Market Overview

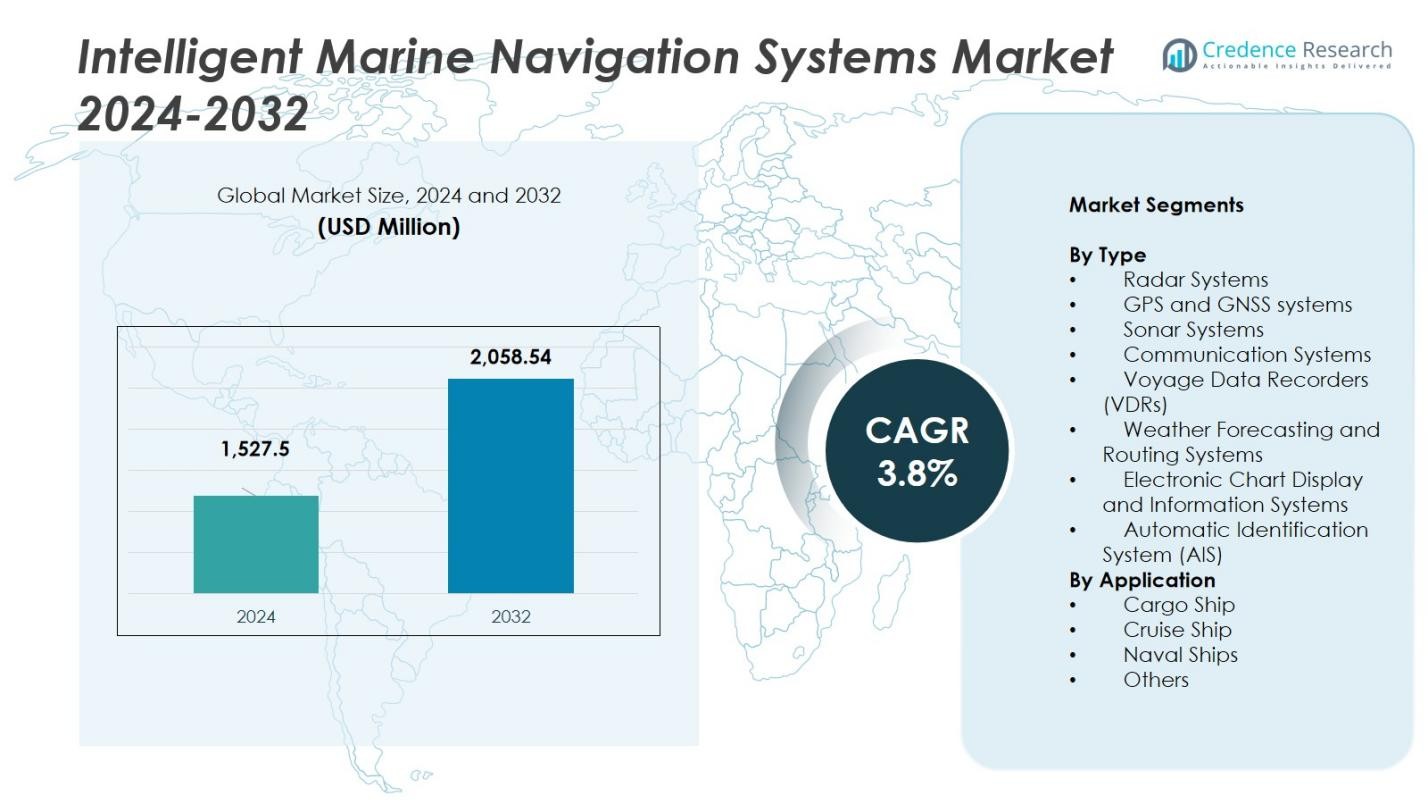

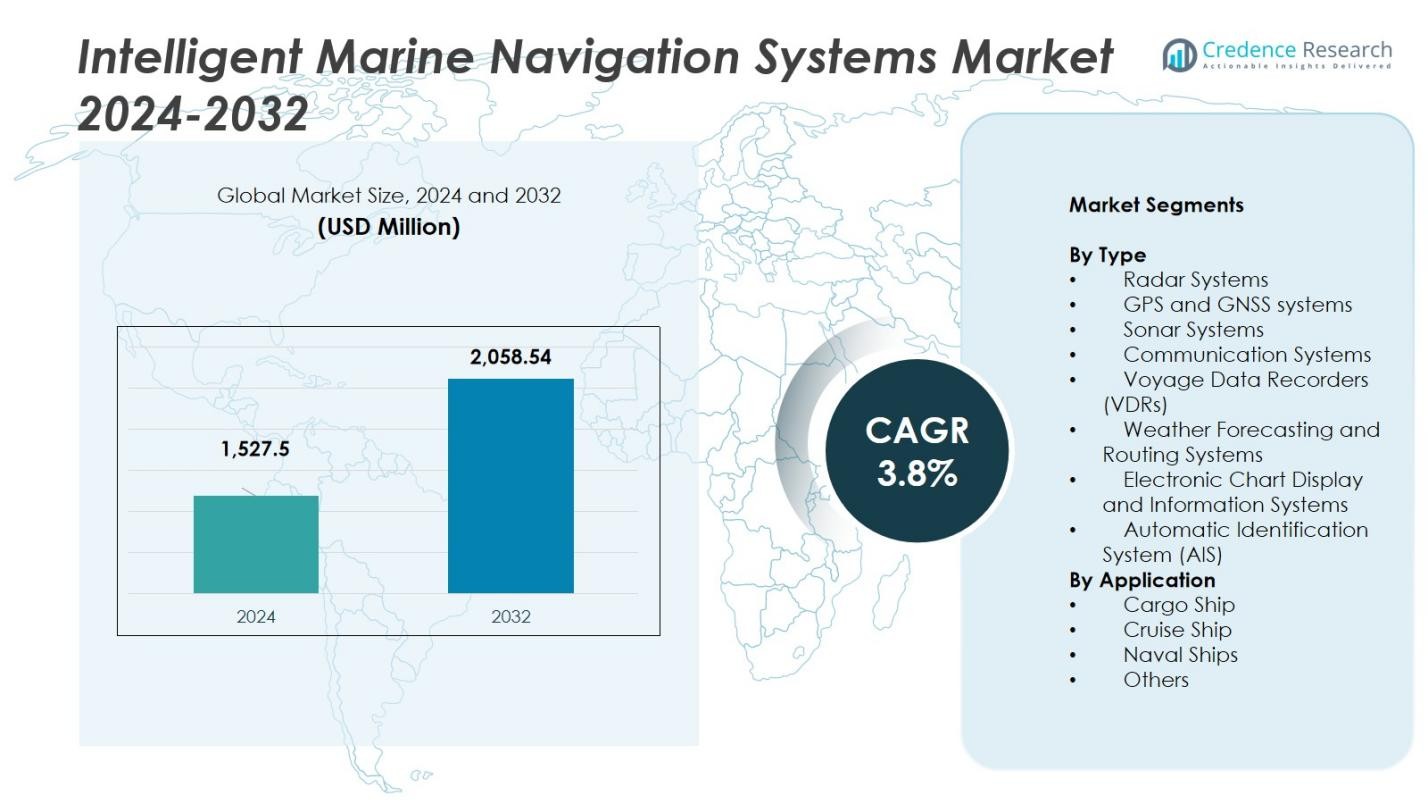

The Intelligent Marine Navigation Systems Market size was valued at USD 1,527.5 Million in 2024 and is anticipated to reach USD 2,058.54 Million by 2032, at a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Intelligent Marine Navigation Systems Market Size 2024 |

