Market Overview

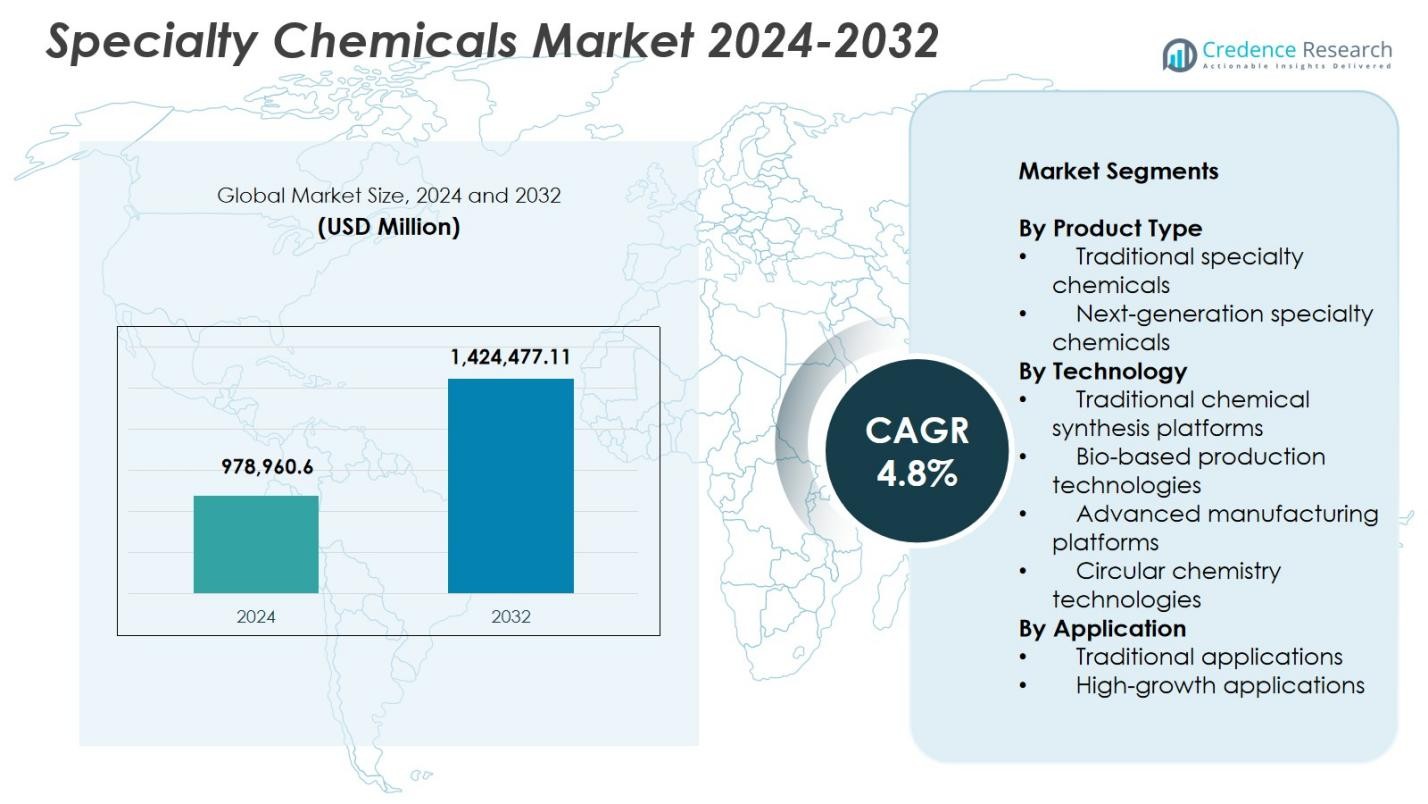

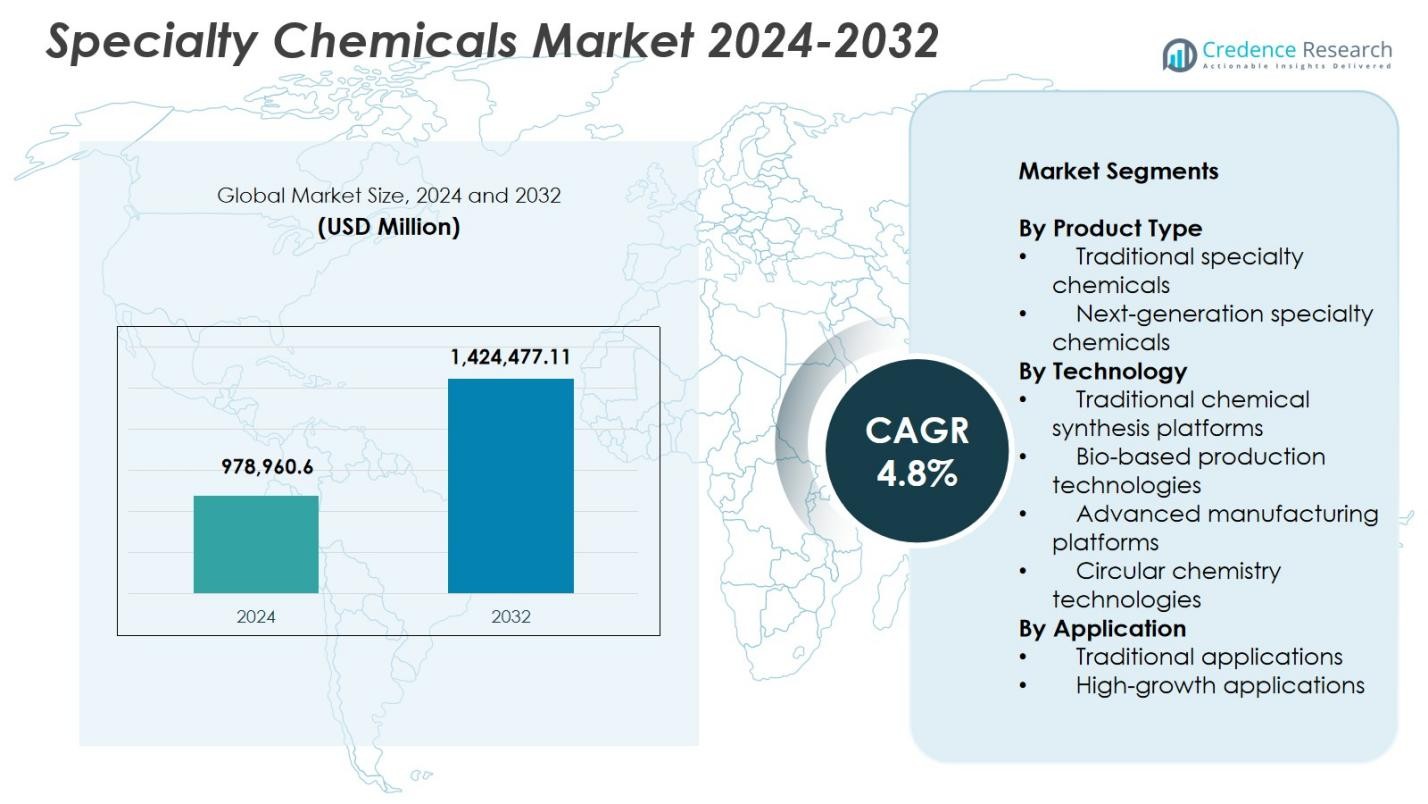

Specialty Chemicals Market size was valued at USD 978,960.6 Million in 2024 and is anticipated to reach USD 1,424,477.11 Million by 2032, at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Specialty Chemicals Market Size 2024 |

USD 978,960.6 Million |

| Specialty Chemicals Market, CAGR |

4.8% |

| Specialty Chemicals Market Size 2032 |

USD 1,424,477.11 Million |

Specialty Chemicals Market is driven by leading producers such as Arkema, Huntsman Corporation, BASF SE, Croda International, LANXESS, Dow Inc., Solvay, Evonik Industries, Ashland, and Clariant AG, all of whom focus on advanced formulations, sustainable materials, and high-performance chemical solutions. These companies strengthen their positions through product innovation, R&D expansion, and increased manufacturing capabilities across high-growth sectors. Regionally, Asia-Pacific leads the market with 38.8% share, supported by rapid industrialization and expansive manufacturing ecosystems. North America follows with 27.6% share, while Europe holds 24.3% share, driven by strong regulations and technological advancements in specialty chemical production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Specialty Chemicals Market reached USD 978,960.6 Million in 2024 and will grow at a CAGR of 4.8% through 2032.

- Rising demand from electronics, automotive, construction, and renewable energy sectors drives the market, with traditional specialty chemicals holding a 62.4% share due to widespread industrial use.

- Key trends include expansion of bio-based solutions, circular chemistry adoption, and strong growth in high-purity chemicals for semiconductors, EV batteries, and advanced manufacturing applications.

