Market Overview

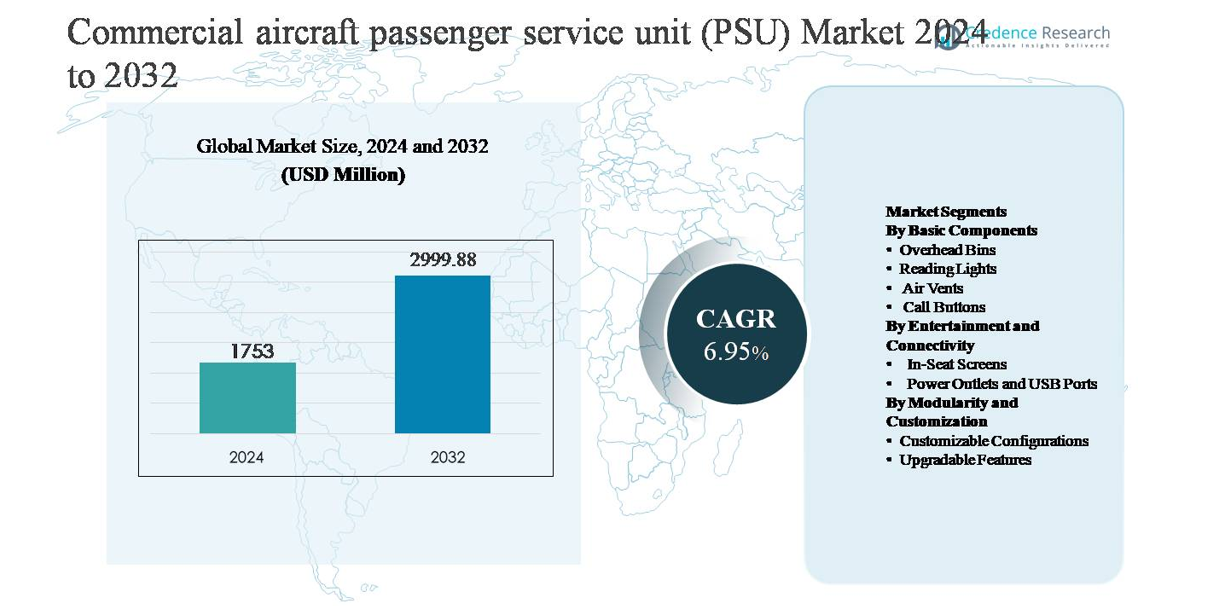

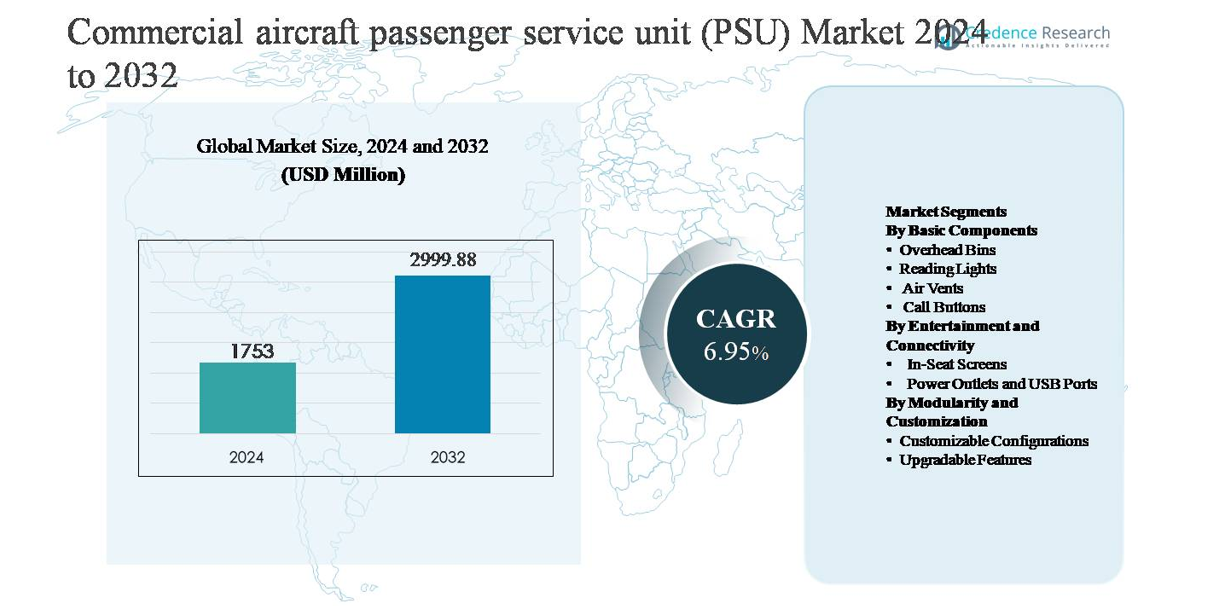

The commercial aircraft passenger service unit (PSU) market was valued at USD 1,753 million in 2024 and is projected to reach USD 2,999.88 million by 2032, expanding at a compound annual growth rate (CAGR) of 6.95% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Aircraft Passenger Service Unit (PSU) Market Size 2024 |

USD 1,753 million |

| Commercial Aircraft Passenger Service Unit (PSU) Market, CAGR |

6.95% |

| Commercial Aircraft Passenger Service Unit (PSU) Market Size 2032 |

USD 2,999.88 million |

The commercial aircraft passenger service unit (PSU) market is led by established aerospace interior specialists with strong OEM and aftermarket positioning, including Safran SA, Raytheon Technologies Corp., Astronics Corp., Triumph Group Inc., LUMINATOR, and Cabin Crew Safety Ltd. These companies compete through certified, lightweight, and modular PSU solutions aligned with evolving cabin comfort and connectivity requirements. North America is the leading regional market, accounting for approximately 34% of global market share, supported by a large installed aircraft fleet, continuous cabin retrofit activity, and the presence of major aircraft manufacturers and tier-1 suppliers. Europe and Asia-Pacific follow closely, driven by aircraft deliveries and modernization programs, while North America maintains leadership through technological maturity and high aftermarket demand.

Market Insights

- The commercial aircraft passenger service unit (PSU) market was valued at USD 1,753 million in 2024 and is projected to reach USD 2,999.88 million by 2032, expanding at a CAGR of 6.95% during the forecast period, supported by steady aircraft production and interior upgrade cycles.

- Market growth is primarily driven by rising commercial aircraft deliveries, increasing fleet utilization, and airline focus on passenger comfort, with overhead bins dominating the basic components segment due to cabin densification and higher carry-on luggage demand.

- Key trends include modular PSU architectures, LED-based smart lighting, and growing integration of power outlets and USB ports, with power and connectivity features holding the largest share within entertainment and connectivity segments.

