Market Overview

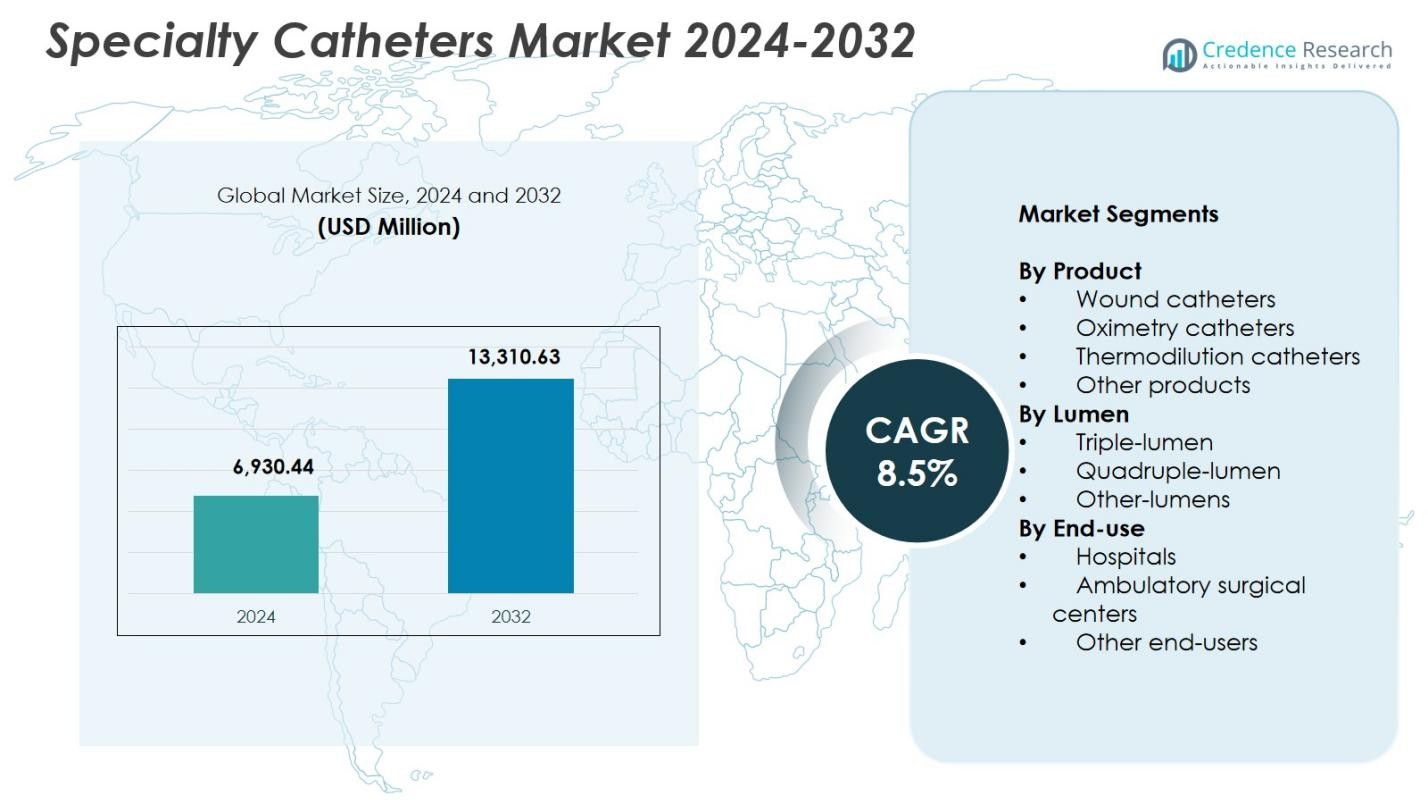

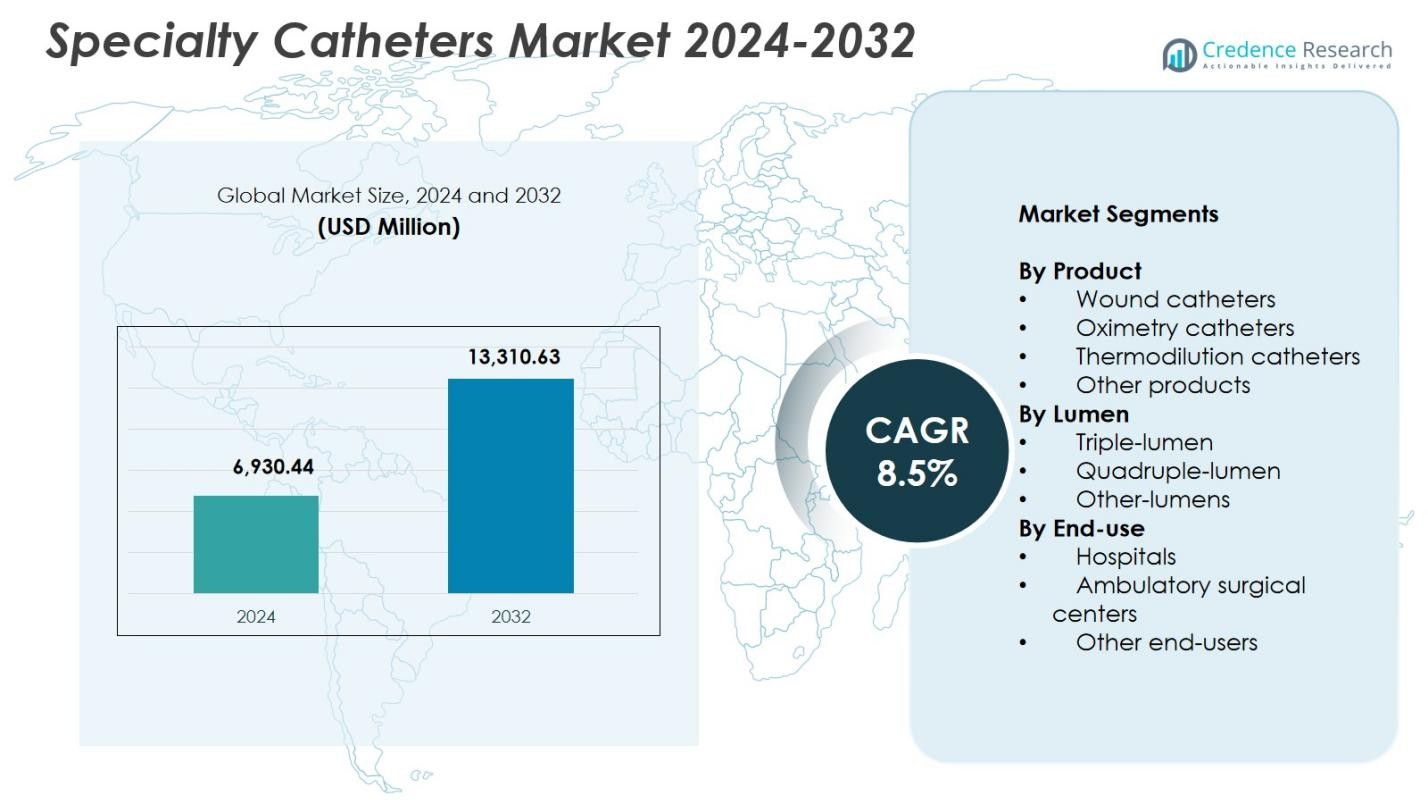

Specialty Catheters Market size was valued at USD 6,930.44 Million in 2024 and is anticipated to reach USD 13,310.63 Million by 2032, at a CAGR of 8.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Specialty Catheters Market Size 2024 |

USD 6,930.44 Million |

| Specialty Catheters Market , CAGR |

8.5% |

| Specialty Catheters Market Size 2032 |

USD 13,310.63 Million |

Specialty Catheters Market features leading players such as Merit Medical Systems, Inc., Abbott, B. Braun, Medline, Edward Life Science Corporation, Hollister Incorporated, ICU Medical, Deroyal, Dyna Medical, and Bioptimal International Pte. Ltd., all focusing on advanced catheter technologies and expanded clinical applications. These companies strengthen their presence through product innovation, enhanced multi-lumen designs, and infection-resistant materials that support high-acuity care. Regionally, North America led the market with a 37.4% share in 2024, driven by strong healthcare infrastructure and high procedure volumes, while Europe and Asia-Pacific followed with accelerating demand from expanding critical care and surgical capacities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Specialty Catheters Market reached USD 6,930.44 Million in 2024 and will grow at a CAGR of 8.5% through 2032.

