Market Overview:

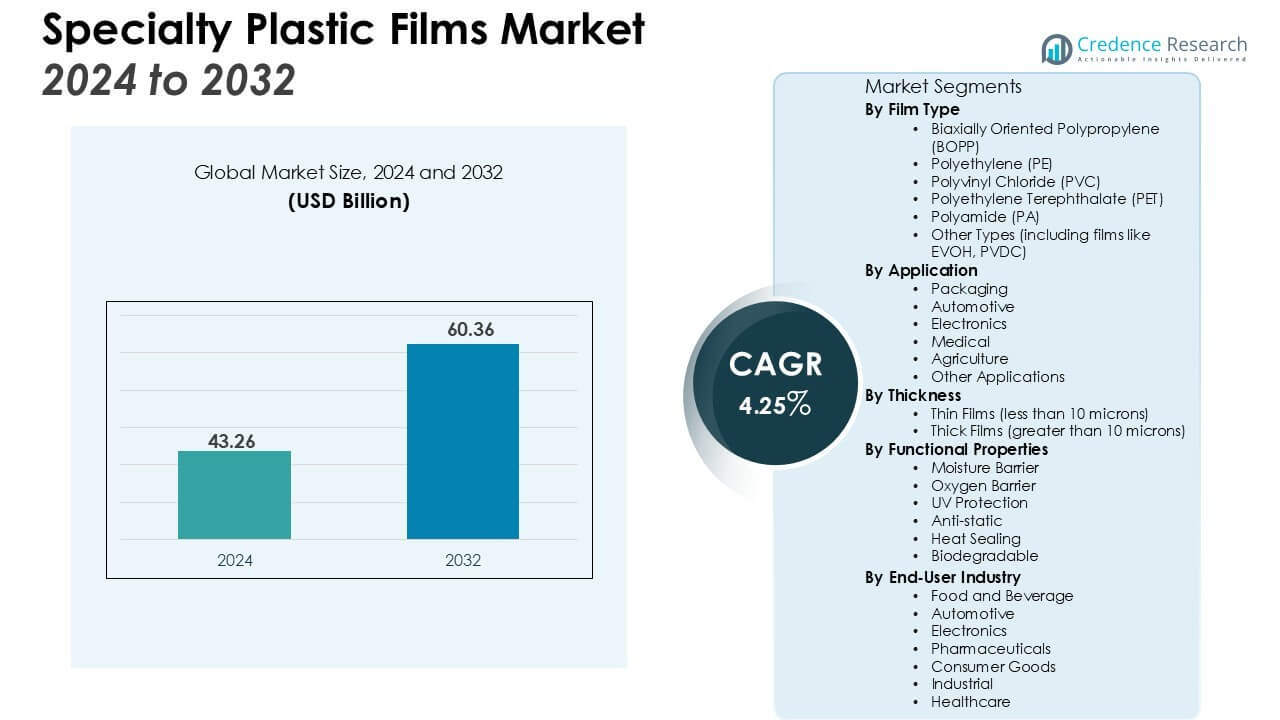

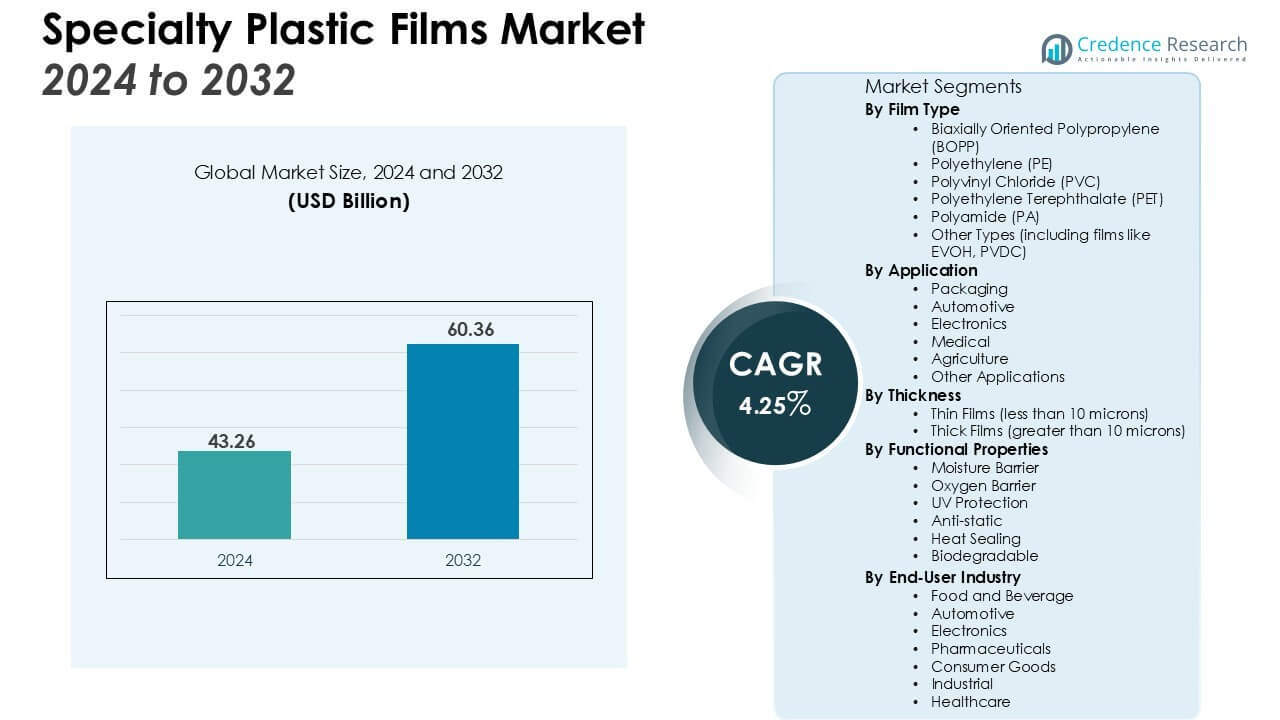

The Specialty Plastic Films Market size was valued at USD 43.26 billion in 2024 and is anticipated to reach USD 60.36 billion by 2032, at a CAGR of 4.25% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Specialty Plastic Films Market Size 2024 |

USD 43.26 Billion |

| Specialty Plastic Films Market, CAGR |

4.25% |

| Specialty Plastic Films Market Size 2032 |

USD 60.36 Billion |

Key market drivers include the rising need for lightweight and cost-effective materials, particularly in the packaging sector, where specialty plastic films offer advantages such as moisture resistance, ease of customization, and improved product shelf life. Additionally, growing consumer preference for eco-friendly packaging solutions has led to innovations in biodegradable and recyclable plastic films, further boosting market growth. The automotive sector’s increasing adoption of plastic films for lightweight components is also a significant driver. Furthermore, advancements in film technology, such as high-performance barrier films and multilayer constructions, are driving further demand.

Regionally, North America holds a substantial market share, owing to the advanced manufacturing infrastructure and high demand for specialty films in the packaging and automotive industries. However, the Asia-Pacific region is expected to witness the fastest growth, driven by expanding industrialization, a large consumer base, and increasing manufacturing capabilities, particularly in China and India. This growth is also supported by favorable government policies promoting sustainable packaging solutions.

Market Insights:

Market Insights:

- The specialty plastic films market size was valued at USD 43.26 billion in 2024 and is anticipated to reach USD 60.36 billion by 2032, growing at a CAGR of 4.25% from 2024 to 2032.

