Market Overview

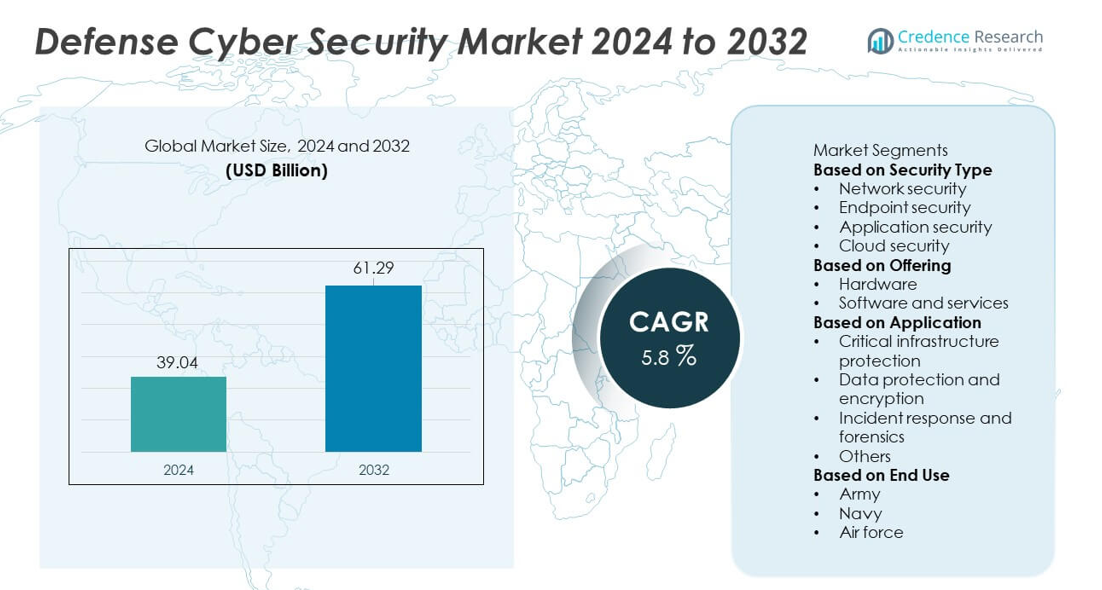

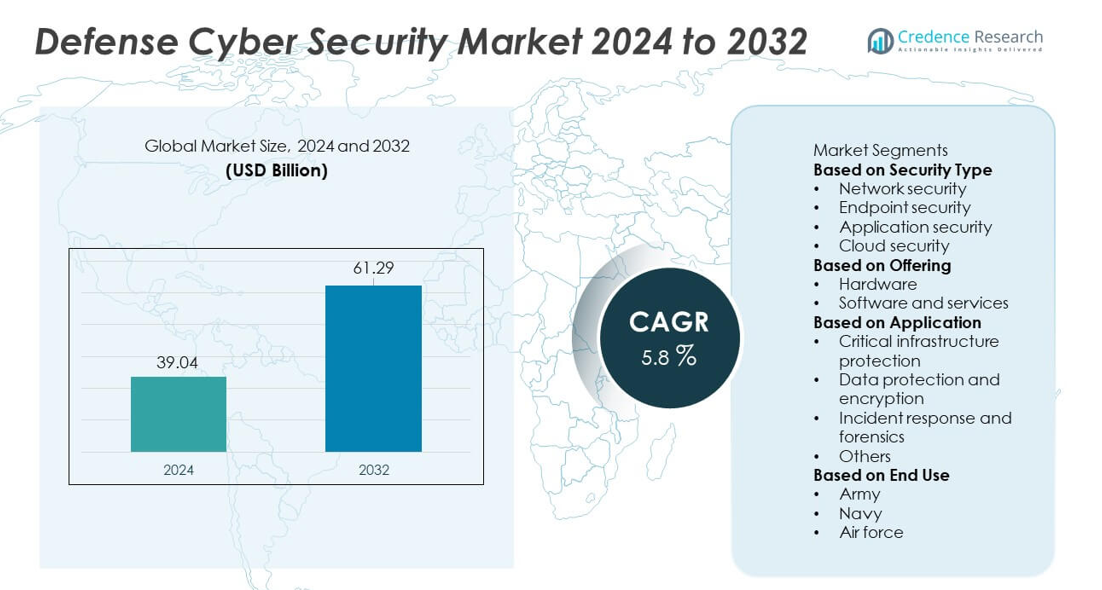

The Defense Cyber Security market reached USD 39.04 billion in 2024 and is projected to grow to USD 61.29 billion by 2032, supported by a 5.8% CAGR during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Defense Cyber Security Market Size 2024 |

