Market Overview

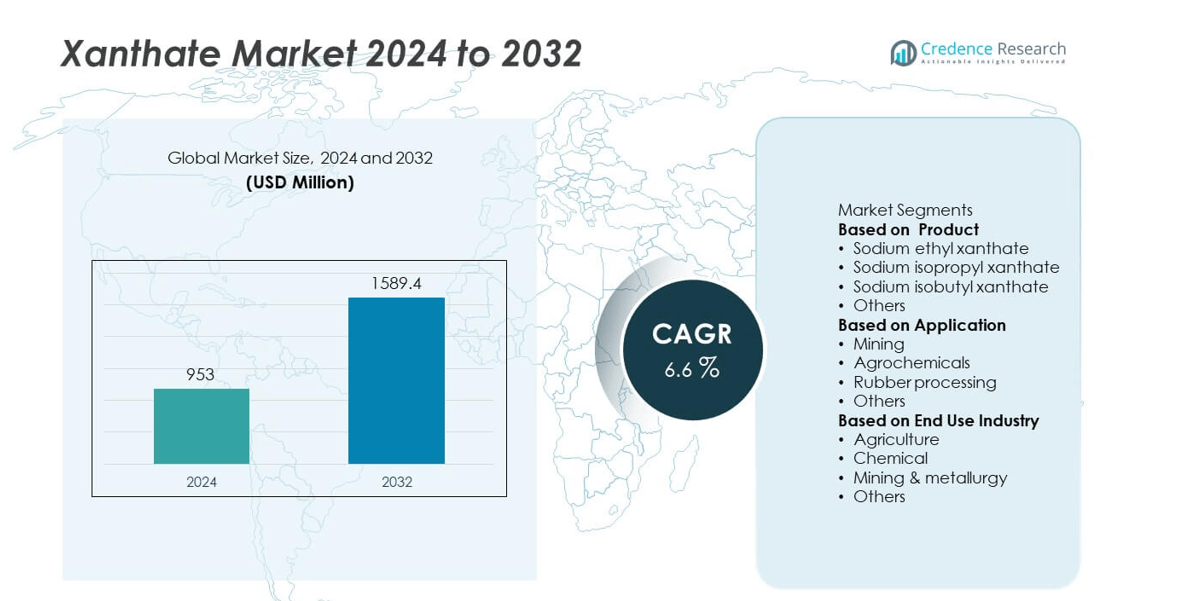

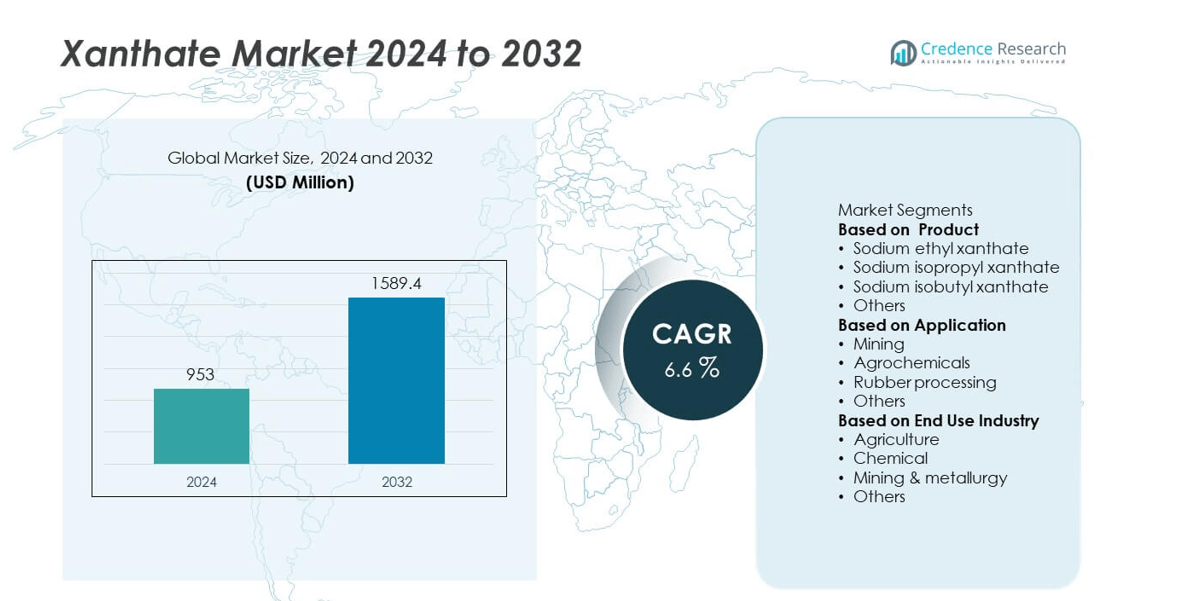

The global xanthate market was valued at USD 953 Million in 2024 and is projected to reach USD 1,589.4 Million by 2032, growing at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Xanthate Market Size 2024 |