- Rising demand for lightweight and cost-effective materials in the packaging industry drives the adoption of specialty plastic films due to their moisture resistance, customization options, and ability to extend product shelf life.

- Consumer preference for eco-friendly packaging solutions is pushing the market, with biodegradable and recyclable films becoming more popular to meet sustainability goals and reduce plastic waste.

- Technological advancements in multilayer and high-performance barrier films enhance the functionality and protection properties of specialty plastic films, particularly in food, beverage, and pharmaceutical applications.

- Specialty plastic films are gaining traction in the automotive and industrial sectors due to their lightweight properties, contributing to improved fuel efficiency and enhanced product protection.

- North America holds 35% of the global market share, driven by high demand in packaging, automotive industries, and technological advancements, with a strong emphasis on sustainable packaging solutions.

- The Asia-Pacific region, holding 30% of the global market, is expected to experience the fastest growth due to expanding industrialization, increasing disposable incomes, and government support for sustainable packaging.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Lightweight and Durable Materials

The growing demand for lightweight materials, particularly in the packaging sector, is one of the key drivers of the specialty plastic films market. Manufacturers prefer these films due to their ability to reduce packaging weight, which lowers transportation costs. The films offer moisture resistance, excellent barrier properties, and durability, which extend the shelf life of products, particularly in food and beverage packaging. These properties make them ideal for use in flexible packaging applications across multiple industries.