USD 39.04 billion |

| Defense Cyber Security Market, CAGR |

5.8% |

| Defense Cyber Security Market Size 2032 |

USD 61.29 billion |

The Defense Cyber Security market is shaped by leading companies including CrowdStrike, Boeing, Hanwha Systems, CACI International, Cisco, IBM, BAE Systems, Carlyle Group, Airbus, and General Dynamics. These players strengthen global defense operations by delivering advanced threat intelligence platforms, secure communication systems, and AI-driven cyber protection tailored for military networks. North America leads the market with a 41% share, supported by strong defense spending and rapid adoption of next-generation cyber capabilities. Europe follows with a 28% share, driven by NATO cyber initiatives and modernization programs, while Asia Pacific continues to expand its presence through rising investment in military digital security.

Market Insights

- The Defense Cyber Security market reached USD 39.04 billion in 2024 and will expand at a 5.8% CAGR through 2032, supported by rising digital defense requirements.

- Strong growth is driven by increased cyber threats targeting military networks, leading to higher investment in AI-based monitoring, secure communication, and advanced threat detection tools.

- Key trends include wider adoption of zero-trust architecture, rapid expansion of cloud-based defense systems, and rising demand for network security, which leads the segment with a 46% share.

- Competitive intensity grows as major players enhance integrated cyber platforms, expand partnerships with defense agencies, and invest in automated threat intelligence and forensic capabilities.

- Regional demand is led by North America with a 41% share, followed by Europe at 28%, Asia Pacific at 22%, Middle East & Africa at 9%, and Latin America at 8%, supported by varied modernization programs and rising defense digitalization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Security Type

The security type segment advances as global defense agencies strengthen digital protection across mission-critical systems. Network security leads with a 46% share, driven by rising cyber intrusions targeting command centers, communication networks, and weapon platforms. Defense organizations prioritize firewalls, intrusion detection systems, and secure gateways to safeguard real-time data flows across land, air, naval, and space operations. Endpoint security adoption grows as militaries deploy connected sensors, tactical devices, and mobile units that require continuous monitoring. Application and cloud security expand with the shift toward digital command systems and classified cloud platforms, enhancing resilience across defense networks.

- For instance, CrowdStrike expanded its Falcon platform to process a massive volume of endpoint events daily, delivering high-speed detection across many critical networks, including those in the public sector.

By Offering

The offering segment evolves as militaries modernize cybersecurity capabilities to counter advanced digital warfare threats. Software and services dominate with a 64% share, supported by strong demand for threat intelligence, vulnerability assessment tools, AI-driven monitoring, and managed security services. Defense agencies increasingly rely on continuous cyber readiness programs, real-time analytics, and automated response systems to mitigate fast-moving attacks. Hardware adoption remains steady, driven by secure servers, encryption devices, and ruggedized communication modules used in field operations. Growing investment in digital transformation and cloud-enabled military systems further accelerates the need for scalable cybersecurity software solutions.

- For instance, CACI International expanded its AI-driven threat analysis platform capable of handling more than 40 billion cybersecurity events each day for defense clients.

By Application

The application segment expands as nations prioritize robust protection of sensitive defense systems and critical assets. Critical infrastructure protection holds a 49% share, driven by growing cyber risks targeting command centers, intelligence networks, satellite systems, and defense industrial bases. Governments deploy advanced monitoring systems, encryption technologies, and AI-supported threat detection to safeguard high-value infrastructure. Data protection and encryption gain momentum as secure information exchange becomes vital for joint operations and cross-border cooperation. Incident response and forensics rise with the need for rapid breach analysis and recovery. These applications strengthen national security and support resilient military operations.

Key Growth Driver

Rising Sophistication of Cyber Threats

Defense cyber security demand increases as military networks face more advanced and persistent cyberattacks. State-sponsored actors target command systems, satellites, surveillance platforms, and secure communication channels. Defense agencies deploy AI-driven monitoring, encrypted communication, and deep network inspection to counter stealth intrusions. Rapid growth in digital warfare tools pushes governments to strengthen cybersecurity investments across land, air, naval, and space domains. As cyberattacks evolve in scale and complexity, defense organizations prioritize continuous security upgrades, real-time threat intelligence, and advanced countermeasures to safeguard mission-critical operations and national security interests.

- For instance, Lockheed Martin expanded its cyber fusion centers that use advanced analytics and machine learning algorithms to analyze network traffic and system data, enabling the rapid fusion of massive amounts of information for defense programs.