USD 953 Million |

| Xanthate Market, CAGR |

6.6% |

| Xanthate Market Size 2032 |

USD 1,589.4 Million |

The xanthate market is led by major players such as Coogee Chemicals, Vizag Chemicals, Yantai Humon Group, Charles Tennant & Company, Newzeal Chem, Kavya Pharma, JAM Group, Tieling Flotation Reagent Co. Ltd, China Qingdao Hong Jin Chemical Company, and Senmin. These companies focus on supplying high-quality sodium ethyl, isopropyl, and isobutyl xanthates for mining and metallurgy applications. Asia-Pacific dominated the market with 42% share in 2024, driven by strong mining activities in China, India, and Australia. North America held 28% share, supported by demand from gold and copper mining operations, while Europe accounted for 20% share, boosted by chemical and industrial applications.

Market Insights

- The xanthate market was valued at USD 953 Million in 2024 and is projected to reach USD 1589.4 Million by 2032, growing at a CAGR of 6.6%.

- Rising demand from the mining sector for efficient flotation reagents is a key driver, as xanthates play a crucial role in improving mineral recovery rates in copper, zinc, and gold processing operations.

- Market trends focus on the development of environmentally friendly and low-toxicity xanthate formulations, along with growing automation in mineral processing plants to enhance efficiency and reduce operational costs.

- The market is competitive with key players including Coogee Chemicals, Vizag Chemicals, Yantai Humon Group, and Charles Tennant & Company expanding production capacity and forming strategic alliances with global mining companies to strengthen supply chains.

- Asia-Pacific led with 42% share in 2024, followed by North America with 28% and Europe with 20%, while sodium ethyl xanthate remained the dominant product segment with over 35% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Sodium isobutyl xanthate dominated the xanthate market with over 40% share in 2024, driven by its high efficiency and selectivity in flotation processes. It is widely used in the beneficiation of sulfide ores such as copper, zinc, and lead due to its strong collecting power and cost-effectiveness. Its superior performance in both alkaline and neutral pH ranges makes it the preferred choice in large-scale mining operations. Rising demand from the mineral processing sector and continued expansion of the mining industry in Asia-Pacific are expected to sustain growth in this product segment.

- For instance, Newzeal Chem, a specialty chemicals supplier established in 2023, has the potential to supply chemicals like sodium isobutyl xanthate to mining companies across India and Southeast Asia. Their supply could complement existing supplies from established Indian manufacturers like Amruta Industries or larger international players such as Qixia Tongda Flotation Reagent.

By Application

Mining accounted for over 70% share of the xanthate market in 2024, making it the dominant application segment. Xanthates are extensively used as flotation agents to separate valuable sulfide ores from gangue materials. Increased global demand for base metals like copper, nickel, and zinc is driving xanthate consumption in mineral processing plants. Ongoing investments in new mining projects, especially in Latin America and Africa, along with efforts to enhance ore recovery efficiency, are fueling sustained growth in this segment.

- For instance, Jam Group supplied xanthate reagents, among other mineral processing chemicals, to support mining operations globally, including in Latin America and Africa. Such supplies are used to increase flotation efficiency and improve metal recovery in the mining of various ores.

By End-Use Industry

The mining and metallurgy industry held the largest share with over 65% in 2024, as xanthates play a crucial role in improving recovery rates in ore processing operations. Expanding metal production and rising consumption in sectors such as construction, automotive, and electronics are boosting demand for xanthate-based flotation chemicals. Chemical and agriculture sectors follow as secondary consumers, using xanthates in pesticide formulations and chemical synthesis. Continued focus on improving yield in mining operations ensures that this end-use industry remains the primary growth driver for the global xanthate market.

Market Overview

Rising Demand from Mining and Metallurgy

The xanthate market is primarily driven by its extensive use in mining and metallurgy, which accounted for over 65% of demand in 2024. Xanthates serve as effective flotation agents for sulfide ores, helping improve recovery rates of copper, zinc, lead, and nickel. Expanding mining operations in Asia-Pacific, Latin America, and Africa are boosting consumption, supported by rising demand for base metals in infrastructure and electronics sectors. Investments in new mining projects and ore beneficiation plants continue to propel xanthate adoption globally.

