Market Overview

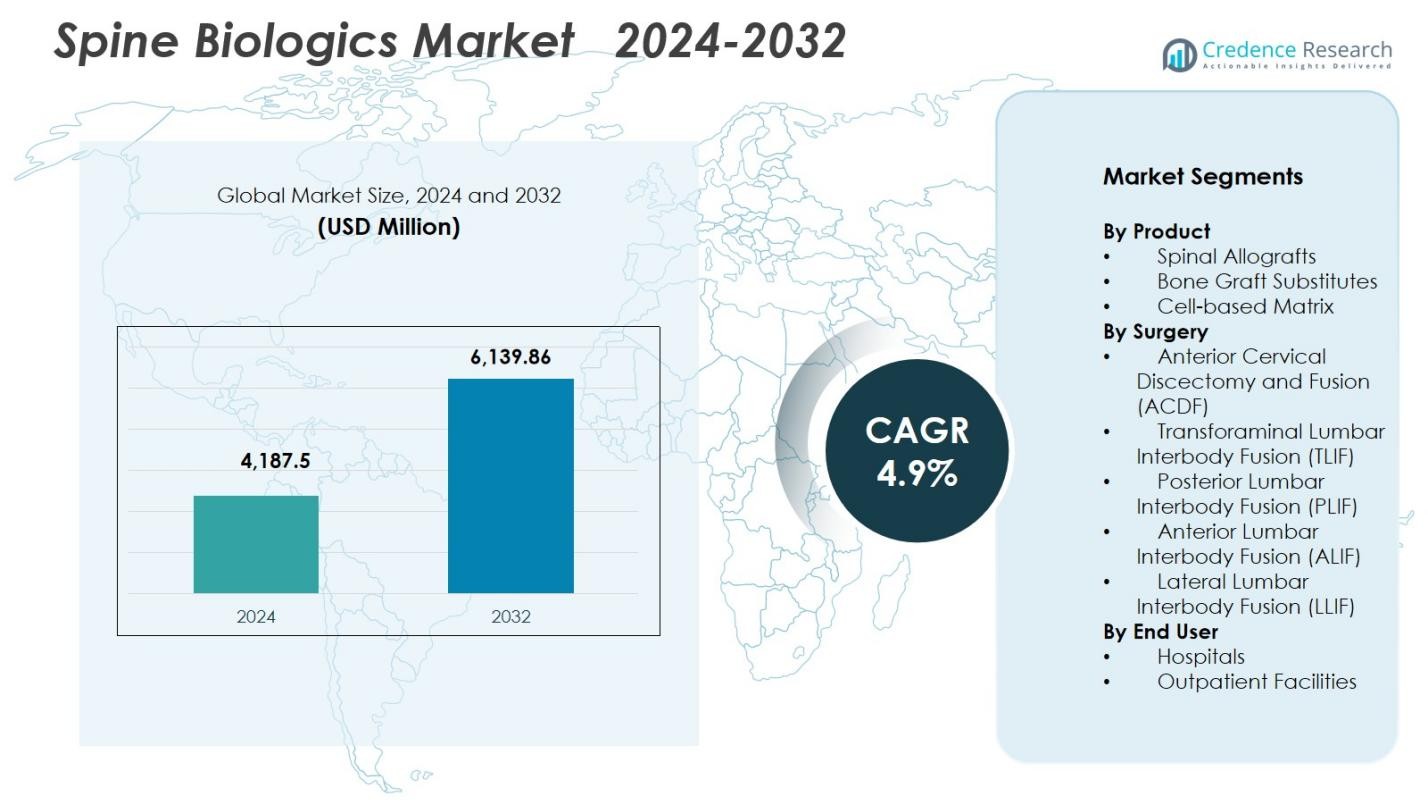

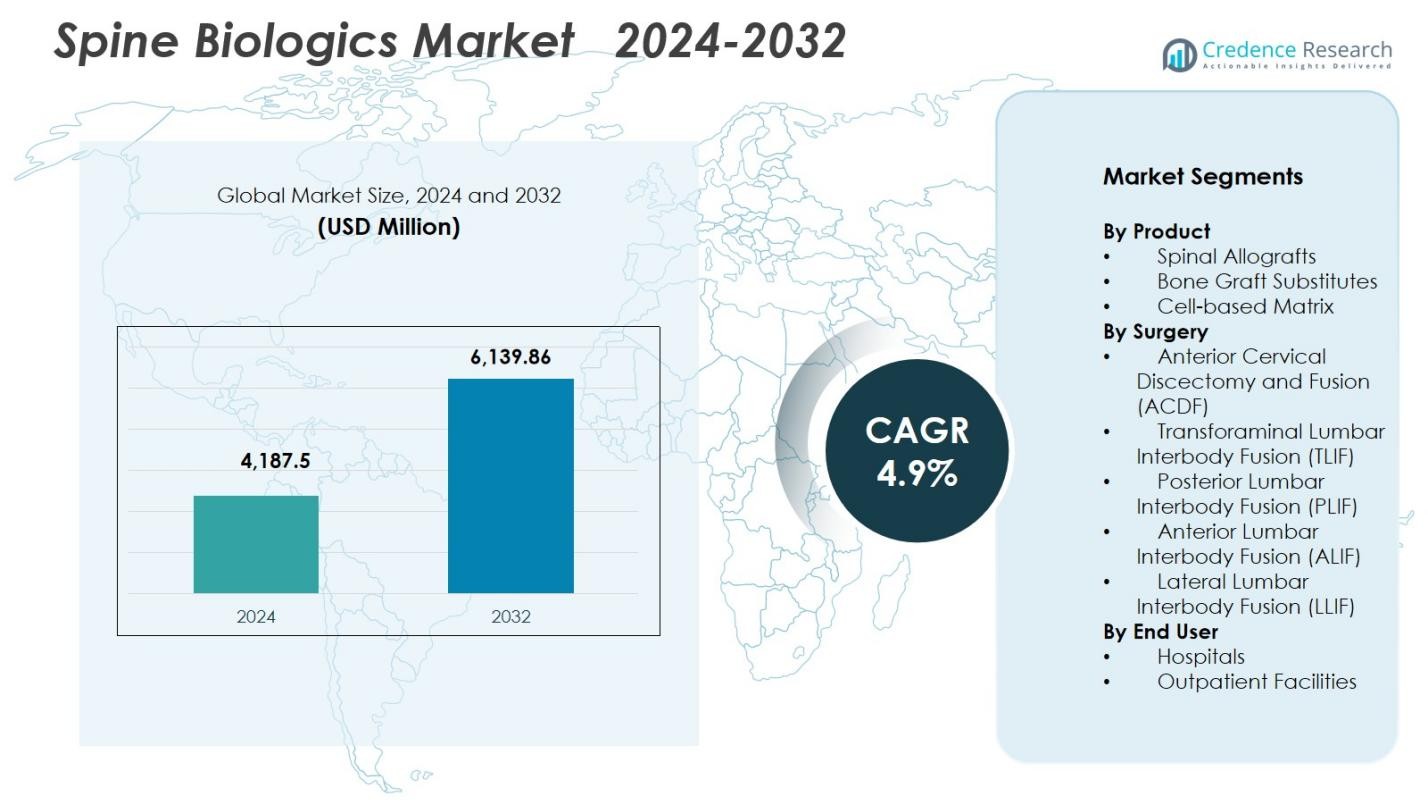

Spine Biologics Market size was valued at USD 4,187.5 Million in 2024 and is anticipated to reach USD 6,139.86 Million by 2032, at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spine Biologics Market Size 2024 |