- The competitive landscape is shaped by established aerospace interior suppliers leveraging OEM contracts, aftermarket retrofits, and certified lightweight designs to maintain long-term positioning and operational reliability.

- Regionally, North America leads with ~34% market share, followed by Asia-Pacific at ~29% and Europe at ~27%, while Middle East & Africa and Latin America together account for the remaining share, supported by premium cabin upgrades and narrow-body fleet growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Basic Components

The By Basic Components segment represents the structural and functional core of passenger service units, encompassing overhead bins, reading lights, air vents, and call buttons. Overhead bins dominate this segment, accounting for the largest market share, driven by increasing carry-on baggage volumes, stricter airline efficiency requirements, and continuous aircraft interior retrofits. Airlines prioritize lightweight composite overhead bins with higher load capacity and improved ergonomics to optimize cabin space and reduce turnaround time. Growing narrow-body aircraft deliveries and cabin densification strategies further reinforce demand for advanced overhead bin systems within PSU assemblies.

- For instance, Airbus’s Airspace XL overhead bins installed on A320neo-family aircraft are engineered to accommodate up to eight standard roller bags per bin, compared with earlier designs that typically held five bags, while maintaining single-latch operation and gas-spring-assisted opening.

By Entertainment and Connectivity

The By Entertainment and Connectivity segment focuses on enhancing passenger comfort and digital experience through in-seat screens, power outlets, and USB ports. Power outlets and USB ports hold the dominant market share, supported by the widespread use of personal electronic devices and airlines’ shift toward bring-your-own-device (BYOD) entertainment models. The rising expectation for uninterrupted device charging across short- and long-haul flights drives consistent integration of multi-standard power solutions within PSUs. Retrofit programs and new aircraft deliveries increasingly standardize USB-A, USB-C, and combined power modules, sustaining strong adoption across global fleets.