USD 1,527.5 Million |

| Intelligent Marine Navigation Systems Market, CAGR |

3.8% |

| Intelligent Marine Navigation Systems Market Size 2032 |

USD 2,058.54 Million |

The Intelligent Marine Navigation Systems Market is dominated by key players such as Northrop Grumman Corporation, Wärtsilä Corporation, Raytheon Anschütz GmbH, and Kongsberg Gruppen ASA, which collectively account for over 80% of the global market share. These companies are at the forefront of technological innovation, developing advanced radar, GPS/GNSS, AIS, and sonar systems that improve vessel safety, navigation precision, and operational efficiency. North America holds the largest market share of 23.68%, driven by stringent maritime safety regulations, a robust naval fleet, and a high adoption rate of advanced navigation systems. Europe follows with a share of approximately 22.5%, supported by strong maritime safety standards, aging fleets in need of modernization, and significant port infrastructure. Asia-Pacific represents 18.3% of the market, propelled by major shipbuilding activities in China, Japan, and South Korea, along with growing fleet expansions in India and Southeast Asia. These regions are expected to maintain strong growth throughout the forecast period.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Intelligent Marine Navigation Systems Market was valued at USD 1,527.5 Million in 2024 and is projected to reach USD 2,058.54 Million by 2032, growing at a CAGR of 3.8% during the forecast period.

- The market is primarily driven by rising maritime safety demands, technological advancements in navigation systems, and the expansion of global trade.

- Key trends include the increasing adoption of autonomous vessels and the integration of IoT and AI technologies to enhance vessel performance and safety.

- The market is highly concentrated, with leading players such as Northrop Grumman, Wärtsilä, Raytheon Anschütz, and Kongsberg Gruppen controlling over 80% of the market share.

- North America holds the largest market share at 23.68%, followed by Europe at 22.5% and Asia-Pacific at 18.3%. The demand for advanced navigation systems is expanding in these regions, driven by commercial shipping, naval upgrades, and technological adoption.

Market Segmentation Analysis:

By Type

The Intelligent Marine Navigation Systems Market is dominated by Radar Systems, which hold around 30% of the market share in 2024. Radar technology is crucial for detecting obstacles and ensuring vessel safety, especially in adverse weather conditions. The segment’s growth is fueled by the increasing demand for enhanced navigation safety and precision, coupled with advancements such as higher resolution and extended range radar capabilities. Following radar, GPS and GNSS Systems represent 25% of the market share. These systems are essential for real-time positioning and route planning, contributing significantly to accurate navigation. The demand for GPS and GNSS systems is driven by the need for precise and reliable location data, along with continuous technological improvements that enhance their accuracy and performance.

- For instance, Northrop Grumman Sperry Marine’s VisionMaster FT Radar utilizes advanced Intel technology and offers features like full redundancy and resolutions where pixel units correspond to 6 meters, enhancing target detection accuracy even in cluttered maritime environments.

By Application

The Cargo Ship segment is the largest in the market, with approximately 35% of the market share in 2024. This segment benefits from the rising global trade and the increasing need for efficient and safe transport of goods. The growing use of advanced navigation technologies like radar and GPS is key to enhancing operational safety and efficiency in cargo ships. Cruise Ships account for around 25% of the market share, driven by the growing demand for luxury cruising and the need for sophisticated navigation systems to ensure passenger safety and comfort. The adoption of intelligent marine navigation systems, including weather forecasting and electronic chart systems, is enhancing the operational efficiency and safety of cruise vessels.

- For instance, Anschütz provides gyrocompasses and integrated bridge systems with high-precision autopilots and safety functions installed on multiple cruise ships, ensuring compliance with IMO/IEC standards and seamless integration with cyber-secure features.

Key Growth Drivers

Rising Demand for Maritime Safety

The growing emphasis on maritime safety is a major driver for the Intelligent Marine Navigation Systems Market. Increasing incidents of maritime accidents and stricter safety regulations are prompting the adoption of advanced navigation technologies. Systems such as radar, GPS, and sonar are crucial in preventing collisions, improving situational awareness, and ensuring safe operations in challenging conditions. The demand for reliable and accurate navigation systems is further amplified by the rise in commercial shipping and the expansion of autonomous vessels, pushing the market toward greater growth.

- For instance, UTEC integrated Sonardyne’s Fusion 2 software into its navigation systems, enhancing underwater obstacle detection and situational awareness for vessels.

Technological Advancements in Navigation Systems

Continuous advancements in navigation technologies play a significant role in the growth of the Intelligent Marine Navigation Systems Market. Innovations such as high-resolution radar, precise GPS and GNSS systems, and integrated electronic charting systems enhance vessel navigation accuracy and efficiency. The integration of Artificial Intelligence (AI) and machine learning in weather forecasting, route optimization, and collision avoidance further boosts the market. These innovations provide real-time, reliable data, improving operational efficiency and safety, making them indispensable in modern maritime operations.