- Growth is driven by rising cardiovascular and chronic disease cases, increasing minimally invasive procedures, and strong adoption of thermodilution catheters, which held a 38.6% share in 2024.

- Key trends include rapid integration of smart monitoring catheters, advanced multi-lumen designs, and expanding use in high-acuity critical care settings across hospitals, which dominated with a 58.4% share.

- Major players such as Abbott, B. Braun, ICU Medical, Medline, and Merit Medical Systems, Inc. enhance market presence through innovation, capacity expansion, and product diversification.

- North America led with a 37.4% share, followed by Europe at 29.6% and Asia-Pacific at 23.1%, while Latin America and Middle East & Africa showed steady growth due to improving healthcare infrastructure.

Market Segmentation Analysis:

By Product:

In the Specialty Catheters Market, thermodilution catheters dominated the product segment with a 38.6% share in 2024, driven by their extensive adoption in cardiac output monitoring and critical care settings. The rising prevalence of cardiovascular diseases and the increasing demand for precise hemodynamic assessment support their strong uptake. Wound catheters and oximetry catheters also gained traction due to expanding minimally invasive procedures and enhanced postoperative drainage needs. Other product types continued to serve niche clinical applications, but thermodilution catheters maintained leadership due to their proven accuracy and strong integration into advanced monitoring systems.

- For instance, Teleflex’s Arrow® Thermodilution Catheters feature four- and five-lumen designs with torque, flexi-torque, and flotation body firmness options for optimized insertion and fluid infusion during pressure and cardiac output measurements.

By Lumen:

The triple-lumen segment accounted for 46.2% of the Specialty Catheters Market in 2024, emerging as the dominant category owing to its higher flexibility in administering medications, performing sampling, and facilitating multiple simultaneous procedures. Their widespread use in intensive care units, emergency care, and complex surgeries significantly contributes to segment leadership. Quadruple-lumen catheters followed due to their utility in high-acuity environments requiring enhanced infusion capabilities. Other-lumen configurations continued to address specialized applications; however, rising demand for multifunctional access devices cemented the strong growth trajectory of triple-lumen catheters.

- For instance, Merit Medical’s trio-ct® triple lumen catheter features a 17G independent lumen for power injection of contrast media at up to 5 mL/sec, alongside two dialysis lumens for short-term hemodialysis and apheresis in ICU patients requiring concurrent CVP monitoring and infusions.

By End-use:

The hospital segment held a commanding 58.4% share of the Specialty Catheters Market in 2024, supported by the large volume of surgical procedures, advanced critical care infrastructure, and higher adoption of premium catheter technologies. Hospitals benefit from improved procurement capabilities and continuous integration of advanced monitoring catheters, reinforcing their dominance. Ambulatory surgical centers captured notable demand as outpatient and day-care procedures increased globally. Other end-users, including specialty clinics and long-term care facilities, contributed steadily; however, hospitals maintained leadership due to high patient throughput and expanded interventional capabilities.

Key Growth Drivers

Rising Burden of Cardiovascular and Chronic Diseases

The growing incidence of cardiovascular disorders, diabetes, and chronic kidney disease continues to fuel demand for specialty catheters across diagnostic and therapeutic procedures. As hospitals increasingly prioritize early intervention and continuous monitoring, catheters such as thermodilution and oximetry devices play a central role in improving clinical outcomes. Expanded adoption of minimally invasive procedures further accelerates usage, as these catheters enable greater precision, reduced procedural risks, and faster recovery times. Together, these clinical needs strengthen long-term market growth and increase procedural volumes globally.

- For instance, BD’s Swan-Ganz IQ Pulmonary Artery Catheters enable continuous monitoring of parameters including SvO2, CCO, SV, SVR, RVEF, and RVEDV for real-time oxygen delivery and right ventricle insights in complex cardiac cases.

Advances in Catheter Design and Material Technologies

The Specialty Catheters Market benefits from rapid advancements in material science, including biocompatible polymers, hydrophilic coatings, and shape-memory alloys that enhance flexibility, durability, and patient comfort. These innovations reduce infection risks, improve navigation through complex anatomies, and enhance performance in critical care applications. Manufacturers are increasingly integrating real-time sensing technologies and improved fluid management capabilities, expanding their utility in cardiology, oncology, and surgical care. Such technological improvements strengthen clinical confidence and drive higher adoption across both mature and emerging healthcare systems.