Expansion of Defense Digitalization Programs

Global militaries continue digital transformation initiatives, increasing reliance on connected platforms, cloud-based command systems, and automated battlefield technologies. This shift creates higher exposure to cyber vulnerabilities, prompting increased cybersecurity investment. Defense agencies enhance protection for UAV networks, smart sensors, logistics systems, and battlefield communication tools. Modernization programs across the U.S., Europe, and Asia-Pacific integrate secure architectures into mission systems. Cyber defense tools become essential for maintaining operational readiness as forces adopt digital command centers, simulation platforms, and AI-enabled decision systems that require uninterrupted and secure data flow.

- For instance, Boeing upgraded its secure mission systems to support numerous encrypted airborne communication links used in joint operations.

Growth in Cross-Border Defense Collaboration

Rising international defense cooperation boosts demand for secure data exchange and joint cyber defense frameworks. NATO members and allied nations share intelligence, coordinate missions, and conduct combined military exercises, requiring strong, interoperable cybersecurity systems. Secure communication networks, encrypted information channels, and multi-domain data-sharing platforms gain higher adoption. Joint command operations depend on cyber-secure connectivity to support real-time situational awareness and mission coordination. As alliances expand their digital infrastructure, defense cybersecurity becomes central to maintaining trust, information integrity, and seamless collaboration across global military partners.

Key Trend & Opportunity

AI-Driven Threat Detection and Automation

AI adoption creates major opportunities by enabling faster detection of advanced cyber intrusions and automating response actions. Defense agencies integrate machine learning tools to identify unusual behavior, analyze massive data streams, and predict attack patterns. Automated systems strengthen rapid containment during breaches and reduce human workload in security centers. AI-enhanced analytics support real-time battlefield awareness and secure communication across distributed forces. As militaries expand digital assets, AI becomes vital for strengthening proactive defense strategies, improving network resilience, and enhancing decision-making in high-risk operational environments.

- For instance, Palantir upgraded its AI-driven decision platform to process a vast amount of battlefield data for defense trials, enabling faster and better decision-making.

Growing Adoption of Zero-Trust Architecture

Zero-trust security gains momentum as defense organizations shift from perimeter-based protection to continuous verification models. This approach strengthens access controls, limits lateral movement, and mitigates insider threats within sensitive defense networks. Governments integrate identity-based authentication, micro-segmentation, and real-time monitoring to secure cloud-based and hybrid military systems. Zero trust improves security across command centers, tactical units, and remote operations. As digital modernization accelerates, adopting zero-trust frameworks becomes a strategic priority for enhancing resilience and ensuring secure mission execution across all defense domains.

- For instance, Zscaler supported defense programs with a zero-trust exchange that handles more than 300 billion secure transactions per day.

Key Challenge

Shortage of Skilled Cyber Defense Professionals

Defense agencies face a critical shortage of cybersecurity experts capable of handling advanced digital warfare threats. High demand for analysts, ethical hackers, and incident response specialists keeps talent competition intense. Many nations struggle to recruit and retain skilled personnel due to complex defense requirements and rapid technological change. Workforce gaps weaken the ability to respond quickly to evolving threats and slow modernization efforts. Training programs and partnerships aim to close this gap, but the shortage remains a significant obstacle for building resilient cyber defense capabilities.

Integration Complexity Across Legacy Military Systems

Integrating advanced cybersecurity tools into outdated defense infrastructure remains challenging for many nations. Legacy command systems, analog platforms, and older communication networks limit seamless adoption of modern security architectures. Upgrading these systems requires high investment, long timelines, and strict operational continuity. Fragmented defense technologies create vulnerabilities and complicate secure data sharing across branches. As militaries transition to digital command and control, resolving compatibility issues becomes essential for ensuring complete protection and maintaining mission reliability in modern cyber-threat environments.

Regional Analysis

North America

North America holds a 41% share of the Defense Cyber Security market, driven by strong investment from the U.S. Department of Defense and advanced military digitalization programs. The region leads in AI-enabled threat detection, secure communication platforms, and cyber warfare capabilities. Large defense contractors collaborate with cybersecurity firms to strengthen protection across satellite networks, weapons platforms, and classified cloud systems. Rising nation-state attacks and modernization of command operations further accelerate adoption. Canada enhances cybersecurity readiness through defense infrastructure upgrades, strengthening overall regional growth and positioning North America as the global leader in defense cyber resilience.

