Market Overview

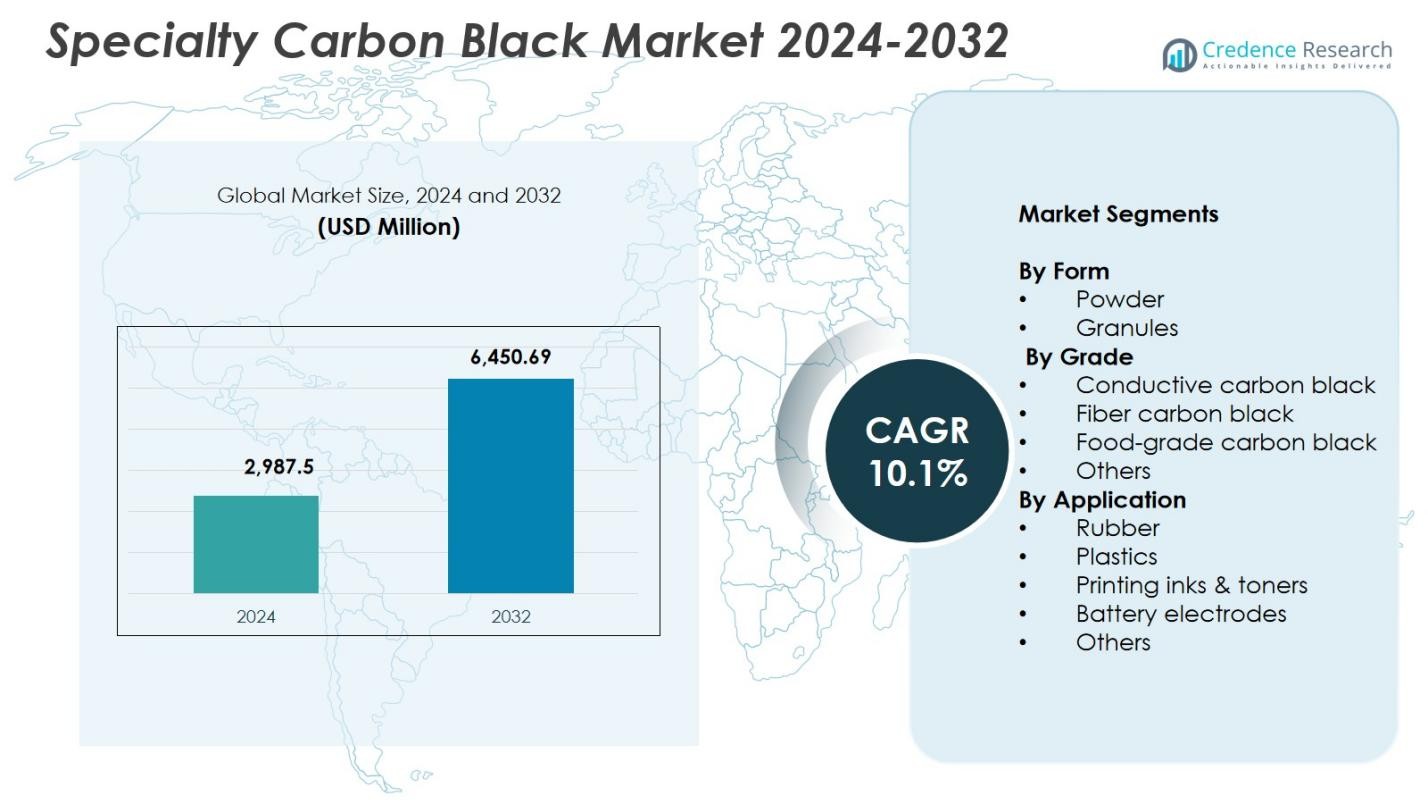

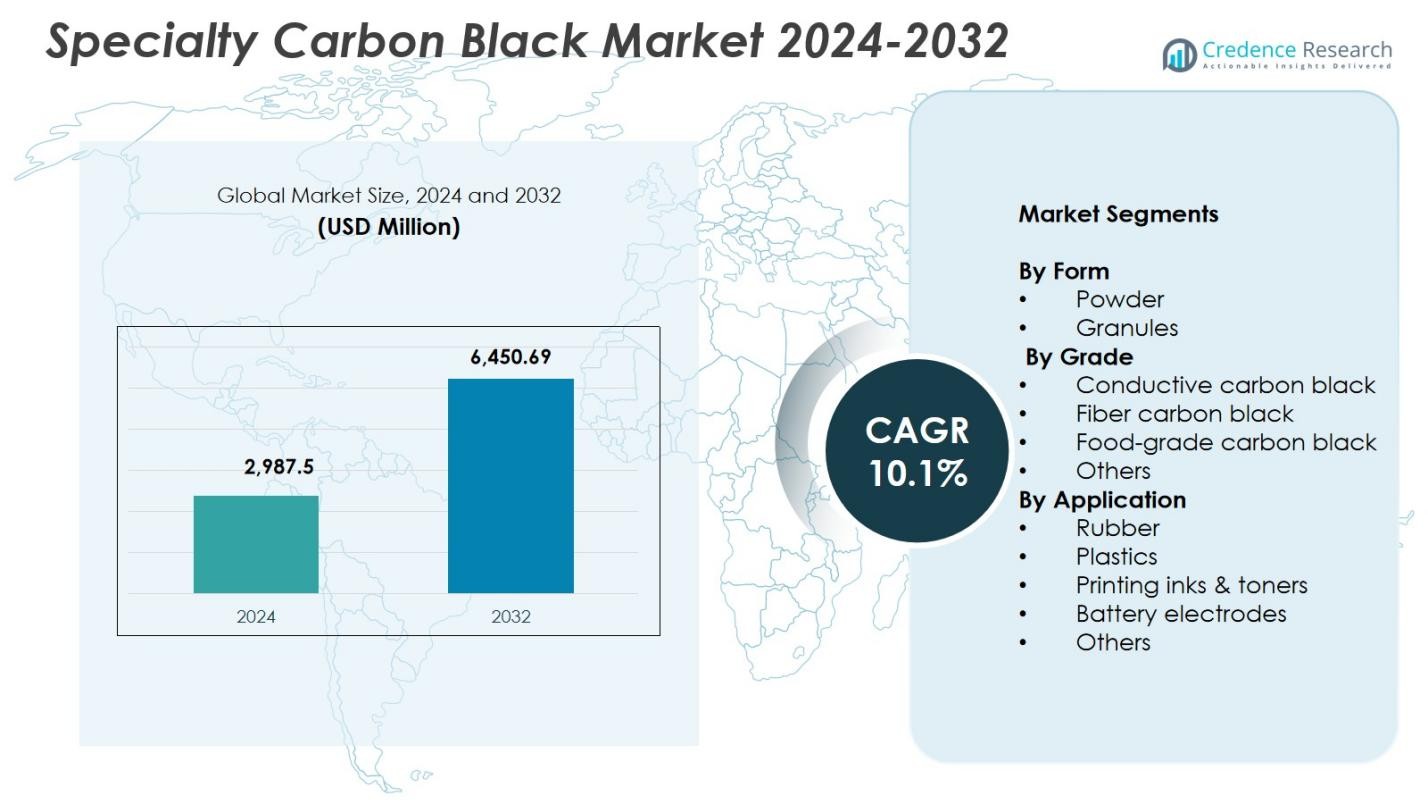

Specialty Carbon Black Market size was valued at USD 2,987.5 Million in 2024 and is anticipated to reach USD 6,450.69 Million by 2032, at a CAGR of 10.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Specialty Carbon Black Market Size 2024 |

USD 2,987.5 Million |

| Specialty Carbon Black Market , CAGR |

10.1% |

| Specialty Carbon Black Market Size 2032 |

USD 6,450.69 Million |

Specialty Carbon Black Market features prominent players such as OMSK Carbon Group Limited, Atlas Organics Pvt. Ltd., Orion Engineered Carbon GmbH, Mitsubishi Chemical Corporation, Ampacet Corporation, Denka Company Limited, Birla Carbon, Cabot Corporation, Himadri Speciality Chemical Ltd., and Continental Carbon Company. These companies strengthen market growth through advancements in conductive, high-dispersion, and specialty-grade formulations serving plastics, inks, coatings, and battery applications. Regionally, Asia-Pacific led the market with **36.9% share in 2024**, driven by strong manufacturing activity, expanding automotive production, and rising demand for specialty polymers and electronics. North America and Europe followed, supported by technological innovation and stringent quality standards across industrial and automotive sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Specialty Carbon Black Market reached USD 2,987.5 Million in 2024 and will grow at a CAGR of 10.1% through 2032.

