Market Overview:

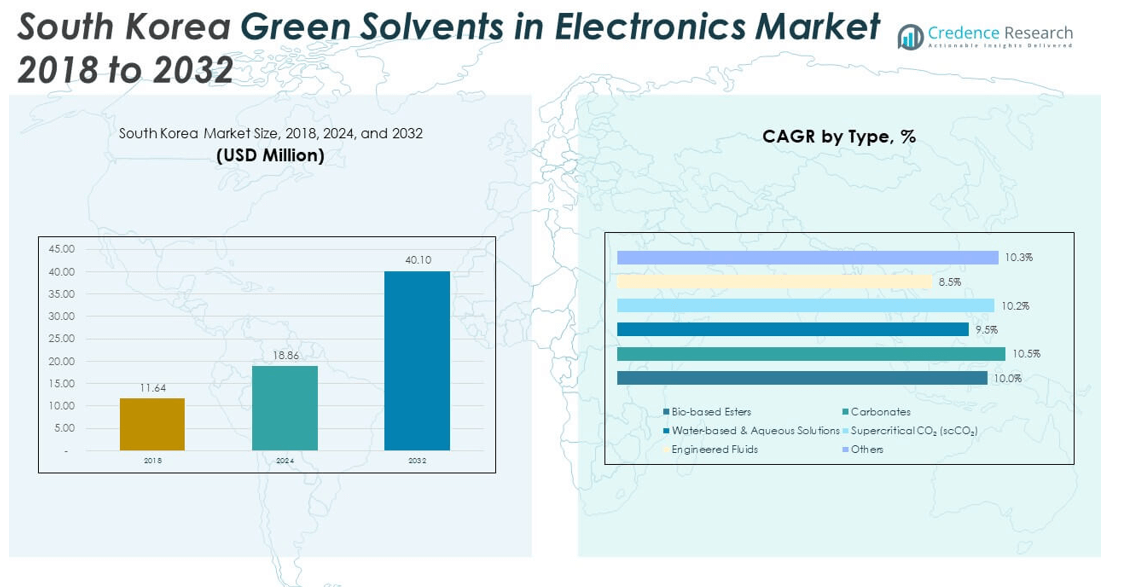

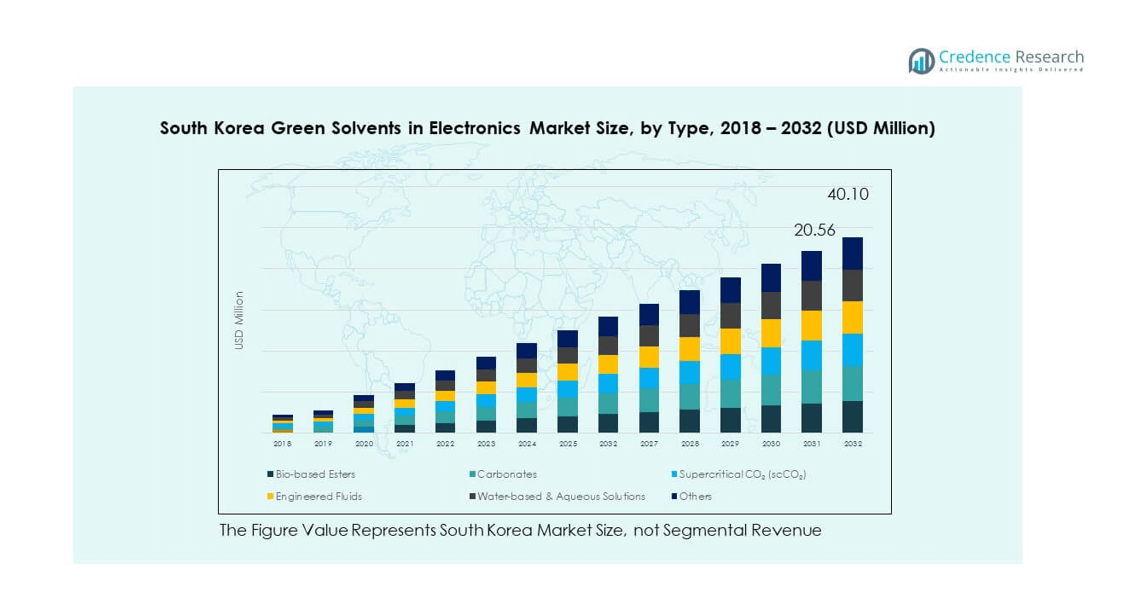

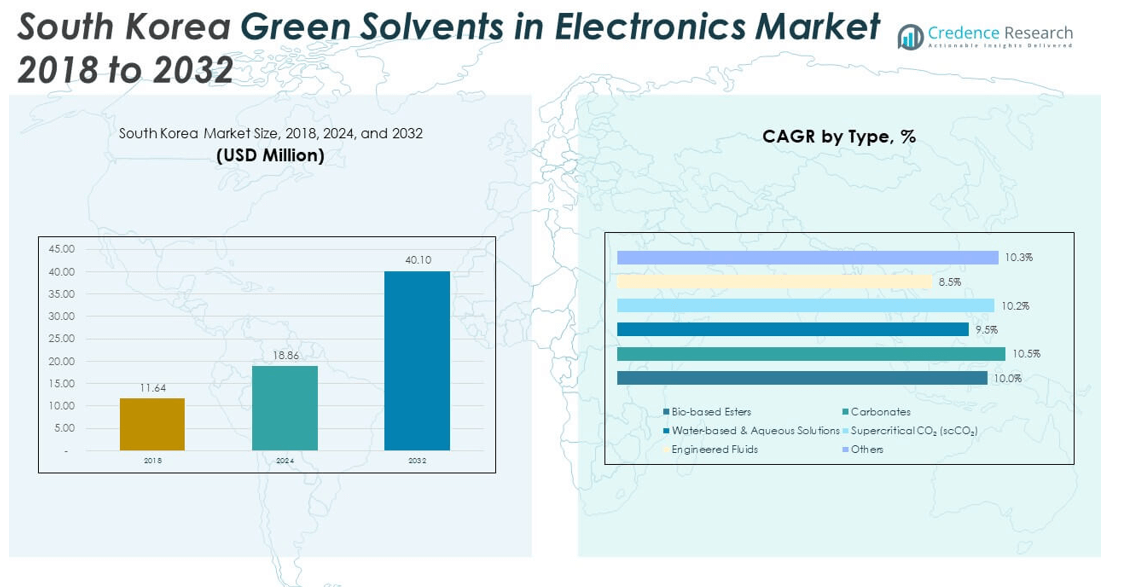

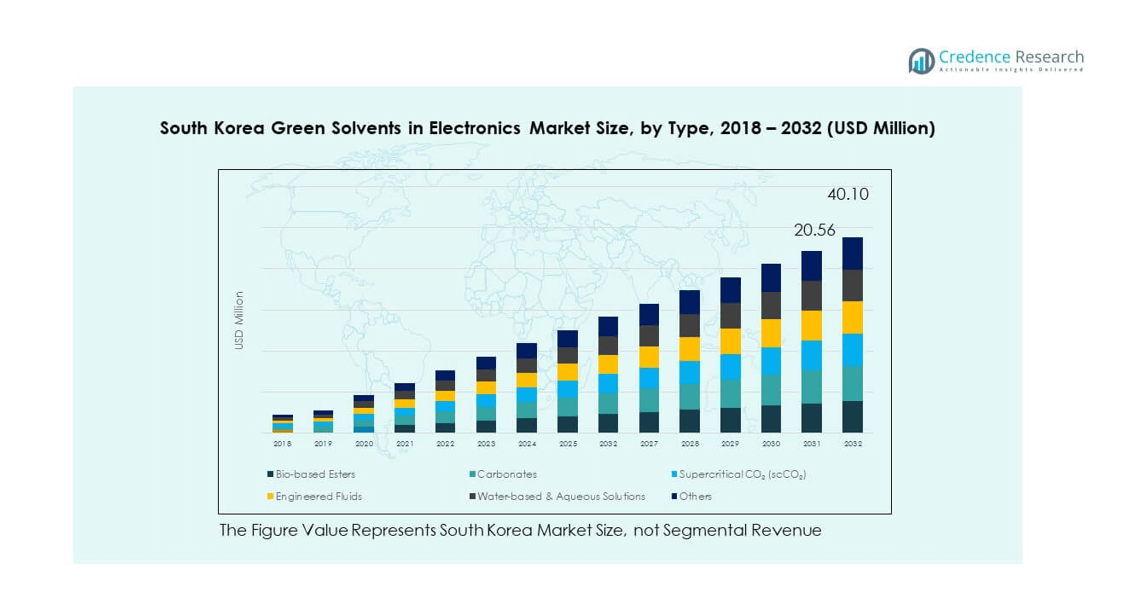

The South Korea Green Solvents in Electronics Market size was valued at USD 11.64 million in 2018, reaching USD 18.86 million in 2024, and is anticipated to hit USD 40.1 million by 2032, at a CAGR of 5.60% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| South Korea Green Solvents in Electronics Market Size 2024 |

