Market Overview

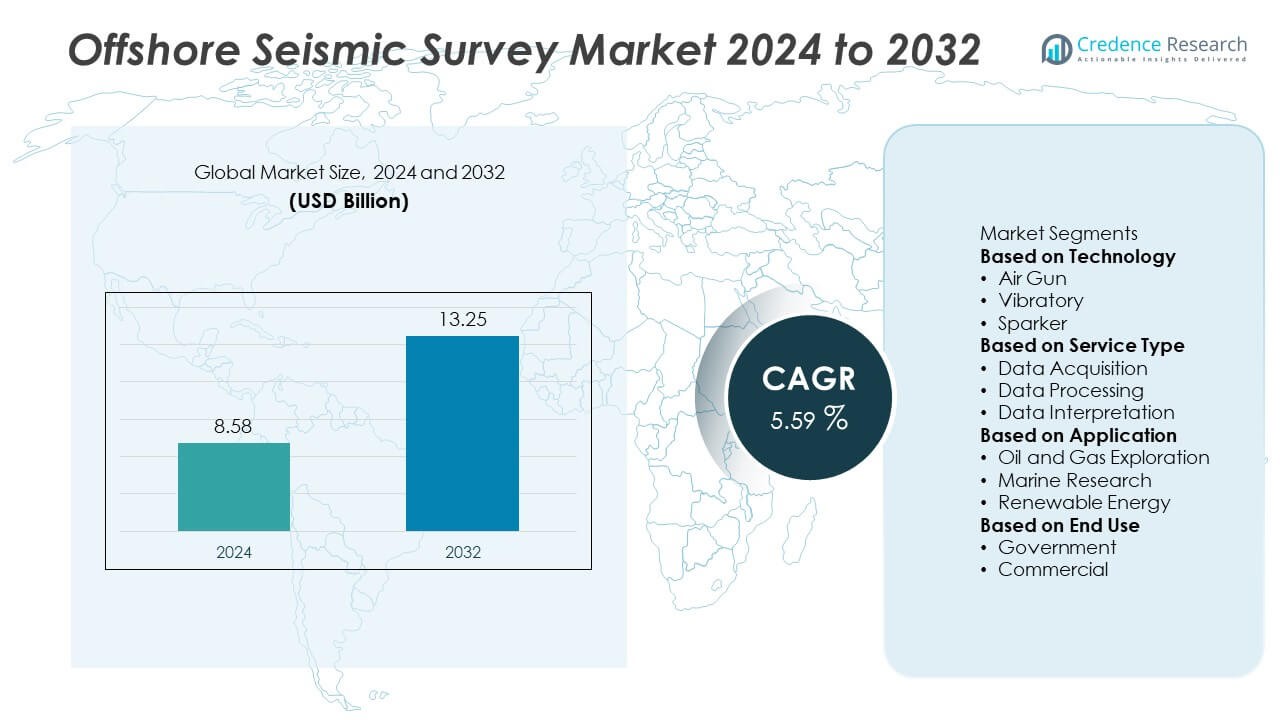

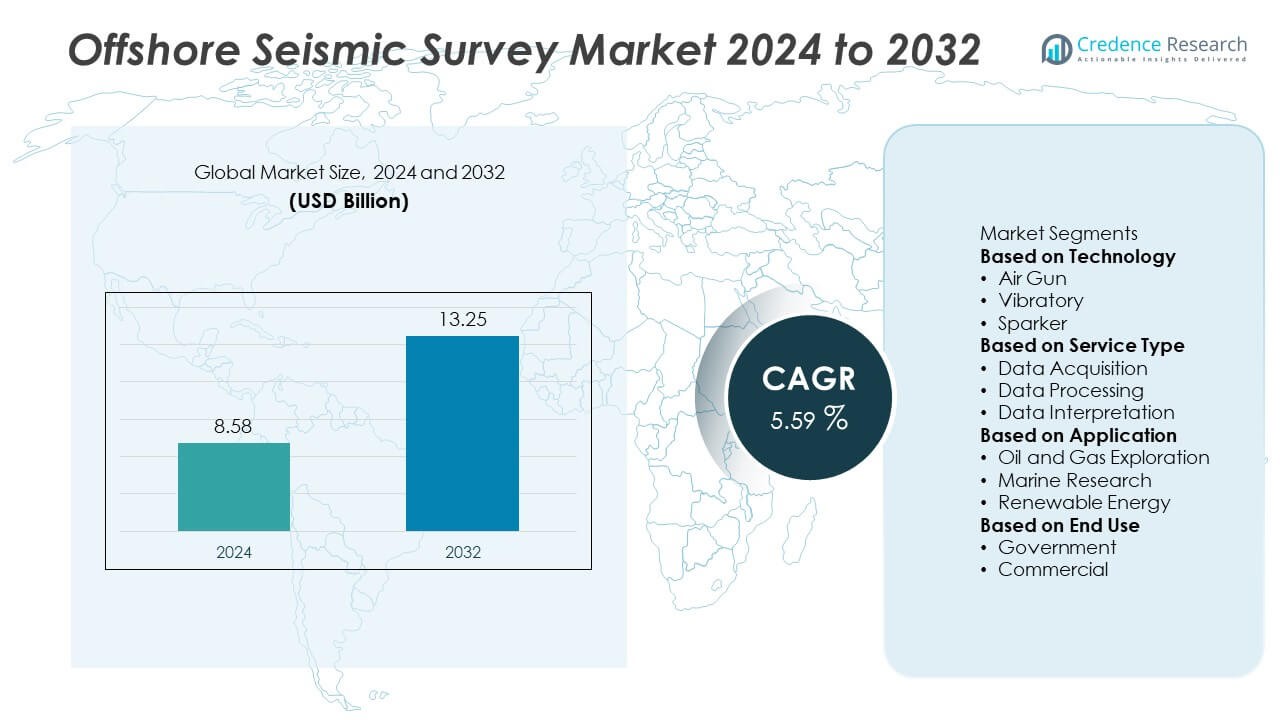

The Offshore Seismic Survey Market was valued at USD 8.58 billion in 2024 and is projected to reach USD 13.25 billion by 2032, growing at a CAGR of 5.59% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Offshore Seismic Survey Market Size 2024 |

USD 8.58 Billion |

| Offshore Seismic Survey Market, CAGR |

5.59% |

| Offshore Seismic Survey Market Size 2032 |

USD 13.25 Billion |

The Offshore Seismic Survey Market grows with rising global energy demand, expanding deepwater exploration projects, and favorable government licensing rounds. Advanced 3D and 4D seismic technologies improve reservoir imaging and reduce drilling risks, encouraging investment from oil and gas operators.Asia-Pacific leads the Offshore Seismic Survey Market with strong exploration activity in China, India, and Southeast Asia, supported by government licensing rounds and rising investment in deepwater projects. North America follows with robust demand from the Gulf of Mexico and offshore Canada, where advanced 3D and 4D seismic surveys are used to enhance recovery rates from mature fields. Europe maintains steady demand, driven by North Sea exploration and increasing use of seismic data for offshore wind site assessments. Latin America shows significant growth potential with Brazil’s pre-salt basin developments and Mexico’s offshore bid rounds attracting global players. Key companies driving the market include Schlumberger, CGG, TGS, and Halliburton, which focus on multi-client surveys, advanced imaging technologies, and integrated geoscience solutions to support operators in reducing exploration risk, improving drilling efficiency, and optimizing project economics across both established and frontier offshore basins.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Offshore Seismic Survey Market was valued at USD 8.58 billion in 2024 and is projected to reach USD 13.25 billion by 2032, growing at a CAGR of 5.59% during the forecast period.

- Growth is driven by rising offshore exploration activities, increasing global energy demand, and government initiatives that encourage new licensing rounds and frontier basin development.

- Trends highlight the adoption of advanced 3D and 4D seismic technologies, integration of AI and cloud-based data processing, and expansion of multi-client survey libraries to optimize costs.

