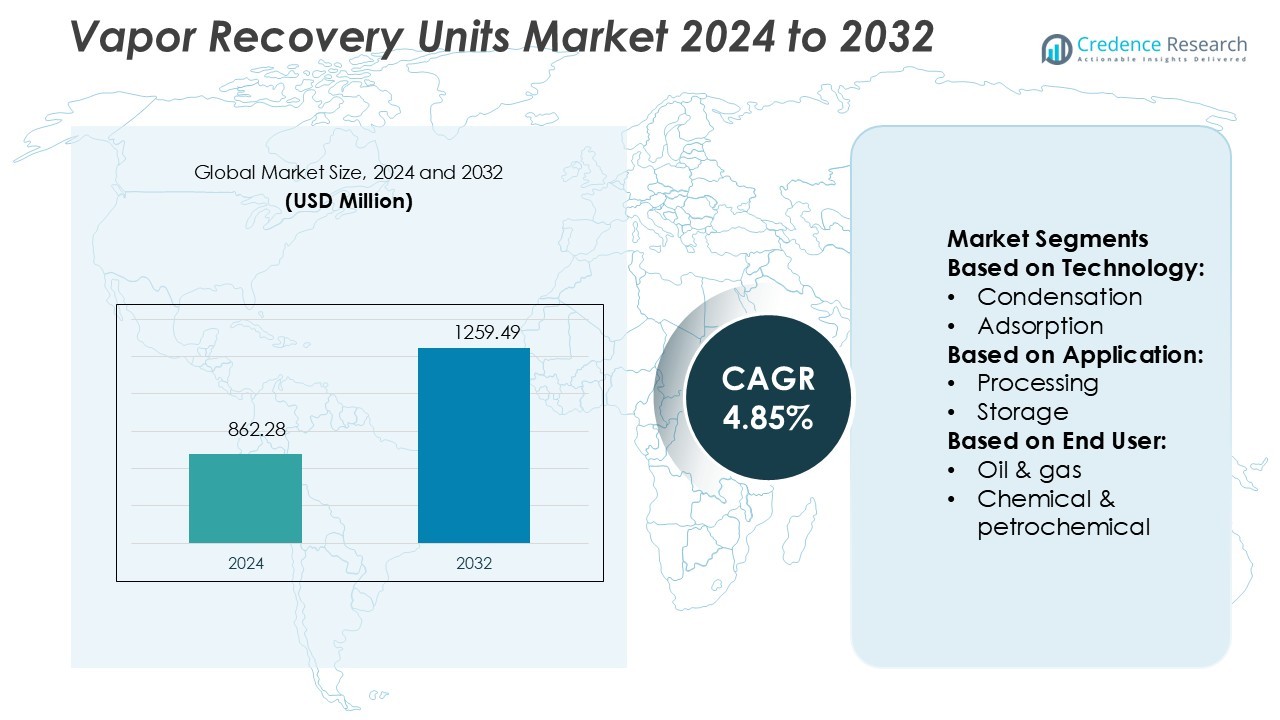

Vapor Recovery Units Market size was valued USD 862.28 million in 2024 and is anticipated to reach USD 1259.49 million by 2032, at a CAGR of 4.85% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vapor Recovery Units Market Size 2024 |

USD 862.28 Million |

| Vapor Recovery Units Market, CAGR |

4.85% |

| Vapor Recovery Units Market Size 2032 |

USD 1259.49 Million |

The vapor recovery units market is shaped by leading players including Kilburn, ALMA Group, Cimarron Energy, Koch Engineered Solutions, PSG, Cool Sorption, KAPPA GI, Ingersoll Rand, Flogistix, and BORSIG. These companies strengthen their positions through advanced technology development, emission reduction solutions, and integration of automation to improve recovery efficiency. North America holds the leading regional share at 36%, supported by strict environmental regulations, strong enforcement of emission control standards, and extensive adoption in oil and gas refineries, petrochemical plants, and storage facilities. This dominance highlights the region’s commitment to sustainability and innovation in emission management.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The vapor recovery units market was valued at USD 862.28 million in 2024 and is projected to reach USD 1259.49 million by 2032, registering a CAGR of 4.85% during the forecast period.

- Stringent environmental regulations and the need to reduce volatile organic compound emissions drive market growth, with industries adopting advanced recovery systems to meet compliance and sustainability goals.

- Key players such as Kilburn, ALMA Group, Cimarron Energy, Koch Engineered Solutions, PSG, Cool Sorption, KAPPA GI, Ingersoll Rand, Flogistix, and BORSIG enhance competitiveness through technology innovation and automation integration.