- Strong market drivers include rising adoption in high-performance plastics, coatings, and battery electrodes, with the Powder form leading at 4% share and Conductive grade dominating at 41.8% share due to growing EV and electronics demand.

- Key trends focus on sustainable low-emission production, high-purity conductive materials, and increasing application in advanced electronics, printing inks, and premium packaging.

- Major players expand capacity, invest in R&D, and strengthen technology capabilities to serve automotive, electronics, and industrial sectors, enhancing product performance and global supply reliability.

- Asia-Pacific led with 9% share, followed by North America at 28.6% and Europe at 24.1%, while Latin America and Middle East & Africa showed steady growth driven by rubber, packaging, and infrastructure applications.

Market Segmentation Analysis:

By Form:

In the Specialty Carbon Black Market, the Powder segment held the dominant position in 2024 with 62.4% share, driven by its superior dispersion properties, high surface area, and suitability for performance-critical applications. Powder-grade carbon black is widely used in conductive plastics, coatings, and high-quality inks due to its ability to enhance tinting strength, UV resistance, and surface smoothness. The Granules segment accounted for 37.6% share, supported by its ease of handling, reduced dust generation, and increasing adoption in masterbatches and rubber compounding where cleaner processing and bulk handling efficiency are essential.

- For instance, Birla Carbon’s Conductex powder carbon blacks provide conductivity for electrostatic discharge (ESD) protection in conductive plastics, such as IC carrier tapes, trays, and anti-static flooring, thanks to their tailored morphology, low ionic impurities, and superior dispersibility in resin systems.

By Grade:

The Conductive carbon black segment dominated the market with 41.8% share in 2024, propelled by rising demand in lithium-ion batteries, antistatic packaging, and conductive polymer applications where high electrical conductivity and superior charge transport are critical. Fiber carbon black held 23.6% share, benefiting from its use in reinforcing synthetic fibers and enhancing tensile strength. Food-grade carbon black contributed 18.9% share, driven by regulatory approvals for coloring and safety compliance. The Others category captured 15.7% share, supported by niche applications requiring customized performance characteristics.

- For instance, Orion Engineered Carbons’ PRINTEX kappa 100 provides high electrical and thermal conductivity for lithium-ion batteries, forming a strong percolation network across cathodes to boost power density and extend battery life.

By Application:

The Rubber segment led the Specialty Carbon Black Market in 2024 with 46.3% share, primarily attributed to its essential role in improving abrasion resistance, tensile strength, and durability in tires, industrial rubber goods, and mechanical components. The Plastics segment accounted for 28.4% share, fueled by demand for UV stabilization, pigmentation, and conductivity enhancement in automotive and packaging products. Printing inks & toners represented 14.2% share, supported by growth in digital and flexographic printing technologies. Battery electrodes held 6.8% share, reflecting rising adoption in EV batteries, while Others captured 4.3% share across specialty uses.

Key Growth Drivers

Rising Demand for High-Performance Plastics and Polymers

The Specialty Carbon Black Market grows significantly due to increasing consumption of high-performance plastics across automotive, electronics, and packaging industries. Manufacturers rely on specialty carbon black to enhance conductivity, UV protection, tinting strength, and mechanical durability in engineered polymers. Its ability to meet stringent performance specifications, especially in lightweight automotive components and advanced electronic housings, accelerates adoption. Additionally, the shift toward premium packaging materials with superior aesthetics and protection further amplifies demand, positioning specialty carbon black as a critical functional additive in high-value plastic formulations.

- For instance, Cabot Corporation’s VULCAN XC615 specialty carbon black provides conductivity at low loadings for electrostatic discharge protection in injected automotive housings and electronic packaging, while enabling low compound moisture absorption to prevent defects in moisture-sensitive applications.

Expansion of Electric Vehicles and Battery Technologies

Rapid growth in electric vehicles (EVs) and energy storage systems drives strong demand for specialty carbon black used in lithium-ion battery electrodes. Its high conductivity and optimized surface structure improve electron transfer, charge acceptance, and overall battery efficiency. As global EV production expands and OEMs increase investment in next-generation battery chemistries, conductive carbon black becomes essential for achieving higher energy density and extended battery life. The rise of battery gigafactories and government incentives for clean mobility further strengthens usage across anode, cathode, and conductive additive applications.

- For instance, Birla Carbon’s Conductex i14 serves as a conductive additive with very high structure and purity for Li-ion batteries, increasing electrical conductivity and enabling higher solids content in electrode slurries to boost manufacturing throughput.