USD 18.86 million |

| South Korea Green Solvents in Electronics Market, CAGR |

5.60% |

| South Korea Green Solvents in Electronics Market Size 2032 |

USD 40.1 million |

Market growth is driven by the shift toward eco-friendly chemicals and regulatory pressure to reduce hazardous emissions. Electronics manufacturers are adopting green solvents to improve sustainability and compliance with environmental standards. Rising demand for high-performance solvents in cleaning, degreasing, and manufacturing of advanced electronic components is fueling adoption. Additionally, technological advancements in biodegradable and bio-based solvents are enhancing their efficiency and expanding their application scope across the industry.

South Korea is a key hub for electronics production, with major companies accelerating green adoption to align with global environmental targets. The country’s robust semiconductor and display manufacturing sector creates strong demand for safe, efficient, and sustainable solvents. While South Korea leads in adoption, other Asian markets such as China and Japan are emerging rapidly, driven by government initiatives and strong manufacturing ecosystems. Western regions, particularly Europe, are also progressing with strict regulatory frameworks that encourage the transition to greener alternatives.

Market Insights:

- The South Korea Green Solvents in Electronics Market was valued at USD 11.64 million in 2018, reached USD 18.86 million in 2024, and is projected to hit USD 40.10 million by 2032, expanding at a CAGR of 5.60%.

- The Seoul Capital Region held the largest share at 46%, driven by semiconductor and display clusters, followed by Gyeonggi and Chungcheong at 32% with strong manufacturing hubs, and Gyeongsang and Jeolla at 22% supported by displays and batteries.

- The Seoul Capital Region is the fastest-growing area with 46% share, led by export-oriented foundries, government-backed R&D, and industrial clusters focusing on sustainable production.

- Bio-based esters accounted for the highest share of segmental revenue in 2024, reflecting strong adoption in semiconductors and displays.

- Carbonates represented the second-largest share in 2024, supported by their use in batteries and specialty electronics applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Sustainable Materials in Electronics Manufacturing:

The South Korea Green Solvents in Electronics Market benefits from the growing focus on eco-friendly materials. Manufacturers are under pressure to replace conventional solvents with safer alternatives that reduce emissions. Demand from semiconductor and display industries is pushing companies toward bio-based and low-VOC options. Strong government policies are accelerating this adoption by offering regulatory clarity. The industry is also supported by global buyers requiring greener production practices. Consumer awareness about sustainability reinforces this shift. It strengthens the position of green solvents across diverse applications in electronics.

- For instance, HighChem Co., Ltd. partnered with Hokkaido University in June 2024 to establish a joint R&D lab focusing on accelerating research into biomass-derived functional resins and fibers. The partnership aims to develop and popularize future plant-based polyester alternatives for applications like PET bottles and textiles, with the ultimate goal of commercialization and contributing to greener production practices. The industry’s demand for sustainable materials, driven by global buyers, supports this initiative.

Regulatory Push Supporting Environmental Compliance Standards:

South Korea has strict environmental standards that drive adoption of green solvents in electronics. Regulators encourage the reduction of hazardous chemicals across industrial supply chains. Compliance requirements incentivize producers to invest in cleaner solutions. The electronics sector, being a critical export industry, aligns quickly with these standards. Global environmental protocols also influence domestic practices. The South Korea Green Solvents in Electronics Market responds by innovating sustainable alternatives. It positions companies to remain competitive in international markets where compliance matters.

Technological Advancements Enhancing Product Performance and Efficiency:

Innovation in solvent formulations is supporting wider adoption in high-precision electronics applications. Bio-based solvents are increasingly matching the performance of conventional solutions. Enhanced thermal stability and cleaning effectiveness make them suitable for semiconductors and circuit boards. Research institutions and companies collaborate to improve scalability of production. These advancements lower risks for manufacturers transitioning to new materials. The South Korea Green Solvents in Electronics Market benefits from this steady R&D pipeline. It ensures consistent improvement in quality and cost-effectiveness for long-term use.

Growing Role of Electronics Export Industry in Shaping Adoption:

South Korea’s strong position as a leading electronics exporter fuels the need for greener production methods. International buyers prefer suppliers that align with sustainability commitments. Export competitiveness strengthens with the adoption of green solvents across processes. The display and semiconductor segments play a central role in driving this demand. Export-oriented firms adopt new solvents faster to maintain global contracts. Industry collaborations further expand adoption across the ecosystem. The South Korea Green Solvents in Electronics Market gains from this export-driven demand. It links sustainability with long-term global competitiveness.

Market Trends:

Integration of Circular Economy Practices into Electronics Production:

The electronics industry is aligning with circular economy principles, and green solvents are central to this shift. Manufacturers adopt processes that reduce waste and improve recyclability. Companies aim to minimize environmental footprints across product lifecycles. Green solvents contribute by ensuring safer production of semiconductors and displays. They also support material recovery processes with reduced emissions. The South Korea Green Solvents in Electronics Market reflects this transition clearly. It positions sustainability as both an operational and strategic industry trend.

- For instance, Vertec BioSolvents Inc. offers lactate ester-based solvents for the electronics industry, which are known to be 100% bio-based and biodegradable and can offer significantly lower VOCs compared to conventional solvents. This facilitates safer cleaning processes, with the company’s patented ELSOL technology expanding applications in precision cleaning.

Collaboration Between Industry Players and Research Institutions:

Collaborative innovation is a defining trend in the development of green solvents. Universities and corporations’ partner to accelerate solvent performance improvements. Joint projects reduce barriers to commercialization of bio-based products. Partnerships with chemical producers further expand the supply base. Electronics manufacturers benefit from these ecosystems of innovation. Government funding programs encourage such collaborations to advance technology faster. The South Korea Green Solvents in Electronics Market benefits from this collective effort. It ensures knowledge-sharing and market alignment with sustainability goals.

- For instance, in August 2025, HighChem Co., Ltd. announced an exclusive distribution agreement with Jiangxi Zhongxin Aksum New Materials, where HighChem will supply Jiangxi Zhongxin’s existing Hydrofluoro Olefin (HFO) products, including HFO-1233zd, to the Japanese market for applications such as semiconductor cleaning.

Shift Toward High-Performance Bio-Based Solvents in Precision Components:

The adoption of high-performance bio-based solvents is gaining traction across advanced electronics manufacturing. Producers design solvents with properties matching or exceeding petrochemical-based options. This shift supports precision cleaning and etching in semiconductors and microelectronics. Bio-based products are also seen as safer for long-term occupational use. Manufacturers adopt them to enhance worker safety and environmental compliance. Continuous trials in production lines improve confidence in scalability. The South Korea Green Solvents in Electronics Market mirrors this transition effectively. It creates new benchmarks for eco-friendly performance.

Increased Influence of Global Supply Chain Standards on Local Practices:

Global sustainability frameworks strongly influence domestic manufacturing practices. Multinational buyers require certified eco-friendly products from suppliers. These requirements cascade through electronics supply chains in South Korea. Companies adapt to ensure they meet both domestic and export compliance. Certifications and audits reinforce the role of green solvents in production. Large electronics firms adopt stricter standards that smaller suppliers follow. The South Korea Green Solvents in Electronics Market evolves in response to these dynamics. It ensures local industries remain aligned with global buyers.

Market Challenges Analysis:

High Production Costs and Limited Raw Material Availability:

The cost of producing bio-based solvents remains a major challenge. Scaling production while ensuring quality is expensive for manufacturers. Limited availability of renewable feedstocks also constrains growth. Smaller suppliers struggle to achieve cost parity with petrochemical-based products. Electronics manufacturers hesitate when operational budgets are tight. The South Korea Green Solvents in Electronics Market must overcome these barriers to expand adoption. It requires industry-wide investment to reduce costs and improve supply chain stability.

Performance Gaps and Reluctance in Industrial Transition:

Green solvents face skepticism in replacing traditional options across critical processes. Certain applications demand high performance levels that are difficult to match. Resistance from conservative manufacturers slows down adoption. Operational risks and compatibility issues remain concerns for industrial users. Transitioning requires both technological assurance and financial support. Companies need confidence in long-term supply and performance stability. The South Korea Green Solvents in Electronics Market must bridge this gap effectively. It depends on advancing both technology and user trust.

Market Opportunities:

Expansion into Advanced Semiconductor and Display Manufacturing Applications:

The South Korea Green Solvents in Electronics Market has significant growth potential in advanced semiconductor and display manufacturing. These segments require precision cleaning and sustainable production, creating new opportunities. Producers can position green solvents as solutions for high-performance applications. R&D investment strengthens their ability to meet evolving requirements. It helps companies align with sustainability targets while ensuring quality output. Expanding into these applications enhances both domestic use and global competitiveness.

Export Opportunities Through Alignment with Global Sustainability Standards:

Global buyers prioritize suppliers with strong sustainability commitments, creating export opportunities for South Korean firms. Adoption of green solvents strengthens compliance with international frameworks. Export-driven companies can leverage these practices to secure contracts in global markets. It reinforces the position of domestic manufacturers as leaders in sustainable electronics production. The South Korea Green Solvents in Electronics Market gains strategic importance from these opportunities. It connects environmental responsibility with business expansion prospects worldwide.

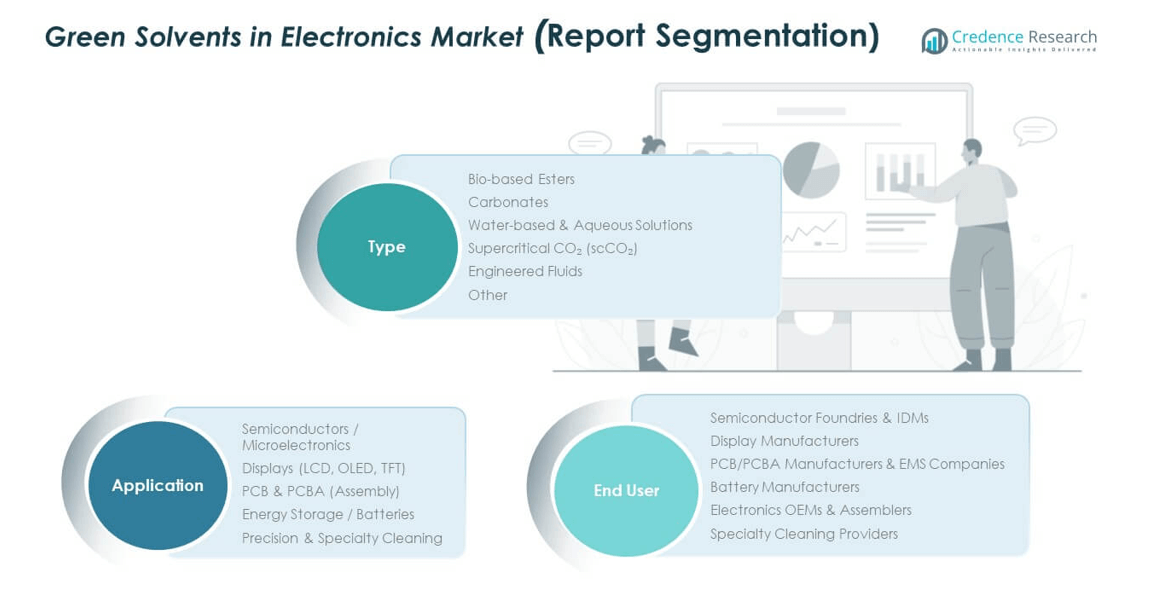

Market Segmentation Analysis:

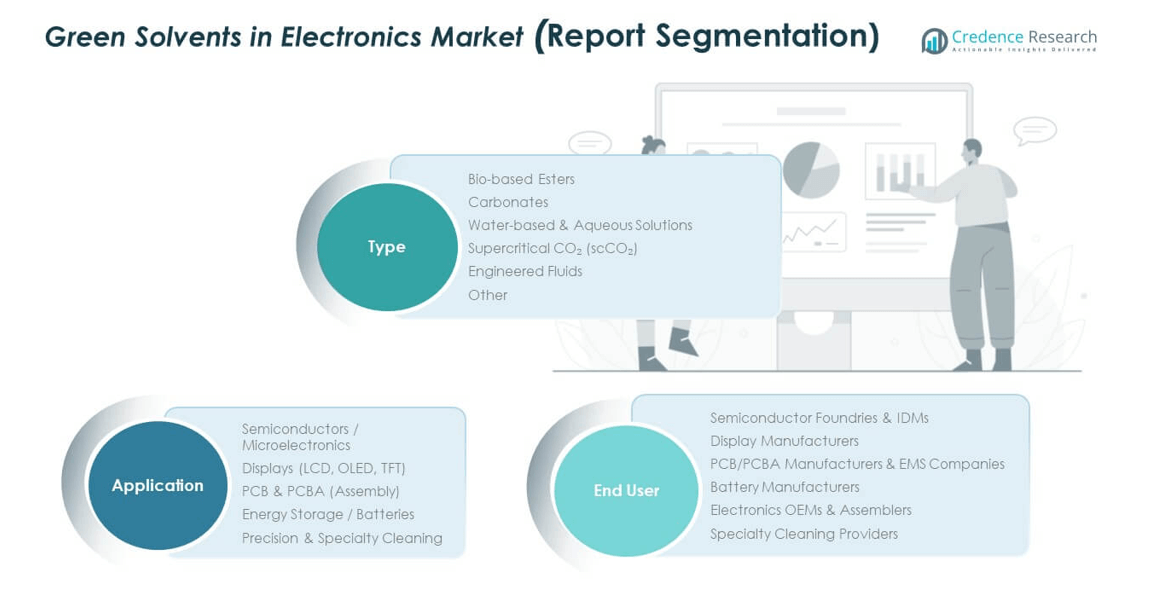

By Type

The South Korea Green Solvents in Electronics Market features diverse solvent categories that support specialized applications. Bio-based esters lead due to their compatibility with semiconductor and display cleaning processes. Carbonates provide stability and low toxicity, making them ideal for precision electronics. Water-based and aqueous solutions gain traction for cost efficiency and safety in assembly operations. Supercritical CO₂ (scCO₂) stands out for advanced cleaning in high-value components, while engineered fluids deliver performance in complex applications. Other niche solvents expand adoption in specialized manufacturing areas.

- For instance, Corbion N.V. produces bio-based lactic acid derivatives (marketed as PURASOLV) used as industrial solvents, including applications in the electronics and semiconductor industry. These bio-based products offer environmental benefits, such as reduced fossil fuel reliance and biodegradability, promoting higher purity levels and reduced environmental impact compared to some traditional solvents.

By Application

Semiconductors and microelectronics dominate demand as they require high-purity solvents for cleaning and etching. Displays, including LCD, OLED, and TFT, rely heavily on eco-friendly solvents to maintain quality and regulatory compliance. PCB and PCBA assembly processes adopt green solvents for flux removal and degreasing. Energy storage and battery sectors increasingly turn to safer solvents to enhance performance and meet environmental targets. Precision and specialty cleaning create consistent opportunities where strict quality standards are critical.

- For example, Zhejiang Kingsun Eco-pack Co., Ltd., a Chinese manufacturer of biodegradable paper tableware, was noted in July 2025 for investing $80.5 million to open its first U.S. manufacturing facility in Robbinsville, North Carolina.

By End User

Semiconductor foundries and IDMs account for the largest consumption due to their stringent production needs. Display manufacturers represent another core segment, driven by global demand for advanced panels. PCB and PCBA manufacturers, along with EMS companies, adopt solvents for cost-effective production. Battery manufacturers expand usage to align with sustainable energy goals. Electronics OEMs and assemblers incorporate green solvents across multiple processes. Specialty cleaning providers create further demand by offering eco-friendly maintenance services. The South Korea Green Solvents in Electronics Market benefits from this broad end-user adoption.

Segmentation:

By Type

- Bio-based Esters

- Carbonates

- Water-based & Aqueous Solutions

- Supercritical CO₂ (scCO₂)

- Engineered Fluids

- Other

By Application

- Semiconductors / Microelectronics

- Displays (LCD, OLED, TFT)

- PCB & PCBA (Assembly)

- Energy Storage / Batteries

- Precision & Specialty Cleaning

By End User

- Semiconductor Foundries & IDMs

- Display Manufacturers

- PCB/PCBA Manufacturers & EMS Companies

- Battery Manufacturers

- Electronics OEMs & Assemblers

- Specialty Cleaning Providers

Regional Analysis:

Seoul Capital Region

The Seoul Capital Region accounts for nearly 46% of the South Korea Green Solvents in Electronics Market, driven by the concentration of semiconductor foundries, display manufacturers, and electronics OEMs. The presence of major global leaders in chipmaking and displays fuels strong adoption of green solvents. Government-backed industrial clusters in this area prioritize sustainability, creating higher demand for bio-based and engineered solvents. Companies in Seoul and its surrounding areas invest heavily in R&D, ensuring consistent innovation in eco-friendly processes. Strong infrastructure and export-oriented production reinforce its position as the leading regional market. It continues to set the benchmark for the wider adoption of green solvents across the country.