- For instance, Astronics’ EmPower® system is a widely deployed in-seat power solution across single-aisle and wide-body aircraft. The company offers various configurations, including new systems like the EmPower UltraLite G2, which can provide up to 60W of continuous power per seat specifically through USB Type-C ports.

By Modularity and Customization

The By Modularity and Customization segment addresses airline demand for flexible PSU architectures through customizable configurations and upgradable features. Customizable configurations lead this segment in market share, as airlines seek cabin differentiation, faster reconfiguration, and lifecycle cost optimization. Modular PSU designs allow operators to tailor lighting, ventilation, and connectivity layouts by cabin class and aircraft type. Drivers include frequent cabin refresh cycles, evolving passenger expectations, and the need to integrate future technologies without full PSU replacement, making modular, scalable designs a strategic priority for aircraft interior manufacturers.

Key Growth Drivers

Rising Commercial Aircraft Deliveries and Fleet Expansion

The sustained increase in global commercial aircraft deliveries remains a primary growth driver for the passenger service unit (PSU) market. Airlines continue to expand and modernize fleets to meet rising air travel demand, particularly in narrow-body aircraft used for short- and medium-haul routes. Each new aircraft delivery requires fully integrated PSU systems, directly driving OEM demand. Additionally, strong order backlogs from major aircraft manufacturers support long-term visibility for PSU suppliers. Growth in low-cost carriers further amplifies demand, as high aircraft utilization rates accelerate cabin wear and prompt frequent interior upgrades. Emerging aviation markets in Asia-Pacific, the Middle East, and Latin America contribute significantly to fleet growth, reinforcing consistent PSU procurement across both line-fit and aftermarket channels.

- For instance, Boeing’s published backlog for the 737 program exceeds 4,500 aircraft, providing multi-year production visibility for PSU suppliers aligned with this platform.

Increasing Focus on Passenger Comfort and Cabin Experience

Airlines are placing greater emphasis on enhancing passenger comfort and perceived cabin quality as a competitive differentiator. PSUs play a central role in the passenger experience by integrating lighting, air circulation, call functions, and connectivity access at each seat row. Improved reading lights with adjustable intensity, optimized air vents for personalized airflow, and intuitive call button interfaces contribute directly to comfort and satisfaction. As airlines compete for customer loyalty, even short-haul operators are upgrading PSU specifications to align with premium service expectations. This shift drives adoption of advanced PSU designs that support ergonomic improvements, noise reduction, and improved reliability, strengthening demand across both new installations and retrofit programs.

- For instance, Collins Aerospace has developed advanced gasper vent systems with 360-degree directional adjustment and low-turbulence nozzles validated through cabin airflow testing to improve localized thermal comfort.

Growth of Cabin Retrofit and Aircraft Modernization Programs

Aircraft retrofit and cabin modernization initiatives represent a major driver for PSU market expansion. Airlines regularly refurbish interiors to extend aircraft service life, comply with updated safety standards, and refresh brand identity. PSU upgrades are often prioritized during retrofits due to their visibility, functional importance, and compatibility with new cabin technologies. Replacement of legacy PSUs with lighter, modular systems helps reduce maintenance complexity and improve operational efficiency. Aging global fleets, particularly among single-aisle aircraft, continue to generate steady aftermarket demand. As operators seek cost-effective ways to modernize cabins without full aircraft replacement, PSU retrofits remain a high-impact investment area.

Key Trends & Opportunities

Shift Toward Modular and Scalable PSU Architectures

A key trend shaping the PSU market is the transition toward modular and scalable system architectures. Airlines increasingly favor PSU designs that allow flexible configuration across different cabin classes and aircraft variants. Modular PSUs enable operators to add, remove, or upgrade components such as power outlets, lighting modules, or sensors without replacing the entire unit. This flexibility supports faster cabin reconfiguration, reduces downtime, and lowers lifecycle costs. For manufacturers, modular platforms create opportunities to offer upgrade kits, long-term service agreements, and future-ready designs compatible with evolving technologies. As fleet operators prioritize adaptability and cost control, modular PSU solutions gain strong traction.