- Competitive landscape includes key players such as Schlumberger, CGG, TGS, Halliburton, and ION Geophysical, focusing on innovative seismic acquisition techniques, improved imaging, and strategic collaborations with oil and gas operators.

- Market restraints include high operational costs, volatile oil prices, and strict environmental regulations that can delay project approvals and restrict survey timelines.

- Asia-Pacific leads demand with strong activity in China, India, and Southeast Asia, while North America grows through deepwater exploration in the Gulf of Mexico and offshore Canada.

- Europe shows consistent demand from the North Sea and offshore wind projects, while Latin America and Middle East & Africa present emerging opportunities driven by pre-salt basin exploration, offshore gas developments, and favorable investment policies.

Market Drivers

Rising Global Energy Demand and Exploration Activities

The Offshore Seismic Survey Market grows with increasing global demand for oil and gas resources. Exploration and production companies invest in new offshore projects to meet energy security needs. It supports discovery of reserves in deepwater and frontier basins where onshore opportunities are declining. High-resolution seismic surveys help reduce drilling risks and improve exploration efficiency. Governments encourage offshore exploration through favorable licensing rounds. It drives strong demand for seismic data acquisition and interpretation services.

- For instance, TGS has expanded its seismic data library in West Africa, such as a 2016 campaign to acquire over 11,500 km of 2D data offshore Northwest Africa, which complemented an existing library of over 28,000 km of 2D data, and later campaigns like the Jaan 3D survey. Completed in 2020, the Jaan 3D project merged new 3D acquisitions with existing 3D datasets, covering over 28,000 km² and creating a seamless 3D volume.

Advancement in Seismic Imaging Technologies

Technological innovations such as 3D, 4D, and ocean-bottom node surveys enhance data accuracy and subsurface imaging. The Offshore Seismic Survey Market benefits from advanced processing algorithms and high-capacity vessels that capture detailed geological information. It enables operators to optimize well placement and reservoir management. Improved imaging reduces non-productive drilling costs and supports better project economics. Integration of AI and machine learning strengthens data interpretation capabilities. It allows faster decision-making and increases exploration success rates.

- For instance, CGG deployed its Sercel 508XT system on large-scale land seismic surveys, such as a major project in Saudi Arabia, where it achieved high productivity and efficient operations.

Growing Investment in Deepwater and Ultra-Deepwater Projects

Deepwater and ultra-deepwater regions attract rising investment from international oil companies. The Offshore Seismic Survey Market gains traction in areas such as the Gulf of Mexico, Brazil pre-salt, and West Africa. It is critical for mapping complex reservoirs and identifying drilling targets at greater depths. Advanced seismic surveys support safe operations in challenging environments. Rising discoveries in offshore basins encourage continued investment in seismic services. It strengthens the role of seismic surveys in upstream exploration strategies.

Supportive Government Policies and Energy Security Initiatives

Many governments launch offshore bidding rounds and offer tax incentives to boost exploration. The Offshore Seismic Survey Market benefits from regulatory frameworks that promote domestic production and reduce import dependence. It aligns with national energy strategies and encourages private sector participation. Public investments in geoscience data acquisition improve access to frontier areas. Growing focus on energy transition also drives surveys for offshore wind farm site assessments. It broadens the application scope of seismic services beyond oil and gas.

Market Trends

Shift Toward 3D and 4D Seismic Surveys

The Offshore Seismic Survey Market witnesses rising adoption of 3D and 4D surveys for detailed reservoir imaging. Operators prefer these methods to improve drilling accuracy and reduce exploration risks. It enables visualization of complex subsurface structures and supports efficient reservoir management. Time-lapse 4D surveys help monitor production changes and optimize recovery strategies. Demand grows for multi-client 3D data libraries that reduce costs for smaller operators. It strengthens exploration decisions and shortens project timelines.

- For instance, In 2023, PGS completed a 3D seismic survey offshore Namibia for a major energy company, while a separate 6,593 km² 3D seismic survey in PEL 87 was conducted with funding from Woodside Energy. The initial claim mistakenly merged these two distinct operations.

