Market Overview:

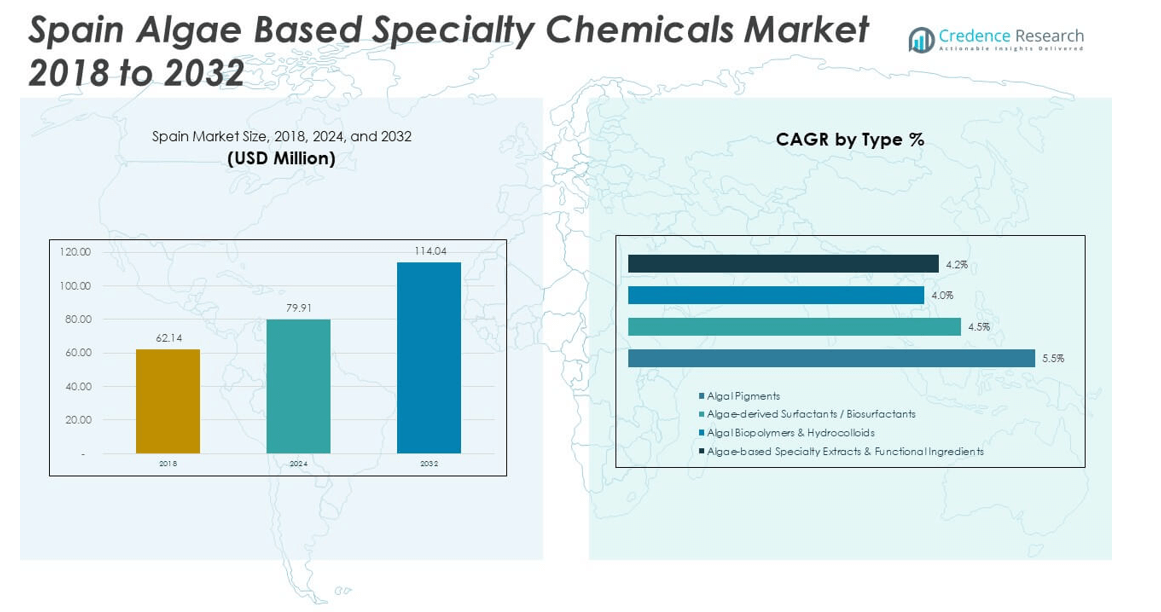

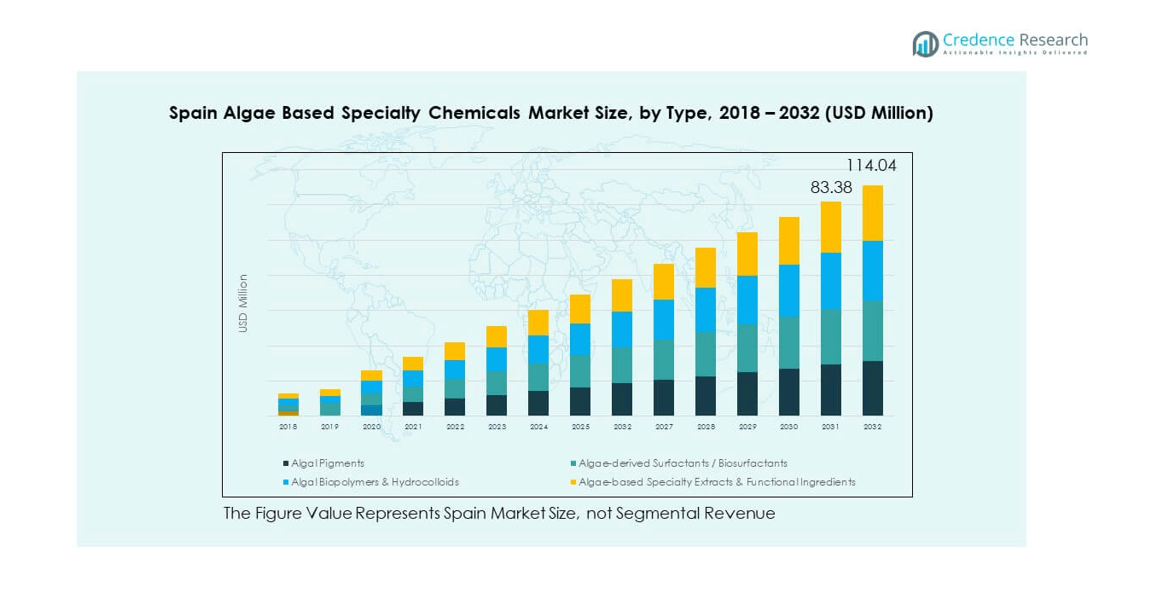

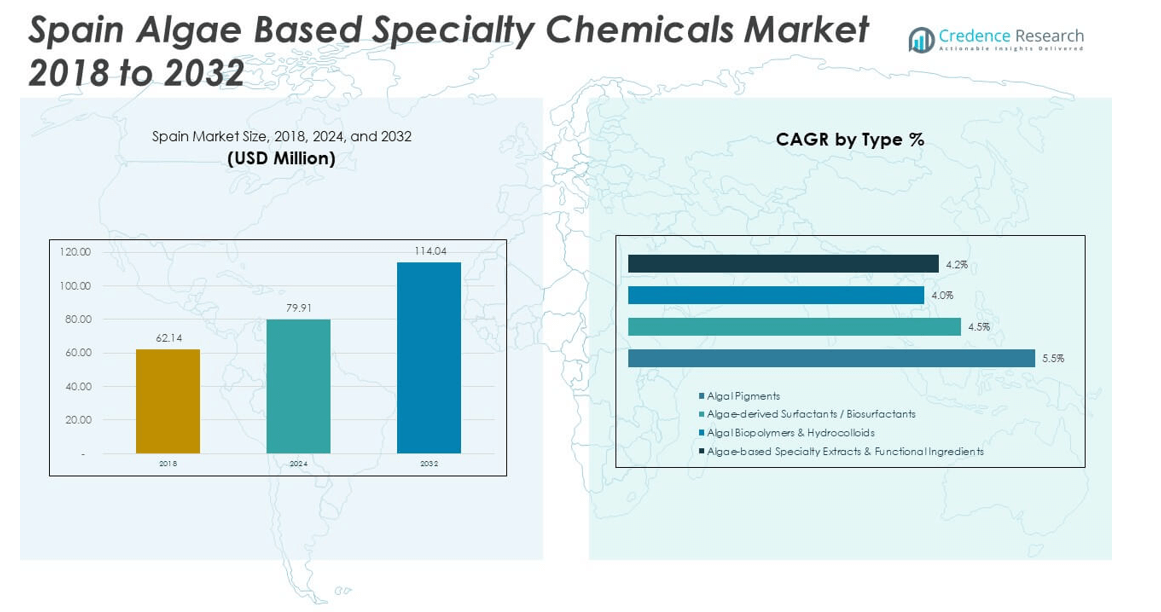

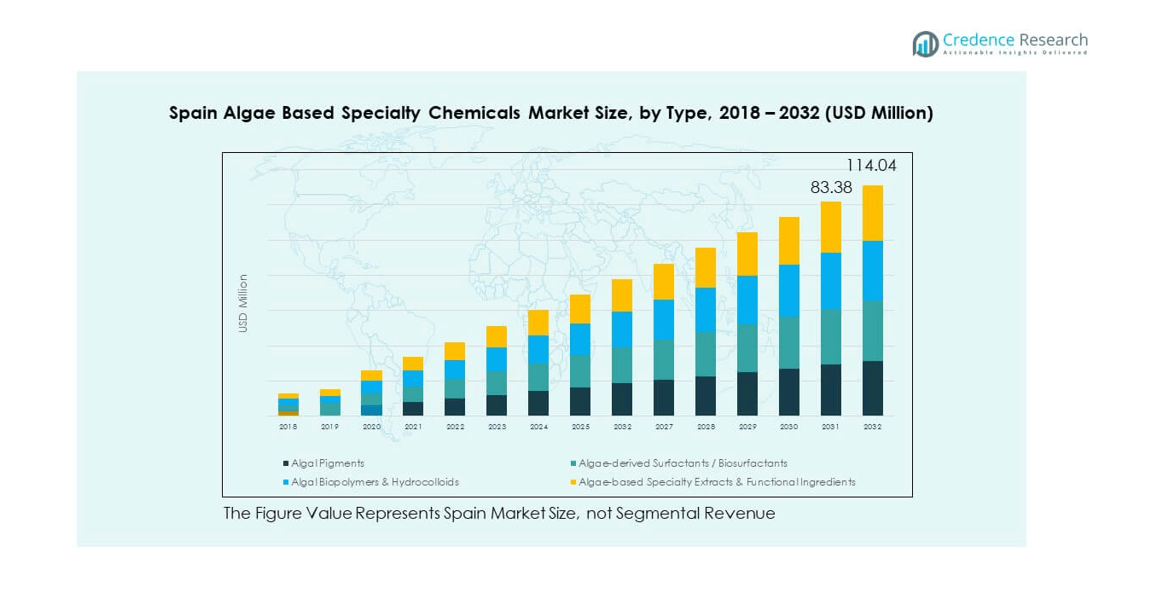

The Spain Algae Based Specialty Chemicals Market size was valued at USD 62.14 million in 2018 to USD 79.91 million in 2024 and is anticipated to reach USD 114.04 million by 2032, at a CAGR of 4.55% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Algae Based Specialty Chemicals Market Size 2024 |

USD 79.91 million |

| Spain Algae Based Specialty Chemicals Market, CAGR |

4.55% |

| Spain Algae Based Specialty Chemicals Market Size 2032 |

USD 114.04 million |

Growth in the market is driven by the rising demand for bio-based and sustainable solutions across multiple industries. Increasing consumer preference for natural products supports adoption in food, nutraceuticals, and cosmetics. Environmental regulations encourage manufacturers to