- For instance, Berry Global and VOID Technologies collaborated and, in December 2024, launched a polyethylene film for pet food packaging engineered with VO+ microstructure technology, enabling the film to achieve a thickness of 70 microns for high-strength, fully recyclable mono-material applications.

Rising Consumer Preference for Eco-Friendly Solutions

The increasing shift toward eco-friendly packaging solutions has also significantly contributed to the growth of the specialty plastic films market. Consumers are becoming more environmentally conscious, prompting companies to invest in sustainable alternatives to traditional plastic. Specialty plastic films, especially biodegradable and recyclable options, meet these consumer demands while providing the same performance benefits as conventional plastic materials. This shift is supported by regulations and initiatives aimed at reducing plastic waste, further fueling innovation in the market.

For instance, BASF’s ecovio® 60 IA 1552 plant clips successfully biodegrade within six weeks in industrial composting, as verified by large-scale trials with Renewi in June 2025.

Technological Advancements in Film Manufacturing

Technological advancements in specialty plastic films are boosting market growth by improving the films’ functionality and performance. Recent innovations in multilayer and high-performance barrier films have enhanced the material’s ability to protect products from environmental factors such as moisture, oxygen, and light. These advancements are critical in industries like pharmaceuticals, food and beverage, and electronics, where product preservation is essential. Manufacturers are continually innovating to meet the ever-growing demands for higher performance and sustainable packaging solutions.

Expansion of Automotive and Industrial Applications

Specialty plastic films are also gaining traction in the automotive and industrial sectors due to their lightweight and versatile properties. In the automotive industry, these films are used for interior applications, including upholstery and trim, reducing vehicle weight and improving fuel efficiency. Additionally, films are increasingly used in electronics, medical devices, and construction materials, where they provide protective coatings and durability. This growing adoption in diverse industries further supports the market’s expansion.

Market Trends:

Increase in Demand for Sustainable Packaging Solutions

Sustainability continues to be a dominant trend in the specialty plastic films market. Consumers and businesses are increasingly adopting eco-friendly alternatives, leading to the development of biodegradable and recyclable films. These films are increasingly used in the packaging sector, especially for food and beverage products, due to their ability to provide durability and protection while reducing environmental impact. Manufacturers are focusing on creating specialty plastic films that offer the same level of performance as traditional plastics, but with minimal environmental footprint. Innovations in material composition, such as the use of plant-based plastics and bio-based additives, are further advancing the trend toward sustainable packaging solutions. This shift aligns with global regulatory movements aimed at reducing plastic waste and promoting recycling, encouraging manufacturers to invest in sustainable film technology.

- For instance, in April 2024, Berry Global expanded its European flexible film recycling capacity by an additional 6,600 metric tons per year, boosting the availability of high-performance recycled films.

Technological Innovations Driving Film Performance

Technological advancements are significantly influencing the growth of the specialty plastic films market. Innovations in film manufacturing, such as the development of multilayer and high-performance barrier films, are enhancing the functionality of these materials across industries. The ability to protect products from moisture, light, and oxygen has made specialty plastic films highly sought after in packaging, especially for perishable goods. Furthermore, improvements in film flexibility and customization allow for better application across diverse sectors, including pharmaceuticals and electronics. As demand for packaging solutions with superior protection capabilities increases, manufacturers are continually focusing on enhancing film performance through new technologies. These advancements are not only boosting the market’s growth but also expanding the scope of applications for specialty plastic films.

- For instance, in March 2024, UFlex commissioned a polyester chips manufacturing facility in Panipat, India, with an installed capacity of 168,000 metric tons per year dedicated to advanced packaging film production.

Market Challenges Analysis:

Rising Raw Material Costs and Supply Chain Disruptions

One of the significant challenges facing the specialty plastic films market is the volatility in raw material costs. Prices of petrochemical-based materials, such as polyethylene and polypropylene, have fluctuated due to geopolitical tensions and global supply chain disruptions. This creates uncertainties for manufacturers, who struggle to maintain consistent production costs while ensuring product quality. The reliance on these materials also impacts the profitability of companies in the industry, particularly smaller manufacturers who may lack the resources to absorb cost increases. Supply chain disruptions further exacerbate these challenges by delaying production timelines and impacting the availability of key materials, making it difficult to meet market demand.