Integration of AI and Advanced Data Analytics

Artificial intelligence and machine learning are transforming seismic data processing and interpretation. The Offshore Seismic Survey Market benefits from faster analysis of large datasets and improved subsurface modeling. It helps operators identify drilling targets with higher accuracy and lower uncertainty. Cloud-based platforms allow real-time collaboration among geoscientists and engineers. Automated workflows reduce processing time and project costs. It drives adoption of digital seismic solutions across both large and mid-sized exploration companies.

- For instance, in June 2019, Schlumberger introduced its GAIA digital exploration platform, which is powered by the DELFI cognitive E&P environment and gives users access to over 3 million square kilometers of 3D seismic surveys and other data for global clients.

Growing Demand from Renewable Energy Sector

Offshore wind development creates a new growth avenue for seismic services. The Offshore Seismic Survey Market supports site characterization and seabed mapping for wind farm installations. It helps identify suitable locations while minimizing environmental impact. Demand grows for high-resolution shallow seismic surveys to avoid construction risks. Collaboration with renewable developers expands the customer base for seismic service providers. It diversifies revenue streams beyond oil and gas exploration.

Focus on Cost-Effective and Environmentally Safe Operations

Operators prioritize seismic solutions that lower costs and minimize environmental footprint. The Offshore Seismic Survey Market adopts quieter airgun technologies and marine life protection measures. It aligns with stricter environmental regulations and stakeholder expectations. Streamerless and node-based surveys reduce noise and improve data quality. Vessel efficiency improvements cut fuel use and emissions during operations. It positions service providers as partners in sustainable exploration.

Market Challenges Analysis

High Operational Costs and Volatile Oil Prices

The Offshore Seismic Survey Market faces challenges due to high costs of data acquisition, vessel operations, and advanced equipment. Smaller exploration companies often delay projects when oil prices are unstable, reducing demand for surveys. It creates uncertainty for service providers who rely on consistent exploration activity. Rising fuel and labor costs further increase project expenses, impacting profitability. Limited access to capital for independent operators slows new exploration campaigns. It pushes the industry to develop cost-efficient survey methods and optimize resource utilization.

Environmental Concerns and Regulatory Restrictions

Seismic operations face criticism for their potential impact on marine life and ecosystems. The Offshore Seismic Survey Market must comply with strict regulations on noise emissions and protected area operations. It can lead to delays in project approvals and restricted survey windows. Environmental groups often pressure governments to limit offshore exploration, influencing policy decisions. Permitting processes can be lengthy and complex, especially in ecologically sensitive regions. It forces companies to invest in quieter technologies and mitigation measures to maintain compliance and public trust.

Market Opportunities

Expansion of Deepwater and Frontier Exploration Projects

The Offshore Seismic Survey Market holds strong potential with increasing investment in deepwater and frontier basin exploration. Energy companies target untapped reserves in regions such as the Gulf of Mexico, Brazil, and West Africa to meet growing global energy demand. It creates opportunities for advanced 3D and 4D seismic surveys that map complex geological structures. Improved imaging technologies support higher drilling success rates and reduce financial risk. National oil companies are also increasing offshore exploration budgets, strengthening demand for large-scale surveys. It ensures steady project pipelines for seismic service providers.

Rising Opportunities in Offshore Renewable Energy Development

The shift toward clean energy creates new demand for seabed mapping and site characterization. The Offshore Seismic Survey Market benefits from surveys used in offshore wind farm planning and subsea infrastructure development. It enables developers to identify safe installation zones and minimize environmental impact. Governments supporting renewable energy expansion drive consistent project activity. Service providers offering high-resolution shallow seismic solutions can expand into this fast-growing segment. It diversifies revenue streams and reduces dependency on oil and gas exploration cycles.