replace synthetic compounds with algae-based ingredients. Technological advances in cultivation and extraction methods improve efficiency, scalability, and product consistency. The ability of algae-derived chemicals to deliver pigments, hydrocolloids, and bioactive compounds further strengthens demand. Growing investment from both domestic companies and international players enhances production capacity and market presence in Spain.

Regionally, Spain demonstrates strong potential due to its favorable coastal conditions and established research ecosystem. Northern Spain benefits from academic partnerships and innovation hubs that support marine biotechnology. Central Spain is expanding adoption through personal care, cosmetics, and packaging industries driven by consumer demand. Southern Spain leads production with large-scale cultivation supported by climate suitability and access to international ports. Emerging regions in Eastern Europe are beginning to adopt algae-based solutions, but Spain remains a central hub in Southern Europe, combining favorable natural resources with industrial infrastructure.

Market Insights

- The Spain Algae Based Specialty Chemicals Market was valued at USD 62.14 million in 2018, reached USD 79.91 million in 2024, and is projected to attain USD 114.04 million by 2032, registering a CAGR of 4.55%.

- Southern Spain commanded 38% market share due to large-scale algae farms and port infrastructure, Northern Spain held 34% driven by strong research hubs, while Central Spain accounted for 28% with cosmetics and packaging adoption.

- Southern Spain is also the fastest-growing subregion with its 38% share, supported by favorable climate, extensive coastal access, and strong export activity.

- Algal pigments represented 35% of the segmental share in 2024, making them the leading category due to wide use in food and cosmetics.

- Algal biopolymers and hydrocolloids captured 28% share, fueled by demand from packaging, food processing, and sustainability-focused industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand For Bio-Based Alternatives

The Spain Algae Based Specialty Chemicals Market is strongly driven by the rising demand for bio-based and sustainable solutions across industries. Cosmetics, pharmaceuticals, agriculture, and food manufacturers are increasingly shifting away from synthetic compounds to embrace algae-derived ingredients. Consumers in Spain are prioritizing eco-friendly products, creating steady pressure on brands to innovate with natural solutions. Government policies supporting low-carbon initiatives further accelerate adoption across value chains. It benefits from the ability of algae to deliver multiple bioactive properties such as antioxidants, pigments, and polysaccharides. Local producers are scaling operations to meet demand for natural inputs. Continuous R&D enhances extraction efficiency and lowers costs. Together, these drivers make bio-based innovation central to long-term market expansion.

Support From Environmental Regulations And Policies

Environmental policies in Spain and across the EU are reinforcing the market’s direction toward sustainable chemical production. Stricter limits on synthetic additives and chemical emissions motivate companies to adopt algae-based inputs. It provides natural, biodegradable alternatives that align with EU Green Deal targets and national sustainability programs. Producers view algae-derived compounds as tools to reduce carbon footprints and comply with future standards. Strong regulatory backing also creates an attractive investment environment. This legal framework ensures consistent demand for compliant products. It fosters collaboration between industries and research institutions. Spain’s alignment with European strategies continues to reinforce confidence in algae-based specialty chemicals.

- For instance, Neoalgae, accredited as an innovative SME by the Spanish Ministry of Economy and Competitiveness, has been recognized by CDTI for its microalgae R&D projects in Spain. These certified initiatives cover applications in biofertilizers, cosmetics, environment, and health, showcasing multi-sector collaboration for sustainable chemical solutions.

Technological Innovation In Algae Cultivation

Advancements in cultivation and processing technology are driving greater adoption in Spain. Algae-based production once faced limitations in scale and efficiency, but innovation now enables reliable output. It benefits from photobioreactors, improved harvesting systems, and precision fermentation techniques. These developments reduce costs and improve yield quality, making adoption viable across industries. Industrial players are now able to design scalable models suited for food-grade and pharmaceutical-grade applications. The technology also improves product consistency and safety profiles, boosting consumer trust. Companies are investing in pilot plants and commercial facilities across Spain. This integration of technology with natural resources strengthens the long-term competitiveness of the sector.

- For instance, AlgaEnergy operates its industrial “Microalgae Production Facility” in Arcos de la Frontera, Cádiz, equipped with advanced photobioreactor technology. The site runs multiple production systems that ensure year-round scalable output for agribusiness and specialty applications.

Expanding Applications Across Industries

The market is driven by expanding use of algae-based specialty chemicals across multiple industries. Spanish agriculture is adopting algae extracts as bio-stimulants, improving crop yield and sustainability. Food and beverage producers use natural pigments and thickeners derived from algae to meet clean-label demand. It also finds applications in nutraceuticals, where omega-3s and polysaccharides are highly valued. Cosmetics brands integrate algae extracts for skincare, anti-aging, and hydration benefits. Pharmaceutical research continues to explore bioactive compounds for therapeutic uses. This diversification minimizes risks tied to reliance on one industry. Together, it provides a solid base for consistent revenue generation in the Spain Algae Based Specialty Chemicals Market.

Market Trends

Shift Toward Clean-Label And Natural Ingredients

The Spain Algae Based Specialty Chemicals Market is witnessing strong momentum from the clean-label movement. Food, beverage, and personal care industries are under pressure to reformulate with transparent ingredient sourcing. Consumers expect natural colorants, thickeners, and antioxidants, making algae-derived solutions a competitive fit. Brands are emphasizing purity and traceability, which algae cultivation supports effectively. Marketing strategies highlight algae’s role as sustainable and renewable. This focus creates brand differentiation in crowded markets. Demand from export-oriented companies is reinforcing this shift. The trend is likely to strengthen as awareness of natural ingredients deepens across consumer demographics.

Integration Into Circular Economy Models

Spain is adopting circular economy principles, and algae-based chemicals align directly with these frameworks. The industry leverages waste streams, renewable resources, and energy-efficient cultivation systems. It reduces dependency on fossil-based inputs and promotes sustainable production. Companies integrate algae into biorefinery models, producing multiple outputs from one source. This trend improves economic viability while lowering environmental footprints. Stakeholders highlight algae as part of Spain’s transition to circular and low-waste industries. Investment in pilot biorefineries is growing under this trend. It establishes algae as a cornerstone of Spain’s future industrial sustainability.

- For instance, the SUSTAINEXT project, funded by the EU CBE JU, is converting a facility in Hervás, Spain into a digitalised circular biorefinery. Once completed, it will process 20,000 tonnes of agricultural sidestreams annually into ingredients for food, feed, cosmetics, biofertilizers, and chemicals, strengthening Spain’s circular bioeconomy.

Collaborations Between Academia And Industry

Collaborations between universities, research institutes, and companies are shaping the innovation pipeline in Spain. The Spain Algae Based Specialty Chemicals Market gains from expertise in marine biology, biotechnology, and chemical engineering. Academic projects are translating into patents, start-ups, and commercialization pathways. Industry participants benefit from shared R&D costs and knowledge transfer. Such collaborations accelerate testing of new applications in pharmaceuticals, cosmetics, and food. This ecosystem strengthens Spain’s global competitiveness in algae-based products. It also ensures a consistent supply of skilled professionals. Long-term collaboration secures Spain’s leadership role in algae-based chemical research.

- For instance, t he EU-funded SABANA project, coordinated by the University of Almería between 2016 and 2021, successfully developed large-scale microalgae cultivation to produce biopesticides and biostimulants. The project validated the use of microalgae strains in greenhouse applications, offering natural alternatives that align with EU sustainability goals.

Rising Investment In Specialized Facilities

Investments in cultivation and processing facilities are a clear trend shaping the market’s scale. Companies are establishing dedicated algae farms, photobioreactor plants, and extraction facilities. It enhances the country’s production capacity and lowers reliance on imports. Government-backed initiatives and private sector funding are both supporting this expansion. Facilities are designed to meet quality standards across industries including pharma and food. Investors are motivated by the growing consumer base for sustainable products. These assets also support export opportunities across Europe. Rising investments indicate confidence in the sector’s commercial viability and long-term demand.

Market Challenges Analysis

High Production Costs And Technical Barriers

The Spain Algae Based Specialty Chemicals Market faces significant challenges due to production costs and technical barriers. Despite innovations, cultivation and extraction remain resource-intensive, requiring advanced equipment and skilled expertise. It struggles with balancing scale and cost efficiency compared to synthetic chemicals. Smaller producers face hurdles in maintaining consistency and quality at industrial levels. High capital requirements limit entry for new participants. Technical complexity also slows down time-to-market for innovative formulations. Dependence on continuous R&D creates financial strain. These factors make it difficult for producers to compete with lower-cost alternatives from traditional chemical sectors.

Market Awareness And Supply Chain Limitations

Another major challenge is the lack of widespread consumer awareness and robust supply chain infrastructure. While demand for sustainable solutions is rising, many consumers are unfamiliar with algae-based products. It creates hesitation in adoption, especially in cost-sensitive segments. Distribution networks for specialty chemicals also remain underdeveloped, limiting accessibility for end-users. Smaller players often lack global reach, restricting growth opportunities. Import dependency for advanced equipment increases operational vulnerabilities. Retailers and manufacturers may delay integration due to uncertainty around long-term performance. Overcoming these gaps requires investment in marketing, education, and infrastructure. Without such measures, growth potential could remain underutilized.

Market Opportunities

Growing Export Potential For Algae-Based Ingredients

The Spain Algae Based Specialty Chemicals Market holds strong opportunities in exports across Europe and beyond. Spanish producers can leverage high-quality standards and sustainable practices to supply international markets. It aligns with rising global demand for clean-label and bio-based solutions. Export potential is reinforced by Spain’s coastal location, providing efficient logistics for distribution. Trade agreements within the EU and with external partners further expand reach. Companies focusing on value-added applications in food, cosmetics, and pharma can capture premium margins. Export growth creates resilience against domestic fluctuations. This opportunity strengthens Spain’s position in the global algae-based chemicals industry.

Innovation In High-Value Applications

Opportunities also emerge from developing high-value applications in pharmaceuticals, nutraceuticals, and advanced cosmetics. Companies are targeting bioactive compounds with specific health and functional benefits. It enhances competitive positioning by moving beyond commodity-grade inputs. Spain’s research institutions are pivotal in testing therapeutic and clinical applications. Partnerships with global firms allow access to new markets and advanced technologies. The push for personalized healthcare and wellness opens new pathways for algae-based innovations. Success in high-value niches boosts profitability and market visibility. This opportunity ensures long-term sustainable growth for producers in Spain.

Market Segmentation Analysis

By type, algal pigments account for the largest share in the Spain Algae Based Specialty Chemicals Market due to their broad use in food, nutraceuticals, and cosmetics. Demand is supported by rising clean-label preferences and the need for natural colorants. Algae-derived surfactants and biosurfactants are gaining traction as eco-friendly alternatives in cleaning products and industrial applications. Algal biopolymers and hydrocolloids show strong growth potential in packaging and food processing, supported by sustainability-driven policies. Algae-based specialty extracts and functional ingredients continue to expand in nutraceutical and pharmaceutical sectors, driven by bioactive properties and therapeutic applications.

- For instance, AIMPLAS, through the BIOPROCESS project, developed algae-based biopolymers and tested pilot-scale extrusion processes. These formulations improved film barrier performance and met standards for compostable food contact materials.

By end user, food and beverage companies represent a significant demand share, driven by consumer preference for natural additives and functional ingredients. Cosmetics and personal care brands actively integrate algae-based compounds for hydration, skin protection, and anti-aging benefits. Pharmaceutical and diagnostics firms use pigments and biomarkers for research and clinical applications, supporting steady adoption. Packaging and bioplastics manufacturers are turning to algae-based polymers to reduce plastic dependency, aligning with EU environmental mandates. Agriculture and aquaculture formulators leverage algae-based bio-stimulants to enhance yield and sustainability. Industrial and household cleaning product makers are gradually adopting biosurfactants, reflecting a shift toward greener formulations. Together, these segments highlight the diverse applications and steady growth trajectory of the Spain Algae Based Specialty Chemicals Market.

- For instance, in the BIOPROCESS project, AIMPLAS and partners validated compostable bioplastics made with algae polysaccharides. These materials were applied in packaging for cosmetic and personal hygiene products, meeting functional and sustainability requirements.

Segmentation

By Type

- Algal Pigments

- Algae-derived Surfactants / Biosurfactants

- Algal Biopolymers & Hydrocolloids

- Algae-based Specialty Extracts & Functional Ingredients

By End User

- Food & Beverage and Nutraceutical Brands

- Cosmetics & Personal Care Companies

- Pharmaceutical & Diagnostics Firms (Pigments/Biomarkers)

- Packaging & Bioplastics Manufacturers

- Agriculture & Aquaculture Formulators

- Industrial & Household Cleaning Product Makers

Regional Analysis

Northern Spain

Northern Spain holds 34% market share in the Spain Algae Based Specialty Chemicals Market. The region benefits from strong coastal access and advanced research hubs located in Basque Country and Galicia. Universities and innovation centers support R&D in marine biotechnology, helping companies scale algae cultivation and extraction. Demand for algae-derived ingredients in pharmaceuticals and nutraceuticals is high due to strong industrial clusters. Investments in photobioreactor facilities enhance production efficiency and quality standards. The presence of key academic partnerships creates a foundation for long-term innovation. Northern Spain continues to serve as a hub for premium-grade algae-based solutions.

Central Spain

Central Spain accounts for 28% market share in the Spain Algae Based Specialty Chemicals Market. The region demonstrates growing adoption across cosmetics and personal care industries centered in Madrid. Companies benefit from robust consumer demand for sustainable beauty and skincare products. Industrial initiatives also focus on integrating algae-derived polymers and biosurfactants into packaging and cleaning formulations. The availability of advanced supply chain networks enables efficient distribution to European markets. It remains attractive for startups seeking market access due to strong business infrastructure. Central Spain plays a vital role in aligning specialty chemical production with rising eco-conscious consumer preferences.

Southern Spain

\Southern Spain represents 38% market share in the Spain Algae Based Specialty Chemicals Market. The region’s favorable climate and extensive coastal zones provide ideal conditions for algae cultivation. Andalusia and Murcia host large-scale algae farms that supply biomass for industrial applications. Food and beverage companies increasingly use natural pigments and hydrocolloids derived from algae to enhance clean-label offerings. Agricultural industries adopt algae-based bio-stimulants to improve crop productivity and sustainability. Export activity is high due to strong port infrastructure, giving Southern Spain a competitive edge. It remains a leading region for high-volume production and international trade of algae-based specialty chemicals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CABB Chemicals

- BASF SE

- I.D. Parry (Parry Nutraceuticals)

- Cyanotech Corporation

- Earthrise Nutritionals

- Algatechnologies (Algatech)

- CP Kelco

- Cargill

- DSM

- Other Key Players

Competitive Analysis

The Spain Algae Based Specialty Chemicals Market is highly competitive, with global leaders and local innovators driving growth. Large players such as BASF SE, Cargill, and DSM maintain strong positions through extensive product portfolios and established distribution channels. These companies emphasize innovation in biopolymers, hydrocolloids, and biosurfactants, addressing demand across multiple end-use sectors. Local companies, including CABB Chemicals and regional startups, focus on niche applications like algal pigments and specialty extracts. It benefits from strong research collaboration, allowing firms to leverage advancements in biotechnology and marine sciences. Strategic moves include mergers, acquisitions, and facility expansions to strengthen production capacity. Market participants also invest in sustainability-driven solutions to align with EU regulations and consumer preferences. The competitive landscape reflects a balance between global scale and localized specialization, ensuring consistent innovation and supply across Spain.

Recent Developments

- In June 2025, CABB Group entered a strategic partnership with Finnish firm Origin by Ocean to establish a first-of-its-kind algae biorefinery at CABB’s facility in Kokkola, Finland. Though outside Spain, this development marks a significant step for CABB in commercializing and scaling algae-based specialty chemical ingredients for European markets, including Spain.

- In July 2025, Corbion secured regulatory approvals from China’s authorities to launch its algae-derived omega-3 DHA products, expanding its global reach in specialty chemicals for both animal feed and human health. In February 2025, GC Riber VivoMega introduced a new algae-based DHA and EPA product called Algae 1060 TG Premium, aimed at supplement manufacturers for easy and cost-effective formulation.

Report Coverage

The research report offers an in-depth analysis based on Type and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising consumer preference for sustainable and natural ingredients will expand adoption across multiple industries.

- Increasing R&D in biotechnology will enhance extraction methods and support advanced algae-based formulations.

- Growth in cosmetic and personal care applications will strengthen demand for premium algae-derived pigments and extracts.

- Expansion of bioplastics manufacturing will create opportunities for algae-based polymers and surfactants.

- Supportive EU environmental policies will continue to encourage investments in bio-based chemical production.

- Export opportunities will grow as Spain positions itself as a reliable supplier within Europe and beyond.

- Collaborations between research institutions and companies will accelerate innovation and product diversification.

- Agriculture and aquaculture industries will integrate algae-based bio-stimulants to improve yield and sustainability.

- Investment in large-scale cultivation and photobioreactor facilities will enhance production efficiency and capacity.

- Strong competition between global leaders and local players will drive continuous innovation and specialization.