- For instance, Hydromer™ Hydrophilic Coatings from Hydromer provide superior lubricity and biocompatibility on catheters for cardiovascular and urological applications, reducing friction for smoother insertion while adhering to diverse substrates.

Expansion of Critical Care and Surgical Infrastructure

Global expansion of intensive care units, ambulatory surgical centers, and specialized treatment facilities continues to propel specialty catheter demand. Healthcare systems in developing regions are investing heavily in advanced monitoring tools and interventional capabilities, broadening the market base. Growth in cardiac surgeries, trauma care services, and complex infusion therapies further strengthens usage across high-acuity settings. Training programs and improved clinician familiarity also contribute to broader deployment, ensuring consistent demand for multifunctional and high-performance catheters.

Key Trends & Opportunities

Integration of Sensor-Based and Smart Monitoring Catheters

A major trend shaping the Specialty Catheters Market is the integration of embedded sensors and data-driven monitoring features. Smart catheters capable of measuring pressure, flow, and oxygen saturation in real time enhance diagnostic accuracy and procedural safety. This evolution enables precise hemodynamic assessment and supports personalized therapeutic interventions. The increasing shift toward AI-enabled monitoring platforms creates future opportunities for connected catheter systems, improving decision-making and reducing clinical complications, particularly in critical care and cardiac applications.

- For instance, Nuwellis’ Aquadex SmartFlow System features an integrated hematocrit sensor for real-time percent blood volume change measurement alongside SvO2 monitoring to track tissue oxygen delivery.

Growing Adoption of Minimally Invasive and Outpatient Procedures

The rising preference for minimally invasive surgeries and outpatient interventions presents strong opportunities for specialized catheters designed for efficiency, lower trauma, and rapid recovery. Ambulatory surgical centers increasingly rely on catheters that support shorter procedure times and reduced hospital stays. As aging populations drive higher procedural volumes, demand grows for catheters optimized for vascular access, drainage, and continuous monitoring. Product innovations that improve ease of insertion and reduce postoperative complications further expand opportunities in both high-income and emerging healthcare markets.

- For instance, Catheter Precision’s LockeT suture retention device achieves 98% hemostasis two hours post-removal, supporting same-day discharge after cardiac ablation by simplifying wound closure for catheters up to 27F.

Key Challenges

Risk of Catheter-Associated Infections and Complications

Despite technological advancements, catheter-associated infections and procedural complications remain a significant restraint in the Specialty Catheters Market. Hospitals must adhere to strict sterilization and insertion protocols, increasing operational burdens and limiting product adoption in resource-constrained settings. Complications such as thrombosis, device occlusion, and tissue irritation also affect clinical outcomes and may reduce clinician confidence. These risks drive demand for improved coatings and antimicrobial materials but continue to pose compliance and safety challenges across diverse end-use environments.

High Cost of Advanced Catheters and Limited Access in Developing Regions

The high cost of specialty catheters, particularly sensor-enabled and multi-lumen variants, poses barriers to widespread adoption, especially in low- and middle-income countries. Limited reimbursement frameworks and strained healthcare budgets restrict procurement of advanced devices, slowing market penetration. Additionally, inadequate training and shortage of skilled personnel constrain effective use of complex catheter technologies. These economic and infrastructural constraints create disparities in adoption rates, hindering market expansion despite rising global demand for advanced interventional and monitoring solutions.

Regional Analysis

North America

North America dominated the Specialty Catheters Market with a 37.4% share in 2024, driven by strong healthcare infrastructure, high adoption of advanced interventional procedures, and substantial investment in critical care technologies. The region benefits from a large patient base with cardiovascular and chronic illnesses, supporting demand for thermodilution, oximetry, and multi-lumen catheters. Growing preference for minimally invasive procedures and rapid integration of smart catheter technologies strengthen market expansion. The presence of leading manufacturers and favorable reimbursement frameworks further enhance utilization across hospitals and ambulatory surgical centers.

Europe

Europe accounted for 29.6% of the Specialty Catheters Market in 2024, supported by rising procedural volumes, strong clinical adoption of advanced monitoring tools, and well-established regulatory systems emphasizing patient safety. Demand is reinforced by high prevalence of chronic diseases such as heart failure and respiratory disorders, which accelerate utilization across intensive care and surgical environments. Continuous investments in digital health and training programs enhance clinician proficiency in specialized catheter applications. Additionally, expanding interventional cardiology and oncology services contribute to steady market growth across major European nations.