Market Segmentation Analysis:

By Technology

The Offshore Seismic Survey Market is segmented by technology into 2D, 3D, and 4D surveys. 3D seismic technology dominates due to its ability to deliver high-resolution subsurface images and reduce drilling risks. It supports better reservoir mapping and well placement decisions for oil and gas companies. 4D seismic, also known as time-lapse seismic, is gaining traction for monitoring reservoir changes and improving recovery rates in producing fields. 2D seismic remains relevant for frontier exploration where cost-effective regional mapping is required. Demand for ocean-bottom node (OBN) technology is rising as it provides superior imaging in complex geology and deepwater locations. It strengthens adoption of advanced seismic solutions across offshore exploration projects.

- For instance, in 2023, Equinor continued its 4D seismic monitoring over the Johan Sverdrup field, which covers approximately 200 km², leveraging its permanent monitoring system to survey parts of the field twice during the year. 2D seismic remains relevant for frontier exploration where cost-effective regional mapping is required.

By Service Type

Service types include data acquisition, data processing and interpretation, and multi-client services. The Offshore Seismic Survey Market sees highest revenue from data acquisition, as it involves deployment of specialized vessels, streamers, and sensors. It is critical for collecting high-quality seismic data used in exploration planning. Data processing and interpretation services are growing in demand with the integration of AI, machine learning, and cloud-based platforms. Multi-client surveys offer shared data access, allowing smaller operators to reduce costs and accelerate decision-making. It helps optimize budgets while improving access to high-quality subsurface information.

- For instance, in October 2024, Shearwater GeoServices was awarded a three-month towed streamer seismic survey project in the Asia Pacific region, to be carried out by one of its multi-sensor vessels.

By Application

Applications cover oil and gas exploration, offshore wind development, and other subsea infrastructure projects. The Offshore Seismic Survey Market records dominant demand from oil and gas exploration, driven by deepwater and ultra-deepwater investments. It plays a key role in identifying reserves, reducing dry well risks, and supporting efficient field development. Offshore wind developers increasingly rely on seismic surveys for seabed characterization and safe turbine installation planning. Subsea pipeline and cable routing projects also use seismic data to ensure structural stability. It diversifies application areas, allowing service providers to serve both energy and infrastructure sectors.

Segments:

Based on Technology

- Air Gun

- Vibratory

- Sparker

Based on Service Type

- Data Acquisition

- Data Processing

- Data Interpretation

Based on Application

- Oil and Gas Exploration

- Marine Research

- Renewable Energy

Based on End Use

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 28% market share in the Offshore Seismic Survey Market, supported by robust exploration activity in the Gulf of Mexico and offshore Canada. The U.S. continues to lead with investments from both major oil companies and independent operators targeting deepwater and ultra-deepwater reserves. It benefits from advanced offshore infrastructure, high-capacity seismic vessels, and strong regulatory frameworks that ensure operational efficiency. Demand grows for 4D seismic surveys to optimize production from mature fields and improve recovery factors. The region also invests in multi-client seismic libraries to reduce costs and improve accessibility for smaller exploration players. It remains a key market for service providers offering advanced imaging technologies and integrated geoscience solutions.

Europe

Europe accounts for 22% market share and maintains steady demand due to offshore projects in the North Sea, Barents Sea, and Norwegian Continental Shelf. The Offshore Seismic Survey Market benefits from activity led by international oil companies and state-owned operators focusing on maximizing recovery from mature assets. It also sees demand from offshore wind developers who rely on seismic surveys for seabed mapping and site assessments. Strict environmental regulations drive adoption of quieter and more sustainable seismic technologies. Growth in multi-client surveys supports smaller operators engaged in exploration across frontier basins. It ensures consistent demand even as some regions transition toward renewable energy sources.

Asia-Pacific

Asia-Pacific holds 30% market share, making it the largest regional contributor to the Offshore Seismic Survey Market. Major exploration campaigns in countries such as China, India, Indonesia, and Malaysia drive strong demand for data acquisition and processing services. It benefits from increasing government support through licensing rounds and exploration incentives. The region sees growing interest in deepwater and frontier exploration areas, particularly in the South China Sea and Bay of Bengal. Demand for ocean-bottom node surveys is rising as operators seek high-resolution imaging for complex reservoirs. It continues to attract investment from global oil majors seeking to expand reserves and support long-term production goals.