- For instance, Australian Gold Reagents (a joint venture between Coogee Chemicals and Wesfarmers CSBP) made a final investment decision in early 2025 to expand its sodium cyanide production capacity in Kwinana, with first production from the expanded plant expected in the 2026 financial year. The expansion will increase capacity to meet growing demand from the gold mining industry in Australia and Asia-Pacific.

Expansion of Global Mineral Production

Growing consumption of metals across construction, automotive, and renewable energy industries is increasing the need for efficient mineral processing chemicals like xanthates. Global copper and zinc production has been rising steadily, creating significant opportunities for xanthate suppliers. Mining companies are focusing on maximizing ore recovery and optimizing operational efficiency, which drives demand for high-performance flotation agents. Technological advancements in mineral processing plants are also supporting the adoption of xanthate-based solutions for enhanced productivity.

- For instance, Yantai Humon Chemical Auxiliary Co., a subsidiary of Yantai Humon Group, has an annual production capacity of 78,000 metric tons of synthetic and dried xanthate products, allowing it to supply advanced xanthate products to mineral processors in China and international markets.

Growth in Emerging Markets

Emerging economies are witnessing rapid industrialization and infrastructure development, leading to rising demand for raw materials. Countries like China, India, and Brazil are investing heavily in mining projects to meet domestic metal requirements. This expansion of the mining sector is fueling xanthate consumption, especially in flotation processes for low-grade ores. Additionally, government initiatives supporting mining exploration and metallurgical process improvements further encourage the adoption of xanthates, driving strong market growth in developing regions during the forecast period.

Key Trends & Opportunities

Shift Toward Environmentally Safer Formulations

Sustainability concerns are encouraging the development of xanthate formulations with lower toxicity and reduced environmental impact. Manufacturers are investing in greener production methods and safer handling processes to comply with stringent regulatory standards. Demand is growing for biodegradable and eco-friendly flotation agents that maintain high selectivity and recovery rates. This trend presents opportunities for innovation and product differentiation, allowing suppliers to strengthen market position while meeting sustainability goals in the mining industry.

- For instance, Hefei TNJ Chemical Co., Ltd. (China) has a publicly stated commitment on its website to environmental protection and compliance with regulations set by China’s environmental authorities.

Technological Advancements in Ore Processing

Advancements in mineral processing technologies are boosting the adoption of xanthates by improving process efficiency and selectivity. Modern flotation systems and automation enable better control of reagent dosage and recovery performance, optimizing xanthate usage. The integration of digital monitoring tools and data analytics in mineral processing plants allows for enhanced performance tracking, creating opportunities for suppliers to offer tailored xanthate solutions. This technological progress drives consistent demand for high-quality, performance-oriented flotation chemicals.

- For instance, a major European chemical plant integrated AI-driven analytics to optimize production, resulting in a documented reduction in waste by preventing its creation in the first place.

Key Challenges

Environmental and Regulatory Restrictions

Stringent regulations on the use and disposal of xanthates pose a challenge for market players. Concerns over toxicity and potential water contamination have led to increased monitoring and restrictions on xanthate use in several regions. Compliance with environmental regulations adds to production and operational costs, impacting profitability. Manufacturers must invest in safer formulations and robust waste management solutions to mitigate regulatory risks and ensure sustainable market presence.

Volatility in Raw Material Prices

The production cost of xanthates is influenced by fluctuations in raw material prices, including carbon disulfide and alcohols. Price volatility can affect margins for manufacturers and create uncertainty in supply contracts with mining companies. This challenge is further compounded by global supply chain disruptions, which can lead to delays and cost escalations. Companies need to adopt effective procurement strategies and explore local sourcing options to minimize the impact of price fluctuations on production and profitability.

Regional Analysis

North America

North America held 28% share of the xanthate market in 2024, driven by robust mining activities and demand for base metals such as copper, zinc, and nickel. The U.S. and Canada are major contributors, with ongoing investments in ore beneficiation plants and exploration projects. Technological advancements in flotation processes and the adoption of environmentally compliant reagents support market growth. The region’s focus on sustainable mining operations and stricter environmental regulations encourage the development of safer xanthate formulations. Growth in infrastructure and renewable energy projects further boosts the need for metals, sustaining demand for flotation chemicals.

Europe

Europe accounted for 22% share in 2024, supported by growing mining and mineral processing activities, particularly in Russia, Poland, and Scandinavia. The region emphasizes eco-friendly and sustainable mineral processing, driving demand for high-performance, low-toxicity xanthates. European regulations encourage the use of safer chemicals, pushing manufacturers to innovate and develop greener solutions. The market is also influenced by demand from downstream industries such as automotive and construction, which require consistent metal supply. Investments in advanced mineral processing technologies enhance flotation efficiency, creating opportunities for xanthate producers to provide tailored, high-quality flotation agents.