- For instance, Navtech’s MAS10 radar employs W-band radar technology to deliver centimetre-level resolution, enabling vessels to detect and classify even the smallest hazards in challenging, low-visibility conditions such as fog and heavy rain.

Expansion of Global Trade and Shipping Activities

The expansion of global trade and the increasing volume of shipping activities are key factors driving the demand for intelligent marine navigation systems. With rising international trade, more vessels are traversing busy shipping routes, requiring sophisticated navigation systems to ensure safety and operational efficiency. Additionally, growing demand for faster and more efficient cargo shipping amplifies the need for automated and precise navigation solutions. This global trade boom has led to a surge in demand for advanced systems that can handle complex maritime environments and regulatory requirements.

Key Trends & Opportunities

Adoption of Autonomous Vessels

The rise of autonomous vessels presents a significant opportunity for the Intelligent Marine Navigation Systems Market. With technological advancements in AI, automation, and sensor systems, vessels can now navigate with minimal human intervention, ensuring higher safety standards and operational efficiency. This trend is expected to accelerate the adoption of intelligent navigation systems, such as autonomous navigation and collision avoidance systems, to support the growing fleet of unmanned vessels. The expansion of this technology opens new revenue streams for companies in the marine navigation sector.

- For instance, Orca AI’s platform is installed on over 1,000 vessels worldwide, integrating day and night camera feeds with navigation sensors to augment situational awareness for crews, especially in challenging conditions like fog or dense traffic, thereby easing their cognitive load and improving decision-making.

Integration with Digitalization and IoT

The integration of digital technologies and the Internet of Things (IoT) into maritime navigation systems is transforming the market. By connecting navigation systems with onboard sensors, weather stations, and fleet management platforms, ships can receive real-time data on route optimization, weather conditions, and traffic patterns. This interconnectedness leads to smarter, more efficient vessels. As digitalization continues to grow in the maritime industry, companies that offer IoT-enabled navigation systems will benefit from increased demand and market expansion.

- For instance, Barantech’s Cruzo Glass Panel integrates IoT-enabled sensors that monitor engine performance and battery health in real-time, providing centralized control for both commercial and leisure vessels.

Key Challenges

High Initial Cost of Advanced Systems

A major challenge in the Intelligent Marine Navigation Systems Market is the high upfront cost of advanced navigation systems. While these systems offer significant benefits in terms of safety, efficiency, and regulatory compliance, the cost of installation and maintenance remains a barrier for small and medium-sized shipping companies. The expense of integrating systems such as radar, GPS, and AIS can deter potential adopters, particularly in regions with less-developed maritime infrastructure. Overcoming this challenge will require innovations that reduce costs and increase accessibility for a broader range of maritime operators.

Regulatory Compliance and Standardization

The rapidly evolving regulatory environment and lack of global standardization present challenges to the growth of the market. Maritime safety and navigation standards vary across regions, making it difficult for manufacturers to develop systems that comply with all local and international regulations. Additionally, the complexity of evolving regulations around autonomous vessels and emissions control can create uncertainties in the market. Companies must continuously adapt their products to meet regulatory requirements, which can lead to delays in product development and market adoption.

Regional Analysis

North America

North America leads the intelligent marine navigation systems market, holding a market share of 23.68% by 2035. This dominance is driven by strict maritime safety regulations and the need for advanced navigation technologies, such as radar, GPS/GNSS, and AIS, particularly in the U.S. and Canada. The region’s significant naval fleet, coupled with busy shipping lanes, contributes to the high demand for these systems. The presence of key system integrators further boosts market growth, with operators focusing on compliance and optimizing route efficiency in crowded waters.

Europe

Europe commands a substantial share of the market, accounting for approximately 22.5%. The region’s growth is driven by rigorous maritime safety regulations, the need for modernized fleets, and the widespread adoption of advanced navigation systems like radar, ECDIS, and AIS. Major European ports and the strong presence of established OEMs and system integrators also contribute to this share. The emphasis on sustainability and emission-reduction goals in European shipping is further pushing the demand for efficient and innovative marine navigation systems.