- For instance, Diehl Aviation’s Eco-PSU platform is designed with interchangeable functional modules, allowing airlines to integrate or replace LED lighting units, passenger call panels, or USB power modules individually, while maintaining a common mechanical housing certified across A320-family cabins.

Integration of Advanced Lighting and Smart Cabin Features

The integration of advanced lighting technologies and smart cabin features presents significant growth opportunities for PSU suppliers. LED-based reading lights with variable color temperature and intensity are increasingly standard, supporting circadian lighting concepts and passenger well-being. PSUs are also becoming integration points for sensors, diagnostics, and cabin management systems that enable predictive maintenance and real-time monitoring. These advancements align with airlines’ digital cabin strategies and operational efficiency goals. Suppliers that develop PSUs compatible with aircraft health monitoring systems and smart cabin platforms are well positioned to capture incremental value beyond traditional hardware sales.

- For instance, Safran Cabin’s LED PSU lighting systems support multiple correlated color temperature settings ranging from 2,700 K to 6,500 K, enabling circadian-aligned lighting scenarios for reading, meal service, and rest phases within narrow-body cabins.

Key Challenges

Stringent Certification and Regulatory Compliance Requirements

One of the primary challenges in the PSU market is the stringent certification and regulatory approval process. PSUs must comply with rigorous aviation safety, flammability, electromagnetic compatibility, and reliability standards set by regulatory authorities. Any design modification, material change, or feature upgrade requires extensive testing and validation, increasing development timelines and costs. These requirements create high entry barriers for new suppliers and slow the adoption of innovative technologies. For established manufacturers, balancing innovation with compliance remains complex, particularly as airlines demand faster customization and shorter lead times within a highly regulated environment.

Cost Pressures and Airline Procurement Sensitivity

Persistent cost pressures across the airline industry pose a challenge for PSU manufacturers. Airlines aggressively negotiate pricing, especially for large-volume narrow-body programs, limiting margin expansion. At the same time, suppliers face rising costs related to materials, certification, and supply chain complexity. Airlines often expect enhanced functionality, lighter weight, and greater modularity without proportional cost increases. This dynamic pressures manufacturers to invest in efficiency, automation, and standardized platforms while maintaining high reliability. Managing cost competitiveness without compromising quality or compliance remains a critical challenge in sustaining long-term profitability.

Regional Analysis

North America

North America accounts for approximately 34% of the global commercial aircraft passenger service unit (PSU) market, driven by strong aircraft production activity and a large installed fleet. The presence of major aircraft OEMs, tier-1 interior suppliers, and advanced MRO infrastructure supports sustained PSU demand across both line-fit and retrofit programs. U.S.-based airlines continue to invest in cabin upgrades to enhance passenger experience, particularly in narrow-body fleets. High adoption of advanced lighting, power outlets, and modular PSU designs further strengthens regional demand, supported by strict regulatory standards that favor technologically mature suppliers.

Europe

Europe represents nearly 27% of the global PSU market, supported by steady aircraft deliveries, cabin refurbishment programs, and strong aerospace manufacturing capabilities. The region benefits from the presence of leading aircraft OEMs and PSU suppliers, particularly in Germany, France, and the UK. European airlines emphasize lightweight materials, energy-efficient lighting, and customizable cabin interiors to meet sustainability and premium service objectives. Ongoing replacement of aging fleets and increasing adoption of modular PSU architectures drive aftermarket demand. Regulatory focus on safety, emissions, and cabin efficiency continues to shape PSU design and procurement strategies across the region.

Asia-Pacific

Asia-Pacific holds around 29% of the global PSU market, making it the fastest-growing regional segment. Rapid air passenger growth, expanding middle-class travel, and aggressive fleet expansion by airlines in China, India, and Southeast Asia drive strong PSU demand. Narrow-body aircraft dominate deliveries, resulting in high-volume PSU installations. Airlines increasingly adopt modern PSUs with integrated power and connectivity to meet rising passenger expectations. Government investments in aviation infrastructure and the emergence of regional MRO hubs further support aftermarket growth, positioning Asia-Pacific as a critical long-term demand center.