- High installation and maintenance costs remain a major restraint, particularly for small operators in developing regions, limiting widespread adoption despite long-term cost savings from recovered fuel.

- North America leads with a 36% share, while processing applications dominate end-use demand, supported by strong uptake in oil and gas refineries and petrochemical facilities across global markets.

Market Segmentation Analysis:

By Technology

In the vapor recovery units market, adsorption technology leads with the largest share. Its dominance comes from high efficiency in capturing volatile organic compounds (VOCs) and cost-effectiveness in large-scale applications. Industries such as oil refineries and petrochemical plants prefer adsorption due to its ability to achieve high recovery rates and reduce emissions effectively. Condensation and absorption follow, supported by their use in specific process conditions where temperature or solubility plays a role. Compression remains a niche option, applied in systems requiring pressure-based recovery methods.

- For instance, Kilburn offers an adsorption-based vapor recovery system designed for refinery and fuel terminal operations that is capable of achieving high hydrocarbon recovery efficiencies, Kilburn claims a removal efficiency of “up to 99.98% of hydrocarbon content from the exhaust air”.

By Application

Processing applications dominate the market, holding the largest share due to extensive use in oil and gas refineries. These facilities require continuous vapor recovery to meet environmental regulations and ensure operational safety. Storage applications also contribute significantly, driven by growing adoption in tank farms and terminals to minimize emissions. Transportation, though smaller, is gaining traction as regulators push for vapor management in fuel distribution and shipping. The widespread use of vapor recovery during processing highlights its critical role in emission control and operational efficiency.

- For instance, Cimarron provides advanced combustor systems, including enclosed combustors and ultra-low NOx solutions. The company has multiple EPA-certified combustor models designed to achieve and exceed 98% Destruction Removal Efficiency (DRE).

By End User

The oil and gas sector is the dominant end-user segment in the vapor recovery units market. High adoption levels are driven by stringent emission norms and the sector’s significant role in VOC generation. Upstream and downstream operators deploy vapor recovery systems to meet compliance standards and reduce product losses. Chemical and petrochemical industries follow, integrating these systems to address emissions from solvents and processing units. The “others” segment, which includes food and beverage and pharmaceuticals, shows steady growth as sustainability efforts expand into diverse industries.

Key Growth Drivers

Stringent Environmental Regulations

Government regulations mandating VOC emission reduction serve as a primary growth driver for the vapor recovery units market. Regulatory bodies across North America, Europe, and Asia-Pacific enforce strict compliance on storage tanks, pipelines, and refineries to curb air pollution. These regulations compel industries such as oil and gas and petrochemicals to adopt vapor recovery systems to meet emission standards. As fines for non-compliance rise, operators are investing in advanced vapor recovery technologies to ensure operational sustainability while aligning with climate and environmental protection goals.

- For instance, John Zink’s Vapor Combustion Units (VCUs) have been field-proven in numerous industrial applications to attain VOC destruction efficiencies greater than 99.99%, resulting in hydrocarbon emissions less than 10 mg per litre of product transferred.

Increasing Oil and Gas Industry Activities

Rising oil and gas production and refining activities significantly boost the demand for vapor recovery units. These systems minimize product loss by capturing hydrocarbons during processing, storage, and transportation. The expanding shale gas sector, coupled with new exploration projects, increases vapor emissions, making recovery systems essential. Furthermore, the growing need for operational efficiency and energy conservation in upstream and downstream operations enhances market adoption. With oil majors focusing on optimizing resources and reducing waste, vapor recovery technology becomes integral to industrial operations.

- For instance, The NG360 Series compressors have a flow rate of 36 CFM (61.2 m³/hr) at maximum rpm.The MAWP is 350 psi (24.1 bar).The compressors are designed for a wide range of wellhead applications in oil and gas production and storage.

Focus on Energy Efficiency and Cost Savings

Industries are increasingly prioritizing energy-efficient operations and cost reductions, which drive vapor recovery unit adoption. Captured vapors are often reused as valuable fuel, helping companies cut energy expenses while reducing emissions. This dual benefit creates strong economic incentives for adoption, particularly in cost-sensitive industries like refining and chemicals. Technological advancements in adsorption and absorption recovery systems further enhance recovery efficiency, maximizing fuel savings. As businesses shift toward cleaner and more efficient operations, demand for vapor recovery solutions continues to expand globally.