Environmental Concerns and Regulatory Pressures

Environmental concerns surrounding plastic waste pose a significant challenge to the growth of the specialty plastic films market. While the demand for sustainable solutions is rising, the widespread use of plastic films remains a point of contention due to their non-biodegradable nature. Governments around the world are implementing stricter regulations on plastic packaging, pushing companies to invest in alternatives or face penalties. Specialty plastic films are under increasing scrutiny to meet recycling standards and contribute to a circular economy. As these regulatory pressures intensify, manufacturers must adapt quickly to comply, which can involve costly investments in new technologies and materials.

Market Opportunities:

Growing Demand for Sustainable and Biodegradable Packaging Solutions

The increasing demand for sustainable and biodegradable packaging presents a significant opportunity for the specialty plastic films market. Consumers and businesses are moving towards eco-friendly alternatives, creating demand for films that offer the same performance as traditional plastics but with a reduced environmental impact. Manufacturers can leverage this trend by developing specialty plastic films made from renewable sources such as plant-based materials, which cater to the growing preference for sustainable packaging. With governments implementing stricter regulations on plastic waste, companies investing in biodegradable and recyclable films stand to capture significant market share while contributing to environmental sustainability goals.

Expansion in Emerging Markets and Technological Advancements

Emerging markets, particularly in Asia-Pacific and Latin America, offer substantial growth potential for the specialty plastic films market. Rapid industrialization, increasing disposable incomes, and changing consumer preferences in these regions are driving the demand for packaged goods, creating opportunities for manufacturers. Technological advancements in film production, such as the development of high-performance barrier films, provide another avenue for growth. Specialty plastic films that enhance product shelf life and offer superior protection can be targeted to sectors like pharmaceuticals and electronics, which are expanding globally. By capitalizing on these market trends and innovations, manufacturers can unlock new growth opportunities in both developed and developing regions.

Market Segmentation Analysis:

By Film Type

The specialty plastic films market is segmented by film type into biaxially oriented polypropylene (BOPP), polyethylene (PE), polyvinyl chloride (PVC), and others. BOPP holds the largest share due to its high tensile strength, low cost, and versatility in packaging applications. It is widely used in food packaging, offering excellent moisture resistance and transparency. PE films are growing in demand, particularly in flexible packaging, driven by their durability and cost-effectiveness. PVC films are commonly used in applications that require rigid yet flexible properties, such as in medical and automotive sectors. The “others” category includes films like PET and polyamide, which cater to specialized uses in electronics and pharmaceuticals.

By Application

Specialty plastic films serve various applications, including packaging, automotive, electronics, and medical sectors. Packaging dominates the market due to the growing demand for flexible and protective packaging solutions in food, beverages, and consumer goods. Automotive applications use these films for lightweight components and interior parts, which reduce vehicle weight and improve fuel efficiency. The electronics industry uses specialty films for protective layers, while the medical sector benefits from high-performance films in medical devices and protective packaging.

For instance, within the electronics industry, DuPont Teijin Films produces ultra-thin Kaladex® PEN films for specialized applications like capacitors, manufacturing them at a thickness of just 1.2 microns.

By Thickness

The market is also segmented by thickness, with thin films (less than 10 microns) and thick films (more than 10 microns) being the primary categories. Thin films are highly preferred in packaging applications due to their flexibility and cost-efficiency. Thick films, used in applications requiring additional strength and protection, are gaining traction in industrial and automotive sectors.

For instance, to serve industrial sectors requiring thick, durable films, Cosmo Films is expanding its specialty film capabilities by commissioning a new BOPET film line with an annual production capacity of 30,000 metric tons.

Segmentations:

By Film Type:

-

- Biaxially Oriented Polypropylene (BOPP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyamide (PA)

- Other Types (including films like EVOH, PVDC)

By Application:

-

- Packaging

- Automotive

- Electronics

- Medical

- Agriculture

- Other Applications

By Thickness:

-

- Thin Films (less than 10 microns)

- Thick Films (greater than 10 microns)

By Functional Properties:

-

- Moisture Barrier

- Oxygen Barrier

- UV Protection

- Anti-static

- Heat Sealing

- Biodegradable

By End-User Industry:

-

- Food and Beverage

- Automotive

- Electronics

- Pharmaceuticals

- Consumer Goods

- Industrial

- Healthcare

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Leading Market Share and Demand for Packaging Solutions

North America accounts for 35% of the global specialty plastic films market, driven by technological advancements and high demand for packaging solutions. The region’s well-established manufacturing infrastructure and advanced research and development capabilities have positioned it as a leader in the production of specialty plastic films. Industries such as food and beverage, pharmaceuticals, and automotive fuel the demand for high-performance films, particularly in packaging and protective applications. The increasing focus on sustainable packaging in North America also drives market growth, as companies invest in biodegradable and recyclable plastic films. Regulatory pressures and consumer preferences for eco-friendly solutions are expected to continue influencing the market’s trajectory in the region.