Asia-Pacific

Asia-Pacific dominated the xanthate market with 35% share in 2024, fueled by extensive mining operations in China, India, and Australia. Rapid industrialization, urbanization, and infrastructure development are increasing demand for metals such as copper, lead, and zinc, driving xanthate consumption. China remains the largest producer and consumer due to its strong base metals industry and focus on improving ore recovery rates. Rising investments in mineral processing plants and government-backed mining initiatives support further market growth. Asia-Pacific’s growing focus on productivity and operational efficiency ensures steady demand for effective flotation agents like xanthates across diverse mining sectors.

Middle East & Africa

The Middle East & Africa captured 10% share in 2024, with South Africa leading due to its significant mining activities in gold, platinum, and base metals. Countries such as Saudi Arabia and UAE are investing in expanding mining infrastructure to diversify their economies, further supporting xanthate demand. The region benefits from abundant mineral reserves, and modernization of processing plants is driving adoption of advanced flotation chemicals. Rising foreign investments and joint ventures with global mining companies are boosting production capacity. Environmental awareness is gradually increasing, encouraging the adoption of safer, high-efficiency xanthate formulations.

Latin America

Latin America accounted for 5% share of the xanthate market in 2024, with key contributions from Brazil, Chile, and Peru. The region is a major hub for copper, gold, and silver mining, creating consistent demand for flotation agents. Expansion of mining projects and the discovery of new ore reserves continue to fuel xanthate consumption. Governments are supporting foreign investments in mineral extraction, encouraging modernization of processing facilities. However, environmental and social regulations are becoming stricter, driving the need for safer, sustainable reagents. Strong export markets for base metals ensure steady growth for xanthate suppliers in the region.

Market Segmentations:

By Product

- Sodium ethyl xanthate

- Sodium isopropyl xanthate

- Sodium isobutyl xanthate

- Others

By Application

- Mining

- Agrochemicals

- Rubber processing

- Others

By End Use Industry

- Agriculture

- Chemical

- Mining & metallurgy

- Others

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

Competitive landscape of the xanthate market is shaped by leading players including Coogee Chemicals, Vizag Chemicals, Yantai Humon Group, Charles Tennant & Company, Newzeal Chem, Kavya Pharma, JAM Group, Tieling Flotation Reagent Co. Ltd, China Qingdao Hong Jin Chemical Company, and Senmin. These companies focus on manufacturing high-quality sodium ethyl, isopropyl, and isobutyl xanthates to meet global demand from mining and metallurgy sectors. Strategies include capacity expansions, partnerships with major mining firms, and investments in sustainable production technologies. Players are also prioritizing compliance with environmental regulations by developing safer, eco-friendly flotation reagents. Competitive dynamics are driven by pricing strategies, product consistency, and global distribution capabilities. Many companies are expanding operations in Asia-Pacific and Latin America, where mining activities are growing rapidly. Continuous R&D efforts to enhance flotation performance and reduce toxicity are helping key players strengthen their market presence and build long-term relationships with end users.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Coogee Chemicals

- Vizag Chemicals

- Yantai Humon Group

- Charles Tennant & Company

- Newzeal Chem

- Kavya Pharma

- JAM Group

- Tieling Flotation Reagent Co. Ltd

- China Qingdao Hong Jin Chemical Company

- Senmin

Recent Developments

- In August 2025, Coogee Chemicals expanded its potassium ethyl xanthate production capacity by 8,000 metric tons annually to meet rising demand from the mining sector, especially copper and gold flotation operations in Asia-Pacific.

- In 2025, Yantai Humon Group upgraded its xanthate manufacturing facility to increase annual production by 10,000 metric tons, focusing on potassium amyl xanthate used extensively in base metal mining in China.

- In 2024, Coogee Chemicals expanded its liquid xanthate production facility in Western Australia, doubling its capacity to supply automated mining sites across the Asia-Pacific region.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for xanthates will grow with expansion of global mining and mineral processing projects.

- Sodium ethyl xanthate will remain the leading product due to high efficiency in flotation applications.

- Adoption of eco-friendly and low-toxicity xanthate formulations will increase to meet regulatory standards.

- Automation and digital monitoring in mineral processing will boost precision use of xanthates.

- Asia-Pacific will continue to dominate driven by strong production in China, India, and Australia.

- Strategic partnerships between suppliers and mining companies will enhance long-term supply security.

- Research into bio-based alternatives will create opportunities for sustainable xanthate production.

- Fluctuations in raw material prices will encourage development of cost-efficient production technologies.

- Growth in copper and gold demand will directly support higher xanthate consumption.

- Investments in capacity expansion and distribution networks will strengthen global market presence.