Key Trends & Opportunities

Integration with Advanced Automation Technologies

The integration of vapor recovery systems with automation and digital monitoring tools represents a key market trend. Operators are adopting IoT-enabled systems and advanced sensors to track VOC levels in real time. These upgrades improve process efficiency, reduce downtime, and enhance compliance monitoring. Automated control systems also optimize vapor recovery under varying operating conditions, providing cost savings. This trend creates opportunities for vendors to offer digitally enhanced, data-driven recovery solutions that align with smart industry practices and regulatory transparency requirements.

- For instance, Cool Sorption’s VRU “Terminal Series” uses a proprietary 3-bed CVA (Carbon Vacuum Adsorption) design with a bed-cycle time of 7 minutes, with each bed in adsorption mode for two cycles.

Rising Adoption in Emerging Economies

Emerging economies across Asia-Pacific, Latin America, and the Middle East present significant growth opportunities. Industrialization and expanding oil and chemical sectors in these regions increase VOC emissions, prompting regulatory actions. As governments introduce emission control measures, demand for vapor recovery units grows rapidly. Additionally, rising investments in refining infrastructure and petrochemical capacity boost adoption. Global manufacturers see these regions as untapped markets where stricter environmental policies and industrial expansion converge, fueling long-term growth opportunities for vapor recovery solutions.

- For instance, Cool Sorption’s VRU “Terminal Series” uses a proprietary 3-bed CVA (Carbon Vacuum Adsorption) design with a bed-cycle time of 7 minutes, with each bed in adsorption mode for two cycles.

Shift Toward Sustainability and Green Operations

The global shift toward sustainability is influencing widespread adoption of vapor recovery technologies. Companies are aligning their strategies with net-zero emission goals, focusing on emission reduction as part of corporate sustainability programs. Vapor recovery units help achieve both environmental and economic targets by reducing greenhouse gases while recovering valuable hydrocarbons. Growing investor and consumer pressure on industries to adopt eco-friendly practices accelerates this shift. This trend strengthens the market’s long-term potential by embedding vapor recovery into sustainability-driven industrial practices.

Key Challenges

High Initial Capital Investment

The high upfront cost of installing vapor recovery systems remains a significant challenge for market growth. Smaller operators and companies in cost-sensitive markets often delay adoption due to financial constraints. The investment includes not only equipment but also engineering, installation, and maintenance expenses. Although long-term savings from recovered fuel can offset costs, budget limitations hinder adoption in developing markets. This barrier particularly affects small refineries, storage facilities, and transport operators who face difficulty justifying the immediate expense.

Complex Maintenance and Operational Issues

Maintenance complexity and operational reliability issues pose another challenge in the vapor recovery units market. Systems require regular monitoring and skilled technicians to maintain performance levels, especially in adsorption and absorption technologies. Inadequate maintenance can lead to inefficiency, downtime, or safety risks, undermining overall effectiveness. Developing regions often face a shortage of technical expertise, creating barriers to effective deployment. Ensuring consistent operational reliability increases costs and complicates adoption for industries seeking low-maintenance, highly reliable solutions.

Regional Analysis

North America

North America dominates the vapor recovery units market with a 36% share, driven by stringent environmental regulations from the Environmental Protection Agency (EPA) and strong enforcement of Clean Air Act standards. The U.S. leads regional adoption, with widespread deployment across refineries, petrochemical plants, and storage facilities. Rising shale gas production and extensive midstream operations further fuel demand for vapor recovery systems. Canada follows with strong investments in emission control technologies to align with national climate commitments. The combination of regulatory enforcement, technological innovation, and robust oil and gas activity secures North America’s leading market position.

Europe

Europe accounts for 28% of the vapor recovery units market, supported by the European Union’s strict emission directives and focus on sustainability. Countries such as Germany, the UK, and France invest heavily in recovery technologies to comply with industrial emission reduction goals. Refineries and chemical industries remain major adopters, while expansion in LNG terminals also supports demand. The EU’s commitment to carbon neutrality by 2050 accelerates adoption across industries. Ongoing integration of automation and advanced monitoring systems enhances efficiency, strengthening Europe’s competitive edge in developing sustainable and regulatory-compliant vapor recovery technologies.

Asia-Pacific

Asia-Pacific holds a 22% share of the vapor recovery units market and is the fastest-growing region. China and India lead adoption due to rapid industrialization, expanding refining capacity, and tightening emission norms. Rising investments in petrochemical facilities and oil storage terminals further drive demand. Japan and South Korea contribute with advanced technology integration in recovery processes. Growing awareness of environmental impacts, coupled with government-backed emission control programs, expands opportunities across the region. With increasing foreign investment and infrastructure development, Asia-Pacific emerges as a critical growth hub for vapor recovery unit adoption.