Gyeonggi and Chungcheong Provinces

Gyeonggi and Chungcheong together hold about 32% share, supported by large-scale electronics manufacturing hubs. These provinces benefit from the expansion of semiconductor fabrication facilities and PCB/PCBA assembly plants. Local manufacturers integrate water-based and supercritical CO₂ solvents for improved safety and efficiency. Partnerships with universities and research parks in Daejeon and Suwon accelerate technology adoption. The South Korea Green Solvents in Electronics Market reflects this regional strength through higher industrial applications and export-ready production capabilities. It shows steady growth as more companies transition from conventional solvents to sustainable alternatives in production lines.

Gyeongsang and Jeolla Provinces

The Gyeongsang and Jeolla regions contribute around 22% share, with growing importance in displays, batteries, and specialty cleaning applications. Industrial clusters in Busan, Daegu, and Gwangju encourage adoption of advanced green solvents for electronics and energy storage. Government incentives in these areas focus on sustainability and industrial diversification. Manufacturers in these provinces use green solvents to meet both domestic demand and global export requirements. It highlights the role of emerging hubs in balancing South Korea’s overall market distribution. The South Korea Green Solvents in Electronics Market gains further momentum as these provinces integrate sustainable practices across expanding electronics sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- HighChem Co., Ltd.

- Vertec BioSolvents Inc.

- Godavari Biorefineries Ltd.

- Galactic

- Kindun Chemical Co.

- Lotte Chemical

- Corbion N.V.

- Green Chemical Inc.

- Merck KGaA

- BASF SE

- Dow Inc.

- SK chemicals

- Other Key Players

Competitive Analysis:

The South Korea Green Solvents in Electronics Market is characterized by strong competition among domestic and global players. Leading companies include SK Chemicals, Lotte Chemical, BASF SE, Dow Inc., and Merck KGaA, each focusing on bio-based and engineered solvent portfolios. Firms invest in research collaborations and sustainable technology development to strengthen product performance. The presence of regional innovators such as Green Chemical Inc. and HighChem Co., Ltd. adds competitive intensity. It shows a balanced mix of large-scale suppliers and niche producers addressing semiconductor, display, and battery applications. Companies differentiate through environmental compliance, cost optimization, and export readiness. The market remains dynamic, with innovation and partnerships shaping long-term competitiveness.

Recent Developments:

- Godavari Biorefineries Ltd. announced in August 2025 that it plans to commission a 200 KLPD grain distillery by Q4 FY26 to enhance ethanol production capacity. The company showed growth in its bio-based chemicals segment, focusing on sustainable chemical production that can support green solvent markets, aligned with India and regional green energy goals.

- Lotte Chemical announced in May 2025 that it plans to start operations of a new cracker plant in Indonesia in H2 2025. This project will increase production capabilities of petrochemical feedstocks; the company is also focusing on divesting non-core assets and restructuring to strengthen its competitiveness in advanced materials and hydrogen energy sectors. These initiatives support its role in green chemicals and sustainable solutions relevant to electronic solvents.

- Corbion N.V. reported strong first half 2025 financial results in August 2025 with volume/mix growth driven by health, nutrition, pharma, and biomedical polymers segments. The company maintains a positive outlook for 2025, emphasizing sustainability focus and innovations in bio-based chemicals which are applicable to green solvents for electronics.

Report Coverage:

The research report offers an in-depth analysis based on type, application, and end-user segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing demand for sustainable solvents will strengthen adoption across semiconductor and display manufacturing.

- R&D in bio-based esters and engineered fluids will enhance performance and reliability.

- Partnerships between electronics firms and chemical producers will drive scalable innovation.

- Regulatory enforcement will continue to accelerate the replacement of traditional solvents.

- Exports will expand as South Korean firms align with global sustainability standards.

- Growth in PCB and PCBA applications will open new avenues for water-based solvents.

- Battery manufacturing will adopt high-purity carbonates to support energy storage expansion.

- Industrial clusters will attract foreign investment to boost production capacity.

- Regional companies will gain competitiveness through government-backed environmental initiatives.

- The South Korea Green Solvents in Electronics Market will evolve into a technology-intensive sector with strong export relevance.