Market Overview

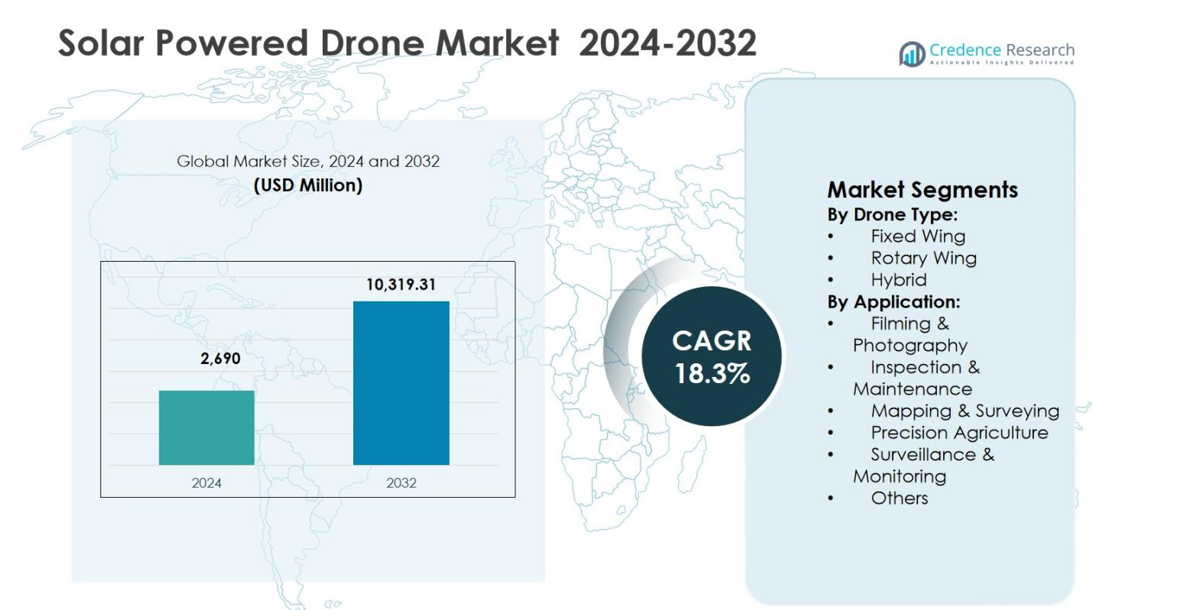

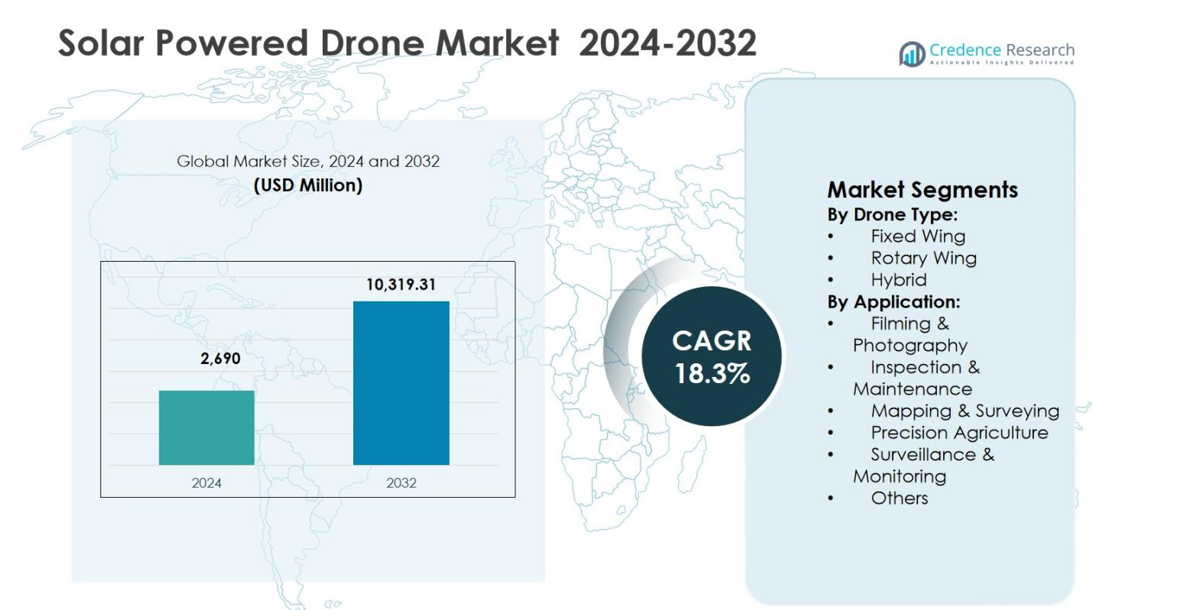

The Solar Powered Drone Market size was valued at USD 2,690 million in 2024 and is anticipated to reach USD 10,319.31 million by 2032, growing at a CAGR of 18.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Solar Powered Drone Market Size 2024 |