Asia-Pacific

Asia-Pacific held a 23.1% share of the Specialty Catheters Market in 2024, emerging as the fastest-growing region due to expanding healthcare infrastructure, rising critical care capacity, and increasing adoption of advanced minimally invasive procedures. Growing populations and higher prevalence of cardiovascular and metabolic diseases significantly drive demand for specialty catheters across hospitals and surgical centers. Government initiatives aimed at strengthening emergency care and improving access to high-tech medical devices further support market penetration. Rapid urbanization and rising medical tourism also contribute to increasing procedure volumes and broader product utilization.

Latin America

Latin America captured a 6.8% share of the Specialty Catheters Market in 2024, with growth supported by increasing investment in public and private healthcare facilities. Higher demand for cardiovascular and surgical interventions drives adoption of multi-lumen and thermodilution catheters across hospitals. Although resource limitations and uneven access to advanced technologies restrain rapid expansion, rising medical training programs and gradual modernization of intensive care units enhance future market potential. Countries such as Brazil and Mexico lead regional demand due to improving infrastructure and rising chronic disease prevalence.

Middle East & Africa

The Middle East & Africa region accounted for 3.1% of the Specialty Catheters Market in 2024, driven by ongoing improvements in tertiary care facilities and rising demand for advanced monitoring devices in high-acuity settings. Growth is concentrated in Gulf countries where investments in cardiovascular care and surgical infrastructure are expanding. However, limited reimbursement systems and constrained access to high-cost specialty catheters in several African nations hinder broader adoption. Increasing partnerships with global manufacturers and government initiatives to enhance critical care capabilities support steady, long-term market development.

Market Segmentations:

By Product

- Wound catheters

- Oximetry catheters

- Thermodilution catheters

- Other products

By Lumen

- Triple-lumen

- Quadruple-lumen

- Other-lumens

By End-use

- Hospitals

- Ambulatory surgical centers

- Other end-users

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Specialty Catheters Market analysis highlights leading players including Abbott, B. Braun, Bioptimal International Pte. Ltd., Deroyal, Dyna Medical, Edward Life Science Corporation, Hollister Incorporated, ICU Medical, Medline, and Merit Medical Systems, Inc. These companies focus on expanding their product portfolios, enhancing catheter performance, and integrating advanced materials to strengthen clinical outcomes. Continuous innovations in multi-lumen configurations, infection-resistant coatings, and sensor-enabled monitoring technologies help manufacturers differentiate their offerings. Strategic initiatives such as product launches, capacity expansions, and collaborations with healthcare institutions further reinforce their industry position. Rising demand for thermodilution and oximetry catheters encourages players to invest in R&D and regulatory approvals. Additionally, global distribution networks and strong relationships with hospitals and surgical centers enable sustained market visibility, while increasing adoption of minimally invasive procedures presents further growth opportunities for established and emerging companies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In January 2025, Argon Medical acquired the SeQure® and DraKon™ microcatheters from Accurate Medical Therapeutics to expand its oncology interventional portfolio with therapeutic delivery options.

- In January 2025, B. Braun Medical Inc. introduced the Clik-FIX Epidural/Peripheral Nerve Block Catheter Securement Device to reduce catheter displacement risks during regional anesthesia procedures.

- In May 2025, Catheter Precision, Inc. completed the acquisition of Cardionomic’s heart failure assets to broaden its product offerings in cardiac treatments.

Report Coverage

The research report offers an in-depth analysis based on Product, Lumen, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience sustained growth driven by rising cardiovascular and chronic disease burdens.

- Adoption of minimally invasive and image-guided procedures will continue to accelerate catheter utilization.

- Smart and sensor-enabled catheters will gain strong traction across critical care and surgical applications.

- Multi-lumen catheter demand will increase as hospitals prioritize multifunctional access devices.

- Improved biocompatible materials and antimicrobial coatings will drive product innovation.

- Emerging markets will expand rapidly with rising healthcare investments and ICU capacity.

- Outpatient and ambulatory surgical centers will contribute significantly to procedural volume growth.

- Partnerships between manufacturers and healthcare providers will enhance technology integration.

- Regulatory focus on safety and infection control will accelerate adoption of advanced catheter designs.

- Training programs and clinician upskilling will strengthen global penetration of specialty catheter technologies.