Latin America

Latin America represents 12% market share, led by Brazil’s pre-salt basin projects and offshore exploration in Mexico. The Offshore Seismic Survey Market records strong activity as national oil companies and international operators invest in large-scale seismic programs. It supports exploration of deepwater and ultra-deepwater reserves with complex geological structures. Demand for 3D and 4D surveys is high to improve recovery rates and optimize field development plans. Expansion of offshore bid rounds in Argentina and Guyana also creates opportunities for seismic service providers. It strengthens Latin America’s position as one of the fastest-growing regions for offshore exploration services.

Middle East & Africa

Middle East & Africa hold 8% market share, driven by exploration in offshore Egypt, Angola, and West Africa’s deepwater basins. The Offshore Seismic Survey Market gains from renewed focus on developing offshore reserves to support energy export capacity. It also benefits from gas exploration programs in the Eastern Mediterranean and offshore Qatar. Service providers deploy advanced seismic vessels to meet demand for large-scale 3D surveys and frontier basin mapping. Governments encourage investment through favorable exploration terms and partnerships with global oil majors. It is expected to grow steadily with rising demand for energy security and new reserve discoveries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ION Geophysical

- Halliburton

- CGG

- Geospace Technologies

- Baker Hughes

- WesternGeco

- Eland Oil and Gas

- Schlumberger

- DNV GL

- TGS

Competitive Analysis

Competitive landscape of the Offshore Seismic Survey Market features leading players such as Schlumberger, CGG, TGS, Halliburton, ION Geophysical, Geospace Technologies, Baker Hughes, WesternGeco, DNV GL, and Eland Oil and Gas. These companies focus on delivering advanced seismic acquisition solutions including 3D, 4D, and ocean-bottom node surveys to support complex offshore exploration projects. They invest heavily in R&D to improve imaging accuracy, reduce operational costs, and integrate AI-driven analytics for faster data interpretation. Strategic collaborations with oil and gas operators, national oil companies, and governments help expand their global presence and secure long-term contracts. Many players strengthen their portfolios with multi-client data libraries that make high-quality seismic data accessible to multiple operators, reducing exploration costs. Expansion into offshore renewable energy surveys provides diversification and new revenue opportunities. Continuous innovation and technological upgrades allow these companies to remain competitive and meet the growing demand for efficient, environmentally responsible seismic solutions worldwide.

Recent Developments

- In August 2025, Shearwater and TGS won contracts for seismic survey work offshore Angola and Indonesia.

- In June 2025, TGS concluded the Amendment Phase 4 ultra-long offset Ocean Bottom Node (OBN) survey in the US Gulf of Mexico, covering 49 outer continental shelf blocks across Mississippi Canyon and Ewing Bank protraction areas.

- In March 2025, Shearwater Geoservices AS entered into a three-year capacity reservation agreement (CRA) with TotalEnergies for global marine seismic streamer acquisition services.

Report Coverage

The research report offers an in-depth analysis based on Technology, Service Type, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for offshore seismic surveys will rise with increasing deepwater and ultra-deepwater exploration projects.

- Adoption of 4D time-lapse seismic surveys will grow to optimize production from mature fields.

- AI and machine learning will play a larger role in seismic data processing and interpretation.

- Multi-client survey models will expand, reducing costs for smaller exploration companies.

- Ocean-bottom node technology will gain popularity for imaging complex reservoirs and deepwater structures.

- Governments will continue to promote offshore licensing rounds to boost domestic production.

- Offshore wind farm development will drive demand for high-resolution shallow seismic surveys.

- Service providers will invest in quieter technologies to meet stricter environmental standards.

- Digital platforms and real-time data sharing will improve decision-making and project efficiency.

- Emerging regions such as Africa and Latin America will offer significant growth opportunities for new exploration projects.