- Leading players such as Arkema, BASF SE, Dow Inc., Solvay, LANXESS, and Evonik Industries focus on innovation, sustainability investments, and capacity expansion to strengthen global presence.

- Asia-Pacific leads with 38.8% share, followed by North America at 27.6% and Europe at 24.3%, while Latin America and Middle East & Africa grow steadily; traditional applications dominate with 58.9% share across end-use industries.

Market Segmentation Analysis:

By Product Type:

The Specialty Chemicals Market exhibits strong momentum across product categories, with traditional specialty chemicals dominating with 62.4% share in 2024 due to their extensive use in coatings, construction chemicals, adhesives, agrochemicals, and personal care formulations. Their entrenched industrial relevance, proven performance consistency, and established global supply chains continue to drive large-scale adoption. Meanwhile, next-generation specialty chemicals gain traction as industries shift toward high-performance, sustainable, and functionally advanced materials. Growth in electronics, renewable energy systems, and lightweight composites further accelerates adoption of innovative formulations, offering long-term opportunities in niche, technology-driven applications.

- For instance, BASF’s Joncryl 910 acrylic resin enables fast-drying polyurethane coatings for metal and plastic components, achieving VOC levels as low as 3.2 pounds per gallon while offering excellent gloss retention in South Florida weathering tests.

By Technology:

Within technology segmentation, traditional chemical synthesis platforms led the market with 55.7% share in 2024, supported by their scalability, cost efficiency, and widespread deployment across industrial production lines. These platforms remain integral for bulk formulations and legacy product lines. However, bio-based production technologies and circular chemistry platforms are expanding rapidly as manufacturers prioritize decarbonization, waste valorization, and renewable feedstock integration. Advanced manufacturing technologies such as process intensification, continuous flow systems, and AI-enabled optimization enhance precision, yield improvement, and resource efficiency, driving substantial transformation across specialty chemical production ecosystems.

- For instance, Cargill’s QIRA bio-BDO plant in Iowa employs a single-step fermentation process using corn-derived sugars for commercial-scale production of this plastic precursor.

By Application:

In the application landscape, traditional applications accounted for 58.9% share in 2024, driven by large-scale consumption in automotive, construction, manufacturing, agriculture, and consumer product industries. Demand is supported by rising urbanization, infrastructure growth, and expanding industrial output. High-growth applications, including electronics materials, battery chemicals, advanced composites, semiconductor-grade chemistries, and performance materials for renewable energy, are witnessing strong acceleration. The surge in electric mobility, miniaturization trends, and high-performance engineering materials boosts adoption, positioning these emerging applications as major contributors to future revenue expansion and technology-driven market diversification.

Key Growth Drivers

Rising Demand from High-Performance and Specialty End-Use Industries

The Specialty Chemicals Market benefits from accelerating demand across high-performance sectors such as electronics, automotive, renewable energy, construction, and advanced manufacturing. Industries increasingly rely on specialty formulations for improved durability, efficiency, precision, and sustainability. Growth in electric vehicles, semiconductor production, lightweight materials, and infrastructure upgrades continues to elevate consumption. Manufacturers prioritize tailored chemical solutions that enhance product functionality and regulatory compliance. This expanding dependence on performance-driven materials strengthens market growth and supports continuous innovation in specialty chemical offerings.

- For instance, Himadri Speciality Chemical partners with Sicona to localize and commercialize SiCx® silicon-carbon anode technology for lithium-ion batteries in electric vehicles. When blended with graphite at 5–20%, SiCx® boosts energy density by 20% and charging speed by 40%.

Shift Toward Sustainable and Bio-Based Chemical Solutions

Global sustainability mandates and stricter environmental regulations drive strong adoption of bio-based and low-emission specialty chemicals. Industries are transitioning toward renewable feedstocks, biodegradable additives, green solvents, and energy-efficient manufacturing platforms to reduce carbon footprints and align with circular economy targets. Government incentives and corporate ESG commitments further accelerate this shift. Companies increasingly invest in bio-catalysis, fermentation technologies, and waste-derived chemistry to create high-value sustainable products. This transition reshapes supply chains, stimulates R&D investments, and opens new opportunities for eco-friendly specialty chemical innovations.

- For instance, LANXESS has transitioned the production of benzoic acid, benzaldehyde, benzyl alcohol, and sodium benzoate at its Botlek site in the Netherlands to low-emission electricity, eliminating fossil fuels and reducing the carbon footprint of these essential ingredients for food, beverages, and personal care products.

Rapid Technological Advancements in Production Platforms

Technological progress in chemical synthesis, process intensification, automation, AI-enabled optimization, and continuous flow manufacturing significantly strengthens market productivity and cost efficiency. These innovations enhance precision, reduce waste, shorten production cycles, and enable scalable customization for niche applications. Advanced manufacturing also improves regulatory compliance by enabling cleaner, safer, and more controlled production environments. Integration of digital twins, predictive maintenance, and data-driven process control further modernizes operations, allowing manufacturers to meet rising quality expectations. These advancements support robust long-term market expansion.

Key Trends & Opportunities

Expansion of Circular Chemistry and Closed-Loop Material Systems

Circular chemistry is emerging as a transformative trend as manufacturers redesign processes to reduce waste, reuse materials, and valorize industrial byproducts. Companies are increasingly evaluating recyclability, energy efficiency, and end-of-life product impacts. Opportunities arise in solvent recovery systems, waste-to-chemical pathways, and depolymerization technologies that support circular plastics and sustainable materials. Adoption of renewable feedstocks and regenerative production cycles enables both cost savings and compliance with global sustainability regulations. This trend positions specialty chemicals at the center of circular value chain innovation.

- For instance, Lonza’s Small Molecules Division recycled 35% of solvents used in its Swiss production processes in 2023, with 20% reused directly in API manufacturing via distillation in 10 columns at its Fine Chemical Complex and seven more at a dedicated recovery plant.

Growing Penetration of Advanced Materials in High-Growth Sectors

Demand for advanced materials such as semiconductor chemicals, battery electrolytes, performance coatings, and lightweight composites is accelerating across emerging industries including EVs, aerospace, semiconductors, and renewable energy. These materials enable superior thermal stability, conductivity, energy storage, and structural performance, making them essential for next-generation technologies. Companies investing in ultra-high-purity chemicals, nano-engineered materials, and functional additives gain substantial growth opportunities. This trend expands the market’s technological depth and aligns specialty chemical development with innovation-driven global industries.

- For instance, Mersen’s graphite heaters deliver high thermal conductivity and resistance to thermal shock in semiconductor processes like epitaxy and silicon crystal growth, ensuring uniform heating and temperature stability.

Key Challenges

Volatility in Raw Material Prices and Supply Chain Disruptions

The Specialty Chemicals Market faces ongoing challenges due to fluctuating crude oil prices, supply shortages, and geopolitical uncertainties that impact raw material availability. These fluctuations disrupt production planning, inflate operational costs, and pressure margins for manufacturers heavily dependent on petrochemical feedstocks. Global supply chain constraints, logistics delays, and regional trade restrictions further complicate procurement stability. Companies must strengthen supplier diversification, adopt resilient sourcing strategies, and invest in alternative feedstocks to mitigate volatility and maintain consistent market delivery.

Increasing Regulatory Pressure and Compliance Complexity

Stringent environmental regulations, chemical safety standards, and emission control mandates create heavy compliance burdens for specialty chemical manufacturers. Requirements related to REACH, hazardous substance restrictions, green chemistry protocols, and carbon reduction targets drive the need for costly process upgrades and extensive documentation. Meeting regional regulatory variations also complicates global operations and slows product commercialization. These pressures require continuous investment in safer formulations, cleaner production technologies, and rigorous testing procedures, posing substantial challenges to small and medium enterprises in particular.

Regional Analysis

North America

North America held 27.6% share of the Specialty Chemicals Market in 2024, supported by strong demand from automotive, construction, electronics, and oil & gas industries. The region benefits from advanced R&D capabilities, robust manufacturing infrastructure, and rapid adoption of high-performance and sustainable chemical solutions. Growth in EV production, semiconductor investments, and renewable energy expansion further boosts consumption. Regulatory emphasis on cleaner and low-VOC formulations accelerates innovation in bio-based and eco-friendly chemicals. Strategic collaborations and capacity expansions among major producers continue to strengthen the region’s position in specialty materials development.

Europe

Europe accounted for 24.3% share of the Specialty Chemicals Market in 2024, driven by mature industrial ecosystems, stringent environmental regulations, and advanced technological capabilities. The region leads in sustainable specialty chemicals due to strong circular economy mandates and widespread adoption of bio-based production platforms. Demand grows across automotive, packaging, construction, and high-value manufacturing sectors. Increasing investments in green chemistry, recycling technologies, and specialty polymers support long-term market expansion. Continued innovation driven by REACH compliance and carbon reduction targets positions Europe as a key hub for next-generation specialty chemical development.

Asia-Pacific

Asia-Pacific dominated with 38.8% share in 2024, making it the largest regional market for specialty chemicals. Rapid industrialization, expanding manufacturing bases, rising construction activity, and significant growth in electronics, automotive, and consumer goods sectors fuel strong demand. China, India, Japan, and South Korea act as major production and consumption centers. Government initiatives promoting industrial modernization, renewable energy, and advanced materials manufacturing further accelerate market penetration. Increasing investments from global chemical companies in capacity expansion, R&D centers, and technology partnerships reinforce Asia-Pacific’s leadership in specialty chemical production and innovation.

Latin America

Latin America captured 5.4% share of the Specialty Chemicals Market in 2024, supported by growing demand from agriculture, mining, construction, and consumer product industries. Brazil and Mexico drive the majority of consumption due to expanding manufacturing activity and rising investments in infrastructure development. Growth in agrochemicals, performance coatings, and personal care formulations enhances regional opportunities. However, supply chain inefficiencies and economic fluctuations remain challenges. Increasing adoption of sustainable and high-performance specialty chemicals, supported by regional industrial modernization initiatives, contributes to the market’s steady progress across Latin America.

Middle East & Africa

The Middle East & Africa region accounted for 3.9% share in 2024, driven by rising industrial diversification, rapid infrastructure expansion, and strong demand from oil & gas, construction, water treatment, and mining sectors. The region’s petrochemical advantage supports cost-effective specialty chemical production, while increasing adoption of advanced materials in energy, transportation, and manufacturing drives additional growth. Investments in downstream chemical projects, renewable energy infrastructure, and industrial transformation programs, particularly in GCC countries, strengthen market potential. Despite regulatory variations and logistical constraints, the region continues to expand its specialty chemicals footprint.

Market Segmentations:

By Product Type

- Traditional specialty chemicals

- Next-generation specialty chemicals

By Technology

- Traditional chemical synthesis platforms

- Bio-based production technologies

- Advanced manufacturing platforms

- Circular chemistry technologies

By Application

- Traditional applications

- High-growth applications

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Specialty Chemicals Market features major players such as BASF SE, Dow Inc., Clariant AG, Evonik Industries, Solvay, Huntsman Corporation, LANXESS, Ashland, Croda International, and Arkema, each leveraging robust R&D capabilities and global production networks to strengthen their market positions. These companies focus on high-performance formulations, sustainable chemistry, and advanced manufacturing technologies to address evolving industrial demands. Strategic initiatives such as mergers, acquisitions, partnerships, and capacity expansions enable them to enhance portfolios and enter high-growth segments including electronics materials, battery chemicals, bio-based additives, and advanced composites. Increasing emphasis on ESG compliance drives investment in renewable feedstocks, circular chemistry platforms, and low-emission production systems. Players also prioritize digital transformation through AI-enabled process optimization and continuous manufacturing to improve operational efficiency. As end-use industries shift toward lightweight, durable, and environmentally friendly materials, leading manufacturers intensify innovation efforts to maintain technological leadership and long-term growth momentum in specialty chemicals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Bhageria Industries Ltd. launched a new product line of plasticizers and ethoxylates, enhancing polymer properties for diverse applications while expanding its specialty chemicals portfolio through sustainable manufacturing.

- In June 2025, DCM Shriram Ltd. approved the acquisition of Hindusthan Specialty Chemicals Ltd. for Rs 375 crore ($44 million), enabling entry into advanced materials for sectors like renewables, aerospace, and electric vehicles.

- In March 2025, Evonik Industries signed an exclusive U.S. distribution agreement with Sea‑Land Chemical Company for its cleaning solutions, significantly expanding its reach in the American home-care and institutional cleaning markets.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by rising demand for high-performance materials across advanced manufacturing sectors.

- Adoption of bio-based and sustainable specialty chemicals will accelerate as industries align with global decarbonization goals.

- Advanced manufacturing technologies will enhance production efficiency and support high-purity specialty chemical development.

- Circular chemistry practices will expand as companies prioritize recycling, waste reduction, and renewable feedstocks.

- High-growth applications in electronics, EV batteries, semiconductors, and renewable energy will strengthen market momentum.

- Digital transformation will improve process optimization, product customization, and supply chain resilience.

- Regulatory pressure will encourage innovation in low-emission, safe, and environmentally compliant chemical solutions.

- Strategic mergers, acquisitions, and partnerships will increase as companies seek portfolio diversification and global expansion.

- Emerging economies will play a larger role in production and consumption due to rapid industrialization.

- Investment in R&D for novel chemistries and functional additives will intensify to meet evolving industry performance demands.