Middle East & Africa

The Middle East & Africa region accounts for approximately 6% of the global PSU market, supported primarily by wide-body fleet investments from Middle Eastern carriers. Airlines in the Gulf region prioritize premium cabin experiences, driving demand for high-specification PSUs with advanced lighting and connectivity features. Fleet modernization and long-haul aircraft utilization support consistent retrofit activity. In Africa, gradual fleet renewal and increasing regional connectivity contribute to modest PSU demand growth. While smaller in share, the region benefits from high-value PSU configurations and strong focus on passenger comfort and brand differentiation.

Latin America

Latin America represents about 4% of the global commercial aircraft PSU market, driven by gradual fleet expansion and increasing aircraft utilization. Airlines in the region focus on cost-efficient cabin upgrades, supporting demand for durable and standardized PSU solutions. Narrow-body aircraft dominate regional fleets, resulting in steady PSU replacement and retrofit requirements. Economic recovery trends and rising low-cost carrier penetration encourage selective interior modernization initiatives. Although market share remains limited, increasing air travel demand and improving MRO capabilities are expected to support stable PSU adoption across major Latin American aviation markets.

Market Segmentations:

By Basic Components

- Overhead Bins

- Reading Lights

- Air Vents

- Call Buttons

By Entertainment and Connectivity

- In-Seat Screens

- Power Outlets and USB Ports

By Modularity and Customization

- Customizable Configurations

- Upgradable Features

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The commercial aircraft passenger service unit (PSU) market features a moderately consolidated competitive landscape dominated by established aerospace interior suppliers with strong OEM relationships and global manufacturing footprints. Leading players compete on product reliability, weight optimization, modular design capability, and certification expertise. Long-term supply agreements with aircraft manufacturers secure high-volume line-fit programs, while robust aftermarket and retrofit offerings strengthen recurring revenue streams. Companies increasingly invest in modular PSU platforms that support customization, faster installation, and future technology integration. Competitive differentiation also stems from advanced lighting systems, integrated power and connectivity modules, and compliance with stringent safety regulations. Strategic partnerships with airlines and MRO providers enhance market access, while continuous product innovation and lifecycle support remain critical to sustaining competitive advantage in this highly regulated market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In December 2025, Safran announced the launch of Safran Tech UK, its first research & technology center outside France, to accelerate innovation in advanced aircraft systems (including electrification and materials technologies relevant to next-generation cabin solutions).

- In April 2025, Astronics announced the SkyShow Server system an advanced 4K in-cabin moving map and entertainment server designed for seamless integration into commercial aircraft cabins, complementing PSU lighting and connectivity functions.

- In February 2025, Triumph Group agreed to be acquired by Warburg Pincus and Berkshire Partners in an all-cash transaction, with shareholders receiving USD 26.00 per share. This transition is expected to shift Triumph’s focus toward expanded aerospace manufacturing and supply of engineered components that support commercial aircraft systems, including those related to cabin and interior assemblies that integrate with PSU platforms.

Report Coverage

The research report offers an in-depth analysis based on Basic Components, Entertainment and Connectivity, Modularity and Customization and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Airlines will continue prioritizing PSU upgrades to enhance passenger comfort and cabin differentiation across narrow-body and wide-body fleets.

- Modular and scalable PSU designs will gain wider adoption as operators seek faster cabin reconfiguration and lower lifecycle costs.

- Integration of advanced LED lighting with adjustable intensity and color temperature will become standard across new aircraft programs.

- Demand for in-seat power outlets and USB connectivity within PSUs will remain strong due to increased use of personal electronic devices.

- Lightweight materials and compact PSU architectures will support airline objectives for fuel efficiency and reduced operating costs.

- Retrofit and modernization programs will sustain aftermarket demand as airlines extend aircraft service life.

- PSUs will increasingly integrate with smart cabin and aircraft health monitoring systems to support predictive maintenance.

- Narrow-body aircraft deliveries will remain the primary volume driver for PSU installations globally.

- Suppliers will focus on certification efficiency and standardized platforms to accelerate product development cycles.

- Emerging aviation markets will contribute to incremental demand through fleet expansion and improved cabin standards.