Growth of Printing, Packaging, and High-End Coatings

Specialty carbon black plays a vital role in premium printing inks, toners, and high-end coatings due to its deep jetness, dispersibility, and controlled particle morphology. The expansion of digital printing, e-commerce packaging, and premium branding strengthens demand for carbon-black-based inks that deliver sharper contrast and enhanced durability. In industrial coatings, the material improves UV resistance, conductivity, and color stability, supporting adoption in automotive parts, appliances, and architectural applications. Growing consumer preference for high-quality visual finishes and protective coatings significantly boosts market growth.

Key Trends & Opportunities

Adoption of Sustainable and Low-Emission Production Technologies

A major emerging trend is the industry’s shift toward sustainable specialty carbon black produced through cleaner processes, including methane-based feedstocks, circular gas utilization, and reduced VOC emissions. Manufacturers increasingly adopt energy-efficient reactors and carbon-capture-enabled processes to meet global decarbonization goals. This trend creates strong opportunities for suppliers offering eco-certified products for automotive, electronics, and packaging applications. Regulatory pressure, ESG commitments, and corporate sustainability programs further accelerate demand for low-carbon specialty carbon black, opening avenues for innovation across the value chain.

- For instance, Birla Carbon develops Continua™ sustainable carbonaceous materials from circular sources to enhance product sustainability in tires, coatings, and inks, integrating these into global operations to support net-zero aspirations.

Growing Use in Advanced Electronics and Semiconductor Applications

Rising miniaturization of electronic components and the need for reliable conductive materials present significant opportunities for specialty carbon black. Its use in EMI shielding, conductive polymers, antistatic layers, and high-precision components expands as consumer electronics become more compact and powerful. The semiconductor industry leverages ultra-high-purity grades for improved stability and performance in sensitive environments. With accelerating demand for wearables, IoT devices, and smart home technologies, specialty carbon black finds increased relevance in electronic materials requiring conductivity, heat dissipation, and structural enhancement.

- For instance, Imerys’ ENSACO conductive carbon blacks provide high electrical conductivity at low filler content for EMI shielding in electronics housings, antennas, and sensors, supporting lightweight polymer solutions that reflect and absorb electromagnetic waves.

Key Challenges

Volatility in Raw Material Prices and Supply Constraints

The Specialty Carbon Black Market faces challenges from fluctuations in feedstock prices, particularly petroleum-derived raw materials such as coal tar and heavy aromatic oils. Supply disruptions, geopolitical tensions, and refinery shutdowns can lead to unpredictable cost swings, directly affecting production economics. Manufacturers often struggle to maintain stable pricing and profitability, especially in regions with limited raw material availability. This volatility forces companies to invest in alternative feedstocks, long-term supply contracts, and optimized production processes to mitigate operational and financial risks.

Stringent Environmental Regulations Impacting Production

Tightening emission standards and environmental regulations impose compliance challenges for specialty carbon black producers. Regulatory frameworks targeting particulate emissions, SOx/NOx levels, and carbon footprints require major investments in advanced filtration, clean-energy technologies, and plant modernization. Smaller manufacturers frequently face difficulties managing compliance costs, resulting in market consolidation. Additionally, the transition toward greener specialty carbon black alternatives pressures traditional production methods. Companies must balance operational efficiency with regulatory compliance while ensuring consistent product quality and competitive cost structures.

Regional Analysis

North America

North America accounted for 28.6% share of the Specialty Carbon Black Market in 2024, driven by strong demand from the automotive, electronics, and advanced plastics industries. The region benefits from well-established manufacturing capabilities, high adoption of conductive polymers, and rising investments in EV battery production. Growth in digital printing, premium packaging, and high-performance coatings further strengthens market expansion. The U.S. leads the regional market due to sustained technological innovation, while Canada supports demand through industrial rubber and infrastructure applications. Increasing preference for sustainable and low-emission specialty carbon black grades also contributes to regional growth.

Europe

Europe held 24.1% share in 2024, supported by the region’s stringent regulatory standards and rising consumption of high-quality specialty plastics, inks, and coatings. The market benefits from strong automotive production, particularly in Germany, where specialty carbon black is essential for lightweight components and conductive applications. The region’s growing focus on circular economy initiatives and carbon-neutral manufacturing encourages adoption of eco-engineered carbon black grades. Demand from advanced electronics, industrial rubber, and architectural coatings also contributes to growth. Manufacturers expand R&D efforts to develop high-purity and sustainable grades to meet evolving regulatory and performance requirements.