USD 2,690 million |

| Solar Powered Drone Market, CAGR |

18.3% |

| Solar Powered Drone Market Size 2032 |

USD 10,319.31 million |

The Solar Powered Drone Market is shaped by the presence of established aerospace firms and specialized UAV developers focusing on long-endurance, energy-efficient aerial platforms. Key players such as Airbus Defence and Space, Aurora Flight Sciences, AeroVironment, Kea Aerospace, Silent Falcon UAS Technologies, AtlantikSolar, XSun, DJI, and Parrot Drones are advancing solar-integrated drone designs for surveillance, mapping, and communications applications. These companies emphasize lightweight airframes, high-efficiency solar cells, and autonomous flight capabilities to enhance mission duration and reliability. Regionally, North America led the Solar Powered Drone Market with a 38% market share in 2024, driven by strong defense spending, advanced UAV research, and early adoption of long-endurance platforms, followed by Asia-Pacific and Europe with growing commercial and governmental deployments.

Market Insights

- Solar Powered Drone Market was valued at USD 2,690 million in 2024 and is projected to reach USD 10,319.31 million by 2032, growing at a CAGR of 18.3% during the forecast period, driven by rising adoption of long-endurance unmanned aerial platforms.

- Market growth is driven by increasing demand for persistent aerial surveillance, environmental monitoring, and infrastructure inspection, with fixed wing drones dominating the market by holding a 52.6% share in 2024 due to superior endurance and payload efficiency.

- Key market trends include integration of high-efficiency solar cells, lightweight composite materials, and AI-enabled autonomous navigation, while leading players focus on extending flight duration and enhancing data collection capabilities across defense and commercial applications.

- Market expansion faces restraints from high initial development costs, complex certification processes, and performance limitations under low-sunlight conditions, which impact adoption among small-scale commercial users.

- Regionally, North America led the market with a 38% share in 2024, followed by Asia-Pacific at 28% and Europe at 22%, while Surveillance & Monitoring remained the leading application segment with a 34.8% market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Drone Type:

The Solar Powered Drone Market, by drone type, is led by the Fixed Wing segment, which accounted for 52.6% market share in 2024, driven by its superior endurance, higher payload efficiency, and ability to operate over long distances using continuous solar energy harvesting. Fixed-wing solar drones are widely deployed for high-altitude, long-endurance missions such as border surveillance, atmospheric research, and large-area mapping. The Hybrid segment follows, holding 29.1% share, supported by rising demand for vertical takeoff combined with extended flight time. Rotary Wing drones captured 18.3% share, mainly used for short-range, precision tasks.

- For instance, Airbus’s Zephyr S, a fixed-wing high-altitude pseudo-satellite (HAPS), completed a maiden flight of over 25 days in Arizona, reaching daytime altitudes around 74,000 feet powered by solar panels on its 25-meter wingspan.

By Application:

By application, Surveillance & Monitoring dominated the Solar Powered Drone Market with a 34.8% market share in 2024, supported by growing defense, homeland security, and environmental monitoring requirements. Solar-powered drones enable persistent aerial surveillance with reduced operational costs and minimal refueling needs. Mapping & Surveying held 21.6% share, driven by adoption in infrastructure planning, mining, and land management. Inspection & Maintenance accounted for 17.9% share, benefiting from utility and telecom inspections. Precision Agriculture captured 14.2% share, while Filming & Photography and Others jointly represented 11.5% share, supported by niche commercial uses.

- For instance, Sunbirds’ SB4 Phoenix supports large-scale surveillance missions, flying up to seven hours on solar power for real-time monitoring in sunny regions.

Key Growth Drivers

Rising Demand for Long-Endurance Aerial Operations

The Solar Powered Drone Market is strongly driven by the increasing need for long-endurance aerial platforms across defense, telecommunications, environmental monitoring, and disaster management applications. Solar-powered drones offer extended flight durations ranging from several days to weeks, enabling continuous data collection over large geographic areas. This capability significantly reduces operational interruptions and refueling requirements compared to conventional battery-powered drones. Governments and commercial operators increasingly deploy these systems for border surveillance, maritime monitoring, and climate observation, reinforcing demand for high-altitude, long-endurance unmanned aerial solutions.

- For instance, Garuda Aerospace’s SURAJ drone, unveiled at Aero India 2023, features J-shaped solar-powered wings and an auxiliary battery for 12-hour endurance at 3,000 feet altitude.