Asia‑Pacific

Asia‑Pacific is rapidly emerging as a key market player, with a market share of 18.3%. The region benefits from extensive shipbuilding activities in China, Japan, and South Korea, along with rising fleet growth in India and Southeast Asia. As port infrastructure expands and trade volume increases, the demand for advanced navigation systems like GPS/GNSS and radar grows. This region is expected to experience the highest growth rate in the forecast period, driven by technological adoption and regulatory advancements, strengthening its market position significantly.

Latin America

Latin America holds a market share of 8.4%, driven by port upgrades, the growth of offshore energy projects, and expanding regional trade routes. While the region’s market share is modest, increasing investments in navigation infrastructure and the rising demand for safety-conscious solutions among commercial and naval operators are key factors contributing to growth. The region’s growing focus on modernizing fleets to comply with maritime safety regulations is expected to boost market penetration and adoption of intelligent navigation systems in the coming years.

Middle East & Africa

The Middle East & Africa region accounts for a smaller market share of 6.1%. Despite its smaller share, the region is witnessing steady growth due to investments in maritime infrastructure, naval fleet upgrades, and offshore oil-and-gas operations. Countries along the Gulf and African coasts are increasingly adopting intelligent navigation systems like AIS and radar to improve safety and operational efficiency. Though market penetration remains lower than in other regions, there is significant potential for growth as regional operators modernize their fleets and adopt new technologies.

Market Segmentations:

By Type

- Radar Systems

- GPS and GNSS systems

- Sonar Systems

- Communication Systems

- Voyage Data Recorders (VDRs)

- Weather Forecasting and Routing Systems

- Electronic Chart Display and Information Systems

- Automatic Identification System (AIS)

By Application

- Cargo Ship

- Cruise Ship

- Naval Ships

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the intelligent marine navigation systems market features key players such as Northrop Grumman Corporation, Wärtsilä Corporation, Raytheon Anschütz, and Kongsberg Gruppen, which collectively control over 80% of the global market share, underscoring high market concentration. These firms leverage comprehensive product portfolios, global service networks, and long-standing relationships with shipbuilders and naval fleets. The sector sees moderate rivalry from smaller electronics and systems integrators, but barriers to entry remain high due to certification requirements and technology complexity. Firms emphasize R&D in radar, GNSS, and sensor-fusion systems, and pursue strategic alliances and acquisitions to strengthen their position and cater to evolving demands for automation and digital navigation platforms.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Vatn Systems launched a new inertial navigation system designed for maritime autonomy, enabling navigation without relying on GPS. This innovation is powered by Anello Photonics.

- In October 2025, Avikus and Honda Marine signed a memorandum of understanding to integrate Avikus’s NEUBOAT semi‑autonomous system with Honda’s iST drive‑by‑wire controls, enhancing autonomous navigation features for vessels.

- In October 2025, iNav4U and Aqua Map announced their collaboration to develop a yacht‑management and navigation platform that combines operational systems with advanced digital navigation tools.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see increased integration of AI and machine learning to enable autonomous navigation and real‑time decision‑making.

- Smaller vessels and offshore service craft will adopt advanced systems, expanding beyond large commercial and naval ships.

- Fusion of satellite communications, IoT sensors and navigation systems will drive smarter vessel operations and route optimisation.

- Manufacturers will offer modular, upgradeable navigation systems to reduce lifecycle costs and ease retrofit of older fleets.

- Rising demand for safety, security and regulatory compliance will accelerate adoption of advanced radar, AIS and electronic chart systems.

- Marine navigation system vendors will focus on sustainability by enhancing fuel‑efficiency, reducing emissions and enabling green routing.

- Growing shipbuilding activity in Asia‑Pacific and expansion of port infrastructure will stimulate regional system uptake and tailor‑made solutions.

- Cyber‑security and resilient navigation in GNSS‑denied environments will become critical features of next‑generation systems.

- Partnerships between navigation‑system providers, shipbuilders and navies will strengthen to offer turnkey solutions and long‑term service contracts.

- System cost reduction through miniaturisation, standardisation and increased competition will improve access for smaller operators and emerging markets.