Asia-Pacific

Asia-Pacific dominated the Specialty Carbon Black Market in 2024 with 36.9% share, driven by large-scale manufacturing activity, expanding automotive production, and rising demand for plastics and rubber products. China, India, and Japan anchor growth through extensive use in tires, industrial rubber goods, and conductive applications for electronics. Rapid urbanization and infrastructure development fuel consumption of specialty coatings and printing materials. The region also benefits from increasing investments in EV production and battery technologies, boosting demand for conductive carbon black. Competitive manufacturing costs and rising technological advancements further strengthen Asia-Pacific’s leading position.

Latin America

Latin America accounted for 5.7% share in 2024, with demand primarily driven by the automotive aftermarket, construction, and packaging sectors. Brazil and Mexico remain the key contributors due to their growing plastics, rubber, and printing industries. Infrastructure development and rising consumer spending support the adoption of specialty carbon black in coatings and premium packaging. The region is gradually expanding its electronics manufacturing base, presenting new opportunities for conductive grades. Despite supply chain constraints and varying regulatory frameworks, steady industrialization and increasing interest in high-performance materials sustain market growth across Latin America.

Middle East & Africa

The Middle East & Africa region held 4.7% share in 2024, supported by rising investments in construction, packaging, and industrial manufacturing. Demand for specialty carbon black grows as regional producers diversify into advanced plastics, high-durability coatings, and automotive components. Countries such as the UAE and Saudi Arabia increasingly adopt specialty materials to support infrastructure and industrial modernization initiatives. Africa contributes through expanding rubber processing and consumer goods sectors. While the region faces challenges related to technology access and production capacity, growing interest in high-performance and conductive formulations continues to drive market expansion.

Market Segmentations:

By Form

By Grade

- Conductive carbon black

- Fiber carbon black

- Food-grade carbon black

- Others

By Application

- Rubber

- Plastics

- Printing inks & toners

- Battery electrodes

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Specialty Carbon Black Market features leading players such as OMSK Carbon Group Limited, Atlas Organics Pvt. Ltd., Orion Engineered Carbon GmbH, Mitsubishi Chemical Corporation, Ampacet Corporation, Denka Company Limited, Birla Carbon, Cabot Corporation, Himadri Speciality Chemical Ltd., and Continental Carbon Company. These companies strengthen their positions through continuous capacity expansions, technological advancements, and development of high-performance conductive, food-grade, and specialty polymer grades. Major manufacturers focus on low-emission and sustainable production technologies to meet stringent regulatory norms and customer sustainability goals. Strategic initiatives, including collaborations with battery producers, acquisition of niche technology providers, and investment in R&D for high-dispersion and ultra-high-purity grades, enhance market presence. Growing demand from EV batteries, high-end plastics, and coatings encourages companies to optimize supply chains and expand geographically. Competitive intensity remains high as global and regional players differentiate through product innovation, performance consistency, and value-added technical services.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Orion S.A. announced plans to rationalize operations by discontinuing production on three to five carbon black lines in the Americas and EMEA by end of 2025.

- In August 2025, Cabot Corporation signed a definitive agreement to acquire Mexico Carbon Manufacturing S.A. de C.V. from Bridgestone Corporation, expanding its reinforcing-carbon manufacturing capacity.

- In November 2025, Birla Carbon announced that its circular-material line, Continua™ Sustainable Carbonaceous Material (SCM), is set to scale up globally potentially accounting for up to 10% of its product portfolio.

Report Coverage

The research report offers an in-depth analysis based on Form, Grade, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as demand rises for high-performance plastics, coatings, and conductive applications.

- EV battery growth will significantly increase the adoption of conductive specialty carbon black grades.

- Manufacturers will invest more in sustainable, low-emission production technologies.

- Advanced electronics and semiconductor applications will create new opportunities for ultra-high-purity grades.

- Digital printing advancements will strengthen demand for high-jetness inks and toners.

- Regulatory pressure will accelerate the shift toward eco-certified and low-carbon carbon black products.

- Capacity expansions in Asia-Pacific will reinforce the region’s dominant supply position.

- Strategic partnerships between carbon black producers and battery manufacturers will accelerate innovation.

- Market consolidation will increase as companies seek stronger technological and supply chain capabilities.

- Growing adoption of lightweight automotive materials will elevate demand for specialty carbon black worldwide.