Expansion of Renewable Energy and Sustainability Initiatives

Growing global emphasis on renewable energy adoption and carbon footprint reduction is accelerating growth in the Solar Powered Drone Market. Solar-powered drones align with sustainability objectives by minimizing reliance on fossil fuels and reducing operational emissions. Public-sector agencies, research institutions, and enterprises are prioritizing environmentally responsible technologies for aerial monitoring and inspection tasks. Regulatory support for clean-energy solutions and rising investments in green aviation technologies further strengthen adoption. These factors collectively position solar-powered drones as an integral component of future low-emission aerial infrastructure.

- For instance, Airbus’s Zephyr UAV set three world records in 2010, including a longest endurance flight of 336 hours powered solely by solar energy, enabling persistent surveillance without fossil fuel use.

Increasing Adoption Across Commercial and Industrial Applications

The expanding use of drones across commercial and industrial sectors is a key growth driver for the Solar Powered Drone Market. Industries such as agriculture, utilities, oil and gas, and infrastructure increasingly rely on drones for mapping, inspection, and monitoring. Solar-powered drones provide cost-efficient operations by lowering maintenance and energy expenses while extending mission duration. Their ability to cover vast agricultural fields, power transmission lines, and remote industrial assets without frequent landings supports productivity gains, making them attractive for large-scale, recurring operational deployments.

Key Trends & Opportunities

Advancements in Lightweight Materials and Solar Cell Efficiency

Technological advancements in lightweight composite materials and high-efficiency photovoltaic cells are creating significant opportunities in the Solar Powered Drone Market. Improved solar cell conversion rates enhance onboard power generation, while lightweight airframes increase payload capacity and flight endurance. These innovations enable manufacturers to design drones capable of operating at higher altitudes with greater reliability. Ongoing research into flexible solar panels and energy storage integration further supports next-generation drone development, opening opportunities for expanded commercial, scientific, and defense-oriented applications.

- For instance, Titan Aerospace’s Solara 50 employs a carbon fiber composite frame with 3,000 photovoltaic cells across a 50-meter wingspan, enabling stratospheric flights at 20km altitude for extended durations.

Growing Integration with AI and Advanced Data Analytics

The integration of artificial intelligence and advanced data analytics represents a major trend in the Solar Powered Drone Market. Solar-powered drones increasingly incorporate AI-driven navigation, real-time image processing, and autonomous decision-making capabilities. These features enhance mission efficiency for applications such as precision agriculture, infrastructure inspection, and surveillance. The ability to analyze large datasets during extended flights improves situational awareness and reduces data processing delays. This trend creates opportunities for solution providers offering intelligent drone platforms with integrated analytics and cloud-based data management systems.

- For instance, XSun’s SolarXOne drone employs an advanced autopilot system with Embention’s Veronte for 100% automated flight, including AI-enabled adaptive control, real-time RTK positioning to centimeter accuracy, and obstacle avoidance during extended solar-powered missions up to 600 km.

Key Challenges

High Initial Development and Deployment Costs

High initial development and deployment costs remain a significant challenge in the Solar Powered Drone Market. Advanced materials, high-efficiency solar panels, and specialized avionics increase manufacturing expenses compared to conventional drones. Additionally, extensive research, testing, and certification requirements add to overall investment costs. These financial barriers can limit adoption among small and mid-sized enterprises. While long-term operational savings are substantial, the upfront capital requirement continues to restrain market penetration, particularly in price-sensitive commercial segments.

Technical Limitations and Weather Dependency

Technical limitations related to weather dependency pose challenges for the Solar Powered Drone Market. Solar-powered drones rely heavily on consistent sunlight, making performance vulnerable to cloud cover, seasonal variations, and adverse weather conditions. Limited energy generation during low-light environments can restrict payload operation and mission reliability. Furthermore, balancing power storage, weight constraints, and flight stability remains complex. Addressing these challenges requires continuous advancements in energy storage systems, hybrid power integration, and adaptive flight technologies to ensure consistent performance across diverse operating environments.

Regional Analysis

North America

North America led the Solar Powered Drone Market in 2024, holding a market share of 38% due to strong defense spending, advanced drone technology adoption, and robust government initiatives supporting solar energy integration. The United States and Canada prioritized long-endurance unmanned aerial missions for border security, environmental monitoring, and disaster response, which amplified demand for solar-powered platforms. A mature aerospace ecosystem, ongoing R&D investments, and supportive regulatory frameworks further bolstered growth. Strategic collaborations between military agencies and tech firms reinforced North America’s leadership in rugged, high-performance solar drone deployment.

Europe

Europe accounted for a market share of 22% in the Solar Powered Drone Market in 2024, propelled by sustainability initiatives and increasing commercial applications. European countries, including Germany, France, and the UK, invested in long-endurance UAVs for environmental monitoring, precision agriculture, and infrastructure inspection. Strong policy support for renewable energy adoption and carbon reduction targets encouraged solar-drone integration into national security and civilian programs. Rising partnerships between aerospace manufacturers and energy-tech providers further stimulated expansion. Growth was further supported by improved regulatory harmonization for beyond-visual-line-of-sight (BVLOS) operations and green technology funding.

Asia-Pacific

Asia-Pacific captured a market share of 28% in 2024, driven by government modernization programs, expanding defense budgets, and quick adoption in agriculture and logistics. China, Japan, India, and South Korea emerged as key contributors, focusing on solar-powered drones for border security, disaster management, and large-scale agricultural surveying. Rapid infrastructure development and increasing investments in renewable technologies supported the region’s growth trajectory. Additionally, rising commercial drone startups and partnerships with international tech firms helped Asia-Pacific narrow the gap with Western markets, reinforcing the region’s strategic importance in future solar UAV deployment.

Latin America

Latin America held a market share of 7% in the Solar Powered Drone Market in 2024, with notable growth in environmental monitoring, mining operations, and agricultural applications. Countries such as Brazil and Argentina increased use of solar drones to survey vast rural landscapes, conduct forestry monitoring, and support precision farming. Limited infrastructure and geographic challenges made solar drones attractive for low-cost, long-duration missions. However, slower regulatory progress and constrained R&D funding moderated regional expansion. Continued investment in drone training, technology adaptation, and cross-border collaborations is expected to strengthen Latin America’s market position.

Middle East & Africa

The Middle East & Africa region accounted for a market share of 5% in 2024, supported by defense modernization and energy sector applications. Gulf Cooperation Council (GCC) countries prioritized solar-powered drones for border surveillance, oilfield inspection, and environmental monitoring in remote desert areas. African markets showed emerging adoption in wildlife protection and agricultural data collection, leveraging solar drones’ long-endurance capabilities where infrastructure is limited. Regional growth was tempered by economic constraints and investment gaps. Nonetheless, strategic defense contracts and renewable energy partnerships provide opportunities for future expansion.

Market Segmentations:

By Drone Type:

- Fixed Wing

- Rotary Wing

- Hybrid

By Application:

- Filming & Photography

- Inspection & Maintenance

- Mapping & Surveying

- Precision Agriculture

- Surveillance & Monitoring

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Airbus Defence and Space, BAE Systems, AeroVironment, Aurora Flight Sciences, Kea Aerospace, Silent Falcon UAS Technologies, AtlantikSolar, XSun, DJI, Parrot Drones. The Solar Powered Drone Market features a mix of aerospace primes, defense innovators, and specialist UAV startups competing on endurance, payload efficiency, autonomy, and reliable high-altitude operations. Established aerospace and defense firms leverage deep R&D budgets, flight-test infrastructure, and government relationships to advance high-altitude, long-endurance platforms for persistent surveillance and communications. Specialist players differentiate through lightweight airframes, high-efficiency photovoltaic integration, and mission-specific sensor packages for mapping, monitoring, and inspection use cases. Commercial drone brands increasingly explore solar augmentation and energy-optimized platforms to extend flight times in permissive environments. Partnerships with telecom operators, component suppliers, and analytics providers strengthen end-to-end offerings, while regulatory progress for BVLOS operations and airspace integration shapes go-to-market speed and deployment scale.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In December 2025, VisionWave Holdings announced the acquisition of Solar Drone Ltd., an autonomous robotics company specializing in solar-powered drones for defense and solar operations and maintenance.

- In July 2025, XSun partnered with H3 Dynamics to develop a new UAV combining solar energy, hydrogen fuel cells, and battery storage for extended flight endurance. This tri-source system targets VTOL, STOL, and HTOL platforms with intelligent power management.

- In February 2025, Kea Aerospace completed a solar-powered stratospheric flight with its Kea Atmos platform, marking progress in high-altitude imaging and long-endurance missions.

Report Coverage

The research report offers an in-depth analysis based on Drone Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Solar powered drones will see wider adoption for long-endurance surveillance and monitoring missions across defense and civil applications.

- Continuous improvements in solar cell efficiency will significantly enhance flight endurance and operational reliability.

- Integration of artificial intelligence will enable higher levels of autonomous navigation and real-time data processing.

- Commercial sectors such as agriculture, utilities, and infrastructure will increasingly deploy solar powered drones for large-area coverage.

- Regulatory advancements for beyond-visual-line-of-sight operations will accelerate large-scale commercial deployments.

- Hybrid power architectures will gain traction to address energy variability and mission flexibility.

- Telecom and connectivity applications will expand, using solar powered drones as aerial communication platforms.

- Manufacturing costs will gradually decline as lightweight materials and standardized components mature.

- Strategic partnerships between drone manufacturers and renewable energy providers will intensify.

- Emerging economies will present new growth opportunities driven by remote monitoring and sustainability initiatives.