USD 4,187.5 Million |

| Spine Biologics Market, CAGR |

4.9% |

| Spine Biologics Market Size 2032 |

USD 6,139.86 Million |

Spine Biologics Market is shaped by a strong competitive presence of leading companies such as Medtronic, Stryker, Zimmer Biomet, NuVasive, Orthofix Medical, Arthrex, Exactech, Organogenesis, Xtant Medical, and Medical Device Business Services, Inc. These players drive innovation through advanced allografts, synthetic grafts, and cell-based matrices designed to improve fusion outcomes and support minimally invasive spine procedures. Regionally, North America leads the market with a 41.2% share, supported by high surgical volumes, strong reimbursement systems, and rapid adoption of next-generation biologics. Europe and Asia-Pacific follow as major growth contributors, driven by expanding spine care infrastructure and rising demand for biologic-enhanced fusion treatments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Spine Biologics Market reached USD 4,187.5 million in 2024 and is projected to hit USD 6,139.86 million by 2032, advancing at a 4.9% CAGR during the forecast period.

- Market growth is driven by rising degenerative spine disorders, increasing adoption of minimally invasive fusion procedures, and expanding use of advanced biologics such as allografts, synthetic grafts, and cell-based matrices.

- Key trends include the shift toward next-generation regenerative biologics, wider adoption of outpatient spine surgeries, and growing demand for synthetic substitutes offering predictable clinical outcomes.

- Competitive activity intensifies as major players like Medtronic, Stryker, Zimmer Biomet, NuVasive, and Orthofix invest heavily in R&D, partnerships, and product expansions, though high biologic costs and strict regulatory pathways restrain broader adoption.

- North America leads with 41.2% share, followed by Europe at 27.6% and Asia-Pacific at 22.8%, while spinal allografts dominate the product segment with a 44.2% share, reinforcing their strong clinical acceptance.

Market Segmentation Analysis

By Product

Spinal allografts dominated the Spine Biologics Market in 2024 with a 44.2% share, driven by their widespread acceptance in fusion surgeries and strong clinical outcomes with reduced donor-site morbidity. Their availability in multiple forms—structural, machined, and demineralized—supports broad adoption across cervical and lumbar procedures. Bone graft substitutes continued to gain momentum due to advancements in synthetic ceramics and bioactive materials, while cell-based matrices expanded steadily with rising interest in regenerative approaches and improved osteoinductive performance.

- For instance, a long-term follow-up study of 147 patients who received structural human allografts in cervical and lumbar fusion surgeries showed robust fusion rates over a decade.

By Surgery

Anterior Cervical Discectomy and Fusion (ACDF) held the largest share of 32.8% in 2024, supported by high procedural volumes and proven effectiveness in treating cervical degenerative disc diseases. Its minimally invasive nature, shorter recovery timelines, and consistent fusion success rates strengthen adoption across hospitals and outpatient spine centers. TLIF and PLIF continued to see strong traction due to their versatility in lumbar stabilization, whereas ALIF and LLIF benefited from reduced tissue disruption and growing preference for lateral and anterior access techniques in complex spine reconstructions.

- For instance, Stryker’s Tritanium TL curved posterior lumbar cage uses additive manufacturing for porous bone in-growth in TLIF, with varied heights and lordotic angles.

By End User

Hospitals accounted for the dominant 61.4% share in 2024, driven by their advanced surgical infrastructure, higher case complexity, and greater availability of skilled spine surgeons. Hospitals also handle a substantial volume of fusion and revision procedures, supporting sustained demand for allografts, substitutes, and biologic enhancers. Outpatient facilities continued to expand their role as minimally invasive spine surgeries increased, supported by faster discharge pathways, lower procedural costs, and improved biologic materials that enhance fusion reliability in ambulatory settings.

Key Growth Drivers

Rising Burden of Degenerative Spine Disorders

The increasing global prevalence of degenerative spine conditions such as spinal stenosis, disc degeneration, and spondylolisthesis serves as a major driver of the Spine Biologics Market. Aging populations, sedentary lifestyles, and rising obesity levels significantly elevate the incidence of spinal instability and chronic back pain. This drives higher demand for fusion procedures where biologics play a critical role in achieving stable bone healing. Additionally, earlier diagnosis through advanced imaging and growing patient preference for reliable surgical outcomes further strengthen the utilization of allografts, bone graft substitutes, and cellular matrices in both primary and revision surgeries.

- For instance, MRI-based population research confirms that cervical disc degeneration is present in over 85% of individuals above age 60, supporting sustained demand for allografts and bone graft substitutes in both primary and revision procedures

Shift Toward Minimally Invasive Spine Procedures

Growing adoption of minimally invasive spine surgery (MISS) is accelerating the demand for advanced biologics that support rapid fusion and reduce postoperative complications. These procedures use smaller incisions, which increases reliance on biologics with strong osteoconductive and osteoinductive properties to ensure effective bone regeneration in constrained surgical environments. MISS offers shorter hospital stays, faster recovery, and reduced tissue damage, encouraging both surgeons and patients to opt for biologic-enhanced techniques. The rising number of outpatient fusion procedures further strengthens market growth as high-performance biologics enable predictable and durable fusion outcomes in ambulatory settings.

- For instance, clinical studies report that MISS procedures reduce perioperative blood loss by more than 50% compared with open approaches, reinforcing surgeon preference for biologics that can reliably achieve fusion with minimal disruption.

Technological Advancements in Regenerative Biologics

Continuous innovation in biologic materials, including next-generation demineralized bone matrices, stem cell–derived scaffolds, and synthetic bone graft substitutes, significantly propels market expansion. These advanced solutions offer improved osteogenic potential, reduced variability, and enhanced biocompatibility, leading to higher fusion success rates. Advances in tissue engineering, 3D-printed grafts, and growth factor–based products enable personalized treatment approaches for complex spinal pathologies. Furthermore, increasing R&D investment, regulatory approvals for novel products, and expanding clinical evidence supporting biologic performance foster greater confidence among surgeons, thereby driving widespread adoption across both cervical and lumbar fusion procedures.

Key Trends & Opportunities

Growing Adoption of Next-Generation Synthetic and Cell-Based Biologics

A major trend shaping the Spine Biologics Market is the rapid shift toward next-generation synthetic grafts and cell-based matrices that offer enhanced osteoconductive and osteoinductive properties. Surgeons increasingly prefer predictable, pathogen-free synthetic materials over traditional autografts, reducing donor-site complications and addressing supply limitations associated with human tissues. Cell-based biologics—including mesenchymal stem cell–enriched scaffolds—are gaining traction due to their regenerative capabilities and potential to accelerate fusion in high-risk patients. This trend aligns with the growing emphasis on evidence-based, high-performance biologics supported by clinical data. As R&D pipelines expand and regulatory pathways for regenerative products mature, manufacturers have strong opportunities to introduce innovative, premium-grade solutions tailored to specific spinal procedures.

- For instance, clinical evaluations of MSC-loaded collagen or hydrogel scaffolds demonstrate accelerated early bone formation and promising radiographic fusion outcomes in high-risk spinal populations.

Expansion of Outpatient Spine Surgery and Ambulatory Centers

The rapid increase in spinal fusions performed in ambulatory surgical centers (ASCs) presents a significant opportunity for biologics manufacturers. Advancements in MISS techniques, anesthesia, and postoperative care enable safe execution of cervical and lumbar fusion procedures outside hospital settings, driving demand for biologics that ensure consistent fusion outcomes with minimal complications. ASCs seek biologics that are easy to handle, cost-effective, and offer reliable performance across various interbody fusion techniques. This shift encourages suppliers to develop procedure-specific kits, pre-hydrated grafts, and ready-to-use biologic formulations suitable for high-efficiency surgical environments. As payers and health systems emphasize cost optimization, the ASC market is expected to remain one of the most influential opportunity areas over the next decade.

- For instance, cross-sectional study of Medicare billing (2010–2021), outpatient spine procedures increased by about 193%, with the annual growth rate in ASCs (15.7%) far outpacing hospital outpatient departments (9.9%).

Key Challenges

High Cost of Advanced Biologic Products

The premium pricing of next-generation biologics—including cell-based matrices, synthetic grafts, and growth factor–enhanced materials—continues to challenge market adoption, particularly in cost-sensitive healthcare systems. Hospitals often face budget constraints, and reimbursement limitations restrict the use of higher-priced biologics in routine spine procedures. Surgeons must balance clinical benefits with economic considerations, which can limit uptake despite strong performance data. This challenge is more pronounced in emerging markets where procurement budgets are lower, creating a widening gap between technological availability and accessibility.

Regulatory and Clinical Evidence Requirements

Spine biologics face stringent regulatory scrutiny due to the need for proven safety, efficacy, and long-term fusion outcomes. Generating robust clinical evidence requires substantial time and investment, delaying product commercialization and limiting the introduction of innovative solutions. Variability in biologic performance, concerns over processing standards for human-derived tissues, and inconsistent surgeon confidence further complicate market penetration. Companies must navigate evolving regulatory frameworks while conducting extensive clinical trials, which can slow market entry and increase development costs. These stringent requirements pose hurdles for both established players and emerging innovators.

Regional Analysis

North America

North America dominated the Spine Biologics Market in 2024 with a 41.2% share, supported by high procedural volumes, strong adoption of advanced biologics, and a well-established spine surgery landscape. The region benefits from leading manufacturers, extensive reimbursement coverage for fusion procedures, and widespread availability of minimally invasive spine surgery capabilities. Aging demographics and a high incidence of degenerative spine disorders further accelerate market demand. Continuous innovation in synthetic grafts, stem cell–based matrices, and demineralized bone products strengthens clinical adoption, while ambulatory surgical centers expand the use of biologics in outpatient fusion procedures.

Europe

Europe accounted for a 27.6% market share in 2024, driven by increasing demand for spinal fusion procedures and advancements in biologic graft materials across major healthcare systems. Strong clinical evidence supporting regenerative solutions and a rising preference for minimally invasive techniques contribute to steady market expansion. The region also benefits from structured reimbursement frameworks in countries such as Germany, France, and the U.K., which support the use of premium biologics in complex spine surgeries. Growing investments in orthopedic research and a rising elderly population further enhance adoption, particularly for cervical and lumbar degenerative conditions.

Asia-Pacific

Asia-Pacific captured a 22.8% share in 2024 and is emerging as the fastest-growing region due to rising healthcare expenditure, expanding spinal surgery infrastructure, and growing awareness of biologic-enhanced fusion procedures. Increasing prevalence of spinal disorders driven by aging populations and sedentary work patterns supports strong procedural demand. Countries such as China, India, Japan, and South Korea are experiencing rapid adoption of synthetic grafts and demineralized matrices as hospitals upgrade to advanced orthopedic technologies. Favorable government initiatives, improving insurance coverage, and the expansion of private healthcare facilities further elevate market penetration across both metropolitan and secondary cities.

Latin America

Latin America held a 5.4% share in 2024, supported by gradual improvements in surgical infrastructure and rising access to specialized orthopedic care. Brazil and Mexico lead the market, driven by increasing adoption of fusion procedures and improved availability of allografts and bone graft substitutes. However, budget constraints and uneven reimbursement policies limit widespread use of premium biologics. Growing investments in private hospitals and medical tourism, along with expanding training programs for minimally invasive spine surgery, create new opportunities. As awareness of biologic-supported fusion outcomes increases, the region is expected to witness steady, long-term growth.

Middle East & Africa

The Middle East & Africa region accounted for 3.0% of the market in 2024, characterized by rising demand for spinal surgeries in GCC countries and gradual improvements in orthopedic care capacity across African nations. Wealthier markets such as the UAE, Saudi Arabia, and Qatar are rapidly adopting advanced biologics due to high investment in healthcare modernization and strong presence of international medical centers. In contrast, limited access to specialized spine surgeons and high biologic costs constrain broader adoption in low-income regions. Ongoing infrastructure development and medical tourism growth continue to support future market expansion.

Market Segmentations

By Product

- Spinal Allografts

- Bone Graft Substitutes

- Cell-based Matrix

By Surgery

- Anterior Cervical Discectomy and Fusion (ACDF)

- Transforaminal Lumbar Interbody Fusion (TLIF)

- Posterior Lumbar Interbody Fusion (PLIF)

- Anterior Lumbar Interbody Fusion (ALIF)

- Lateral Lumbar Interbody Fusion (LLIF)

By End User

- Hospitals

- Outpatient Facilities

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Spine Biologics Market features a highly competitive landscape characterized by continuous innovation, strategic partnerships, and strong product pipelines from global medical device leaders. Key players such as Medtronic, Stryker, Zimmer Biomet, NuVasive, Orthofix Medical, Arthrex, Exactech, Organogenesis, Xtant Medical, and Medical Device Business Services, Inc. focus on expanding their biologic portfolios through advanced allografts, next-generation synthetic grafts, and cell-based regenerative solutions. Companies increasingly invest in R&D to enhance osteoinductive and osteoconductive properties, improve handling characteristics, and deliver predictable fusion outcomes across complex spine procedures. Strategic acquisitions and collaborations with tissue banks, biomaterial developers, and research institutions strengthen market positioning. Growing emphasis on minimally invasive and outpatient spine procedures also drives manufacturers to develop biologics optimized for rapid fusion and ease of use. As clinical evidence requirements intensify, market leaders prioritize high-quality manufacturing, regulatory compliance, and surgeon education to maintain competitive advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Exactech, Inc. (U.S.)

- Stryker (U.S.)

- Organogenesis Inc. (U.S.)

- Zimmer Biomet (U.S.)

- Arthrex, Inc. (U.S.)

- Medtronic (Ireland)

- Xtant Medical (U.S.)

- NuVasive®, Inc. (U.S.)

- Orthofix Medical Inc (U.S.)

- Medical Device Business Services, Inc (U.S.)

Recent Developments

- In July 2025, Orthofix announced the full U.S. commercial launch of the Reef™ L Interbody System for lateral lumbar fusion procedures. The system integrates proprietary NanoMetalene™ surface technology and distinctive Reef undercuts to improve surgical accuracy and support better patient outcomes.

- In May 2025, Xtant Medical introduced OsteoFactor Pro™, a naturally derived, growth factor-rich formulation engineered to enhance the biologic activity and regenerative capability of bone grafts in spinal fusion. The product is designed to accelerate healing and reduce recovery time for patients undergoing spine surgeries.

- In October 2024, Theradaptive’s OsteoAdapt™ SP received the Gold Level Award for Best Technology in Spine 2024 from Orthopedics This Week. OsteoAdapt™ SP is an investigational device developed using Theradaptive’s targeted protein therapeutics platform, aimed at advancing innovation in spine and orthopedic applications

Report Coverage

The research report offers an in-depth analysis based on Product, Surgery, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as demand for spinal fusion procedures continues to rise globally.

- Advancements in regenerative biologics and cell-based therapies will enhance fusion success rates and expand clinical applications.

- Synthetic bone graft substitutes will gain stronger preference due to consistent performance and reduced infection risks.

- Minimally invasive and outpatient spine surgeries will accelerate the adoption of easy-to-handle, fast-acting biologics.

- Increased R&D investment will lead to next-generation graft materials with improved osteoinductive and osteogenic properties.

- Surgeons will adopt personalized biologic solutions tailored to patient risk profiles and specific spinal pathologies.

- Regulatory clarity and expanding clinical evidence will support wider acceptance of innovative biologic technologies.

- Emerging markets will witness rapid growth as spine care infrastructure and reimbursement frameworks improve.

- Strategic partnerships between device companies and tissue banks will strengthen product availability and innovation.

- Integration of digital planning tools and biologic-optimized implants will enhance procedural efficiency and outcomes.