Europe

Europe accounts for a 28% share of the market, supported by NATO-aligned cyber defense initiatives and increased investment in secure digital infrastructure. Countries such as the U.K., Germany, and France lead adoption through advanced incident response systems, encrypted communication networks, and cyber training programs. The region strengthens cross-border intelligence sharing and operational coordination to counter sophisticated attacks. Modernization of military platforms and expansion of secure cloud systems enhance demand. Eastern European nations increase investment due to rising geopolitical tensions, contributing to sustained growth across the broader European defense cybersecurity landscape.

Asia Pacific

Asia Pacific holds a 22% share of the Defense Cyber Security market, driven by rising defense budgets and growing cyber threats targeting national security assets. China, India, South Korea, and Japan invest in advanced cyber command centers, AI-based threat detection tools, and secure battlefield communication systems. Regional militaries enhance protection for satellite networks, surveillance platforms, and border security infrastructure. Increasing emphasis on indigenous capability development and collaboration with global cybersecurity vendors supports market expansion. Growing geopolitical tensions and rapid digitalization across defense sectors drive strong future adoption across Asia Pacific nations.

Middle East & Africa

The Middle East & Africa region holds a 9% share, supported by rising investment in military digital transformation and protection of critical defense infrastructure. Gulf nations deploy advanced monitoring tools and cyber command platforms to counter targeted attacks on defense networks and strategic assets. Israel leads regional innovation through development of high-end cyber defense technologies and intelligence systems. African nations increase adoption as they modernize defense communication networks and secure border surveillance platforms. Expanding cloud adoption and heightened security risks continue to accelerate cybersecurity upgrades across defense agencies in the region.

Latin America

Latin America accounts for an 8% share of the Defense Cyber Security market, driven by growing awareness of cyber threats targeting military communication systems and national defense infrastructure. Brazil, Mexico, and Colombia lead adoption as they strengthen cyber command units and upgrade digital surveillance networks. Governments invest in encrypted communication channels, incident response frameworks, and forensic capabilities to counter evolving attacks. Modernization of naval, air, and land defense systems further increases cybersecurity requirements. Despite budget constraints in some countries, rising digital transformation and regional security challenges support steady adoption of defense cybersecurity solutions.

Market Segmentations:

By Security Type

- Network security

- Endpoint security

- Application security

- Cloud security

By Offering

- Hardware

- Software and services

By Application

- Critical infrastructure protection

- Data protection and encryption

- Incident response and forensics

- Others

By End Use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Defense Cyber Security market features strong participation from major players such as CrowdStrike, Boeing, Hanwha Systems, CACI International, Cisco, IBM, BAE Systems, Carlyle Group, Airbus, and General Dynamics. These companies compete by advancing threat detection platforms, enhancing secure communication systems, and deploying AI-enabled cybersecurity solutions tailored for defense operations. Leading vendors invest in real-time analytics, cyber forensics, and zero-trust architectures to safeguard mission-critical systems across land, air, naval, and space domains. Partnerships with defense ministries, intelligence agencies, and military contractors strengthen market presence and expand solution capabilities. Many players focus on integrating cybersecurity with next-generation command centers, classified cloud environments, and digital battlefield systems. Continuous upgrades, acquisitions, and innovation in advanced threat intelligence technologies further intensify competition as nations prioritize resilient, high-performance defense cyber infrastructure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CrowdStrike

- Boeing

- Hanwha Systems

- CACI International

- Cisco

- IBM

- BAE Systems

- Carlyle Group

- Airbus

- General Dynamics

Recent Developments

- In 2025, Cisco released its third annual Cybersecurity Readiness Index, outlining how global organizations — including a broad range of private sector firms across various industries — stand in readiness to face evolving cyber threats in a landscape increasingly shaped by AI, hybrid cloud, and zero-trust demand.

- In 2025, cybersecurity experts and industry leaders, including IBM, emphasize that defence-linked cybersecurity heavily relies on securing data, artificial intelligence (AI) models, and identity frameworks

Report Coverage

The research report offers an in-depth analysis based on Security Type, Offering, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Military networks will adopt stronger AI-driven defense systems to counter advanced cyber threats.

- Zero-trust security models will become standard across critical defense infrastructure.

- Cloud-based command and control platforms will expand across global defense agencies.

- Real-time threat intelligence sharing will strengthen collaboration among allied nations.

- Autonomous cyber defense tools will support faster detection and automated response.

- Secure communication networks will evolve to protect next-generation weapons platforms.

- Cyber protection for satellites and space-based assets will gain higher priority.

- Defense forces will invest more in training cyber specialists and strengthening workforce capabilities.

- Integration of cybersecurity with unmanned systems and digital battlefield platforms will increase.

- Governments will boost procurement of advanced encryption, forensics, and resilience solutions.