Asia-Pacific: Fastest Growing Region with Expanding Industrialization

The Asia-Pacific region holds 30% of the global specialty plastic films market and is expected to experience the fastest growth. Countries such as China, India, and Japan are experiencing rapid economic development, increasing disposable incomes, and a shift toward modern packaging solutions. The region’s growing manufacturing capabilities, particularly in food and beverage packaging, electronic products, and automotive components, create a strong market for specialty films. Government policies supporting sustainability and the adoption of green packaging further contribute to the demand for eco-friendly plastic films in the region.

Europe: Strong Presence and Focus on Sustainability

Europe represents 25% of the global specialty plastic films market, with a strong emphasis on sustainability and regulatory compliance. The European Union’s stringent environmental regulations, particularly related to plastic waste, are driving the demand for recyclable and biodegradable films. Leading industries, such as food packaging, pharmaceuticals, and electronics, are increasingly adopting specialty films to enhance product preservation and meet regulatory requirements. The region’s commitment to reducing carbon footprints and adopting circular economy practices is pushing manufacturers to innovate in the development of sustainable packaging solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor

- Jindal Poly

- RPC

- Sealed Air

- Toray Plastics

- Covestro

- Honeywell

- AEP Industries (Berry Global Group)

- DuPont Teijin Films

- SABIC (Saudi Aramco)

- AkzoNobel

Competitive Analysis:

The specialty plastic films market is competitive, with key players such as Amcor, Berry Global, SABIC, Toray Industries, and Sealed Air leading the way. These companies leverage technological innovation to offer high-performance films with advanced properties like moisture resistance, barrier protection, and recyclability. They focus on sustainability, driven by increasing consumer demand for eco-friendly solutions and regulatory pressures. Market leaders frequently invest in new technologies and production capacity expansions to stay ahead, with recent examples including Jindal Poly Films’ ₹700 crore investment to increase its BOPP and CPP film production. Smaller regional companies also contribute to market growth by targeting niche applications, offering customized products, and catering to local demand. Competitive dynamics in the market are shaped by technological advancements, sustainability initiatives, and strategic expansions, which drive growth and foster differentiation across various segments.

Recent Developments:

- In September 2025, Amcor launched the Grace head, a new pump actuator designed for its mono-material Wave 2CC pump, targeting the beauty and personal care markets.

- In May 2025, Jindal Poly Films announced its plan to acquire full ownership of Enerlite Solar Films India, a company that produces films used in photovoltaic modules.

- In November 2024, Toray Advanced Composites, a part of the Toray Group, acquired the assets and technology of Gordon Plastics, a Colorado-based manufacturer of thermoplastics.

Report Coverage:

The research report offers an in-depth analysis based on Film Type, Application, Thickness, Functional Properties, End-User Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for sustainable and eco-friendly packaging solutions will continue to drive growth in the specialty plastic films market.

- Technological advancements in film manufacturing will enhance barrier properties, improving the protection and shelf life of products.

- Innovations in biodegradable and recyclable films will meet increasing consumer preference for environmentally responsible packaging.

- Growth in the food and beverage industry will fuel the demand for flexible and protective packaging solutions using specialty plastic films.

- The automotive sector will expand its use of lightweight plastic films for interior components, further increasing demand.

- Increased adoption of specialty films in electronics and medical packaging will open new opportunities for the market.

- Regional growth in Asia-Pacific, driven by industrialization and shifting consumer trends, will present significant growth opportunities.

- Strong regulatory frameworks aimed at reducing plastic waste will encourage the development of sustainable plastic film alternatives.

- The growing popularity of e-commerce and the need for protective packaging will further boost market demand.

- Ongoing investments in R&D and production capabilities will enable manufacturers to offer innovative, high-performance films that meet evolving market requirements.

Market Insights:

Market Insights: