Market Overview

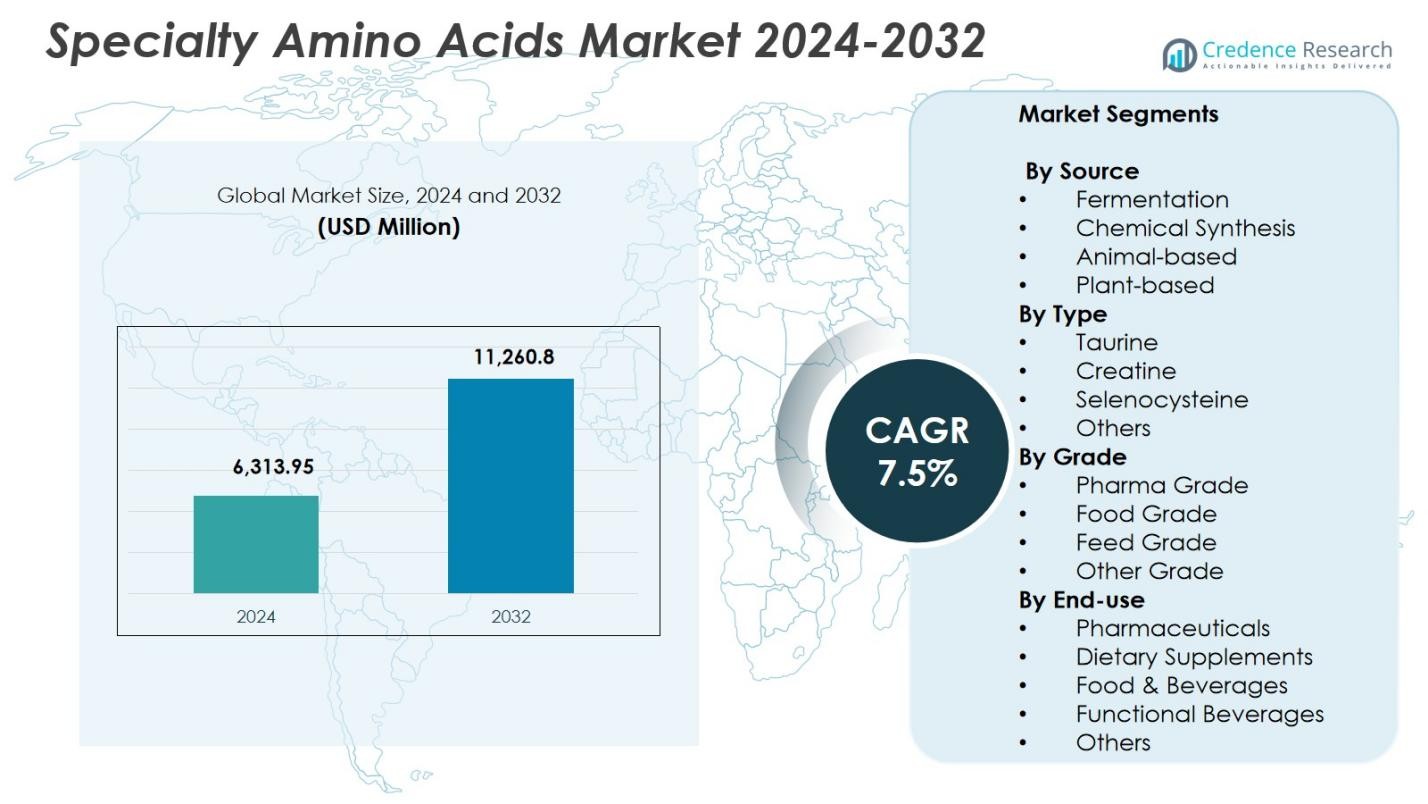

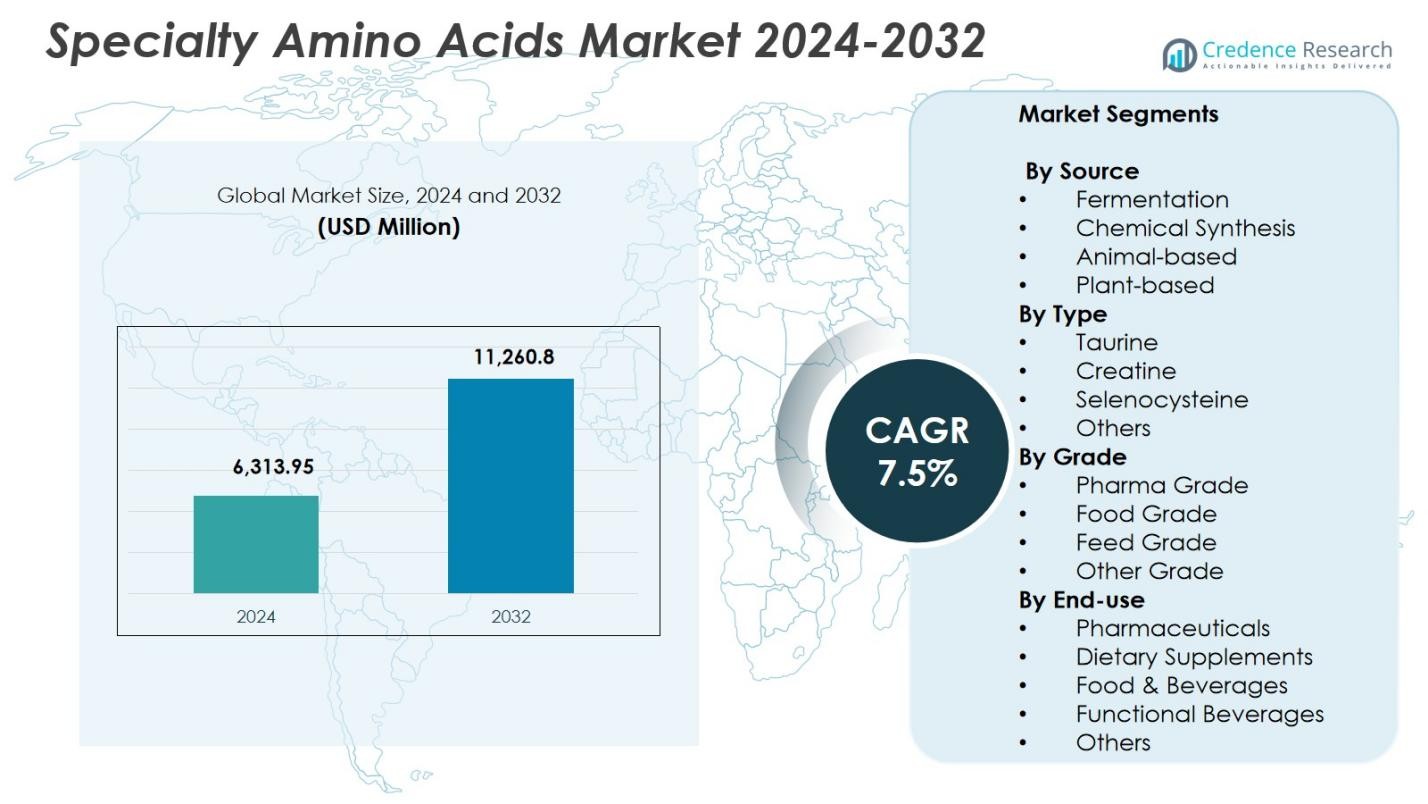

Specialty Amino Acids Market size was valued at USD 6,313.95 Million in 2024 and is anticipated to reach USD 11,260.8 Million by 2032, at a CAGR of 7.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Specialty Amino Acids Market Size 2024 |

USD 6,313.95 Million |

| Specialty Amino Acids Market , CAGR |

7.5% |

| Specialty Amino Acids Market Size 2032 |

USD 11,260.8 Million |

Specialty Amino Acids Market is shaped by the presence of key players such as ADM Company, Ajinomoto Co., Inc., Cargill, Incorporated, Evonik Industries AG, Fufeng Group Company Limited, Hebei Huayang Group Co., Ltd., IRIS BIOTECH GmbH, Novus International, RSP Amino Acid, LLC, and Sumitomo Chemical Co. Ltd., who drive growth through advancements in fermentation technologies, high-purity product development, and expanded application portfolios across pharmaceuticals, nutraceuticals, and functional foods. North America emerged as the leading region with 34.6% market share in 2024, supported by strong biotechnology infrastructure, robust clinical nutrition demand, and high consumer spending on wellness and dietary supplements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Specialty Amino Acids Market was valued at USD 6,313.95 Million in 2024 and is projected to grow at a CAGR of 7.5% through 2032.

- Market growth is driven by rising demand for nutraceuticals, sports nutrition, and pharma-grade amino acids used in biologics, clinical nutrition, and vaccine development.

- Key trends include the expansion of personalized nutrition, increasing adoption of fermentation-based sustainable production, and strong uptake of taurine, which held 38.5% share in 2024.

- Major players such as ADM, Ajinomoto, Cargill, Evonik, Fufeng Group, and others enhance market growth through technological advancements and product innovations across multiple end-use sectors.

- Regionally, North America led with 34.6% share, followed by Europe at 27.4% and Asia-Pacific at 29.8%, supported by strong manufacturing bases and rising consumption across pharmaceuticals, functional foods, and dietary supplements.

Market Segmentation Analysis:

By Source:

The Specialty Amino Acids Market demonstrates strong traction across fermentation, chemical synthesis, animal-based, and plant-based sources, with fermentation emerging as the dominant sub-segment holding 46.8% share in 2024. Its leadership is driven by high purity output, lower environmental impact, and scalability for pharmaceutical and nutraceutical applications. Fermentation-based production supports consistent quality standards essential for medical-grade and functional food formulations. Growing consumer demand for clean-label and sustainably produced ingredients further accelerates adoption. Advancements in microbial fermentation technologies continue to enhance yield efficiency, strengthening this segment’s market dominance.

- For instance, Ajinomoto Co., Inc. pioneered fermentation techniques to produce amino acids like glutamine, valine, leucine, and isoleucine at its Brazil facility, which leverages sugar cane for scalable output serving food and pharmaceutical sectors.

By Type:

Within the type segmentation, taurine, creatine, selenocysteine, and others contribute to overall market growth, with taurine leading the segment at 38.5% share in 2024. Its dominance stems from extensive use in energy drinks, infant formulas, dietary supplements, and pharmaceutical preparations. Taurine’s role in cardiovascular function, neural development, and detoxification drives its widespread application. The rising global consumption of functional beverages and sports nutrition products significantly boosts demand. Increasing clinical research on taurine’s metabolic and therapeutic benefits further supports its continued leadership in the Specialty Amino Acids Market.

- For instance, Red Bull Energy Drink contains 1000 mg of taurine per 250 ml serving to aid heart and muscle function.

By Grade:

Across pharma grade, food grade, feed grade, and other grades, pharma grade amino acids accounted for the largest share at 41.2% in 2024, driven by stringent quality requirements across biopharmaceutical manufacturing, parenteral nutrition, and active pharmaceutical ingredient (API) production. High-purity specialty amino acids are essential for cell culture media, vaccine development, and therapeutic formulations, supporting consistent clinical outcomes. The expanding biologics and biosimilars pipeline amplifies demand for premium-grade inputs. Increasing regulatory emphasis on safety, traceability, and contamination-free materials further reinforces the dominance of the pharma-grade segment in global markets.

Key Growth Drivers

Rising Demand for Nutraceuticals and Functional Foods

The Specialty Amino Acids Market experiences strong growth driven by increasing consumer preference for nutraceuticals, sports nutrition, and functional food products enriched with amino acid supplements. Heightened awareness of preventive healthcare, improved metabolic health, and muscle recovery benefits fuels widespread adoption. Taurine, creatine, and other specialty amino acids play vital roles in energy regulation, immunity support, and cellular repair, accelerating their integration into high-performance formulations. Expanding retail penetration of fortified food products and sustained innovation by manufacturers continue to elevate market expansion globally.

- For instance, Thorne Creatine provides creatine monohydrate as a single-ingredient supplement, NSF Certified for Sport, aiding muscle strength and workout performance for athletes.

Expanding Applications in Biopharmaceutical and Clinical Nutrition

The market benefits significantly from the rising use of specialty amino acids in biopharmaceutical manufacturing, cell culture media, and parenteral nutrition solutions. Pharma-grade amino acids ensure high purity, stability, and performance, supporting vaccine production, therapeutic protein synthesis, and metabolic disorder treatments. Increasing investment in biologics and biosimilars strengthens demand for consistent, contamination-free raw materials. The growing prevalence of chronic diseases and higher hospitalization rates further boost the requirement for clinical nutrition formulas, positioning specialty amino acids as essential components in advanced medical therapies.

- For instance, Evonik supplies its REXIM® portfolio of highly purified amino acids for over 40 years, enhancing intravenous formulations in parenteral nutrition for metabolic disorders, pre- and post-surgery diets, and malnutrition treatments.

Advancements in Fermentation and Production Technologies

Continuous improvements in microbial fermentation, enzymatic processing, and precision biotechnology drive cost-efficiency and scalability in specialty amino acid production. These innovations enhance yield, reduce carbon footprint, and lower dependency on chemical synthesis or animal-derived inputs. Enhanced bioprocessing technologies also enable better customization for pharmaceutical, food, and feed applications. As manufacturers adopt integrated automation and digital quality control systems, production consistency strengthens, enabling broader commercialization opportunities. Such technological advancements improve supply reliability and contribute substantially to the market’s long-term expansion.

Key Trends & Opportunities

Growth of Personalized Nutrition and Precision Health Solutions

A major trend shaping the Specialty Amino Acids Market is the expansion of personalized nutrition platforms and precision health programs that tailor amino acid intake to individual metabolic requirements. With rising consumer interest in DNA-based diets, gut microbiome profiling, and biomarker-driven wellness plans, demand for specialized amino acid formulations is increasing. Companies are leveraging AI-enabled nutrition analysis and customized supplement delivery models, creating new revenue opportunities. This shift toward individualized health management accelerates adoption of premium-grade amino acids across food, nutraceutical, and wellness sectors.

- For instance, DSM provides Quali®-Blends nutrient premixes featuring customized amino acid formulations in liquid or dry forms for personalized nutrition applications.

Increasing Shift Toward Plant-Based and Sustainable Amino Acid Production

The market sees a growing opportunity in plant-based and eco-friendly amino acid sources as manufacturers respond to sustainability goals and clean-label preferences. Plant-derived and fermentation-based amino acids reduce reliance on animal-based production while offering improved ethical profiles and reduced environmental impact. As consumers prioritize transparency and natural ingredient sourcing, companies are expanding investments in green bioprocessing technologies. This sustainability-driven shift supports regulatory compliance, strengthens brand value, and opens new growth avenues across food, pharmaceutical, and animal nutrition markets.

- For instance, CJ BIO produces L-Lysine through microbial fermentation at plants in Indonesia, China, Brazil, and the United States, minimizing industrial waste by repurposing byproducts as fertilizer.

Key Challenges

High Production Costs and Complex Manufacturing Processes

Despite rising demand, the Specialty Amino Acids Market faces challenges due to the high cost of advanced purification technologies, bioprocess equipment, and quality assurance systems. Production requires precise environmental controls, specialized microbial strains, and regulatory-compliant infrastructure, increasing operational expenses. These cost pressures limit participation from smaller manufacturers and keep product prices elevated for end users. Additionally, volatility in raw material availability further affects production stability. Such complexities hinder large-scale adoption in cost-sensitive segments, particularly feed and food applications.

Stringent Regulatory Requirements and Compliance Burden

Manufacturers must adhere to rigorous global regulations governing purity standards, contamination control, labeling accuracy, and safety testing across pharmaceutical, food, and feed applications. Meeting these standards demands frequent audits, documentation, and process validation, increasing administrative burden. Variations in regulatory frameworks between regions add complexity, especially for companies seeking international expansion. Non-compliance risks product recalls, financial penalties, and brand damage. These regulatory challenges restrict market flexibility and slow the introduction of innovative specialty amino acid formulations.

Regional Analysis

North America

North America held the largest share of the Specialty Amino Acids Market, accounting for 34.6% in 2024, supported by strong demand from nutraceuticals, pharmaceuticals, and sports nutrition sectors. The region benefits from advanced biotechnology capabilities, significant investments in clinical nutrition, and high consumer spending on wellness supplements. Growing adoption of amino acid–based therapies for chronic disease management boosts market expansion. The presence of leading manufacturers and research institutions enhances innovation in fermentation and purification technologies, further strengthening market leadership across the United States and Canada.

Europe

Europe captured 27.4% share in 2024, driven by expanding applications in pharmaceutical formulations, infant nutrition, and functional food products. Strict regulatory standards encourage the production of high-purity amino acids, supporting growth across pharma-grade and food-grade segments. Rising preference for clean-label, plant-based ingredients accelerates the adoption of sustainably sourced amino acids. The region also benefits from a strong bioprocessing infrastructure and increasing investment in personalized nutrition programs, particularly in Germany, France, and the United Kingdom. These factors collectively reinforce Europe’s position as a key contributor to global market demand.

Asia-Pacific

Asia-Pacific emerged as the fastest-growing region with 29.8% share in 2024, supported by large-scale amino acid production, strong presence of fermentation-based manufacturers, and expanding consumption of dietary and sports nutrition supplements. China, Japan, South Korea, and India contribute significantly through rising biotech investments and increasing demand for pharma-grade ingredients. Growing health awareness, rapid urbanization, and rising disposable incomes accelerate adoption across food, feed, and medical applications. Government support for industrial biotechnology and export-oriented production further boosts Asia-Pacific’s prominence in the Specialty Amino Acids Market.

Latin America

Latin America accounted for 5.9% share in 2024, driven by growing utilization of specialty amino acids in animal feed, functional beverages, and pharmaceutical formulations. Increasing investments in livestock nutrition and expanding sports nutrition trends in countries such as Brazil, Mexico, and Argentina support market demand. Strengthening retail penetration and awareness of dietary supplementation further enhance adoption. Although production capabilities remain limited, the region increasingly imports high-purity amino acids from global suppliers. Rising focus on preventive healthcare and nutrition enrichment positions Latin America as a steadily expanding market.

Middle East & Africa

The Middle East & Africa region held 2.3% share in 2024, supported by rising demand for clinical nutrition, fortified food products, and animal feed applications. Increasing prevalence of metabolic disorders and expanding healthcare infrastructure drive the uptake of pharma-grade amino acids. Countries such as the UAE, Saudi Arabia, and South Africa are witnessing higher imports of specialty amino acids due to limited domestic production. Growth in sports nutrition consumption, combined with improving distribution networks, enhances regional market penetration. Although still developing, MEA presents long-term opportunities for expansion through healthcare modernization and nutrition awareness initiatives.

Market Segmentations:

By Source

- Fermentation

- Chemical Synthesis

- Animal-based

- Plant-based

By Type

- Taurine

- Creatine

- Selenocysteine

- Others

By Grade

- Pharma Grade

- Food Grade

- Feed Grade

- Other Grade

By End-use

- Pharmaceuticals

- Dietary Supplements

- Food & Beverages

- Functional Beverages

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the Specialty Amino Acids Market features leading companies such as ADM Company, Ajinomoto Co., Inc., Cargill, Incorporated, Evonik Industries AG, Fufeng Group Company Limited, Hebei Huayang Group Co., Ltd., IRIS BIOTECH GmbH, Novus International, RSP Amino Acid, LLC, and Sumitomo Chemical Co. Ltd. These players strengthen market expansion through advanced fermentation technologies, strategic capacity enhancements, and a strong focus on pharma-grade and food-grade amino acids. Companies actively invest in biotechnology innovation to improve purity levels, scalability, and sustainability of production processes. Many firms pursue partnerships with nutraceutical, pharmaceutical, and animal nutrition manufacturers to widen application reach and secure long-term supply agreements. Product diversification into taurine, creatine, selenocysteine, and customized amino acid blends enhances competitive positioning. Continuous R&D investment, expanding geographical footprints, and adoption of environmentally responsible bioprocessing methods further reinforce industry leadership and intensify competition among global and regional producers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- RSP Amino Acid, LLC

- Cargill, Incorporated

- Sumitomo Chemical Co. Ltd.

- IRIS BIOTECH GmbH

- Ajinomoto Co., Inc.

- Fufeng Group Company Limited

- Novus International

- Evonik Industries AG

- Hebei Huayang Group Co., Ltd.

- ADM Company

Recent Developments

- In November 2025, Croda International Plc entered a strategic supply partnership with Amino GmbH to strengthen global availability of high-purity amino acids for pharmaceutical formulation and biomanufacturing.

- In December 2025, Verdesian Life Sciences introduced an innovative blend featuring peptides and amino acids with over 300 fermentation-derived metabolites to enhance microbial activity in agricultural nutrition.

- In April 2025, Granules India completed the acquisition of Senn Chemicals AG through its subsidiary Granules Peptides Private Limited, enhancing capabilities in pharmaceutical-grade amino acids and peptide synthesis.

Report Coverage

The research report offers an in-depth analysis based on Source, Type, Grade, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Specialty Amino Acids Market will witness rising adoption in nutraceuticals and functional foods driven by health and wellness trends.

- Demand for pharma-grade amino acids will grow with expanding biologics, biosimilars, and clinical nutrition therapies.

- Fermentation-based production will gain momentum as manufacturers prioritize sustainable and high-purity amino acid sourcing.

- Personalized nutrition platforms will create new opportunities for tailored amino acid formulations.

- Sports nutrition and energy supplement categories will continue to boost taurine and creatine consumption.

- Technological advancements in bioprocessing will enhance production efficiency and reduce manufacturing costs.

- Expansion of animal feed applications will drive growth in amino acids that support livestock performance and immunity.

- Regulatory focus on product safety and traceability will push manufacturers toward improved quality systems.

- Asia-Pacific will strengthen its role as a global production hub with increased capacity investments.

- Strategic partnerships and mergers will accelerate innovation and global distribution capabilities.