Latin America

Latin America captures a 9% share in the vapor recovery units market, with Brazil and Mexico as key contributors. Expanding oil and gas exploration activities, combined with increasing regulatory measures, drive adoption of vapor recovery technologies. Refineries and fuel storage facilities in Brazil integrate these systems to limit emissions and product losses. Mexico, under its energy reforms, is enhancing recovery systems to modernize operations and attract investment. However, slower regulatory enforcement compared to developed regions limits rapid penetration. Despite this, industrial expansion and infrastructure projects support steady growth prospects in Latin America’s vapor recovery unit demand.

Middle East & Africa

The Middle East & Africa region represents 5% of the vapor recovery units market, driven primarily by the oil-rich economies of Saudi Arabia, UAE, and South Africa. Adoption is motivated by rising global pressure on emission reductions and the need to enhance operational efficiency in hydrocarbon sectors. Refineries and petrochemical complexes invest in vapor recovery systems to reduce losses and align with international environmental standards. Africa’s growth remains moderate due to weaker regulatory frameworks, though infrastructure projects in South Africa show potential. The region’s expansion is tied closely to oil and gas sector modernization and global sustainability trends.

Market Segmentations:

By Technology:

By Application:

By End User:

- Oil & gas

- Chemical & petrochemical

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The vapor recovery units market features strong competition from key players such as Kilburn, ALMA Group, Cimarron Energy, Koch Engineered Solutions, PSG, Cool Sorption, KAPPA GI, Ingersoll Rand, Flogistix, and BORSIG. The vapor recovery units market is highly competitive, shaped by continuous technological advancements and growing regulatory pressures. Companies are focusing on delivering solutions that enhance efficiency, reduce operational costs, and ensure compliance with stringent emission norms. Innovation in adsorption, absorption, and digital monitoring technologies is central to maintaining market competitiveness. Strategic partnerships, mergers, and acquisitions are also common, allowing firms to expand global presence and strengthen product portfolios. Additionally, sustainability-driven initiatives and integration of automation are key differentiators, as industries demand reliable, cost-effective, and environmentally aligned vapor recovery solutions to support long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kilburn

- ALMA Group

- Cimarron Energy

- Koch Engineered Solutions

- PSG

- Cool Sorption

- KAPPA GI

- Ingersoll Rand

- Flogistix

- BORSIG

Recent Developments

- In February 2025, Zeeco launched an advanced research complex at its Global Technology Center in Oklahoma. The ARC is a cutting-edge addition to the GTC, which already houses the world’s largest industrial-scale combustion research and test facility. It offers multiple fully equipped pad sites to support heavy industries in designing, developing, and testing new combustion and pollution-control technologies.

- In January 2025, LyondellBasell was selected by Indian Oil Corporation Ltd. (IOCL) for its advanced HDPE technology, marking a significant step in enhancing polyethylene production capabilities. This partnership is expected see the development of high-density polyethylene (HDPE) resins that can be utilized in a range of industries, including packaging, infrastructure, and agriculture.

- In July 2024, Dover announced the acquisition of Demaco Holland B.V. The company joined OPW Clean Energy Solutions division within Dover’s Clean Energy & Fueling segment. The company specializes in cryogenic flow control components including vacuum-jacketed piping, separators, sub-coolers, valves, couplings, loading arms, and level sensors, supporting hydrogen and industrial gas applications.

- In June 2024, SCS Technologies unveiled a new line of pre-engineered vapor recovery units at the Mitigation Technology & Innovation Summit. Designed for flexibility and efficiency, these configurable VRUs offer tailored performance to meet diverse customer equipment, while delivering cost-effective, high-value solutions for emission control and hydrocarbon recovery.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as stricter emission regulations drive widespread adoption of vapor recovery units.

- Oil and gas operators will continue leading demand, supported by new refining and storage projects.

- Asia-Pacific will emerge as the fastest-growing region due to rapid industrialization and regulatory actions.

- Integration of IoT and automation will enhance monitoring, efficiency, and compliance across recovery systems.

- Sustainability goals will push industries to adopt vapor recovery as part of green operations.

- Chemical and petrochemical industries will increase investments to manage emissions effectively.

- Cost-saving benefits from fuel recovery will encourage adoption in cost-sensitive industries.

- Partnerships and acquisitions will accelerate technology expansion and global market penetration.

- Rising awareness in emerging markets will create new opportunities for adoption and growth.

- Continuous innovation in adsorption and absorption technologies will strengthen system performance and reliability.